Franklin Resources, Inc. Announces Month-End Assets Under Management

May 09 2024 - 4:01PM

Business Wire

Franklin Resources, Inc. (Franklin Templeton) (NYSE: BEN) today

reported preliminary month-end assets under management (AUM) of

$1.60 trillion at April 30, 2024, compared to $1.64 trillion at

March 31, 2024. This month's decrease in AUM reflected the impact

of negative markets and slight long-term net outflows inclusive of

$5.9 billion related to the $25 billion from Great-West Lifeco.

By Asset Class:

(In USD billions)

Preliminary

30-Apr-24

31-Mar-24

31-Dec-23

30-Sep-23

30-Apr-23

Equity

$564.4

$592.7

$467.5

$430.4

$441.6

Fixed Income

559.6

571.4

511.7

483.1

510.4

Alternative

255.0

255.5

256.2

254.9

257.8

Multi-Asset

162.6

163.4

154.6

145.0

146.8

Long Term:

1,541.6

1,583.0

1,390.0

1,313.4

1,356.6

Cash Management

62.2

61.7

65.5

60.8

64.1

Total

$1,603.8

$1,644.7

$1,455.5

$1,374.2

$1,420.7

About Franklin Templeton

Franklin Resources, Inc. [NYSE:BEN] is a global investment

management organization with subsidiaries operating as Franklin

Templeton and serving clients in over 150 countries. Franklin

Templeton’s mission is to help clients achieve better outcomes

through investment management expertise, wealth management and

technology solutions. Through its specialist investment managers,

the company offers specialization on a global scale, bringing

extensive capabilities in equity, fixed income, alternatives and

multi-asset solutions. With more than 1,500 investment

professionals, and offices in major financial markets around the

world, the California-based company has over 75 years of investment

experience. The company posts information that may be significant

for investors in the Investor Relations and News Center sections of

its website and encourages investors to consult those sections

regularly. For more information, please visit

investors.franklinresources.com.

Forward-Looking Statements

The financial results in this press release are preliminary.

Some of the statements herein may include forward-looking

statements that reflect our current views with respect to future

events, financial performance and market conditions. Such

statements are provided under the “safe harbor” protection of the

Private Securities Litigation Reform Act of 1995. Forward-looking

statements include all statements that do not relate solely to

historical or current facts and generally can be identified by

words or phrases written in the future tense and/or preceded by

words such as “anticipate,” “believe,” “could,” “depends,”

“estimate,” “expect,” “intend,” “likely,” “may,” “plan,”

“potential,” “preliminary,” “seek,” “should,” “will,” “would,” or

other - similar words or variations thereof, or the negative

thereof, but these terms are not the exclusive means of identifying

such statements.

Forward-looking statements involve a number of known and unknown

risks, uncertainties and other important factors that may cause

actual results and outcomes to differ materially from any future

results or outcomes expressed or implied by such forward-looking

statements, including market and volatility risks, investment

performance and reputational risks, global operational risks,

competition and distribution risks, third-party risks, technology

and security risks, human capital risks, cash management risks, and

legal and regulatory risks. While forward-looking statements are

our best prediction at the time that they are made, you should not

rely on them and are cautioned against doing so. Forward-looking

statements are based on our current expectations and assumptions

regarding our business, the economy and other possible future

conditions. Because forward-looking statements relate to the

future, they are subject to inherent uncertainties, risks and

changes in circumstances that are difficult to predict. They are

neither statements of historical fact nor guarantees or assurances

of future performance. Factors or events that could cause our

actual results to differ may emerge from time to time, and it is

not possible for us to predict all of them.

These and other risks, uncertainties and other important factors

are described in more detail in our recent filings with the U.S.

Securities and Exchange Commission, including, without limitation,

in Risk Factors and Management’s Discussion and Analysis of

Financial Condition and Results of Operations in our Annual Report

on Form 10-K for the fiscal year ended September 30, 2023 and our

subsequent Quarterly Reports on Form 10-Q. If a circumstance occurs

after the date of this press release that causes any of our

forward-looking statements to be inaccurate, whether as a result of

new information, future developments or otherwise, we undertake no

obligation to announce publicly the change to our expectations, or

to make any revision to our forward-looking statements, to reflect

any change in assumptions, beliefs or expectations, or any change

in events, conditions or circumstances upon which any

forward-looking statement is based, unless required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240509701711/en/

Franklin Resources, Inc. Investor Relations: Selene Oh (650)

312-4091, selene.oh@franklintempleton.com Media Relations: Matt

Walsh (650) 312-2245, matthew.walsh@franklintempleton.com

investors.franklinresources.com

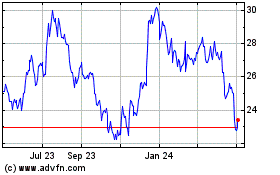

Franklin Resources (NYSE:BEN)

Historical Stock Chart

From Oct 2024 to Nov 2024

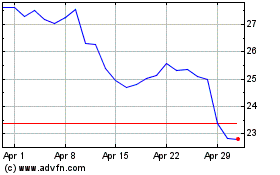

Franklin Resources (NYSE:BEN)

Historical Stock Chart

From Nov 2023 to Nov 2024