UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN

PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of July 2024

Commission File Number: 001-36298

GeoPark Limited

(Exact name of registrant as specified in its

charter)

Calle 94 N°

11-30 8° piso

Bogota, Colombia

(Address of principal

executive office)

Indicate by check

mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

GEOPARK LIMITED

TABLE OF CONTENTS

| ITEM |

|

| 1. |

Press Release dated July 22, 2024 titled “GeoPark Announces Second

Quarter 2024 Operational Update” |

Item

1

FOR IMMEDIATE DISTRIBUTION

GEOPARK ANNOUNCES SECOND QUARTER 2024 OPERATIONAL

UPDATE

NEW QUARTERLY PRODUCTION RECORD IN CPO-5

CONSOLIDATED PRO FORMA PRODUCTION OVER 41,000

BOEPD AS OF JULY 1, 2024

Bogota, Colombia – July 22, 2024 - GeoPark

Limited (“GeoPark” or the “Company”) (NYSE: GPRK), a leading independent Latin American oil and gas explorer,

operator and consolidator, today announces its operational update for the three-month period ended June 30, 2024 (“2Q2024”).

Oil and Gas Production and Operations

| · | 2Q2024 consolidated average oil and gas production

of 35,608 boepd, up slightly versus 1Q2024 |

| · | Production increased 11% in Ecuador and 3% in

Colombia, offsetting suspended production at the Manati gas field in Brazil (GeoPark non-operated, 10% WI) due to unscheduled maintenance |

| · | As

of July 1, 2024,1 GeoPark is producing over 41,000 boepd, adding approximately

5,700 boepd on a proforma basis from the Mata Mora Norte Block (GeoPark non-operated, 45%

WI) in Argentina |

| · | 11 rigs currently in operation (7 drilling rigs

and 4 workover rigs), including one drilling rig in Argentina |

Llanos 34 Block (GeoPark operated, 45% WI):

Secondary Recovery Underway

| · | 2Q2024 average production of 23,039 bopd net (51,198

boepd gross), 3% lower than 1Q2024 due to sporadic blockades and weather-associated flooding |

| · | Three horizontal wells were drilled in 2Q2024, including the first two in the Jacana field which initiated

testing in April and June 2024, respectively |

| · | Eight horizontal wells in aggregate have been put on production since the beginning of the horizontal

well drilling program in early 2023, currently contributing 16% of total production in the block |

| · | Waterflooding projects performing above plan, delivering around 3,700 bopd in 2Q2024, 13% of total production

in the block |

CPO-5 Block (GeoPark non-operated, 30% WI):

Record High Quarterly Production

| · | 2Q2024 record average production of 7,921 boepd net (26,403 boepd gross) after putting the Indico-3 development

well on production |

| · | The Lark 1 exploration well in the northern part of the block reached total depth in July 2024 and

will delineate hydrocarbon potential in the Ubaque and the Guadalupe Formations, initiating testing during August |

| · | Increased

seismic coverage to 85% after completing the acquisition

of 232 sq. km of 3D seismic,2 currently being processed |

Llanos Exploration: Drilling Success Continues

| · | Llanos 123 Block (GeoPark operated, 50% WI): |

| - | Drilled the Toritos Norte 1 appraisal well during June 2024, testing the Barco Formation and currently

producing 520 bopd gross |

| - | The Toritos 2 appraisal well reached total depth in July 2024, and will initiate testing in the Barco

Formation in August 2024 |

| · | Llanos 86 and Llanos 104 Blocks (GeoPark operated, 50% WI): |

| - | Processing 650+ sq. km of 3D seismic, targeting exploration drilling in 1Q2025 |

1 Vaca Muerta transaction effective

date.

2 Seismic area represented

as full fold.

Ecuador: Stepping up Production and Exploration

| · | Perico Block (GeoPark non-operated, 50% WI): |

| - | Production increased 11% compared to 1Q2024, reaching 1,652 bopd net during the quarter due to the contribution

from the Perico Centro 2 appraisal well in May 2024 |

| · | Espejo Block (GeoPark operated, 50% WI): |

| - | Drilled the Espejo Sur 3 exploration well in June 2024, testing the U-Sand Formation, currently producing

400 bopd gross |

Argentina: Vaca Muerta Adds Pro forma Production

| · | 2Q2024 average production of 12,508 bopd gross from the Mata Mora Norte Block |

| · | Encouraging initial results of Mata Mora Norte 2223 well, producing an average of 2,136 boepd gross during

2Q2024, in line with the best producing well in the block |

| · | Transaction effective date July 1, 2024. Regulatory closing of acquisition is expected by end of 3Q2024 |

Upcoming Catalysts 3Q2024

| · | Drilling 8-10 gross wells in 3Q2024 for the base business and 6-8 gross wells in Argentina, targeting

conventional, unconventional, short-cycle development, injector, appraisal and exploration projects |

| - | Llanos 34 Block: Drilling the first well with short radius design, the first horizontal well targeting

the Guadalupe Formation and two additional waterflooding injection patterns |

| - | CPO-5 Block: Drilling one appraisal well |

| - | Llanos 123 Block: Drilling one appraisal well |

| - | Perico Block: Executing workover campaign |

| - | Espejo Block: Drilling one exploratory well |

| - | Mata Mora Norte Block: Drilling four unconventional horizontal wells |

| - | Confluencia Norte Block (GeoPark non-operated, 50% WI): Drilling three unconventional exploration wells |

Breakdown of Quarterly Production

by Country

The following table shows production figures for

2Q2024, as compared to 2Q2023:

| |

2Q2024 |

|

2Q2023 |

| |

Total

(boepd) |

Oil

(bopd)a |

Gas

(mcfpd) |

|

Total

(boepd) |

% Change |

| Colombia |

33,956 |

33,852 |

623 |

|

33,045 |

3% |

| Ecuador |

1,652 |

1,652 |

- |

|

634 |

161% |

| Brazil |

- |

- |

- |

|

1,212 |

-100% |

| Chileb |

- |

- |

- |

|

1,690 |

-100% |

| Total |

35,608 |

35,504 |

623 |

|

36,581 |

-3% |

| a) | Includes royalties

and other economic rights paid in kind in Colombia for approximately 6,956 bopd in 2Q2024.

No royalties were paid in kind in Ecuador, Chile or Brazil. Production in Ecuador is reported

before the Government’s production share of approximately 512 bopd |

| b) | Closing of the

divestment transaction in January 2024 |

Quarterly

Production

| (boepd) |

2Q2024 |

1Q2024 |

4Q2023 |

3Q2023 |

2Q2023 |

| Colombia |

33,956 |

32,832 |

34,154 |

31,780 |

33,045 |

| Ecuador |

1,652 |

1,483 |

1,419 |

659 |

634 |

| Brazil |

- |

893 |

1,101 |

774 |

1,212 |

| Chilea |

- |

264 |

1,41 |

1,565 |

1,690 |

| Totalb |

35,608 |

35,473 |

38,315 |

34,778 |

36,581 |

| Oil |

35,504 |

34,255 |

35,842 |

32,510 |

33,672 |

| Gas |

104 |

1,218 |

2,473 |

2,268 |

2,909 |

| a) | Closing of the

divestment transaction in January 2024 |

| b) | In Colombia,

production includes royalties paid in kind, and in Ecuador it is shown before the Government’s

production share |

Reporting Date for 2Q2024 Results Release, Conference

Call and Webcast

GeoPark will report its 2Q2024 financial results

on Wednesday, August 14, 2024, after the market close.

GeoPark management will host a conference call

on August 15, 2024, at 10:00 am (Eastern Daylight Time) to discuss the 2Q2024 financial results.

To listen to the call, participants can access

the webcast located in the Invest with Us section of the Company’s website at www.geo-park.com, or by clicking below:

https://events.q4inc.com/attendee/332625400

Interested parties may participate in the conference

call by dialing the numbers provided below

United States Participants: +1 404-975-4839

Global Dial-In Numbers:

https://www.netroadshow.com/conferencing/global-numbers?confId=68476

Passcode: 027838

Please allow extra time prior to the call to visit

the website and download any streaming media software that might be required to listen to the webcast.

An archive of the webcast replay will be made available

in the Invest with Us section of the Company’s website at www.geo-park.com after the conclusion of the live call.

| For further information, please contact: |

|

| |

|

| INVESTORS: |

|

| |

|

| Stacy Steimel

|

ssteimel@geo-park.com |

| Shareholder Value Director |

|

| T: +562 2242 9600 |

|

| |

|

| Miguel Bello |

mbello@geo-park.com |

| Market Access Director |

|

| T: +562 2242 9600 |

|

| |

|

| Diego Gully

|

dgully@geo-park.com |

| Capital Markets Director |

|

| T: +55 21 99636 9658 |

|

| |

|

| MEDIA: |

|

| |

|

| Communications Department |

communications@geo-park.com |

NOTICE

Additional information about GeoPark can be found

in the “Invest with Us” section on the website at www.geo-park.com.

Rounding amounts and percentages: Certain amounts

and percentages included in this press release have been rounded for ease of presentation. Percentages included in this press release

have not in all cases been calculated on the basis of such rounded amounts, but on the basis of such amounts prior to rounding. For this

reason, certain percentages in this press release may vary from those obtained by performing the same calculations on the basis of the

amounts in the financial statements. Similarly, certain other amounts included in this press release may not sum due to rounding.

CAUTIONARY

STATEMENTS RELEVANT TO FORWARD-LOOKING INFORMATION

This press release contains statements that constitute

forward-looking statements. Many of the forward-looking statements contained in this press release can be identified by the use of forward-looking

words such as ‘‘anticipate,’’ ‘‘believe,’’ ‘‘could,’’ ‘‘expect,’’

‘‘should,’’ ‘‘plan,’’ ‘‘intend,’’ ‘‘will,’’

‘‘estimate’’ and ‘‘potential,’’ among others.

Forward-looking statements that appear in a number

of places in this press release include, but are not limited to, statements regarding the intent, belief or current expectations, regarding

various matters, including, drilling campaign, production guidance and capital expenditures. Forward-looking statements are based on management’s

beliefs and assumptions, and on information currently available to the management. Such statements are subject to risks and uncertainties,

and actual results may differ materially from those expressed or implied in the forward-looking statements due to various factors.

Forward-looking statements speak only as of the

date they are made, and the Company does not undertake any obligation to update them in light of new information or future developments

or to release publicly any revisions to these statements in order to reflect later events or circumstances, or to reflect the occurrence

of unanticipated events. For a discussion of the risks facing the Company which could affect whether these forward-looking statements

are realized, see filings with the U.S. Securities and Exchange Commission (SEC).

Oil and gas production figures included in this

release are stated before the effect of royalties paid in kind, consumption and losses. Annual production per day is obtained by dividing

total production by 365 days.

SIGNATURE

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

| |

GeoPark Limited |

| |

|

| |

|

| |

By: |

/s/ Jaime Caballero Uribe |

| |

|

Name: |

Jaime Caballero Uribe |

| |

|

Title: |

Chief Financial Officer |

Date:

July 22, 2024

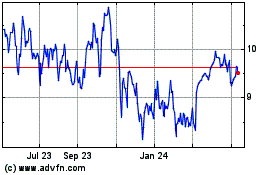

GeoPark (NYSE:GPRK)

Historical Stock Chart

From Nov 2024 to Dec 2024

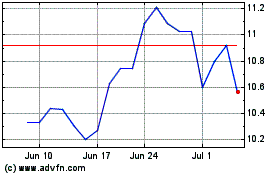

GeoPark (NYSE:GPRK)

Historical Stock Chart

From Dec 2023 to Dec 2024