000005072500000507250000050725000005072500000507250000050725false00000507252023-09-052023-09-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 5, 2023

GRIFFON CORPORATION

(Exact Name of Registrant as Specified in Charter)

Delaware 1-06620 11-1893410

(State or Other Jurisdiction (Commission (I.R.S. Employer

of Incorporation) File Number) Identification No.)

712 Fifth Avenue, 18th Floor

New York, New York 10019

(Address of Principal Executive Offices) (Zip Code)

(212) 957-5000

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

(17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

(17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.25 par value | | GFF | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On September 5, 2023 Griffon Corporation (the “Company”) entered into an agreement (the “Stock Purchase Agreement”) to repurchase, and repurchased, 400,000 shares of its common stock, par value $0.25 per share (the “Common Stock”), beneficially owned by two separately managed accounts of which Voss Capital, LLC is the investment manager (the “Selling Shareholders”), in a private transaction to facilitate redemptions by investors in the Selling Shareholders. The purchase price per share is $41.8656, for an aggregate purchase price of $16,746,240, and represents a 2% discount from the price of $42.72 of the Common Stock at the close of trading on September 1, 2023. The Selling Shareholders are affiliates of Voss Capital, LLC. Travis W. Cocke, the Founder, Chief Investment Officer and Managing Member of Voss Capital, LLC, is a member of the Board of Directors of the Company (the “Board”). The Stock Purchase Agreement contains customary representations, warranties and covenants of the parties.

The repurchase of the shares of Common Stock pursuant to the Stock Purchase Agreement was consummated under the Company’s Board authorized share repurchase program, and the repurchased shares will be held in treasury. The Audit Committee of the Board, comprised solely of independent directors not affiliated with the Selling Shareholders, approved the transactions contemplated by the Stock Purchase Agreement.

The foregoing description of the Stock Purchase Agreement is qualified in its entirety by reference to the full text of the Stock Purchase Agreement filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

10.1 Stock Purchase Agreement, dated September 5, 2023.

104 Cover Page Interactive Data File (embedded within the Inline XBRL document).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

GRIFFON CORPORATION

By: /s/ Seth L. Kaplan

Seth L. Kaplan

Senior Vice President

Date: September 5, 2023

Exhibit Index

104 Cover Page Interactive Data File (embedded within the Inline XBRL document).

Exhibit 10.1

Execution Copy

STOCK PURCHASE AGREEMENT

THIS STOCK PURCHASE AGREEMENT (this “Agreement”) is entered into as of September 5, 2023, by and between Griffon Corporation, a Delaware corporation (the “Company”), and each of two separately managed accounts of which Voss Capital, LLC is the investment manager, the names of which are set forth on Schedule I hereto (collectively, the “Selling Shareholders”).

WHEREAS, the Selling Shareholders beneficially own an aggregate of 850,543 shares of the Company’s outstanding common stock, par value $0.25 per share (the “Common Stock”);

WHEREAS, each of the Selling Shareholders desires to sell to the Company, and the Company desires to purchase from the Selling Shareholders, an aggregate of 400,000 shares of Common Stock (the “Shares”) at a price of $41.8656 per Share, for an aggregate price of $16,746,240 for the Shares (such aggregate purchase price, the “Purchase Price”), upon the terms and subject to the conditions set forth in this Agreement;

WHEREAS, each of the Selling Shareholders desires to sell the Shares to the Company in order to facilitate redemptions by investors of one or more of its affiliated funds;

WHEREAS, the Company has an existing share repurchase program (the “Program”), and the Board of Directors (the “Board”) of the Company approved a $200 million increase to the Program in April 2023; and

WHEREAS, the Audit Committee of the Board has reviewed the terms of the transaction contemplated by this Agreement and has determined that they are fair to the Company and in the best interests of the Company and its stockholders.

NOW, THEREFORE, in consideration of the mutual covenants herein and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the undersigned hereby agree as follows:

1.Share Purchase.

(a)Purchase and Sale. On the date of the Closing (as defined below), upon the terms and subject to the conditions of this Agreement, the Company hereby agrees to purchase from the Selling Shareholders, and each of the Selling Shareholders hereby agrees, severally and not jointly, to sell, convey, assign, transfer and deliver, or cause to be delivered, to the Company, for the Purchase Price the number of Shares as set forth opposite their respective names in Schedule 1 hereto, free and clear of any and all mortgages, pledges, encumbrances, liens, security interests, options, charges, claims, deeds of trust, deeds to secure debt, title retention agreements, rights of first refusal or offer, limitations on voting rights, proxies, voting agreements, limitations on transfer or other agreements or claims of any kind or nature whatsoever (collectively, “Liens”).

(b)Closing. Subject to the terms and conditions of this Agreement and the delivery of the deliverables contemplated by Section 1(c), the closing of the sale of the Shares contemplated hereby (the “Closing”) will take place immediately prior to the commencement of trading of the Company’s common stock on the New York Stock Exchange on September 5, 2023. The Closing shall take place remotely.

(c)Closing Deliveries and Actions.

(i)At the Closing, the Selling Shareholders shall arrange for an appropriate electronic transfer (including through Deposit and Withdrawal at Custodian) of the Shares to an account of the Company at its transfer agent, Equiniti Trust Company (f/k/a American Stock Transfer & Trust Company, LLC), sufficient to convey to the Company good, valid and marketable title in and to the Shares, free and clear of any and all Liens.

(ii)At the Closing, the Company shall deliver to the Selling Shareholders by wire transfer to the account to be designated by the Selling Shareholders immediately available funds in U.S. dollars in an amount equal to the Purchase Price.

(d)Conditions of the Selling Shareholders’ Obligations at Closing. The obligation of the Selling Shareholders to sell the Shares is subject to the fulfillment, on or before the Closing, of each of the following conditions, unless otherwise waived:

(i)The representations and warranties contained in Section 3 shall be true and correct in all respects as of the Closing.

(ii)The Company shall have performed and complied with all covenants, agreements, obligations and conditions contained in this Agreement that are required to be performed or complied with by the Company on or before the Closing.

(iii)There shall be no pending suit, action or proceeding by any federal, state, local or foreign court, administrative agency or governmental or regulatory authority or body (each, an “Authority”) to which the Company or any of its properties is subject, seeking to challenge, restrain, preclude, enjoin or prohibit the transactions contemplated by this Agreement.

(e)Conditions of the Company’s Obligations at Closing. The obligation of the Company to purchase the Shares is subject to the fulfillment, on or before the Closing, of each of the following conditions, unless otherwise waived:

(i)The representations and warranties contained in Section 2 shall be true and correct in all respects as of the Closing.

(ii)The Selling Shareholders shall have performed and complied with all covenants, agreements, obligations and conditions contained in this Agreement that are required to be performed or complied with by the Selling Shareholders on or before the Closing.

(iii)There shall be no pending suit, action or proceeding by any Authority to which the Company or any of its properties is subject, seeking to challenge, restrain, preclude, enjoin or prohibit the transactions contemplated by this Agreement.

(f)Possibility of Delay in Transfer of Record Ownership.

(i)The parties to this Agreement acknowledge that the transfer of record title to the Shares may not take place on the date of the Closing due to administrative delay in connection with certain procedures relating to the custodian holding record title to the Shares. Notwithstanding anything else to the contrary contained in this Agreement, in the event of such administrative delay:

(1)the transfer of ownership of the Shares from the Selling Shareholders to the Company will nonetheless be deemed to take place, for all purposes, immediately prior to the commencement of trading of the Company’s common stock on the New York Stock Exchange on September 5, 2023;

(2)all filings to be submitted to the Securities and Exchange Commission by the parties to this Agreement relating to or in connection with the transfer of the Shares (including, but not limited to, (A) the Current Report on Form 8-K to be filed by the Company, (B) any “SEC Form 4: Statement of Changes in Beneficial Ownership” to be filed by Voss Capital, LLC (or any affiliate of Voss Capital, LLC) with respect to transfer of the Shares, and (C) any Schedule 13D to be filed by Voss Capital, LLC (or any affiliate of Voss Capital, LLC) with respect to the transfer of the Shares), shall reflect that ownership to the Shares was transferred from the Selling Shareholders to the Company on September 5, 2023; and

(3)the Company will deliver payment for the Shares via wire transfer on the date record title of the Shares is transferred to the Company.

2.Representations of the Company. The Company represents and warrants to the Selling Shareholders that, as of the date hereof and at the Closing:

(a)The Company is duly organized, validly existing and in good standing under the laws of the State of Delaware.

(b)The Company has the full power and authority to execute, deliver and carry out the terms and provisions of this Agreement and to consummate the transactions contemplated hereby, and has taken all necessary action to authorize the execution, delivery and performance of this Agreement.

(c)This Agreement has been duly and validly authorized, executed and delivered by the Company and constitutes a legal, valid and binding obligation of the Company, enforceable in accordance with its terms, except to the extent that (i) such enforceability may be limited by bankruptcy, insolvency, reorganization, moratorium or other similar laws relating to or affecting creditors’ rights generally and (ii) the remedy of specific performance and injunctive and other forms of equitable relief may be subject to certain equitable defenses and to the discretion of the court before which any proceedings may be brought.

(d)The execution and delivery of this Agreement by the Company and the consummation by the Company of the transactions contemplated hereby (i) does not require the consent, approval, authorization, order, registration or qualification of, or (except for filings pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) filing with, any Authority having jurisdiction over the Company; and (ii) does not and will not constitute or result in a breach of, or violation or default under, any note, bond, mortgage, deed, indenture, lien, instrument, contract, agreement, lease or license to which the Company is a party, the Company’s organizational documents, or any statute, law, ordinance, decree, order, injunction, rule, directive, judgment or regulation of any Authority applicable to the Company, except in each case in this clause (ii) as would not materially adversely affect the ability of the Company to consummate the transactions contemplated by this Agreement.

3.Representations of the Selling Shareholders. Each of the Selling Shareholders severally represents and warrants to the Company that, as of the date hereof and at the Closing:

(a)The Selling Shareholder is duly organized, validly existing and in good standing under the laws of the jurisdiction of its organization.

(b)The Selling Shareholder has the full power and authority to execute, deliver and carry out the terms and provisions of this Agreement and consummate the transactions contemplated hereby, and has taken all necessary action to authorize the execution, delivery and performance of this Agreement.

(c)This Agreement has been duly and validly authorized, executed and delivered by the Selling Shareholder, and constitutes a legal, valid and binding obligation of the Selling Shareholder, enforceable in accordance with its terms, except to the extent that (i) such enforceability may be limited by bankruptcy, insolvency, reorganization, moratorium or other similar laws relating to or affecting creditors’ rights generally and (ii) the remedy of specific performance and injunctive and other forms of equitable relief may be subject to certain equitable defenses and to the discretion of the court before which any proceedings may be brought.

(d)The execution and delivery of this Agreement by the Selling Shareholder and the consummation by the Selling Shareholder of the transactions contemplated hereby (i) do not require the consent, approval, authorization, order, registration or qualification of, or (except for filings pursuant to Section 16 and Section 13 under the Exchange Act) filing with, any Authority having jurisdiction over the Selling Shareholder; and (ii) do not and will not constitute or result in a breach of, or violation or default under, any note, bond, mortgage, deed, indenture, lien, instrument, contract, agreement, lease or license to which the Selling Shareholder is a party, the Selling Shareholder’s organizational documents, or any statute, law, ordinance, decree, order, injunction, rule, directive, judgment or regulation of any Authority applicable to the Selling Shareholder, except in each case of this clause (ii) as would not materially adversely affect the ability of the Selling Shareholder to consummate the transactions contemplated by this Agreement.

(e)The Selling Shareholder has good and valid title to the Shares to be sold at the Closing by the Selling Shareholder hereunder, and the transfer of Shares made by the Selling Shareholder at the Closing will be valid and binding obligations of the Selling Shareholder, enforceable in accordance with their respective terms, and vest in the Company good, valid and marketable title to all Shares purchased by the Company, free and clear of any and all Liens.

(f)The Selling Shareholder is a sophisticated investor and knows that the Company may have material non-public information concerning the Company and its condition (financial and otherwise), results of operations, businesses, properties, plans and prospects and that such information could be material to the Selling Shareholder’s decision to sell the Shares or otherwise materially adverse to the Selling Shareholder’s interests. The Selling Shareholder acknowledges and agrees that the Company shall have no obligation to disclose to it any such information and hereby waives and releases, to the fullest extent permitted by applicable law, any and all claims and causes of action it has or may have against Company and its affiliates, officers, directors, employees, agents and representatives based upon, relating to or arising out of nondisclosure of such information or the sale of the Shares hereunder.

(g)The Selling Shareholder has adequate information concerning the business and financial condition of the Company to make an informed decision regarding the sale of the

Shares and has, independently and without reliance upon the Company, made its own analysis and decision to sell the Shares. With respect to legal, tax, accounting, financial and other considerations involved in the transactions contemplated by this Agreement, including the sale of the Shares, the Selling Shareholder is not relying on the Company (or any agent or representative thereof). The Selling Shareholder has carefully considered and, to the extent it believes such discussion is necessary, discussed with professional legal, tax, accounting, financial and other advisors the suitability of the transactions contemplated by this Agreement, including the sale of the Shares.

4.Additional Covenant. Each of the Selling Shareholders severally covenants and agrees with the Company that such Selling Shareholder shall be responsible for the payment of any stock transfer or similar taxes in connection with the transactions contemplated by this Agreement.

5.Publicity. Each of the Selling Shareholders and the Company agrees that it shall not, and that it shall cause its affiliates and representatives not to, publish, release or file any press release or other public statement or announcement relating to the transactions contemplated by this Agreement without the prior written consent of the other party (such consent not to be unreasonably withheld, conditioned or delayed); provided, however, that nothing in this Section 5 shall restrict the ability of the Company to file a Current Report on Form 8-K or periodic reports on Form 10-Q or Form 10-K, or either of the Selling Shareholders or any of its affiliates to file a Form 4, in each case relating to the transactions contemplated by this Agreement, without further review or consent from the other party; provided further that the Company will provide to the Selling Shareholders an advance draft of the Current Report on Form 8-K it intends to file disclosing the transactions contemplated by this Agreement, and each Selling Shareholder agrees that (i) the disclosure included in any Schedule 13D or amendment thereto filed by such Selling Shareholder describing the transactions contemplated by this Agreement shall be consistent with the disclosure included in such Current Report on Form 8-K describing the transactions contemplated by this Agreement and (ii) such Selling Shareholder shall provide the Company with a reasonable opportunity to review and comment on any such Schedule 13D or amendment thereto prior to filing with the Securities and Exchange Commission. The parties acknowledge and agree that nothing in this Section 5 alters the parties’ obligations under Section 2(a) or any other provision of the Cooperation Agreement, dated as of January 8, 2023, by and among Voss Value Master Fund, L.P., Voss Value-Oriented Special Situations Fund, L.P., Voss Advisors GP, LLC, Voss Capital, LLC and the Company, which remains in full force and effect in accordance with its terms.

6.Notices. All notices, requests, claims, demands or other communications to be given or delivered under or by reason of the provisions of this Agreement will be in writing and will be deemed to have been given when delivered personally, mailed by certified or registered mail (return receipt requested and postage prepaid), sent via a nationally recognized overnight courier, or sent via email (receipt of which is confirmed) to the recipient. Such notices, demands and other communications shall be sent as follows:

If to the Selling Shareholders:

c/o Voss Capital, LLC

3373 Richmond Ave., Suite 500

Houston, TX 77046

Attention: Travis W. Cocke

Email: t@vosscap.com

If to the Company:

Griffon Corporation

712 Fifth Avenue, 18th Floor

New York, New York 10019

Attention: Seth L. Kaplan, Senior Vice President, General Counsel and Secretary

Email: kaplan@griffon.com

or such other address or to the attention of such other person as the recipient party shall have specified by prior written notice to the sending party.

7.Miscellaneous.

(a)Survival of Representations and Warranties. All representations and warranties contained herein or made in writing by either party in connection herewith shall survive the execution and delivery of this Agreement and the consummation of the transactions contemplated hereby until the expiration of the applicable statute of limitations.

(b)Severability. Whenever possible, each provision of this Agreement will be interpreted in such manner as to be effective and valid under applicable law, but if any provision of this Agreement is held to be invalid, illegal, or unenforceable in any respect under any applicable law or rule in any jurisdiction, the remainder of the terms, provisions, covenants and restrictions of this Agreement shall remain in full force and effect and shall in no way be affected, impaired or invalidated.

(c)Complete Agreement. This Agreement supersedes all prior agreements and understandings (whether written or oral) between the Company and the Selling Shareholders with respect to the subject matter hereof.

(d)Counterparts. This Agreement may be executed by any one or more of the parties hereto in counterparts, each of which shall be deemed to be an original, but all such counterparts shall together constitute one and the same instrument. This Agreement, and any and all agreements and instruments executed and delivered in accordance herewith, to the extent signed and delivered by means of facsimile or other electronic format or signature (including email, “pdf,” “tif,” “jpg,” DocuSign and Adobe Sign), shall be treated in all manner and respects and for all purposes as an original signature and an original agreement or instrument and shall be considered to have the same legal effect, validity and enforceability as if it were the original signed version thereof delivered in person.

(e)Further Assurances. Subject to the other terms of this Agreement, the parties hereto agree to execute and deliver such other instruments and perform such acts, in addition to the matters herein specified, as may be reasonably appropriate or necessary, from time to time, to effectuate the transactions contemplated by this Agreement.

(f)Successors and Assigns. Neither this Agreement nor any of the rights, interests or obligations hereunder shall be assigned, in whole or in part, by either party without the prior written consent of the other party. Except as otherwise provided herein, this Agreement shall bind and inure to the benefit of and be enforceable by the Selling Shareholders and the Company and their respective successors and assigns.

(g)No Third Party Beneficiaries or Other Rights. This Agreement is for the sole benefit of the parties and their successors and permitted assigns and nothing herein express

or implied shall give or shall be construed to confer any legal or equitable rights or remedies to any person other than the parties to this Agreement and such successors and permitted assigns.

(h)Governing Law. This Agreement and any matters related to the transactions contemplated hereby shall be governed by and construed in accordance with the laws of the State of New York, without regard to conflict of laws principles thereof.

(i)Waiver of Jury Trial. The Company and the Selling Shareholders each hereby irrevocably waives, to the fullest extent permitted by applicable law, any and all right to trial by jury in any legal proceeding arising out of or relating to this Agreement or the transactions contemplated hereby.

(j)Mutuality of Drafting. The parties have participated jointly in the negotiation and drafting of this Agreement. In the event an ambiguity or question of intent or interpretation arises, this Agreement shall be construed as jointly drafted by the parties, and no presumption or burden of proof shall arise favoring or disfavoring either party by virtue of the authorship of any provision of the Agreement.

(k)Remedies. Each of the parties hereto agree and acknowledge that money damages may not be an adequate remedy for any breach of the provisions of this Agreement and that either party may in its sole discretion apply to any court of law or equity of competent jurisdiction (without posting any bond or deposit) for specific performance or other injunctive relief in order to enforce, or prevent any violations of, the provisions of this Agreement.

(l)Amendment and Waiver. No modification of or amendment to this Agreement shall be effective unless in a writing signed by the parties to this Agreement, and no waiver of any rights under this Agreement shall be effective unless in a writing signed by the waiving party.

(m)Expenses. Each of the Company and the Selling Shareholders shall bear its own costs and expenses in connection with the drafting, negotiation, execution and delivery of this Agreement and the consummation of the transactions contemplated hereby.

[Signature pages follow]

IN WITNESS WHEREOF, the Company has executed this Stock Purchase Agreement as of the date first written above.

COMPANY:

GRIFFON CORPORATION

By: /s/ Seth L. Kaplan

Name: Seth L. Kaplan

Title: Senior Vice President

[Selling Shareholders Signature Page follows]

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

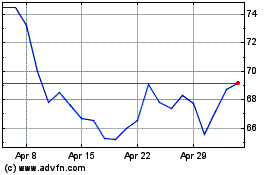

Griffon (NYSE:GFF)

Historical Stock Chart

From Jun 2024 to Jul 2024

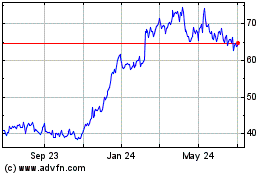

Griffon (NYSE:GFF)

Historical Stock Chart

From Jul 2023 to Jul 2024