Filed with the Securities and Exchange Commission

on January 7, 2025

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Guild Holdings Company

(Exact name of registrant as specified in its

charter)

| Delaware |

|

6162 |

|

85-2453154 |

|

(State or other jurisdiction of

incorporation or organization) |

|

(Primary Standard Industrial

Classification Code Number) |

|

(I.R.S. Employer

Identification Number) |

5887 Copley Drive

San Diego, California 92111

(858) 560-6330

(Address, including zip code, and telephone

number, including area code, of registrant’s principal executive offices)

Terry L. Schmidt

Chief Executive Officer

Guild Holdings Company

5887 Copley Drive

San Diego, California 92111

(858) 560-6330

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies to:

| |

|

|

|

Desiree A. Kramer

Chief Financial Officer

Guild Holdings Company

5887 Copley Drive

San Diego, California 92111

(858) 560-6330 |

|

April Hamlin

Ballard Spahr LLP

2000 IDS Center

80 South 8th Street

Minneapolis, MN 55402-2119

Tel: (612) 371-3211 |

Approximate date of commencement of proposed sale to the public:

From time to time after the effective date of this Registration Statement.

If the only securities being registered on this Form are being

offered pursuant to dividend or interest reinvestment plans, check the following box. ¨

If any of the securities being registered on this Form are to

be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered

only in connection with dividend or interest reinvestment plans, check the following box. x

If this Form is filed to register additional securities for an

offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under

the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration

statement for the same offering. ¨

If this Form is a registration statement pursuant to General Instruction

I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under

the Securities Act, check the following box. ¨

If this Form is a post-effective amendment to a registration statement

filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under

the Securities Act, check the following box. ¨

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of

“large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth

company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

|

¨ |

|

Accelerated filer |

|

x |

| |

|

|

|

| Non-accelerated filer |

|

¨ |

|

Smaller reporting company |

|

x |

| |

|

|

|

| |

|

|

|

Emerging growth company |

|

¨ |

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 7(a)(2)(B) of the Securities Act. ¨

The Registrant hereby amends this Registration Statement on such

date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states

that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of

1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting

pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete

and may be changed. The selling stockholders may not sell these securities until the registration statement filed with the Securities

and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and the selling stockholders are not soliciting

offers to buy these securities, in any state where the offer or sale of these securities is not permitted.

SUBJECT

TO COMPLETION, DATED JANUARY 7, 2025

PROSPECTUS

48,499,632 Shares

Guild Holdings

Company

Class A

Common Stock

This prospectus relates to the offer

and sale from time to time by the selling stockholders (which term as used in this prospectus includes their respective transferees,

pledgees, distributees, donees, and successors–in–interest) named herein of up to 48,499,632 shares of our Class A common

stock. The shares covered by this prospectus include shares of our Class A common stock resulting from the conversion of shares

of our Class B common stock held by one of the selling stockholders. The registration of the securities covered by this prospectus

does not mean that the selling stockholders will offer or sell any of the securities. We are not offering any shares of common stock

under this prospectus and will not receive any of the proceeds from sales or other dispositions of the shares of common stock under this

prospectus.

The selling stockholders may, from time

to time, sell, transfer or otherwise dispose of the shares or interests therein on any stock exchange, market or trading facility on

which the shares are traded or in private transactions at fixed prices, at market prices prevailing at the time of sale, at prices related

to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices. We will bear all costs, expenses

and fees in connection with the registration of these securities, including with regard to compliance with state securities or “blue

sky” laws. We will also pay the fees and disbursements of one outside counsel for the selling stockholders, as described in the

Registration Rights Agreement (as defined herein). The selling stockholders will bear any underwriting discounts or selling commissions

related to the securities registered hereby and other expenses of the selling stockholders not specifically covered by the terms of the

Registration Rights Agreement. See “Plan of Distribution” beginning on page 12 of this prospectus.

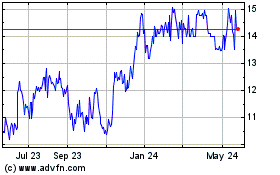

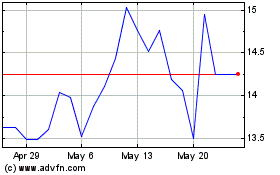

Our Class A common stock is listed

on the New York Stock Exchange under the symbol “GHLD”. On January 3, 2025, the last reported sale price of our Class A

common stock was $13.76 per share.

You should read this prospectus and

any prospectus supplement, together with additional information described under the headings “Incorporation of Certain Information

by Reference” and “Where You Can Find More Information,” carefully before you invest in any of our securities.

Investing in our Class A common

stock involves a high degree of risk. See “Risk Factors” beginning on page 5 of this prospectus and under similar headings

in the documents incorporated by reference into this prospectus.

NEITHER THE SECURITIES AND EXCHANGE

COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY

OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this

prospectus is , 2025

TABLE OF CONTENTS

Page

ABOUT THIS PROSPECTUS

This prospectus is filed in conjunction

with a registration statement that we filed with the Securities and Exchange Commission. Under this registration process, the selling

stockholders may from time to time sell up to 48,499,632 shares of our Class A common stock in one or more offerings. This prospectus

provides you with a general description of the securities that our selling stockholders may offer. Specific information about the offering

may also be included in a prospectus supplement, which may update or change information included in this prospectus. You should read

both this prospectus and any prospectus supplement together with additional information described under the headings “Where You

Can Find More Information” and “Incorporation of Certain Information by Reference” before deciding to invest in our

Class A common stock.

You should rely only on the information

contained in this prospectus, any amendment or supplement to this prospectus or any free writing prospectus prepared by us or on our

behalf. Neither we, nor the selling stockholders, have authorized any other person to provide you with different or additional information.

Neither we, nor the selling stockholders, take responsibility for, nor can we provide assurance as to the reliability of, any other information

that others may provide. The selling stockholders are not making an offer to sell these securities in any jurisdiction where the offer

or sale is not permitted. The information contained in this prospectus is accurate only as of the date of this prospectus or such other

date stated in this prospectus, and our business, financial condition, results of operations and/or prospects may have changed since

those dates.

Except as otherwise set forth in this

prospectus, neither we nor the selling stockholders have taken any action to permit a public offering of these securities outside the

United States or to permit the possession or distribution of this prospectus outside the United States. Persons outside the United States

who come into possession of this prospectus must inform themselves about and observe any restrictions relating to the offering of these

securities and the distribution of this prospectus outside the United States.

PROSPECTUS SUMMARY

The following summary highlights

information contained or incorporated by reference elsewhere in this prospectus and does not contain all of the information that you

should consider in making your investment decision. Before investing in our Class A common stock, you should carefully read this

entire prospectus, including our financial statements and the related notes and other documents incorporated by reference into this prospectus,

as well as the information under the caption “Risk Factors” herein and under similar headings in the other documents that

are incorporated by reference into this prospectus.

Except as otherwise indicated herein

or as the context otherwise requires, references in this prospectus to “Guild,” the “company,” “we,”

“us” and “our” refer to Guild Holdings Company, together with our subsidiary, Guild Mortgage Company LLC.

Company Overview

Guild is a growth-oriented mortgage

company that employs a relationship-based loan sourcing strategy to execute on our mission of delivering the promise of homeownership

in neighborhoods and communities across the United States. Our business model is centered on providing a personalized mortgage-borrowing

experience that is delivered by our knowledgeable loan officers and supported by our diverse product offerings.

Our business is operated through our

wholly-owned subsidiary, Guild Mortgage Company. Guild Mortgage Company was founded in 1960 in California.

Guild is among the longest-operating

mortgage seller-servicers in the United States. Over the course of our operating history, we have navigated numerous economic cycles

and market dislocations. We have also expanded our retail origination operation to 49 states, operating our origination segment from

approximately 450 branch locations as of September 30, 2024 and we have developed end-to-end technology systems, a reputable brand,

industry expertise and many durable relationships with our clients and members of our referral network.

In 2007, seeing an opportunity to expand

our sales and production strategy and grow our market share, a management-led partnership that included a majority investment from Fulcrum

Mortgage, LLC, now known as McCarthy Capital Mortgage Investors, LLC, or MCMI, acquired Guild Mortgage Company LLC, or GMC, from its

founder.

Immediately prior to our initial public

offering in 2020, we engaged in an internal reorganization that simplified our organizational structure, incorporating Guild Holdings

Company in Delaware, making Guild Mortgage Company its wholly owned subsidiary and converting Guild Mortgage Company to a California

limited liability company.

Our business model benefits from the

complementary relationship between our origination and servicing segments which, together, have propelled our performance through interest

rate and market cycles. We believe that maintaining both an origination segment and a servicing segment provides us with a more balanced

business model in both rising and declining interest rate environments, compared to industry participants that predominantly focus on

either origination or servicing, instead of both. Typically, in an interest rising market environment, originations tend to shift to

purchase originations rather than refinances. Due to our physical presence and footprint throughout the country we believe that we are

in an advantageous position when the market is more purchase focused as compared to our competitors that are more refinance focused and

have to significantly change their business model during purchase cycles.

Our Business Model

Our origination strategy focuses on

increasing our purchase-mortgage business and providing a superior personalized mortgage-borrowing experience that encourages our clients

to return to us. This is successfully executed through a combination of our experienced loan officers, our technology platform, and diverse

product offerings. Our business model provides clients with both a digital interface and an experienced team that delivers high-tech,

high-touch client service, allowing clients to engage with us in whatever format and frequency provides them the most comfort and convenience.

This strategy allows us to generate consistent origination volume through differing market environments, contributes to our servicing

segment and facilitates business from repeat clients.

Our in-house servicing platform creates

opportunities to extend our relationship with clients and generates refinance and purchase volume that replenishes run-off from our servicing

portfolio. In coordination with our portfolio recapture team, our loan officers handle recapture activity for their existing client base

directly, rather than outsourcing that function through a call center. This approach creates a continuous client relationship that we

believe encourages repeat business. In addition, our scalable servicing platform provides a recurring stream of revenue that is complementary

to our origination business.

Company Information

We were incorporated in the State of

Delaware on August 11, 2020, in connection with our initial public offering. GMC was incorporated in the State of California on

August 10, 1960 and was converted into a limited liability company in October 2020. Our principal executive office is located

at 5887 Copley Drive, San Diego, California 92111, and our telephone number at that address is (858) 560-6330. Our website address is

www.guildmortgage.com. Information contained on or accessible through our website is not incorporated by reference into this prospectus,

and you should not consider that information to be part of this prospectus or in deciding whether to purchase shares of our Class A

common stock.

The Offering

| Class A common stock being offered by the selling stockholders |

Up to 48,499,632 shares of Class A common stock (including 40,333,019 shares

of Class A common stock resulting from the conversion of shares of Class B common stock) |

| Class A Common stock outstanding |

21,552,795 shares (as of October 31, 2024) |

| Use of proceeds |

The selling stockholders will receive all of the proceeds from the sale of the

shares offered for sale by them under this prospectus. We will not receive proceeds from the sale of the shares by the selling stockholders. |

| New York Stock Exchange (“NYSE”) symbol |

“GHLD” |

| Risk factors |

Investing in our Class A common stock involves a high degree of risk. You

should carefully review and consider the “Risk Factors” section of this prospectus beginning on page 5 and the other

information included in this prospectus and incorporated by reference herein for a discussion of factors to consider before deciding

to invest in shares of our Class A common stock. |

The number of shares of Class A

common stock outstanding as of October 31, 2024 excludes:

| |

· |

|

1,200,183 shares of Class A common stock issuable

upon the vesting and settlement of restricted stock units outstanding as of October 31, 2024; |

| |

· |

|

3,717,031shares of Class A common stock reserved for

future issuance under our 2020 Omnibus Incentive Plan as of October 31, 2024; and |

| |

· |

|

40,333,019 shares of Class A common stock issuable

upon conversion of 40,333,019 shares of Class B common stock outstanding as of October 31, 2024, all of which shares of

Class A common stock are being offered by one of the selling stockholders under this prospectus. |

Unless otherwise indicated, all information

contained in this prospectus assumes no settlement of the outstanding restricted stock units described above.

RISK FACTORS

Investing in our Class A common

stock involves a high degree of risk. You should consider carefully the risks and uncertainties described in the section entitled “Risk

Factors” contained in our Annual Report on Form 10-K for the year ended December 31, 2023, as filed with the SEC on March 14, 2024, as well as any amendment or updates to our risk factors reflected in subsequent filings with the SEC, which descriptions are incorporated

into this prospectus by reference in their entirety, as well as in any prospectus supplement hereto. These risks and uncertainties are

not the only risks and uncertainties we face. Additional risks and uncertainties not currently known to us, or that we currently view

as immaterial, may also impair our business. If any of the risks or uncertainties described in our SEC filings or any additional risks

and uncertainties actually occur, our business, financial condition, results of operations and cash flow could be materially and adversely

affected. In that case, the trading price of our Class A common stock could decline and you might lose all or part of your investment.

The number of shares of Class A

common stock being registered for sale is significant in relation to the number of our outstanding shares of Class A common stock

We have filed a registration statement

of which this prospectus is a part to register shares of Class A common stock offered hereunder for sale into the public market

by the selling stockholders. These shares of Class A common stock offered under this prospectus and any prospectus supplement represent

a significant percentage of the shares of our outstanding Class A common stock, and if sold in the market all at once or at about

the same time, could likely depress the market price of our Class A common stock. The possible sale of a large percentage of such

shares during the period the registration statement remains effective also could depress the market price of our Class A common

stock and adversely affect our ability to raise equity capital, if desired.

CAUTIONARY NOTE

REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the information

incorporated by reference contains forward-looking statements. These forward-looking statements reflect our current views with respect

to, among other things, future events and our financial performance. These statements are often, but not always, made through the use

of words or phrases such as “may,” “should,” “could,” “predict,” “potential,”

“believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,”

“seek,” “estimate,” “intend,” “plan,” “projection,” “would” and

“outlook,” or the negative version of those words or other comparable words or phrases of a future or forward-looking nature.

These forward-looking statements are not historical facts and are based on current expectations, estimates and projections about our

industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain

and beyond our control. Accordingly, we caution you that any such forward-looking statements are not guarantees of future performance

and are subject to risks, assumptions and uncertainties that are difficult to predict. Although we believe that the expectations reflected

in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the

results expressed or implied by the forward-looking statements.

Important factors that could cause our

actual results to differ materially from those indicated in these forward-looking statements include, but are not limited to, the following:

| · | A disruption in the secondary home

loan market or our ability to sell the loans that we originate could have a detrimental effect

on our business. |

| · | Macroeconomic and U.S. residential

real estate market conditions have and may continue to materially and adversely affect our

revenue and results of operations. |

| · | Because we are highly dependent

on certain U.S. government-sponsored entities and government agencies, we may be adversely

impacted by any organizational or pricing changes or changes in our relationship with these

entities and agencies. |

| · | Changes in prevailing interest

rates or U.S. monetary policies have had and may continue to have a detrimental effect on

our business. |

| · | Our servicing rights are subject

to termination with or without cause. |

| · | If a significant number of our

warehouse lines of credit, on which we are highly dependent, are terminated or reduced, we

may be unable to find replacement financing on favorable terms, or at all, which would have

a material adverse effect on us. |

| · | Our existing and any future indebtedness

could adversely affect our ability to operate our business, our financial condition or the

results of our operations. |

| · | If we do not maintain and improve

the technology infrastructure that supports our origination and servicing platform or if

we suffer any significant disruption in service on our platform, our ability to serve our

clients may be materially and adversely impacted. |

| · | Acquisitions and investments have

in the past, and may in the future, cause our financial results to differ from our expectations

or the expectations of the investment community and we may not be able to achieve anticipated

benefits from such acquisitions and investments. |

| · | Pressure from existing and new

competitors may adversely affect our business, operating results, financial condition and

prospects. |

| · | Our failure to maintain or grow

our historical referral relationships with our referral partners may materially and adversely

affect us. |

| · | We are required to make servicing

advances that can be subject to delays in recovery or may not be recoverable in certain circumstances. |

| · | A substantial portion of our assets

are measured at fair value. From time to time our estimates of their value prove to be inaccurate

and we are required to write them down. |

| · | The success and growth of our business

will depend upon our ability to adapt to and implement technological changes and to develop

and market attractive products and services. |

| · | Adverse events to our clients could

occur, which can result in substantial losses that could adversely affect our financial condition. |

| · | Our business could be materially

and adversely affected by a cybersecurity breach or other vulnerability involving our computer

systems or those of certain third-party service providers. |

| · | Operating and growing our business

may require additional capital, and if capital is not available to us, our business, operating

results, financial condition, and prospects may suffer. |

| · | We are subject to certain operational

risks, including, but not limited to, employee or customer fraud, the obligation to repurchase

sold loans in the event of a documentation error, and data processing system failures and

errors. |

| · | We are periodically required to

repurchase mortgage loans that we have sold or indemnify purchasers of our mortgage loans. |

| · | Seasonality may cause fluctuations

in our financial results. |

| · | If we fail to protect our brand

and reputation, our ability to grow our business and increase the volume of mortgages we

originate and service may be adversely affected. |

| · | We are subject to certain risks

associated with investing in real estate and real estate related assets, including risks

of loss from adverse weather conditions, man-made or natural disasters, pandemics, terrorist

attacks and the effects of climate change. |

| · | If we are unable to attract, integrate

and retain qualified personnel, our ability to develop and successfully grow our business

could be harmed. |

| · | Our risk management strategies

may not be fully effective in mitigating our risk exposures in all market environments or

against all types of risk. |

| · | Changes in, or our failure to comply

with, the highly complex legal and regulatory framework applicable to our mortgage loan origination

and servicing activities could harm our business, operating results, financial condition,

and prospects. |

| · | Our failure to comply with fair

lending laws and regulations could lead to a wide variety of negative consequences. |

| · | Our failure to obtain and maintain

the appropriate state licenses would prohibit us from originating or servicing mortgages

in those states and adversely affect our operations. |

| · | Changes in the guidelines of the

Federal National Mortgage Association, or Fannie Mae, the Federal Home Loan Mortgage Corporation,

or Freddie Mac (Fannie Mae and Freddie Mac, together, the “GSEs”), the Federal

Housing Administration, or FHA, the U.S. Department of Veterans Affairs, U.S. Department

of Agriculture, and Government National Mortgage Association, or Ginnie Mae, could adversely

affect our business |

| · | Material changes to the laws, regulations

or practices applicable to reverse mortgage programs operated by FHA and U.S. Housing and

Urban Development could adversely affect our reverse mortgage business. |

| · | Our actual or perceived failure

to comply with stringent and evolving legal obligations related to data privacy and security

may materially and adversely affect us. |

| · | We may from time to time be subject

to litigation, which may be extremely costly to defend, could result in substantial judgment

or settlement costs and could subject us to other remedies. |

| · | We are controlled by MCMI, one

of the selling stockholders, and MCMI’s interests may conflict with our interests and

the interests of our other stockholders. |

| · | Our directors and executive officers

have significant control over our business. |

| · | As a “controlled company,”

we rely on exemptions from certain corporate governance requirements that provide protection

to stockholders of other companies. If we lose such status as a result of sales under this

prospectus, we will need to comply with such corporate governance requirements. |

| · | We are a holding company and depend

upon distributions from GMC to meet our obligations. |

| · | Sales of a substantial number of

shares of our Class A common stock by our existing stockholders in the public market,

including pursuant to this prospectus, could cause the price of our Class A common stock

to fall. |

| · | Our issuance of capital stock in

connection with financings, acquisitions, investments, our equity incentive plans or otherwise

would dilute all other stockholders. |

| · | There is no assurance that we will

pay dividends in the future. |

| · | Certain provisions in our certificate

of incorporation and bylaws and of Delaware law may prevent or delay an acquisition of Guild,

which could decrease the trading price of our stock. |

| · | The dual class structure of our

common stock may adversely affect the trading market for our Class A common stock. |

| · | Our quarterly and annual operating

results or other operating metrics may fluctuate significantly and may not meet expectations

of research analysts, which could cause the trading price of our Class A common stock

to decline. |

| · | If we fail to maintain effective

internal control over financial reporting or disclosure controls and procedures, we may be

unable to report our financial results accurately on a timely basis, which would result in

the loss of investor confidence, delisting, claims or investigations, and cause the market

price of our Class A common stock to decline. |

The foregoing factors should not be

construed as exhaustive and should be read together with the other cautionary statements included in this prospectus and in the information

incorporated by reference. If one or more events related to these or other risks or uncertainties materialize, or if our underlying assumptions

prove to be incorrect, actual results may differ materially from what we anticipate. Many of the important factors that will determine

these results are beyond our ability to control or predict. Accordingly, you should not place undue reliance on any such forward-looking

statements. Any forward-looking statement speaks only as of the date on which it is made, and, except as otherwise required by law, we

do not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future

developments or otherwise. New factors emerge from time to time, and it is not possible for us to predict which will arise. In addition,

we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual

results to differ materially from those contained in any forward-looking statements.

DIVIDEND POLICY

Our board of directors declares and

pays dividends from time to time, after consideration of the availability of funds and future earnings, if any, to support our operations

and finance the growth and development of our business. Our board of directors declared and paid $30.7 million in common stock dividends

during the nine months ended September 30, 2024 and declared and paid $30.5 million in dividends during the year ended December 31,

2023. Dividends are paid to the holders of our Class A common stock and Class B common stock in accordance with our certificate

of incorporation. Any future determination to declare and pay cash dividends, if any, will be made at the discretion of our board of

directors and will depend on a variety of factors, including applicable laws, our financial condition, results of operations, contractual

restrictions, capital requirements, business prospects, general business or financial market conditions, and other factors our board

of directors may deem relevant. As a Delaware corporation, we are subject to certain restrictions on dividends under the Delaware General

Corporation Law. Generally, a Delaware corporation may only pay dividends either out of “surplus” or out of the current or

the immediately preceding year’s net profits. Surplus is defined as the excess, if any, at any given time, of the total assets

of a corporation over its total liabilities and statutory capital. The value of a corporation’s assets can be measured in a number

of ways and may not necessarily equal their book value.

We are a holding company and have no

material assets other than our ownership of equity interests in GMC, which is our wholly owned subsidiary. Our ability to pay cash dividends

will depend on our receipt of distributions from our current or future operating subsidiaries and such distributions may be restricted

as a result of regulatory restrictions or contractual agreements, including agreements governing our indebtedness. See “Risk Factors

— Risks Related to Our Organization and Structure — We are a holding company and depend upon distributions from GMC to meet

our obligations” in our Annual Report on Form 10-K for the year ended December 31, 2023, which is incorporated herein

by reference. In addition, any future debt financing arrangement will likely contain terms restricting or limiting the amount of dividends

that may be declared or paid on our common stock.

Investors should not purchase our Class A

common stock with the expectation of receiving cash dividends.

USE OF PROCEEDS

We are filing the registration statement

of which this prospectus forms a part to permit the holders of the shares of our Class A common stock described in the section entitled

“Selling Stockholders” to resell such shares. We are not selling any securities under this prospectus, and we will not receive

any proceeds from the sale or other disposition of shares of our Class A common stock held by the selling stockholders.

We will bear all costs, expenses and

fees in connection with the registration of these securities, including with regard to compliance with state securities or “blue

sky” laws. We will also pay the fees and disbursements of one outside counsel for the selling stockholders, as described in the

Registration Rights Agreement (as defined herein). The selling stockholders will bear any underwriting discounts or selling commissions

related to the securities registered hereby and other expenses of the selling stockholders not specifically covered by the terms of the

Registration Rights Agreement.

DESCRIPTION OF

OUR CAPITAL STOCK

As of the date of this prospectus, we

have one class of securities registered under Section 12 of the Securities Exchange Act of 1934, as amended, or the Exchange Act,

which is our Class A common stock. We also have Class B common stock authorized and outstanding, and preferred stock authorized,

none of which is outstanding, as of the date of this prospectus. The description of the general terms of our Class A common stock,

Class B common stock and other capital stock is incorporated by reference as Exhibit 4.1 to our Annual Report on Form 10-K

for the fiscal year ended December 31, 2023, filed with the SEC on March 14, 2024, and that description has been incorporated

by reference into this prospectus as described in “Information Incorporated by Reference” below. That summary of our Class A

common stock does not purport to be complete and is subject to, and is qualified in its entirety by express reference to, the provisions

of our Amended and Restated Certificate of Incorporation, or our Certificate of Incorporation, and our Amended and Restated Bylaws currently

in effect, or the Bylaws, each of which is incorporated by reference as an exhibit to the Annual Report on Form 10-K for the year ended December 31, 2023. We encourage you to read the Certificate of Incorporation, the Bylaws, and the applicable provisions of

the Delaware General Corporation Law, or the DGCL, for additional information.

SELLING STOCKHOLDERS

The selling stockholders may offer and

sell any or all of the shares of our Class A common stock set forth below pursuant to this prospectus. When we refer to the “selling

stockholders” in this prospectus, we mean the persons listed in the table below, and their respective pledgees, donees, permitted

transferees, assignees, successors and others who later come to hold any of the selling stockholders’ interests in shares of our

Class A common stock other than through a public sale.

The following table sets forth, as of

the date of this prospectus, the name of the selling stockholders for whom we are registering shares for sale to the public, the number

of shares of Class A common stock beneficially owned by the selling stockholders prior to this offering, the total number of shares

of Class A common stock that the selling stockholders may offer pursuant to this prospectus and the number of shares of Class A

common stock that the selling stockholders will beneficially own after this offering, as well as the percentages of beneficial ownership

of our Class A common stock and combined voting power of our outstanding common stock held by the selling stockholders prior to

and after this offering.

On October 21, 2020, we entered

into a registration rights agreement, or the Registration Rights Agreement, with McCarthy Capital Mortgage Investors, LLC, or MCMI, and

certain of our other stockholders, including Mary Ann McGarry, a director, Terry L. Schmidt, our Chief Executive Officer, David Neylan,

our President and Chief Operating Officer, and Desiree A. Kramer, our Chief Financial Officer, pursuant to which each of MCMI and the

other stockholders party thereto are entitled to certain rights to require the registration of the sale of certain or all of the shares

of our Class A common stock (or, in the case of MCMI, the shares of our Class A common stock received upon conversion of shares

of our Class B common stock) that they beneficially own. Among other things, under the terms of the Registration Rights Agreement:

| · | if we propose to file certain types

of registration statements under the Securities Act of 1933, as amended, or the Securities

Act, with respect to an offering of equity securities, subject to certain conditions and

exceptions, we will be required to use our reasonable best efforts to offer the stockholders

party to the Registration Rights Agreement the opportunity to register the sale of all or

part of their shares that constitute registrable securities under the Registration Rights

Agreement on the terms and conditions set forth in the Registration Rights Agreement (customarily

known as “piggyback rights”); and |

| · | MCMI has the right, subject to

certain conditions and exceptions, to request that we file (i) registration statements

with the SEC for one or more underwritten offerings of all or some of the shares of our Class A

common stock received upon conversion of shares of our Class B common stock that it

beneficially owns and/or (ii) as soon as we become eligible to register the sale of

our securities on Form S-3 under the Securities Act, a shelf registration statement

that includes all or some of the shares of our Class A common stock received upon conversion

of shares of our Class B common stock that it beneficially owns, and we are required

to cause any such registration statements to be filed with the SEC, and to become (and remain)

effective, as promptly as reasonably practicable. |

The registration rights granted in the

Registration Rights Agreement are subject to customary restrictions such as blackout periods, minimums and limitations on the number

of shares to be included in an underwritten offering. The Registration Rights Agreement also contains customary indemnification and contribution

provisions. The Registration Rights Agreement is governed by Delaware law.

The number of shares beneficially owned

by each stockholder is determined under rules of the SEC and includes voting or investment power with respect to securities. Under

these rules, beneficial ownership includes any shares as to which the individual or entity has sole or shared voting power or investment

power. In computing the number of shares beneficially owned by an individual or entity and the percentage ownership of that person, shares

of common stock subject to options, warrants or other rights held by such person that are currently exercisable or will become exercisable

within 60 days are considered outstanding, although these shares are not considered outstanding for purposes of computing the percentage

ownership of any other person.

Unless otherwise indicated, the address

of all listed stockholders is c/o Guild Holdings Company, 5887 Copley Drive, San Diego, California 92111. Each of the stockholders listed

has sole voting and investment power with respect to the shares beneficially owned by the stockholder unless noted otherwise, subject

to community property laws where applicable.

Based on the information provided to

us by the selling stockholders, assuming that the selling stockholders sell all of the shares of our Class A common stock beneficially

owned by them that have been registered by us and do not acquire any additional shares during the offering, the selling stockholders

will not own any shares, as reflected in the column entitled “Beneficial Ownership After This Offering.” We cannot advise

you as to whether the selling stockholders will in fact sell any or all of such shares of Class A common stock. In addition, the

selling stockholders may have sold, transferred or otherwise disposed of, or may sell, transfer or otherwise dispose of, at any time,

the shares of our Class A common stock in transactions exempt from the registration requirements of the Securities Act after the date on which they provided the information set forth in the table below.

| | |

Shares of Class A

Common Stock

Owned Prior to

this Offering | |

Shares of

Class A

Common

Stock

Being

Offered | |

Beneficial

Ownership

After this

Offering(1)(2) | |

Combined Voting

Power(3) | |

| Name | |

Number of

Shares | |

% | |

| |

Number

of

Shares | |

% | |

Before

this

Offering | |

After

this

Offering | |

| McCarthy Capital Mortgage Investors, LLC(4) | |

40,333,019 | |

65.2 | |

40,333,019 | |

0 | |

0 | |

94.9 | |

0 | |

| Desiree Amber Kramer | |

248,735 | |

* | |

248,735 | |

0 | |

| |

* | |

0 | |

| David Neylan | |

381,705 | |

* | |

381,705 | |

0 | |

| |

* | |

0 | |

| Mary Ann McGarry(5) | |

4,760,243 | |

7.7 | |

4,760,243 | |

0 | |

| |

1.1 | |

0 | |

| McGarry Strategic Enterprises, LLC(6) | |

4,380,740 | |

7.1 | |

4,380,740 | |

0 | |

| |

1.0 | |

0 | |

| Terry L. Schmidt | |

2,775,930 | |

4.5 | |

2,775,930 | |

0 | |

| |

* | |

0 | |

| * |

Represents less than 1% of outstanding shares. |

| (1) |

Assumes the sale of all shares of Class A common stock registered pursuant

to this prospectus, although the selling stockholders are under no obligation known to us to sell any shares of Class A common

stock at this time. |

| |

|

| (2) |

The beneficial ownership of the Company’s common stock is based on 21,552,795 shares of Class A

common stock and 40,333,019 shares of Class B common stock issued and outstanding. The voting powers, preferences and relative

rights of Class A common stock and Class B common stock are identical in all respects, except that the holders of Class A

common stock have one vote per share and the holders of Class B common stock have ten votes per share. |

| |

|

| (3) |

Percentage of voting power represents the combined voting power with respect to all shares of our

Class A common stock and shares of our Class B common stock, voting together as a single class. |

| |

|

| (4) |

MCMI currently holds 40,333,019 shares of Class B common stock, which shares will automatically

convert to shares of Class A common stock upon any sale under this prospectus or any prospectus supplement. We are

listing the Class A common stock underlying the shares of Class B common stock held by this selling stockholder. McCarthy

Partners Management, LLC (“MPM”) is the manager of MCMI and as such, exercises voting and dispositive control over the

shares held by MCMI. MPM is managed under the exclusive direction of McCarthy Partners, LLC. In his capacity as the President of

McCarthy Partners, LLC, Patrick J. Duffy may be deemed to exercise voting and dispositive control over the shares of Class B

common stock held by MCMI. |

| |

|

| (5) |

Includes 379,503 shares of our Class A common stock held by Mary Ann McGarry and 4,380,740

shares of our Class A common stock held by McGarry Strategic Enterprises, LLC. Mary Ann McGarry serves as the manager of McGarry

Strategic Enterprises, LLC and exercises voting and investment control over the Class A common stock held by McGarry Strategic

Enterprises, LLC. |

| |

|

| (6) |

Mary Ann McGarry serves as the manager of McGarry Strategic Enterprises, LLC and exercises voting

and investment control over the Class A common stock held by McGarry Strategic Enterprises, LLC. |

PLAN OF DISTRIBUTION

We are registering the shares of Class A

common stock issued to the selling stockholders to permit the sale and resale of these shares of common stock by the selling stockholders

from time to time from after the date of this prospectus.

The selling stockholders may, from time

to time, sell any or all of their shares of common stock covered hereby on the New York Stock Exchange or any other stock exchange, market

or trading facility on which the shares are traded or in private transactions. These sales may be at fixed prices, at prevailing market

prices at the time of the sale, at varying prices determined at the time of sale, or at privately negotiated prices. The selling stockholders

may use any one or more of the following methods when selling shares:

| · | ordinary brokerage transactions

and transactions in which the broker-dealer solicits purchasers; |

| · | block trades in which the broker-dealer

will attempt to sell the shares as agent but may position and resell a portion of the block

as principal to facilitate the transaction; |

| · | an over-the-counter distribution

in accordance with the rules of the New York Stock Exchange; |

| · | purchases by a broker-dealer as

principal and resale by the broker-dealer for its account; |

| · | through trading plans entered into

by the selling stockholders pursuant to Rule 10b5-1 under the Exchange Act that are

in place at the time of an offering pursuant to this prospectus and any applicable prospectus

supplement hereto that provide for periodic sales of their securities on the basis of parameters

described in such trading plans; |

| · | through the distribution of the

shares of common stock by the selling stockholder to its partners, members or stockholders; |

| · | an exchange distribution in accordance

with the rules of the applicable exchange; |

| · | through one or more underwritten

offerings on a firm commitment or best efforts basis; |

| · | privately negotiated transactions; |

| · | in options transactions; |

| · | settlement of short sales, to the

extent permitted by law; |

| · | in transactions through broker-dealers

that agree with the selling stockholders to sell a specified number of such shares at a stipulated

price per share; |

| · | through the writing or settlement

of options or other hedging transactions, whether through an options exchange or otherwise; |

| · | in “at the market”

offerings, as defined in Rule 415 under the Securities Act, at negotiated prices, at

prices prevailing at the time of sale or at prices related to such prevailing market prices,

including sales made directly on a national securities exchange or sales made through a market

maker other than on an exchange or other similar offerings through sales agents; |

| · | a combination of any such methods

of sale; or |

| · | any other method permitted pursuant

to applicable law. |

In addition, a selling stockholder that

is an entity may elect to distribute common stock to its members, partners or stockholders in-kind pursuant to the registration statement

of which this prospectus is a part by delivering a prospectus with an appropriate prospectus supplement. Such members, partners or stockholders

would thereby receive freely tradeable securities pursuant to the distribution through a registration statement. To the extent a distributee

is an affiliate of ours (or to the extent otherwise required by law), we may file a prospectus supplement in order to permit the distributees

to use the prospectus to resell the securities acquired in the distribution.

The selling stockholders may also sell

the shares of common stock under Rule 144 under the Securities Act, if available, rather than under this prospectus.

Broker-dealers engaged by the selling

stockholders may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts from

the selling stockholders (or, if any broker-dealer acts as agent for the purchaser of shares, from the purchaser) in amounts to be negotiated,

but, except as set forth in a supplement to this prospectus, in the case of an agency transaction not in excess of a customary brokerage

commission in compliance with FINRA Rule 2121; and in the case of a principal transaction a markup or markdown in compliance with

FINRA IM-2121.

The aggregate proceeds to the selling

stockholders from the sale of the common stock offered by them will be the purchase price of the common stock less discounts or commissions,

if any. Each of the selling stockholders reserves the right to accept and, together with their agents from time to time, to reject, in

whole or in part, any proposed purchase of common stock to be made directly or through agents. We will not receive any of the proceeds

from the sale by the selling stockholders of the shares of common stock.

In connection with the sale of the shares

of common stock or interests therein, the selling stockholders may enter into hedging transactions with broker-dealers or other financial

institutions, which may in turn engage in short sales of the shares of common stock in the course of hedging the positions they assume.

The selling stockholders may also sell the shares of common stock short and deliver these securities to close out their short positions

or to return borrowed shares in connection with such short sales, or loan or pledge the shares of common stock to broker-dealers that

in turn may sell these securities. The selling stockholders may also enter into option or other transactions with broker-dealers or other

financial institutions or create one or more derivative securities which require the delivery to such broker-dealer or other financial

institution of shares of common stock offered by this prospectus, which shares such broker-dealer or other financial institution may

resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

In order to facilitate the offering

of the securities, any underwriters or agents, as the case may be, involved in the offering of such securities may engage in transactions

that stabilize, maintain or otherwise affect the price of our securities. Specifically, the underwriters or agents, as the case may be,

may overallot in connection with the offering, creating a short position in our securities for their own account. In addition, to cover

overallotments or to stabilize the price of our securities, the underwriters or agents, as the case may be, may bid for, and purchase,

such securities in the open market. Finally, in any offering of securities through a syndicate of underwriters, the underwriting syndicate

may reclaim selling concessions allotted to an underwriter or a broker-dealer for distributing such securities in the offering if the

syndicate repurchases previously distributed securities in transactions to cover syndicate short positions, in stabilization transactions

or otherwise. Any of these activities may stabilize or maintain the market price of the securities above independent market levels. The

underwriters or agents, as the case may be, are not required to engage in these activities, and may end any of these activities at any

time.

The selling stockholders may solicit

offers to purchase the securities directly from, and they may sell such securities directly to, institutional investors or others. In

this case, no underwriters or agents likely would be involved.

The selling stockholders and any broker-dealers

or agents that are involved in selling the shares of common stock may be deemed to be “underwriters” within the meaning of

the Securities Act in connection with such sales. In such event, any discounts or commissions received by such selling stockholders,

broker-dealers or agents and any profit on the resale of the shares purchased by them may be deemed to be underwriting commissions or

discounts under the Securities Act. Selling stockholders who are “underwriters” within the meaning of Section 2(11)

of the Securities Act will be subject to the prospectus delivery requirements of the Securities Act and may be subject to certain statutory

liabilities of, including but not limited to, Sections 11, 12 and 17 of the Securities Act and Rule 10b-5 under the Exchange Act.

The selling stockholders have informed us that they are not registered broker-dealers or affiliates of a registered broker-dealer.

We are required to pay certain fees

and expenses incurred by us incident to the registration of the shares and certain fees and expenses of the selling stockholders under

the terms of the Registration Rights Agreement. Under the Registration Rights Agreement, we have agreed to indemnify the selling stockholders

against certain losses, claims, damages and liabilities, including liabilities under the Securities Act, and the selling stockholders

may be entitled to contribution. We may be indemnified by the selling stockholders against certain losses, claims, damages and liabilities,

including liabilities under the Securities Act that may arise from any written information furnished to us by the selling stockholders

specifically for use in this prospectus, or we may be entitled to contribution.

The selling stockholders will be subject

to the prospectus delivery requirements of the Securities Act including Rule 172 thereunder unless an exemption therefrom is available.

We agreed to cause the registration

statement of which this prospectus is a part to remain effective for the period set forth in the Registration Rights Agreement. Shares

of common stock will be sold only through registered or licensed brokers or dealers if required under applicable state securities laws.

In addition, in certain states, the shares of common stock covered hereby may not be sold unless they have been registered or qualified

for sale in the applicable state or an exemption from the registration or qualification requirement is available and complied with.

Under applicable rules and regulations

under the Exchange Act, any person engaged in the distribution of the shares of common stock may not simultaneously engage in market

making activities with respect to the shares of common stock for the applicable restricted period, as defined in Regulation M, prior

to the commencement of the distribution. In addition, the selling stockholders will be subject to applicable provisions of the Exchange

Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of shares

of common stock by the selling stockholders or any other person. We will make copies of this prospectus available to the selling stockholders

and have informed them of the need to deliver a copy of this prospectus at or prior to the time of the sale (including by compliance

with Rule 172 under the Securities Act).

To the extent required, the shares of

our common stock to be sold, the names of the selling stockholders, the respective purchase prices and public offering prices, the names

of any agents, dealers or underwriters, and any applicable commissions or discounts with respect to a particular offer will be set forth

in an accompanying prospectus supplement or, if appropriate, a post-effective amendment to the registration statement that includes this

prospectus.

There can be no assurance that the selling

stockholder will sell any or all of the shares of common stock we registered on behalf of the selling stockholders pursuant to the registration

statement of which this prospectus forms a part.

Once sold under the registration statement

of which this prospectus forms a part, the shares of common stock will be freely tradable in the hands of persons other than our affiliates.

LEGAL MATTERS

The validity of the shares of Class A

common stock being offered by this prospectus will be passed upon for us by Ballard Spahr LLP, Minneapolis, Minnesota.

EXPERTS

The consolidated financial statements

of Guild Holdings Company as of December 31, 2023 and 2022, and for each of the years in the two-year period ended December 31,

2023, have been incorporated by reference herein in reliance upon the report of KPMG LLP, independent registered public accounting firm,

incorporated by reference herein, and upon the authority of said firm as experts in accounting and auditing.

WHERE YOU CAN

FIND MORE INFORMATION

We have filed with the SEC a registration

statement on Form S-3 under the Securities Act, with respect to the shares of Class A common stock offered hereby. This prospectus,

which constitutes a part of the registration statement, does not contain all of the information set forth in the registration statement

or the exhibits and schedules filed therewith. For further information about us and the Class A common stock offered hereby, we

refer you to the registration statement and the exhibits filed thereto. Statements contained in this prospectus regarding the contents

of any contract or any other document that is filed as an exhibit to the registration statement are not necessarily complete, and each

such statement is qualified in all respects by reference to the full text of such contract or other document filed as an exhibit to the

registration statement. We are required to file periodic reports, proxy statements and other information with the SEC pursuant to the

Exchange Act.

The SEC maintains an Internet website

that contains reports, proxy statements and other information about registrants, like us, that file electronically with the SEC. The

address of that site is http://www.sec.gov.

We file periodic reports, proxy statements

and other information with the SEC. Such periodic reports, proxy statements and other information will be available at the website of

the SEC referred to above. We maintain a website at www.guildmortgage.com. You may access our annual reports on Form 10-K, quarterly

reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or

15(d) of the Exchange Act with the SEC free of charge at our website as soon as reasonably practicable after such material is electronically

filed with, or furnished to, the SEC. The reference to our website address does not constitute incorporation by reference of the information

contained on our website, and you should not consider the contents of our website in making an investment decision with respect to our

Class A common stock.

INCORPORATION

OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate

by reference” information from other documents that we file with it, which means that we can disclose important information to

you by referring you to those documents. The information incorporated by reference is considered to be part of this prospectus.

We incorporate by reference into this

prospectus and the registration statement of which this prospectus form a part the information or documents listed below that we have

filed with the SEC, and any future filings we will make with the SEC under Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act

after the date of the initial filing of the registration statement of which this prospectus is a part and prior to effectiveness of such

registration statement, and until the termination of the offering of the shares covered by this prospectus (other than information furnished

under Item 2.02 or Item 7.01 of Form 8-K and exhibits filed on such form that are related to such items):

| |

· |

|

our Quarterly Reports on Form 10-Q for the quarters

ended March 31, 2024, June 30, 2024 and September 30, 2024 filed with the SEC on May 9, 2024, August 8, 2024, and November 7, 2024, respectively; and |

| |

· |

|

our Current Reports on Form 8-K (other than information

furnished rather than filed) filed with the SEC on February 13, 2024 (Items 8.01 and 9.01), May 9, 2024 (Item 8.01) and

May 10, 2024 (Item 5.07). |

Any statement contained in this prospectus

or in a document incorporated or deemed to be incorporated by reference into this prospectus will be deemed to be modified or superseded

for purposes of this prospectus to the extent that a statement contained in this prospectus or any other subsequently filed document

that is deemed to be incorporated by reference into this prospectus modifies or supersedes the statement. Any statements so modified

or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

We will furnish without charge to you,

on written or oral request, a copy of any or all of the documents incorporated by reference into this prospectus, including exhibits

to these documents. You should direct any requests for documents to Guild Holdings Company, 5887 Copley Drive, San Diego, California

92111; telephone: (858) 956-5130.

You also may access these filings on

our website at www.guildmortgage.com. We do not incorporate the information on our website into this prospectus or any supplement to

this prospectus and you should not consider any information on, or that can be accessed through, our website as part of this prospectus

or any supplement to this prospectus (other than those filings with the SEC that we specifically incorporate by reference into this prospectus).

____________

Shares

Class A

Common Stock

PROSPECTUS

, 2025

PART II

— INFORMATION NOT REQUIRED IN PROSPECTUS

| Item 14. |

Other Expenses of Issuance and Distribution |

The expenses payable by Guild Holdings

Company (the “Registrant” or the “Company”) in connection with the issuance and distribution of the securities

being registered (other than underwriting discounts and commissions, if any) are set forth below. Each item listed is estimated, except

for the U.S. Securities and Exchange Commission (the “SEC”) registration fee.

| SEC registration fee | |

$ | 102,172.04 | |

| Accounting fees and expenses | |

| 25,000.00 | |

| Legal fees and expenses | |

| 30,000.00 | |

| Printing fees and miscellaneous expenses | |

| 10,827.96 | |

| Total expenses | |

$ | 168,000.00 | |

| Item 15. |

Indemnification of Directors and Officers |

Section 102(b)(7) of the Delaware

General Corporation Law (“DGCL”) permits a corporation to provide in its certificate of incorporation that a director of

the corporation shall not be personally liable to the corporation or its stockholders for monetary damages for breach of fiduciary duty

as a director, except for liability (1) for any breach of the director’s duty of loyalty to the corporation or its stockholders,

(2) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (3) under

Section 174 of the DGCL (regarding, among other things, the payment of unlawful dividends or unlawful stock purchases or redemptions),

or (4) for any transaction from which the director derived an improper personal benefit. Our certificate of incorporation provides

for such limitation of liability.

Section 145(a) of the DGCL

empowers a corporation to indemnify any director, officer, employee or agent, or former director, officer, employee or agent, who was

or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil,

criminal, administrative or investigative (other than an action by or in the right of the corporation), by reason of such person’s

service as a director, officer, employee or agent of the corporation, or such person’s service, at the corporation’s request,

as a director, officer, employee or agent of another corporation or enterprise, against expenses (including attorneys’ fees), judgments,

fines and amounts paid in settlement actually and reasonably incurred by such person in connection with such action, suit or proceeding;

provided that such director or officer acted in good faith and in a manner reasonably believed to be in or not opposed to the best interests

of the corporation; and, with respect to any criminal action or proceeding, provided that such director or officer had no reasonable

cause to believe his or her conduct was unlawful.

Section 145(b) of the DGCL

empowers a corporation to indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or

completed action or suit by or in the right of the corporation to procure a judgment in its favor by reason of the fact that such person

is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director,

officer, employee or agent of another enterprise, against expenses (including attorneys’ fees) actually and reasonably incurred

in connection with the defense or settlement of such action or suit; provided that such director or officer acted in good faith and in

a manner he or she reasonably believed to be in or not opposed to the best interests of the corporation, except that no indemnification

may be made in respect of any claim, issue or matter as to which such director or officer shall have been adjudged to be liable to the

corporation unless and only to the extent that the Delaware Court of Chancery or the court in which such action or suit was brought shall

determine upon application that, despite the adjudication of liability but in view of all the circumstances of the case, such director

or officer is fairly and reasonably entitled to indemnity for such expenses that the court shall deem proper.

Notwithstanding the preceding sentence,

except as otherwise provided in our bylaws, we are required to indemnify any such person in connection with a proceeding (or part thereof)

commenced by such person only if the commencement of such proceeding (or part thereof) by any such person was authorized by the board

of directors.

Our bylaws require us to indemnify any

person who was or is a party or is threatened to be made a party to or is otherwise involved in any threatened, pending or completed

action, suit or proceeding by reason of the fact that he or she is or was a director or officer of Guild, or is or was serving at the

request of Guild as a director, officer, trustee, employee or agent of another corporation or of a partnership, joint venture, trust

or other enterprise, including service with respect to employee benefit plans maintained or sponsored by Guild, against all expense,

liability and loss (including attorneys’ fees, judgments, fines, ERISA excise taxes or penalties and amounts paid or to be paid

in settlement) incurred or suffered by such person in connection with such proceeding if the person acted in good faith and in a manner

reasonably believed to be in or not opposed to the best interests of Guild and, with respect to any criminal action or proceeding, had

no reasonable cause to believe his or her conduct was unlawful.

We are authorized under our bylaws to

purchase and maintain insurance to protect Guild and any current or former director, officer, employee or agent of Guild or another corporation,

partnership, joint venture, trust or other enterprise against any expense, liability or loss, whether or not Guild would have the power

to indemnify such person against such expense, liability or loss under the DGCL. We believe that these indemnification provisions and

the directors’ and officers’ insurance are useful to attract and retain qualified directors and executive officers.

* Filed

herewith

(a) The undersigned

registrant hereby undertakes:

(1) To file,

during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include

any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii) To reflect

in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective

amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration

statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities

offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range

may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes

in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation of

Filing Fee” table in the effective registration statement; and

(iii) To include

any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material

change to such information in the registration statement;

provided, however, that

paragraphs (1)(i), (ii) and (iii) above do not apply if the information required to be included in a post–effective amendment

by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to section 13 or section

15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement or is contained in

a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2) That,

for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to

be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be

deemed to be the initial bona fide offering thereof.

(3) To remove

from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination

of the offering.

(4) That,

for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

(A) Each prospectus

filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date

the filed prospectus was deemed part of and included in the registration statement; and

(B) Each prospectus

required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B

relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required

by section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the

earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities

in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that

is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities

in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be

the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus

that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration

statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such

effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration

statement or made in any such document immediately prior to such effective date; and

(C) The information

omitted from the form of prospectus filed as part of this registration statement in reliance upon Rule 430A and contained in the

form of prospectus filed by the registrant pursuant to Rule 424(b)(1) or (4) or 497(h) under the Securities Act of

1933 shall be deemed to be part of the registration statement as of the time it was declared effective.

(b) The undersigned

registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s

annual report pursuant to section 13(a) or section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each

filing of an employee benefit plan’s annual report pursuant to section 15(d) of the Securities Exchange Act of 1934) that

is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities

offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

Insofar as indemnification for liabilities

arising under the Securities Act may be permitted for our directors, officers and controlling persons of the Registrant pursuant to our

Certificate of Incorporation or Bylaws, or otherwise, the Registrant has been advised that in the opinion of the SEC such indemnification

is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification

against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer, or controlling

person in the successful defense of any action, suit or proceeding) is asserted by such director, officer, or controlling person in connection

with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling

precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by the Registrant is against public