Net Revenues Growth of 25.2% YoY, Net Income of

$4.0 million, Net Income Margin of 3.1% and Adjusted EBITDA Margin

of 16.4%

FIGS, Inc. (NYSE: FIGS) (the “Company”), the direct-to-consumer

healthcare apparel and lifestyle brand, today released its third

quarter 2022 financial results and published a financial highlights

presentation on its investor relations website at

ir.wearfigs.com/financials/quarterly-results/.

Third Quarter 2022 Financial Highlights

- Net revenues were $128.6 million, an increase of 25.2%

year over year, driven by an increase in orders from existing and

new customers and, to a lesser extent, an increase in AOV.

- Gross margin was 70.6%, a decrease of 210 basis points

year over year, primarily due to an increase in freight-in costs,

related to increased utilization of more expensive air freight and

elevated ocean freight costs, and to a lesser extent, a higher mix

of promotional sales and product mix shift.

- Operating expenses were $79.6 million, an increase of

24.1% year over year. As a percentage of net revenues, operating

expenses decreased to 61.9% from 62.5% in the prior year period due

to lower general and administrative expenses, partially offset by

higher selling expenses related to fulfillment costs.

- Net income was $4.0 million and diluted earnings per

share was $0.02.

- Net income margin(1) was 3.1%, as compared to 6.8% in

the same period last year.

- Net income, as adjusted(2) was $4.1 million and

diluted earnings per share, as adjusted(1) was $0.02.

- Adjusted EBITDA(2) was $21.0 million, a decrease of $1.2

million year over year.

- Adjusted EBITDA margin(1)(2) was 16.4%, as compared to

21.6% in the same period last year.

Key Operating Metrics

- Active customers(3) as of September 30, 2022 increased

23.6% to 2.2 million.

- Net revenues per active customer(3) was $227, an

increase of 3.7% year over year.

- Average Order Value (“AOV”)(3) was $112, an increase of

9.8% year over year primarily driven by higher units per

transaction as well as an increase in average unit retail.

“Our third quarter performance reflects strength in both our

financial results and a number of our key operating metrics,” said

Trina Spear, Chief Executive Officer and Co-Founder. “With

frequency trends continuing to slow largely due to sustained

macroeconomic pressures, we are adjusting our plans to focus even

more on product innovation and customer engagement strategies,

while managing cost pressures. Importantly, our brand remains

strong and we continue to gain market share as we strive to become

the largest provider of scrubs and lifestyle apparel to the

healthcare community.”

Financial Outlook

For Full-Year 2022, the Company now expects:

- Net revenues of approximately $495 million, representing

year-over-year growth of approximately 18%.

- Adjusted EBITDA margin(4) of approximately 16%.

Daniella Turenshine, Chief Financial Officer, commented, “We

have a strong balance sheet and are financially well positioned to

navigate this environment,” said Daniella Turenshine, Chief

Financial Officer. “By right-sizing inventory and controlling costs

while continuing to make strategic investments in the long-term

growth of our business, we expect to further advance our leadership

position in the market.”

(1) “Net income margin” and “adjusted

EBITDA margin” are calculated by dividing net income and adjusted

EBITDA by net revenues, respectively.

(2) “Net income, as adjusted,” “diluted

earnings per share, as adjusted,” “adjusted EBITDA” and “adjusted

EBITDA margin” are non-GAAP financial measures. Please see the

sections titled “Non-GAAP Financial Measures and Key Operating

Metrics” and “Reconciliations of GAAP to Non-GAAP Measures” below

for more information regarding the Company’s use of non-GAAP

financial measures and reconciliations to the most directly

comparable GAAP measures.

(3) “Active customers,” “net revenues per

active customer” and “average order value” are key operational and

business metrics that are important to understanding the Company's

performance. For information regarding how the Company calculates

its key operational and business metrics, please see the section

titled “Non-GAAP Financial Measures and Key Operating Metrics.”

(4) The Company has not provided a

quantitative reconciliation of its adjusted EBITDA margin outlook

to a GAAP net income margin outlook because it is unable, without

making unreasonable efforts, to project certain reconciling items.

These items include, but are not limited to, future stock-based

compensation expense, income taxes, expenses related to

non-ordinary course disputes, and transaction costs. These items

are inherently variable and uncertain and depend on various

factors, some of which are outside of the Company’s control or

ability to predict. For more information regarding the Company’s

use of non-GAAP financial measures, please see the section titled

“Non-GAAP Financial Measures and Key Operating Metrics.”

Conference Call Details

FIGS management will host a conference call and webcast today at

2:00 p.m. PT / 5:00 p.m. ET to discuss the Company’s financial and

business results and outlook. To participate, please dial

1-844-200-6205 (US) or 1-929-526-1599 (International) and the

conference ID 541472. The call is also accessible via webcast at

ir.wearfigs.com. A recording will be available shortly after the

conclusion of the call until 11:59 p.m. ET on November 17, 2022. To

access the replay, please dial 1-866-813-9403 (US) or

+44-204-525-0658 (International) and the conference ID 612866. An

archive of the webcast will be available on FIGS’ investor

relations website at ir.wearfigs.com.

Non-GAAP Financial Measures and Key Operating Metrics

In addition to the GAAP financial measures set forth in this

press release, the Company has included non-GAAP financial measures

within the meaning of Regulation G and Item 10(e) of Regulation

S-K. The Company has also included “active customers,” “net

revenues per active customer” and “average order value,” which are

key operational and business metrics that are important to

understanding Company performance. The Company calculates “active

customers” as unique customer accounts that have made at least one

purchase in the preceding 12-month period. The Company calculates

“net revenues per active customer” as the sum of the total net

revenues in the preceding 12-month period divided by the current

period “active customers.” The Company calculates “average order

value” as the sum of the total net revenues in a given period

divided by the total orders placed in that period. Total orders are

the summation of all completed individual purchase transactions in

a given period.

The Company uses “net income, as adjusted,” “diluted earnings

per share, as adjusted,” “adjusted EBITDA” and “adjusted EBITDA

margin” to provide useful supplemental measures that assist in

evaluating its ability to generate earnings, provide consistency

and comparability with its past financial performance and

facilitate period-to-period comparisons of its core operating

results as well as the results of its peer companies. The Company

calculates “net income, as adjusted,” as net income adjusted to

exclude transaction costs, expenses related to non-ordinary course

disputes, stock-based compensation, including expense related to

award modifications, accelerated performance awards and ambassador

grants in connection with its initial public offering, and expense

resulting from the retirement of the Company's previous CFO, and

the income tax impact of these adjustments. The Company calculates

“diluted earnings per share, as adjusted” as net income, as

adjusted divided by diluted shares outstanding. The Company

calculates “adjusted EBITDA” as net income adjusted to exclude:

other income (loss), net; gain/loss on disposal of assets;

provision for income taxes; depreciation and amortization expense;

stock-based compensation and related expense; transaction costs;

and expenses related to non-ordinary course disputes. The Company

calculates “adjusted EBITDA margin” by dividing adjusted EBITDA by

net revenues.

Reconciliations of non-GAAP financial measures to the most

directly comparable GAAP measures are included below under the

heading “Reconciliations of GAAP to Non-GAAP Measures.”

About FIGS

FIGS is a founder-led, direct-to-consumer healthcare apparel and

lifestyle brand that seeks to celebrate, empower, and serve current

and future generations of healthcare professionals. We create

technically advanced apparel and products for healthcare

professionals that feature an unmatched combination of comfort,

durability, function, and style. We market and sell our products

directly through our digital platform to provide a seamless

experience for healthcare professionals.

Forward Looking Statements

This press release contains various forward-looking statements

about the Company within the meaning of the Private Securities

Litigation Reform Act of 1995, as amended, that are based on

current management expectations, and which involve substantial

risks and uncertainties that could cause actual results to differ

materially from the results expressed in, or implied by, such

forward-looking statements. All statements contained in this press

release that do not relate to matters of historical fact should be

considered forward-looking. These forward-looking statements

generally are identified by the words “anticipate”, “believe”,

“contemplate”, “continue”, “could”, “estimate”, “expect”,

“forecast”, “future”, “intend”, “may”, “might”, “opportunity”,

“outlook”, “plan”, “possible”, “potential”, “predict”, “project,”

“should”, “strategy”, “strive”, “target”, “will” or “would”, the

negative of these words or other similar terms or expressions. The

absence of these words does not mean that a statement is not

forward-looking. These forward-looking statements address various

matters, including the Company’s adjustment to and ability to

navigate current macroeconomic conditions; the Company’s plan to

implement product innovation, customer engagement strategies and

maintain cost pressures; the Company’s aim to become the largest

provider of scrubs and lifestyle apparel to the healthcare

community; the Company’s plan to right-size inventory and control

costs; the Company’s plan to invest in the long-term growth of the

business; the Company's advancement of its leadership position in

the market and the Company’s outlook as to net revenues and

adjusted EBITDA margin for the full year ending December 31, 2022;

all of which reflect the Company’s expectations based upon

currently available information and data. Because such statements

are based on expectations as to future financial and operating

results and are not statements of fact, our actual results

performance or achievements may differ materially from those

expressed or implied by the forward-looking statements, and you are

cautioned not to place undue reliance on these forward-looking

statements. The following important factors and uncertainties,

among others, could cause actual results, performance or

achievements to differ materially from those described in these

forward-looking statements: the impact of COVID-19 and

macroeconomic trends on the Company’s operations; the Company’s

ability to maintain its recent rapid growth; the Company’s ability

to maintain profitability; the Company’s ability to maintain the

value and reputation of its brand; the Company’s ability to attract

new customers, retain existing customers, and to maintain or

increase sales to those customers; the success of the Company’s

marketing efforts; the Company’s ability to maintain a strong

community of engaged customers and Ambassadors; negative publicity

related to the Company’s marketing efforts or use of social media;

the Company’s ability to successfully develop and introduce new,

innovative and updated products; the competitiveness of the market

for healthcare apparel; the Company's ability to maintain its key

employees; the Company’s ability to attract and retain highly

skilled team members; risks associated with expansion into, and

conducting business in, international markets; changes in, or

disruptions to, the Company’s shipping arrangements; the Company’s

ability to accurately forecast customer demand, manage its

inventory, and plan for future expenses; the impact of changes in

consumer confidence, shopping behavior and consumer spending on

demand for the Company's products; the Company’s reliance on a

limited number of third-party suppliers; the fluctuating costs of

raw materials; the Company’s failure to protect its intellectual

property rights; the fact that the operations of many of the

Company’s suppliers and vendors are subject to additional risks

that are beyond its control; and other risks, uncertainties, and

factors discussed in the “Risk Factors” section of the Company’s

Quarterly Report on Form 10-Q for the quarter ended September 30,

2022 to be filed with the Securities and Exchange Commission

(“SEC”), the Company’s Annual Report on Form 10-K for the year

ended December 31, 2021 filed with the SEC on March 10, 2022, and

the Company’s other periodic filings with the SEC. The

forward-looking statements in this press release speak only as of

the time made and the Company does not undertake to update or

revise them to reflect future events or circumstances.

FIGS, INC.

BALANCE SHEETS

(In thousands, except share

and per share data)

As of

September 30,

2022

December 31,

2021

Assets

(Unaudited)

Current assets

Cash and cash equivalents

$

155,582

$

195,374

Restricted cash

—

2,056

Accounts receivable

8,368

2,441

Inventory, net

168,088

86,068

Prepaid expenses and other current

assets

13,870

7,400

Total current assets

345,908

293,339

Non-current assets

Property and equipment, net

10,823

7,613

Operating lease right-of-use assets

15,974

—

Deferred tax assets

11,215

10,239

Other assets

1,738

560

Total non-current assets

39,750

18,412

Total assets

$

385,658

$

311,751

Liabilities and stockholders’

equity

Current liabilities

Accounts payable

$

21,162

$

14,604

Operating lease liabilities

3,379

—

Accrued expenses

32,365

24,677

Accrued compensation and benefits

5,216

6,464

Sales tax payable

3,703

3,728

Gift card liability

5,993

5,590

Deferred revenue

1,236

596

Returns reserve

3,424

2,761

Income tax payable

—

3,973

Total current liabilities

76,478

62,393

Non-current liabilities

Operating lease liabilities,

non-current

16,520

—

Deferred rent and lease incentive

—

3,542

Other non-current liabilities

215

243

Total liabilities

$

93,213

66,178

Commitments and contingencies

Stockholders’ equity

Class A Common stock — par value $0.0001

per share, 1,000,000,000 shares authorized as of September 30, 2022

and December 31, 2021; 159,025,697 and 152,098,257 shares issued

and outstanding as of September 30, 2022 and December 31, 2021,

respectively

15

15

Class B Common stock — par value $0.0001

per share, 150,000,000 shares authorized as of September 30, 2022

and December 31, 2021; 6,872,643 and 12,158,187 shares issued and

outstanding as of September 30, 2022 and December 31, 2021,

respectively

1

1

Preferred stock — par value $0.0001 per

share, 100,000,000 shares authorized as of September 30, 2022 and

December 31, 2021; zero shares issued and outstanding as of

September 30, 2022 and December 31, 2021

—

—

Additional paid-in capital

256,703

227,626

Retained earnings

35,726

17,931

Total stockholders’ equity

292,445

245,573

Total liabilities and stockholders’

equity

$

385,658

$

311,751

FIGS, INC.

STATEMENTS OF OPERATIONS AND

COMPREHENSIVE INCOME (LOSS)

(In thousands, except share

and per share data)

(Unaudited)

Three months ended September

30,

Nine months ended September

30,

2022

2021

2022

2021

Net revenues

$

128,589

$

102,696

$

360,937

$

290,892

Cost of goods sold

37,756

27,991

105,325

79,674

Gross profit

90,833

74,705

255,612

211,218

Operating expenses

Selling

31,940

19,945

80,801

56,282

Marketing

20,031

15,779

56,263

42,107

General and administrative

27,652

28,430

84,142

118,280

Total operating expenses

79,623

64,154

221,206

216,669

Net income (loss) from operations

11,210

10,551

34,406

(5,451

)

Other income (loss), net

Interest income (expense)

604

(110

)

683

(176

)

Other income (expense)

1

(823

)

—

(825

)

Total other income (loss), net

605

(933

)

683

(1,001

)

Net income (loss) before provision for

income taxes

11,815

9,618

35,089

(6,452

)

Provision for income taxes

7,771

2,664

17,294

15,700

Net income (loss) and comprehensive

income (loss)

$

4,044

$

6,954

$

17,795

$

(22,152

)

Earnings (loss) attributable to Class A

and Class B common stockholders

Basic earnings (loss) per share

$

0.02

$

0.04

$

0.11

$

(0.14

)

Diluted earnings (loss) per

share

$

0.02

$

0.03

$

0.09

$

(0.14

)

Weighted-average shares

outstanding—basic

165,543,067

161,348,021

164,960,561

157,620,573

Weighted-average shares

outstanding—diluted

186,991,769

199,385,061

189,762,364

157,620,573

FIGS, INC.

STATEMENTS OF CASH

FLOWS

(In thousands)

(Unaudited)

Nine months ended

September 30,

2022

2021

Cash flows from operating

activities:

Net income (loss)

$

17,795

$

(22,152

)

Adjustments to reconcile net income (loss)

to net cash (used in) provided by operating activities:

Depreciation and amortization expense

1,287

1,021

Deferred income taxes

(976

)

(1,450

)

Non-cash operating lease cost

1,719

—

Stock-based compensation

26,288

68,280

Changes in operating assets and

liabilities:

Accounts receivable

(5,927

)

1,015

Due from related party

—

(501

)

Inventory

(82,020

)

(19,621

)

Prepaid expenses and other current

assets

(6,470

)

(3,380

)

Other assets

(678

)

91

Accounts payable

6,421

2,196

Accrued expenses

7,584

15,070

Deferred revenue

640

2,699

Accrued compensation and benefits

(1,248

)

1,902

Returns reserve

663

1,523

Sales tax payable

(25

)

2,359

Income tax payable

(3,973

)

2,961

Gift card liability

403

568

Deferred rent and lease incentive

—

(77

)

Operating lease liabilities

(1,336

)

—

Other non-current liabilities

(28

)

—

Net cash (used in) provided by operating

activities

(39,881

)

52,504

Cash flows from investing

activities:

Purchases of property and equipment

(4,256

)

(2,008

)

Purchases of held-to-maturity

securities

(500

)

—

Net cash used in investing activities

(4,756

)

(2,008

)

Cash flows from financing

activities:

Proceeds from issuance of Class A common

stock in initial public offering, net of underwriting discounts

—

95,881

Payments of initial public offering

issuance costs, net of reimbursements

—

(780

)

Proceeds from stock option exercises and

employee stock purchases

2,310

648

Tax payments related to net share

settlements on restricted stock units

—

(21,556

)

Payments of debt issuance costs

—

(169

)

Capital contributions

479

1,301

Net cash provided by financing

activities

2,789

75,325

Net (decrease) increase in cash, cash

equivalents, and restricted cash

(41,848

)

125,821

Cash, cash equivalents, and restricted

cash, beginning of period

197,430

58,133

Cash, cash equivalents, and restricted

cash, end of period

$

155,582

$

183,954

FIGS, INC.

RECONCILIATIONS OF GAAP TO

NON-GAAP MEASURES

(Unaudited)

The following table presents a

reconciliation of Net income, as adjusted and Diluted earnings per

share, as adjusted to Net income (loss), which is the most directly

comparable financial measure calculated in accordance with

GAAP:

Three months ended

September 30,

Nine months ended

September 30,

2022

2021

2022

2021

(in thousands, except share

and per share data)

Net income (loss)

$

4,044

$

6,954

$

17,795

$

(22,152

)

Add (deduct):

Transaction costs

—

1,621

145

1,960

Expenses related to non-ordinary course

disputes(1)

254

1,791

5,458

6,207

Stock-based compensation expense in

connection with the IPO and other(2)

—

—

—

50,384

Income tax impacts of items above

(167

)

(945

)

(2,458

)

918

Net income, as adjusted

$

4,131

$

9,421

$

20,940

$

37,317

Diluted EPS, as adjusted

$

0.02

$

0.05

$

0.11

$

0.20

Weighted-average shares used to compute

Diluted EPS, as adjusted(3)

186,991,769

199,385,061

189,762,364

186,100,037

(1) Represents certain legal fees incurred

in connection with the litigation claims described in the section

titled “Legal Proceedings” appearing in the Company’s Quarterly

Report on Form 10-Q for the quarter ended September 30, 2022.

(2) Includes stock-based compensation

expense and payroll taxes related to equity award activity.

(3) We adjust the weighted-average number

of shares outstanding for the dilutive effect of potential common

equivalent shares in each period presented.

The following table presents a reconciliation of Adjusted EBITDA

to Net income (loss), which is the most directly comparable

financial measure calculated in accordance with GAAP, and presents

Adjusted EBITDA margin with Net income (loss) margin, which is the

most directly comparable financial measure calculated in accordance

with GAAP:

Three months ended

September 30,

Nine months ended

September 30,

2022

2021

2022

2021

(in thousands, except

margin)

Net income (loss)

$

4,044

$

6,954

$

17,795

$

(22,152

)

Add (deduct):

Other income (loss), net

(605

)

933

(683

)

1,001

Provision for income taxes

7,771

2,664

17,294

15,700

Depreciation and amortization

expense(1)

479

365

1,287

1,021

Stock-based compensation and related

expense(2)

9,082

8,683

26,335

70,415

Transaction costs

—

800

—

1,139

Expenses related to non-ordinary course

disputes(3)

254

1,791

5,458

6,207

Adjusted EBITDA

$

21,025

$

22,190

$

67,486

$

73,331

Net revenues

$

128,589

$

102,696

$

360,937

$

290,892

Net income (loss) margin(4)

3.1

%

6.8

%

4.9

%

(7.6

) %

Adjusted EBITDA Margin

16.4

%

21.6

%

18.7

%

25.2

%

(1) Excludes amortization of debt issuance

costs included in “Other income (loss), net.”

(2) Includes stock-based compensation

expense and payroll taxes related to equity award activity.

(3) Represents certain legal fees incurred

in connection with the litigation claims described in the section

titled “Legal Proceedings” appearing in the Company’s Quarterly

Report on Form 10-Q for the quarter ended September 30,

2022.

(4) Net income (loss) margin represents

Net income (loss) as a percentage of Net revenues.

FIGS, INC.

KEY OPERATING METRICS

(Unaudited)

Active customers as of September 30, 2022

and 2021, respectively, net revenues per active customer as of

September 30, 2022 and 2021, respectively, and average order value

for the three and nine months ended September 30, 2022 and 2021,

respectively, are presented in the following tables:

As of September 30,

2022

2021

(in thousands)

Active customers

2,154

1,743

As of September 30,

2022

2021

Net revenues per active customer

$

227

$

219

Three months ended

September 30,

Nine months ended

September 30,

2022

2021

2022

2021

Average order value

$

112

$

102

$

112

$

102

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221110006032/en/

Investors: Jean Fontana IR@wearfigs.com

Media: Todd Maron press@wearfigs.com

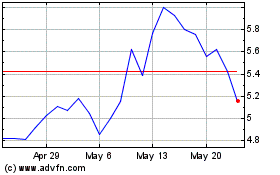

FIGS (NYSE:FIGS)

Historical Stock Chart

From Oct 2024 to Nov 2024

FIGS (NYSE:FIGS)

Historical Stock Chart

From Nov 2023 to Nov 2024