0001819438False00018194382024-03-062024-03-060001819438wk:CommonStock0.0001ParValuePerShareMember2024-03-062024-03-060001819438wk:WarrantsEachWholeWarrantExercisableForOneShareOfCommonStockAtAnExercisePriceOf11.50Member2024-03-062024-03-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): March 6, 2024

ESS TECH, INC.

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-39525 | | 98-1550150 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

| | | | | | | | |

26440 SW Parkway Ave., Bldg. 83 Wilsonville, Oregon | | 97070 |

| (Address of principal executive offices) | | (Zip code) |

(855) 423-9920

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | | GWH | | The New York Stock Exchange |

| Warrants, each whole warrant exercisable for one share of common stock at an exercise price of $11.50 | | GWH.W | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On March 6, 2024, ESS Tech, Inc. (the “Company”) received a written notice (the “Notice”) from the New York Stock Exchange (“NYSE”) indicating that the Company did not satisfy the continued listing standard set forth in Section 802.01C of the NYSE’s Listed Company Manual (“Section 802.01C”), as the average closing price of the Company’s common stock was less than $1.00 per share over a consecutive 30 trading-day period. As of March 5, 2024, the 30 trading-day average closing share price of the security was $0.94. The Notice is a notice of deficiency, not delisting, and does not currently affect the listing or trading of the Company’s common stock on the NYSE.

Section 802.01C requires the Company to notify the NYSE, within 10 business days of receipt of the Notice, of its intent to cure this deficiency. The Company intends to notify the NYSE within this time period that it intends to regain compliance. Pursuant to Section 802.01C, the Company has a period of six months following receipt of the Notice to regain compliance with the minimum share price requirement, with the possibility of extension at the discretion of the NYSE. The Company can regain compliance with the average closing price requirement at any time during the six-month cure period if, on the last trading day of any calendar month during the cure period the Company has a closing share price of at least $1.00, and an average closing share price of at least $1.00 over the 30 trading-day period ending on the last trading day of that month or the last trading day of the cure period. If the Company determines to remedy the non-compliance by taking action that will require shareholder approval, the Company must obtain shareholder approval no later than its next annual meeting and implement such action promptly thereafter.

The Company intends to monitor closely the closing bid price of its common stock and to consider plans for regaining compliance with Section 802.01C, including initiating a reverse stock split. While the Company plans to review all available options, there can be no assurance that it will be able to regain compliance with the applicable rules during the six-month compliance period, any subsequent extension period, or at all.

Item 8.01 Other Events.

On March 8, 2024, the Company issued a press release discussing the matters disclosed in Item 3.01 above. A copy of the press release is attached hereto as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit

No. | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

Forward-Looking Statements

The Company cautions you that statements included in this report that are not a description of historical facts are forward-looking statements. These forward-looking statements include statements regarding any liquidity concern and attention to regaining compliance with Section 802.01C. The inclusion of forward-looking statements should not be regarded as a representation by the Company that any of these results will be achieved. Actual results may differ from those set forth in this report due to the risks and uncertainties associated with liquidity concerns that may affect other banking institutions, as well as risks and uncertainties inherent in the Company’s business, including those described in the Company's other filings with the Securities Exchange Commission. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof, and the Company undertakes no obligation to revise or update this report to reflect events or circumstances after the date hereof. All forward-looking statements are qualified in their entirety by this cautionary statement. This caution is made under the safe harbor provisions of Section 21E of the Private Securities Litigation Reform Act of 1995.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

Dated: March 8, 2024

| | | | | |

| ESS TECH, INC. |

| |

| By: | /s/ Anthony Rabb |

| Name: | Anthony Rabb |

| Title: | Chief Financial Officer |

ESS Tech, Inc. Receives Continued Listing Standard Notice From NYSE

WILSONVILLE, OREGON – March 8, 2024 – ESS Tech, Inc. (“ESS,” “ESS, Inc.” or the “Company”) (NYSE:GWH), a leading manufacturer of long-duration energy storage systems (LDES) for commercial and utility-scale applications, today announced that on March 6, 2024, it received notice (the “Notice”) from the New York Stock Exchange (the “NYSE”) indicating that the Company did not satisfy the continued listing standard set forth in Section 802.01C of the NYSE Listed Company Manual because the average closing price of the Company’s common stock was less than $1.00 per share over a consecutive 30 trading-day period. As of March 5, 2024, the 30 trading-day average closing share price of the security was $0.94. The Notice is a notice of deficiency, not delisting, and does not currently affect the listing or trading of the Company’s common stock on the NYSE.

In accordance with applicable NYSE rules, the Company intends to notify the NYSE within 10 business days of its intent to regain compliance with Rule 802.01C and return to compliance with the applicable NYSE continued listing standards. The Company can regain compliance at any time within a six-month cure period following its receipt of the Notice if, on the last trading day of any calendar month during such cure period, the Company has both: (i) a closing share price of at least $1.00 and (ii) an average closing share price of at least $1.00 over the 30 trading-day period ending on the last trading day of the applicable calendar month.

The Company intends to remain listed on the NYSE and is considering all available options to regain compliance with the NYSE’s continued listing standards. The NYSE notice has no immediate impact on the listing of the Company’s common stock, which will continue to be listed and traded on the NYSE during such cure period, subject to the Company’s compliance with other NYSE continued listing standards.

Furthermore, the Notice is not anticipated to impact the ongoing business operations of the Company or its reporting requirements with the U.S. Securities and Exchange Commission (“SEC”).

About ESS, Inc.

At ESS (NYSE: GWH), our mission is to accelerate global decarbonization by providing safe, sustainable, long-duration energy storage that powers people, communities and businesses with clean, renewable energy anytime and anywhere it’s needed. As more renewable energy is added to the grid, long-duration energy storage is essential to providing the reliability and resiliency we need when the sun is not shining and the wind is not blowing.

Our technology uses earth-abundant iron, salt and water to deliver environmentally safe solutions capable of providing up to 12 hours of flexible energy capacity for commercial and utility-scale energy storage applications. Established in 2011, ESS Inc. enables project developers, independent power producers, utilities and other large energy users to deploy reliable, sustainable long-duration energy storage solutions. For more information visit www.essinc.com.

Forward-Looking Statements

This communication contains certain forward-looking statements, including statements regarding ESS and its management team’s expectations, hopes, beliefs, intentions or strategies regarding the future. The words “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “intends”, “may”, “might”, “plan”, “possible”,

“potential”, “predict”, “project”, “should”, “will” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Examples of forward-looking statements include, among others, statements regarding the Company’s ability to maintain the listing of its common stock on the NYSE and any potential plans to regain compliance with the continued listing standards of the NYSE. These forward-looking statements are based on ESS’ current expectations and beliefs concerning future developments and their potential effects on ESS. Many factors could cause actual future events to differ materially from the forward-looking statements in this communication. There can be no assurance that the future developments affecting ESS will be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond ESS’ control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements, which include, but are not limited to, the Company’s ability to regain compliance with the continued listing standards of the NYSE within the applicable cure period, as well as those risks and uncertainties set forth in the section entitled “Risk Factors” in the Company’s Quarterly Report on Form 10-Q for the nine months ended September 30, 2023, filed with the SEC on November 14, 2023, the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, to be filed with the SEC, and its other filings filed with the SEC. Except as required by law, ESS is not undertaking any obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise.

Contacts

Investors:

Erik Bylin

investors@essinc.com

Media:

Morgan Pitts

503.568.0755

Morgan.Pitts@essinc.com

Source: ESS Tech, Inc.

v3.24.0.1

Cover

|

Mar. 06, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Mar. 06, 2024

|

| Entity Registrant Name |

ESS TECH, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39525

|

| Entity Tax Identification Number |

98-1550150

|

| Entity Address, Address Line One |

26440 SW Parkway Ave.

|

| Entity Address, Address Line Two |

Bldg. 83

|

| Entity Address, City or Town |

Wilsonville

|

| Entity Address, State or Province |

OR

|

| Entity Address, Postal Zip Code |

97070

|

| City Area Code |

(855)

|

| Local Phone Number |

423-9920

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity Central Index Key |

0001819438

|

| Amendment Flag |

false

|

| Common Stock 0.0001 Par Value Per Share |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value per share

|

| Trading Symbol |

GWH

|

| Security Exchange Name |

NYSE

|

| Warrants Each Whole Warrant Exercisable For One Share Of Common Stock At An Exercise Price Of 11.50 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each whole warrant exercisable for one share of common stock at an exercise price of $11.50

|

| Trading Symbol |

GWH.W

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=wk_CommonStock0.0001ParValuePerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=wk_WarrantsEachWholeWarrantExercisableForOneShareOfCommonStockAtAnExercisePriceOf11.50Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

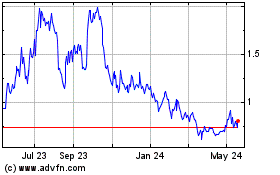

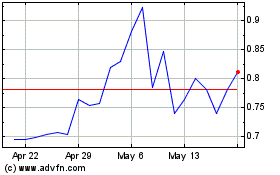

ESS Tech (NYSE:GWH)

Historical Stock Chart

From Jun 2024 to Jul 2024

ESS Tech (NYSE:GWH)

Historical Stock Chart

From Jul 2023 to Jul 2024