H&R Block’s 2024 Outlook on American Life Data Shows Rise in Consumer Debt Amidst Increased Holiday Spending

December 18 2024 - 8:42AM

Even as rising levels of debt further strain household budgets, and

with many Americans already facing financial pressures that could

lead to even greater economic challenges in the year ahead, holiday

spending is increasing. These findings echo H&R Block’s (NYSE:

HRB) fourth annual 2024 Outlook on American Life report, which

reveals that while many generations remain optimistic about their

income and buying power, they are simultaneously burdened by

overwhelming debt – especially Gen Z.

This year’s report found that most Americans (66%) across income

levels and generations feel optimistic about their income growth,

retirement prospects, and ability to maintain financial stability.

Simultaneously, this theme of optimism is met with the reality that

debt and loans are threatening to crush economic momentum for many

consumers.

“Following record Black Friday spending, we understand that it

can be challenging to make the most of your money while balancing

financial responsibilities,” said John Thompson, Vice President of

Financial Services at H&R Block. “H&R Block is committed to

helping people navigate these pressures by providing the tools,

guidance, and support they need to manage their finances wisely and

avoid falling deeper into debt during the holiday season.”

A Deeper Look at Americans’ Debt

This holiday season, people are already exceeding expectations

set for retail holiday shopping. Online and in-store purchases were

higher than expected during both Black Friday and Cyber Monday,

nodding to the increase in buying power that Americans of all

generations report experiencing.1 While holiday shopping is higher

than expected, many consumers are feeling the strain of this

spending – particularly Gen Z and Gen X.

According to this year’s Outlook on American Life report, Gen X

is carrying the most credit card debt (55%), followed closely by

Millennials (49%), Boomers (47%), and then Gen Z (39%) – though

it’s Gen Z that feels the most burdened. Of those holding credit

card debt, as many as two in three people say their level of debt

is unmanageable. Further, Gen X’s outlook on their finances and

greater economic opportunity conflict with younger Americans, as

they are the most likely to be “not at all confident” they’re doing

what is needed to meet longer-term goals such as saving for

retirement.

Credit card debt isn’t the only factor weighing these consumers

down: H&R Block found that 1 in 6 Americans hold student debt,

over a third reporting they have more debt than they can

manage.

Americans of All Ages are Spending More Than They

Earn

In addition to increasing amounts of debt, the Outlook on

American Life report found that despite growing income and buying

power, a third of all respondents across generations reported

spending more than they earned in the last 12 months. Only 30% of

Gen Z say they do not buy what they cannot afford (vs. 54% of

Boomers, 40% of Gen X, and 28% of Millennials), leading them to

make unaffordable purchases that pile onto their credit card debt.

Plus, with 1 in 5 Americans agreeing that they wouldn't be able to

cover household expenses for a full week without a source of

income, there is a clear gap between American spending and

earning.

“We recognize that spending, earning, and saving looks unique

for each and every person, and it is our goal to help every H&R

Block client reach the financial future they deserve,” said

Thompson. “The insights gathered from the Outlook on American Life

report on how Americans are faring financially allow us to further

understand how generations are evolving, and what they’re concerned

about, so that we can better assist our clients all year

round.”

To learn more and read the full Outlook on American Life report,

please visit www.hrblock.com/outlook-on-american-life/. To view

media assets, including a downloadable report and infographics,

visit

https://www.hrblock.com/tax-center/media-kit/outlook-on-american-life-report-media-kit/.

1 “197 Million Consumers Shop Over Thanksgiving Holiday

Weekend”, National Retail Federation,

https://nrf.com/media-center/press-releases/197-million-consumers-shop-over-thanksgiving-holiday-weekend

About H&R BlockH&R Block, Inc. (NYSE:

HRB) provides help and inspires confidence in its clients and

communities everywhere through global tax preparation services,

financial products, and small-business solutions. The company

blends digital innovation with human expertise and care as it helps

people get the best outcome at tax time and also be better with

money using its mobile banking app, Spruce. Through Block Advisors

and Wave, the company helps small-business owners thrive with

year-round bookkeeping, payroll, advisory, and payment processing

solutions. For more information, visit H&R Block

News.

| Media Contacts: |

| Media

Relations: |

Heather Woodard, (816) 379-2568, heather.woodard@hrblock.com |

| |

Media Desk, mediadesk@hrblock.com |

| |

|

| Investor Relations: |

Jordyn Eskijian, (816) 854-5674,

jordyn.eskijian@hrblock.com |

| |

|

An infographic accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/cc323fae-2274-4d33-80d3-3ec992daeef1

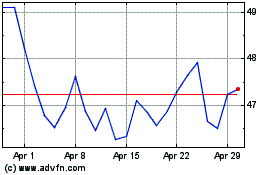

H and R Block (NYSE:HRB)

Historical Stock Chart

From Jan 2025 to Feb 2025

H and R Block (NYSE:HRB)

Historical Stock Chart

From Feb 2024 to Feb 2025