0001614806

false

0001614806

2023-10-20

2023-10-20

0001614806

us-gaap:CommonStockMember

2023-10-20

2023-10-20

0001614806

ajx:ConvertibleSeniorNotesMember

2023-10-20

2023-10-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

October 20, 2023

GREAT AJAX CORP.

(Exact name of registrant as specified in charter)

| Maryland |

|

001-36844 |

|

46-5211870 |

(State

or other jurisdiction of

incorporation) |

|

(Commission File Number) |

|

(IRS

Employer Identification No.) |

13190 SW 68th Parkway

Suite 110

Tigard, OR 97223

(Address

of principal executive offices)

Registrant’s

telephone number, including area code:

503- 505-5670

Securities

registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbols |

|

Name

of each exchange on which registered |

| Common stock, par value $0.01 per share |

AJX |

New York Stock Exchange |

| 7.25% Convertible Senior Notes due 2024 |

AJXA |

New York Stock Exchange |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934

(17 CFR §240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

ITEM 1.01 Entry into a Material Definitive Agreement.

The disclosure set forth below under Item 1.02

of this Current Report on Form 8-K is incorporated by reference herein.

ITEM 1.02 Termination of a Material Definitive

Agreement.

As

previously disclosed, on June 30, 2023, Great Ajax Corp., a Maryland corporation (“Great Ajax”), Ellington Financial

Inc., a Delaware corporation (“EFC”), and EF Acquisition I LLC, a Maryland limited liability company and a direct, wholly-owned

subsidiary of EFC (“Merger Sub”), entered into an Agreement and Plan of Merger (the “Merger Agreement”), pursuant

to which it was agreed that, subject to the terms and conditions therein, Great Ajax would be merged with and into Merger Sub, with Merger

Sub remaining as a wholly-owned subsidiary of EFC.

On October 20, 2023, Great Ajax and EFC entered

into a Termination Agreement (the “Termination Agreement”) pursuant to which, among other things, Great Ajax and EFC mutually

agreed to terminate the Merger Agreement and the transactions contemplated thereby. EFC has agreed to pay Great Ajax $16 million of which

$5 million is payable in cash and $11 million was paid as consideration for 1,666,666 shares of Great Ajax common stock,

which were purchased at a per share price of $6.60. EFC will now hold approximately 6.1% of Great Ajax’s stock. In addition, an

affiliate of the external manager of EFC owned 273,983 shares of Great Ajax common stock as of June 30, 2023. EFC remains a securitization

joint venture partner as well. The Termination Agreement also mutually releases the parties from any claims of liability to one another

relating to the Merger Agreement and the terminated transaction.

The foregoing descriptions of the Merger Agreement

and the Termination Agreement do not purport to be complete and are qualified in their entirety by reference to the full text of (i) the

Merger Agreement, which was previously filed as Exhibit 2.1 to Great Ajax’s Current Report on Form 8-K filed on July 3, 2023, and

(ii) the Termination Agreement, which is attached hereto as Exhibit 10.1 and is incorporated by reference herein.

ITEM 7.01 Regulation FD Disclosure.

On October 20, 2023, Great Ajax and EFC issued

a joint press release announcing the termination of the Merger Agreement. A copy of the press release is furnished with this Current Report

on Form 8-K as Exhibit 99.1 and is hereby incorporated by reference.

The information in Item 7.01 of this Current Report

on Form 8-K, including Exhibit 99.1 furnished pursuant to Item 9.01, shall not be deemed “filed” for the purposes of Section 18

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that

Section, nor shall such information, including Exhibit 99.1, be deemed incorporated by reference in any filing under the Securities Act

of 1933, as amended (the “Securities Act”), or the Exchange Act, regardless of the general incorporation language of such

filing, except as shall be expressly set forth by specific reference in such filing.

ITEM 9.01 Financial

Statements and Exhibits

Forward-Looking Statements

This communication contains forward-looking statements

within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are

not historical in nature and can be identified by words such as “believe,” “expect,” “anticipate,”

“estimate,” “project,” “plan,” “continue,” “intend,” “should,”

“would,” “could,” “goal,” “objective,” “will,” “may,” “seek”

or similar expressions or their negative forms. Forward-looking statements are subject to numerous assumptions, risks and uncertainties,

which change over time and are beyond our control. Forward-looking statements speak only as of the date they are made. Neither EFC nor

Great Ajax assumes any duty or obligation (and does not undertake) to update or supplement any forward-looking statements. Because forward-looking

statements are, by their nature, to different degrees, uncertain and subject to numerous assumptions, risks and uncertainties, actual

results or future events, circumstances or developments could differ, possibly materially, from those that EFC or Great Ajax anticipated

in its forward-looking statements, and future results and performance could differ materially from historical performance. Factors that

could cause or contribute to such differences include, but are not limited to, those set forth in the section entitled “Risk Factors”

in EFC’s most recent Annual Report on Form 10-K and Great Ajax’s most recent Annual Report on Form 10-K and EFC’s and

Great Ajax’s Quarterly Reports on Form 10-Q filed with the SEC, and other reports filed by EFC and Great Ajax with the SEC, copies

of which are available on the SEC’s website, www.sec.gov. The list of factors presented here is not, and should not be, considered

a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization

of forward-looking statements.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

GREAT AJAX CORP. |

| Date: October 20, 2023 |

|

|

| |

|

|

| |

By: |

/s/ Mary Doyle |

| |

Name: |

Mary Doyle |

| |

Title: |

Chief Financial Officer |

Exhibit 10.1

TERMINATION AGREEMENT

THIS TERMINATION AGREEMENT

(this “Termination Agreement”), dated as of October 20, 2023, is made by and between Ellington Financial Inc., a Delaware

corporation (“Parent”), and Great Ajax Corp., a Maryland corporation (the “Company”, each a “Party”

and together the “Parties”). Unless otherwise indicated, each capitalized term used and not otherwise defined in this

Termination Agreement has the meaning given to such term in the Merger Agreement (as defined below).

RECITALS

WHEREAS, Parent, EF Acquisition

I LLC, a Maryland limited liability company and a direct, wholly-owned Subsidiary of Parent, and the Company are parties to that certain

Agreement and Plan of Merger dated as of June 30, 2023 (the “Merger Agreement”); and

WHEREAS, Section 8.1(a) of

the Merger Agreement provides that the Merger Agreement may be terminated prior to the Effective Time by mutual written consent of the

Company and Parent.

AGREEMENT

NOW, THEREFORE, in consideration

of the foregoing, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties

hereby agree as follows:

1. Termination of the Merger Agreement. The Parties agree that, immediately upon execution and

delivery of this Termination Agreement, the Merger Agreement is (i) terminated, such agreement constituting the requisite mutual written

consent required to terminate the Merger Agreement pursuant to Section 8.1(a) of the Merger Agreement and otherwise as may be required

pursuant to applicable law and (ii) forthwith void and without effect, and notwithstanding anything in the Merger Agreement (including

Section 8.2 thereof) to the contrary, no party to the Merger Agreement shall have any liability of any nature whatsoever under the Merger

Agreement or in connection with the transactions contemplated by the Merger Agreement, provided that Section 6.6(b) of the Merger Agreement

and the Non-Disclosure Agreement shall survive such termination of the Merger Agreement and the Non-Disclosure Agreement shall remain

in full force and effect in accordance with the terms and conditions thereof.

2. Termination Fee. The Parties acknowledge and agree that concurrently with the execution and

delivery of this Termination Agreement, Parent has paid a termination fee of five million dollars ($5,000,000) to the Company in cash

by wire transfer of immediately available funds, free of costs and charges, to an account previously designated by the Company to Parent

in writing. In addition, Parent has agreed with the Company to purchase 1.666 million shares of the Company’s common stock, par

value $0.01 per share, pursuant to an effective registration statement in a registered direct offering on the date hereof, with such securities

purchase commitment evidenced by a separate purchase agreement (the “Purchase Agreement”), at a price of $6.60 per

common share, all as detailed in the Purchase Agreement.

3. Release of Claims.

(a) Release and Discharge by the Company. In consideration of the terms and conditions set forth in this Termination Agreement,

the Company, on behalf of itself and its Subsidiaries and Affiliates, hereby fully, finally and completely releases and discharges Parent

and its Subsidiaries and Affiliates (collectively, the “EFC Parties”), of and from any and all claims, rights, causes

of action, liens, debts, liabilities, demands, agreements, damages or injuries of any nature or sort (whether known or unknown, liquidated

or unliquidated, contingent or fixed, past, present, or future) that are based on, arise out of, incidental to, in connection with, or

related in any way to, the Merger Agreement or the transactions contemplated thereby (the “Released Claims”), from

the beginning of time through the date hereof, except for any claims arising as a result of breach of this Termination Agreement or the

Purchase Agreement. For purposes of this Termination Agreement, “Affiliates” means a Party’s current and future

parent companies, subsidiaries and other affiliated entities, and the officers, directors, shareholders, managers, members, partners,

principals, employees, consultants, representatives and agents of such Party, and of such Party’s parent company, subsidiaries and

other affiliated entities, and the successors and assigns of each of them.

(b) Release and Discharge by the EFC Parties. In consideration of the terms and conditions set forth in this Termination Agreement,

the EFC Parties, hereby fully, finally and completely release and discharge each of the Company, its Subsidiaries and Affiliates, of and

from any and all Released Claims, from the beginning of time through the date hereof, except for any claims arising as a result of breach

of this Termination Agreement or the Purchase Agreement.

4. No Reliance.

(a) Each Party acknowledges and agrees that in entering into this Termination Agreement, except as expressly set forth herein, it is

not relying on any representations or warranties made by any Person (including any officers, directors, attorneys, representatives, employees,

agents, and insurers of any Party) regarding this Termination Agreement or the implications hereof.

(b) With respect to the Released Claims, the Parties, on behalf of themselves and their Subsidiaries and Affiliates, as applicable,

expressly waive, to the fullest extent permitted by Law, the provisions, rights, and benefits of § 1542 of the California Civil Code

(and any similar Law of any other state, territory or jurisdiction), which provides:

A GENERAL RELEASE DOES NOT EXTEND TO CLAIMS WHICH

THE CREDITOR DOES NOT KNOW OR SUSPECT TO EXIST IN HIS OR HER FAVOR AT THE TIME OF EXECUTING THE RELEASE, WHICH IF KNOWN BY HIM OR HER

MUST HAVE MATERIALLY AFFECTED HIS OR HER SETTLEMENT WITH THE DEBTOR OR RELEASED PARTY.

5. Further Cooperation to Effectuate This Termination Agreement. The Parties covenant and agree

that, without expanding their substantive obligations hereunder, they shall do all acts and execute and obtain all documents, to the full

extent necessary or appropriate, to implement and enforce this Termination Agreement according to its terms.

6. Confidential Information. Within five (5) business days of the date hereof, each Party shall

return or destroy all Confidential Information (as defined in the Non-Disclosure Agreement), subject to and in accordance with Section

8 of the Non-Disclosure Agreement. Section 15 of the Non-Disclosure Agreement is hereby deleted and replaced in its entirety with the

following: “This Agreement shall terminate on October 20, 2025.”

7. Entity Level Power/Authorization. The Parties warrant and represent that:

(a) each of them has the entity level power and authority and the legal right to make, deliver and perform under this Termination Agreement,

and have taken all necessary entity level actions to authorize execution, delivery and performance under this Termination Agreement;

(b) this Termination Agreement has been duly executed and delivered on behalf of the Parties; and

(c) this Termination Agreement constitutes legal, valid and binding obligations of the Parties, enforceable against them in accordance

with its terms, except as such enforceability may be limited by bankruptcy, insolvency, reorganization, moratorium or similar Laws relating

to or affecting the rights and remedies of creditors generally and the effect of general principles of equity (regardless of whether such

enforceability is considered in a Proceeding in equity or at Law).

8. Authority to Execute Agreement. By signing below, each Party represents and warrants that

the person signing this Termination Agreement on its behalf has authority to bind that Party and that the Party’s execution of this

Termination Agreement is not in violation of any by-law, covenants, and/or other restrictions placed upon them by their respective entities.

9. Expenses; Costs of Enforcement. Each Party shall bear its own costs, expenses, and fees incurred

by it in connection with the enforcement of this Termination Agreement.

10. Public Statements and Mutual Non-Disparagement. The joint press release of Parent and the

Company announcing the termination of the Merger Agreement pursuant to this Termination Agreement is set forth on Annex A. Parent

and the Company shall each issue the joint press release at 4:30 p.m., New York City time, on October 20, 2023. Thereafter, neither Party

shall, nor shall it permit any of its Representatives to make any public or private disparaging statement about the other Party, the other

Party’s current or former directors in their capacity as such, the other Party’s officers or employees (including with respect

to such persons’ service at the other Party), the other Party’s subsidiaries, the business of the other Party’s subsidiaries

or any of its or its subsidiaries’ current directors, officers or employees, including the business and current or former directors,

officers and employees of the other Party’s Affiliates, the transactions contemplated by the Merger Agreement or the termination

of the Merger Agreement, as applicable, except as required by applicable Law, regulation or stock exchange rule to which the relevant

Party is subject, or by the order of any court of competent jurisdiction, or in direct connection with any claim not prohibited by this Termination Agreement (in which case such statements must be limited to

the facts and circumstances surrounding such claim).

11. Miscellaneous Provisions.

(a) This Termination Agreement contains the entire agreement between the Parties and supersedes any and all prior agreements, arrangements,

negotiations, discussions or understandings between the Parties relating to the subject matter hereof. No oral understanding, statements,

promises or inducements contrary to the terms of this Termination Agreement exist. This Termination Agreement cannot be changed or terminated

orally. Should any provision of this Termination Agreement be held invalid, illegal or unenforceable, it shall be deemed to be modified

so that its purpose can lawfully be effectuated and the balance of this Termination Agreement shall be enforceable and remain in full

force and effect.

(b) This Termination Agreement shall extend to, be binding upon, and inure to the benefit of the Parties and their respective successors,

heirs and assigns.

(c) This Termination Agreement shall be governed by and construed in accordance with the laws of the State of Maryland without regard

to its conflict of law rules. Each of the Parties hereby consents to the personal jurisdiction of the state and federal courts located

in the State of Maryland in connection with any action arising from or relating in whole or part to this Termination Agreement.

(d) EACH PARTY HEREBY IRREVOCABLY WAIVES ALL RIGHT TO TRIAL BY JURY IN ANY ACTION, PROCEEDING OR COUNTERCLAIM (WHETHER BASED ON CONTRACT,

TORT OR OTHERWISE) DIRECTLY OR INDIRECTLY BASED UPON, ARISING OUT OF OR RELATING TO THIS TERMINATION AGREEMENT.

(e) This Termination Agreement may be executed in any number of counterparts each of which when so executed shall be deemed to be an

original and all of which when taken together shall constitute one and the same agreement.

[Signature Page Follows]

IN WITNESS WHEREOF, each Party

has caused this Termination Agreement to be signed by its respective officer thereunto duly authorized, all as of the date first written

above.

| |

ELLINGTON FINANCIAL INC. |

| |

|

| |

|

| |

By: |

/s/ Laurence Penn |

| |

|

Name: Laurence Penn |

| |

|

Title: Chief Executive Officer and President |

| |

|

| |

|

| |

GREAT AJAX CORP. |

| |

|

| |

|

| |

By: |

/s/ Lawrence Mendelsohn |

| |

|

Name: Lawrence Mendelsohn |

| |

|

Title: Chief Executive Officer |

Annex A

Press Release

Exhibit 99.1

ELLINGTON FINANCIAL AND GREAT AJAX CORP. ANNOUNCE

MUTUAL TERMINATION OF MERGER AGREEMENT

OLD

GREENWICH, Conn. and New York, NY– (BUSINESS WIRE) – October 20, 2023 – Ellington Financial Inc. (NYSE: EFC) (“Ellington

Financial”), a real estate investment trust investing in a diverse array of financial assets including residential and

commercial mortgage loans, and Great Ajax Corp. (NYSE: AJX) (“Great Ajax”), a real estate investment trust that invests

primarily in residential mortgage loans, jointly announced today they have agreed to terminate the merger agreement announced on July

3, 2023, effective immediately.

The termination was approved

by both companies’ boards of directors after careful consideration of the proposed merger and the progress made towards completing

the proposed merger. In addition, Ellington Financial has agreed to pay Great Ajax $16 million of which $5 million is payable in cash

and $11 million was paid as consideration for 1,666,666 shares of Great Ajax common stock, which were purchased at a

per share price of $6.60. Ellington Financial will now hold approximately 6.1% of Great Ajax’s stock. In addition, an affiliate

of the external manager of Ellington Financial owned 273,983 shares of Great Ajax common stock as of June 30, 2023. Ellington Financial

remains a securitization joint venture partner as well. The two companies intend to continue to work together on mortgage loan opportunities.

Forward-Looking Statements

This communication contains forward-looking statements

within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are

not historical in nature and can be identified by words such as “believe,” “expect,” “anticipate,”

“estimate,” “project,” “plan,” “continue,” “intend,” “should,”

“would,” “could,” “goal,” “objective,” “will,” “may,” “seek”

or similar expressions or their negative forms. Forward-looking statements are subject to numerous assumptions, risks and uncertainties,

which change over time and are beyond our control. Forward-looking statements speak only as of the date they are made. Neither Ellington

Financial nor Great Ajax assumes any duty or obligation (and does not undertake) to update or supplement any forward-looking statements.

Because forward-looking statements are, by their nature, to different degrees, uncertain and subject to numerous assumptions, risks and

uncertainties, actual results or future events, circumstances or developments could differ, possibly materially, from those that Ellington

Financial or Great Ajax anticipated in its forward-looking statements, and future results and performance could differ materially from

historical performance. Factors that could cause or contribute to such differences include, but are not limited to, those set forth in

the section entitled “Risk Factors” in Ellington Financial’s most recent Annual Report on Form 10-K and Great Ajax’s

most recent Annual Report on Form 10-K and Ellington Financial’s and Great Ajax’s Quarterly Reports on Form 10-Q filed with

the SEC, and other reports filed by Ellington Financial and Great Ajax with the SEC, copies of which are available on the SEC’s

website, www.sec.gov. The list of factors presented here is not, and should not be, considered a complete statement of all potential

risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements.

About Ellington Financial Inc.

Ellington Financial Inc. (NYSE: EFC) invests in

a diverse array of financial assets, including residential and commercial mortgage loans, reverse mortgage loans, residential and commercial

mortgage-backed securities, consumer loans and asset-backed securities backed by consumer loans, collateralized loan obligations, non-mortgage

and mortgage-related derivatives, debt and equity investments in loan origination companies, and other strategic investments. Ellington

Financial is externally managed and advised by Ellington Financial Management LLC, an affiliate of Ellington Management Group, LLC.

About Great Ajax Corp.

Great Ajax Corp.

(NYSE: AJX) is a real estate investment trust that focuses primarily on acquiring, investing

in and managing re-performing loans (“RPLs”) and non-performing loans (“NPLs”) secured by single-family residences

and commercial properties. In addition to its continued focus on RPLs and NPLs, it also originates and acquires small balance commercial

mortgage loans secured by multi-family retail/residential and mixed use properties. Great Ajax is externally managed by Thetis Asset Management

LLC, an affiliated entity. Great Ajax’s mortgage loans and other real estate assets are serviced by Gregory Funding LLC, an affiliated

entity.

Contact

Ellington Financial Inc.

Investor Relations

(203) 409-3575

info@ellingtonfinancial.com

Great Ajax Corp.

Mary Doyle

Chief Financial Officer

(503) 444-4224

mary.doyle@great-ajax.com

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ajx_ConvertibleSeniorNotesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

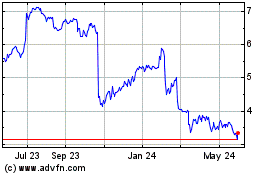

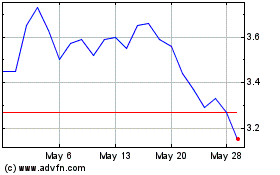

Great Ajax (NYSE:AJX)

Historical Stock Chart

From Feb 2025 to Mar 2025

Great Ajax (NYSE:AJX)

Historical Stock Chart

From Mar 2024 to Mar 2025