Gulfport Energy Corporation (NYSE: GPOR) (“Gulfport” or the

“Company”) today reported financial and operating results for the

three months ended June 30, 2024 and provided an update on its 2024

development plan and financial guidance.

Second Quarter 2024 and Recent Highlights

- Delivered total net production of 1,050.1 MMcfe per day

- Incurred capital expenditures of $122.2 million, below analyst

consensus expectations

- Reported $26.2 million of net loss, $54.0 million of adjusted

net income(1) and $164.4 million of adjusted EBITDA(1)

- Generated $123.5 million of net cash provided by operating

activities and $20.2 million of adjusted free cash flow(1), above

analyst consensus expectations

- Repurchased approximately 160.6 thousand shares for

approximately $25.0 million during the second quarter of 2024

- Completed opportunistic discretionary acreage acquisitions

totaling $19.0 million

- Turned to sales the Company’s first Utica condensate pad in

four years and recently completed drilling of a second Utica

condensate pad in Harrison County, Ohio

Full Year 2024 Outlook

- Narrowing full year 2024 net production guidance to 1,055 MMcfe

- 1,070 MMcfe per day

- Forecasting over $25 million in capital expenditure savings

from operating efficiencies on drilling and completion activities

during 2024, with the allocation of these savings to be determined

pending the commodity price outlook

- Planning to allocate approximately $45 million to targeted

discretionary acreage acquisitions, of which $19.0 million was

deployed during the second quarter of 2024

- Reiterating plans to allocate substantially all 2024 adjusted

free cash flow(1) towards common share repurchases after

discretionary acreage acquisitions

John Reinhart, President and CEO, commented, "During the second

quarter, our drilling and completions teams continued to perform

extremely well and, as a result, we estimate the Company will

realize over $25 million in capital savings on our drilling and

completion activities during 2024. As we navigate a volatile and

ever-changing commodity price environment, the Company retains its

flexibility to dynamically employ these savings pending the

commodity price environment later in the year. These options

include development of our high-quality assets, incremental

shareholder returns, further balance sheet improvements or

enhancing the Company’s inventory runway. Maintaining the Company’s

top-tier financial position allows us the optionality to be

responsive to the market and act quickly to maximize shareholder

value. Further to that, there is no change to our full year capital

guidance at this time pending our ongoing assessment of the

commodity price environment."

Reinhart continued, "The continuous optimization of our

development program emphasizes the free cash flow generation

capability of the Company and highlights the team’s efforts to

lower expenses and capital costs, enhance realized pricing and

prioritize the highest-margin development within our robust,

low-breakeven inventory. We believe the gains realized to date will

create long-lasting improvements in our operations going forward,

allowing Gulfport to reduce our future maintenance capital

requirements on comparable drilling programs or deliver more

activity on similar base capital expenditures in future years.”

"We continue to forecast robust adjusted free cash flow

generation for 2024 and we are pleased to announce today our plans

to allocate approximately $45 million towards targeted

discretionary acreage acquisition opportunities, of which

approximately $19 million was deployed during the second quarter of

2024. In addition to the impact of these recent liquids-rich

inventory additions, the Company’s initial Marcellus development on

our stacked-pay acreage in Belmont County, Ohio continues to

exhibit strong oil performance and we are also very encouraged with

the initial production results from our latest four-well Utica

condensate pad in Harrison County, Ohio that was recently turned to

sales in mid-July. These and other liquids-rich focus areas

targeted for acquisition and development add significant

optionality of high-margin, low-breakeven inventory to augment the

Company’s development plans for years to come. We remain consistent

in our free cash flow allocation framework and will continue to

return substantially all of our full year 2024 adjusted free cash

flow, excluding discretionary acreage acquisitions, to our

shareholders through common stock repurchases," Reinhart

concluded.

A company presentation to accompany the Gulfport earnings

conference call can be accessed by clicking here.

- A non-GAAP financial measure. Reconciliations of these non-GAAP

measures and other disclosures are provided with the supplemental

financial tables available on our website at

www.gulfportenergy.com.

Operational Update

The table below summarizes Gulfport's operated drilling and

completion activity for the second quarter of 2024:

Quarter Ended June 30,

2024

Gross

Net

Lateral Length

Spud

Utica

5

5.0

12,700

SCOOP

—

—

—

Drilled

Utica

3

3.0

14,300

SCOOP

2

1.5

12,500

Completed

Utica

8

7.5

18,200

SCOOP

—

—

—

Turned-to-Sales

Utica

4

3.8

19,200

SCOOP

—

—

—

Gulfport’s net daily production for the second quarter of 2024

averaged 1,050.1 MMcfe per day, primarily consisting of 836.9 MMcfe

per day in the Utica/Marcellus and 213.2 MMcfe per day in the

SCOOP. For the second quarter of 2024, Gulfport’s net daily

production mix was comprised of approximately 92% natural gas, 6%

natural gas liquids ("NGL") and 2% oil and condensate.

Three Months Ended June 30,

2024

Three Months Ended June 30,

2023

Production

Natural gas (Mcf/day)

972,487

945,910

Oil and condensate (Bbl/day)

2,747

3,533

NGL (Bbl/day)

10,195

12,036

Total (Mcfe/day)

1,050,137

1,039,323

Average Prices

Natural Gas:

Average price without the impact of

derivatives ($/Mcf)

$

1.63

$

1.85

Impact from settled derivatives

($/Mcf)

$

1.03

$

0.57

Average price, including settled

derivatives ($/Mcf)

$

2.66

$

2.42

Oil and condensate:

Average price without the impact of

derivatives ($/Bbl)

$

76.51

$

70.30

Impact from settled derivatives

($/Bbl)

$

(1.08

)

$

1.15

Average price, including settled

derivatives ($/Bbl)

$

75.43

$

71.45

NGL:

Average price without the impact of

derivatives ($/Bbl)

$

28.18

$

23.80

Impact from settled derivatives

($/Bbl)

$

(0.25

)

$

2.47

Average price, including settled

derivatives ($/Bbl)

$

27.93

$

26.27

Total:

Average price without the impact of

derivatives ($/Mcfe)

$

1.99

$

2.20

Impact from settled derivatives

($/Mcfe)

$

0.94

$

0.56

Average price, including settled

derivatives ($/Mcfe)

$

2.93

$

2.76

Selected operating metrics

Lease operating expenses ($/Mcfe)

$

0.17

$

0.17

Taxes other than income ($/Mcfe)

$

0.07

$

0.08

Transportation, gathering, processing and

compression expense ($/Mcfe)

$

0.91

$

0.91

Recurring cash general and administrative

expenses ($/Mcfe) (non-GAAP)

$

0.12

$

0.11

Interest expenses ($/Mcfe)

$

0.16

$

0.15

Capital Investment

Capital investment was $122.2 million (on an incurred basis) for

the second quarter of 2024, of which $106.2 million related to

drilling and completion (“D&C”) activity and $16.0 million

related to maintenance leasehold and land investment. In addition,

Gulfport invested approximately $19.0 million in discretionary

acreage acquisitions.

For the six-month period ended June 30, 2024, capital investment

was $246.5 million (on an incurred basis), of which $212.5 million

related to D&C activity and $34.0 million to maintenance

leasehold and land investment. In addition, Gulfport invested

approximately $19.0 million in discretionary acreage

acquisitions.

Common Stock Repurchase Program

Gulfport repurchased approximately 160.6 thousand shares of

common stock at a weighted-average price of $155.65 during the

second quarter of 2024, totaling approximately $25.0 million. As of

July 29, 2024, the Company had repurchased approximately 4.8

million shares of common stock at a weighted-average share price of

$96.42 since the program initiated in March 2022, totaling

approximately $461.2 million in aggregate. The Company currently

has approximately $188.8 million of remaining capacity under the

share repurchase program.

Financial Position and Liquidity

As of June 30, 2024, Gulfport had approximately $1.2 million of

cash and cash equivalents, $130.0 million of borrowings under its

revolving credit facility, $63.8 million of letters of credit

outstanding and $550 million of outstanding 2026 senior notes.

Gulfport’s liquidity at June 30, 2024, totaled approximately

$707.4 million, comprised of the $1.2 million of cash and cash

equivalents and approximately $706.2 million of available borrowing

capacity under its credit facility.

Derivatives

Gulfport enters into commodity derivative contracts on a portion

of its expected future production volumes to mitigate the Company's

exposure to commodity price fluctuations. For details, please refer

to the "Derivatives" section provided with the supplemental

financial tables available on our website at

ir.gulfportenergy.com.

Second Quarter 2024 Conference Call

Gulfport will host a teleconference and webcast to discuss its

second quarter of 2024 results beginning at 9:00 a.m. ET (8:00 a.m.

CT) on Wednesday, August 7, 2024.

The conference call can be heard live through a link on the

Gulfport website, www.gulfportenergy.com. In addition, you may

participate in the conference call by dialing 866-373-3408

domestically or 412-902-1039 internationally. A replay of the

conference call will be available on the Gulfport website and a

telephone audio replay will be available from August 7, 2024 to

August 21, 2024, by calling 877-660-6853 domestically or

201-612-7415 internationally and then entering the replay passcode

13747661.

Financial Statements and Guidance Documents

Second quarter of 2024 earnings results and supplemental

information regarding quarterly data such as production volumes,

pricing, financial statements and non-GAAP reconciliations are

available on our website at ir.gulfportenergy.com.

Non-GAAP Disclosures

This news release includes non-GAAP financial measures. Such

non-GAAP measures should be not considered as an alternative to

GAAP measures. Reconciliations of these non-GAAP measures and other

disclosures are provided with the supplemental financial tables

available on our website at ir.gulfportenergy.com.

About Gulfport

Gulfport is an independent natural gas-weighted exploration and

production company focused on the exploration, acquisition and

production of natural gas, crude oil and NGL in the United States

with primary focus in the Appalachia and Anadarko basins. Our

principal properties are located in eastern Ohio targeting the

Utica and Marcellus formations and in central Oklahoma targeting

the SCOOP Woodford and SCOOP Springer formations.

Forward Looking Statements

This press release includes “forward-looking statements” for

purposes of the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995, Section 27A of the Securities Act of

1933, as amended, and Section 21E of the Securities Exchange Act of

1934. Forward-looking statements are statements other than

statements of historical fact. They include statements regarding

Gulfport’s current expectations, management's outlook guidance or

forecasts of future events, projected cash flow and liquidity,

inflation, share repurchases and other return of capital plans, its

ability to enhance cash flow and financial flexibility, future

production and commodity mix, plans and objectives for future

operations, the ability of our employees, portfolio strength and

operational leadership to create long-term value and the

assumptions on which such statements are based. Gulfport believes

the expectations and forecasts reflected in the forward-looking

statements are reasonable, Gulfport can give no assurance they will

prove to have been correct. They can be affected by inaccurate or

changed assumptions or by known or unknown risks and uncertainties.

Important risks, assumptions and other important factors that could

cause future results to differ materially from those expressed in

the forward-looking statements are described under "Risk Factors"

in Item 1A of Gulfport’s annual report on Form 10-K for the year

ended December 31, 2023 and any updates to those factors set forth

in Gulfport's subsequent quarterly reports on Form 10-Q or current

reports on Form 8-K (available at

https://www.gulfportenergy.com/investors/sec-filings). Gulfport

undertakes no obligation to release publicly any revisions to any

forward-looking statements, to report events or to report the

occurrence of unanticipated events.

Investors should note that Gulfport announces financial

information in SEC filings, press releases and public conference

calls. Gulfport may use the Investors section of its website

(www.gulfportenergy.com) to communicate with investors. It is

possible that the financial and other information posted there

could be deemed to be material information. The information on

Gulfport’s website is not part of this filing.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240806246517/en/

Investor Contact: Jessica Antle – Vice President,

Investor Relations jantle@gulfportenergy.com 405-252-4550

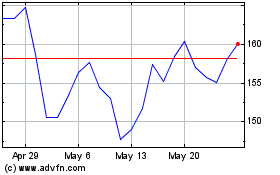

Gulfport Energy (NYSE:GPOR)

Historical Stock Chart

From Oct 2024 to Nov 2024

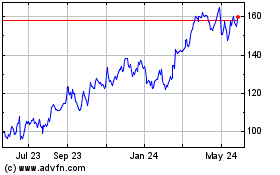

Gulfport Energy (NYSE:GPOR)

Historical Stock Chart

From Nov 2023 to Nov 2024