SECURITIES & EXCHANGE

COMMISSION

Washington, D.C. 20549

SCHEDULE 13D*

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED PURSUANT TO

13d-1(a) AND AMENDMENTS THERETO FILED PURSUANT TO 13d-2(a)

EASTERN LIGHT CAPITAL, INCORPORATED

(Name of Issuer)

Common Stock

(Title of Class of Securities)

276650108

(CUSIP Number)

Michael Glickstein

G Asset Management LLC, 546 Fifth Avenue, 14th Floor, New York NY 10036

Tel: (646) 840-5417

With a copy to:

James Rieger, Esq.

Tannenbaum Helpern Syracuse & Hirschtritt LLP

900 Third Avenue

New York, NY 10022

Tel: (212) 508-6728

(Name, address and telephone number of person

authorized to receive notices and communications)

January 4, 2012

(Date of event which requires filing of this statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition which is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box [ ].

NOTE: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent.

(Continued on following pages)

(Page 1 of 10 Pages)

*The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter the disclosures provided in a prior cover page.

The information required in the remainder of this cover page shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

CUSIP No. 276650108

|

|

13D

|

|

Page 2 of 10 Pages

|

|

|

|

|

|

|

|

|

(1)

|

NAME OF REPORTING PERSONS

|

|

|

|

|

I.R.S. IDENTIFICATION NOS.

|

|

|

|

|

OF ABOVE PERSONS (ENTITIES ONLY)

|

|

|

|

|

G Asset Management, LLC

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2)

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP **

|

|

|

|

|

|

|

|

(a)

o

|

|

|

|

|

|

|

(b)

o

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(3)

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(4)

|

SOURCE OF FUNDS **

|

|

|

|

|

AF

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(5)

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2 (d) OR 2 (e)

o

|

|

|

|

|

|

|

|

|

|

|

|

(6)

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

|

|

|

|

Delaware

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NUMBER OF

|

|

(7)

|

SOLE VOTING POWER

|

|

|

|

|

|

|

|

-0-

|

|

|

SHARES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BENEFICIALLY

|

|

(8)

|

SHARED VOTING POWER

|

|

|

|

|

|

|

|

34,772

|

|

|

OWNED BY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EACH

|

|

(9)

|

SOLE DISPOSITIVE POWER

|

|

|

|

|

|

|

|

-0-

|

|

|

REPORTING

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PERSON WITH

|

|

(10)

|

SHARED DISPOSITIVE POWER

|

|

|

|

|

|

|

|

34,772

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(11)

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

|

|

34,772

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(12)

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES **

o

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(13)

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

|

|

5.8%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(14)

|

TYPE OF REPORTING PERSON **

|

|

|

|

|

|

|

IA

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

** SEE INSTRUCTIONS BEFORE FILLING OUT!

|

|

CUSIP No.

276650108

|

|

13D

|

|

Page 3 of 10 Pages

|

|

|

|

|

|

|

|

|

(1)

|

NAME OF REPORTING PERSONS

|

|

|

|

|

I.R.S. IDENTIFICATION NOS.

|

|

|

|

|

OF ABOVE PERSONS (ENTITIES ONLY)

|

|

|

|

|

Michael Glickstein

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2)

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP **

|

|

|

|

|

|

|

|

(a)

o

|

|

|

|

|

|

|

(b)

o

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(3)

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(4)

|

SOURCE OF FUNDS **

|

|

|

|

|

AF

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(5)

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2 (d) OR 2 (e)

o

|

|

|

|

|

|

|

|

|

|

|

|

(6)

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NUMBER OF

|

|

(7)

|

SOLE VOTING POWER

|

|

|

|

|

|

|

|

-0-

|

|

|

SHARES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BENEFICIALLY

|

|

(8)

|

SHARED VOTING POWER

|

|

|

|

|

|

|

|

34,772

|

|

|

OWNED BY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EACH

|

|

(9)

|

SOLE DISPOSITIVE POWER

|

|

|

|

|

|

|

|

-0-

|

|

|

REPORTING

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PERSON WITH

|

|

(10)

|

SHARED DISPOSITIVE POWER

|

|

|

|

|

|

|

|

34,772

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(11)

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

|

|

34,772

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(12)

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES **

o

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(13)

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

|

|

5.8%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(14)

|

TYPE OF REPORTING PERSON **

|

|

|

|

|

|

|

IN

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

** SEE INSTRUCTIONS BEFORE FILLING OUT!

|

|

CUSIP No. 276650108

|

|

13D

|

|

Page 4 of 10 Pages

|

|

Item 1.

|

Security and Issuer.

|

This statement relates to the common stock, par value $0.01 (the “Common Stock”) of Eastern Light Capital Incorporated (the “Company”). The Company’s principal executive offices are located at 100 Pine Street, Suite 560, San Francisco, California 94111.

|

Item 2.

|

Identity and Background.

|

|

|

(a)

|

This statement is filed by:

|

(i)

G Asset Management, LLC, a Delaware limited liability company (“GAM”), which serves as the investment manager to (A) G Real Estate Partners, LP, a Delaware limited partnership (“G RE Partners”) and (B) G Value Fund, LLC, a Delaware limited liability company (“GVF”); and

(ii)

Michael Glickstein, the Managing Member of GAM.

The foregoing persons are hereinafter sometimes collectively referred to as the “Reporting Persons.” Any disclosures herein with respect to persons other than the Reporting Persons are made on information and belief after making inquiry to the appropriate party.

(b)

The address of the principal business and principal office of GAM, and Mr. Glickstein is 546 Fifth Avenue, 14th Floor, New York NY 10036.

(c)

The principal business of GAM is that of an investment manager engaging in the purchase and sale of securities on behalf of private investment partnerships and certain managed accounts. Mr. Glickstein is a United States citizen and serves as the Managing Member of G Real Estate Partners GP, LLC (the General Partner of G RE Partners), GAM, and the general partner of one other private investment partnership. GAM is the managing member of GVF and the investment manager of G RE Partners. Each of G RE Partners and GVF are private, collective investment vehicles.

(d)

None of the Reporting Persons has, during the last five years, been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors).

(e)

None of the Reporting Persons has, during the last five years, been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and, as a result of such proceeding, was, or is subject to, a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, Federal or State securities laws or finding any violation with respect to such laws.

|

Item 3.

|

Source and Amount of Funds and Other Consideration.

|

The net investment cost (including commissions, if any) of the shares of

Common Stock directly owned by G RE Partners and GVF, is approximately $46,889. All of such funds were obtained (and the funds for option exercises, if any, will be obtained) through the working capital of G RE Partners and GVF. Neither Mr. Glickstein nor GAM directly owns any shares of Common Stock.

|

CUSIP No. 276650108

|

|

13D

|

|

Page 5 of 10 Pages

|

|

Item 4.

|

Purpose of the Transaction.

|

The Common Stock was acquired for investment purposes.

On January 13, 2012, the Reporting Persons sent a letter to the Board of Directors of the Company expressing certain concerns with the direction of the Company. Such letter is filed as an Exhibit hereto and is reproduced in full below:

G Asset Management, LLC

546 5

th

Avenue, 14

th

FL

New York, NY 10036

(646) 840-5417

January 13, 2012

Members of the Board of Directors

c/o Eastern Light Capital, Incorporated

100 Pine Street, Suite 560

San Francisco, California 94111

Dear Members of the Board of Directors:

G Asset Management, LLC and its affiliates (“GAM”) are shareholders of Eastern Light Capital, Incorporated (“ELC” or “the Company”) and currently beneficially own approximately 5.8% of the shares outstanding.

We are extremely concerned with the strategic direction of the Company, including the deterioration of stockholder’s equity

1

and the apparent lack of urgency in responding to the Company’s pending delisting from the NYSE Amex

2

. We previously participated in a proposal that was intended to address the NYSE Amex listing requirement, but the Company inexplicably did not respond to the proposal. In the meantime, the clock continues to tick towards the Company’s potential delisting, which would likely result in the further destruction of shareholder liquidity and value.

We look forward to working with the Board on a solution that would allow the Company to meet the listing requirements and create shareholder value.

Regards

1

Stockholder’s equity was $7.5 million as of 12/31/08 vs. $2.7 million as of 9/30/11.

Source: SEC Filings.

2

On 5/10/2010, the Company received a Deficiency Letter dated 5/7/2010 from the NYSE Amex. The letter indicated that the Company was not in compliance with the NYSE Amex continued listing standards. On 11/21/11, the Company disclosed it had been denied an additional extension and requested a hearing before the Exchange's Listing Qualifications Panel.

Source: Yahoo Finance, SEC Filings.

|

CUSIP No. 276650108

|

|

13D

|

|

Page 6 of 10 Pages

|

Michael Glickstein

President

G Asset Management, LLC

(646) 840-5417 (Office)

michael.glickstein@gassetmgmt.com

Each Reporting Person expects to continuously review such person’s investment in the Company and, depending on various factors including but not limited to, the price of the shares of Common Stock, the terms and conditions of the transaction, prevailing market conditions and such other considerations as such Reporting Person deems relevant, may at any time or from time to time, and subject to any required regulatory approvals, acquire additional shares of Common Stock, preferred stock or other securities convertible into or exercisable or exchangeable for Common Stock from time to time on the open market, in privately-negotiated transactions, directly from the Company, or upon the exercise or conversion of securities convertible into or exercisable or exchangeable for Common Stock.

Each Reporting Person also may, at any time, subject to compliance with applicable securities laws and regulatory requirements dispose or distribute some or all of its or his Common Stock or such other securities as it or he owns or may subsequently acquire depending on various factors, including but not limited to, the price of the shares, the terms and conditions of the transaction and prevailing market conditions, as well as liquidity and diversification objectives.

Consistent with their investment intent, each Reporting Person may from time to time discuss with the Company’s management, directors, other shareholders and others, the Company’s performance, business, operations, strategic direction, board composition, capital structure, real estate portfolio, stock exchange listing criteria, prospects and management, as well as various ways of maximizing stockholder value, which may or may not include extraordinary transactions. Each Reporting Person intends to participate in and influence the affairs of the Company through the exercise of its voting rights with respect to their shares of the Company’s Common Stock.

Except as indicated herein, no Reporting Person, as a stockholder of the Company, has any plan or proposal that relates or would result in any of the transactions or other matters specified in clauses (a) through (j) of Item 4 of Schedule 13D. Each Reporting Person may, at any time and from time to time, review or reconsider its or his position and/or change its or his purpose and/or formulate plans or proposals with respect thereto.

|

CUSIP No. 276650108

|

|

13D

|

|

Page 7 of 10 Pages

|

The information set forth in response to this Item 4 is qualified in its entirety by the exhibits hereto, which are incorporated by reference.

|

Item 5.

|

Interest in Securities of the Issuer.

|

For each Reporting Person:

|

|

(a)

|

Aggregate number of shares beneficially owned: 34,772. Percentage: 5.8%

|

|

|

(b)

|

1.

|

Sole power to vote or direct vote: 0

|

|

|

|

2.

|

Shared power to vote or direct vote: 34,772

|

|

|

|

3.

|

Sole power to dispose or direct the disposition: 0

|

|

|

|

4.

|

Shared power to dispose or direct the disposition: 34,772

|

(c)

The trading dates, number of shares of Common Stock purchased or sold and the price per share for all transactions in the Common Stock within the last sixty days on behalf of the Reporting Persons are set forth in Schedule A, and are incorporated by reference. All of such transactions were effected in the open market except for the acquisition of two call options in privately negotiated transactions.

(d)

G RE Partners owns in excess of 99% of the Common Stock reported herein and GVF owns less than 1% of such Common Stock and, thus, each has the right to receive any dividends from, or the proceeds from the sale of, such securities.

(e)

Not applicable.

For purposes of calculating the percentages set forth in this Item 5, the number of shares of Common Stock outstanding is assumed to be 597,608, which is the number of shares of Common Stock referred to by the Company in its Quarterly Report on Form 10-Q for the period ended September 30, 2011.

|

ITEM 6.

|

Contract, Arrangement, Understandings or Relationship with Respect to Securities of the Company.

|

G RE Partners entered into two privately negotiated, arms-length, call option agreements on January 4, 2012, giving the Reporting Persons the option to acquire beneficial ownership of an aggregate of 23,904 shares of Common Stock at an exercise price of $2.39 per share. Such options have a term of one year and are exercisable immediately. One of such options agreements, relating to 17,928 shares of Common Stock, is with Capital Alliance Advisors, Inc., an affiliate of Dennis Konczal, a former Chief Executive Officer of the Company. The other such option agreement, relating to 5,976 shares of Common Stock, is with Dennis Konczal, a former Chief Executive Officer of the Company. Such call option agreements are filed herewitas Exhibits 99.3 and 99.4 and are incorporated herein.

Except as described in this Item 6, neither of the Reporting Persons is a party to any contract, arrangement, understanding or relationship with respect to any securities of the Company, including, but not limited to transfer or voting of any of the securities, finders fees, joint ventures, loan or option arrangements, puts or calls, guarantees of profits, division of profits or loss, or the giving or withholding of proxies or a pledge or contingency the occurrence of which would give another person voting power over the securities of the Company.

|

CUSIP No. 276650108

|

|

13D

|

|

Page 8 of 10 Pages

|

|

ITEM 7.

|

Material to be Filed as Exhibits.

|

|

Exhibit

|

Description

|

|

|

|

|

99.1

|

Joint Filing Agreement, dated as of January 13, 2012, by and between G Asset Management, LLC, and Michael Glickstein.

|

|

|

|

|

99.2

|

Letter to Board of Directors of Eastern Light Capital, Incorporated by G Asset Management , LLC dated January 13, 2012.

|

|

|

|

|

99.3

|

Call Option Agreement, dated as of January 3, 2012, by and between Capital Alliance Advisors, Inc., as optioner, and G Real Estate Partners, LP, as optionee.

|

|

|

|

|

99.4

|

Call Option Agreement, dated as of January 3, 2012, by and between Dennis Konczal, as optioner, and G Real Estate Partners, LP, as optionee.

|

|

|

|

SIGNATURES

After reasonable inquiry and to the best of our knowledge and belief, the

undersigned certifies that the information set forth in this statement is true, complete and correct.

DATED: January 13, 2012

|

|

/s/ Michael Glickstein

|

|

|

Michael Glickstein, individually

|

|

|

G ASSET MANAGEMENT, LLC

|

|

|

|

|

|

|

By:

|

/s/ Michael Glickstein

|

|

|

|

Michael Glickstein, its managing member

|

|

CUSIP No. 276650108

|

|

13D

|

|

Page 9 of 10 Pages

|

Schedule A

|

Date of Transaction

|

|

Number of Shares

Purchased/(Sold)

|

|

Price Per Share (including

commissions, if any)

|

|

|

|

|

|

|

|

11/17/2011

|

|

211

|

|

$2.16

|

|

11/17/2011

|

|

200

|

|

$2.30

|

|

11/17/2011

|

|

100

|

|

$2.33

|

|

11/18/2011

|

|

300

|

|

$2.50

|

|

11/23/2011

|

|

89

|

|

$2.45

|

|

1/4/2012

|

|

23,904*

|

|

$2.39

|

|

1/5/2012

|

|

200

|

|

$2.45

|

|

1/9/2012

|

|

100

|

|

$2.55

|

|

* On 1/4/2012 G Real Estate Partners, LP purchased two call options in a private transaction that gives G REAL ESTATE PARTNERS, LP the ability to purchase up to 23,904 shares at an exercise price of $2.39. The options have a term of one (1) year and are exercisable immediately.

|

|

CUSIP No. 276650108

|

|

13D

|

|

Page 10 of 10 Pages

|

Index to Exhibits

|

99.1

|

Joint Filing Agreement, dated as of January 13, 2012, by and between G Asset Management, LLC, and Michael Glickstein.

|

|

|

|

|

99.2

|

Letter to Board of Directors of Eastern Light Capital, Incorporated by G Asset Management , LLC dated January 13, 2012.

|

|

|

|

|

99.3

|

Call Option Agreement, dated as of January 3, 2012, by and between Capital Alliance Advisors, Inc., as optioner, and G Real Estate Partners, LP, as optionee.

|

|

|

|

|

99.4

|

Call Option Agreement, dated as of January 3, 2012, by and between Dennis Konczal, as optioner, and G Real Estate Partners, LP, as optionee.

|

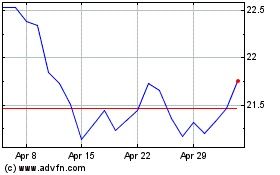

Entergy Louisiana (NYSE:ELC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Entergy Louisiana (NYSE:ELC)

Historical Stock Chart

From Jul 2023 to Jul 2024