Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

May 11 2021 - 4:17PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

May 11, 2021

Commission File Number 1-15200

Equinor ASA

(Translation of registrant’s name into English)

FORUSBEEN 50, N-4035, STAVANGER, NORWAY

(Address of principal executive offices )

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F X Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

This Report on Form 6-K contains a press release issued by Equinor ASA on May 11, 2021, entitled "Annual general meeting approved dividend of USD 0.12 per share for fourth quarter 2020".

Annual general meeting approved dividend of USD 0.12 per share for fourth quarter 2020

On 11 May 2021, the annual general meeting (AGM) of shareholders in Equinor ASA (OSE: EQNR, NYSE: EQNR) approved the annual report and accounts for Equinor ASA for 2020, as proposed by the board of directors.

The annual accounts and the annual report for Equinor ASA and the Equinor group for 2020 were approved, and a dividend of US dollar (”USD”) 0.12 per share will be distributed for the fourth quarter of 2020.

The fourth quarter 2020 dividend accrues to the shareholders as registered in Equinor’s shareholder register with the Norwegian Central Securities Depository (VPS) as of expiry of 14 May 2021 (the ”Record Date”). Subject to ordinary settlement in VPS, this implies that the right to dividend accrues to shareholders as of 11 May 2021. For US ADR (American Depository Receipts) holders, dividend accrues also as of 11 May 2021.The shares will be traded ex-dividend on the Oslo Stock Exchange (Oslo Børs) from and including 12 May 2021. On New York Stock Exchange, the ADRs will trade ex-dividend from and including 13 May 2021. Shareholders whose shares trade on the Oslo Børs will receive their dividend in Norwegian kroner (”NOK”). The NOK dividend will be communicated on 21 May 2021. The expected payment date for the dividend in NOK and in USD under the ADR program is on 27 May 2021. The AGM authorised the board of directors to resolve quarterly dividend payments until the next annual general meeting, but no later than 30 June 2022.

The below proposals from shareholders were up for voting. The shareholders’ supporting statements and the board’s responses are available at www.equinor.com/agm

-

To set short-, medium-, and long-term targets for greenhouse gas (GHG) emissions of the company’s operations and the use of energy products (including Scope 1, 2 and 3). The proposal was not adopted.

-

To report key information on both climate risk and nature. The proposal was not adopted.

-

To stop all exploration activity and test drilling for fossil energy resources. The proposal was not adopted.

-

To present a strategy for real business transformation to sustainable energy production. The proposal was not adopted.

-

To stop all oil and gas exploration in the Norwegian sector of the Barents Sea. The proposal was not adopted.

-

To spin-out Equinor’s renewable energy business in wind and solar power to a separate company, “NewCo”. The proposal was not adopted.

-

To divest all non-petroleum-related business overseas and to consider withdrawing from all petroleum-related business overseas. The proposal was not adopted.

-

That all exploration for new oil and gas discoveries is discontinued, that Equinor multiplies its green investments, improves its EGS profile and reduces its risk for future lawsuits. The proposal was not adopted.

-

Proposal for actions to avoid big losses overseas, receive specific answers with regards to safety incidents and get the audit’s evaluation of improved quality assurance and internal control. The proposal was not adopted.

-

To include nuclear in Equinor’s portfolio. The proposal was not adopted.

The AGM endorsed the board’s report for 2020 on Corporate Governance. Furthermore, the AGM approved the board of directors’ remuneration policy on determination of salary and other remuneration for leading personnel. The AGM endorsed the board of directors’ remuneration report for leading personnel.

Remuneration to the company's external auditor for 2020 was approved.

Furthermore, the nomination committee’s proposed determination of remuneration for the corporate assembly members and remuneration for the nomination committee members were approved, effective from 12 May 2021.

The AGM authorised the board to acquire Equinor ASA shares in the market on behalf of the company in order to continue the share savings plan for employees. The authorisation is valid until the next annual general meeting, but no later than 30 June 2022.

The AGM also authorised the board on behalf of the company to acquire Equinor ASA shares in the market for subsequent annulment. Own shares acquired pursuant to this authorisation may only be used for annulment through a reduction on the company’s share capital. The authorisation is valid until the next annual general meeting, but no later than 30 June 2022.

Please find enclosed minutes of the AGM.

MINUTES OF THE ANNUAL GENERAL MEETING OF EQUINOR ASA 11 MAY 2021

The annual general meeting of Equinor ASA was held on 11 May 2021 as a digital meeting.

The chair of the board, the chair of the corporate assembly, the president and CEO, general counsel and the company’s auditor attended. Company secretary Marte Johanson Hanasand recorded the minutes of the meeting.

The agenda was as follows:

|

1.

|

Opening of the annual general meeting by the chair of the corporate assembly

Tone Lunde Bakker, chair of the corporate assembly, opened the meeting.

|

|

2.

|

Registration of represented shareholders and proxies

Overview of shareholders represented at the annual general meeting, either by personal attendance, by proxy, or by advance voting, is attached in Appendix 1 to these minutes.

|

|

3.

|

Election of the chair of the meeting

The general meeting agreed on the following resolution:

“Tone Lunde Bakker, chair of the corporate assembly, is elected chair of the meeting.”

|

|

4.

|

Approval of the notice and the agenda

The general meeting agreed on the following resolution:

“The notice and proposed agenda are approved.”

|

|

5.

|

Election of two persons to co-sign the minutes together with the chair of the meeting

The general meeting adopted the following resolution:

“Bjørn Ståle Haavik and Siv Helen Rygh Torstensen are elected to co-sign the minutes together with the chair of the meeting.”

|

|

6.

|

Approval of the annual report and accounts for Equinor ASA and the Equinor group for 2020, including the board of directors’ proposal for distribution of fourth quarter 2020 dividend

The chair of the meeting informed the general meeting that the annual report and accounts, the auditor’s report and the recommendation from the corporate assembly have been made available on the company’s webpage. Recitation was therefore not necessary.

In accordance with the proposal of the board, the general meeting adopted the following resolution:

“The annual accounts and the annual report for 2020 for Equinor ASA and the Equinor group, including group contribution of NOK 3,132 million are approved. A fourth quarter 2020 dividend of USD 0.12 per share is approved to be distributed.”

|

|

7.

|

Authorisation to distribute dividend based on approved annual accounts for 2020

In accordance with the proposal from the board, the general meeting adopted the following resolution:

“The general meeting of Equinor ASA hereby authorises the board of directors to resolve the payments of dividend based on the company’s approved annual accounts for 2020, cf. the Norwegian Public Limited Liability Companies Act section 8-2, second paragraph.

The board of directors shall, when using the authorisation, make its decision in accordance with the company’s approved dividend policy. The board of directors shall before each decision to approve the payment of dividends consider if the company, after the payment of dividends, will have sufficient equity and liquidity.

The authorisation shall be valid until the next annual general meeting, but no later than 30 June 2022.”

|

|

8.

|

Proposal from shareholder to set short-, medium-, and long-term targets for greenhouse gas (GHG) emissions of the company’s operations and the use of energy products (including Scope 1, 2 and 3)

A shareholder had proposed that the company would set short-, medium-, and long-term targets for greenhouse gas (GHG) emissions of the company’s operations and the use of energy products (including Scope 1, 2 and 3).

The shareholder’s proposal was not adopted.

|

|

9.

|

Proposal from shareholders to report key information on both climate risk and nature risk

Two shareholders had proposed that the company would report key information on both climate risk and nature risk.

The shareholders’ proposal was not adopted.

|

|

10

|

Proposal from shareholder to stop all exploration activity and test drilling for fossil energy resources

A shareholder had proposed that the company would stop all exploration activity and test drilling for fossil energy resources.

The shareholder’s proposal was not adopted.

|

|

11.

|

Proposal from shareholders to present a strategy for real business transformation to sustainable energy production

A shareholder had proposed that the company would present a strategy for real business transformation to sustainable energy production.

The shareholder’s proposal was not adopted.

|

|

12.

|

Proposal from shareholders to stop all oil and gas exploration in the Norwegian sector of the Barents Sea

Shareholders had proposed that the company would stop all oil and gas exploration in the Norwegian sector of the Barents Sea.

The shareholders’ proposal was not adopted.

|

|

13.

|

Proposal from shareholders to spin-out Equinor’s renewable energy business in wind and solar power to a separate company, “NewCo”

Shareholders had proposed that the company would spin-out Equinor’s renewable energy business in wind and solar power to a separate company, “NewCo”.

The shareholders’ proposal was not adopted.

|

|

14.

|

Proposal from shareholder to divest all non-petroleum-related business overseas and to consider withdrawing from all petroleum-related business overseas

A shareholder had proposed that the company would divest all non-petroleum-related business overseas and consider withdrawing from all petroleum-related business overseas.

The shareholder’s proposal was not adopted.

|

|

15.

|

Proposal from shareholder that all exploration for new oil and gas discoveries is discontinued, that Equinor multiplies its green investments, improves its EGS profile and reduces its risk for future lawsuits

A shareholder had proposed that the company would discontinue all exploration for new oil and gas discoveries, that Equinor would multiply its green investments, improve its EGS profile and reduce its risk for future lawsuits.

The shareholder’s proposal was not adopted.

|

|

16.

|

Proposal from shareholder for actions to avoid big losses overseas, receive specific answers with regards to safety incidents and get the audit’s evaluation of improved quality assurance and internal control

A shareholder had proposed that the company would take actions to avoid big losses overseas, give specific answers with regards to safety incidents and get the audit’s evaluation of improved quality assurance and internal control.

The shareholder’s proposal was not adopted.

|

|

17.

|

Proposal from shareholder to include nuclear in Equinor’s portfolio

A shareholder had proposed that nuclear would be included in Equinor’s portfolio.

The shareholder’s proposal was not adopted.

|

|

18.

|

The board of directors’ report on Corporate Governance

The board’s report on Corporate Governance was presented. The report is included in the annual report.

In accordance with the proposal from the board, the general meeting adopted the following resolution:

“The general meeting endorses the board of directors’ report on Corporate Governance.”

|

|

19.

|

The board of directors’ remuneration policy on determination of salary and other remuneration for leading personnel and remuneration report for salary and other remuneration for leading personnel

Jon Erik Reinhardsen, chair of the board of directors, presented the board’s remuneration policy on determination of salary and other remuneration for leading personnel and remuneration report for salary and other remuneration for leading personnel.

|

|

19.1

|

Approval of the board of directors’ remuneration policy on determination of salary and other remuneration for leading personnel

In accordance with the proposal from the board, the general meeting adopted the following resolution:

“The general meeting approves the board of directors’ remuneration policy on determination of salary and other remuneration for leading personnel.”

|

|

19.2

|

Advisory vote of the board of directors’ remuneration report for leading personnel

In accordance with the proposal from the board, the general meeting adopted the following resolution:

“The general meeting endorses the board of directors’ remuneration report for leading personnel.”

|

|

20

|

Approval of remuneration for the company’s external auditor for 2020

The general meeting adopted the following resolution:

“Remuneration to the auditor for 2020 of NOK 51,235,147 for Equinor ASA is approved.”

|

|

21.

|

Determination of remuneration for the corporate assembly

In accordance with the proposal of the nomination committee, the general meeting adopted the following resolution:

“The remuneration to the corporate assembly is from 12 May 2021 as follows:

Chair NOK 133,100/annually

Deputy chair NOK 70,200/annually

Members NOK 49,300/annually

Deputy members NOK 7,100/meeting”

|

|

22.

|

Determination of remuneration to the nomination committee

In accordance with the proposal of the nomination committee, the general meeting adopted the following resolution:

“The remuneration to the nomination committee is from 12 May 2021 as follows:

Chair NOK 13,200/meeting

Members NOK 9,800/meeting”

|

|

23.

|

Authorisation to acquire Equinor ASA shares in the market to continue operation of the share savings plan for employees

In accordance with the proposal of the board, the general meeting adopted the following resolution:

“The board of directors is authorised on behalf of the company to acquire Equinor shares in the market. The authorisation may be used to acquire own shares at a total nominal value of up to NOK 38,000,000. Shares acquired pursuant to this authorisation may only be used for sale and transfer to employees of the Equinor group as part of the group’s share saving plan, as approved by the board of directors. The minimum and maximum amount that may be paid per share will be NOK 50 and 500 respectively.

The authorisation is valid until the next annual general meeting in 2022, but not beyond 30 June 2022.

This authorisation replaces the previous authorisation to acquire own shares for implementation of the share saving plan for employees granted by the annual general meeting on 14 May 2020.”

|

|

24.

|

Authorisation to acquire Equinor ASA shares in the market for subsequent annulment

In accordance with the proposal of the board, the general meeting adopted the following resolution:

“The general meeting of Equinor ASA hereby authorises the board of directors to acquire in the market on behalf of the company, Equinor shares with a face value of up to NOK 187,500,000.

The minimum and maximum amount that can be paid per share will be NOK 50 and NOK 500, respectively. Within these limits, the board of directors shall itself decide at what price and at what time such acquisition shall take place.

Own shares acquired pursuant to this authorisation may only be used for annulment through a reduction of the company’s share capital, pursuant to the Norwegian Public Limited Liability Companies Act section 12-1.

The authorisation shall be valid until the next annual general meeting, but no later than 30 June 2022.”

|

|

|

*****

There were no further matters for discussion and the annual general meeting was closed.

Stavanger, 11 May 2021

|

|

|

|

|

|

_________[Signed]___________

|

_________[Signed]___________

|

_________[Signed]___________

|

|

Tone Lunde Bakker

|

Bjørn Ståle Haavik

|

Siv Helen Rygh Torstensen

|

Appendix 1: Overview of shares represented at the annual general meeting, either by personal attendance, by proxy, or by advance voting.

Appendix 2: The voting results for the individual issues

|

Attendance Summary Report

|

|

|

Registered Attendees:

|

90

|

|

Total Votes Represented:

|

2 603 902 148

|

|

Total Accounts Represented:

|

3 490

|

|

Total Capital:

|

3 257 687 707

|

|

Total Voting Capital:

|

3 247 567 333

|

|

% Total Voting Capital Represented:

|

80,18 %

|

|

% Total Capital Represented:

|

79,93 %

|

|

Sub Total:

|

90

|

0

|

2 603 902 148

|

|

|

Capacity

|

Registered Attendees

|

Registered Non-Voting Attendees

|

Registered Votes

|

Accounts

|

|

Shareholder (web)

|

86

|

0

|

2 182 916 660

|

86

|

|

3rd Party Proxy (web)

|

1

|

0

|

727

|

14

|

|

Chair of the Board WITH PROXY

|

1

|

0

|

3 266 359

|

549

|

|

Chair of the Board WITH INSTRUCTIONS

|

1

|

0

|

294 803 345

|

2375

|

|

ADVANCE VOTES

|

1

|

0

|

122 915 057

|

466

|

|

|

|

|

|

_________[Signed]___________

|

_________[Signed]___________

|

|

|

Freddy Hermansen

|

Marte J Hanasand

|

|

|

DNB Bank ASA Issuer Services

|

For Equinor ASA

|

|

Equinor ASA

As scrutineer appointed for the purpose of the Poll taken at the Annual General Meeting of the Members of the Company held on May 11. 2021, I HEREBY CERTIFY that the result of the Poll is correctly set out as follows:-

Issued share capital: 3 247 567 333

|

|

VOTES FOR

|

%

|

VOTES Against

|

%

|

VOTES Abstained

|

VOTES TOTAL

|

% of ISC VOTED

|

NO VOTES

|

|

3

|

2 603 615 530

|

100,00

|

16 548

|

0,00

|

150 803

|

2 603 782 881

|

80,18%

|

119 267

|

|

4

|

2 603 642 395

|

100,00

|

15 887

|

0,00

|

134 968

|

2 603 793 250

|

80,18%

|

108 898

|

|

5

|

2 603 612 392

|

100,00

|

13 569

|

0,00

|

161 150

|

2 603 787 111

|

80,18%

|

115 037

|

|

6

|

2 591 104 205

|

99,68

|

8 398 856

|

0,32

|

4 299 185

|

2 603 802 246

|

80,18%

|

99 902

|

|

7

|

2 596 661 080

|

99,73

|

7 057 388

|

0,27

|

75 331

|

2 603 793 799

|

80,18%

|

108 349

|

|

8

|

144 432 835

|

5,56

|

2 452 096 043

|

94,44

|

7 265 159

|

2 603 794 037

|

80,18%

|

108 111

|

|

9

|

64 980 945

|

2,50

|

2 536 054 349

|

97,50

|

2 760 079

|

2 603 795 373

|

80,18%

|

106 775

|

|

10

|

13 015 018

|

0,50

|

2 585 974 702

|

99,50

|

4 803 828

|

2 603 793 548

|

80,18%

|

108 600

|

|

11

|

14 158 465

|

0,54

|

2 584 872 670

|

99,46

|

4 762 425

|

2 603 793 560

|

80,18%

|

108 588

|

|

12

|

22 220 584

|

0,85

|

2 576 843 809

|

99,15

|

4 730 844

|

2 603 795 237

|

80,18%

|

106 911

|

|

13

|

11 400 820

|

0,44

|

2 588 858 128

|

99,56

|

3 535 458

|

2 603 794 406

|

80,18%

|

107 742

|

|

14

|

12 166 185

|

0,47

|

2 588 152 374

|

99,53

|

3 475 847

|

2 603 794 406

|

80,18%

|

107 742

|

|

15

|

16 707 283

|

0,64

|

2 586 596 173

|

99,36

|

491 677

|

2 603 795 133

|

80,18%

|

107 015

|

|

16

|

17 997 803

|

0,70

|

2 544 931 222

|

99,30

|

40 865 529

|

2 603 794 554

|

80,18%

|

107 594

|

|

17

|

1 614 289

|

0,06

|

2 596 365 254

|

99,94

|

5 815 738

|

2 603 795 281

|

80,18%

|

106 867

|

|

18

|

2 602 885 200

|

99,97

|

702 271

|

0,03

|

200 570

|

2 603 788 041

|

80,18%

|

114 107

|

|

19.1

|

2 571 884 627

|

98,96

|

27 024 593

|

1,04

|

4 881 487

|

2 603 790 707

|

80,18%

|

111 441

|

|

19.2

|

2 576 026 284

|

98,96

|

27 042 432

|

1,04

|

721 904

|

2 603 790 620

|

80,18%

|

111 528

|

|

20

|

2 603 205 137

|

99,99

|

313 378

|

0,01

|

272 182

|

2 603 790 697

|

80,18%

|

111 451

|

|

21

|

2 602 872 772

|

99,98

|

649 326

|

0,02

|

268 599

|

2 603 790 697

|

80,18%

|

111 451

|

|

22

|

2 602 872 466

|

99,97

|

652 331

|

0,03

|

265 900

|

2 603 790 697

|

80,18%

|

111 451

|

|

23

|

2 518 914 732

|

96,74

|

84 750 088

|

3,26

|

128 439

|

2 603 793 259

|

80,18%

|

108 889

|

|

24

|

2 596 186 100

|

99,71

|

7 440 997

|

0,29

|

166 162

|

2 603 793 259

|

80,18%

|

108 889

|

Yours faithfully,

|

|

|

|

|

_________[Signed]___________

|

_________[Signed]___________

|

|

|

Freddy Hermansen

|

Marte J Hanasand

|

|

Contact persons:

Investor relations

Peter Hutton, senior vice president for investor relations,

Tel: +44 7881 918 792

Helge Hove Haldorsen, vice president for investor relations USA,

Tel: + 1 281 224 0140

Press

Bård Glad Pedersen, vice president for media relations,

Tel: +47 91 80 17 91

This information is subject to the disclosure requirements pursuant to section 5-12 of the Norwegian Securities Trading Act.

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

EQUINOR ASA

(Registrant)

|

|

Dated: May 11, 2021

|

By:

|

___/s/ Svein Skeie

Name: Svein Skeie

Title: Chief Financial Officer

|

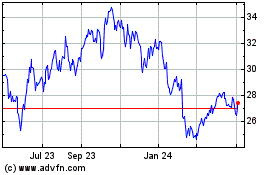

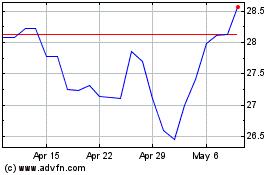

Equinor ASA (NYSE:EQNR)

Historical Stock Chart

From Aug 2024 to Sep 2024

Equinor ASA (NYSE:EQNR)

Historical Stock Chart

From Sep 2023 to Sep 2024