0001839824

false

0001839824

2023-09-01

2023-09-01

0001839824

FZT:UnitsEachConsistingOfOneShareOfClassCommonStockAndOnequarterOfOneRedeemableWarrantMember

2023-09-01

2023-09-01

0001839824

FZT:ClassCommonStockParValue0.0001PerShareMember

2023-09-01

2023-09-01

0001839824

FZT:RedeemableWarrantsEachWarrantExercisableForOneShareOfClassCommonStockEachAtExercisePriceOf11.50PerShareMember

2023-09-01

2023-09-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): September

1, 2023

FAST Acquisition Corp. II

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-40214 |

|

86-1258014 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

109 Old Branchville Road

Ridgefield, CT 06877

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code:

(201) 956-1969

Not Applicable

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Units, each consisting of one share of Class A common stock and one-quarter of one redeemable warrant |

|

FZT.U |

|

The New York Stock Exchange |

| Class A common stock, par value $0.0001 per share |

|

FZT |

|

The New York Stock Exchange |

| Redeemable warrants, each warrant exercisable for one share of Class A common stock, each at an exercise price of $11.50 per share |

|

FZT WS |

|

The New York Stock Exchange |

Check the appropriate box below if the Form 8-K filing is

intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if

the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01. Entry into a Material Definitive Agreement.

Amendment to Merger Agreement

On September 1, 2023, Falcon’s Beyond Global, LLC, a

Florida limited liability company (the “Company”), Falcon’s Beyond Global, Inc., a Delaware corporation and a

wholly owned subsidiary of the Company (“Pubco”), Palm Merger Sub LLC, a Delaware limited liability company and a wholly

owned subsidiary of Pubco (“Merger Sub”), and FAST Acquisition Corp. II, a Delaware corporation (“SPAC”),

executed the third amendment (the “Amendment”) to that certain Amended and Restated Agreement and Plan of Merger, dated

as of January 31, 2023 (as amended, the “Merger Agreement”), among SPAC, the Company, Pubco and Merger Sub. Prior to

the Amendment, SPAC would have had the right to terminate the Merger Agreement upon the Company’s entry into certain specified interim

financing agreements if all of the conditions to closing have been satisfied (except for those that by their nature can only be satisfied

at the closing of the business combination but are expected to be satisfied) and the pro forma condensed combined financial information

(which combines the historical financial information of SPAC and the Company) that is included in the Form S-4 at the time of its effectiveness,

taking into account such specified interim financing arrangements, did not reflect the consolidation of Falcon’s Creative Group,

LLC, a Florida limited liability company and a subsidiary of the Company, with the Company (together, the “Revised Interim Financing

Termination”). The Amendment eliminated the Revised Interim Financing Termination.

The foregoing description of the Amendment does not purport

to be complete and is qualified in its entirety by the terms and conditions of the Amendment, a copy of which is attached hereto as Exhibit

2.1 to this Current Report on Form 8-K and incorporated herein by reference.

Important Information About the Mergers and Where to Find It

In connection with the transactions contemplated by the Merger

Agreement (the “Mergers”), Pubco has filed with the SEC a registration statement on Form S-4 (Registration No. 333-269778)

(as amended, the “Registration Statement”) containing a proxy statement/prospectus and certain other related documents. The

version of the proxy statement/prospectus included in the effective Registration Statement will be both the proxy statement to be distributed

to holders of SPAC’s common stock in connection with SPAC’s solicitation of proxies for the vote by SPAC’s stockholders

with respect to the Mergers and other matters as may be described in the Registration Statement, as well as the prospectus relating to

the offer and sale of the securities of Pubco to be issued in connection with the Mergers. SPAC’s stockholders and other interested

persons are advised to read carefully and in their entirety, when available, the preliminary proxy statement/prospectus included in the

Registration Statement (including any amendments or supplements thereto) and the definitive proxy statement/prospectus, as well as other

documents filed with the SEC, as these materials will contain important information about the parties to the Merger Agreement, SPAC and

the Mergers. After the Registration Statement is declared effective, the definitive proxy statement/prospectus will be mailed to stockholders

of SPAC as of the record date that has been established for voting on the Mergers and other matters as may be described in the Registration

Statement. Stockholders will also be able to obtain copies of the proxy statement/prospectus and other documents filed with the SEC that

will be incorporated by reference in the proxy statement/prospectus, without charge, once available, at the SEC’s web site at sec.gov,

or by directing a request to: FAST Acquisition Corp. II, 109 Old Branchville Road, Ridgefield, CT 06877, Attention: Chief Financial Officer,

(201) 956-1969.

Participants in the Solicitation

SPAC and its directors and executive officers may be deemed

participants in the solicitation of proxies from SPAC’s stockholders with respect to the Mergers. A list of the names of those directors

and executive officers and a description of their interests in SPAC is contained in the Registration Statement.

The Company and its managers and executive officers may also

be deemed to be participants in the solicitation of proxies from the stockholders of SPAC in connection with the Mergers. A list of the

names of such directors and executive officers and information regarding their interests in the Mergers is contained in the Registration

Statement when available.

Forward-Looking Statements

This Current Report on Form 8-K includes “forward-looking

statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995.

SPAC’s and the Company’s actual results may differ from their expectations, estimates and projections and consequently, you

should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “estimate,”

“project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,”

“may,” “will,” “could,” “should,” “believe,” “predict,” “potential,”

“continue,” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements

involve significant risks and uncertainties that could cause actual results to differ materially from expected results, including factors

that are outside of SPAC’s and the Company’s control and that are difficult to predict. Factors that may cause such differences

include, but are not limited to: (1) changes in domestic and foreign business, market, financial, political, and legal conditions in general

and in the entertainment industry in particular, (2) the outcome of any legal proceedings that may be instituted against SPAC, the Company

or Pubco following the announcement of the Merger Agreement and the transactions contemplated therein, (3) the inability of the parties

to successfully or timely consummate the Mergers or the other transactions contemplated by the Merger Agreement, including the risk that

any regulatory approvals or the SEC’s declaration of the effectiveness of the proxy statement/prospectus relating to the transaction

are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect Pubco or the expected benefits of

the transactions contemplated by the Merger Agreement or that the approval of the requisite equity holders of SPAC is not obtained, (4)

the occurrence of any event, change or other circumstance that could give rise to the termination of the Merger Agreement, (5) volatility

in the price of SPAC’s or Pubco’s securities, (6) the risk that the Mergers or the other transactions contemplated by the

Merger Agreement disrupt current plans and operations as a result of the announcement and consummation thereof, (7) the enforceability

of the Company’s intellectual property, including its patents, and the potential infringement on the intellectual property rights

of others, cyber security risks or potential breaches of data security, (8) any failure to realize the anticipated benefits of the Mergers

or the other transactions contemplated by the Merger Agreement, (9) risks relating to the uncertainty of the projected financial information

with respect to the Company, (10) risks related to the rollout of the Company’s business and the timing of expected business milestones,

(11) the effects of competition on the Company’s business, (12) the risk that the Mergers or the other transactions contemplated

by the Merger Agreement may not be completed by SPAC’s deadline and the potential failure to obtain an extension of its business

combination deadline if sought by SPAC, (13) the amount of redemption requests made by stockholders of SPAC, (14) the ability of SPAC,

the Company or Pubco to issue equity or equity-linked securities or obtain debt financing in connection with the Mergers or the other

transactions contemplated by the Merger Agreement or in the future, (15) and those factors discussed under the heading “Risk Factors”

in the Registration Statement, SPAC’s Annual Report on Form 10-K for the year ended December 31, 2022, as filed with the SEC on

March 29, 2023, and other documents SPAC has filed, or will file, with the SEC.

SPAC cautions that the foregoing list of factors is not exhaustive.

Although SPAC believes the expectations reflected in these forward-looking statements are reasonable, nothing in this Current Report on

Form 8-K should be regarded as a representation by any person that the forward-looking statements or projections set forth herein will

be achieved or that any of the contemplated results of such forward-looking statements or projections will be achieved. There may be additional

risks that SPAC and the Company presently do not know of or that SPAC and the Company currently believe are immaterial that could also

cause actual results to differ from those contained in the forward-looking statements. SPAC cautions readers not to place undue reliance

upon any forward-looking statements, which speak only as of the date made. Neither SPAC nor the Company undertakes any duty to update

these forward-looking statements, except as otherwise required by law.

No Offer or Solicitation

This Current Report on Form 8-K and the exhibits hereto shall

not constitute a solicitation of a proxy, consent, or authorization with respect to any securities or in respect of the Mergers. This

Current Report on Form 8-K shall also not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall

there be any sale of securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of such state or jurisdiction. No offering of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the Securities Act.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

Exhibit

Number |

|

Description |

| 2.1 |

|

Amendment No. 3, dated September 1, 2023, to Amended and Restated Agreement and Plan of Merger, dated January 31, 2023, by and among FAST Acquisition Corp. II, Falcon’s Beyond Global, LLC, Falcon’s Beyond Global, Inc. and Palm Merger Sub, LLC. |

| 104 |

|

Cover Page Interactive Data File (embedded with the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

FAST ACQUISITION CORP. II |

| |

|

| |

By: |

/s/ Sandy Beall |

| |

|

Name: |

Sandy Beall |

| |

|

Title: |

Chief Executive Officer |

Dated: September 6, 2023

4

Exhibit 2.1

Execution Version

AMENDMENT NO. 3 TO AMENDED AND RESTATED AGREEMENT

AND PLAN OF MERGER

This AMENDMENT NO. 3 TO AMENDED

AND RESTATED AGREEMENT AND PLAN OF MERGER (this “Amendment”) is made and entered into as of September 1, 2023, by and

among FAST Acquisition Corp. II, a Delaware corporation (“SPAC”), Falcon’s Beyond Global, LLC, a Florida limited

liability company (the “Company”), Falcon’s Beyond Global, Inc., a Delaware corporation and a wholly owned subsidiary

of the Company which was formerly known as Palm Holdco, Inc. (“Pubco”), and Palm Merger Sub LLC, a Delaware limited

liability company and a wholly owned subsidiary of Pubco (“Merger Sub”). Each of the SPAC, the Company, Pubco and Merger

Sub shall individually be referred to herein as a “Party” and, collectively, the “Parties.” Capitalized

terms used but not defined herein shall have the meanings ascribed to them in the A&R Business Combination Agreement (as defined below).

RECITALS

WHEREAS, SPAC, the Company,

Pubco and Merger Sub previously entered into that certain Amended and Restated Agreement and Plan of Merger, dated January 31, 2023 (as

amended by Amendment No. 1 to Amended and Restated Agreement and Plan of Merger dated June 25, 2023, and as further amended by Amendment

No. 2 to Amended and Restated Agreement and Plan of Merger dated July 7, 2023, the “A&R Business Combination Agreement”);

WHEREAS, Section 11.10 of

the A&R Business Combination Agreement provides that the A&R Business Combination Agreement may be amended or modified in whole

or in part, only by a duly authorized agreement in writing executed in the same manner as the A&R Business Combination Agreement and

which makes reference to the A&R Business Combination Agreement; and

WHEREAS, the Parties desire

to amend the A&R Business Combination Agreement as set forth in this Amendment.

NOW, THEREFORE, the Parties,

intending to be legally bound, agree as follows:

| 1. | Section 10.01(k). Section 10.01(k) of the A&R Business Combination Agreement is hereby deleted

in its entirety and replaced by “[Reserved]”. |

| 2. | Section 10.02(a). All references to “Section 10.01(k)” in Section 10.02(a) shall be

deemed removed. |

| 3. | No Further Amendment. Except as expressly provided in this Amendment, all of the terms and conditions

of the A&R Business Combination Agreement remain unchanged and continue in full force and effect. |

| 4. | No Waiver. Except as specifically set forth herein, the execution of this Amendment shall not operate

as a waiver of any right, power or remedy of the parties under the A&R Business Combination Agreement nor shall it constitute a waiver

of any provision of the A&R Business Combination Agreement. |

| 5. | Effect of Amendment. This Amendment shall form a part of the A&R Business Combination Agreement

for all purposes, and each party to this Amendment and to the A&R Business Combination Agreement shall be bound by this Amendment. |

| 6. | Governing Law. This Amendment, and any action, suit, dispute, controversy or claim arising out

of this Amendment, or the validity, interpretation, breach or termination of this Amendment shall be governed by and construed in accordance

with the laws of the State of Delaware without giving effect to conflict of laws principles. |

| 7. | Entire Agreement; Counterparts. This Amendment, the A&R Business Combination Agreement (as

amended by this Amendment) and any other documents and instruments and agreements among the Parties as contemplated by or specifically

referred to in the A&R Business Combination Agreement (including the Exhibits and Schedules thereto) constitute the entire agreement

among the Parties relating to the subject matter hereof and thereof and supersede any other agreements, whether written or oral, that

may have been made or entered into by or among the Parties relating to the subject matter hereof and thereof. This Amendment may be executed

in two (2) or more counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same

instrument. Delivery by electronic transmission to counsel for the other Parties of a counterpart executed by a Party shall be deemed

to meet the requirements of the previous sentence. |

[Signature Pages Follow]

IN WITNESS WHEREOF,

the Parties have caused this Amendment to be executed and delivered as of the date first written above by their respective officers thereunto

duly authorized.

| |

FAST ACQUISITION CORP. II |

| |

|

|

| |

By: |

/s/ Garrett Schreiber |

| |

Name: |

Garrett Schreiber |

| |

Title: |

CFO |

[Signature Page to Amendment No. 3 to A&R Business

Combination Agreement]

| |

FALCON’S BEYOND GLOBAL, LLC |

| |

|

|

| |

By: |

/s/ L. Scott Demerau |

| |

Name: |

L. Scott Demerau |

| |

Title: |

Executive Chairman |

[Signature Page to Amendment No. 3 to A&R Business

Combination Agreement]

| |

FALCON’S BEYOND GLOBAL, INC. |

| |

|

|

| |

By: |

/s/ L. Scott Demerau |

| |

Name: |

L. Scott Demerau |

| |

Title: |

Executive Chairman |

[Signature Page to Amendment No. 3 to A&R Business

Combination Agreement]

| |

PALM MERGER SUB, LLC |

| |

|

|

| |

By: |

/s/ L. Scott Demerau |

| |

Name: |

L. Scott Demerau |

| |

Title: |

Executive Chairman |

[Signature Page to Amendment No. 3 to A&R Business

Combination Agreement]

v3.23.2

Cover

|

Sep. 01, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 01, 2023

|

| Entity File Number |

001-40214

|

| Entity Registrant Name |

FAST Acquisition Corp. II

|

| Entity Central Index Key |

0001839824

|

| Entity Tax Identification Number |

86-1258014

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

109 Old Branchville Road

|

| Entity Address, City or Town |

Ridgefield

|

| Entity Address, State or Province |

CT

|

| Entity Address, Postal Zip Code |

06877

|

| City Area Code |

201

|

| Local Phone Number |

956-1969

|

| Written Communications |

true

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Units, each consisting of one share of Class A common stock and one-quarter of one redeemable warrant |

|

| Title of 12(b) Security |

Units, each consisting of one share of Class A common stock and one-quarter of one redeemable warrant

|

| Trading Symbol |

FZT.U

|

| Security Exchange Name |

NYSE

|

| Class A common stock, par value $0.0001 per share |

|

| Title of 12(b) Security |

Class A common stock, par value $0.0001 per share

|

| Trading Symbol |

FZT

|

| Security Exchange Name |

NYSE

|

| Redeemable warrants, each warrant exercisable for one share of Class A common stock, each at an exercise price of $11.50 per share |

|

| Title of 12(b) Security |

Redeemable warrants, each warrant exercisable for one share of Class A common stock, each at an exercise price of $11.50 per share

|

| Trading Symbol |

FZT WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=FZT_UnitsEachConsistingOfOneShareOfClassCommonStockAndOnequarterOfOneRedeemableWarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=FZT_ClassCommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=FZT_RedeemableWarrantsEachWarrantExercisableForOneShareOfClassCommonStockEachAtExercisePriceOf11.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

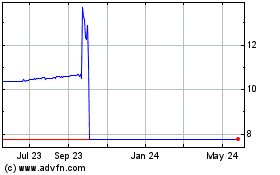

FAST Acquisition Corp II (NYSE:FZT)

Historical Stock Chart

From Oct 2024 to Nov 2024

FAST Acquisition Corp II (NYSE:FZT)

Historical Stock Chart

From Nov 2023 to Nov 2024