Current Report Filing (8-k)

November 18 2014 - 12:57PM

Edgar (US Regulatory)

_________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 18, 2014

EQUUS TOTAL RETURN, INC.

(Exact Name of Registrant as Specified in its

Charter)

| Delaware |

814-00098 |

76-0345915 |

| (State or Other Jurisdiction |

(Commission File |

(IRS Employer |

| Of Incorporation) |

Number) |

Identification No.) |

|

700 Louisiana Street, 48th Floor

Houston,

Texas |

77002 |

| (Address of Principal Executive Offices) |

(Zip Code) |

Registrant’s telephone number, including

area code: (713) 529-0900

N/A

(Former Name or Former Address,

if Changed Since Last Report)

Check the appropriate box below if the Form 8-k filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01 Other Events.

On November 18, 2014, Equus Total Return, Inc.

issued a press release announcing its net asset value for the quarter ended September 30, 2014. The text of the press release is

included as Exhibit 99.1 to this Current Report and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

99.1 Press release issued on November 18, 2014.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

Equus Total Return, Inc. |

| |

|

|

| Date: November 18, 2014 |

|

By: /s/ Kenneth I. Denos |

| |

|

Name: Kenneth I. Denos |

| |

|

Title: Secretary |

Exhibit 99.1

Contact:

Patricia Baronowski

Pristine Advisers, LLC

(631) 756-2486

EQUUS ANNOUNCES THIRD QUARTER NET ASSET VALUE

HOUSTON, TX – November 18, 2014 –

Equus Total Return, Inc. (NYSE: EQS) (the “Fund” or “Equus”) reports net assets as of September

30, 2014, of $37.6 million, a decrease of approximately $0.4 million since June 30, 2014. Net assets per share decreased to $2.97

as of September 30, 2014 from $3.00 as of June 30, 2014. Comparative data is summarized below (in thousands, except per share amounts):

| As of the Quarter Ended |

9/30/2014 |

6/30/2014 |

3/31/2014

|

12/31/2013 |

9/30/2013 |

| Net assets |

$37,604 |

$38,041 |

$32,679 |

$33,217 |

$29,373 |

| Shares outstanding |

12,674 |

12,674 |

10,562 |

10,562 |

10,562 |

| Net assets per share |

$2.97 |

$3.00 |

$3.09 |

$3.14 |

$2.78 |

The Fund also reported a 13.1% decrease in

operating expenses of the Fund for the third quarter of 2014 as compared to the third quarter of 2013. Operating expenses for the

nine months ended September 30, 2014 were also 23.6% lower than for the nine months ended September 30, 2013.

The overall decrease in the Fund’s net

assets during the third quarter of 2014 was principally due to a decrease in cash resulting from operating expenses of the Fund

and changes in the fair values of the following portfolio holdings:

| · | Increase in Fair Value of Holdings in

Equus Energy. We formed Equus Energy in 2011 as a wholly-owned subsidiary of the Fund, to make investments in companies in

the energy sector, with particular emphasis on income producing oil & gas properties. In December 2012, Equus Energy acquired

working interests in 132 producing and non-producing oil and gas wells, including associated development rights of approximately

21,620 acres situated on 13 separate properties in Texas and Oklahoma. The fair value of our holdings in Equus Energy increased

from $8.8 million to $9.8 million during the quarter, primarily due to increased oil and gas production from our working interests,

additional proved reserves from new drilling and recompletion activities, as well as increases in comparable transactions for mineral

leases. We received advice and assistance from a third-party valuation firm to support our determination of the fair value of this

investment. |

| · | Decrease in Fair Value of Holdings in

MVC Capital. On May 15, 2014, Equus announced its intention to effect a transformational reorganization under the Investment

Company Act of 1940. The reorganization also involved the exchange by Equus of 2,112,000 shares of its common stock to MVC Capital,

Inc. (NYSE: MVC), a business development company based in Purchase, NY that trades on the New York Stock Exchange (“MVC”),

and the Fund receiving 395,839 shares of MVC. Under the terms of the reorganization, Equus intends to pursue a merger or consolidation

with MVC, or a subsidiary of MVC, or one or more of MVC’s portfolio companies during the 12 month period following the announcement.

During the third quarter of 2014, the fair value of our shareholding in MVC declined $0.8 million due to a decrease in MVC’s

trading price per share during that period, which decreased from $12.95 at June 30, 2014 to $10.76 at September 30, 2014. On July

31, 2014, we received 4,308 shares ($53,438) of MVC as a dividend payment. The Fund held 400,147 shares of MVC at September 30,

2014. |

| · | Decrease in Fair Value of Holdings in

Orco Property Group. Expressed in Euros, we increased the fair value of our holding of 5-year notes of Orco Property Group

from €1.15M at June 30, 2014 to €1.21M at September 30, 2014. Expressed in U.S. Dollars, however, because of adverse

changes in the EUR-USD exchange rate from 1.36883 at June 30, 2014 to 1.26908 at September 30, 2014, the fair value of the New

OPG Notes decreased by approximately $50,000. |

About Equus

The Fund is a business development company

that trades as a closed-end fund on the New York Stock Exchange, under the symbol "EQS". Additional information on the

Fund may be obtained from the Fund’s website at www.equuscap.com.

This

press release may contain certain forward-looking statements regarding future circumstances. These forward-looking statements are

based upon the Fund’s current expectations and assumptions and are subject to various risks and uncertainties that could

cause actual results to differ materially from those contemplated in such forward-looking statements including, in particular,

the performance of the Fund, including our ability to achieve our expected

financial and business objectives, our ability to execute our reorganization and complete the transactions contemplated thereby,

the performance of our new investment in MVC and the other risks and uncertainties described in the Fund’s filings with the

SEC. Actual results, events, and performance may differ. Readers are cautioned not to place undue reliance on these forward-looking

statements, which speak only as to the date hereof. Except as required by law, the Fund undertakes no obligation to release publicly

any revisions to these forward-looking statements that may be made to reflect events or circumstances after the date hereof or

to reflect the occurrence of unanticipated events. The inclusion of any statement in this release does not constitute an admission

by the Fund or any other person that the events or circumstances described in such statements are material.

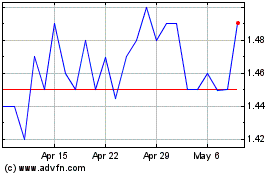

Equus Total Return (NYSE:EQS)

Historical Stock Chart

From Jun 2024 to Jul 2024

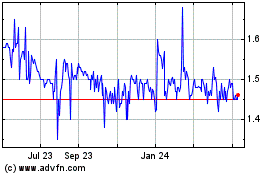

Equus Total Return (NYSE:EQS)

Historical Stock Chart

From Jul 2023 to Jul 2024