false00017596312024FYhttp://fasb.org/us-gaap/2024#RestructuringChargeshttp://fasb.org/us-gaap/2024#RestructuringChargesP1YP1YP1Yhttp://fasb.org/us-gaap/2024#AccountsPayableAndOtherAccruedLiabilitiesCurrentiso4217:USDxbrli:sharesiso4217:USDxbrli:shareshyln:contracthyln:generatorxbrli:purehyln:renewal_optionhyln:extension00017596312024-01-012024-12-3100017596312024-06-3000017596312025-02-2000017596312024-12-3100017596312023-12-310001759631hyln:ProductSalesAndOtherMember2024-01-012024-12-310001759631hyln:ProductSalesAndOtherMember2023-01-012023-12-310001759631hyln:ResearchAndDevelopmentServicesMember2024-01-012024-12-310001759631hyln:ResearchAndDevelopmentServicesMember2023-01-012023-12-3100017596312023-01-012023-12-310001759631us-gaap:CommonStockMember2022-12-310001759631us-gaap:TreasuryStockCommonMember2022-12-310001759631us-gaap:AdditionalPaidInCapitalMember2022-12-310001759631us-gaap:RetainedEarningsMember2022-12-3100017596312022-12-310001759631us-gaap:CommonStockMember2023-01-012023-12-310001759631us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001759631us-gaap:TreasuryStockCommonMember2023-01-012023-12-310001759631us-gaap:RetainedEarningsMember2023-01-012023-12-310001759631us-gaap:CommonStockMember2023-12-310001759631us-gaap:TreasuryStockCommonMember2023-12-310001759631us-gaap:AdditionalPaidInCapitalMember2023-12-310001759631us-gaap:RetainedEarningsMember2023-12-310001759631us-gaap:CommonStockMember2024-01-012024-12-310001759631us-gaap:AdditionalPaidInCapitalMember2024-01-012024-12-310001759631us-gaap:TreasuryStockCommonMember2024-01-012024-12-310001759631us-gaap:RetainedEarningsMember2024-01-012024-12-310001759631us-gaap:CommonStockMember2024-12-310001759631us-gaap:TreasuryStockCommonMember2024-12-310001759631us-gaap:AdditionalPaidInCapitalMember2024-12-310001759631us-gaap:RetainedEarningsMember2024-12-310001759631hyln:StrategicPlanMember2024-01-012024-12-310001759631hyln:StrategicPlanMember2023-01-012023-12-310001759631us-gaap:EmployeeSeveranceMemberhyln:StrategicPlanMember2023-12-310001759631us-gaap:EmployeeSeveranceMemberhyln:StrategicPlanMember2024-01-012024-12-310001759631us-gaap:EmployeeSeveranceMemberhyln:StrategicPlanMember2024-12-310001759631us-gaap:ContractTerminationMemberhyln:StrategicPlanMember2023-12-310001759631us-gaap:ContractTerminationMemberhyln:StrategicPlanMember2024-01-012024-12-310001759631us-gaap:ContractTerminationMemberhyln:StrategicPlanMember2024-12-310001759631hyln:WarrantyObligationMemberhyln:StrategicPlanMember2023-12-310001759631hyln:WarrantyObligationMemberhyln:StrategicPlanMember2024-01-012024-12-310001759631hyln:WarrantyObligationMemberhyln:StrategicPlanMember2024-12-310001759631hyln:StrategicPlanMember2023-12-310001759631hyln:StrategicPlanMember2024-12-310001759631us-gaap:EmployeeSeveranceMemberhyln:StrategicPlanMember2022-12-310001759631us-gaap:EmployeeSeveranceMemberhyln:StrategicPlanMember2023-01-012023-12-310001759631us-gaap:ContractTerminationMemberhyln:StrategicPlanMember2022-12-310001759631us-gaap:ContractTerminationMemberhyln:StrategicPlanMember2023-01-012023-12-310001759631hyln:WarrantyObligationMemberhyln:StrategicPlanMember2022-12-310001759631hyln:WarrantyObligationMemberhyln:StrategicPlanMember2023-01-012023-12-310001759631hyln:StrategicPlanMember2022-12-310001759631hyln:ReportableSegmentMember2024-01-012024-12-310001759631hyln:ReportableSegmentMember2023-01-012023-12-310001759631hyln:SupplierMember2024-12-310001759631hyln:CorporateHeadquartersLessorMember2024-12-310001759631srt:MinimumMemberus-gaap:MachineryAndEquipmentMember2024-12-310001759631srt:MaximumMemberus-gaap:MachineryAndEquipmentMember2024-12-310001759631srt:MinimumMemberus-gaap:VehiclesMember2024-12-310001759631srt:MaximumMemberus-gaap:VehiclesMember2024-12-310001759631us-gaap:LeaseholdImprovementsMember2024-12-310001759631us-gaap:FurnitureAndFixturesMember2024-12-310001759631srt:MinimumMemberus-gaap:ComputerEquipmentMember2024-12-310001759631srt:MaximumMemberus-gaap:ComputerEquipmentMember2024-12-3100017596312024-01-012024-09-300001759631hyln:ResearchAndDevelopmentServiceMembersrt:MaximumMember2024-09-300001759631hyln:ResearchAndDevelopmentServiceMember2024-01-012024-12-3100017596312024-10-012024-12-310001759631hyln:ResearchAndDevelopmentServiceMembersrt:MaximumMember2024-12-310001759631hyln:ResearchAndDevelopmentServiceMember2024-12-310001759631hyln:CustomerAMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-01-012024-12-310001759631hyln:CustomerAMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-01-012023-12-310001759631hyln:CustomerBMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-01-012024-12-310001759631hyln:CustomerBMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-01-012023-12-310001759631hyln:CustomerCMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-01-012024-12-310001759631hyln:CustomerCMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-01-012023-12-310001759631hyln:CustomerDMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-01-012024-12-310001759631hyln:CustomerDMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-01-012023-12-310001759631hyln:SignificantCustomersMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-01-012024-12-310001759631hyln:SignificantCustomersMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-01-012023-12-310001759631srt:MinimumMember2024-12-310001759631srt:MaximumMember2024-12-310001759631us-gaap:CommercialPaperMember2024-12-310001759631us-gaap:USGovernmentAgenciesDebtSecuritiesMember2024-12-310001759631us-gaap:MunicipalBondsMember2024-12-310001759631us-gaap:CorporateBondSecuritiesMember2024-12-310001759631us-gaap:CommercialPaperMember2023-12-310001759631us-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-12-310001759631us-gaap:MunicipalBondsMember2023-12-310001759631us-gaap:CorporateBondSecuritiesMember2023-12-310001759631us-gaap:FairValueInputsLevel1Member2024-12-310001759631us-gaap:FairValueInputsLevel2Member2024-12-310001759631us-gaap:FairValueInputsLevel3Member2024-12-310001759631us-gaap:FairValueInputsLevel1Memberus-gaap:CommercialPaperMember2024-12-310001759631us-gaap:FairValueInputsLevel2Memberus-gaap:CommercialPaperMember2024-12-310001759631us-gaap:FairValueInputsLevel3Memberus-gaap:CommercialPaperMember2024-12-310001759631us-gaap:FairValueInputsLevel1Memberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2024-12-310001759631us-gaap:FairValueInputsLevel2Memberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2024-12-310001759631us-gaap:FairValueInputsLevel3Memberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2024-12-310001759631us-gaap:FairValueInputsLevel1Memberus-gaap:USStatesAndPoliticalSubdivisionsMember2024-12-310001759631us-gaap:FairValueInputsLevel2Memberus-gaap:USStatesAndPoliticalSubdivisionsMember2024-12-310001759631us-gaap:FairValueInputsLevel3Memberus-gaap:USStatesAndPoliticalSubdivisionsMember2024-12-310001759631us-gaap:USStatesAndPoliticalSubdivisionsMember2024-12-310001759631us-gaap:FairValueInputsLevel1Memberhyln:CorporateBondsAndNotesMember2024-12-310001759631us-gaap:FairValueInputsLevel2Memberhyln:CorporateBondsAndNotesMember2024-12-310001759631us-gaap:FairValueInputsLevel3Memberhyln:CorporateBondsAndNotesMember2024-12-310001759631hyln:CorporateBondsAndNotesMember2024-12-310001759631us-gaap:FairValueInputsLevel1Member2023-12-310001759631us-gaap:FairValueInputsLevel2Member2023-12-310001759631us-gaap:FairValueInputsLevel3Member2023-12-310001759631us-gaap:FairValueInputsLevel1Memberus-gaap:CommercialPaperMember2023-12-310001759631us-gaap:FairValueInputsLevel2Memberus-gaap:CommercialPaperMember2023-12-310001759631us-gaap:FairValueInputsLevel3Memberus-gaap:CommercialPaperMember2023-12-310001759631us-gaap:FairValueInputsLevel1Memberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-12-310001759631us-gaap:FairValueInputsLevel2Memberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-12-310001759631us-gaap:FairValueInputsLevel3Memberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-12-310001759631us-gaap:FairValueInputsLevel1Memberus-gaap:USStatesAndPoliticalSubdivisionsMember2023-12-310001759631us-gaap:FairValueInputsLevel2Memberus-gaap:USStatesAndPoliticalSubdivisionsMember2023-12-310001759631us-gaap:FairValueInputsLevel3Memberus-gaap:USStatesAndPoliticalSubdivisionsMember2023-12-310001759631us-gaap:USStatesAndPoliticalSubdivisionsMember2023-12-310001759631us-gaap:FairValueInputsLevel1Memberhyln:CorporateBondsAndNotesMember2023-12-310001759631us-gaap:FairValueInputsLevel2Memberhyln:CorporateBondsAndNotesMember2023-12-310001759631us-gaap:FairValueInputsLevel3Memberhyln:CorporateBondsAndNotesMember2023-12-310001759631hyln:CorporateBondsAndNotesMember2023-12-310001759631hyln:A2024EquityIncentivePlanMember2024-12-310001759631hyln:HyliionHoldingsCorpEmployeeStockPurchasePlanMember2024-12-310001759631hyln:EquityIncentivePlanTwentyTwentyFourMember2024-05-210001759631hyln:EquityIncentivePlanTwentyTwentyMemberus-gaap:RestrictedStockUnitsRSUMembersrt:MinimumMember2024-01-012024-12-310001759631hyln:EquityIncentivePlanTwentyTwentyMemberus-gaap:RestrictedStockUnitsRSUMembersrt:MaximumMember2024-01-012024-12-310001759631hyln:EquityIncentivePlanTwentyTwentyFourMember2023-12-310001759631hyln:EquityIncentivePlanTwentyTwentyFourMember2024-01-012024-12-310001759631hyln:EquityIncentivePlanTwentyTwentyFourMember2024-12-310001759631hyln:EquityIncentivePlanTwentyTwentyFourMember2023-01-012023-12-310001759631us-gaap:RestrictedStockUnitsRSUMemberhyln:EquityIncentivePlanTwentyTwentyFourMember2024-01-012024-12-310001759631us-gaap:RestrictedStockUnitsRSUMemberhyln:EquityIncentivePlanTwentyTwentyFourMember2023-01-012023-12-310001759631hyln:EquityIncentivePlanTwentyTwentyMember2020-10-010001759631us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-12-310001759631hyln:EquityIncentivePlanTwentyTwentyMember2022-12-310001759631hyln:EquityIncentivePlanTwentyTwentyMember2023-01-012023-12-310001759631hyln:EquityIncentivePlanTwentyTwentyMember2023-12-310001759631hyln:EquityIncentivePlanTwentyTwentyMember2024-01-012024-12-310001759631hyln:EquityIncentivePlanTwentyTwentyMember2024-12-310001759631hyln:EquityIncentivePlanTwentyTwentyMemberhyln:AwardDateOneMember2022-12-310001759631hyln:EquityIncentivePlanTwentyTwentyMemberhyln:AwardDateOneMember2023-01-012023-12-310001759631hyln:EquityIncentivePlanTwentyTwentyMemberhyln:AwardDateOneMember2023-12-310001759631us-gaap:RestrictedStockUnitsRSUMemberhyln:EquityIncentivePlanTwentyTwentyMember2024-01-012024-12-310001759631us-gaap:RestrictedStockUnitsRSUMemberhyln:EquityIncentivePlanTwentyTwentyMember2023-01-012023-12-310001759631hyln:EquityIncentivePlanTwentySixteenMember2024-12-310001759631hyln:EquityIncentivePlanTwentySixteenMember2022-12-310001759631hyln:EquityIncentivePlanTwentySixteenMember2022-01-012022-12-310001759631hyln:EquityIncentivePlanTwentySixteenMember2023-01-012023-12-310001759631hyln:EquityIncentivePlanTwentySixteenMember2023-12-310001759631hyln:EquityIncentivePlanTwentySixteenMember2024-01-012024-12-310001759631us-gaap:EmployeeStockMember2024-12-310001759631us-gaap:EmployeeStockMember2024-01-012024-12-3100017596312021-12-310001759631us-gaap:MachineryAndEquipmentMember2024-12-310001759631us-gaap:MachineryAndEquipmentMember2023-12-310001759631us-gaap:VehiclesMember2024-12-310001759631us-gaap:VehiclesMember2023-12-310001759631us-gaap:LeaseholdImprovementsMember2023-12-310001759631us-gaap:OfficeEquipmentMember2024-12-310001759631us-gaap:OfficeEquipmentMember2023-12-310001759631us-gaap:ComputerEquipmentMember2024-12-310001759631us-gaap:ComputerEquipmentMember2023-12-310001759631us-gaap:SellingGeneralAndAdministrativeExpensesMember2024-01-012024-12-310001759631us-gaap:ResearchAndDevelopmentExpenseMember2024-01-012024-12-310001759631us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-01-012023-12-310001759631us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-12-310001759631hyln:ExitAndTerminationCostsMember2023-01-012023-12-310001759631us-gaap:DomesticCountryMember2024-12-310001759631us-gaap:DomesticCountryMember2023-12-310001759631hyln:OperatingLossExpirationPeriodPeriodOneMemberus-gaap:DomesticCountryMember2024-12-310001759631hyln:OperatingLossExpirationPeriodPeriodTwoMemberus-gaap:DomesticCountryMember2024-12-310001759631us-gaap:StateAndLocalJurisdictionMember2024-12-310001759631us-gaap:StateAndLocalJurisdictionMember2023-12-310001759631hyln:OperatingLossExpirationPeriodPeriodThreeMember2024-12-3100017596312024-03-310001759631us-gaap:EmployeeStockOptionMember2024-01-012024-12-310001759631us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001759631us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-12-310001759631us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

þ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2024

or

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______________ to _______________

Commission File Number 001-38823

HYLIION HOLDINGS CORP.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 83-2538002 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| | | | | | | | |

1202 BMC Drive, Suite 100 Cedar Park, Texas | | 78613 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (833) 495-4466

Securities Registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock | | HYLN | | NYSE American LLC |

| $0.0001 per share | | | | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☐ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☑ | | Smaller reporting company | ☑ |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ¨

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements

of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ¨

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant

to §240.10D-1(b). ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No þ

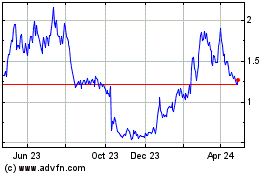

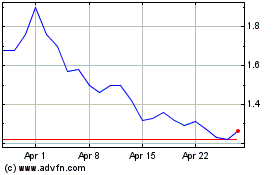

The aggregate market value of the registrant’s voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 2024, based upon the closing price of such stock on The New York Stock Exchange on such date of $1.62, was $224 million. This calculation excludes shares held by the registrant’s current directors and executive officers and stockholders that the registrant has concluded are affiliates of the registrant.

As of February 20, 2025, 174,820,174 shares of the registrant’s common stock, par value $0.0001 per share, were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for the 2025 Annual Meeting of Stockholders, to be filed no later than 120 days after the end of the fiscal year to which this Annual Report on Form 10-K relates, are incorporated by reference into Part III of this Annual Report on Form 10-K.

TABLE OF CONTENTS

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (“Form 10-K”) contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements, other than statements of historical fact, contained in this Annual Report on Form 10-K are forward-looking statements, including, but not limited to, statements regarding our strategy, prospects, plans, objectives, future operations, future revenue and earnings, projected margins and expenses, markets for our services, potential acquisitions or strategic alliances, financial position, and liquidity and anticipated cash needs and availability. The words “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “will,” “would,” variations of such words and similar expressions or the negatives thereof are intended to identify forward-looking statements. However, not all forward-looking statements contain these identifying words. These forward-looking statements represent our management’s expectations as of the date of this filing and involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance and achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. We cannot guarantee the accuracy of the forward-looking statements, and you should be aware that results and events could differ materially and adversely from those contained in the forward-looking statements due to a number of risks and uncertainties including, but not limited to, those described in the section entitled “Risk Factors” included in this Annual Report on Form 10-K and in other documents we file from time to time with the U.S. Securities and Exchange Commission (the “Commission” or the “SEC”) that disclose risks and uncertainties that may affect our business. Readers are urged to carefully review and consider the various disclosures made in this Annual Report on Form 10-K and in other documents we file from time to time with the Commission. Furthermore, such forward-looking statements speak only as of the date of this Annual Report on Form 10-K. Except as required by law, we do not undertake, and expressly disclaim any duty, to publicly update or revise these statements, whether as a result of new information, new developments, or otherwise and even if experience or future changes make it clear that any projected results expressed in this Annual Report on Form 10-K or future quarterly reports, press releases or company statements will not be realized. Unless specifically indicated otherwise, the forward-looking statements in this Form 10-K do not reflect the potential impact of any divestitures, mergers, acquisitions or other business combinations that have not been completed as of the date of this filing. In addition, the inclusion of any statement in this Annual Report on Form 10-K does not constitute an admission by us that the events or circumstances described in such statement are material. We qualify all of our forward-looking statements by these cautionary statements. In addition, the industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors including those described in the section entitled “Risk Factors.” These and other factors could cause our results to differ materially from those expressed in this Annual Report on Form 10-K.

Note Regarding Third-Party Information

Unless otherwise indicated, information contained in this Annual Report on Form 10-K concerning our industry and the markets in which we operate, including our general expectations and market position, market opportunity and market size, is based on information from various sources, on assumptions that we have made that are based on those data and other similar sources, and on our knowledge of the markets for our services. This information includes a number of assumptions and limitations, and you are cautioned not to give undue weight to such information. In addition, projections, assumptions and estimates of our future performance and the future performance of the industry in which we operate are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section entitled “Risk Factors” and elsewhere in this Annual Report on Form 10-K and in other documents we file from time to time with the Commission that disclose risks and uncertainties that may affect our business. These and other factors could cause results to differ materially and adversely from those expressed in the estimates made by third parties and by us.

Unless otherwise indicated or unless the context requires otherwise, all references in this document to “Hyliion,” “our company,” “we,” “us,” “our,” and similar names refer to Hyliion Holdings Corp. and, where appropriate, its subsidiary.

Part I

ITEM 1. BUSINESS

Overview

Hyliion Holdings Corp. is a Delaware corporation headquartered in Cedar Park, Texas, with research and development (“R&D”) facilities in Cincinnati, Ohio, that designs and develops power generators for stationary and mobile applications and provides R&D services. References to the “Company,” “Hyliion,” “we,” or “us” in this report refer to Hyliion Holdings Corp. and its wholly owned subsidiary, unless expressly indicated or the context otherwise requires. The Company was incorporated on November 7, 2018 and is listed on the NYSE American.

Hyliion is committed to creating innovative solutions that enable clean, efficient, and flexible electricity production while contributing positively to the environment in the energy economy. Hyliion’s primary product offering, the KARNOTM generator, is a modular, fuel-agnostic power generating solution, enabled by additive manufacturing. The KARNO generator leverages a thermal converter coupled to a linear generator to produce electricity with significant improvements in efficiency, emissions and lifecycle cost compared to conventional generators. Hyliion’s KARNO generators enable effective distributed power generation using a wide range of fuel sources, including conventional fuels, waste fuels such as landfill gas, wellhead gas, and zero carbon fuels such as renewable hydrogen and ammonia. Hyliion is initially targeting the commercial and industrial sectors with a locally-deployable generator designed to meet a wide range of power generation needs. The Company plans to scale up its generator solution to address larger utility-scale power needs and to develop future variants for industrial waste heat, household use and e-mobility applications such as vehicles and marine vessels. Additionally, the generator technology is well-suited to provide combined heat and power (“CHP”) in various stationary applications.

Strategic Business Developments

In September 2024, Hyliion was awarded a cost-plus-fixed-fee contract of up to $16 million by the United States Department of the Navy’s Office of Naval Research (“ONR”) to assess the suitability of its KARNO generator for Navy vessels and stationary power applications. The contract aligns with ONR’s objective of leveraging advanced technology to reduce its carbon footprint while enhancing operating capabilities. Hyliion believes the KARNO generator can provide a versatile, efficient, and reliable power solution to meet the unique demands of U.S. naval operations in maritime environments. Prior to September 2024, the Company was performing under two contracts as both a prime and subcontractor to the United States government to provide R&D services for up to $2.4 million. Upon successful validation and demonstration, the KARNO generator could be used as an electric power system in future platforms and for stationary power needs.

In December 2024, Hyliion was awarded a $6 million grant from the U.S. Department of Energy’s (“DOE”) Methane Emissions Reduction Program which backs projects targeting advancement in monitoring, measuring, and mitigating methane emissions across the oil and gas industry. The funding awarded to Hyliion is contingent upon the completion of final negotiations and the execution of a definitive agreement with the U.S. DOE. For this project, representing a total of $8.4 million in federal and non-federal funding, Hyliion will install up to 2 megawatts of KARNO generators in collaboration with oil and gas partners. We expect that the project will demonstrate the KARNO generator’s unique ability to operate on wellhead gas to produce sustainable, near-zero emissions electricity. In 2023, Hyliion successfully tested gas from the Permian Basin, highlighting the generator’s fuel-agnostic design and its capability to utilize unprocessed gas. This distinctive capability positions the KARNO generator as a groundbreaking solution for reducing flaring and methane emissions while delivering efficient, scalable power. We expect that this grant will empower Hyliion to deploy KARNO generators in the oil and gas industry, advancing sustainable energy generation, as well as economic growth and job creation in local communities.

Products and Services

KARNO Generator System

The KARNO generator emerged out of General Electric’s long-running R&D investments in aerospace and metal additive manufacturing across multiple industries and in areas such as generator thermal and performance design. We initially envisioned utilizing the KARNO generator as new range-extending power source for our Hypertruck powertrain system, given its ability to operate on a wide range of fuel sources, including natural gas and hydrogen. After the previously announced wind down of our powertrain operations, we shifted our focus to the development and commercialization of the KARNO generator as a standalone product and related R&D services that we have undertaken pursuant to contracts with the United States government. We believe that the unique capabilities of the KARNO generator will make it competitive in the market for distributed power systems, competing favorably against conventional generating systems and new alternative power systems such as fuel cells and other linear generators. The KARNO generator technology, including the technology that we acquired

from General Electric, and the technology developed by Hyliion subsequent to the acquisition, is protected by numerous patents and trademarks which we believe provide Hyliion extensive and lasting protection for its intellectual property.

The Science of the KARNO Generator

The KARNO generator is distinguished from conventional generating systems that rely on reciprocating internal combustion engines or gas turbines to drive a rotating shaft. Instead, the KARNO generator uses an innovative thermal converter to power a linear electricity generating system. The generator produces linear motion from temperature differences within the system. Heat is generated through flameless oxidation of fuels, such as natural gas, hydrogen, or propane. The thermal energy heats helium gas enclosed within a sealed cylinder, causing it to expand and drive linear motion in a connected piston-shaft system. The shaft includes a sequence of permanent magnets that pass through electrical coils as the system oscillates, generating electricity. Subsequently, the countermotion generated by a piston at the opposite end of the shaft flows the helium gas to the cold side of a piston in an adjacent shaft, where excess heat is efficiently dissipated. This cyclical process continues, resulting in a continuous source of electrical power as long as heat is supplied to the generator.

Linear generators present several advantages over conventional generators, including higher thermal efficiency, lower emissions and reduced maintenance, benefits that are partly attributable to the generator’s simplified design with few moving parts. Additionally, they exhibit high power density and higher efficiency by circumventing the mechanical losses linked to rotating components such as bearings and gears while producing less noise and vibration. In the case of the KARNO generator, each shaft of the generator relies on a single moving part and utilizes a pressurized helium bearing system in place of oil-based lubricants.

Thermal converters offer the advantages of fuel flexibility and high operating efficiency. The KARNO generator stands out for its ability to maximize heat transfer between components and working fluids. Enabled by advances in additive manufacturing systems, parts are designed with many intricate flow channels for the movement of heat, coolant, helium and exhaust gases such that contact surface areas for heat transfer are maximized. This enables the KARNO generator to achieve high levels of efficiency.

The KARNO generator is expected to surpass the efficiency of conventional generating systems when employing various fuel sources and its high efficiency is expected to remain consistent across a broad range of output power levels. In contrast, fuel cells reach peak efficiency at low power levels but experience diminishing efficiency as output increases towards full power. Internal combustion engines typically achieve peak efficiency within a limited operational output range and may suffer increased wear at low power levels. The KARNO generator offers a distinct advantage in power adjustment by modulating the rate of heat introduction, enabling seamless power adjustments without compromising the generator’s efficiency.

We anticipate that the KARNO generator will achieve an electrical generating efficiency of approximately 45%, calculated by considering the usable output power in relation to the energy from the fuel source. High efficiency is expected to remain relatively consistent across a wide range of output power levels, spanning from tens of kilowatts to multiple megawatts. In contrast, internal combustion diesel generators typically operate within an efficiency range of 25% to 40% over a similar power spectrum, while the U.S. electrical power grid is estimated to operate at an efficiency between 33% and 40%. Notably, best-in-class grid-level gas turbine powerplants can obtain efficiencies above 50% but often incur transmission and distribution losses between 5% and 10% which the KARNO generator is expected to circumvent by being strategically located near the point of power consumption.

Conventional generators emit pollutants because of incomplete combustion of fuel-air mixtures and operating conditions, with the formation of nitrous-oxide (“NOx”) and carbon monoxide (“CO”) compounds being particularly prominent. Unlike conventional generators, the KARNO generator is designed for continuous flameless oxidation of the fuel at lower temperatures and extended reaction times. This is achieved partly through the recirculation of exhaust gases, which serves to prolong oxidation, and by pre-heating incoming air. As a result, the KARNO generator is anticipated to achieve ultra-low levels of emissions, with NOx and CO emissions expected to be reduced by over 95% compared to best-in-class diesel engines and targeting California’s Air Resources Board (“CARB”) 2027 standards without the need for aftertreatment.

One of the notable advantages of the KARNO generator in comparison to traditional generating units is the expected reduction in maintenance requirements and cost. Conventional generators typically incur periodic and usage-based maintenance expense that can range between 5% to 20% of their total operating cost throughout their lifespan, influenced by factors such as utilization and operating parameters. The KARNO generator’s primary advantage arises from having only a single moving linear actuator per shaft (4 shafts per 200 kW generator), which glides on low friction helium bearings. This innovative design significantly mitigates efficiency losses attributed to friction, enhancing the system’s operational longevity and eliminating the need for oil-based lubricants.

The KARNO generator derives advantages from its expected capability to operate across a diverse spectrum of over 20 available fuel sources and fuel mixtures. These include natural gas, propane, gasoline, jet fuel, and alternative fuels like biodiesel, hydrogen and ammonia. Moreover, the generator can transition between these fuels or fuel blends. This versatility

enables a single generator to adapt to different use cases. For example, the generator may operate on natural gas for prime power generation when a pipeline connection is available and on waste gas near a landfill or dairy farm. Furthermore, as hydrogen becomes more widely available, the KARNO generator will be able to adapt to this cleaner fuel. As the energy landscape evolves, the KARNO generator’s fuel-agnostic nature positions it as a flexible solution to electricity generation needs.

Benefits of the KARNO Generator Versus Conventional Competitors

We believe the versatility and operating characteristics of the KARNO generator will make it an effective system for a variety of conventional and emerging electricity generating applications. Key attributes of the KARNO generator distinguish it from its conventional generator counterparts, which may open new market opportunities:

•Generator Efficiency: The anticipated operating efficiency of the KARNO generator could result in lower marginal cost of electricity generation versus conventional generating systems and, in some markets, grid power.

•Low Maintenance: With only a single moving part per shaft, the simplicity of the KARNO generator is expected to reduce both periodic maintenance expenses, overhaul costs and longer uptime.

•Fuel Agnostic: While many traditional generators operate on a single fuel source or require system modification to achieve fuel flexibility, the KARNO generator is truly fuel-agnostic and can switch between fuel choices during operation with few or no modifications.

•Low Noise and Vibration: Unlike conventional generators, the KARNO generator operates without internal combustion, resulting in a significantly lower noise level of approximately 67 decibels at six feet.

•Higher Power Density: The unique architecture and features of the KARNO generator that are achieved by advances in additive manufacturing are expected to enable the generator to achieve a high power density.

•Modularity: The DC output of the KARNO generator allows multiple generators to be connected on a single bus to achieve higher power outputs without impacting other performance characteristics.

Market Opportunity

As economies and industries evolve, the demand for electricity is accelerating, driven by the electrification of society, urbanization, increasing industrial output and technological growth. Electricity powers factories, drives the digital revolution, supports healthcare, education, and financial services, and serves as the foundation of economic productivity. Additional growth drivers include the widespread adoption of automation, artificial intelligence, expanding data centers and the electrification of transportation. However, as global energy demand rises, traditional centralized power generation and distribution models face mounting challenges.

Aging grid transmission infrastructure across the world faces growing challenges as it strives to balance the availability of affordable, reliable power with maintaining grid stability and integrating new sources of clean power generation. The addition of intermittent renewable power generation further complicates grid management, emphasizing the need for resilient and adaptive electricity systems. Distributed power generation offers a solution by decentralizing electricity production, reducing transmission needs and delivering power closer to consumption points.

Hyliion’s KARNO generator is an innovative solution in the emerging distributed generation space, offering a reliable power generator that combines high efficiency, fuel flexibility, and low emissions. Designed for both stationary and mobile applications, the KARNO generator addresses many of the challenges that have traditionally limited the widespread adoption of onsite power solutions. These include high operating costs, reliability issues, complex maintenance, noise pollution, space constraints, and dependency on limited fuel sources.

Hyliion’s initial KARNO generator product is a 200 kW system that is power-dense and easy to deploy. It features a compact, space-efficient rectangular design with a footprint of approximately 25 square feet, housing a single four-shaft linear generating unit and integrated balance-of-plant components. The KARNO generator supports fuel switching during operation without power loss, while flexible deployment options allow it to operate in grid-following, grid-forming, or islanded configurations (when paired with an external inverter), making it suitable for a wide range of applications. Additionally, the KARNO generator features real-time monitoring of over 1,000 operational parameters through its KARNO Cloud® platform, enabling proactive diagnostics, predictive maintenance, and performance optimization, ensuring maximum uptime. With cloud connectivity, users gain instant access to remote monitoring and control features, providing insights into system performance, fuel efficiency, and system health.

Beyond the 200 kW variant, Hyliion is advancing the development of a larger 2 MW KARNO system, which integrates multiple 200 kW generator units operating in tandem within a compact 160 square-foot footprint - approximately the size of a 20’ shipping container. We believe that this modular and scalable approach enables seamless power expansion while maintaining high efficiency and reliability. Scheduled for commercialization in 2026, the 2 MW solution will target key market

segments such as data centers and industrial prime power applications. By utilizing multiple 200 kW generating blocks, the system offers built-in redundancy and the flexibility for customers to customize capacity to match their power needs.

Hyliion also plans to expand the KARNO product line with both larger and smaller capacity versions, adjusting power levels by varying the number of generator shafts and component sizes. Initially, the KARNO generator will address power applications ranging from 200 kW to the low hundreds of megawatts, addressing a broad spectrum of distributed generation needs. With its ability to deliver reliable, fuel-flexible, and highly efficient power, the KARNO generator is uniquely positioned to serve a variety of key market segments, including:

•Data Centers: As cloud computing, artificial intelligence, machine learning, and edge computing continue to expand, data centers are projected to grow rapidly, consuming an increasing share of global energy demand. Onsite generation is an emerging solution to power new data center installations. Hyliion’s 2 MW KARNO generator is being designed to address the needs of data center developers by providing a scalable, fuel-flexible onsite power solution with best-in-class power density. Capable of operating on more than 20 different fuels, the KARNO generator enables data center developers to minimize onsite generation infrastructure. Its ability to easily transition between pipeline-supplied fuels, such as hydrogen or natural gas, and onsite stored fuels, like methanol or diesel, eliminates the need for separate backup generation systems, reducing capital and operational costs. Furthermore, the KARNO generator maintains high efficiency across broad range of load factors.

•Vehicle Charging: The rapid adoption of electric vehicles (“EVs”) is placing increasing strain on grid capacity, a challenge expected to grow with the introduction of commercial EVs, including buses, delivery vans, and heavy-duty trucks. These vehicles require substantial power for charging, intensifying grid demands. While Direct Current (“DC”) fast charging technology and infrastructure are evolving to meet this need, many commercial operators cite limited grid capacity and high electricity costs as barriers to scaling their EV fleets. Hyliion’s KARNO generator offers an advantaged solution for commercial EV charging. Its native DC output integrates seamlessly with DC fast charging infrastructure, eliminating power losses associated with conversion. Additionally, the KARNO generator’s compact footprint and quiet operation make it ideal for deployment in space-constrained locations, such as urban charging hubs, fleet depots, and remote charging stations where grid access is limited or expensive. When paired with onsite energy storage systems and renewable energy sources like solar or wind, KARNO generators can enable resilient and sustainable microgrids for EV charging.

•Biogas (Landfill, Waste Water & Digester Gas): Biogas sourced from landfills, wastewater treatment plants, and dairy digesters represents a rapidly growing market as industries and municipalities seek to convert methane-rich waste gases into electricity and prevent methane, a potent greenhouse gas, from escaping into the environment or being flared. Current power generation technologies often struggle to process biogas due to contaminants such as hydrogen sulfide (“H₂S”) and siloxanes, as well as moisture and fluctuating gas compositions, necessitating preconditioning and purification before the fuel can be utilized. The KARNO generator’s advanced architecture and corrosion-resistant materials enable it to operate with minimal gas preconditioning, making it a cost-effective, high-performance solution for converting waste gas into reliable power.

•Oil & Gas and Syngas Gas: The oil and gas industry is rapidly electrifying due to growing power needs across drilling, production, refining, and transportation operations. However, wellhead and flare gas, byproducts of oil and gas extraction, are often wasted due to insufficient pipeline capacity or poor gas quality, leading to lost energy and increased emissions. The KARNO generator enables conversion of waste gas into usable electricity with minimal pre-treatment, enabling onsite power generation and grid integration. Its fuel flexibility, use of corrosion-resistant materials, and ability to handle variable fuel quality make it an ideal technology of choice for oilfield electrification while significantly reducing emissions. Additionally, the KARNO generator’s fuel-agnostic capability allows it to generate clean electricity from hydrogen-rich syngas, a valuable byproduct of gasification or industrial processes.

•Prime Power & Microgrids: As electricity demand increases and grid infrastructure struggles, microgrids and prime power solutions are becoming essential for industries facing high consumption charges, peak demand pricing, and grid reliability concerns. Businesses, industrial sites, and remote facilities increasingly seek localized power generation to mitigate rising energy costs, monetize assets, and improve operational resilience. With relatively high efficiency, fuel adaptability and low maintenance needs, KARNO generators provide a cost-effective alternative to grid electricity, allowing businesses to optimize energy costs while ensuring uninterrupted operations. Its ability to seamlessly integrate with energy storage and renewable sources enables installation of effective hybrid energy solutions. Additionally, the KARNO generator’s cogeneration capabilities allow industries to utilize both electricity and thermal energy, improving overall system efficiency and recovering usable waste heat.

•Backup Power: The market for local backup power generators is well established and positioned to grow due to decreasing grid reliability, the increasing share of intermittent renewable energy sources, rising extreme weather events, and the need for uninterrupted power. Also, the grid balancing and servicing market is expanding as utilities

and independent power producers seek fast-ramping, distributed generation assets to balance supply and demand fluctuations. Innovative business models such as Resiliency-as-a-Service and Virtual Power Plants have emerged to leverage distributed generation assets for grid resilience. With growing concerns over emissions from internal combustion engine-powered generators in the backup power market we believe the KARNO generator presents an opportunity to provide solutions for end users that desire a lower emissions profile and in the event emissions regulations are further tightened.

•Mobility: The KARNO generator is particularly suitable for applications that require a source of electric power in mobile applications such as electric vehicles, railroad locomotives, remote power generation and marine vessels. Compared to conventional power sources the KARNO generator is expected to offer higher efficiency, lower emissions, quieter operation, reduced maintenance needs and the flexibility to operate on a wider range of fuel sources. Additionally, the generator’s high power density, modularity and native DC power output offers an added advantage where space constraints and integration are considerations.

•Waste Heat: In hard-to-decarbonize industrial sectors such as cement, glass, and primary metals production, vast amounts of high-grade waste heat (1000°C+) are released during manufacturing processes. Traditionally, much of this thermal energy is lost due to limited efficient recovery solutions. Since the KARNO generator uses heat as its primary energy source to generate electricity, high-temperature industrial waste heat is expected to be able to be directly utilized to produce clean electricity, enabling industries to recover wasted energy, improve efficiency, and reduce emissions.

KARNO Generator Development

Research and Development

Most of our current activities are focused on the R&D of our KARNO generator. We undertake significant testing and validation of our products and components to ensure that they will meet the demands of our customers. Our R&D activities primarily take place at our facility in Cincinnati, Ohio and at our headquarters in Cedar Park, Texas. Our R&D is primarily focused on:

•development of the KARNO generator including testing and validation;

•integration of the KARNO generator technology into various applications;

•accelerated lifetime testing processes to improve reliability, maintainability and system-level robustness;

•development of battery systems that can be used as a starter power source for the KARNO generator or as a load buffer solution;

•data analytics; and

•alternative products for existing and in-development components and technology.

Since acquiring the KARNO generator technology from GE in September 2022, Hyliion has made significant R&D investments to support an expected commercial launch of the 200 kW product in 2025. Early efforts focused on the development of a 125 kW generator, which has been successfully operated in our Ohio facility and utilized for extensive testing and further advancements. Through this system, we validated the ability of the generator’s fuel oxidation system to operate on a wide range of fuel sources, including natural gas, hydrogen, gas mixtures, and untreated landfill and Permian Basin well gas. Additionally, testing of the oxidation system demonstrated very low levels of pollutant emissions in the exhaust stream. The 125 kW generator also served as platform for developing and validating key components that are now incorporated into the larger 200 kW KARNO generator slated for market launch. These advancements include improved helium bearings for greater durability, a magnetic encoder for precise shaft position detection and optimized printed components to increase generator efficiency and manufacturing speed. The higher powered 200 kW generator also incorporates a larger Hyliion-designed linear electric motor. Development activities in 2024 included developing production processes for this new motor as well as testing and validation of design parameters.

During 2024, we completed the design and sourcing of components for the balance-of-plant systems that support linear generator operation for the 200 kW system, including the system enclosure. The balance of plant includes cooling, pressure control, fuel and air, battery, high and low voltage, inlet air and exhaust systems. Development work also includes control software, safety systems, the human-to-machine interface and the physical integration of systems. Validation of essential operating parameters, including efficiency, emissions and reliability, were also part of R&D activities. Initial generator

deployments, coupled with our ongoing testing and development efforts, will continue to help validate other critical design specifications, including the generator’s projected operating life, maintenance requirements and durability.

Research and Development Services

We provide R&D services to third parties, including the U.S. government. In September 2024, Hyliion was awarded a cost-plus-fixed-fee contract of up to $16 million by the ONR to assess the suitability of its KARNO generator for Navy vessels and stationary power applications. The contract aligns with ONR’s objective of leveraging advanced technology to reduce its carbon footprint while enhancing operating capabilities. Upon successful validation and demonstration, the KARNO generator could be used as an electric power system in future platforms and for stationary power needs.

We will continue to provide R&D services to third parties under existing contracts and, based on interest from current and prospective customers, anticipate entering into additional R&D agreements in the future. Customers engage Hyliion to explore and validate the KARNO generator’s capabilities tailored to their specific requirements. Key areas of interest include testing its low-emissions flameless oxidation system and evaluating applications that leverage the KARNO generator’s high power output and compact configuration. Customers are also drawn to the generator’s fuel versatility including the ability to easily transition between fuels. R&D services may also involve testing the generator under various operating conditions, including harsh environments, and in mobile applications to assess its performance. Certain customers seek to measure and validate its low emissions profile and test different power configurations to ensure the technology aligns with their operational and environmental needs.

Commercial Deployment

We expect to deliver initial KARNO generators and generator systems to early deployment customers during 2025. These deployments, combined with our ongoing internal R&D efforts, will serve to test and validate the product’s attributes while identifying potential design and software enhancement opportunities. We expect to receive compensation for these deployments as outlined in customer contracts subject to achievement of certain key-performance-indicators, given the tangible benefits the KARNO generator is expected to deliver. Initial KARNO generators may not be able to utilize all fuels anticipated in subsequently commercialized units. Initial deployment applications will include vehicle charging, waste gas-to-power generation, and mobility-focused R&D activities. These early deployments are also likely to highlight opportunities for addressing hardware and software deficiencies, as well as potential enhancements to further refine and optimize the product.

In 2025, additional development activities will focus on implementing identified improvement opportunities to enhance the KARNO generator. These efforts may include design modifications, including for additively-manufactured parts, adjustments to and procurement of purchased components, and further software development. We plan to address these enhancements in parallel with the rollout of early deployment units and the ongoing testing of in-house engineering development generators. While the full scope of additional development work is difficult to predict at this stage, we currently anticipate completing these improvements in the second half of the year, leading to our ability to achieve product commercialization, at which point we will ramp up delivery of KARNO generators to customers.

Following the commercialization of the KARNO generator, we anticipate sales growth in 2026, as we address the backlog of customer interest based on signed letters-of-intent at the end of 2024. This growth will be supported by the commissioning of new additive printers installed at the end of 2024 and expected to be delivered in 2025. Additionally, we plan to deliver and commercialize the 2 MW KARNO generator system during 2026, following the completion of development work under way in 2025. In parallel, we plan to expand our sales, distribution and service networks to support the generator’s expected growing market presence. Currently, these functions are managed in-house to ensure efficient delivery and service for our customers; however, we may explore outsourcing or partnerships with established sales, service and distribution channels as we scale operations.

Production, Assembly, Installation and Suppliers

The standalone generator set, or genset system, integrates the KARNO generator with an enclosure housing key balance-of-plant components such as the cooling system, generator controls, a battery system and high voltage electrical elements. The planned 2 MW KARNO system is expected to feature ten 200 kW KARNO generators combined with shared balance-of-plant systems in a compact configuration approximately the size of a 20’ shipping container. Key generator components will initially be produced internally using advanced additive manufacturing processes, while other components will either be manufactured in-house or sourced from suppliers following proprietary Hyliion designs. Hyliion is actively developing a base of suppliers for generator systems, including linear motor components, support systems and enclosure materials. Initially, the assembly, installation and maintenance of KARNO generator systems will be performed by Hyliion, from our Cincinnati, Ohio facility for our early production units.

Additive manufacturing is a key enabler of KARNO generator technology and performance characteristics and is considered a core competency of Hyliion as well as a source of competitive advantage versus other linear power generating systems. In 2024, Hyliion procured state-of-the-art laser sintering machines (3-D additive printers) manufactured by GE to begin building

out print capacity. Hyliion’s R&D facility in Cincinnati also houses additive printers that support R&D activities and commercial production needs. Hyliion has placed orders with GE for additional additive printing machines, which are expected to be delivered in 2025, providing a growing base of print production capacity.

Advancements in additive printer technology are expected to grow over time, driven by improvements in laser technology and other printing innovations. New printer models are expected to offer progressively greater printing speed, with some enhancements potentially available as retrofits for existing machine platforms. In parallel, we are pursuing design modifications to enable the production of components with less complex geometry using conventional manufacturing processes, reducing reliance on additive printing where feasible. For less critical components, we are exploring utilization of lower-cost and lightweight materials like aluminum and stainless steel. Additionally, as production volumes increase, we expect economies of scale to contribute to reduced system component costs, enhancing the overall competitiveness of the KARNO generator system.

Hyliion currently plans to print all key generator components in-house for early system deployments to optimize production parameters, component quality, printing innovation and system throughput. As production volumes rise, we may consider outsourcing certain production and assembly functions including the printing, manufacturing and assembly of specific components or the entire generator to third parties.

Suppliers of generator components include fabricators, machine shops, suppliers of mechanical and electrical components like pumps, blowers, tubing and wiring harnesses, as well as metal powder manufacturers. The majority of these components are sourced domestically, supported by a large network of available vendors. We source some components from overseas suppliers, including magnets and battery cells, due to cost advantages or limited domestic availability. While domestic alternatives may exist, they are often available in more limited quantities or at a higher cost. As we scale up product capacity, we plan to expand our supplier base to achieve cost efficiencies and mitigate supply chain risk.

Intellectual Property

Intellectual property is important to our business, and we seek protection for our strategic intellectual property. We rely upon a combination of patents, copyrights, trade secrets, know-how and trademarks, along with employee and third-party non-disclosure agreements and other contractual restrictions to establish and protect our intellectual property rights.

As of December 31, 2024, we had 68 issued U.S. patents, 28 pending U.S. patent applications, and 22 foreign patent applications. Of the foregoing patent and application totals, 61 pertain to our KARNO generator and the remainder primarily relate to powertrain technology, which we may retain for potential future use or sale. We pursue the registration of our domain names, trademarks and service marks in the United States and in some locations abroad. In an effort to protect our brand, as of December 31, 2024, we had three registered and six pending trademarks in the United States and 44 registered and three pending trademarks internationally.

We regularly review our development efforts to assess the existence and patentability of new intellectual property. To that end, we are prepared to file additional patent applications as we consider appropriate under the circumstances relating to the new technologies that we develop. Generally, our patents have a term of 20 years from the date the application is filed.

We cannot be sure that patents will be granted with respect to any of our pending patent applications or with respect to any patent applications we may own or license in the future, nor can we be sure that any of our existing patents or any patents we may own or license in the future will be useful in protecting our technology.

Human Capital

As of December 31, 2024, we had approximately 93 full-time employees. All full-time employees are located within the United States. Our people are integral to our business, and we are highly dependent on our ability to attract, engage, develop and retain key employees while hiring qualified management, technical, and vehicle engineering personnel. We welcome the diversity of all team members and encourage the integration of their unique skills, thoughts, experiences and identities. By fostering an inclusive culture, we enable every member of the workforce to leverage their unique talents and deliver high-performance standards to drive innovation and success.

Government Regulations

We operate in an industry that is subject to extensive environmental regulation, which has become more stringent over time. The laws and regulations to which we are subject govern, among others:

•water use;

•air emissions;

•energy sources;

•the storage, handling, treatment, transportation and disposal of hazardous materials;

•the protection of the environment; and

•natural resources.

We may be required to obtain and comply with the terms and conditions of multiple environmental permits, many of which are difficult and costly to obtain and could be subject to legal challenges. Compliance with such laws and regulations at an international, regional, national, provincial and local level is an important aspect of our ability to continue operations and grow the business. Environmental standards applicable to us are established by the laws and regulations of the countries in which we operate, and our product are sold, and standards adopted by regulatory agencies and the permits and licenses that we hold. Each of these sources is subject to periodic modifications and increasingly stringent requirements. Violations of these laws, regulations, or permits and licenses may result in substantial civil and criminal fines, penalties, orders to cease the violating operations, or to conduct or pay for corrective works. In some instances, violations may also result in the suspension or revocation of permits and licenses.

Specific standards, certifications, and rules for which we seek to be in compliance include the following:

•Military Standard (“MIL-STD”) 1399 requirements over power quality;

•MIL-STD-810, MIL-STD-901, and MIL-STD-167 requirements over shock and vibrations;

•MIL-STD-810G requirements over environmental exposure;

•UL Solutions (“UL”) 2200 and 1741 requirements over generator set and inverter safety, respectively;

•Institute of Electrical and Electronics Engineers (“IEEE”) 1547 and 519 requirements over grid interconnection and harmonic control, respectively;

•South Coast Air Quality Management District (“SCAQMD”) in California Rule 1110.3, the first of its kind regulation focused on linear generators, “Emissions for Linear Generators.” This rule governs, among other things, the steady state emissions from technologies such as the KARNO generator. We work closely with SCAQMD to help evaluate the various criteria and as a result, believe that the KARNO generator will comply with this regulation;

•Environmental Protection Agency Clean Air Act regulatory standards which mandate strict controls on emissions to ensure compliance with environmental protection guidelines;

•CARB Distributed Generation Certification standards which impose stringent emission limits and performance criteria to protect air quality and public health standards; and

•National Fire Protection Association (“NFPA”) 37, Standard for the installation and Use of Stationary Combustion Engines and Gas Turbines.

Competition

We have experienced, and expect to continue to experience, competition from a number of companies. We face competition from many different sources, including utility-scale grid power and manufacturers of fixed and portable generator equipment. Key generator manufacturing competitors include Cummins, Bloom Energy, Generac, Kohler, Caterpillar, Mainspring and Jenbacher, several of which maintain the largest market shares in the sector. We believe the primary competitive factors in the stationary generator market include, but are not limited to:

•total cost of ownership;

•emissions profile;

•availability of fueling sources;

•ease of integration into existing operations;

•product performance and uptime; and

•generator quality, reliability, safety and noise.

We believe that we compete favorably with our competitors on the basis of these factors; however, most of our current and potential competitors have greater financial, technical, manufacturing, marketing and other resources than us. Our competitors may be able to deploy greater resources to the design, development, manufacturing, distribution, promotion, sales, marketing and support of their generator products. Additionally, our competitors also have greater name recognition, longer operating histories, larger sales forces, broader customer and industry relationships and other tangible and intangible resources than us. These competitors also compete with us in recruiting and retaining qualified R&D, sales, marketing and management personnel, as well as in acquiring technologies complementary to, or necessary for, our products. Additional mergers and acquisitions may

result in even more resources being concentrated in our competitors. We cannot provide assurances that our stationary generators will be broadly adopted or will provide benefits that overcome their capital costs.

We also face competition in the market for R&D services from companies that specialize in the design, development and testing of electric generator systems and components and other engineering services. However, we believe that we are well-positioned to compete effectively in this space, as our R&D customers engage us specifically to deliver and perform testing and validation work on the KARNO generator. Unlike our competitors, who lack access to the KARNO generator’s technology and capabilities, we can provide a combination of product delivery and specialized testing services that our customers are seeking.

Legal Proceedings

From time to time, we may become involved in legal proceedings or be subject to claims arising in the ordinary course of our business. We are not currently a party to any material legal proceedings. Regardless of outcome, such proceedings or claims can have an adverse impact on us because of defense and settlement costs, diversion of resources and other factors and there can be no assurances that favorable outcomes will be obtained.

Information About Our Executive Officers

The following table and notes set forth information about our executive officers:

| | | | | | | | | | | | | | |

| Name of Individual | | Age | | Position |

Thomas Healy(1) | | 32 | | Chief Executive Officer |

Jon Panzer(2) | | 58 | | Chief Financial Officer |

Cheri Lantz(3) | | 49 | | Chief Strategy Officer |

Joshua Mook(4) | | 43 | | Chief Technology Officer |

Jose Oxholm(5) | | 58 | | Chief Legal & Compliance Officer |

Govindaraj Ramasamy(6) | | 44 | | Chief Commercial Officer |

1 Mr. Healy has served as our Chief Executive Officer since October 2020 and prior to this, served as Chief Executive Officer of Hyliion Inc., (“Legacy Hyliion”) since January 26, 2016. While leading the Company, Mr. Healy has been awarded numerous patents in the space of electrifying commercial vehicles. Mr. Healy founded Legacy Hyliion while studying to obtain a Master’s in mechanical engineering and had previously founded multiple start-ups during his undergraduate studies. He took a leave of absence during his Master’s program in 2015 to found Legacy Hyliion. Mr. Healy holds a B.S. in mechanical engineering with a double-major in engineering and public policy from Carnegie Mellon University.

2 Mr. Panzer has served as Chief Financial Officer since September 2022. Prior to joining Hyliion, Mr. Panzer spent 26 years at Union Pacific, one of the nation’s largest railroads. His most recent position at Union Pacific was Senior Vice President of Intermodal Operations and he also served as Senior Vice President of Technology and Strategic Planning, Vice President and Treasurer, Vice President, Financial Planning and Analysis, and Assistance Vice President, Marketing and Sales. As head of Union Pacific’s information technology organization, Mr. Panzer was responsible for managing application development, technology infrastructure and cybersecurity. Prior to joining Union Pacific, Mr. Panzer served in the United States Navy as a nuclear engineer. Mr. Panzer holds a B.S. in electrical engineering from the University of Nebraska, Lincoln and an MBA from Carnegie Mellon.

3 Ms. Lantz has served as Chief Strategy Officer since 2022. Ms. Lantz is a seasoned strategy leader who has spent 25 years developing and leading operations and growth strategies for manufacturers in the mobility sector. Prior to joining the Company, Ms. Lantz served as the Vice President of Strategy for the Transportations Solution Segment at TE Connectivity, an electronics manufacturer. Prior to that role, Ms. Lantz served as the Chief Strategy Officer and executive leader responsible for advanced and shared engineering and global test labs at Meritor, Inc., a leading manufacturer of axles and brakes to the commercial vehicle industry. Additionally, Ms. Lantz has advised companies on growth and operational topics as a strategist for Boston Consulting Group and Booz and Company. Ms. Lantz holds three degrees from the University of Michigan, an MBA from the Ross School of Business with a focus on corporate strategy and economics, a master’s in manufacturing engineering and a B.S. in chemical engineering.

4 Mr. Mook has served as Chief Technology Officer since March 2024 and prior to this, served as Chief Engineer since January 2023. Mr. Mook has extensive experience with engineering, new product development, and executive leadership for companies in the aerospace and power generation sector. From 2005 to 2023, Mr. Mook served in multiple engineering positions for General Electric Company and served as an executive starting in 2018. Mr. Mook holds a master’s degree in aerospace engineering from the University of Cincinnati and a bachelor’s degree in Aeronautical and Astronautical Engineering from Purdue University.

5 Mr. Oxholm has served as Chief Legal & Compliance Officer since February 2024 and prior to this, served as Vice President, General Counsel, and Chief Compliance Officer since 2020. Mr. Oxholm has extensive experience with complex business

transactions, litigation, and new market entries for companies in the automotive and transportation sectors. From January 2017 to February 2020, Mr. Oxholm served as Vice President, Deputy General Counsel and Chief Compliance Officer for Meritor, Inc. Prior to that, Mr. Oxholm was Senior Vice President, General Counsel and Secretary for LoJack Corporation from 2012 to 2016. Mr. Oxholm holds a J.D. from the University of Pennsylvania and a bachelor’s degree from the University of Michigan.

6 Mr. Ramasamy has served as Chief Commercial Officer at Hyliion since February 2024, bringing extensive expertise in sales, business strategy, product marketing, engineering, project development, execution, and supply chain management within the power generation sector. Prior to joining Hyliion, Mr. Ramasamy spent over 17 years at Cummins Inc. from 2006 to 2024, where he held several senior leadership roles across multiple global markets. Most recently, he served as Executive Director for Global Datacenter Business, leading one of Cummins’ fastest-growing power generation segments. Before that, he held key leadership positions, including Managing Director for Cummins Arabia in the Middle East and General Manager for Power Generation in East Asia, overseeing business growth, operational strategy, and market expansion. Before his tenure at Cummins, he held supply chain leadership roles at Kimball International, where he played a critical role in streamlining operations and optimizing supply chain strategies. Mr. Ramasamy holds a B.S. in mechanical engineering from Anna University, India, a M.S. in Industrial & Systems Engineering from Auburn University, and a MBA from Northwestern University, Chicago.

Available Information

Additional information about Hyliion is available at www.hyliion.com. On the Investor Relations page of the website, the public may obtain free copies of our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as soon as reasonably practicable following the time that they are filed with, or furnished to, the Securities and Exchange Commission (“SEC”). References to our website do not constitute incorporation by reference of the information contained in such website, and such information is not part of this Form 10-K.

1A. RISK FACTORS.

Investing in our securities involves risks. Before you make a decision to buy our securities, in addition to the risks and uncertainties discussed above under “Cautionary Note Regarding Forward-Looking Statements,” you should carefully consider the specific risks set forth herein. If any of these risks actually occur, it may materially harm our business, financial condition, liquidity and results of operations. As a result, the market price of our securities could decline, and you could lose all or part of your investment. Additionally, the risks and uncertainties described are not the only risks and uncertainties that we face. Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial may become material and adversely affect our business.

Risks Related to our Business

We may experience significant delays in the design, production and launch of the KARNO generator which could harm our business, prospects, financial condition and operating results.

The KARNO generator is still in the development and testing phase, and commercial deliveries are not expected to begin until 2025 or later, and may not occur at all. Initial deployments may not be recognized as revenue, or there may be a need to deploy units at a decreased price or for free for initial customers. Some of our target customers may be expecting to receive government incentives for deployments and may not purchase our KARNO generators in the event those incentives are delayed or not received. Any delay in the financing, design, production and launch of the KARNO generator would materially damage our brand, business, prospects, financial condition and operating results.

We depend on government funding, which if lost or reduced, could have a material adverse effect on our research and development activities and our ability to begin recognizing revenue. Our largest contract is with ONR and is the largest single source of revenue for us. Our ONR contract may not be guaranteed to be extended beyond its current scope.

We have not made any commercial sales of our KARNO generator to date and our ONR contract is the largest single source of revenue for us. In September 2024 we were awarded a cost-plus-fixed-fee contract of up to $16 million by ONR to assess the suitability of our KARNO generator for Navy vessels and stationary power applications. We currently receive almost all of our revenue from fees and costs payable by ONR pursuant to our R&D contracts. While we believe we have a good working relationship with ONR, the loss of our contracts with ONR may have an adverse impact on our business, prospects, results of operations and financial condition. While we expect to sell our KARNO generator to commercial customers beginning with initial deployments in 2025, for the time being we are substantially dependent on funding from ONR.

We are an early-stage company with a history of losses, and expect to incur significant expenses and continuing losses for the foreseeable future.

We have historically incurred net losses ($52.0 million and $123.5 million for the years ended December 31, 2024 and 2023, respectively). We believe that we will continue to incur significant operating and net losses each quarter until we are generating sufficient positive gross margins from sales of KARNO generator products or R&D services, and we may never achieve such

performance.

Additionally, we expect to adopt initiatives in an effort to improve operating efficiencies and lower our cost structure. There may be unanticipated difficulties in implementing one or more of these initiatives, and we may not ultimately realize the full benefits of, or be able to sustain the benefits anticipated by, these initiatives.

We require significant capital to develop and grow our business, including developing, producing and servicing KARNO generators and our brand and investing in additive printing machines. We expect to incur significant expenses, which will impact our profitability and available capital, including costs for R&D efforts, component and service procurement, sales, general and administrative costs, and production, distribution and support.

Our ability to become profitable in the future will require us to complete the design, development and testing of our KARNO generator while achieving projected performance criteria. We must also successfully market our KARNO generator and related services to customers, sell our systems at prices needed to achieve positive gross margins, and reduce production costs. We may need to sell our products at a loss or discounted prices in the short term in order to win initial customer orders and gain the confidence of potential customers. If we are unable to efficiently design, produce, market, sell, distribute and service our KARNO generator, our margins, profitability, and long-term prospects will be materially and adversely affected.

We have no experience manufacturing the KARNO generator on a large-scale basis and if we do not develop adequate manufacturing processes and capabilities to do so, or if we fail to identify qualified outsourced manufacturing partners, in a timely manner, we will be unable to achieve our growth and profitability objectives.