Second highest silver reserves in company

history

Hecla Mining Company (NYSE:HL) today reported exploration

results and year-end mineral reserves. Significant exploration

success at key properties provides the base for future resource

growth while silver reserves reached the second highest in Hecla’s

history.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20250212842244/en/

Figure 1: District geology with fourth

quarter 2024 drill target locations. (Graphic: Business Wire)

HIGHLIGHTS

- Achieved near-record silver reserves, reaching 240 million

ounces and approaching an all-time high

- Fully replaced silver production from reserves through

strategic reserve replacement across operations

- Restored nearly all silver reserves at Greens Creek through

targeted exploration

- Grew Keno Hill reserves by 17% to reach 64 million silver

ounces

- Maintained gold reserves with production replaced and added 21

thousand ounces at Casa Berardi

- Demonstrated robust economics using conservative pricing

($22/oz silver, $1,900/oz gold)

- Disciplined resource estimation with updated cut-off grades

reflecting current costs

- Discovered and expanded high-grade zones across multiple

properties through focused drilling

- Accelerated development of high-priority exploration targets to

drive future growth

"Hecla's silver reserves stand at 240 million ounces, the

second-highest level in our 134-year history and only 1 million

ounces below our peak in 2022," said Rob Krcmarov, President and

CEO. "Our 2024 exploration program continued to deliver exceptional

results at both Keno Hill and Greens Creek while Keno Hill reserves

grew by over 17% and silver production was nearly replaced at

Greens Creek. These achievements position Hecla for continued

growth as the largest silver producer in the U.S. and Canada and

lay the foundation for sustained future growth."

Kurt Allen, Vice President of Exploration, commented on the

exploration success: "The 2024 drilling program has significantly

advanced our understanding of the high-grade mineralization

controls at both Keno Hill and Greens Creek. At Keno Hill, the

Bermingham Footwall and Main Vein zones continue to deliver

exceptional silver grades over mineable widths and remain open for

expansion. The emerging cluster of high-grade silver values beneath

the Bermingham Deep Northeast Ore Zone is particularly exciting,

suggesting proximity to a new ore-shoot that will be a key focus of

our 2025 drilling program. At Greens Creek, the strong results from

the West Zone and 5250 Zone support our view that this world-class

deposit continues to hold significant exploration potential."

EXPLORATION HIGHLIGHTS BY PROPERTY

Select drill highlights from the company’s exploration programs

include the following drill holes, additional drill holes and

details are included later in this release.

Keno Hill (Yukon Territory)

Bermingham Vein Zone – Notable Intercepts

- Bear Vein: 13.2 oz/ton silver, 2.6% lead, and 0.9% zinc over

7.5 feet

- Footwall Vein: 36.6 oz/ton silver, 3.0% lead, and 0.9% zinc

over 11.2 feet

- Includes: 48.4 oz/ton silver, 3.7% lead, and 1.0% zinc over 8.1

feet

- Main Vein: 42.8 oz/ton silver, 9.3% lead, and 9.7% zinc over

6.8 feet

Operational Context:

Underground definition drilling continued to expand

mineralization in the high-grade Bermingham Bear Zone Veins, while

surface exploration focused on new discoveries. The Footwall and

Main Vein mineralized zones remain open for expansion at depth,

with further drilling planned in the first half of 2025.

Greens Creek (Alaska)

West Zone – Notable Intercepts:

- 34.6 oz/ton silver, 0.44 oz/ton gold, 2.8% lead and 5.9% zinc

over 12.1 feet

- 40.1 oz/ton silver, 0.36 oz/ton gold, 4.3% lead and 8.2% zinc

over 8.0 feet

9A Zone – Notable Intercepts:

- 10.8 oz/ton silver, 0.21 oz/ton gold, 4.5% lead, and 8.7% lead

over 17.3 feet

- 11.1 oz/ton silver, 0.03 oz/ton gold, 4.9% lead, and 11.6% zinc

over 18.5 feet

- 27.4 oz/ton silver, 0.03 oz/ton gold, 5.8% lead, and 11.5% zinc

over 6.2 feet

5250 Zone – Notable Intercepts

- 24.3 oz/ton silver, 0.07 oz/ton gold, 4.3% lead and 9.2% zinc

over 46.6 feet

- 29.7 oz/ton silver, 0.08 oz/ton gold, 3.4% lead and 4.4% zinc

over 24.3 feet

RESERVES & RESOURCES HIGHLIGHTS

- Silver reserves at 240 million ounces, an increase of 1% over

last year, with additions at Keno Hill.

- On a consolidated basis, while the Company mined 18.7 million

ounces of silver during 2024, it successfully replaced 14.6 million

ounces in reserves. The difference primarily reflects production

from areas outside of reserve blocks.

- Keno Hill reserves increased almost 17% to 64 million silver

ounces.

- Gold reserves are flat over last year with production replaced

and a slight increase at Casa Berardi.

Reserves And Resources Summary

Year-End 2024 Position:

- Proven and Probable silver reserves: 240 million ounces

- Measured and Indicated silver resources: 180 million

ounces

- Inferred silver resources: 492 million ounces

- Proven and Probable gold reserves: 2.2 million ounces

- Measured and Indicated gold resources: 4.3 million ounces

- Inferred gold resources: 6.2 million ounces

A breakdown of the Company’s reserves and resources along with

metal price assumptions are set out in Table A at the end of this

news release.

EXPLORATION UPDATE

Keno Hill, Yukon Territory

Fourth quarter drilling at Keno Hill substantially expanded

high-grade mineralization through an aggressive dual-focus program

of underground definition and surface exploration drilling.

Underground drilling completed 7,100 feet, concentrating on

resource conversion and expansion of the high-grade Bermingham Bear

Zone Veins. Concurrent surface exploration deployed five core

drills to complete 28,000 feet across multiple promising targets

including the Bermingham Deep, Elsa 17-Dixie, Inca, and

Hector-Calumet areas (Figure 1).

Definition drilling in the Bear Zone veins yielded significant

results, particularly in the Footwall and Main Veins where

high-grade mineralization was extended both at depth and along

strike. While drilling in the Bear Vein identified narrow vein

mineralization between the Ursa and Arctic faults, the most

substantial gains came from the Footwall and Main Veins, where

strong high-grade intercepts significantly expanded the known

mineralized zones. Both the Footwall and Main Vein zones remain

open at depth, with further drilling planned for the first half of

2025 to test their expansion potential. Assay highlights include

(reported widths are estimates of true width):

- Bear Vein: 13.2 oz/ton silver, 2.6% lead, and 0.9% zinc over

7.5 feet

- Bear Vein: 12.6 oz/ton silver, 1.9% lead, and 0.1% zinc over

5.7 feet

- Footwall Vein: 37.3 oz/ton silver, 4.8% lead, and 1.2% zinc

over 12.5 feet

- Includes: 117.2 oz/ton silver, 15.9% lead, and 10.2% zinc over

0.9 feet

- Footwall Vein: 36.6 oz/ton silver, 3.0% lead, and 0.9% zinc

over 11.2 feet

- Includes: 48.4 oz/ton silver, 3.7% lead, and 1.0% zinc over 8.1

feet

- Main Vein: 42.8 oz/ton silver, 9.3% lead, and 9.7% zinc over

6.8 feet

- Main Vein: 23.8 oz/ton silver, 2.9% lead, and 0.9% zinc over

7.5 feet

Surface exploration drilling delivered exciting results from

both the Bermingham system and Inca Vein target areas.

At Bermingham, drilling intercepted significant mineralization

across multiple veins, highlighted by an 11.3-foot intersection in

the Footwall Vein grading 11.1 oz/ton silver with associated base

metals. This intercept, located beneath the northeastern edge of

the Bermingham Deep Northeast Ore Zone, suggests proximity to a new

ore-shoot controlled by an interpreted vein intersection. The area

is slated for follow-up drilling in 2025.

At the Inca Vein target, initial drilling has outlined over 800

feet of mineralized strike length, delivering exceptional results

including 22.3 feet grading 18.1 oz/ton silver, 16.1% zinc, and

significant indium values. The zone remains open for expansion in

all directions, demonstrating strong potential for resource growth.

The best intercept included 14.3 feet grading 26.1 oz/ton silver

and 20.9% zinc, with notable indium credits of 7.0 oz/ton.

Greens Creek, Alaska

At Greens Creek, two underground drilling rigs completed 27

drillholes, totaling 17,083 feet. Definition drilling was focused

on resource conversion and exploration and resulted in extending

mineralization from known resources. Underground definition

drilling targeted the 9A, East, and Gallagher zones and exploration

targeted the Gallagher Zone (Figure 5). Assay results were received

during the quarter from the 5250, 9A, Gallagher, West, 200S, and

UPP zones.

Underground definition drilling delivered mixed but overall

positive results across multiple zones. At the Gallagher Zone, four

drillholes across two sections encountered elevated alteration,

with 61% of received assays from 23 holes expected to positively

impact the resource. Highlights from this drilling include:

- 8.0 oz/ton silver, 0.15 oz/ton gold, 4.7% lead, and 10.4% zinc

over 11.1 feet

During the quarter, assay results for the 5250 Zone were

received for 22 drillholes, targeting 13 cross-sections, of which

41% are expected to have a positive impact on the resource.

Highlights from this drilling include:

- 24.3 oz/ton silver, 0.07 oz/ton gold, 4.3% lead and 9.2% zinc

over 46.6 feet

- 29.7 oz/ton silver, 0.08 oz/ton gold, 3.4% lead and 4.4% zinc

over 24.3 feet

During the quarter, assay results for the West Zone were

received for 15 drillholes, targeting eight cross-sections, of

which 40% are expected to have a positive impact on the resource.

Highlights from this drilling include:

- 34.6 oz/ton silver, 0.44 oz/ton gold, 2.8% lead and 5.9% zinc

over 12.1 feet

- 40.1 oz/ton silver, 0.36 oz/ton gold, 4.3% lead and 8.2% zinc

over 8.0 feet

The 9A Zone drilling campaign successfully established important

continuity across several gaps within the zone. Highlights from

this drilling include:

- 10.8 oz/ton silver, 0.21 oz/ton gold, 4.5% lead, and 8.7% lead

over 17.3 feet

- 11.1 oz/ton silver, 0.03 oz/ton gold, 5.0% lead, and 11.6% zinc

over 18.5 feet

- 27.4 oz/ton silver, 0.03 oz/ton gold, 5.8% lead, and 11.5% zinc

over 6.2 feet

Detailed drill assay highlights can be found in Table B at the

end of the release.

ABOUT HECLA

Founded in 1891, Hecla Mining Company (NYSE: HL) is the largest

silver producer in the United States and Canada. In addition to

operating mines in Alaska, Idaho, and Quebec, Canada, the Company

is developing a mine in the Yukon, Canada, and owns a number of

exploration and pre-development projects in world-class silver and

gold mining districts throughout North America.

Cautionary Statements Regarding

Estimates and Forward-Looking Statements

Statements made or information provided in this news release

that are not historical facts are "forward-looking statements"

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, which are intended to be covered by the safe harbor

created by such sections and other applicable laws, and

"forward-looking information" within the meaning of Canadian

securities laws. When a forward-looking statement expresses or

implies an expectation or belief as to future events or results,

such expectation or belief is expressed in good faith and believed

to have a reasonable basis. However, such statements are subject to

risks, uncertainties and other factors, which could cause actual

results to differ materially from future results expressed,

projected or implied by the forward-looking statements.

Forward-looking statements often address our expected future

business and financial performance and financial condition and

often contain words such as “anticipate,” “intend,” “plan,” “will,”

“could,” “would,” “estimate,” “should,” “expect,” “believe,”

“project,” “target,” “indicative,” “preliminary,” “potential” and

similar expressions. Estimates or expectations of future events or

results are based upon certain assumptions, which may prove to be

incorrect, which could cause actual results to differ from

forward-looking statements. Such assumptions, include, but are not

limited to: (i) there being no significant change to current

geotechnical, metallurgical, hydrological and other physical

conditions; (ii) permitting, development, operations and expansion

of the Company’s projects being consistent with current

expectations and mine plans; (iii) political/regulatory

developments in any jurisdiction in which the Company operates

being consistent with its current expectations; (iv) certain price

assumptions for gold, silver, lead and zinc; (v) prices for key

supplies being approximately consistent with current levels; (vi)

the accuracy of our current mineral reserve and mineral resource

estimates; (vii) the Company’s plans for development and production

will proceed as expected and will not require revision as a result

of risks or uncertainties, whether known, unknown or unanticipated;

(viii) sufficient workforce is available and trained to perform

assigned tasks; (ix) weather patterns and rain/snowfall within

normal seasonal ranges so as not to impact operations; (x)

relations with interested parties, including Native Americans,

remain productive; and (xi) factors do not arise that reduce

available cash balances.

In addition, material risks that could cause actual results to

differ from forward-looking statements include, but are not limited

to: (i) gold, silver and other metals price volatility; (ii)

operating risks; (iii) currency fluctuations; (iv) increased

production costs and variances in ore grade or recovery rates from

those assumed in mining plans; (v) community relations; (vi)

conflict resolution and outcome of projects or oppositions; (vii)

litigation, political, regulatory, labor and environmental risks;

(viii) exploration risks and results, including that mineral

resources are not mineral reserves, they do not have demonstrated

economic viability and there is no certainty that they can be

upgraded to mineral reserves through continued exploration; (ix)

the failure of counterparties to perform their obligations under

hedging instruments; (x) we take a material impairment charge on

any of our assets; and (xi) inflation causes our costs to rise more

than we currently expect. For a more detailed discussion of such

risks and other factors, see the Company’s 2024 Annual Report on

Form 10-K, to be filed with the Securities and Exchange Commission

(“SEC”) on February 13, 2025. The Company does not undertake any

obligation to release publicly, revisions to any “forward-looking

statement,” including, without limitation, outlook, to reflect

events or circumstances after the date of this presentation, or to

reflect the occurrence of unanticipated events, except as may be

required under applicable securities laws. Investors should not

assume that any lack of update to a previously issued

“forward-looking statement” constitutes a reaffirmation of that

statement. Continued reliance on “forward-looking statements” is at

investors’ own risk.

Cautionary Statements to Investors on

Reserves and Resources

This news release uses the terms “mineral resources,” “measured

mineral resources,” “indicated mineral resources” and “inferred

mineral resources”. Mineral resources that are not mineral reserves

do not have demonstrated economic viability. You should not assume

that all or any part of measured or indicated mineral resources

will ever be converted into mineral reserves. Further, inferred

mineral resources have a great amount of uncertainty as to their

existence and as to whether they can be mined legally or

economically, and an inferred mineral resource may not be

considered when assessing the economic viability of a mining

project, and may not be converted to a mineral reserve. We report

reserves and resources under the SEC’s mining disclosure rules

(“S-K 1300”) and Canada’s National Instrument 43-101 – Standards of

Disclosure for Mineral Projects (“NI 43-101”) because we are a

“reporting issuer” under Canadian securities laws. Unless otherwise

indicated, all resource and reserve estimates contained in this

press release have been prepared in accordance with S-K 1300 as

well as NI 43-101.

Qualified Person (QP)

Kurt D. Allen, MSc., CPG, VP -Exploration of Hecla Mining

Company and Keith Blair, MSc., CPG, Chief Geologist of Hecla

Limited, who serve as a Qualified Person under S-K 1300 and NI

43-101, supervised the preparation of the scientific and technical

information concerning Hecla’s mineral projects in this news

release. Technical Report Summaries for the Company’s Greens Creek,

Lucky Friday, Casa Berardi and Keno Hill properties are filed as

exhibits 96.1 - 96.4, respectively, to the Company’s Annual Report

on Form 10-K for the year ended December 31, 2023 and are available

at www.sec.gov. Information regarding data verification, surveys

and investigations, quality assurance program and quality control

measures and a summary of analytical or testing procedures for (i)

the Greens Creek Mine are contained in its Technical Report Summary

and in its NI 43-101 technical report titled “Technical Report for

the Greens Creek Mine” effective date December 31, 2018, (ii) the

Lucky Friday Mine are contained in its Technical Report Summary and

in its NI 43-101 technical report titled “Technical Report for the

Lucky Friday Mine Shoshone County, Idaho, USA” effective date April

2, 2014, (iii) Casa Berardi are contained in its Technical Report

Summary and in its NI 43-101 technical report titled “Technical

Report on the Casa Berardi Mine, Northwestern Quebec, Canada”

effective date December 31, 2023, (iv) Keno Hill are contained in

its Technical Report Summary titled “S-K 1300 Technical Report

Summary on the Keno Hill Mine, Yukon, Canada” and in its NI 43-101

technical report titled “Technical Report on the Keno Hill Mine,

Yukon, Canada” effective date December 31, 2023, and (v) the San

Sebastian Mine, Mexico, are contained in a NI 43-101 technical

report prepared for Hecla titled “Technical Report for the San

Sebastian Ag-Au Property, Durango, Mexico” effective date September

8, 2015. Also included in each Technical Report Summary and

technical report listed above is a description of the key

assumptions, parameters and methods used to estimate mineral

reserves and resources and a general discussion of the extent to

which the estimates may be affected by any known environmental,

permitting, legal, title, taxation, socio-political, marketing, or

other relevant factors. Information regarding data verification,

surveys and investigations, quality assurance program and quality

control measures and a summary of sample, analytical or testing

procedures are contained in NI 43-101 technical reports prepared

for Klondex Mines Ltd. for (i) the Fire Creek Mine (technical

report dated March 31, 2018), (ii) the Hollister Mine (technical

report dated May 31, 2017, amended August 9, 2017), and (iii) the

Midas Mine (technical report dated August 31, 2014, amended April

2, 2015). Information regarding data verification, surveys and

investigations, quality assurance program and quality control

measures and a summary of sample, analytical or testing procedures

are contained in a NI 43-101 technical reports prepared for ATAC

Resources Ltd. for (i) the Osiris Project (technical report dated

July 28, 2022) and (ii) the Tiger Project (technical report dated

February 27, 2020). Copies of these technical reports are available

under the SEDAR profiles of Klondex Mines Unlimited Liability

Company and ATAC Resources Ltd., respectively, at www.sedar.com

(the Fire Creek technical report is also available under Hecla’s

profile on SEDAR). Mr. Allen and Mr. Blair reviewed and verified

information regarding drill sampling, data verification of all

digitally collected data, drill surveys and specific gravity

determinations relating to all the mines. The review encompassed

quality assurance programs and quality control measures including

analytical or testing practice, chain-of-custody procedures, sample

storage procedures and included independent sample collection and

analysis. This review found the information and procedures meet

industry standards and are adequate for Mineral Resource and

Mineral Reserve estimation and mine planning purposes.

Table A

Hecla Mining Company -

Reserves and Resources – 12/31/2024 (1)

Proven Reserves (1)

Silver

Gold

Lead

Zinc

Silver

Gold

Lead

Zinc

Asset

Location

Ownership

Tons (000)

(oz/ton)

(oz/ton)

%

%

(000 oz)

(000 oz)

Tons

Tons

Greens Creek (2,3)

United States

100.0%

9

7.6

0.07

2.4

6.5

70

1

220

600

Lucky Friday (2,4)

United States

100.0%

5,285

11.9

-

7.6

3.6

62,825

-

400,400

189,860

Casa Berardi Underground (2,5)

Canada

100.0%

87

-

0.15

-

-

-

13

-

-

Casa Berardi Open Pit (2,5)

Canada

100.0%

4,958

-

0.08

-

-

-

415

-

-

Keno Hill (2,6)

Canada

100.0%

13

28.1

-

3.0

1.6

364

-

380

200

Total

10,353

63,259

429

401,000

190,660

Probable Reserves (7)

Silver

Gold

Lead

Zinc

Silver

Gold

Lead

Zinc

Asset

Location

Ownership

Tons (000)

(oz/ton)

(oz/ton)

%

%

(000 oz)

(000 oz)

(Tons)

(Tons)

Greens Creek (2,3)

United States

100.0%

10,438

9.9

0.08

2.3

6.2

103,641

864

240,450

645,410

Lucky Friday (2,4)

United States

100.0%

790

11.4

-

7.6

3.1

9,011

-

60,210

24,620

Casa Berardi Underground (2,5)

Canada

100.0%

391

-

0.15

-

-

-

59

-

-

Casa Berardi Open Pit (2,5)

Canada

100.0%

10,457

-

0.08

-

-

-

804

-

-

Keno Hill (2,6)

Canada

100.0%

2,630

24.3

0.01

2.4

2.4

63,914

17

63,440

62,790

Total

24,706

176,566

1,745

364,100

732,820

Proven and Probable

Reserves

Silver

Gold

Lead

Zinc

Silver

Gold

Lead

Zinc

Asset

Location

Ownership

Tons (000)

(oz/ton)

(oz/ton)

%

%

(000 oz)

(000 oz)

(Tons)

(Tons)

Greens Creek (2,3)

United States

100.0%

10,447

9.9

0.08

2.3

6.2

103,711

865

240,670

646,010

Lucky Friday (2,4)

United States

100.0%

6,075

11.8

-

7.6

3.5

71,836

-

460,610

214,480

Casa Berardi Underground (2,5)

Canada

100.0%

479

-

0.15

-

-

-

72

-

-

Casa Berardi Open Pit (2,5)

Canada

100.0%

15,415

-

0.08

-

-

-

1,220

-

-

Keno Hill (2,6)

Canada

100.0%

2,643

24.3

0.01

2.4

2.4

64,278

17

63,820

62,990

Total

35,059

239,825

2,174

765,100

923,480

(1)

The term “reserve” means an estimate of

tonnage and grade or quality of indicated and measured mineral

resources that, in the opinion of the qualified person, can be the

basis of an economically viable project.

More specifically, it is the economically

mineable part of a measured or indicated mineral resource, which

includes diluting materials and allowances for losses that may

occur when the material is mined or extracted.

The term “proven reserves” means the

economically mineable part of a measured mineral resource and can

only result from conversion of a measured mineral resource. See

footnotes 8 and 9 below.

(2)

Mineral reserves are based on $22/oz

silver, $1900/oz gold, $0.90/lb lead, $1.15/lb zinc, unless

otherwise stated. All Mineral Reserves are reported in-situ with

estimates of mining dilution and mining loss.

(3)

The reserve NSR cut-off values for Greens

Creek are $230/ton for all zones; metallurgical recoveries (actual

2024): 79% for silver, 72% for gold, 81% for lead, and 89% for

zinc.

(4)

The reserve NSR cut-off values for Lucky

Friday are $225/ton for the 30 Vein and $236/ton for the

Intermediate Veins; metallurgical recoveries (actual 2024): 94% for

silver, 94% for lead, and 86% for zinc

(5)

The average reserve cut-off grades at Casa

Berardi are 0.12 oz/ton gold (4.1 g/tonne) underground and 0.03

oz/ton gold (1.1 g/tonne) for open pit. Metallurgical recovery

(actual 2024): 85% for gold; US$/CAN$ exchange rate: 1:1.35.

(6)

The reserve NSR cut-off value at Keno Hill

is $235.20/ton (CAN$350/tonne), Metallurgical recovery (actual

2024): 97% for silver, 95% for lead, 87% for zinc; US$/CAN$

exchange rate: 1:1.35

(7)

The term “probable reserves” means the

economically mineable part of an indicated and, in some cases, a

measured mineral resource. See footnotes 9 and 10 below.

Totals may not represent the sum

of parts due to rounding

Mineral Resources - 12/31/2024

(8)

Measured Resources (9)

Silver

Gold

Lead

Zinc

Copper

Silver

Gold

Lead

Zinc

Copper

Asset

Location

Ownership

Tons (000)

(oz/ton)

(oz/ton)

%

%

%

(000 oz)

(000 oz)

(Tons)

(Tons)

(Tons)

Greens Creek (12,13)

United States

100.0%

-

-

-

-

-

-

-

-

-

-

-

Lucky Friday (12,14)

United States

100.0%

3,781

8.7

-

5.8

2.6

-

32,795

-

217,490

99,840

-

Casa Berardi Underground (12,15)

Canada

100.0%

1,486

-

0.20

-

-

-

-

300

-

-

-

Casa Berardi Open Pit (12,15)

Canada

100.0%

84

-

0.03

-

-

-

-

3

-

-

-

Keno Hill (12,16)

Canada

100.0%

-

-

-

-

-

-

-

-

-

-

-

San Sebastian - Oxide(17)

Mexico

100.0%

-

-

-

-

-

-

-

-

-

-

-

San Sebastian - Sulfide (17)

Mexico

100.0%

-

-

-

-

-

-

-

-

-

-

-

Fire Creek (18,19)

United States

100.0%

-

-

-

-

-

-

-

-

-

-

-

Hollister (18,20)

United States

100.0%

19

4.7

0.57

-

-

-

88

11

-

-

-

Midas (18,21)

United States

100.0%

2

7.1

0.62

-

-

-

15

1

-

-

-

Heva (22)

Canada

100.0%

-

-

-

-

-

-

-

-

-

-

-

Hosco (22)

Canada

100.0%

-

-

-

-

-

-

-

-

-

-

-

Star (12,23)

United States

100.0%

-

-

-

-

-

-

-

-

-

-

-

Rackla - Tiger Open Pit (29)

Canada

100.0%

881

-

0.09

-

-

-

-

75

-

-

-

Rackla - Tiger Underground (29)

Canada

100.0%

32

-

0.06

-

-

-

-

2

-

-

-

Rackla - Osiris Open Pit (30)

Canada

100.0%

-

-

-

-

-

-

-

-

-

-

-

Rackla - Osiris Underground (30)

Canada

100.0%

-

-

-

-

-

-

-

-

-

-

-

Total

6,285

32,898

392

217,490

99,840

-

Indicated Resources

(10)

Silver

Gold

Lead

Zinc

Copper

Silver

Gold

Lead

Zinc

Copper

Asset

Location

Ownership

Tons (000)

(oz/ton)

(oz/ton)

%

%

%

(000 oz)

(000 oz)

(Tons)

(Tons)

(Tons)

Greens Creek (12,13)

United States

100.0%

7,619

14.1

0.10

3.0

8.0

-

107,226

760

227,360

607,600

-

Lucky Friday (12,14)

United States

100.0%

845

8.7

-

6.6

2.3

-

7,350

-

55,890

19,700

-

Casa Berardi Underground (12,15)

Canada

100.0%

3,522

-

0.17

-

-

-

-

594

-

-

-

Casa Berardi Open Pit (12,15)

Canada

100.0%

126

-

0.03

-

-

-

-

4

-

-

-

Keno Hill (12,16)

Canada

100.0%

1,050

13.7

0.01

1.1

2.1

-

14,431

12

11,610

22,460

-

San Sebastian - Oxide (17)

Mexico

100.0%

1,233

6.6

0.10

-

-

-

8,146

121

-

-

-

San Sebastian - Sulfide (17)

Mexico

100.0%

1,164

5.3

0.01

2.0

3.1

1.3

6,211

15

23,500

35,900

15,240

Fire Creek (18,19)

United States

100.0%

197

0.8

0.37

-

-

-

162

73

-

-

-

Hollister (18,20)

United States

100.0%

74

1.8

0.56

-

-

-

134

41

-

-

-

Midas (18,21)

United States

100.0%

95

5.4

0.40

-

-

-

514

38

-

-

-

Heva (22)

Canada

100.0%

1,208

-

0.05

-

-

-

-

62

-

-

-

Hosco (22)

Canada

100.0%

32,152

-

0.03

-

-

-

-

1,097

-

-

-

Star (12,23)

United States

100.0%

834

3.4

-

7.2

8.5

-

2,820

-

60,120

70,450

-

Rackla - Tiger Open Pit (29)

Canada

100.0%

3,116

-

0.10

-

-

-

-

311

-

-

-

Rackla - Tiger Underground (29)

Canada

100.0%

960

-

0.08

-

-

-

-

76

-

-

-

Rackla - Osiris Open Pit (30)

Canada

100.0%

4,843

-

0.12

-

-

-

-

577

-

-

-

Rackla - Osiris Underground (30)

Canada

100.0%

927

-

0.13

-

-

-

-

123

-

-

-

Total

59,963

146,993

3,905

378,480

756,110

15,240

Measured & Indicated

Resources

Silver

Gold

Lead

Zinc

Copper

Silver

Gold

Lead

Zinc

Copper

Asset

Location

Ownership

Tons (000)

(oz/ton)

(oz/ton)

%

%

%

(000 oz)

(000 oz)

(Tons)

(Tons)

(Tons)

Greens Creek (12,13)

United States

100.0%

7,619

14.1

0.10

3.0

8.0

-

107,226

760

227,360

607,600

-

Lucky Friday (12,14)

United States

100.0%

4,627

8.7

-

6.2

2.5

-

40,145

-

273,380

119,540

-

Casa Berardi Underground(12,15)

Canada

100.0%

5,007

-

0.18

-

-

-

-

895

-

-

-

Casa Berardi Open Pit (12,15)

Canada

100.0%

210

-

0.03

-

-

-

-

6

-

-

-

Keno Hill (12,16)

Canada

100.0%

1,050

13.7

0.01

1.1

2.1

-

14,431

12

11,610

22,460

-

San Sebastian - Oxide (17)

Mexico

100.0%

1,233

6.6

0.10

-

-

-

8,146

121

-

-

-

San Sebastian - Sulfide (17)

Mexico

100.0%

1,164

5.3

0.01

2.0

3.1

1.3

6,211

15

23,500

35,900

15,240

Fire Creek (18,19)

United States

100.0%

197

0.8

0.37

-

-

-

162

73

-

-

-

Hollister (18,20)

United States

100.0%

93

2.4

0.56

-

-

-

223

52

-

-

-

Midas (18,21)

United States

100.0%

97

5.5

0.40

-

-

-

529

39

-

-

-

Heva (22)

Canada

100.0%

1,208

-

0.05

-

-

-

-

62

-

-

-

Hosco (22)

Canada

100.0%

32,152

-

0.03

-

-

-

-

1,097

-

-

-

Star (12,23)

United States

100.0%

834

3.4

-

7.2

8.5

-

2,820

-

60,120

70,450

-

Rackla - Tiger Open Pit (29)

Canada

100.0%

3,997

-

0.10

-

-

-

-

386

-

-

-

Rackla - Tiger Underground(29)

Canada

100.0%

991

-

0.08

-

-

-

-

78

-

-

-

Rackla - Osiris Open Pit (30)

Canada

100.0%

4,843

-

0.12

-

-

-

-

577

-

-

-

Rackla - Osiris Underground(30)

Canada

100.0%

927

-

0.13

-

-

-

-

123

-

-

-

Total

66,248

179,891

4,297

595,970

855,950

15,240

Inferred Resources

(11)

Silver

Gold

Lead

Zinc

Copper

Silver

Gold

Lead

Zinc

Copper

Asset

Location

Ownership

Tons (000)

(oz/ton)

(oz/ton)

%

%

%

(000 oz)

(000 oz)

(Tons)

(Tons)

(Tons)

Greens Creek (12,13)

United States

100.0%

1,878

13.4

0.08

2.9

6.9

-

25,106

151

54,010

130,120

-

Lucky Friday (12,14)

United States

100.0%

3,811

10.3

-

7.7

3.2

-

39,183

-

293,010

121,710

-

Casa Berardi Underground(12,15)

Canada

100.0%

2,076

-

0.20

-

-

-

-

408

-

-

-

Casa Berardi Open Pit (12,15)

Canada

100.0%

577

-

0.10

-

-

-

-

57

-

-

-

Keno Hill (12,16)

Canada

100.0%

1,300

14.8

0.005

1.3

2.7

-

19,270

6

16,450

34,940

-

San Sebastian - Oxide (17)

Mexico

100.0%

2,163

7.1

0.06

-

-

-

15,364

134

-

-

-

San Sebastian - Sulfide (17)

Mexico

100.0%

326

4.3

0.01

1.7

2.6

0.9

1,388

4

5,680

8,420

3,090

Fire Creek (18,19)

United States

100.0%

1,197

0.4

0.42

-

-

-

524

500

-

-

-

Fire Creek - Open Pit (24)

United States

100.0%

74,584

0.1

0.03

-

-

-

5,232

2,178

-

-

-

Hollister (18,20)

United States

100.0%

742

2.7

0.40

-

-

-

2,037

294

-

-

-

Midas (18,21)

United States

100.0%

1,480

5.3

0.44

-

-

-

7,918

657

-

-

-

Heva (22)

Canada

100.0%

1,615

-

0.08

-

-

-

-

136

-

-

-

Hosco (22)

Canada

100.0%

14,460

-

0.03

-

-

-

-

461

-

-

-

Star (12,23)

United States

100.0%

2,044

3.5

-

6.7

6.7

-

7,129

-

137,040

137,570

-

San Juan Silver (12,25)

United States

100.0%

2,351

15.8

0.01

1.4

1.1

-

37,026

27

47,430

38,020

-

Monte Cristo (26)

United States

100.0%

523

0.2

0.24

-

-

-

126

101

-

-

-

Rock Creek (12,27)

United States

100.0%

99,997

1.5

-

-

-

0.7

148,688

-

-

-

658,410

Libby Exploration Project (12,28)

United States

100.0%

112,185

1.6

-

-

-

0.7

183,346

-

-

-

759,420

Rackla - Tiger Open Pit (29)

Canada

100.0%

30

-

0.05

-

-

-

-

2

-

-

-

Rackla - Tiger Underground(29)

Canada

100.0%

153

-

0.07

-

-

-

-

11

-

-

-

Rackla - Osiris Open Pit (30)

Canada

100.0%

5,919

-

0.09

-

-

-

-

529

-

-

-

Rackla - Osiris Underground(30)

Canada

100.0%

4,398

-

0.12

-

-

-

-

515

-

-

-

Total

333,808

492,338

6,171

553,620

470,780

1,420,920

Note: All estimates are in-situ except for

the proven reserves at Greens Creek and Keno Hill which are in

surface stockpiles. Stockpile materials make up 26.5 k tons of the

total proven reserves at Casa Berardi. Mineral resources are

exclusive of reserves.

(8)

The term "mineral resources" means a

concentration or occurrence of material of economic interest in or

on the Earth's crust in such form, grade or quality, and quantity

that there are reasonable prospects for economic extraction.

A mineral resource is a reasonable

estimate of mineralization, taking into account relevant factors

such as cut-off grade, likely mining dimensions, location or

continuity, that, with the assumed and justifiable technical and

economic conditions, is likely to, in whole or in part, become

economically extractable. It is not merely an inventory of all

mineralization drilled or sampled.

(9)

The term "measured resources" means that

part of a mineral resource for which quantity and grade or quality

are estimated on the basis of conclusive geological evidence and

sampling. The level of geological certainty associated with a

measured mineral resource is sufficient to allow a qualified person

to apply modifying factors in sufficient detail to support detailed

mine planning and final evaluation of the economic viability of the

deposit.

Because a measured mineral resource has a

higher level of confidence than the level of confidence of either

an indicated mineral resource or an inferred mineral resource, a

measured mineral resource may be converted to a proven mineral

reserve or to a probable mineral reserve.

(10)

The term "indicated resources" means that

part of a mineral resource for which quantity and grade or quality

are estimated on the basis of adequate geological evidence and

sampling. The level of geological certainty associated with an

indicated mineral resource is sufficient to allow a qualified

person to apply modifying factors in sufficient detail to support

mine planning and evaluation of the economic viability of the

deposit. Because an indicated mineral resource has a lower

confidence level than a measured mineral resource, an indicated

mineral resource may only be converted to a probable mineral

reserve.

(11)

The term "inferred resources" means that

part of a mineral resource for which quantity and grade or quality

are estimated on the basis of limited geological evidence and

sampling. The level of geological uncertainty associated with an

inferred mineral resource is too high to apply relevant technical

and economic factors likely to influence the prospects of economic

extraction in a manner useful for evaluation of economic viability.

Because an inferred mineral resource has the lowest level of

geological confidence of all mineral resources, which prevents the

application of the modifying factors in a manner useful for

evaluation of economic viability, an inferred mineral resource may

not be considered when assessing the economic viability of a mining

project and may not be converted to a mineral reserve.

(12)

Mineral resources are based on $2000/oz

gold, $24/oz silver, $1.15/lb lead, $1.35/lb zinc and $4.00/lb

copper, unless otherwise stated.

(13)

The resource NSR cut-off values for Greens

Creek are $230/ton for all zones; metallurgical recoveries (actual

2024): 79% for silver, 72% for gold, 81% for lead, and 89% for

zinc.

(14)

The resource NSR cut-off value for Lucky

Friday is $236/ton; metallurgical recoveries (actual 2024): 94% for

silver, 94% for lead, and 86% for zinc

(15)

The average resource cut-off grades at

Casa Berardi are 0.11 oz/ton gold (3.7 g/tonne) for underground and

0.03 oz/ton gold (1.05 g/tonne) for open pit; metallurgical

recovery (actual 2024): 85% for gold; US$/CAN$ exchange rate:

1:1.35.

(16)

The resource NSR cut-off value at Keno

Hill is $134.40/ton (CAN$200/tonne); using minimum width of 4.9

feet (1.5m); metallurgical recovery (actual 2024): 97% for silver,

95% for lead, 87% for zinc; US$/CAN$ exchange rate: 1:1.35

(17)

Mineral resources for underground zones at

San Sebastian reported at a cut-off grade of $158.8/ton

($175/tonne), open pit resources reported at a cut-off grade of

$72.6/ton ($80/tonne);

Metallurgical recoveries based on grade

dependent recovery curves: recoveries at the mean resource grade

average 89% for silver and 84% for gold for oxide material and 85%

for silver, 83% for gold, 81% for lead, 86% for zinc, and 83% for

copper for sulfide material.

Resources reported at a minimum mining

width of 8.2 feet (2.5m) for Middle Vein, North Vein, and East

Francine, 6.5ft (1.98m) for El Toro, El Bronco, and El Tigre, and

4.9 feet (1.5 m) for Hugh Zone and Andrea.

(18)

Mineral resources for Fire Creek,

Hollister and Midas are reported using a minimum mining width of

four feet or the vein true thickness plus two feet, whichever is

greater.

(19)

Fire Creek underground mineral resources

are reported at a gold equivalent cut-off grade of 0.22 oz/ton.

Metallurgical recoveries: 90% for gold and 70% for silver.

(20)

Hollister mineral resources, including the

Hatter Graben are reported at a gold equivalent cut-off grade of

0.21 oz/ton. Metallurgical recoveries: 88% for gold and 66% for

silver

(21)

Midas mineral resources are reported at a

gold equivalent cut-off grade of 0.20 oz/ton. Metallurgical

recoveries: 90% for gold and 70% for silver. Inferred resources for

the Sinter Zone are reported undiluted.

(22)

Mineral resources at Heva and Hosco are

based on a gold cut-off grade of 0.011 oz/ton (0.37 g/tonnes) for

open pit and 0.117 oz/ton (4 g/tonne) for underground and

metallurgical recoveries of 95% for gold at Heva and 81.5% and

87.7% for gold at Hosco depending on zone.

Heva and Hosco resources are diluted 20%

and reported using a 7% mining loss.

(23)

Indicated and Inferred resources at the

Star property are reported using a minimum mining width of 4.3 feet

and an NSR cut-off value of $200/ton; Metallurgical recovery: 93%

for silver, 93% for lead, and 87% for zinc.

(24)

Inferred open-pit resources for Fire Creek

calculated November 30, 2017, using gold and silver recoveries of

65% and 30% for oxide material and 60% and 25% for mixed

oxide-sulfide material. Indicated Resources reclassified as

Inferred in 2019.

Open pit resources are calculated at $1400

gold and $19.83 silver and cut-off grade of 0.01 Au Equivalent

oz/ton and is inclusive of 10% mining dilution and 5% ore loss.

Open pit mineral resources exclusive of underground mineral

resources.

NI43-101 Technical Report for the Fire

Creek Project, Lander County, Nevada; Effective Date March 31,

2018; prepared by Practical Mining LLC, Mark Odell, P.E. for Hecla

Mining Company, June 28, 2018.

(25)

Inferred resources reported at a minimum

mining width of 6.0 feet for Bulldog and an NSR cut-off value of

$200/ton and 5.0 feet for Equity and North Amethyst veins at an NSR

cut-off value of $175/ton; Metallurgical recoveries based on grade

dependent recovery curves; metal recoveries at the mean resource

grade average 89% silver, 74% lead, and 81% zinc for the Bulldog

and a constant 85% gold and 85% silver for North Amethyst and

Equity.

(26)

Inferred resource at Monte Cristo reported

at a minimum mining width of 5.0 feet and a 0.10 oz/ton gold

cut-off grade. Metallurgical recovery: 90% for gold and 90%

silver.

(27)

Inferred resource at Rock Creek reported

at a minimum thickness of 15 feet and an NSR cut-off value of

$31.50/ton; Metallurgical recoveries: 88% for silver and 92% for

copper.

Resources adjusted based on mining

restrictions as defined by U.S. Forest Service, Kootenai National

Forest in the June 2003 'Record of Decision, Rock Creek

Project'.

(28)

Inferred resource at Libby reported at a

minimum thickness of 15 feet and an NSR cut-off value of $31.50/ton

NSR; Metallurgical recoveries: 88% for silver and 92% copper.

Resources adjusted based on mining

restrictions as defined by U.S. Forest Service, Kootenai National

Forest, Montana DEQ in December 2015 'Joint Final EIS, Montanore

Project' and the February 2016 U.S Forest Service - Kootenai

National Forest 'Record of Decision, Montanore Project'.

(29)

Mineral resources at the Rackla-Tiger

Project are based on a gold price of $1650/oz, metallurgical

recovery of 95% for gold, and cut-off grades of 0.02 oz/ton gold

for the open pit portion of the resources and 0.04 oz/ton gold for

the underground portions of the resources; US$/CAN$ exchange rate:

1:1.3.

(30)

Mineral resources at the Rackla-Osiris

Project are based on a gold price of $1850/oz, metallurgical

recovery of 83% for gold, and cut-off grades of 0.03 oz/ton gold

for the open pit portion of the resources and 0.06 oz/ton gold for

the underground portions of the resources; US$/CAN$ exchange rate:

1:1.3.

Totals may not represent the sum

of parts due to rounding.

Table B

Assay Results – Q4

2024

Keno Hill (Yukon)

Zone

Drillhole Number

Drillhole Azm/Dip

Sample From (feet)

Sample To (feet)

True Width (feet)

Silver (oz/ton)

Gold (oz/ton)

Lead (%)

Zinc (%)

Depth From Surface

(feet)

Underground Definition

Bermingham - Main Vein

BMUG24-154

107/-17

765.5

787.5

7.5

23.8

0.00

2.9

0.9

1283

Bermingham - Main Vein

Including

765.5

777.6

4.1

36.9

0.01

3.7

0.8

1283

Bermingham - Main Vein

Including

786.9

787.5

0.2

133.9

0.01

35.0

12.4

1283

Bermingham - Main Vein

BMUG24-159

125/-15

641.4

652.2

6.8

42.8

0.01

9.3

9.7

1207

Bermingham - Main Vein

Including

643.0

652.2

5.8

49.5

0.01

10.9

9.3

1207

Bermingham - Footwall Vein

BMUG24-149

126/-5

450.1

451.8

1.5

35.0

0.00

4.9

0.5

1083

Bermingham - Footwall Vein

BMUG24-153

144/-11

459.6

479.7

16.8

7.0

0.00

0.9

0.7

1138

Bermingham - Footwall Vein

Including

459.6

462.4

2.3

35.0

0.01

4.6

1.9

1138

Bermingham - Footwall Vein

BMUG24-154

107/-17

529.4

540.2

10.3

13.7

0.00

1.1

1.8

1198

Bermingham - Footwall Vein

Including

529.4

531.8

2.2

27.9

0.00

0.6

4.5

1198

Bermingham - Footwall Vein

BMUG24-157

112/-15

528.8

551.8

14.2

5.8

0.00

1.0

1.3

1175

Bermingham - Footwall Vein

Including

528.8

529.3

0.3

43.2

0.00

18.7

3.9

1175

Bermingham - Footwall Vein

Including

546.3

547.6

0.8

45.6

0.01

4.7

5.4

1175

Bermingham - Footwall Vein

BMUG24-158

116/-17

559.1

563.3

2.8

32.4

0.01

5.6

0.7

1201

Bermingham - Footwall Vein

Including

559.1

559.9

0.5

171.5

0.02

30.6

3.3

1201

Bermingham - Footwall Vein

BMUG24-159

125/-15

481.6

497.0

12.5

37.3

0.00

4.8

1.2

1158

Bermingham - Footwall Vein

Including

492.5

493.6

0.9

117.2

0.01

15.9

10.2

1158

Bermingham - Footwall Vein

BMUG24-160

130/-14

479.7

493.4

11.2

36.6

0.00

3.0

0.9

1188

Bermingham - Footwall Vein

Including

481.8

491.7

8.1

48.4

0.01

3.7

1.0

1188

Bermingham - Bear Vein

BMUG24-151

138/-11

364.5

373.7

5.7

12.6

0.01

1.9

0.1

1099

Bermingham - Bear Vein

Including

364.5

366.8

1.4

44.9

0.01

6.6

0.1

1099

Bermingham - Bear Vein

BMUG24-152

150/-6

328.2

339.4

7.5

13.2

0.01

2.6

0.9

1066

Bermingham - Bear Vein

Including

328.2

330.5

1.5

38.1

0.00

6.0

1.1

1066

Bermingham - Bear Vein

Including

338.3

339.4

0.8

42.1

0.02

8.1

6.0

1066

Bermingham - Bear Vein

BMUG24-154

107/-17

375.0

377.0

0.9

4.2

0.00

0.7

0.0

1168

Surface Exploration

Elsa 17- Dixie Vein

K-24-0900

356/-53

867.8

868.7

0.5

0.5

0.00

0.0

1.5

526

Elsa 17- Dixie Vein

K-24-0901

351/-76

1424.6

1428.6

2.6

7.8

0.00

0.8

3.3

1280

Elsa 17- Dixie Vein

K-24-0902

316/-65

1624.5

1631.2

6.0

0.1

0.00

0.0

0.0

1171

Elsa 17- Dixie Vein

K-24-0906

246/-69

1191.1

1192.6

1.0

0.9

0.00

0.1

0.1

1027

Elsa 17- Dixie Vein

K-24-0907

314/-74

1316.9

1317.9

0.7

0.3

0.00

0.0

0.0

1174

Elsa 17- Dixie Vein

K-24-0915

264/-69

378.9

384.4

3.9

0.1

0.00

0.0

0.0

331

Elsa 17- Dixie Vein

K-24-0917

345/-55

429.3

442.4

9.9

0.1

0.00

0.0

0.0

296

Elsa 17 - Ruby Vein

K-24-0906

246/-69

761.6

763.1

0.6

1.9

0.00

0.0

0.0

664

Elsa 17 - Ruby Vein

K-24-0907

314/-74

1222.2

1227.4

3.4

0.8

0.00

0.1

0.3

1099

Bermingham Deep - Ruby Vein

K-24-0903

280/-63

3294.6

3294.9

0.3

41.6

0.06

0.0

0.0

2734

Bermingham Deep - Unknown

Vein

K-24-0904

280/-63

2524.2

2526.0

1.7

3.2

0.00

1.3

0.9

2145

Bermingham Deep - Chance Vein

K-24-0913

279/-66

775.5

777.1

1.1

21.1

0.00

4.0

3.1

700

Bermingham Deep - Main Vein

K-24-0924

292/-68

1872.2

1873.7

1.3

54.4

0.01

3.3

1.6

1663

Bermingham Deep - Footwall

Vein

K-24-0903

280/-63

3500.3

3506.6

4.8

0.1

0.00

0.1

0.1

2857

Bermingham Deep - Footwall

Vein

K-24-0904

280/-63

2594.7

2603.8

7.5

0.2

0.01

0.0

0.0

2202

Bermingham Deep - Footwall

Vein

K-24-0913

279/-66

3110.2

3120.4

7.6

0.8

0.00

0.3

0.8

2678

Bermingham Deep - Footwall

Vein

K-24-0924

292/-68

1954.1

1967.8

11.3

11.1

0.00

0.5

0.5

1739

Bermingham Deep - Footwall

Vein

Including

1959.0

1967.8

7.3

14.2

0.00

0.6

0.6

1739

Hector Calumet - Ruby Vein

K-24-0909

316/-63

2123.1

2124.3

1.2

0.1

0.00

0.0

0.0

1773

Hector Calumet - Ruby Vein

K-24-0911

326/-59

2387.1

2388.5

1.2

0.3

0.00

0.1

0.1

2082

Inca - Inca Vein

K-24-0908

150/-90

144.4

144.9

0.3

0.2

0.00

0.0

0.1

143

Inca - Inca Vein

K-24-0910

332/-55

329.5

331.6

1.8

0.5

0.00

0.0

0.3

227

Inca - Inca Vein

K-24-0912

221/-68

417.5

452.9

22.3

18.1

0.01

2.3

16.1

394

Inca - Inca Vein

Including

425.0

447.8

14.3

26.1

0.02

2.8

20.9

401

Inca - Inca Vein

K-24-0914

352/-58

600.7

603.3

1.9

1.0

0.01

0.1

0.2

531

Inca - Inca Vein

K-24-0918

262/-69

498.7

503.6

3.9

25.7

0.02

0.6

0.7

934

Inca - Inca Vein

Including

499.7

500.6

0.6

89.2

0.06

2.4

0.4

934

Greens Creek (Alaska)

Zone

Drillhole Number

Drillhole Azm/Dip

Sample From (feet)

Sample To (feet)

True Width (feet)

Silver (oz/ton)

Gold (oz/ton)

Lead (%)

Zinc (%)

Depth From Mine Portal

(feet)

Underground Definition

5250

GC-6484

47/-56

198.3

202.4

3.8

4.3

0.01

6.7

11.5

-73

5250

GC-6484

47/-56

272.7

297.2

24.3

29.7

0.08

3.4

4.4

-151

5250

GC-6512

65/-65

186.9

191.0

4.1

2.1

0.01

7.6

9.8

-63

5250

GC-6533

88/-26

48.0

71.9

15.6

17.2

0.04

3.2

7.4

-15

5250

GC-6533

88/-26

77.0

134.0

46.6

24.3

0.07

4.3

9.2

-44

5250

GC-6538

64/-41

35.3

47.2

11.8

4.2

0.03

8.6

22.7

-33

5250

GC-6539

64/-19

48.7

64.0

14.2

5.1

0.03

8.3

17.6

-15

5250

GC-6541

80/-12

30.1

41.3

8.8

1.7

0.01

6.5

12.6

-10

5250

GC-6541

80/-12

67.8

81.3

6.6

27.6

0.15

9.2

27.0

-19

5250

GC-6543

64/-57

145.3

156.2

9.1

16.7

0.01

1.3

2.7

-129

9A

GC-6559

64/-17

107.2

118.8

11.0

11.1

0.07

2.0

3.9

-88

9A

GC-6560

64/-25

72.5

76.2

3.4

14.2

0.02

3.8

11.0

-88

9A

GC-6560

64/-25

80.0

92.2

11.2

34.2

0.05

0.9

1.6

-94

9A

GC-6571

73/16

248.5

267.0

17.3

10.8

0.21

4.5

8.7

-320

9A

GC-6573

56/7

334.7

341.0

2.2

46.8

0.23

11.2

18.6

-368

9A

GC-6575

70/38

511.2

536.5

18.5

11.1

0.03

4.9

11.6

-93

9A

GC-6575

70/38

546.3

551.6

3.9

26.3

0.02

8.1

13.8

-73

9A

GC-6575

70/38

563.8

572.3

6.2

27.4

0.03

5.8

11.5

-59

Gallagher

GC-6483

336/-50

76.3

79.4

3.1

67.7

0.10

3.5

8.2

-794

Gallagher

GC-6497

212/-53

72.7

76.9

4.0

12.8

0.21

3.6

9.1

-798

Gallagher

GC-6504

295/-32

51.3

55.5

4.1

3.0

0.09

2.4

11.8

-767

Gallagher

GC-6504

295/-32

64.1

68.2

4.0

6.2

0.02

4.6

11.1

-777

Gallagher

GC-6505

353/-43

154.9

179.0

16.7

3.7

0.30

3.8

10.8

-840

Gallagher

GC-6514

20/-37

170.0

181.1

11.1

8.0

0.15

4.7

10.4

-849

Gallagher

GC-6516

34/-53

153.2

157.5

3.5

6.6

0.15

3.3

9.0

-861

Gallagher

GC-6524

278/-58

147.1

155.7

8.3

5.3

0.12

4.3

12.5

-859

West

GC-6474

66/3

67.0

77.7

10.2

6.0

0.24

6.8

21.2

-482

West

GC-6486

64/-11

670.0

678.0

8.0

40.1

0.36

4.3

8.2

-69

West

GC-6494

60/-8

671.1

677.4

5.3

24.6

0.17

5.4

8.9

-54

West

GC-6508

55/-9

670.0

683.2

12.1

34.6

0.44

2.8

5.9

-62

West

GC-6511

55/-13

666.1

684.8

18.6

19.6

0.34

1.3

2.5

-90

West

GC-6521

52/-6

669.9

673.0

3.1

4.9

0.22

0.3

0.6

-28

West

GC-6521

52/-6

683.3

693.0

9.6

7.1

0.14

0.6

1.3

-29

West

GC-6542

69/-18

503.6

507.0

3.4

3.5

0.02

7.7

11.4

-156

UG Expl

Upper Plate

GC-6554

270/56

261.0

264.0

2.3

15.1

0.01

3.7

8.4

263

Surface Exploration

Upper Plate

PS-0486

25/-48

337.1

349.8

11.9

7.9

0.01

7.4

3.7

401

Upper Plate

PS-0486

25/-48

426.0

427.0

0.8

0.3

0.00

8.9

6.3

330

Upper Plate

PS-0489

273/-73

326.0

330.4

3.7

8.5

0.04

5.4

3.3

338

Upper Plate

PS-0493

257/-49

291.0

292.5

1.1

0.5

0.00

20.0

5.2

288

Upper Plate

PS-0500

252/-53

391.8

395.4

3.4

6.7

0.01

7.4

4.0

337

Mammoth Zone

PS-0485

63/-80

11.1

14.7

3.1

1.4

0.01

0.2

0.4

2113

Mammoth Zone

PS-0491

63/75

201.5

209.8

7.6

0.5

0.11

1.0

0.4

1866

Mammoth Zone

PS-0491

63/75

248.8

249.8

0.8

0.3

0.00

7.1

0.0

1824

Gallagher

PS-0490

270/83

3736.4

3739.3

0.0

2.0

0.04

1.9

1.2

1641

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250212842244/en/

For further information, please contact:

Anvita M. Patil Vice President - Investor Relations and

Treasurer

Cheryl Turner Communications Coordinator

Investor Relations Email: hmc-info@hecla.com Website:

http://www.hecla.com

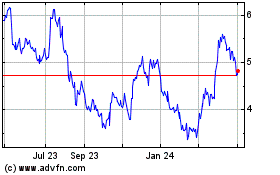

Hecla Mining (NYSE:HL)

Historical Stock Chart

From Jan 2025 to Feb 2025

Hecla Mining (NYSE:HL)

Historical Stock Chart

From Feb 2024 to Feb 2025