Toyota Unwraps FY12 Guidance - Analyst Blog

June 10 2011 - 12:38PM

Zacks

Toyota Motor Corp. (TM) broke its silence on

sales and earnings outlook for its fiscal year ending March 31,

2012 since the release of its fiscal 2011 results last month. The

automaker could not provide any guidance for fiscal 2012 earlier as

it needed more time to absorb the adverse impact of production

disruptions caused in its production and sales plans due to

the earthquake and tsunami in Japan.

Toyota expects the full year profit to fall 31% to ¥280 billion

($3.5 billion) from ¥408 billion a year ago, driven by lower sales

and stronger yen. The company has projected global sales to

decrease to 7.24 million vehicles from 7.31 million vehicles in

fiscal 2011, which will reduce earnings by ¥120 billion. These

figures include sales at truck maker Hino Motors Ltd. and compact

car maker Daihatsu Motor Co.

Toyota’s forecast was based on an average dollar to yen exchange

rate of ¥82 for the year compared with ¥86 last year. The automaker

revealed strong yen to reduce the yearly profit by ¥100

billion.

FY11 Results Review

The Zacks #3 Rank (Hold) company reported a profit of ¥408.18

billion ($5.07 billion) or ¥130.16 ($1.60) per share for the fiscal

2011 ended March 31, 2011 that almost doubled from ¥209.46 billion

or ¥66.79 per share a year ago.

The increase in profit was attributable to positive impact of

¥490.0 billion due to marketing efforts and ¥180.0 billion due to

cost reduction measures, partially offset by a negative impact of

¥110.0 billion due to the earthquake in Japan and ¥290.0 billion

due to unfavorable exchange rates. The twin disaster in Japan has

also led to a 52% fall in profit during the January-March

quarter.

Consolidated revenues in the fiscal year rose marginally by

0.23% to ¥18.99 trillion ($235.80 billion) from ¥18.95 trillion,

driven by a growth in unit sales in Asia (28%) and Other regions

(15%), offset partially by a decline in unit sales in Japan

(11.5%), North America (3%) and Europe (7%). Total unit sales

increased 0.98% to 7.31 million units during the fiscal year.

Last month, Toyota revealed that improving world economy,

expansion in the emerging markets such as China, technological

development, new product launches and higher demand for

fuel-efficient compact cars will positively affect its results. The

company now believes that its domestic output will revive by 90% to

its normal level this month, while its global production will

normalize by December this year.

What about Honda?

Toyota’s domestic competitor, Honda Motor Co.

(HMC) revealed a 38% fall in profit to ¥44.55 billion ($536

million) or ¥24.72 per share (30 cents per share) in the fourth

quarter of the fiscal year ended March 31, 2011 from ¥72.18 billion

or ¥39.78 per share in the same quarter of prior fiscal year.

The decline in profit was attributable to unfavorable currency

translation effects, higher selling, general and administrative

expenses, and the tsunami and earthquake in Japan. These more than

offset the positive impact from cost reduction measures, lower

R&D expenses, increase in sales volume (except in the

Automobile segment) and model mix, and operating income related to

licensing agreements.

Honda would release its earnings guidance for the fiscal year on

June 14. The company could not furnish any guidance for the next

fiscal six months ending September 30, 2011 or for the fiscal year

ending March 31, 2012 probably due to the same reasons cited by

Toyota.

HONDA MOTOR (HMC): Free Stock Analysis Report

TOYOTA MOTOR CP (TM): Free Stock Analysis Report

Zacks Investment Research

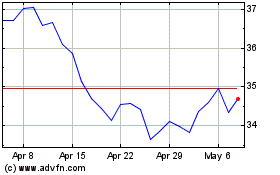

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Aug 2024 to Sep 2024

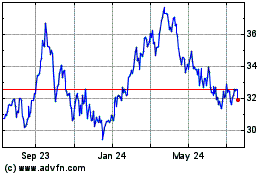

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Sep 2023 to Sep 2024