Statement of Changes in Beneficial Ownership (4)

September 03 2021 - 7:29PM

Edgar (US Regulatory)

FORM 4

[X]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

VIKING GLOBAL INVESTORS LP |

2. Issuer Name and Ticker or Trading Symbol

FIGS, Inc.

[

FIGS

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director __X__ 10% Owner

_____ Officer (give title below) _____ Other (specify below)

|

|

(Last)

(First)

(Middle)

55 RAILROAD AVENUE, |

3. Date of Earliest Transaction

(MM/DD/YYYY)

9/2/2021 |

|

(Street)

GREENWICH, CT 06830

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

___ Form filed by One Reporting Person

_

X

_ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Class A Common Stock | 9/2/2021 | | S | | 157587 | D | $47.28 (5) | 14785102 | I | See Explanation Responses (1)(2)(3)(4) |

| Class A Common Stock | 9/3/2021 | | S | | 42413 | D | $44.92 (6) | 14742689 | I | See Explanation Responses (1)(2)(3)(4) |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Explanation of Responses: |

| (1) | Andreas Halvorsen, David C. Ott and Rose S. Shabet are Executive Committee members of certain management entities, including Viking Global Partners LLC, the general partner of Viking Global Investors LP ("VGI") and Viking Global Opportunities GP LLC ("Opportunities GP"), the sole owner of Viking Global Opportunities Portfolio GP LLC ("Opportunities Portfolio GP"). VGI provides managerial services to various investment funds, including Viking Global Opportunities Illiquid Investments Sub-Master LP ("Opportunities Fund"). Each of VGI, Opportunities GP, Opportunities Portfolio GP, VGOL, Opportunities Fund, Mr. Halvorsen, Mr. Ott and Ms. Shabet (collectively the "Reporting Persons") may be deemed to beneficially own the shares reported on this form. |

| (2) | VGI provides managerial services to Opportunities Fund, which directly holds the shares of Common Stock reported herein. Because of the relationship between VGI and VGOP, VGI may be deemed to beneficially own the shares of Common Stock held directly by Opportunities Fund. |

| (3) | Opportunities Portfolio GP is the general partner of Opportunities Fund. Because of the relationship between Opportunities Portfolio GP and Opportunities Fund, Opportunities Portfolio GP may be deemed to beneficially own the shares of Common Stock held directly by Opportunities Fund. Opportunities GP is the sole owner of Opportunities Portfolio GP. Because of the relationship between Opportunities GP and Opportunities Portfolio GP, Opportunities GP may be deemed to beneficially own the shares of Common Stock held directly by Opportunities Fund. |

| (4) | The Reporting Persons disclaim beneficial ownership of these securities except to the extent of their pecuniary interest therein, and the inclusion of these securities in this report shall not be deemed an admission of beneficial ownership of the reported securities for purposes of Section 16 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or for any other purpose. |

| (5) | The price reported in Column 4 is a weighted average price. The shares were sold in multiple transactions at prices ranging from $45.39 to $48.34. The Reporting Persons undertake to provide to the Issuer, any security holder of the Issuer, or the staff of the Securities and Exchange Commission, upon request, full information

regarding the number of shares sold at each separate price within the range set forth in footnotes (5) and (6). |

| (6) | The price reported in Column 4 is a weighted average price. The shares were sold in multiple transactions at prices ranging from $44.67 to $46.07. |

Remarks:

7. The Reporting Persons are jointly filing this Form 4 pursuant to Rule 16a-3(j) under the Exchange Act.

8. Scott M. Hendler is signing on behalf of Mr. Halvorsen, Mr. Ott and Ms. Shabet, each individually and as an Executive Committee Member of VIKING GLOBAL PARTNERS LLC, on behalf of VIKING GLOBAL INVESTORS LP, and as an Executive Committee Member of VIKING GLOBAL OPPORTUNITIES GP LLC, on behalf of itself and VIKING GLOBAL OPPORTUNITIES PORTFOLIO GP LLC, and VIKING GLOBAL OPPORTUNITIES ILLIQUID INVESTMENTS SUB-MASTER LP, pursuant to authorization and designation letters dated February 9, 2021, which were filed with the Securities and Exchange Commission on June 7, 2021. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

VIKING GLOBAL INVESTORS LP

55 RAILROAD AVENUE

GREENWICH, CT 06830 |

| X |

|

|

Viking Global Opportunities Illiquid Investments Sub-Master LP

MORGAN STANLEY SERVICES (CAYMAN)

CRICKET SQ., HUTCHINS DR., P.O. BOX 2681

GRAND CAYMAN, E9 KY1-1111 |

| X |

|

|

Viking Global Opportunities Portfolio GP LLC

55 RAILROAD AVENUE

GREENWICH, CT 06830 |

| X |

|

|

Viking Global Opportunities GP LLC

55 RAILROAD AVENUE

GREENWICH, CT 06830 |

| X |

|

|

HALVORSEN OLE ANDREAS

C/O VIKING GLOBAL INVESTORS LP

280 PARK AVE 35TH

NEW YORK, NY 10017 |

| X |

|

|

Ott David C.

C/O VIKING GLOBAL INVESTORS LP

280 PARK AVE 35TH

NEW YORK, NY 10017 |

| X |

|

|

Shabet Rose Sharon

C/O VIKING GLOBAL INVESTORS LP

280 PARK AVE 35TH

NEW YORK, NY 10017 |

| X |

|

|

Signatures

|

| /s/ Scott M. Hendler signing on behalf of O. Andreas Halvorsen (7) (8) | | 9/3/2021 |

| **Signature of Reporting Person | Date |

| /s/ Scott M. Hendler signing on behalf of David C. Ott (7) (8) | | 9/3/2021 |

| **Signature of Reporting Person | Date |

| /s/ Scott M. Hendler signing on behalf of Rose S. Shabet (7) (8) | | 9/3/2021 |

| **Signature of Reporting Person | Date |

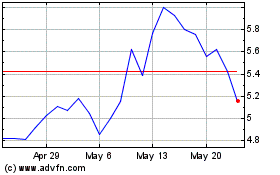

FIGS (NYSE:FIGS)

Historical Stock Chart

From Jun 2024 to Jul 2024

FIGS (NYSE:FIGS)

Historical Stock Chart

From Jul 2023 to Jul 2024