By Mike Colias

General Motors Co. is raising its bet on electric cars by more

than a third, as it hustles to convince a skeptical Wall Street

that it too can be successful in the nascent market.

The nation's biggest auto maker by sales said Thursday that it

will spend $27 billion through 2025 to develop electric and

driverless vehicles. That is up from a $20 billion figure that GM

pegged in March, days before the Covid-19 pandemic forced the

industry to shut its North American factories and touched off an

industrywide cash crisis.

GM's new spending target represents more than half of its

planned capital expenditures through mid-decade, even though

electric and driverless vehicles today account for around 2% of the

company's global sales, roughly mirroring the broader market.

Electric vehicles generally have been money losers for car

companies because of their high battery costs, although GM has said

its next generation of electric cars will be profitable.

Traditional auto makers are racing for an inside edge in what

investors see as the auto sector's next big growth opportunity. The

soaring share prices of Tesla Inc., China's Nio Inc. and other

young companies with pure-electric portfolios has added to the

sense of urgency.

"We want to lead in this space," GM product-development chief

Doug Parks said during a media briefing. "Tesla's got a good jump,

and they've done great things. There's a lot of startups, and

everyone else invading the space."

But so far, GM and other legacy auto makers have been largely

ignored amid a frenzy of electric-vehicle investment.

Tesla's shares have leapt roughly sixfold this year as investors

cheer its sales growth in China and budding revenue growth from

selling connected-car services. Little-known Nio -- which in April

needed a roughly $1 billion infusion from Chinese state investors

amid mounting losses -- has seen its valuation rocket to $63

billion in recent months, just beyond that of GM.

Meanwhile, a slew of green-energy vehicle startups have had

stellar debuts after being taken public this year through

blank-check companies, including Hyliion Inc. and Fisker Inc.

GM shares have more than doubled since cratering in March during

the factory shutdowns, but its stock price, along with many other

auto companies, has lagged behind the broader market for years,

even as electric-vehicle newcomers have seen shares jump.

Analysts have lauded GM's technology and commitment to growing

its plug-in-car business. But, they say investors are more enticed

by pure-play electric vehicle companies that come without the

lower-margin, capital-intensive aspects of traditional car

companies, including vast factory footprints and unionized

workforces.

Some analysts have suggested GM spin off its electric-vehicle

business to boost the share price. Chief Executive Mary Barra has

said she is open to changes in GM's capital structure that would

reward shareholders, but won't make a move simply to get a

short-term pop in valuation.

Speaking at a Barclays investor conference Thursday, Ms. Barra

said GM has the scale in areas like manufacturing and sales to

eventually overtake Tesla as the leader in electric-vehicle sales

in North America.

"We've developed these assets and capabilities over decades.

They are real, competitive, innovative strengths that startups will

struggle to match," Ms. Barra said.

Tighter regulations on tailpipe emissions in Europe and China

also are pressuring auto makers to offer greener vehicle lineups.

The European Union's stricter rules on carbon-dioxide emissions

have many auto makers there facing the prospect of paying billions

of dollars in fines. Some states and countries have imposed future

bans on gas- and diesel-powered vehicles, including the 2035

deadline recently set by California.

Investors are paying especially close attention to auto makers'

capital-spending plans for signs of substantial bets on future

technologies that could drive growth. This week, analysts at UBS

said they favored GM shares over Ford Motor Co.'s, in part because

Ford isn't spending as much as its rival on electric-vehicle

development.

"An 'all-in' EV strategy is a prerequisite to avoid a further

de-rating of shares," UBS analyst Patrick Hummel wrote in a

research note.

A Ford spokesman pointed to past statements from chief executive

Jim Farley, who is focusing on electric versions of vehicles that

commercial customers use in their businesses, including a

battery-powered Transit cargo van Ford revealed last week. Ford has

said it is spending $11.5 billion on electric vehicles over a

five-year period ending in 2022.

"We expect demand for capable, productive and affordable

electric commercial vehicles, for example, to be massive," the

spokesman said.

Volkswagen AG, which is making among the industry's largest

investments in electric cars, this week said it would increase its

spending to about $41 billion through mid-decade, 6% higher than an

earlier target. The German auto giant said about half of its

overall capital spending during that period will go toward future

technologies, which include electric cars, more-advanced factories

and self-driving vehicles.

Electric vehicles underpin Ms. Barra's growth strategy. During

her seven-year tenure, she has pulled GM out of Europe and many

other international markets, redirecting capital toward electric

and driverless cars and other technologies.

GM said Thursday that it is working to get some electric models

to market earlier than initially planned, including a Cadillac SUV,

the Lyriq, which will hit showrooms by early 2022, nine months

ahead of schedule, Mr. Parks said.

GM said 40% of the vehicles it will sell in the U.S. by

mid-decade will be fully electric.

Write to Mike Colias at Mike.Colias@wsj.com

(END) Dow Jones Newswires

November 19, 2020 14:49 ET (19:49 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

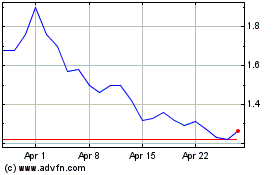

Hyliion (NYSE:HYLN)

Historical Stock Chart

From Sep 2024 to Oct 2024

Hyliion (NYSE:HYLN)

Historical Stock Chart

From Oct 2023 to Oct 2024