FedEx Corporation Announces Accelerated Share Repurchase Program

October 04 2022 - 9:00AM

Business Wire

FedEx Corp. (NYSE: FDX) today announced that it has entered into

an accelerated share repurchase agreement (“ASR”) with Morgan

Stanley & Co. LLC (“Morgan Stanley”) as part of the company’s

previously announced share repurchase program. Under the terms of

the ASR, FedEx has agreed to repurchase an aggregate of $1.5

billion of its common stock from Morgan Stanley, with an initial

delivery of approximately 7.9 million shares based on current

market prices. The final number of shares to be repurchased under

the ASR will be based on a discount to the average of the daily

volume-weighted average stock prices for Rule 10b-18 eligible

transactions in FedEx’s common stock during the term of the ASR.

Purchases under the ASR are expected to be completed prior to the

end of FedEx’s current fiscal year. FedEx may continue to

repurchase shares in the open market from time to time subject to

market and other conditions.

Corporate Overview

FedEx Corp. (NYSE: FDX) provides customers and businesses

worldwide with a broad portfolio of transportation, e-commerce and

business services. With annual revenue of $95 billion, the company

offers integrated business solutions through operating companies

competing collectively, operating collaboratively and innovating

digitally under the respected FedEx brand. Consistently ranked

among the world's most admired and trusted employers, FedEx

inspires its nearly 550,000 employees to remain focused on safety,

the highest ethical and professional standards and the needs of

their customers and communities. FedEx is committed to connecting

people and possibilities around the world responsibly and

resourcefully, with a goal to achieve carbon-neutral operations by

2040. To learn more, please visit fedex.com/about.

Certain statements in this press release may be considered

forward-looking statements, such as statements relating to

management’s views with respect to future events and financial

performance and underlying assumptions. Forward-looking statements

include those preceded by, followed by or that include the words

“will,” “may,” “could,” “would,” “should,” “believes,” “expects,”

“anticipates,” “plans,” “estimates,” “targets,” “projects,”

“intends” or similar expressions. Such forward-looking statements

are subject to risks, uncertainties and other factors which could

cause actual results to differ materially from historical

experience or from future results expressed or implied by such

forward-looking statements. Potential risks and uncertainties

include, but are not limited to, constraints, volatility, or

disruptions in the capital markets or other factors affecting the

amount and timing of share repurchases, including our ability to

complete the ASR within the expected timeframe, the number of

shares that will be delivered to FedEx under the ASR, whether or

not FedEx will continue, and the timing of, any open market share

repurchases, and other factors which can be found in FedEx Corp.’s

press releases and filings with the Securities and Exchange

Commission. Any forward-looking statement speaks only as of the

date on which it is made. FedEx does not undertake or assume any

obligation to update or revise any forward-looking statement,

whether as a result of new information, future events or

otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221004005437/en/

Media Contact: Jenny Robertson 901-434-4829 Investor Contact:

Mickey Foster 901-818-7468 Home Page: fedex.com

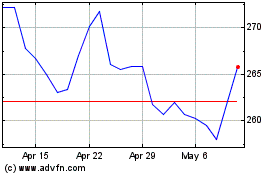

FedEx (NYSE:FDX)

Historical Stock Chart

From Apr 2024 to May 2024

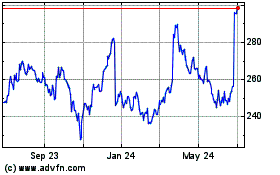

FedEx (NYSE:FDX)

Historical Stock Chart

From May 2023 to May 2024