Form 8-K - Current report

September 26 2023 - 4:37PM

Edgar (US Regulatory)

0001839824

false

0001839824

2023-09-26

2023-09-26

0001839824

FZT:UnitsEachConsistingOfOneShareOfClassCommonStockAndOnequarterOfOneRedeemableWarrantMember

2023-09-26

2023-09-26

0001839824

FZT:ClassCommonStockParValue0.0001PerShareMember

2023-09-26

2023-09-26

0001839824

FZT:RedeemableWarrantsEachWarrantExercisableForOneShareOfClassCommonStockEachAtExercisePriceOf11.50PerShareMember

2023-09-26

2023-09-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

September 26, 2023

FAST Acquisition Corp. II

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-40214 |

|

86-1258014 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

109 Old Branchville Road

Ridgefield, CT 06877

(Address of principal executive offices, including

zip code)

Registrant’s telephone number, including

area code: (201) 956-1969

Not Applicable

(Former name or former address, if changed since

last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Units, each consisting of one share of Class A common stock and one-quarter of one redeemable warrant |

|

FZT.U |

|

The New York Stock Exchange |

| Class A common stock, par value $0.0001 per share |

|

FZT |

|

The New York Stock Exchange |

| Redeemable warrants, each warrant exercisable for one share of Class A common stock, each at an exercise price of $11.50 per share |

|

FZT WS |

|

The New York Stock Exchange |

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 5.07. Submission of Matters to a Vote

of Security Holders.

On September 26, 2023, FAST Acquisition Corp.

II, a Delaware corporation (the “Company”), held a special meeting of stockholders (the “Special Meeting”) in

virtual format. At the Special Meeting, a total of 10,363,268 (or 81.64%) of the Company’s issued and outstanding shares of Class

A common stock and Class B common stock held of record as of August 21, 2023, the record date for the Special Meeting, were present or

represented by proxy, which constituted a quorum. The Company’s stockholders voted on the following proposals at the Special Meeting,

each of which was approved. The final vote tabulation for each proposal is set forth below.

| 1. | The Business Combination Proposal – Proposal to

approve the Amended and Restated Agreement and Plan of Merger, dated as of January 31, 2023, as amended by the First Amendment, dated

as of June 25, 2023, the Second Amendment, dated as of July 7, 2023, and the Third Amendment, dated as of September 1, 2023 (as it may

be further amended, supplemented or otherwise modified from time to time in accordance with its terms, the “Merger Agreement”),

by and among the Company, Falcon’s Beyond Global, LLC, a Florida limited liability company (“FBG”), Falcon’s

Beyond Global, Inc., a Delaware corporation and a wholly owned subsidiary of FBG (“Pubco”), and Palm Merger Sub, LLC, a Delaware

limited liability company and a wholly owned subsidiary of Pubco (“Merger Sub”), and the transactions contemplated by the

Merger Agreement, pursuant to which (a) the Company will merge with and into Pubco (the “SPAC Merger”), with Pubco surviving

as the sole owner of Merger Sub, followed by a contribution by Pubco of all of its cash (except for cash required to pay certain transaction

expenses) to Merger Sub to effectuate the “UP-C” structure; and (b) on the date immediately following the SPAC Merger, Merger

Sub will merge with and into FBG (the “Acquisition Merger,” and collectively with the SPAC Merger, the “Business Combination”),

with FBG as the surviving entity of such merger: |

| For |

|

Against |

|

Abstained |

| 9,733,996 |

|

629,272 |

|

0 |

| 2. | The Pubco Organizational Documents Advisory Proposals

– The following proposals to approve the material differences between the Company’s certificate of incorporation and bylaws

and the certificate of incorporation and bylaws of Pubco to be adopted by Pubco in connection with the SPAC Merger, each of which was

voted on separately on a non-binding advisory basis: |

| A. | Authorized Capital Stock – Proposal to approve authorized capital stock of Pubco of 500,000,000

shares of Pubco’s Class A common stock, par value $0.0001 per share (“Pubco Class A Common Stock”), 150,000,000 shares

of Pubco’s Class B common stock, par value $0.0001 per share (“Pubco Class B Common Stock”), and 30,000,000 shares of

preferred stock: |

| For |

|

Against |

|

Abstained |

| 8,896,994 |

|

1,466,274 |

|

0 |

| B. | Removal of Directors – Proposal to approve a provision that any or all of the directors of

Pubco may be removed from office at any time, but only for cause and only by the affirmative vote of holders of 66 2/3% of the voting

power of all then-outstanding shares of capital stock of Pubco entitled to vote generally in the election of directors, voting together

as a single class: |

| For |

|

Against |

|

Abstained |

| 8,896,995 |

|

1,466,273 |

|

0 |

| C. | DGCL 203 Opt Out and Replacement – Proposal to approve a provision that Pubco will not be

governed by Section 203 of the Delaware General Corporation Law, and instead, include a provision that is substantially similar to Section

203, but excludes certain parties from the definition of “interested stockholder”: |

| For |

|

Against |

|

Abstained |

| 8,896,994 |

|

1,466,274 |

|

0 |

| D. | Stockholder Action by Written Consent – Proposal to approve a provision that any action required

or permitted to be taken by the stockholders of Pubco must be effected by a duly called annual or special meeting of such stockholders

and may not be effected by written consent of the stockholders, provided that for so long as holders of Pubco Class B Common Stock own

a majority of the total voting power of stock entitled to vote generally in the election of directors, any action required or permitted

to be taken by stockholders may be taken by written consent in lieu of a meeting: |

| For |

|

Against |

|

Abstained |

| 8,886,995 |

|

1,466,273 |

|

10,000 |

| E. | Special Meetings of Stockholders – Proposal to approve a provision that special meetings

of Pubco stockholders may be called only by or at the direction of Pubco’s board of directors (the “Pubco Board”), the

chairperson of the Pubco Board or the Chief Executive Officer of Pubco and may not be called by any stockholder, provided that for so

long as the holders of Pubco Class B Common Stock own a majority of the total voting power of stock entitled to vote generally in the

election of directors, special meetings may be called by or at the request of stockholders collectively holding a majority of the total

voting power of stock entitled to vote generally in the election of directors: |

| For |

|

Against |

|

Abstained |

| 8,886,994 |

|

1,466,274 |

|

10,000 |

| F. | Amendment of the Charter – Proposal to approve a provision that amendment of the certificate

of incorporation of Pubco following the closing of the Business Combination generally requires the approval of the Pubco Board and a majority

of the combined voting power of the then-outstanding shares of voting stock, voting together as a single class, with the exception of

certain provisions that would require the affirmative vote of at least 66 2/3% of the total voting power of the then-outstanding shares

of stock of Pubco entitled to vote thereon, voting as a single class; |

| For |

|

Against |

|

Abstained |

| 9,733,996 |

|

629,272 |

|

0 |

| G. | Amendment of the Bylaws – Proposal to approve a provision expressly authorizing the Pubco

Board to make, alter, amend or repeal the bylaws of Pubco (the “Pubco Bylaws”) by an affirmative vote of a majority of the

Pubco Board. The Pubco Bylaws may also be adopted, amended, altered or repealed by the Pubco stockholders representing at least 66 2/3%

of the voting power of all of the then-outstanding shares of capital stock of Pubco entitled to vote generally in the election of directors: |

| For |

|

Against |

|

Abstained |

| 9,733,995 |

|

629,273 |

|

0 |

| H. | Provisions Related to Status as Blank Check Company – Proposal to approve the exclusion of

certain provisions applicable only to blank check companies: |

| For |

|

Against |

|

Abstained |

| 9,732,996 |

|

629,272 |

|

1,000 |

As there were sufficient votes to approve the

Business Combination Proposal, the “Adjournment Proposal” described in the Company’s definitive proxy statement filed

with the U.S. Securities and Exchange Commission on September 15, 2023 was not required and the Company did not call the vote on that

proposal.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

FAST ACQUISITION CORP. II |

| |

|

| |

By: |

/s/ Garrett Schreiber |

| |

|

Name: |

Garrett Schreiber |

| |

|

Title: |

Chief Financial Officer |

Dated: September 26, 2023

3

v3.23.3

Cover

|

Sep. 26, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 26, 2023

|

| Entity File Number |

001-40214

|

| Entity Registrant Name |

FAST Acquisition Corp. II

|

| Entity Central Index Key |

0001839824

|

| Entity Tax Identification Number |

86-1258014

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

109 Old Branchville Road

|

| Entity Address, City or Town |

Ridgefield

|

| Entity Address, State or Province |

CT

|

| Entity Address, Postal Zip Code |

06877

|

| City Area Code |

201

|

| Local Phone Number |

956-1969

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Units, each consisting of one share of Class A common stock and one-quarter of one redeemable warrant |

|

| Title of 12(b) Security |

Units, each consisting of one share of Class A common stock and one-quarter of one redeemable warrant

|

| Trading Symbol |

FZT.U

|

| Security Exchange Name |

NYSE

|

| Class A common stock, par value $0.0001 per share |

|

| Title of 12(b) Security |

Class A common stock, par value $0.0001 per share

|

| Trading Symbol |

FZT

|

| Security Exchange Name |

NYSE

|

| Redeemable warrants, each warrant exercisable for one share of Class A common stock, each at an exercise price of $11.50 per share |

|

| Title of 12(b) Security |

Redeemable warrants, each warrant exercisable for one share of Class A common stock, each at an exercise price of $11.50 per share

|

| Trading Symbol |

FZT WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=FZT_UnitsEachConsistingOfOneShareOfClassCommonStockAndOnequarterOfOneRedeemableWarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=FZT_ClassCommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=FZT_RedeemableWarrantsEachWarrantExercisableForOneShareOfClassCommonStockEachAtExercisePriceOf11.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

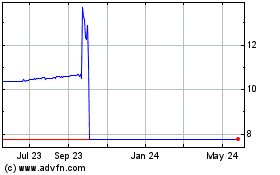

FAST Acquisition Corp II (NYSE:FZT)

Historical Stock Chart

From Jun 2024 to Jul 2024

FAST Acquisition Corp II (NYSE:FZT)

Historical Stock Chart

From Jul 2023 to Jul 2024