0001128928false00011289282024-11-082024-11-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): November 8, 2024

FLOWERS FOODS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Georgia |

|

1-16247 |

|

58-2582379 |

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

|

|

1919 Flowers Circle, Thomasville, GA |

|

31757 |

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (229) 226-9110

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock, par value $0.01 per share |

|

FLO |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On November 8, 2024, Flowers Foods, Inc. issued a press release announcing its financial condition and results of operations as of and for the 12 weeks ended October 5, 2024. A copy of the press release is furnished with this Report as Exhibit 99.1.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

FLOWERS FOODS, INC. |

|

|

|

|

By: |

|

/s/ R. Steve Kinsey |

|

|

|

Name: R. Steve Kinsey |

|

|

|

Title: Chief Financial Officer and Chief Accounting Officer |

Date: November 8, 2024

Exhibit 99.1

Company Press Release

|

|

|

November 8, 2024 |

|

Flowers Foods (NYSE: FLO) |

FLOWERS FOODS, INC. REPORTS THIRD QUARTER 2024 RESULTS

THOMASVILLE, Ga. – Flowers Foods, Inc. (NYSE: FLO) today reported financial results for the company’s 12-week third quarter ended October 5, 2024.

Third Quarter Summary:

Compared to the prior year third quarter where applicable

•Net sales(1) decreased 0.7% to $1.191 billion as positive pricing/mix was more than offset by volume declines.

•Net income increased $111.7 million to $65.0 million, primarily due to growth in operating income from a decrease in legal settlements and related costs, partially offset by higher net interest expense. Adjusted net income(2) increased 12.4% to $69.3 million.

•Adjusted EBITDA(2) increased 10.0% to $133.3 million, representing 11.2% of net sales, a 110-basis point increase.

•Diluted EPS increased $0.53 to $0.31. Adjusted diluted EPS(2) increased $0.04 to $0.33.

Chairman and CEO Remarks:

“Strong performance by our leading brands and successful execution of our cost initiatives and portfolio strategy drove better-than-expected earnings in the third quarter,” said Ryals McMullian, chairman and CEO of Flowers Foods. “We handily outpaced the bread category, growing tracked channel sales in both units and dollars. Those results were achieved despite headwinds from a pressured consumer, which also particularly impacted our sweet baked goods and fast food businesses. Additionally, implementation of our portfolio strategy enhanced performance in our away-from-home business, improving profitability of existing business and adding higher margin new accounts.

“We are narrowing our 2024 financial outlook to reflect greater certainty as we enter the fourth quarter and strong relative performance in the branded retail bread category, partially offset by headwinds from consumer and promotional behavior. We also expect continued benefits from new business wins and efficiency initiatives. Beyond 2024, our focus remains on enhancing shareholder value and delivering results consistent with our long-term financial targets.”

For the 52-week Fiscal 2024, the Company Expects:

•Net sales in the range of approximately $5.116 billion to $5.147 billion, representing 0.5% to 1.1% growth compared to the prior year. Prior guidance called for net sales in the range of approximately $5.091 billion to $5.172 billion, representing 0.0% to 1.6% growth.

•Adjusted EBITDA(3) in the range of approximately $530 million to $542 million, compared to prior guidance of approximately $524 million to $553 million.

•Adjusted diluted EPS(2) in the range of approximately $1.24 to $1.28, compared to prior guidance of approximately $1.20 to $1.30.

The company’s outlook is based on the following assumptions:

•Depreciation and amortization in the range of $155 million to $160 million.

•Net interest expense of approximately $20 million to $24 million.

•An effective tax rate of approximately 25%.

•Weighted average diluted share count for the year of approximately 212.5 million shares.

•Capital expenditures in the range of $130 million to $140 million, with $5 million to $7 million related to the ERP upgrade, compared to prior guidance in the range of $145 million to $155 million, with $3 million to $6 million related to the ERP upgrade.

Matters Affecting Comparability:

Reconciliation of Earnings per Share to Adjusted Earnings per Share

|

|

|

|

|

|

|

|

|

|

|

For the 12-Week Period Ended |

|

|

For the 12-Week Period Ended |

|

|

|

October 5, 2024 |

|

|

October 7, 2023 |

|

Net income (loss) per diluted common share |

|

$ |

0.31 |

|

|

$ |

(0.22 |

) |

Business process improvement costs |

|

NM |

|

|

|

0.02 |

|

Plant closure costs and impairment of assets |

|

|

0.02 |

|

|

NM |

|

Restructuring charges |

|

|

— |

|

|

NM |

|

Legal settlements and related costs |

|

NM |

|

|

|

0.49 |

|

Adjusted net income per diluted common share |

|

$ |

0.33 |

|

|

$ |

0.29 |

|

|

NM - not meaningful. Certain amounts may not add due to rounding. |

Consolidated Third Quarter Operating Highlights

Compared to the prior year third quarter where applicable

•Net sales decreased 0.7% to $1.191 billion. Pricing/mix(4) increased 1.7% and volume(5) declined 2.4%.

•Branded Retail net sales decreased $11.5 million or 1.5% to $760.6 million due to unfavorable price/mix resulting from increased promotional activity, and volume declines. Branded cake drove the volume decrease, partially offset by volume growth in branded bread products. Pricing/mix(4) declined 0.9% and volume(5) decreased 0.6%.

•Other net sales increased $2.8 million or 0.7% to $430.0 million due to significant favorable price/mix from optimizing our non-retail business, most notably in foodservice, partially offset by volume declines concentrated in vending, foodservice, and institutional sales. Pricing/mix(4) rose 4.9% and volume(5) declined 4.2%.

▪Materials, supplies, labor, and other production costs (exclusive of depreciation and amortization) were 50.2% of net sales, a 130-basis point decrease. These costs decreased as a percentage of net sales due to moderating ingredient and packaging costs, improved net sales price/mix, and decreased product returns. Lower production volumes, higher workforce-related costs, and increased outside purchases of product (sales with no associated ingredient costs) partially offset the overall improvement.

▪Selling, distribution, and administrative (SD&A) expenses were 38.7% of net sales, a 1,170-basis point decrease. SD&A decreased as a percentage of net sales due to significantly lower legal settlements and related costs, as well as lower distributor distribution fees, marketing expense, logistics and freight costs, and consulting costs. These items were partially offset by increased workforce-related costs, higher rent expense, and lower scrap dough income. Excluding matters affecting comparability, adjusted SD&A(2) was 38.6% of net sales, a 20 basis point increase.

•Legal settlements and related costs were $0.8 million, or 0.1% of net sales, compared to $137.5 million, or 11.5% of net sales in the prior year quarter.

•The company recognized plant closure costs and asset impairments of $4.5 million, which represented 0.4% of net sales, primarily related to the closure of its Baton Rouge bakery. In the prior year quarter, the company recorded an impairment charge of $1.0 million, or 0.1% of net sales, related to an agreement to sell a warehouse classified as held for sale.

•Depreciation and amortization (D&A) expenses were $37.3 million or 3.1% of net sales, a 10-basis point increase.

•Net interest expense increased $0.8 million primarily due to lower interest income resulting from decreases in distributor notes receivable outstanding.

•Net income increased $111.7 million to $65.0 million. Adjusted net income(2) increased 12.4% to $69.3 million.

•Adjusted EBITDA(2) increased 10.0% to $133.3 million, representing 11.2% of net sales, a 110-basis point increase.

Cash Flow, Capital Allocation, and Capital Return

Year-to-date, through the third quarter of fiscal 2024, cash flow from operating activities increased $25.1 million to $282.4 million, capital expenditures decreased $10.4 million to $86.6 million, and dividends paid to shareholders increased $5.8 million to $152.5 million. Cash and cash equivalents were $15.0 million at quarter end.

(1)Any reference to sales refers to net sales inclusive of allowances and deductions against gross sales

(2)Adjusted for items affecting comparability. See reconciliations of non-GAAP measures in the financial statements following this release. Earnings are net income (loss). EBITDA and Adjusted EBITDA are reconciled to net income (loss).

(3)No reconciliation of the forecasted range for adjusted EBITDA to net income for the 52-week Fiscal 2024 is included in this press release because the company is unable to quantify certain amounts that would be required to be included in the GAAP measure without unreasonable efforts. In addition, the company believes such reconciliation would imply a degree of precision that would be confusing or misleading to investors.

(4)Calculated as (current year period units X change in price per unit) / prior year period net sales dollars

(5)Calculated as (prior year period price per unit X change in units) / prior year period net sales dollars

Pre-Recorded Management Remarks and Question and Answer Webcast

In conjunction with this release, pre-recorded management remarks and a supporting slide presentation will be posted to the Flowers Foods website. The company will host a live question and answer webcast at 8:30 a.m. (Eastern) on November 8, 2024. The pre-recorded remarks and webcast will be archived on the investors page of flowersfoods.com.

About Flowers Foods

Headquartered in Thomasville, Ga., Flowers Foods, Inc. (NYSE: FLO) is one of the largest producers of packaged bakery foods in the United States with 2023 net sales of $5.1 billion. Flowers operates bakeries across the country that produce a wide range of bakery products. Among the company’s top brands are Nature’s Own, Dave’s Killer Bread, Wonder, Canyon Bakehouse, and Tastykake. Learn more at www.flowersfoods.com.

Investor Contact: Eric Jacobson, InvestorRelations@flocorp.com

Media Contact: http://flowersfoods.com/contact/

Forward-Looking Statements

Statements contained in this press release and certain other written or oral statements made from time to time by Flowers Foods, Inc. (the “company”, “Flowers Foods”, “Flowers”, “us”, “we”, or “our”) and its representatives that are not historical facts are forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements relate to current expectations regarding our business and our future financial condition and results of operations and are often identified by the use of words and phrases such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “should,” “will,” “would,” “is likely to,” “is expected to” or “will continue,” or the negative of these terms or other comparable terminology. These forward-looking statements are based upon assumptions we believe are reasonable. Forward-looking statements are based on current information and are subject to risks and uncertainties that could cause our actual results to differ materially from those projected. Certain factors that may cause actual results, performance, liquidity, and achievements to differ materially from those projected are discussed in our Annual Report on Form 10-K for the year ended December 30, 2023 (the “Form 10-K”) and Quarterly Reports on Form 10-Q filed with the Securities and Exchange Commission (“SEC”) and may include, but are not limited to, (a) unexpected changes in any of the following: (1) general economic and business conditions; (2) the competitive setting in which we operate, including advertising or promotional strategies by us or our competitors, as well as changes in consumer demand; (3) interest rates and other terms available to us on our borrowings; (4) supply chain conditions and any related impact on energy and raw materials costs and availability and hedging counter-party risks; (5) relationships with or increased costs related to our employees and third-party service providers; (6) laws and regulations (including environmental and health-related issues); and (7) accounting standards or tax rates in the markets in which we operate, (b) the loss or financial instability of any significant customer(s), including as a result of product recalls or safety concerns related to our products, (c) changes in consumer behavior, trends and preferences, including health and whole grain trends, and the movement toward less expensive store branded products, (d) the level of success we achieve in developing and introducing new products and entering new markets, (e) our ability to implement new technology and customer requirements as required, (f) our ability to operate existing, and any new, manufacturing lines according to schedule, (g) our ability to implement and achieve our corporate responsibility goals in accordance with regulatory requirements and expectations of stakeholders, suppliers, and customers; (h) our ability to execute our business strategies which may involve, among other things, (1) the ability to realize the intended benefits of completed, planned or contemplated acquisitions, dispositions or joint ventures, (2) the deployment of new systems (e.g., our enterprise resource planning ("ERP") system), distribution channels and technology, and (3) an enhanced organizational structure (e.g., our sales and supply chain reorganization), (i) consolidation within the baking industry and related industries, (j) changes in pricing, customer and consumer reaction to pricing actions (including decreased volumes), and the pricing environment among competitors within the industry, (k) our ability to adjust pricing to offset, or partially offset, inflationary pressure on the cost of our products, including ingredient and packaging costs; (l) disruptions in our direct-store-delivery distribution model, including litigation or an adverse ruling by a court or regulatory or governmental body that could affect the independent contractor classifications of the independent distributor partners, and changes to our direct-store-delivery distribution model in California, (m) increasing legal complexity and legal proceedings that we are or may become subject to, (n) labor shortages and turnover or increases in employee and employee-related costs, (o) the credit, business, and legal risks associated with independent distributor partners and customers, which operate in the highly competitive retail food and foodservice industries, (p) any business disruptions due to political instability, pandemics, armed hostilities (including the ongoing conflict between Russia and Ukraine and the conflict in the Middle East), incidents of terrorism, natural disasters, labor strikes or work stoppages, technological breakdowns, product contamination, product recalls or safety concerns related to our products, or the responses to or repercussions from any of these or similar events or conditions and our ability to insure against such events, (q) the failure of our information technology systems to perform adequately, including any interruptions, intrusions, cyber-attacks or security breaches of such systems or risks associated with the implementation of the upgrade of our ERP system; and (r) the potential impact of climate change on the company, including physical and transition risks, availability or restriction of resources, higher regulatory and compliance costs, reputational risks, and availability of capital on attractive terms. The foregoing list of important factors does not include all such factors, nor does it necessarily present them in order of importance. In addition, you should consult other disclosures made by the company (such as in our other filings with the SEC or in company press releases) for other factors that may cause actual results to differ materially from those projected by the company. Refer to Part I, Item 1A., Risk Factors, of the Form 10-K, Part II, Item 1A., Risk Factors, of the Form 10-Q for the quarter ended October 5, 2024 and subsequent filings with the SEC for additional information regarding factors that could affect the company’s results of operations, financial condition and liquidity. We caution you not to place undue reliance on forward-looking statements, as they speak only as of the date made and are inherently uncertain. The company undertakes no obligation to publicly revise or update such statements, except as required by law. You are advised, however, to consult any further public disclosures by the company (such as in our filings with the SEC or in company press releases) on related subjects.

Information Regarding Non-GAAP Financial Measures

The company prepares its consolidated financial statements in accordance with U.S. Generally Accepted Accounting Principles (GAAP). However, from time to time, the company may present in its public statements, press releases and SEC filings, non-GAAP financial measures such as, EBITDA, adjusted EBITDA, adjusted EBITDA margin, adjusted net income, adjusted diluted EPS, adjusted income tax expense, adjusted selling, distribution and administrative expenses (SD&A), and gross margin excluding depreciation and amortization. The reconciliations attached provide reconciliations of the non-GAAP measures used in this presentation or release to the most comparable GAAP financial measure. The company’s definitions of these non-GAAP measures may differ from similarly titled measures used by others. These non-GAAP measures should be considered supplemental to, and not a substitute for, financial information prepared in accordance with GAAP.

The company defines EBITDA as earnings before interest, taxes, depreciation and amortization. Earnings are net income. The company believes that EBITDA is a useful tool for managing the operations of its business and is an indicator of the company’s ability to incur and service indebtedness and generate free cash flow. The company also believes that EBITDA measures are commonly reported and widely used by investors and other interested parties as measures of a company’s operating performance and debt servicing ability because EBITDA measures assist in comparing performance on a consistent basis without regard to depreciation or amortization, which can vary significantly depending upon accounting methods and non-operating factors (such as historical cost). EBITDA is also a widely-accepted financial indicator of a company’s ability to incur and service indebtedness.

EBITDA should not be considered an alternative to (a) income from operations or net income (loss) as a measure of operating performance; (b) cash flows provided by operating, investing and financing activities (as determined in accordance with GAAP) as a measure of the company’s ability to meet its cash needs; or (c) any other indicator of performance or liquidity that has been determined in accordance with GAAP.

The company defines adjusted EBITDA, adjusted EBITDA margin, adjusted net income, adjusted diluted EPS, adjusted income tax expense and adjusted SD&A, respectively, to exclude additional costs that the company considers important to present to investors to increase the investors’ insights about the company’s core operations. These costs include, but are not limited to, the costs of closing a plant or costs associated with acquisition-related activities, restructuring activities, certain impairment charges, legal settlements, costs to implement an enterprise resource planning system and enhance bakery digital capabilities (business process improvement costs) to provide investors direct insight into these costs, and other costs impacting past and future comparability. The company believes that these measures, when considered together with its GAAP financial results, provides management and investors with a more complete understanding of its business operating results, including underlying trends, by excluding the effects of certain charges. Adjusted EBITDA is used as the primary performance measure in the company’s 2014 Omnibus Equity and Incentive Compensation Plan (Amended and Restated Effective May 25, 2023).

Presentation of gross margin includes depreciation and amortization in the materials, supplies, labor and other production costs according to GAAP. Our method of presenting gross margin excludes the depreciation and amortization components, as discussed above.

The reconciliations attached provide reconciliations of the non-GAAP measures used in this release to the most comparable GAAP financial measure.

Flowers Foods, Inc.

Condensed Consolidated Balance Sheets

(000’s omitted)

|

|

|

|

|

|

|

|

|

|

|

October 5, 2024 |

|

|

December 30, 2023 |

|

Assets |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

14,975 |

|

|

$ |

22,527 |

|

Other current assets |

|

|

676,506 |

|

|

|

655,422 |

|

Property, plant and equipment, net |

|

|

947,702 |

|

|

|

962,981 |

|

Right-of-use leases, net |

|

|

308,995 |

|

|

|

276,864 |

|

Distributor notes receivable (1) |

|

|

128,576 |

|

|

|

133,335 |

|

Other assets |

|

|

39,765 |

|

|

|

40,286 |

|

Cost in excess of net tangible assets, net |

|

|

1,313,440 |

|

|

|

1,335,538 |

|

Total assets |

|

$ |

3,429,959 |

|

|

$ |

3,426,953 |

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

Current liabilities |

|

$ |

504,388 |

|

|

$ |

611,546 |

|

Long-term debt |

|

|

1,054,143 |

|

|

|

1,048,144 |

|

Right-of-use lease liabilities (2) |

|

|

315,803 |

|

|

|

284,501 |

|

Other liabilities |

|

|

149,099 |

|

|

|

130,980 |

|

Stockholders’ equity |

|

|

1,406,526 |

|

|

|

1,351,782 |

|

Total liabilities and stockholders’ equity |

|

$ |

3,429,959 |

|

|

$ |

3,426,953 |

|

|

|

|

|

|

|

|

(1) Includes current portion of $16,243 and $9,764, respectively.

(2) Includes current portion of $64,673 and $47,606, respectively.

Flowers Foods, Inc.

Consolidated Statement of Operations

(000’s omitted, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the 12-Week Period Ended |

|

|

For the 12-Week Period Ended |

|

|

For the 40-Week Period Ended |

|

|

For the 40-Week Period Ended |

|

|

|

October 5, 2024 |

|

|

October 7, 2023 |

|

|

October 5, 2024 |

|

|

October 7, 2023 |

|

Net sales |

|

$ |

1,190,561 |

|

|

$ |

1,199,260 |

|

|

$ |

3,992,362 |

|

|

$ |

3,961,803 |

|

Materials, supplies, labor and other production costs (exclusive of

depreciation and amortization shown separately below) |

|

|

598,209 |

|

|

|

617,468 |

|

|

|

2,008,757 |

|

|

|

2,044,417 |

|

Selling, distribution, and administrative expenses |

|

|

460,359 |

|

|

|

603,954 |

|

|

|

1,557,010 |

|

|

|

1,671,813 |

|

Restructuring charges |

|

|

— |

|

|

|

179 |

|

|

|

7,403 |

|

|

|

6,873 |

|

Plant closure costs and impairment of assets |

|

|

4,483 |

|

|

|

1,034 |

|

|

|

9,860 |

|

|

|

1,034 |

|

Depreciation and amortization expense |

|

|

37,331 |

|

|

|

35,974 |

|

|

|

122,393 |

|

|

|

114,693 |

|

Income (loss) from operations |

|

|

90,179 |

|

|

|

(59,349 |

) |

|

|

286,939 |

|

|

|

122,973 |

|

Other pension benefit |

|

|

(119 |

) |

|

|

(62 |

) |

|

|

(395 |

) |

|

|

(207 |

) |

Interest expense, net |

|

|

4,778 |

|

|

|

4,010 |

|

|

|

15,297 |

|

|

|

12,147 |

|

Income (loss) before income taxes |

|

|

85,520 |

|

|

|

(63,297 |

) |

|

|

272,037 |

|

|

|

111,033 |

|

Income tax expense (benefit) |

|

|

20,536 |

|

|

|

(16,567 |

) |

|

|

67,043 |

|

|

|

23,293 |

|

Net income (loss) |

|

$ |

64,984 |

|

|

$ |

(46,730 |

) |

|

$ |

204,994 |

|

|

$ |

87,740 |

|

Net income (loss) per diluted common share |

|

$ |

0.31 |

|

|

$ |

(0.22 |

) |

|

$ |

0.97 |

|

|

$ |

0.41 |

|

Diluted weighted average shares outstanding |

|

|

211,975 |

|

|

|

211,522 |

|

|

|

212,123 |

|

|

|

213,455 |

|

Flowers Foods, Inc.

Condensed Consolidated Statement of Cash Flows

(000’s omitted)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the 12-Week Period Ended |

|

|

For the 12-Week Period Ended |

|

|

For the 40-Week Period Ended |

|

|

For the 40-Week Period Ended |

|

|

|

October 5, 2024 |

|

|

October 7, 2023 |

|

|

October 5, 2024 |

|

|

October 7, 2023 |

|

Cash flows from operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

64,984 |

|

|

$ |

(46,730 |

) |

|

$ |

204,994 |

|

|

$ |

87,740 |

|

Adjustments to reconcile net income (loss) to net cash from operating

activities: |

|

|

|

|

|

|

|

|

|

|

|

|

Total non-cash adjustments |

|

|

58,273 |

|

|

|

6,458 |

|

|

|

182,843 |

|

|

|

111,814 |

|

Changes in assets and liabilities and pension plan contributions |

|

|

(9,308 |

) |

|

|

168,683 |

|

|

|

(105,467 |

) |

|

|

57,764 |

|

Net cash provided by operating activities |

|

|

113,949 |

|

|

|

128,411 |

|

|

|

282,370 |

|

|

|

257,318 |

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

Purchase of property, plant and equipment |

|

|

(25,373 |

) |

|

|

(28,618 |

) |

|

|

(86,624 |

) |

|

|

(97,003 |

) |

Proceeds from sale of property, plant and equipment |

|

|

1,231 |

|

|

|

1,503 |

|

|

|

2,040 |

|

|

|

2,278 |

|

Acquisition of business |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(274,755 |

) |

Investment in unconsolidated affiliate |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,981 |

) |

Other |

|

|

(12,295 |

) |

|

|

(1,051 |

) |

|

|

(28,358 |

) |

|

|

4,926 |

|

Net cash disbursed for investing activities |

|

|

(36,437 |

) |

|

|

(28,166 |

) |

|

|

(112,942 |

) |

|

|

(366,535 |

) |

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

Dividends paid |

|

|

(50,543 |

) |

|

|

(48,603 |

) |

|

|

(152,489 |

) |

|

|

(146,726 |

) |

Stock repurchases |

|

|

— |

|

|

|

(4,647 |

) |

|

|

(22,703 |

) |

|

|

(30,891 |

) |

Net change in debt borrowings |

|

|

(15,000 |

) |

|

|

(37,000 |

) |

|

|

5,000 |

|

|

|

145,000 |

|

Payments on financing leases |

|

|

(66 |

) |

|

|

(461 |

) |

|

|

(235 |

) |

|

|

(1,513 |

) |

Other |

|

|

(3,794 |

) |

|

|

(6,684 |

) |

|

|

(6,553 |

) |

|

|

(7,226 |

) |

Net cash disbursed for financing activities |

|

|

(69,403 |

) |

|

|

(97,395 |

) |

|

|

(176,980 |

) |

|

|

(41,356 |

) |

Net increase (decrease) in cash and cash equivalents |

|

|

8,109 |

|

|

|

2,850 |

|

|

|

(7,552 |

) |

|

|

(150,573 |

) |

Cash and cash equivalents at beginning of period |

|

|

6,866 |

|

|

|

11,711 |

|

|

|

22,527 |

|

|

|

165,134 |

|

Cash and cash equivalents at end of period |

|

$ |

14,975 |

|

|

$ |

14,561 |

|

|

$ |

14,975 |

|

|

$ |

14,561 |

|

Flowers Foods, Inc.

Net Sales by Sales Class and Net Sales Bridge

(000’s omitted)

Net Sales by Sales Class

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Sales by Sales Class |

|

For the 12-Week Period Ended |

|

|

For the 12-Week Period Ended |

|

|

|

|

|

|

|

|

|

October 5, 2024 |

|

|

October 7, 2023 |

|

|

$ Change |

|

|

% Change |

|

Branded Retail |

|

$ |

760,580 |

|

|

$ |

772,082 |

|

|

$ |

(11,502 |

) |

|

|

(1.5 |

)% |

Other |

|

|

429,981 |

|

|

|

427,178 |

|

|

|

2,803 |

|

|

|

0.7 |

% |

Total Net Sales |

|

$ |

1,190,561 |

|

|

$ |

1,199,260 |

|

|

$ |

(8,699 |

) |

|

|

(0.7 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Sales by Sales Class |

|

For the 40-Week Period Ended |

|

|

For the 40-Week Period Ended |

|

|

|

|

|

|

|

|

|

October 5, 2024 |

|

|

October 7, 2023 |

|

|

$ Change |

|

|

% Change |

|

Branded Retail |

|

$ |

2,565,310 |

|

|

$ |

2,539,890 |

|

|

$ |

25,420 |

|

|

|

1.0 |

% |

Other |

|

|

1,427,052 |

|

|

|

1,421,913 |

|

|

|

5,139 |

|

|

|

0.4 |

% |

Total Net Sales |

|

$ |

3,992,362 |

|

|

$ |

3,961,803 |

|

|

$ |

30,559 |

|

|

|

0.8 |

% |

Net Sales Bridge

|

|

|

|

|

|

|

|

|

|

|

|

|

For the 12-week period ended October 5, 2024 |

|

Branded Retail |

|

|

Other |

|

|

Total |

|

Pricing/mix* |

|

|

(0.9 |

)% |

|

|

4.9 |

% |

|

|

1.7 |

% |

Volume* |

|

|

(0.6 |

)% |

|

|

(4.2 |

)% |

|

|

(2.4 |

)% |

Total percentage point change in net sales |

|

|

(1.5 |

)% |

|

|

0.7 |

% |

|

|

(0.7 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

For the 40-week period ended October 5, 2024 |

|

Branded Retail |

|

|

Other |

|

|

Total |

|

Pricing/mix* |

|

|

0.9 |

% |

|

|

3.2 |

% |

|

|

2.0 |

% |

Volume* |

|

|

(0.1 |

)% |

|

|

(3.0 |

)% |

|

|

(1.4 |

)% |

Acquisition until cycled on February 17, 2024 |

|

|

0.2 |

% |

|

|

0.2 |

% |

|

|

0.2 |

% |

Total percentage point change in net sales |

|

|

1.0 |

% |

|

|

0.4 |

% |

|

|

0.8 |

% |

|

|

|

|

|

|

|

|

|

|

* Computations above are calculated as follows (the Total column is consolidated and is not adding the Branded Retail and Other columns): |

|

Price/Mix $ = Current year period units × change in price per unit |

|

Price/Mix % = Price/Mix $ ÷ Prior year period Net Sales $ |

|

|

|

|

|

|

|

|

|

|

|

Volume $ = Prior year period price per unit × change in units |

|

Volume % = Volume $ ÷ Prior year period Net Sales $ |

|

Flowers Foods, Inc.

Reconciliation of GAAP to Non-GAAP Measures

(000’s omitted, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Earnings (Loss) per Share to Adjusted Earnings per Share |

|

|

|

For the 12-Week Period Ended |

|

|

For the 12-Week Period Ended |

|

|

For the 40-Week Period Ended |

|

|

For the 40-Week Period Ended |

|

|

|

October 5, 2024 |

|

|

October 7, 2023 |

|

|

October 5, 2024 |

|

|

October 7, 2023 |

|

Net income (loss) per diluted common share |

|

$ |

0.31 |

|

|

$ |

(0.22 |

) |

|

$ |

0.97 |

|

|

$ |

0.41 |

|

Business process improvement costs |

|

NM |

|

|

|

0.02 |

|

|

|

0.02 |

|

|

|

0.07 |

|

Plant closure costs and impairment of assets |

|

|

0.02 |

|

|

NM |

|

|

|

0.03 |

|

|

NM |

|

Restructuring charges |

|

|

— |

|

|

NM |

|

|

|

0.03 |

|

|

|

0.02 |

|

Restructuring-related implementation costs |

|

|

— |

|

|

|

— |

|

|

|

0.01 |

|

|

|

— |

|

Acquisition-related costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.01 |

|

Legal settlements and related costs |

|

NM |

|

|

|

0.49 |

|

|

NM |

|

|

|

0.48 |

|

Adjusted net income per diluted common share |

|

$ |

0.33 |

|

|

$ |

0.29 |

|

|

$ |

1.06 |

|

|

$ |

1.00 |

|

NM - not meaningful. |

|

|

|

|

|

|

|

|

|

|

|

|

Certain amounts may not add due to rounding. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Gross Margin |

|

|

|

For the 12-Week Period Ended |

|

|

For the 12-Week Period Ended |

|

|

For the 40-Week Period Ended |

|

|

For the 40-Week Period Ended |

|

|

|

October 5, 2024 |

|

|

October 7, 2023 |

|

|

October 5, 2024 |

|

|

October 7, 2023 |

|

Net sales |

|

$ |

1,190,561 |

|

|

$ |

1,199,260 |

|

|

$ |

3,992,362 |

|

|

$ |

3,961,803 |

|

Materials, supplies, labor and other production costs (exclusive

of depreciation and amortization) |

|

|

598,209 |

|

|

|

617,468 |

|

|

|

2,008,757 |

|

|

|

2,044,417 |

|

Gross margin excluding depreciation and amortization |

|

|

592,352 |

|

|

|

581,792 |

|

|

|

1,983,605 |

|

|

|

1,917,386 |

|

Less depreciation and amortization for production activities |

|

|

20,914 |

|

|

|

19,225 |

|

|

|

67,581 |

|

|

|

62,932 |

|

Gross margin |

|

$ |

571,438 |

|

|

$ |

562,567 |

|

|

$ |

1,916,024 |

|

|

$ |

1,854,454 |

|

Depreciation and amortization for production activities |

|

$ |

20,914 |

|

|

$ |

19,225 |

|

|

$ |

67,581 |

|

|

$ |

62,932 |

|

Depreciation and amortization for selling, distribution, and

administrative activities |

|

|

16,417 |

|

|

|

16,749 |

|

|

|

54,812 |

|

|

|

51,761 |

|

Total depreciation and amortization |

|

$ |

37,331 |

|

|

$ |

35,974 |

|

|

$ |

122,393 |

|

|

$ |

114,693 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Selling, Distribution, and Administrative Expenses to

Adjusted SD&A |

|

|

|

For the 12-Week Period Ended |

|

|

For the 12-Week Period Ended |

|

|

For the 40-Week Period Ended |

|

|

For the 40-Week Period Ended |

|

|

|

October 5, 2024 |

|

|

October 7, 2023 |

|

|

October 5, 2024 |

|

|

October 7, 2023 |

|

Selling, distribution, and administrative expenses

(SD&A) |

|

$ |

460,359 |

|

|

$ |

603,954 |

|

|

$ |

1,557,010 |

|

|

$ |

1,671,813 |

|

Business process improvement costs |

|

|

(490 |

) |

|

|

(5,814 |

) |

|

|

(5,779 |

) |

|

|

(18,621 |

) |

Restructuring-related implementation costs |

|

|

— |

|

|

|

— |

|

|

|

(2,979 |

) |

|

|

— |

|

Acquisition-related costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(3,712 |

) |

Legal settlements and related costs |

|

|

(827 |

) |

|

|

(137,529 |

) |

|

|

(827 |

) |

|

|

(137,529 |

) |

Adjusted SD&A |

|

$ |

459,042 |

|

|

$ |

460,611 |

|

|

$ |

1,547,425 |

|

|

$ |

1,511,951 |

|

Flowers Foods, Inc.

Reconciliation of GAAP to Non-GAAP Measures

(000’s omitted, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Net Income (Loss) to EBITDA and Adjusted EBITDA |

|

|

|

For the 12-Week Period Ended |

|

|

For the 12-Week Period Ended |

|

|

For the 40-Week Period Ended |

|

|

For the 40-Week Period Ended |

|

|

|

October 5, 2024 |

|

|

October 7, 2023 |

|

|

October 5, 2024 |

|

|

October 7, 2023 |

|

Net income (loss) |

|

$ |

64,984 |

|

|

$ |

(46,730 |

) |

|

$ |

204,994 |

|

|

$ |

87,740 |

|

Income tax expense (benefit) |

|

|

20,536 |

|

|

|

(16,567 |

) |

|

|

67,043 |

|

|

|

23,293 |

|

Interest expense, net |

|

|

4,778 |

|

|

|

4,010 |

|

|

|

15,297 |

|

|

|

12,147 |

|

Depreciation and amortization |

|

|

37,331 |

|

|

|

35,974 |

|

|

|

122,393 |

|

|

|

114,693 |

|

EBITDA |

|

|

127,629 |

|

|

|

(23,313 |

) |

|

|

409,727 |

|

|

|

237,873 |

|

Other pension benefit |

|

|

(119 |

) |

|

|

(62 |

) |

|

|

(395 |

) |

|

|

(207 |

) |

Business process improvement costs |

|

|

490 |

|

|

|

5,814 |

|

|

|

5,779 |

|

|

|

18,621 |

|

Plant closure costs and impairment of assets |

|

|

4,483 |

|

|

|

1,034 |

|

|

|

9,860 |

|

|

|

1,034 |

|

Restructuring charges |

|

|

— |

|

|

|

179 |

|

|

|

7,403 |

|

|

|

6,873 |

|

Restructuring-related implementation costs |

|

|

— |

|

|

|

— |

|

|

|

2,979 |

|

|

|

— |

|

Acquisition-related costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3,712 |

|

Legal settlements and related costs |

|

|

827 |

|

|

|

137,529 |

|

|

|

827 |

|

|

|

137,529 |

|

Adjusted EBITDA |

|

$ |

133,310 |

|

|

$ |

121,181 |

|

|

$ |

436,180 |

|

|

$ |

405,435 |

|

Net sales |

|

$ |

1,190,561 |

|

|

$ |

1,199,260 |

|

|

$ |

3,992,362 |

|

|

$ |

3,961,803 |

|

Adjusted EBITDA margin |

|

|

11.2 |

% |

|

|

10.1 |

% |

|

|

10.9 |

% |

|

|

10.2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Income Tax Expense (Benefit) to Adjusted Income Tax Expense |

|

|

|

For the 12-Week Period Ended |

|

|

For the 12-Week Period Ended |

|

|

For the 40-Week Period Ended |

|

|

For the 40-Week Period Ended |

|

|

|

October 5, 2024 |

|

|

October 7, 2023 |

|

|

October 5, 2024 |

|

|

October 7, 2023 |

|

Income tax expense (benefit) |

|

$ |

20,536 |

|

|

$ |

(16,567 |

) |

|

$ |

67,043 |

|

|

$ |

23,293 |

|

Tax impact of: |

|

|

|

|

|

|

|

|

|

|

|

|

Business process improvement costs |

|

|

123 |

|

|

|

1,453 |

|

|

|

1,445 |

|

|

|

4,655 |

|

Plant closure costs and impairment of assets |

|

|

1,122 |

|

|

|

259 |

|

|

|

2,466 |

|

|

|

259 |

|

Restructuring charges |

|

|

— |

|

|

|

45 |

|

|

|

1,851 |

|

|

|

1,718 |

|

Restructuring-related implementation costs |

|

|

— |

|

|

|

— |

|

|

|

745 |

|

|

|

— |

|

Acquisition-related costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

928 |

|

Legal settlements and related costs |

|

|

207 |

|

|

|

34,382 |

|

|

|

207 |

|

|

|

34,382 |

|

Adjusted income tax expense |

|

$ |

21,988 |

|

|

$ |

19,572 |

|

|

$ |

73,757 |

|

|

$ |

65,235 |

|

Flowers Foods, Inc.

Reconciliation of GAAP to Non-GAAP Measures

(000’s omitted, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Net Income (Loss) to Adjusted Net Income |

|

|

|

For the 12-Week Period Ended |

|

|

For the 12-Week Period Ended |

|

|

For the 40-Week Period Ended |

|

|

For the 40-Week Period Ended |

|

|

|

October 5, 2024 |

|

|

October 7, 2023 |

|

|

October 5, 2024 |

|

|

October 7, 2023 |

|

Net income (loss) |

|

$ |

64,984 |

|

|

$ |

(46,730 |

) |

|

$ |

204,994 |

|

|

$ |

87,740 |

|

Business process improvement costs |

|

|

367 |

|

|

|

4,361 |

|

|

|

4,334 |

|

|

|

13,966 |

|

Plant closure costs and impairment of assets |

|

|

3,361 |

|

|

|

775 |

|

|

|

7,394 |

|

|

|

775 |

|

Restructuring charges |

|

|

— |

|

|

|

134 |

|

|

|

5,552 |

|

|

|

5,155 |

|

Restructuring-related implementation costs |

|

|

— |

|

|

|

— |

|

|

|

2,234 |

|

|

|

— |

|

Acquisition-related costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,784 |

|

Legal settlements and related costs |

|

|

620 |

|

|

|

103,147 |

|

|

|

620 |

|

|

|

103,147 |

|

Adjusted net income |

|

$ |

69,332 |

|

|

$ |

61,687 |

|

|

$ |

225,128 |

|

|

$ |

213,567 |

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Earnings per Share -

Full Year Fiscal 2024 Guidance |

|

|

|

Range Estimate |

|

Net income per diluted common share |

|

$ |

1.15 |

|

to |

$ |

1.19 |

|

Business process improvement costs |

|

|

0.02 |

|

|

|

0.02 |

|

Plant closure costs and impairment of assets |

|

|

0.03 |

|

|

|

0.03 |

|

Restructuring charges |

|

|

0.03 |

|

|

|

0.03 |

|

Restructuring-related implementation costs |

|

|

0.01 |

|

|

|

0.01 |

|

Legal settlements and related costs |

|

NM |

|

|

NM |

|

Adjusted net income per diluted common share |

|

$ |

1.24 |

|

to |

$ |

1.28 |

|

NM - not meaningful. |

|

|

|

|

|

|

Certain amounts may not add due to rounding. |

|

|

|

|

|

|

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

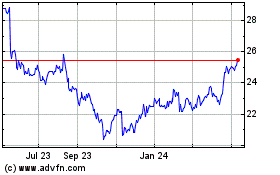

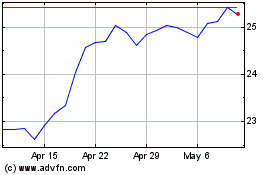

Flowers Foods (NYSE:FLO)

Historical Stock Chart

From Oct 2024 to Nov 2024

Flowers Foods (NYSE:FLO)

Historical Stock Chart

From Nov 2023 to Nov 2024