Enterprise Declares Quarterly Distribution

October 02 2024 - 7:00AM

Business Wire

Enterprise Products Partners L.P. (NYSE: EPD) (“Enterprise”)

announced today that the board of directors of its general partner

declared a quarterly cash distribution to be paid to Enterprise

common unitholders with respect to the third quarter of 2024 of

$0.525 per unit, or $2.10 per unit on an annualized basis.

The quarterly distribution will be paid Thursday, November 14,

2024, to common unitholders of record as of the close of business

Thursday, October 31, 2024. This distribution represents a 5.0

percent increase over the distribution declared with respect to the

third quarter of 2023.

Enterprise repurchased $76 million of its common units in the

open market during the third quarter of 2024, bringing total common

unit repurchases in the first nine months of 2024 to $156 million

and total common unit repurchases for the last twelve months to

$252 million. Inclusive of these purchases, the partnership has

repurchased approximately $1.1 billion of common units under its

authorized $2.0 billion buyback program.

Enterprise will announce its earnings for the third quarter of

2024 on Tuesday, October 29, 2024, before the New York Stock

Exchange opens for trading. Following the announcement, the

partnership will host a conference call at 9 a.m. CDT with analysts

and investors to discuss earnings. The call will be webcast live on

the Internet and may be accessed through the “Investors” section of

the partnership’s website at www.enterpriseproducts.com. A replay

of the webcast will be available following the conference call and

may be accessed approximately one hour after completion of the

call.

Enterprise Products Partners L.P. is one of the largest publicly

traded partnerships and a leading North American provider of

midstream energy services to producers and consumers of natural

gas, NGLs, crude oil, refined products and petrochemicals. Services

include: natural gas gathering, treating, processing,

transportation and storage; NGL transportation, fractionation,

storage and marine terminals; crude oil gathering, transportation,

storage and marine terminals; petrochemical and refined products

transportation, storage and marine terminals; and a marine

transportation business that operates on key U.S. inland and

intracoastal waterway systems. The partnership’s assets currently

include more than 50,000 miles of pipelines; over 300 million

barrels of storage capacity for NGLs, crude oil, petrochemicals and

refined products; and 14 billion cubic feet of natural gas storage

capacity.

Qualified Notice for Non-U.S. Unitholder Income Tax

Withholding

This release is intended to serve as qualified notice under

Treasury Regulation Section 1.1446-4(b)(4) and (d). Brokers and

nominees should treat one hundred percent of Enterprise’s

distributions to non-U.S. investors as being attributable to income

that is effectively connected with a United States trade or

business. Accordingly, Enterprise’s distributions to non-U.S.

investors are subject to federal income tax withholding at the

highest applicable effective tax rate. For purposes of Treasury

Regulation section 1.1446(f)-4(c)(2)(iii), brokers and nominees

should treat one hundred percent of the distributions as being in

excess of cumulative net income for purposes of determining the

amount to withhold. Nominees, and not Enterprise Products Partners

L.P., are treated as withholding agents responsible for any

necessary withholding on amounts received by them on behalf of

foreign investors.

This press release includes “forward-looking statements” as

defined by the Securities and Exchange Commission. All statements,

other than statements of historical fact, included herein that

address activities, events, developments or transactions that

Enterprise and its general partner expect, believe or anticipate

will or may occur in the future are forward-looking statements.

These forward-looking statements are subject to risks and

uncertainties that may cause actual results to differ materially

from expectations, including required approvals by regulatory

agencies, the possibility that the anticipated benefits from such

activities, events, developments or transactions cannot be fully

realized, the possibility that costs or difficulties related

thereto will be greater than expected, the impact of competition,

and other risk factors included in Enterprise’s reports filed with

the Securities and Exchange Commission. Readers are cautioned not

to place undue reliance on these forward-looking statements, which

speak only as of their dates. Except as required by law, Enterprise

does not intend to update or revise its forward-looking statements,

whether as a result of new information, future events or

otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241002339884/en/

Libby Strait, Investor Relations (713) 381-4754 or (866)

230-0745, investor.relations@eprod.com Rick Rainey, Media Relations

(713) 381-3635, RRainey@eprod.com

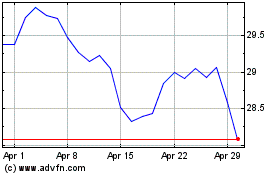

Enterprise Products Part... (NYSE:EPD)

Historical Stock Chart

From Feb 2025 to Mar 2025

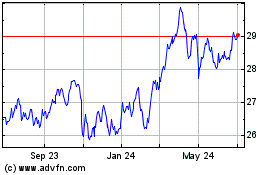

Enterprise Products Part... (NYSE:EPD)

Historical Stock Chart

From Mar 2024 to Mar 2025