Current Report Filing (8-k)

June 12 2019 - 4:17PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

June 6, 2019

Date

of report (date of earliest event reported)

FIVE POINT

HOLDINGS, LLC

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-38088

|

|

27-0599397

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

|

|

15131 Alton Parkway, 4

th

Floor, Irvine, California

|

|

92618

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(949)

349-1000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of

the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17

CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Class A common shares

|

|

FPH

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of

1933 (§230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934

(§240.12b-2

of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain

Officers; Compensatory Arrangements of Certain Officers.

Five Point Holdings, LLC (the “Company”) held its 2019 Annual

Meeting of Shareholders on June 6, 2019 (the “Annual Meeting”). At the Annual Meeting, the Company’s shareholders approved the Five Point Holdings, LLC Amended and Restated 2016 Incentive Award Plan (the “Amended

Plan”), which amends and restates the Company’s 2016 Incentive Award Plan (the “Prior Plan”) in its entirety. The Amended Plan was approved by the Company’s Board of Directors (the “Board”) on April 12, 2019

and became effective on June 6, 2019, the date the Amended Plan was approved by shareholders at the Annual Meeting.

The Amended Plan

provides for the grant of options, restricted shares, restricted share units, dividend equivalents, share appreciation rights and cash or share-based performance awards to eligible individuals. Employees and consultants of the Company and its

subsidiaries and affiliates, as well as

non-employee

members of the Board, are eligible to receive awards under the Amended Plan.

The Amended Plan increases the aggregate number of common shares available for issuance under the Prior Plan by 3,209,326 shares. The Amended

Plan will be administered by the Compensation Committee of the Board (or by the Board or another Board committee as may be determined by the Board from time to time). The Company may alter, amend, suspend or terminate the Amended Plan at any time

and from time to time, subject to shareholder approval to the extent required by applicable law, rule or regulation (including any applicable stock exchange rule).

For a more complete description of the Amended Plan, reference is made to the description of the Amended Plan set out in “Proposal

2” in the Company’s Definitive Proxy Statement on Schedule 14A filed with the Securities and Exchange Commission on April 26, 2019 (the “Proxy Statement”), which description is incorporated herein by reference. Such summary

and the foregoing description of the Amended Plan are qualified by reference to the actual text of the Amended Plan, which is attached as Appendix A to the Proxy Statement and likewise incorporated herein by reference.

Item 5.07. Submission of Matters to a Vote of Security Holders.

The Company held its Annual Meeting on June 6, 2019. There were 68,746,555 Class A common shares and 79,275,234 Class B common

shares outstanding and entitled to vote at the Annual Meeting as of April 9, 2019, the record date for the Annual Meeting. Each Class A common share and each Class B common share was entitled to one vote per share. Accordingly, as of

the record date, the total voting power of all of the outstanding shares entitled to vote at the Annual Meeting was 148,021,789 votes. There were present in person or represented by proxy at the Annual Meeting shareholders holding an aggregate of

134,023,849 common shares representing 90.5% of the issued and outstanding common shares of the Company entitled to vote at the Annual Meeting as determined on the record date.

At the Annual Meeting, the shareholders of the Company elected all three (3) of the Company’s nominees for director, with voting

results as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

Votes Cast For

|

|

|

Votes Withheld

|

|

|

Broker Non-Votes

|

|

|

Richard Beckwitt

|

|

|

128,845,825

|

|

|

|

227,526

|

|

|

|

4,950,498

|

|

|

William Browning

|

|

|

129,039,001

|

|

|

|

34,350

|

|

|

|

4,950,498

|

|

|

Michael Rossi

|

|

|

128,062,163

|

|

|

|

1,011,188

|

|

|

|

4,950,498

|

|

Based on the foregoing votes, each of the three nominees named in the table above was elected and will serve

as a director until the 2022 annual meeting of shareholders or until such director’s successor is duly elected and qualified or, if earlier, such director’s death, resignation or removal.

At the Annual Meeting, the shareholders of the Company approved the Five Point Holdings, LLC

Amended and Restated 2016 Incentive Award Plan, with voting results as follows:

|

|

|

|

|

|

|

|

|

Votes Cast For

|

|

Votes Cast Against

|

|

Abstentions

|

|

Broker Non-Votes

|

|

127,180,667

|

|

1,879,263

|

|

13,421

|

|

4,950,498

|

Also at the Annual Meeting, the shareholders of the Company ratified the selection of Deloitte &

Touche LLP as the Company’s independent registered public accountants for the fiscal year ending December 31, 2019, with voting results as follows:

|

|

|

|

|

|

|

|

|

Votes Cast For

|

|

Votes Cast Against

|

|

Abstentions

|

|

Broker Non-Votes

|

|

133,884,911

|

|

117,325

|

|

21,613

|

|

—

|

SIGNATURES

Pursuant to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned duly authorized.

Date: June 12, 2019

|

|

|

|

|

FIVE POINT HOLDINGS, LLC

|

|

|

|

|

By:

|

|

/s/ Michael Alvarado

|

|

Name:

|

|

Michael Alvarado

|

|

Title:

|

|

Chief Legal Officer, Vice President and Secretary

|

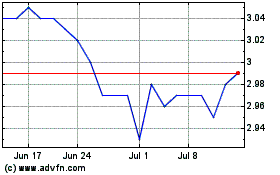

Five Point (NYSE:FPH)

Historical Stock Chart

From Oct 2024 to Nov 2024

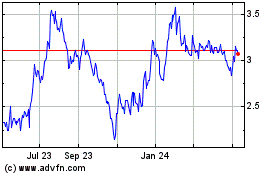

Five Point (NYSE:FPH)

Historical Stock Chart

From Nov 2023 to Nov 2024