Form SC14D9C - Written communication relating to third party tender offer

January 08 2024 - 4:49PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14D-9

(RULE 14d-101)

SOLICITATION/RECOMMENDATION STATEMENT

UNDER SECTION 14(D)(4) OF THE SECURITIES EXCHANGE ACT OF 1934

Euronav NV

(Name of Subject Company)

Euronav NV

(Name of Person(s) Filing Statement)

Ordinary shares, no par value

(Title of Class of Securities)

B38564108

(CUSIP Number of Class of Securities)

Seward & Kissel LLP

Attention: Keith Billotti, Esq.

One Battery Park Plaza

New York, New York 10004

(212) 574-1200

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications

on Behalf of the Person(s) Filing Statement)

With copies to

|

Euronav NV

De Gerlachekaai 20

2000 Antwerpen

Belgium

Tel: 011-32-3-247-4411

|

Keith Billotti, Esq.

Seward & Kissel LLP

One Battery Park Plaza

New York, New York 10004

(212) 574-1200 (telephone number)

(212) 480-8421 (facsimile number)

|

|

☒

|

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

|

This Schedule 14D-9 consists of a communication by Euronav NV (“Euronav”) and CMB NV (“CMB”), which is attached hereto as Exhibit 99.1, inviting Euronav shareholders

to participate in the Special General Meeting to be held on Wednesday, February 7, 2024 to discuss the proposed acquisition of CMB.TECH NV. Attached hereto as Exhibit 99.2 is a copy of the Special General Meeting presentation.

Important Information

The tender offer described in this communication has not yet commenced. We expect it to consist of two separate offers from CMB: (i) an offer for all ordinary

shares (the “Securities”) of Euronav conducted in accordance with the laws of Belgium, and (ii) an offer for all Securities held by holders of who are resident in the United States in accordance with applicable U.S. law (the “U.S. Tender

Offer”).

This communication is for informational purposes only and is neither a recommendation, an offer to purchase nor a

solicitation of an offer to sell any securities of Euronav. This communication does not constitute a formal notification of a public takeover bid within the meaning of the Belgian Law of 1 April 2007 on public

takeover bids and the Belgian Royal Decree of 27 April 2007 on public takeover bids. CMB has advised us that full details thereof will be included in the prospectus to be filed with the Belgian Financial Services and Markets Authority.

The U.S. Tender Offer will only be made pursuant to an offer to purchase and related materials. CMB has advised us that it will file, or cause to be filed, a

tender offer statement on Schedule TO with the United States Securities and Exchange Commission (the “SEC”) at the time the U.S. Tender Offer commences. Thereafter, Euronav will file a solicitation/recommendation statement on Schedule 14d-9

with respect to the U.S. Tender Offer.

Euronav urges holders of the Securities subject to the U.S. Tender Offer who wish to participate in the U.S. Tender Offer to carefully review the documents

relating to the U.S. Tender Offer that CMB will file with the SEC since these documents will contain important information, including the terms and conditions of the U.S. Tender Offer. Euronav also urges these Holders to read the related

solicitation/recommendation statement on Schedule 14d-9 that Euronav will file with the SEC relating to the U.S. Tender Offer. You may obtain a free copy of these documents after they have been filed with the SEC, and other documents filed by Euronav

and CMB with the SEC, at the SEC’s website at www.sec.gov. In addition to the offer and certain other tender offer documents, as well as the solicitation/recommendation statement, Euronav files reports and other information with the SEC.

You should read the filings CMB and Euronav make with the SEC carefully before making a decision concerning the U.S. Tender Offer.

Forward-Looking Statements

Matters discussed in this communication may constitute forward-looking statements. The Private Securities Litigation Reform Act of 1995 provides safe harbour protections for

forward-looking statements in order to encourage companies to provide prospective information about their business. Forward-looking statements include statements concerning plans, objectives, goals, strategies, future events or performance, and

underlying assumptions and other statements, which are other than statements of historical facts. Euronav desires to take advantage of the safe harbour provisions of the Private Securities Litigation Reform Act of 1995 and is including this

cautionary statement in connection with this safe harbour legislation. The words "believe", "anticipate", "intends", "estimate", "forecast", "project", "plan", "potential", "may", "should", "expect", "pending" and similar expressions identify

forward-looking statements.

The forward-looking statements in this communication are based upon various assumptions, many of which are based, in turn, upon further assumptions, including without limitation,

our management's examination of historical operating trends, data contained in our records and other data available from third parties. Although we believe that these assumptions were reasonable when made, because these assumptions are inherently

subject to significant uncertainties and contingencies which are difficult or impossible to predict and are beyond our control, we cannot assure you that we will achieve or accomplish these expectations, beliefs or projections.

In addition to these important factors, other important factors that, in our view, could cause actual results to differ materially from those discussed in the forward-looking

statements include the risk that the proposed transaction may not be completed, or if it is completed, that it will close in a timely manner, uncertainty surrounding how many of Euronav’s stockholders will tender their shares in the tender offer, the

possibility of business disruptions due to transaction-related uncertainty and the response of business partners to the announcement, including customers, the risk that stockholder litigation in connection with the proposed transaction may result in

significant costs of defense, indemnification and liability, the failure of counterparties to fully perform their contracts with us, the strength of world economies and currencies, general market conditions, including fluctuations in charter rates

and vessel values, changes in demand for tanker vessel capacity, changes in our operating expenses, including bunker prices, dry-docking and insurance costs, the market for our vessels, availability of financing and refinancing, charter counterparty

performance, ability to obtain financing and comply with covenants in such financing arrangements, changes in governmental rules and regulations or actions taken by regulatory authorities, potential liability from pending or future litigation,

general domestic and international political conditions, potential disruption of shipping routes due to accidents or political events, vessels breakdowns and instances of off-hires and other factors. Please see our filings with the United States

Securities and Exchange Commission for a more complete discussion of these and other risks and uncertainties.

EXHIBIT 99.1

|

|

PRESS RELEASE

Regulated information

8 January 2024 – 08:00 a.m. CET

|

EURONAV – SPECIAL GENERAL MEETING OF 7 FEBRUARY 2024

ANTWERP, Belgium, 8 January 2024 – Euronav NV (NYSE: EURN & Euronext: EURN) (“Euronav” or the “Company”) invites

its shareholders to participate to the Special General Meeting to be held on Wednesday 7 February 2024 at 11:00 a.m. CET in 2000 Antwerp, De Gerlachekaai 20.

In view of the record date of Wednesday 24 January 2023, shareholders may not reposition shares between the Belgian Register and the U.S. Register during the period

from Tuesday 23 January 2024 at 8.00 a.m. (Belgian time) until Thursday 25 January 2024 at 8.00 a.m. (Belgian time) (“Freeze Period”).

The convening notice and the other documents related to this meeting are available on the company’s website https://www.euronav.com/investors/legal-information/sgm/2024/ The practical formalities for participation in this meeting are described in the convening notice.

*

* *

Contact Euronav:

Communications Coordinator – Enya Derkinderen Tel: +32 476646359 Email: communications@euronav.com

Announcement Q4 Earnings 2023: Thursday 2 February 2024

About Euronav

Euronav is an independent tanker company engaged in the ocean transportation and storage of crude oil. The company is headquartered in Antwerp, Belgium,

and has offices throughout Europe and Asia. Euronav is listed on Euronext Brussels and on the NYSE under the symbol EURN. Euronav employs its fleet both on the spot and period market. VLCCs on the spot market are traded in the Tankers International

pool of which Euronav is one of the major partners. Euronav’s owned and operated fleet consists of 1 V-Plus vessel, 26 VLCCs (with a further 3 under construction), 21 Suezmaxes (with a further five under construction) and 2 FSO vessels.

Regulated information within the meaning of the Royal Decree of 14 November 2007.

|

|

PRESS RELEASE

Regulated information

8 January 2024 – 08:00 a.m. CET

|

Forward-Looking Statements

Matters discussed in this press release may constitute forward-looking statements. The Private Securities Litigation Reform Act of 1995 provides safe harbor protections

for forward-looking statements in order to encourage companies to provide prospective information about their business. Forward-looking statements include statements concerning plans, objectives, goals, strategies, future events or performance, and

underlying assumptions and other statements, which are other than statements of historical facts. The Company desires to take advantage of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and is including this

cautionary statement in connection with this safe harbor legislation. The words "believe", "anticipate", "intends", "estimate", "forecast", "project", "plan", "potential", "may", "should", "expect", "pending" and similar expressions identify

forward-looking statements.

The forward-looking statements in this press release are based upon various assumptions, many of which are based, in turn, upon further assumptions, including without

limitation, our management's examination of historical operating trends, data contained in our records and other data available from third parties. Although we believe that these assumptions were reasonable when made, because these assumptions are

inherently subject to significant uncertainties and contingencies which are difficult or impossible to predict and are beyond our control, we cannot assure you that we will achieve or accomplish these expectations, beliefs or projections.

In addition to these important factors, other important factors that, in our view, could cause actual results to differ materially from those discussed in the

forward-looking statements include the failure of counterparties to fully perform their contracts with us, the strength of world economies and currencies, general market conditions, including fluctuations in charter rates and vessel values, changes

in demand for tanker vessel capacity, changes in our operating expenses, including bunker prices, dry-docking and insurance costs, the market for our vessels, availability of financing and refinancing, charter counterparty performance, ability to

obtain financing and comply with covenants in such financing arrangements, changes in governmental rules and regulations or actions taken by regulatory authorities, potential liability from pending or future litigation, general domestic and

international political conditions, potential disruption of shipping routes due to accidents or political events, vessels breakdowns and instances of off-hires and other factors. Please see our filings with the United States Securities and Exchange

Commission for a more complete discussion of these and other risks and

uncertainties.

EXHIBIT 99.2

anchor

Special General Meeting (SGM)Euronav proposed acquisition of CMB.TECH Published

– 08 January 2024 SGM – 07 February 2024

Forward-Looking statements Matters discussed in this presentation may

constitute forward-looking statements under U.S. federal securities laws, including the Private Securities Litigation Reform Act of 1995. Forward-looking statements reflect the Company’s current views with respect to future events and

financial performance and may include statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions and other statements, which are other than statements of historical facts. All

statements, other than statements of historical facts, that address activities, events or developments that the Company expects, projects, believes or anticipates will or may occur in the future, including, without limitation, the delivery of

vessels, the outlook for tanker shipping rates, general industry conditions future operating results of the Company’s vessels, capital expenditures, expansion and growth opportunities, bank borrowings, financing activities and other such

matters, are forward-looking statements. Although the Company believes that its expectations stated in this presentation are based on reasonable assumptions, actual results may differ from those projected in the forward-looking statements.

Important factors that, in our view, could cause actual results to differ materially from those discussed in the forward-looking statements include the failure of counterparties to fully perform their obligations to us, the strength of the

world economies and currencies, general market conditions, including changes in tanker vessel charter hire rates and vessel values, changes in demand for tankers, changes in our vessel operating expenses, including dry-docking, crewing and

insurance costs, or actions taken by regulatory authorities, ability of customers of our pools to perform their obligations under charter contracts on a timely basis, potential liability from future litigation, domestic and international

political conditions, potential disruption of shipping routes due to accidents and political events or acts by terrorists. We undertake no obligation to publicly update or revise any forward-looking statement contained in this presentation,

whether as a result of new information, future events or otherwise, except as required by law. In light of the risks, uncertainties and assumptions, the forward-looking events discussed in this presentation might not occur, and our actual

results could differ materially from those anticipated in these forward-looking statements. In addition to these important factors, other important factors that, in our view, could cause actual results to differ materially from those

discussed in the forward-looking statements include the risk that the Transaction may not be completed, or if it is completed, that it will close in a timely manner; uncertainty surrounding how many of Euronav’s stockholders will tender their

shares in the tender offer; the possibility of business disruptions due to Transaction-related uncertainty and the response of business partners to the announcement, including customers; the risk that stockholder litigation in connection with

the Transaction may result in significant costs of defense, indemnification and liability; the failure of counterparties to fully perform their contracts with us; the strength of world economies and currencies; general market conditions,

including fluctuations in charter rates and vessel values; changes in demand for tanker vessel capacity; changes in our operating expenses, including bunker prices, dry-docking and insurance costs; the market for our vessels; availability of

financing and refinancing; charter counterparty performance,; ability to obtain financing and comply with covenants in such financing arrangements; changes in governmental rules and regulations or actions taken by regulatory authorities;

potential liability from pending or future litigation; general domestic and international political conditions; potential disruption of shipping routes due to accidents or political events, vessels breakdowns and instances of off-hires; and

other factors. the risk that the Transaction may not be completed, or if it is completed, that it will close in a timely manner; uncertainty surrounding how many of Euronav’s stockholders will tender their shares in the tender offer; the

possibility of business disruptions due to Transaction-related uncertainty and the response of business partners to the announcement, including customers; the risk that stockholder litigation in connection with the Transaction may result in

significant costs of defense, indemnification and liability; the failure of counterparties to fully perform their contracts with us; the strength of world economies and currencies; general market conditions, including fluctuations in charter

rates and vessel values; changes in demand for tanker vessel capacity; changes in our operating expenses, including bunker prices, dry-docking and insurance costs; the market for our vessels; availability of financing and refinancing; charter

counterparty performance,; ability to obtain financing and comply with covenants in such financing arrangements; changes in governmental rules and regulations or actions taken by regulatory authorities; potential liability from pending or

future litigation; general domestic and international political conditions; potential disruption of shipping routes due to accidents or political events, vessels breakdowns and instances of off-hires; and other factors. Additional

information The tender offer by CMB NV referred to elsewhere in this presentation has not yet commenced. This presentation is for informational purposes only, and is neither an offer to purchase nor a solicitation of an offer to sell any

ordinary shares of Euronav NV or any other securities, nor is it a substitute for (i) the prospectus of CMB NV and the response memorandum of the supervisory board of Euronav NV to be approved by the Belgian Financial Services and Markets

Authority or (ii) the Tender Offer Statement on Schedule TO and other necessary filings that CMB NV will file with the Securities and Exchange Commission (the “Commission”), and the Solicitation/Recommendation Statement on Schedule 14D-9 and

other necessary filings that Euronav NV will file with the Commission, at the time the tender offer is commenced. Any solicitation and offer to buy ordinary shares of Euronav NV will only be made pursuant to a public takeover bid within the

meaning of the Belgian Law of 1 April 2007 and the Belgian Royal Decree of 27 April 2007 on public takeover bids addressed to shareholders of Euronav NV wherever located (the “Belgian Offer”) and a concurrent offer to purchase and related

tender offer materials in accordance with applicable U.S. federal securities laws addressed to U.S. holders (within the meaning of Rule 14d-1(d) under the Securities Exchange Act of 1934, as amended) of Euronav NV’s ordinary shares (the “U.S.

Offer"). At the time the tender offer is commenced, CMB NV will file with the Commission a Tender Offer Statement on Schedule TO and other necessary filings, and in connection therewith, Euronav NV will file with the Commission a

Solicitation/Recommendation Statement on Schedule 14D-9 and other necessary filings. The prospectus of CMB NV and the response memorandum of the supervisory board of Euronav NV will contain important information in relation to the Belgian

offer. Shareholders of Euronav NV are urged to read these documents carefully when they become available because they will contain important information that shareholders of Euronav NV should consider before making any decision with respect

to the Belgian Offer. The Tender Offer Statement (including an offer to purchase, a related letter of transmittal and certain other offer documents) and the Solicitation/Recommendation Statement on Schedule 14D-9 will contain important

information in relation to the U.S. Offer. U.S. holders of Euronav NV’s ordinary shares are urged to read these documents carefully when they become available because they will contain important information that U.S. holders of Euronav NV’s

ordinary shares should consider before making any decision with respect to the tender offer U.S. Offer. When the tender offer is commenced, (i) the prospectus and the response memorandum will be made available for free at the website of

Euronav NV, and (ii) the offer to purchase, the related letter of transmittal and the solicitation/recommendation statement and other filings related to the offer will be made available for free at the Commission’s website at www.sec.gov.

U.S. holders of Euronav’s ordinary shares also may obtain free copies of the Tender Offer Statement and other offer documents that the Offeror will file with the Commission by contacting the information agent for the tender offer that will be

named in the Tender Offer Statement and the Solicitation/Recommendation Statement.

Presentation topics – Euronav proposed acquisition of CMB.TECH Context Company

profiles Key terms: structure, timing, and Share Purchase Agreement Financial terms Enterprise value to equity value bridge Marine division Fair Market Value (FMV), Industry division Discounted Cash Flow (DCF), and H2 Infrastructure

division DCF Fairness opinion Illustrative balance sheet: Euronav, CMB.TECH, and combined Investment highlights: CMB.TECH Expected timing

1. Context The proposed Acquisition Euronav NV, a public limited company

incorporated under Belgian law with registered office and administrative office at De Gerlachekaai 20, 2000 Antwerp, Belgium and registered with the Crossroads Bank for Enterprises under number 0860.402.767, business court of Antwerp

(“Euronav”), has signed a Share Purchase Agreement on the 22nd of December 2023 with CMB NV, having its registered office at De Gerlachekaai 20, 2000 Antwerp, Belgium and registered with the Crossroads Bank for Enterprises under number

0404.535.431 (“CMB”) for the acquisition of all issued shares in CMB.TECH NV, having its registered office at De Gerlachekaai 20, 2000 Antwerp, Belgium and registered with the Crossroads Bank for Enterprises under number 0766.552.396,

business court of Antwerp (“CMB.TECH”), for a purchase price of USD 1.150 billion in cash (the “Acquisition Price”) Committee of independent directors The proposed Acquisition was assessed by a committee composed of the independent members

of Euronav’s supervisory board in the context of decisions and transactions concerning relations with a related party in accordance with article 7:116 of the Belgian Code on Companies and Associations (“CCA”) The Committee advised favorably

on the Acquisition The Fairness Opinion In light thereof, the Committee appointed Degroof Petercam Corporate Finance NV/SA, having its registered office at Guimardstraat 18,1040 Brussels, Belgium and registered at the Crossroads Bank for

Entreprises under the number 0864.424.606 (“Degroof Petercam”), to render an independent expert opinion in relation to the fairness of the valuation considered in the proposed Acquisition, in order for the Committee to prepare its advice to

the supervisory board of the Company Degroof Petercam has concluded that “in the context of the intended acquisition announced on all the shares of CMB.TECH, we [Degroof Petercam] are of the opinion that the Acquisition Price is fair to

Euronav shareholders.” (1) Publicly available documents The following documentation has been made publicly available on the Euronav website (2): Advice of the committee of the independent members of Euronav’s supervisory board in

application of article 7:116 CCA Share Purchase Agreement dated 22 December 2023 Fairness opinion of Degroof relating to the proposed Acquisition Closing The Transaction is also subject to important conditions, including the approval by

a special general meeting of Euronav’s shareholders in accordance with Article 7:152 CCA (the “SGM”) and customary waivers of change of control provisions in view of the rollover of certain contracts. The Company and CMB expect to close the

Transaction in February 2024 Special General Meeting Euronav has convened a special general meeting to approve the Acquisition in accordance with Article 7:152 of the CCA, which is to take place on 7 February 2024. This information note

has been prepared by Euronav in the framework of the SGM to provide its shareholders with relevant information in relation to the items on the agenda. (1) Based upon the analysis and qualified in its entirety by the statements in the

fairness opinion. See section 5 below. (2) https://www.euronav.com/investors/legal-information/sgm/2024/ 4

Industry-leading shareholder returns, tier 1 customer portfolio, and at the

centre of the on-going energy transition. Older tanker tonnage provides excellent opportunities to recycle capital into more future-proof (tanker) tonnage. 2nd largest quoted crude oil tanker company Shareholder return Euronav in

numbers VLCC Suezmax FSO Type # of vessels Average age(1) 9.9 years 7.8 years Ship on water Under construction Trading Storage Stock listed platform Euronav is the world’s second largest independent quoted crude oil tanker

company (dwt) engaged in the ocean transportation and storage of crude oil Sustainability is a core value at Euronav Fleet rejuvenation and future-proof(2) newbuilding program at the heart of its long-term value creation strategy $1.5bn

Cash dividends $200m Share buyback $3.5 bn Market Cap on 14/12/2023 NH3 Each $5k per day uplift in VLCC and Suezmax rates improves EBITDA by $70m $ 70 million + $ 5,000 per day $ 210 million + $ 15,000 per day $

350million + $ 25,000 per day $ 770 million + $ 55,000 per day BASE since 2015 2. Company profile – Euronav (1) Age calculation: new building fleet set at 0 years. (2) For purposes of this presentation, “future-proof” means owning

and operating efficient low-carbon emitting ships and/or ships powered by hydrogen and/or ships powered by ammonia. (3) These firms have not consented to the use of their names in this presentation, nor have they endorsed the transaction or

made any recommendations relating thereto. (3) Uplift in rates: 5

Total of 60+46 vessels with an average age of 0.17 years (1) Category

(2) 52+10 off-shore wind 1+4 container 2+26 dry-bulk 2+6 chemical 3 other 50 conventional NH3 21 dual fuel hydrogen Energy (1) Age calculation: new building fleet set at 0, excluding CTV’s (Avg. age 8.9 years) (2) Data format: fleet

on the water + new building orders CMB.TECH’s business model is to own/lease out or sell assets to customers looking for low/zero carbon solutions. CMB.TECH solves the chicken and egg discussion by offering H2 and NH3 molecules, either

through own production or by sourcing it from third party producers. 35 ammonia ready ammonia fitted CMB.TECH marine in numbers 2. Company profile – CMB.TECH 6 Design, building and operate a future-proof fleet powered by hydrogen and

ammonia: Design and retrofit of port and industrial applications to run on hydrogen – in cooperation with leading OEMs and port operators Technology and infrastructure to produce and distribute green H2 and NH3, the fuelof the future A

well-equipped technology centre powered by highly skilled engineers specialized in H2 systems H2 infrastructure Technology & Dev Industry Chemical tankers powered by NH3 Dry-Bulk carriers powered by NH3 Container vessels powered by

NH3 Marine Crew Transfer Vessels (CTV) powered by H2Commissioning service operationvessels (CSOV) powered by H2 Suezmax tankers / VLCC tankersFloating Storage and Offloading unitsStorage tankers (FSO) Tugboats powered by H2Ferry units

powered by H2

Q4 2021 BeHydro launches the first hydrogen-powered dual-fuel engine Launch of

first multimodal hydrogen refuelling station Launch of hydrogen-powered truck & launch of hydrogen-powered excavator BeHydro launches 100% hydrogen engines for heavy-duty applications Volvo Penta & CMB.TECH partner on dual fuel

hydrogen engines Opening CMB.TECH dual fuel workshop WinGD and CMB.TECH agree to co-develop large ammonia-fuelled two-stroke engines ATS & CMB.TECH launch World's First Hydrogen Dual Fuel Straddle

Carrier 2017 2020 2020 2021 2021 2021 2022 2022 2022 2023 2023 2023 Time Technology performance and scalability 2. Company profile – CMB.TECH evolution over time 52+5 CTV 2+6 25.000 dwt chem 1+3 6,000 TEU 2+24

Newcastlemax 3 Other 0+2 5000 dwt 0+1 1,400 TEU 0+5 CSOV 44+6 CTV 0+4 25.000 dwt chem 0+12 6,000 TEU 0+8 Newcastlemax 3 Other 2 years 47+30 ~FMV $ 1,787 million (1) 60+46 FMV $ 3,402 million (2) Marine H2 infra and

industry (1) Based on data of VesselsValue Ltd. of 01/01/2022. CTV valuation based on 28/11/2023. VesselsValue Ltd. has not consented to the use of its name in this presentation, nor has it endorsed the transaction or made any

recommendations relating thereto. (2) Based on valuations as of 28/11/2023. Fair Market Value (FMV) sources: Arrow, BRS, Howe Robinson, Maersk Broker, SSY, and Hagland Shipbrokers. These firms have not consented to the use of their names in

this presentation, nor have they endorsed the transaction or made any recommendations relating thereto. CMB, ITOCHU Corporation and Nippon Coke & Engineering Company join forces to build a company dedicated to local hydrogen

production Cleanergy Solutions Namibia kicks off construction works for Africa's first public refuelling station with onsite green hydrogen production Q4 2023 7 Delivery of the world’s first hydrogen powered ship, Hydroville, powered by

CMB.TECH’s converted Volvo Penta D4 engines Delivery of Asia’s first hydrogen powered ferry, HydroBingo, powered by CMB.TECH’s converted Volvo Penta D13 engines 2023 Delivery of the world’s first hydrogen powered tugboat, Hydrotug, powered

by 2 x 2MW BeHydro engines

3. Key terms: transaction structure and timing Corporate governance

safeguards In accordance with Article 7:116 of the CCA, the Committee of Independent Directors of Euronav appointed Degroof Petercam as Independent expert to advise on the fairness of the Acquisition Price for CMB.TECH Following the

recommendation by the Committee of Independent Directors, which was also reviewed by Euronav’s statutory auditor, the Supervisory Board of Euronav has approved the Transaction In accordance with Article 7:152 of the CCA, the approval of

Euronav’s shareholders at the SGM is required Location Intention to maintain all current offices of Euronav and CMB.TECH Headquarters will remain in Antwerp, Belgium Euronav leadership & governance remains unchanged CEO: Alexander

Saverys CFO: Ludovic Saverys Supervisory Board composed of Marc Saverys (chairman), Bjarte Bøe, Patrick De Brabandere and 3 independent directors (Patrick Molis, Catharina Scheers, Julie De Nul) Closing conditions Approval of Euronav’s

shareholders at the SGM pursuant to Article 7:152 of the CCA Customary change of control waivers in view of the rollover of certain CMB.TECH contracts Long-stop date of 30 June 2024 Time to completion Announcement on 22 December

2023 Planned SGM on 7 February 2024, with closing expected to take place on or about the same date Purchase Price $ 1.150 billion in cash More information regarding the financial terms of the Acquisition can be found in the joint press

release by Euronav and CMB announcing the Transaction of 22 December 2023 and the fairness opinion issued by Degroof Petercam Due Diligence Euronav engaged the following professional advisors to perform due diligence investigations in view

of the CMB.TECH Group: Linklaters LLP (in respect of corporate and general legal matters), Watson Farley & Williams LLP (in respect of certain shipping related information) and Monard Law BV and Evelyn Partners LLP (both in respect of

tax) Additionally, Euronav’s inhouse legal department performed due diligence in respect of insurance 8

3. Key terms: Share Purchase Agreement In addition to the purchase price and

conditions precedent described on the previous slide, the Share Purchase Agreement of 22 December 2023 includes the following key terms: 9 Additional funding Prior to the SPA closing, CMB may, to the extent necessary in view of contractual

commitments or obligations of CMB.TECH and its subsidiaries (the “CMB.TECH Group”), investments or capital expenditure contemplated by the business plan of the CMB.TECH Group or otherwise agreed upon between the CMB and Euronav, provide

additional funding to the CMB.TECH Group by means of shareholder loans at an interest not exceeding SOFR + 2% per year. At Closing, the Additional Funding will be paid in cash to CMB Prior consent of Euronav is required for any Additional

Funding in excess of an aggregate amount of USD 65 million Warranties The SPA contains a customary set of fundamental and business warranties by CMB to Euronav in respect of the CMB.TECH Group Leakage protection The SPA contains leakage

protection for Euronav for any value extraction by CMB from the CMB.TECH Group between 30 June 2023 and the closing date Interim covenants The SPA contains customary pre-closing covenants, including restrictions on the conduct of business

of the CMB.TECH Group between the date of the SPA and closing and the termination of certain cross-perimeter agreements Indemnification and Warranty & Indemnity (W&I) insurance CMB undertakes to indemnify Euronav for breach of CMB’s

warranties in the SPA, subject to customary limitations In addition to the indemnification provided by CMB, Euronav is planning to obtain, prior to closing of the Transaction, W&I insurance to cover CMB’s warranties in the SPA. The

insurance would become the first (but not sole) recourse for claims of breach of CMB’s warranties Any amounts payable under or in relation to the W&I Insurance (including any premiums, broker fees or costs as well as any taxes related

thereto) to be borne by CMB by means of a deduction from the Purchase Price Rights to name and IP rights CMB transfers all rights to the CMB.TECH name to Euronav for no additional consideration In this respect, CMB shall assign to

CMB.TECH any rights to the “CMB.TECH” sign as well as any trademarks, trade names, domain names, copyrights and similar IP rights. Furthermore, CMB shall grant a royalty-free license to Euronav for the use of “Bocimar”, “Bochem” and “Delphis”

signs Priority right to certain charters Euronav to have a priority right to any potential charters for a term exceeding three months for which both vessels owned by Euronav or its affiliates and vessels owned by the CMB Group (with the

exclusion of Euronav and its affiliates) compete, always provided (i) that these vessels are of a similar design and age profile and (ii) are not operating under the same revenue sharing agreement CMB shall not charge any consideration or

fee to Euronav for the (application of the) priority right

Note: Based on valuations as of 28/11/2023. Fair Market Value (FMV) sources:

Arrow, BRS, Howe Robinson, Maersk Broker, SSY, and Hagland Shipbrokers. Others: Tugboats & Ferries. These firms have not consented to the use of their names in this presentation, nor have they endorsed the transaction or made any

recommendations relating thereto. Discounted cash Flow (DCF): intrinsic and prospective method valuing the business until end of holding period through its future free cash flows discounted using the weighted average cost of capital (WACC)

to obtain Enterprise Value (EV). (1) (1) H2 Infrastructure DCF $ 22 (-) Overheads and HQ Costs DCF $ 3,649 Enterprise Value $ 510 $ 1,888 $ 361 $ 1,625 (-) Net Debt Total Nominal 0utstanding Capital Commitments $ 1,153 Equity

Value Dry Bulk FMV $ 441 Container FMV $ 394 Chemical FMV $ 679 Off-Shore Wind, Others FMV $ 181 Industry DCF $ 89 $ 1,986 (-) Net Debt Net Existing Finacial Debt 67 Vessels 5 Vessels 28 Vessels 8 Vessels In $

millions Unfunded – comes from Euronav cash 4.a. Financial terms: enterprise value to equity value bridge Secured – rolled over Financial terms The Acquisition Price for 100% of the shares in CMB.TECH is $ 1.150 billion in cash.

Approximate enterprise value of $ 3.649 billion and an equity value of $ 1.150 billion The transaction includes $ 2.496 billion roll-over debt (bank, leasing and shipyard liabilities). This includes: Net existing financial debt of $ 510

million Total nominal outstanding capital commitments of $ 1.986 billion – to be paid over the coming 3 years: (i) $ 1.625 billion has been secured and will be rolled over; (ii) remaining unfunded capital commitment of $ 361 million will

come from Euronav’s own cash. Financing by Euronav The Acquisition Price will be financed by Euronav from the cash proceeds of the sale of 24 VLCCs fleet to Frontline plc (which was announced by Euronav on 9 October 2023) 10

4.b. Financial terms: Marine division FMV 11 52+5 CTV 67 Vessels 5

Vessels 28 Vessels 8 Vessels $ 679 $ 1,888 Marine FMV $ 3,402 $ 394 $ 441 2+6 25.000 dwt chem 1+3 6,000 TEU 2+24 Newcastlemax 3 Other Broker 1 Average FMV/vessel Broker 2 Average FMV/vessel Broker 3 Average

FMV/vessel Broker 4 Average FMV/vessel Broker 5 Average FMV/vessel Broker 6 Average FMV/vessel Internal valuation Average FMV/vessel Sub Total FMV $ 2.4 $ 6.0 Newbuilding CTVs $ 51.2 $ 47.2 $ 104.0 $ 90.0 $ 71.7 $ 71.7 0+2

5000 dwt $ 11.7 0+1 1,400 TEU 0+5 CSOV $ 76.5 $ 12.4 Hydrotug $ 1.0 Hydroville/Hydrobingo $ 164.2 (1) $ 393.8 $ 388 $ 1,864 $ 23,5 $ 52.7 $ 500.0 (2) $ 14.6 In $ millions Total FMV $ 679 $ 394 $ 441 $ 1,888 Calculation

methodology: FMV basis 28 November 2023 Brokers used: Arrow, BRS, Howe Robinson, Maersk Broker, SSY, and Hagland Shipbrokers (1) Desk appraisals without physical inspection Average of FMV if multiple broker reports were available FMV

includes value of charter (if applicable) No valuation has been requested for the NB CTVs, NB 1400 TEU (value assumed to be equal to the contract price) No valuation was provided for Hydroville and Hydrobingo – internal assessment made FMV

represents the % share in case of JV’s (1) A 25% premium to FMV has been applied to reflect the Windcat platform's premium offering in terms of predominant numberof CTV vessels in the market, global recognition, unique contractual

operational know-how ($ 33 million) (2) CSOV broker valuation has been complemented to reflect the H2 dual fuel capabilities. 1 more CSOV option is held by CMB.TECH NV and has been valued accordingly $ 52.7 $ 6.8 CSOV H2 premium (1)

These firms have not consented to the use of their names in this presentation, nor have they endorsed the transaction or made any recommendations relating thereto.

4.b. Financial terms: Industry division DCF 12 Calculation methodology &

comments: Valuation as of 31 December 2023 Normative year reached in 2044 (20-year DCF) Perpetual growth rate (PGR) of 2,5% in line with peers average Normative EBITDA margin of 19% in line with best-in class industrial margins WACC of

10.5% based on bottom-up calculation $ million (# units) 2024E 2025E 2026E Truck 18.0 (75 #) 35.9 (150 #) 39.5 (165 #) Generator 0.2 (10 #) 0.6 (30 #) 0.8 (36 #) Port Equipment 0.8 (5 #) 0.8 (5 #) 6.1 (40 #)

Behydro 3.2 (9 #) 7.4 (21 #) 12.6 (36 #) Locomotive - - (2 #) 0.8 (4 #) Total Revenue 22.1 44.7 59.8 OPEX -15.2 -31.1 -40.9 EBITDA 0.8 7.4 12.6 EBIT 0.8 7.4 12.3 NOPAT 0.6 5.5 9.3 Free Cash

Flow 0.6 2.8 4.1 Discounted Cash Flow 0.6 2.4 3.2 Business plan (in $ million) Equity value (in $ million) WACC 10.5% Perpetual growth rate 2.5% Present value of Free Cash Flow 116 Present value of Terminal

Value 65 Perpetual Growth Rate

(%) -0.4% -0.2% - +0.2% +0.4% 2.1% 2.3% 2.5% 2.7% 2.9% -0.4% 10.1% 192 193 195 198 200 -0.2% 10.3% 184 186 188 190 192 - 10.5% 178 179 181 183 185 +0.2% 10.7% 171 173 174 176 178 +0.4% 10.9% 165 167 168 170 171 WACC

(%) Enterprise value (in $ million) Financials in group share for Engineering (100%), Truck (100%), Generator (100%), BeHydro (50%), Port equipment (100%) and Locomotive (50%); Capex mainly represents acquisition; EV=EqV as debt free

cash free Macroeconomic assumption 2% inflation on the costs of allocated FTEs from Engineering division Net working capital variation assumed to be nil for all segments Terminal Value: calculated using the Gordon Shapiro formula

4.b. Financial terms: Industry division DCF 13 Business plan – main

operational assumptions Truck Generator BeHydro Port Locomotive Fixed price by truck times number of trucks sold Number of trucks sold assumed to grow by 10% until 2030 and 5% onwards Revenue Overhead costs: allocated full time

equivalents (FTEs) from the Engineering division No maintenance capex required as all applications are sold hence no depreciation & amortization (D&A) Overhead & CAPEX Fixed price by generator times number of generators

sold Number of generators sold assumed to grow by 20% Fixed price by engine times number of engines sold Number of engines sold assumed to grow by 10% Fixed price by straddle carrier retrofit kit times number of kits sold Number of kits

sold forecasted to grow over the business plan period Locomotive leased on annual basis Number of locomotives to reach 20 in 2030 then assumed to grow annually by 5% D&A: Linear depreciation of locomotives over 10 years Overhead

costs: allocated FTEs from Engineering division Capex corresponding to locomotive acquisition and retrofitting cost Includes the cost per truck and the retrofit cost which are assumed to be constant over the business plan

period OPEX Includes the retrofit cost per generator which is assumed to be constant over the business plan period Includes the cost per engine which is assumed to be constant over the business plan period Includes the cost per straddle

carrier retrofit kit which is assumed to be constant over the business plan period Includes yearly maintenance per locomotive, assumed to be constant over the business plan period Ownership 100% CMB.TECH 100% CMB.TECH 50% CMB.TECH 100%

CMB.TECH 50% CMB.TECH

4.b. Financial terms: H2 infrastructure division DCF 14 $

million 2024E 2025E 2026E 2027E 2028E 2029E 2030E 2031E PV2Fuel pilot - - 1.3 1.3 1.3 1.4 1.4 1.4 PV2Fuel - - - - - 117.8 120.2 122.6 Refueling station 1.5 1.4 1.4 1.4 1.4 1.3 1.3 1.3 Total

Revenue 1.5 1.4 2.7 2.7 2.8 120.5 122.9 125.3 OPEX -1.0 -1.3 -1.8 -1.7 -1.7 -18.5 -18.6 -19.0 EBITDA -0.9 -1.5 -0.7 -0.6 -0.6 100.3 102.5 104.5 EBIT -1.1 -1.7 -1.5 -1.4 -1.3 73.1 75.3 77.3 NOPAT -1.1 -1.7 -1.5 -1.4 -1.3 49.7 51.2 52.6 Free

Cash Flow -20.1 -71.0 -277.4 -300.0 -132.0 76.9 78.4 79.8 Discounted CF -19.0 -60.4 -214.7 -213.6 -87.4 47.9 44.8 41.8 Business plan (in $ million) Equity value (in $ million) WACC 24E-29E 12.0% WACC

30E-31E 9.0% Perpetual growth rate 2.5% Present value of Free Cash Flow -126 Present value of Terminal Value 215 Perpetual Growth Rate

(%) -0.2% -0.1% - +0.1% +0.2% 2.3% 2.4% 2.5% 2.6% 2.7% -0.5% 8.5% 140 144 149 154 158 -0.25% 8.8% 110 114 118 122 126 - 9.0% 82 85 89 92 96 +0.25% 9.3% 56 59 62 65 69 +0.5% 9.5% 32 35 37 40 43 WACC

(%) Enterprise value (in $ million) Calculation methodology & comments: Valuation as of 31 December 2023 Normative year reached in 2044 (20-year DCF) Perpetual growth rate (PGR) of 2,5% in line with selected peers average Normative

EBITDA margin of 84.6% in line with the average EBITDA margin since FCF breakeven in 2029E until the end of the forecast period Rolling WACC retained: 12.0% in 2024E and 9.0% from 2030E onwards, with linear interpolation between 2024E and

2030E Financials in group share for PV2Fuel pilot (49%), PV2Fuel (25%) and Refueling station (100%) EV=EqV as debt free cash free Implied tax rate resulting from H2 Infra consolidated cash-flows Macroeconomic assumptions: 2% inflation

on the costs of allocated FTEs from Engineering division, opex inflation of 1%, and inflation on green ammonia’s price of 2% Net working capital variation assumed to be nil for all segments Terminal Value: calculated using the Gordon

Shapiro formula

4.b. Financial terms: H2 infrastructure division DCF 15 PV2Fuel

Pilot PV2Fuel Refueling Station Green ammonia price per kg times volume produced Revenue D&A: Linear depreciation of the equipment Overhead costs: allocated FTEs from Engineering division Overhead Green ammonia price per kg times

volume produced Volume of hydrogen produced times hydrogen price which is assumed flat from 2029E onwards Includes the various costs associated with the facilities OPEX Includes the various costs associated with the facilities Includes

fixed and variable costs (electricity, water and other) Maintenance costs Business plan – main operational assumptions CAPEX Capex includes group’s share of investment Replacement and maintenance capex are treated as opex hence no

additional depreciation Total capex of circa $ 40 million (excluding subsidy) Capex includes group’s share of investment Replacement and maintenance capex are treated as opex hence no additional depreciation Total capex of circa $ 3.1

billion Capex includes group’s share of investment Replacement and maintenance capex are treated as opex hence no additional depreciation Total capex of circa $ 4.4 million Status Construction ongoing, delivery expected June 2024 Front

End Engineering Design (FEED) phase on-going Final Investment Decision (FID) – Q4 2024 In operation expected 2029 Delivered & in operation Ownership 49% CMB.TECH 25% CMB.TECH 100% CMB.TECH

5. Fairness opinion Extract out of the fairness opinion performed by Degroof

Petercam(1) Estimated Equity Value of CMB.TECH based on the DCF valuation method within the range of $ 1,157-1,449 million(1) with a midpoint of $ 1,302 million. Secondary method, the NAV, yields a valuation range of $ 1,105-1,435

million(2) with a midpoint of $ 1,327 million Based on the aforementioned valuation range for the primary and secondary valuation method, Degroof Petercam concluded that the Acquisition Price is within its valuation range Hence, in the

context of the intended Acquisition announced on all the shares of CMB.TECH, Degroof Petercam is of the opinion that the Acquisition Price is fair to Euronav shareholders (1) Fairness opinion of Degroof Petercam is available at Euronav’s

website: https://www.euronav.com/media/67615/20231222_project-cmb2_valuation-opinion_.pdf (2) Based on the maximum and minimum of the upper and lower limits of each sensitivity (3) WACC = weighted-average cost of capital CMB.TECH

acquisition price is at the lower end of the valuation range 16 (3)

5. Fairness opinion: agreed valuation versus fairness opinion Overall, the

Enterprise Value is aligned between the internal valuation exercise, and the fairness opinion performed by Degroof Petercam Differing methodology in regard of the capital commitments (discounted capital commitments versus capital

commitments) Marine FMV 181 Industry DCF 89 H2 Infrastructure DCF 22 (-) Overheads and HQ Costs DCF Enterprise Value 2,496 (-) Net Debt Equity Value 3,649 3,402 1,153 215 57 0 2,321 1,327 3,648 3,377 Agreed

valuation Degroof Petercam valuation Note: Based on valuations as of 28/11/2023. Fair Market Value (FMV) sources: Arrow, BRS, Howe Robinson, Maersk Broker, SSY, and Hagland Shipbrokers. Others: Tugboats & Ferries. These firms have not

consented to the use of their names in this presentation, nor have they endorsed the transaction or made any recommendations relating thereto. Discounted Cash Flow (DCF) 17

6. Illustrative balance sheet(1): Euronav, CMB.TECH, and combined 18 in k

USD EURONAV 15/02/2024 CMB.TECH 15/02/2024 COMBINED 15/02/2024 CMB.TECH acquisition price CMB - CMB.TECH receivable settlement Other consolidation entries Illustrative 15/02/2024 ASSETS NON-CURRENT

ASSETS 1.840.681 991.094 2.831.775 1.150.000 0 -1.150.000 2.831.775 Vessels 1.711.995 426.344 2.138.339 2.138.339 Assets under construction 82.264 525.233 607.497 607.497 CMB.TECH

participation 0 0 0 1.150.000 -1.150.000 0 Other non-current assets 46.422 39.517 85.939 85.939 CURRENT ASSETS 2.066.938 49.696 2.116.634 -1.150.000 0 -65.000 901.634 Trade and other

receivables 242.496 39.899 282.395 65.000 -65.000 282.395 Cash and cash equivalents 1.823.642 0 1.823.642 -1.150.000 -65.000 608.642 Other current assets 800 9.797 10.597 10.597 TOTAL

ASSETS 3.907.619 1.040.790 4.948.409 0 0 -1.215.000 3.733.409 EQUITY and LIABILITIES EQUITY 2.843.007 361.371 3.204.378 0 0 -1.150.000 2.054.378 Equity attributable to equity

holders of the Company 2.843.007 361.371 3.204.378 -1.150.000 2.054.378 Non-controlling interest 0 0 0 0 NON-CURRENT LIABILITIES 737.290 552.446 1.289.736 0 0 0 1.289.736 Loans and

borrowings 735.302 552.334 1.287.636 1.287.636 Other non-current liabilaties 1.988 112 2.100 2.100 CURRENT LIABILITIES 327.322 126.973 454.296 0 0 -65.000 389.296 Loans and

borrowings 254.199 113.051 367.250 -65.000 302.250 Trade and other payables 70.313 13.570 83.883 83.883 Other current liabilities 2.811 352 3.163 3.163 TOTAL EQUITY and LIABILITIES

3.907.619 1.040.790 4.948.409 0 0 -1.215.000 3.733.409 (1) The Balance Sheet is provided for illustrative purposes only, is not a pro forma, is not based on historical financial data and has not been reviewed by Euronav’s auditors.

Other CMB’s cleantech marine division – ready to scale rapidly 52+10

Vessels 1+4 Vessels 2+26 Vessels 2+6 Vessels 3Vessels Zero-carbon maritime solutions CMB.TECH builds, owns, operates and designs large marine applications that run on hydrogen and ammonia CMB.TECH also offers hydrogen and ammonia

fuel to its customers, either through own production or bysourcing it from third party producers (and thereby solving the industry dilemma) CMB.TECH uses proven and accredited monofuel and dual fuel combustion engines that use hydrogen and

ammonia Ideally positioned in the growing market of sustainable shipping Positioned for the global fuel transition Energy demand expected to turn from 80% fossil and 20% electricity to 80% clean molecules and green electricity by

2050.Energy demand supplied from hydrogen is expected to witness north of 25% CAGR next 30 years Increasing premium on TC rates for low-carbon vessels Regulatory framework (e.g. EU ETS, FuelEU, IMO) supporting the commercial attractiveness

of the future-proof CMB.TECH fleet Economic highlights Enterprise value of 3,649 million USD Equity value of 1,153 million USD Diversified, young, and growing fleet Exposed to attractive end markets Diversification across different

shipping types enables investment for the future through shipping cycles: offshore wind vessels, dry-bulk vessels, chemical tankers, container vessels, and other segment (H2 tug & H2 ferry) Extensive project pipeline of 46 committed new

building vessels for delivery – and a pipeline of + 125 vessels $ 1888 FMV $ 394 FMV $ 441 FMV $ 631 FMV $ 15,3 FMV Fair Market Value (FMV) sources: Arrow, BRS, Howe Robinson, Maersk Broker, SSY, and Hagland Shipbrokers – basis

fleet on the water + new building orders. These firms have not consented to the use of their names in this presentation, nor have they endorsed the transaction or made any recommendations relating thereto. Data format Vessels count: fleet

on the water+ new building orders Offshore wind Dry Bulk Chemical Container 7. Investment highlights: CMB.TECH $ in millions 19

The reference in sustainable shipping Creating value through a diversified

fleet and a strong focus on decarbonization Use, produce, distribute, and carrylow carbon fuels Best-in-class tanker platform High-quality asset base: VLCC,Suezmax, and FSO Strong customer portfolio at the centerof the energy

transition Market leader in green ships Modern fleet comprising over 100low-carbon future-proof vessels expected (1) Integrated hydrogen andammonia value chain The only investable diversified green shipping platform for ESG fundsand

investors Intended to continue NYSE and EURONEXT listings under future symbol “CMBT” (1) Upon completion of newbuilding deliveries expected in 2026 (2) After the closing of the acquisition transaction and CMB’s announced mandatory

take-over bid for all shares in Euronav that CMB and its affiliates do not currently own (the “MTO”), Euronav will propose to its shareholders to change its corporate name to “CMB.TECH NV” and CMB.TECH will change its corporate name. The

trading symbol for the re-named company will also be changed to “CMBT” on both the NYSE and BE Euronext. ~ 6.8 $ Billion Marine Asset FMV (fleet on the water + new building orders) 53.37% Strong anchor shareholder CMB (entailing voting

rights) 7. Creation of the leading, future-proof shipping platform (2) Euronav to be renamed 20

8. Expected Timing (1) The offer price may be further reduced by the gross

amount of any future dividends distributions paid by Euronav to its shareholders with an ex-dividend date prior to the end of acceptance period in settlement date of the MTO. 21 CMB and Frontline plc/ Famatown Finance Ltd, reach an

agreement on a transaction that puts an end to the deadlock arising from their entrenched differences over the future strategy of the company Agreement Euronav and CMB announced that they entered into a SPA for the acquisition of 100% of

the share in CMB.TECH Announcement of CMB.TECH transaction As a consequence of exceeding the 30% threshold in November 2023 – CMB will offer all shareholders $ 17.86, i.e. $ 18.43 minus dividend of $ 0.57 paid in December 2023 (1) Target

for Euronav to remain listed on NYSE and EURONEXT Close MandatoryTake-Over Bid Shareholders approve conditionality of (i) Frontline’s acquisition of 24 VLCC for 2.35 billion USD and (ii) termination of arbitration case against Frontline plc

/ Famatown Finance Ltd, following which CMB acquired Frontline’s 26.12% stake for $ 18.43 and a new Euronav Supervisory Board and Management Board was installed SGM - Special Shareholder Meeting SGM scheduled on 7 February 2023 to approve

CMB.TECH transaction (pursuant to Art. 7:152 CCA) Expected closing of the transaction SGM - Special Shareholder Meeting 22 December 2023 15 March 2024 21/22 November 2023 February 2024 09 October 2023 Capital Market Day 12 January

2024 Euronav intends to change name to CMB.TECH (CMBT NYSE / BE EURONEXT) Convening of SGM to approve CMB.TECH transaction Targeted approval date of MTO Prospectus CMB expects to launch MTO for Euronav on 14 February 2024

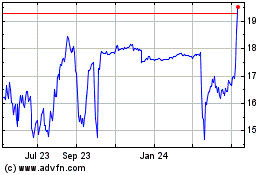

Euronav NV (NYSE:EURN)

Historical Stock Chart

From Dec 2024 to Jan 2025

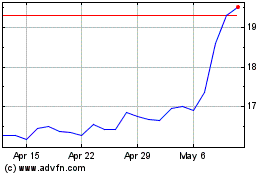

Euronav NV (NYSE:EURN)

Historical Stock Chart

From Jan 2024 to Jan 2025