According to H&R Block’s 2024 Outlook on American Life report

released today, Americans are optimistic about their economic

mobility, and the data shows they have reason to be. The fourth

annual report from H&R Block (NYSE: HRB) details how

most Americans (66%) across income levels and generations feel

optimistic about their income growth, retirement prospects, and

ability to maintain financial stability—despite the threat of

unmanageable debt.

The analysis from this year’s Outlook on American Life report

draws upon anonymized, aggregated tax return data from the 11.4

million tax filers who H&R Block tax professionals assisted

virtually or in one of 9,000 offices during tax season 2024. Tax

returns from the past 25 years were also utilized to identify

historical income trends across generations.

The report also includes findings from four nationwide surveys

of 7,852 Americans fielded between July and August 2024 to gather

perspectives on how Americans feel about their current financial

situations. All surveys were weighted to be nationally

representative of gender, age, ethnicity/race, education and

region. Among those surveyed were 1,503 Gen Z respondents, one of

the largest surveys to date of Americans ages of 18 and 28.

Collectively, H&R Block analyzed billions of data points to

paint a portrait of earning, investing, saving, career aspirations

and debt trends among four generations—Gen Z, Millennials, Gen X

and Boomers—representing hardworking Americans nationwide.

“Nearly 70 years of experience and preparing more than 20

million returns each year gives H&R Block a unique perspective

on hardworking American’s financial situations and the behaviors

that are shaping the economy,” said Curtis Campbell, President of

Global Consumer Tax, H&R Block. “We understand that as the

economy evolves, so do the needs of our clients. These insights,

drawn from decades of anonymized, aggregated data and extensive

research, enable us to help individuals, families and small

businesses navigate their financial journeys.”

Each Generation Has Greater Income and Buying Power Than

the Last

This year’s report found that most Americans, regardless of

income and demographics, are optimistic about their income growth

and ability to retire and maintain financial stability despite

rising costs and debt. In fact, most Americans expect to exceed

their parents’ economic opportunities, including 70% of Gen Z, 65%

of Millennials, 53% of Gen X and 60% of Boomers.

Tax-return data shows this optimism is well-founded: 71% of Gen

Z, 62% of Millennials, 56% of Gen X, and 51% of Boomers are earning

income at rates that beat inflation. Gen Z experienced the largest

relative increase in earnings, making 30% more in 2023 than they

did in 2022. Of those surveyed, 60% of Gen Z and 53% of Millennials

anticipate their financial situation improving in the coming year

primarily due to rising income.

Each generation has greater buying power as well. Gen Z is

enjoying as much as 30% more buying power than Millennials at their

same age. Similarly, Millennials enjoy as much as 30% more buying

power than Gen X at their same age. Gen X has about 20% more buying

power than Boomers at their same age.

Shrinking Households, Market Gains and Tax Credits are

Boosting Income

More Americans are opting not to have children, realizing a

significant cost savings. On average, it costs $237,482 to raise a

child to age 18.1 The number of Millennials—taxpayers in their

childbearing years—who file as DINKS (double-income-no-kids) has

more than doubled in less than a decade, from 7% in 2015 to 16.7%

in 2024.

For those who do have kids, they are benefiting from tax

credits. In 2023, the Child Tax Credit (CTC) collectively reduced

Americans' taxes by $74 billion and returned $48 billion to

taxpayers through refunds.2

More Americans are benefiting from market gains as well. About

32% of H&R Block tax filers reported investment dividends and

interest last year, up from 27% in 2015.

Gen Z Is Job-Hopping, State-Hopping, and Investing Their

Way to Success

Gen Z is more innovative and financially savvy than Americans

might expect. This generation is changing jobs at unprecedented

rates primarily to increase their salary. Masters of the side

hustle, they are also earning more by starting new businesses,

following their passions, and investing.

One in three changed jobs last year and more than one-third did

so to increase their salary. While a majority (59%) prefer to work

for a large company as a salaried employee, 29% aspire to work for

themselves by starting a business, influencing others on social

media, or working as an artist/maker.

Nearly one in four (24%) drives for an app to augment their

income, and more than half (51%) anticipate monetizing a hobby in

the coming year. To help reach their financial goals—which include

buying a house (63%) and saving for retirement (86%)—Gen Z is also

investing, primarily through employer-sponsored plans (41%), as

well as in cryptocurrencies (22%) and gold and silver (15%).

Further, this generation is more than twice as likely as

Millennials (9% vs 4%) to invest in fine art and collectibles.

Job-hopping Gen Zers changed state residency more than any other

generation last year, moving to cities where they could capitalize

on more lucrative career opportunities. The top destinations for

Gen Z were New York, Chicago, Brooklyn, San Antonio, and

Austin.

But Debt Is the Monster Lurking Under the

Bed

While the cost of living might keep Americans awake at night,

it’s debt that threatens to derail future financial stability. Gen

X is carrying the most credit card debt (55%), followed closely by

Millennials (49%), Boomers (47%), and then Gen Z (39%) – though

it’s Gen Z that feels the most burdened. Of those holding credit

card debt, as many as two in three people say their level of credit

card debt is unmanageable. On top of credit card debt, as many as 1

in 6 Americans hold student debt, and more than a third say they

have more student debt than they can manage.

Ongoing financial pressure and spending continue to undermine

Americans’ ability to save. Nearly one in three taxpayers say they

spent all or more than they earned last year. Almost one in five

say that, without income, they wouldn’t be able to cover household

expenses for a full week. Gen X is the most likely to be “not at

all confident” that they are doing what is needed to meet

longer-term goals, such as saving for retirement.

“No matter their life stage, or tax situation, H&R Block

helps hardworking Americans receive the best possible outcome at

tax time—with the care, dependability and expertise for which we

are known,” said Campbell.

To learn more and read the full Outlook on American Life report,

please visit

www.hrblock.com/outlook-on-american-life/.

To view media assets, including a downloadable report and

infographics, visit

www.hrblock.com/tax-center/media-kit/outlook-on-american-life-report-media-kit/.

1 “Annual Costs to Raise a Small Child Increased By 19.3%

Nationwide to $21,681 Between 2016 and 2021,” LendingTree.

https://www.lendingtree.com/debt-consolidation/raising-a-child-study/

2 “Filing season statistics for week ending May 10, 2024,” IRS.

https://www.irs.gov/newsroom/filing-season-statistics-for-week-ending-may-10-2024

About H&R BlockH&R Block, Inc. (NYSE:

HRB) provides help and inspires confidence in its clients and

communities everywhere through global tax preparation services,

financial products, and small-business solutions. The company

blends digital innovation with human expertise and care as it helps

people get the best outcome at tax time and also be better with

money using its mobile banking app, Spruce. Through Block Advisors

and Wave, the company helps small-business owners thrive with

year-round bookkeeping, payroll, advisory, and payment processing

solutions. For more information, visit H&R Block News.

|

Media Contacts: |

| Media Relations: |

Heather Woodard, (816) 379-2568,

heather.woodard@hrblock.com Media Desk, mediadesk@hrblock.com |

| |

|

| Investor Relations: |

Jordyn Eskijian, (816) 854-5674,

jordyn.eskijian@hrblock.com |

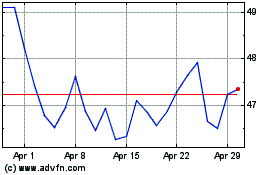

H and R Block (NYSE:HRB)

Historical Stock Chart

From Nov 2024 to Dec 2024

H and R Block (NYSE:HRB)

Historical Stock Chart

From Dec 2023 to Dec 2024