false000180373700018037372024-11-062024-11-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): November 6, 2024

Enhabit, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-41406 | 47-2409192 |

| (State or other jurisdiction | (Commission | (IRS Employer |

| of incorporation) | File Number) | Identification No.) |

6688 N. Central Expressway, Suite 1300, Dallas, Texas 75206

(Address of principal executive offices, including zip code)

(214) 239-6500

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

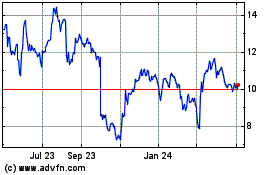

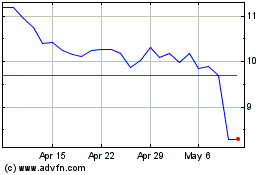

| Common Stock, par value $0.01 per share | EHAB | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.*

On November 6, 2024, Enhabit, Inc. (the “Company”) issued a press release reporting the financial results of the Company for the quarter ended September 30, 2024 (the “Earnings Press Release”). A copy of the Earnings Press Release is attached to this report as Exhibit 99.1 and incorporated herein by reference.

Item 7.01. Regulation FD Disclosure.*

A copy of the supplemental information which will be discussed during the Company’s earnings call at 10:00 a.m. Eastern Time on Thursday, November 7, 2024, is attached to this report as Exhibit 99.2 and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit Number | | Description |

| | |

| | |

| 104 | | Cover Page Interactive Data File - the cover page iXBRL tags are embedded within the Inline XBRL document |

* The information in Item 2.02 and 7.01, including Exhibit 99.1 and Exhibit 99.2, is being “furnished” and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section and shall not be incorporated into any registration statement or other document pursuant to the Securities Act of 1933, as amended, or the Exchange Act, unless specifically identified as being incorporated therein by reference.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| ENHABIT, INC. |

| By: | /s/ Dylan C. Black |

| Name: | Dylan C. Black |

| Title: | General Counsel |

Dated: November 6, 2024

Enhabit Reports Third Quarter 2024 Financial Results

Company to host a conference call tomorrow, November 7, 2024, at 10 a.m. EST

DALLAS, TX – November 6, 2024 – Enhabit, Inc. (NYSE: EHAB), a leading home health and hospice care provider, today reported its results of operations for the third quarter ended September 30, 2024.

“Our continued progress in our strategies during the third quarter resulted in Adjusted EBITDA growth year over year and strong free cash flow generation that led to further debt reduction,” said Enhabit’s President and Chief Executive Officer Barb Jacobsmeyer. “The payor innovation strategy continues to foster Medicare Advantage growth in our home health segment, and average daily census continues to grow in our hospice segment.”

QUARTERLY PERFORMANCE - CONSOLIDATED

•Net service revenue of $253.6 million

•Net loss attributable to Enhabit, Inc. of $110.2 million

•Adjusted EBITDA of $24.5 million

•Loss per share of $2.20

•Adjusted earnings per share of $0.03

RECENT COMPANY HIGHLIGHTS

•Non-Medicare admissions increased 20.1%, driving total admissions growth of 5.6% year over year

◦45% of non-Medicare visits are now in payor innovation contracts at improved rates

•Home health cost per visit increased 1.1% year over year

•30-day hospital readmission rate in home health is 23.3% better than the national average

•Hospice average daily census increased 6.9% year over year

◦Average daily census increased sequentially every month since January

◦Admissions increased 5.7% year over year

•Hospice cost per day flat year over year

•53.2% better than the national average for hospice patient visits in last days of life

•Consolidated Adjusted EBITDA grew to $24.5 million from $23.2 million, a 5.6% improvement year over year primarily due to home office expense reductions and revenue growth in hospice

•Reduced bank debt by $10 million in the quarter

FINANCIAL RESULTS

Consolidated

| | | | | | | | | | | | | | | | | | | | |

| ($ in millions, except per share data) | Q3 | '24 vs. '23 |

| 2024 | 2023 |

| Home health net service revenue | $ | 201.0 | $ | 210.9 | (4.7)% |

| Hospice net service revenue | 52.6 | 47.4 | 11.0% |

| Total net service revenue | $ | 253.6 | $ | 258.3 | (1.8)% |

| | | | | |

| % of revenue | | % of revenue | | |

| Cost of service | 51.9% | $ | 131.7 | 51.9% | $ | 134.0 | (1.7)% |

| Gross margin | 48.1% | 121.9 | 48.1% | 124.3 | (1.9)% |

| General and administrative expenses | 38.1% | 96.7 | 39.1% | 101.0 | (4.3)% |

| Total operating expenses | 90.1% | $ | 228.4 | 91.0% | $ | 235.0 | (2.8)% |

| | | | | |

| | | |

| Other income | — | (0.1) | |

| Net income attributable to noncontrolling interests | 0.7 | 0.2 | |

| | | |

| Adjusted EBITDA | $ | 24.5 | $ | 23.2 | 5.6% |

| Adjusted EBITDA margin | 9.7% | 9.0% | |

| Impairment of goodwill | $ | 107.9 | $ | — | N/A |

| Net loss attributable to Enhabit, Inc. | $ | (110.2) | $ | (2.4) | (4,491.7)% |

| Reported diluted EPS | $ | (2.20) | $ | (0.05) | (4,300.0)% |

Adjusted EPS | $ | 0.03 | $ | 0.03 | —% |

Consolidated Adjusted EBITDA grew 5.6% year over year primarily due to home office expense reductions and revenue growth in hospice.

Consolidated revenue decreased $4.7 million, or 1.8%, year over year primarily due to lower Medicare volume as a result of lower recertifications in the home health segment.

Our payor innovation strategy continues to foster Medicare Advantage growth. 45% of non-Medicare visits are now in payor innovation contracts at improved rates. Non-Medicare revenue per visit increased from $140 in 2023 to $147 in 2024.

SEGMENT RESULTS

Home Health

| | | | | | | | | | | | | | |

| ($ in millions) | | Q3 | '24 vs. '23 |

| | 2024 | 2023 |

| Net service revenue: | | | |

| Medicare | $ | 117.3 | $ | 141.0 | (16.8)% |

| Non-Medicare | 81.5 | 67.4 | 20.9% |

Private duty(1) | 2.2 | 2.5 | (12.0)% |

| Home health net service revenue | 201.0 | 210.9 | (4.7)% |

| Cost of service | 105.9 | 110.0 | (3.7)% |

| Gross margin | 47.3% | 47.8% | |

| General and administrative expenses | 58.2 | 59.0 | (1.4)% |

| Other income | — | (0.1) | (100.0)% |

| Net income attributable to noncontrolling interests | 0.4 | 0.2 | 100.0% |

| Adjusted EBITDA | $ | 36.5 | $ | 41.8 | (12.7)% |

| % Adj. EBITDA margin | 18.2% | 19.8% | |

Operational metrics (actual amounts) | | | |

| Medicare: | | | |

| Admissions | 23,422 | 25,585 | (8.5)% |

| Recertifications | 16,101 | 19,321 | (16.7)% |

| Completed episodes | 38,866 | 44,350 | (12.4)% |

| Visits | 561,525 | 660,380 | (15.0)% |

| Visits per episode | 14.4 | 14.9 | (3.4)% |

| Revenue per episode | $ | 3,018 | $ | 3,179 | (5.1)% |

| Non-Medicare: | | | |

| Admissions | 29,950 | 24,938 | 20.1% |

| Recertifications | 14,112 | 13,411 | 5.2% |

| Visits | 552,815 | 501,764 | 10.2% |

| | | |

| Total: | | | |

| Admissions | 53,372 | 50,523 | 5.6% |

Same-store total admissions growth | | | 5.5% |

| Recertifications | 30,213 | 32,732 | (7.7)% |

Same-store total recertifications growth | | | (7.8)% |

| | | |

| | | |

| Visits | 1,114,340 | 1,162,144 | (4.1)% |

| | | |

| | | |

| Visits per episode | 14.1 | 14.9 | (5.4)% |

| Cost per visit | $ | 94 | $ | 93 | 1.1% |

(1) Private duty represents long-term comprehensive hourly nursing medical care. |

Non-Medicare admissions increased 20.1%, driving total admissions growth of 5.6% year over year. Revenue declined $9.9 million, or 4.7%, year over year primarily due to lower Medicare volume as a result of lower recertifications. Revenue per episode in Q3 2023 included a positive impact from changes in our estimated recoverability of net service revenue, leading to a negative year-over-year comparison in 2024.

Adjusted EBITDA decreased $5.3 million, or 12.7%, year over year primarily due to the decrease in revenue. Cost per visit increased 1.1% year over year primarily due to the decrease in visits and merit and market increases, partially offset by a reduction in contract labor and favorable experience in workers' compensation and group medical claims. Year-to-date cost per visit was flat year over year. Visits per episode decreased 5.4% year over year to 14.1 primarily due to our continued focus on establishing a just right plan of care for patients, ongoing clinician education, team collaboration, and the thoughtful integration of predictive analytics.

Hospice

| | | | | | | | | | | | | | |

| ($ in millions) | | Q3 | '24 vs. '23 |

| | 2024 | 2023 |

| Net service revenue | $ | 52.6 | $ | 47.4 | 11.0% |

| Cost of service | 25.8 | 24.0 | 7.5% |

| Gross margin | 51.0% | 49.4% | |

| General and administrative expenses | 16.5 | 15.7 | 5.1% |

| Net income attributable to noncontrolling interests | 0.3 | — | N/A |

| Adjusted EBITDA | $ | 10.0 | $ | 7.7 | 29.9% |

| % Adj. EBITDA margin | 19.0% | 16.2% | |

Operational metrics (actual amounts) | | | |

| Total admissions | 3,046 | 2,882 | 5.7% |

| Same-store total admissions growth | | | 4.1% |

| Patient days | 333,247 | 311,719 | 6.9% |

| Discharged average length of stay | 100 | 107 | (6.5)% |

| Average daily census | 3,622 | 3,388 | 6.9% |

| Revenue per patient day | $ | 158 | $ | 152 | 3.9% |

| Cost per patient day | $ | 77 | $ | 77 | —% |

Revenue increased $5.2 million, or 11.0%, year over year due to a 6.9% increase in patient days and increased Medicare reimbursement rates. Admissions increased 5.7% year over year. Revenue per day increased 3.9% year over year primarily due to increased Medicare reimbursement rates. In the third quarter, the Company accrued $1.4 million in Medicare Cap billing limitations compared to $20 thousand in the third quarter of 2023.

Average daily census increased 6.9% year over year. Average daily census increased sequentially every month since January 2024.

Adjusted EBITDA increased $2.3 million, or 29.9%, year over year primarily due to increased revenue. Cost per day was flat year over year.

GUIDANCE

Based on the impact of lower recertifications in the third quarter and the impact from hurricanes in September and October, the Company revised its guidance ranges for full-year 2024.The Company updated its full-year 2024 guidance as follows:

| | | | | | | | | |

($ in millions, except per share data) | | 2024 Previous Guidance | 2024 Updated Guidance |

|

Net service revenue | | $1,050 to $1,063 | $1,031 to $1,046 |

Adjusted EBITDA | | $100 to $106 | $98 to $102 |

Adjusted EPS | | $0.19 to $0.37 | $0.19 to $0.29 |

For additional considerations regarding the Company’s 2024 guidance ranges, see the supplemental information posted on the Company’s website at http://investors.ehab.com.

CONFERENCE CALL INFORMATION

The Company will host an investor conference call at 10 a.m. EST on November 7, 2024 to discuss its results for the third quarter of 2024. To access the live call by phone, dial toll-free (888) 660-6150 or

international (929) 203-0843; the conference ID is 5248158. A simultaneous webcast of the call, along with supplemental information, may be accessed by visiting https://events.q4inc.com/attendee/164004764. Following the call, a replay will be available on the Company’s website at http://investors.ehab.com.

ABOUT ENHABIT HOME HEALTH & HOSPICE

Enhabit Home Health & Hospice (Enhabit, Inc.) is a leading national home health and hospice provider working to expand what's possible for patient care in the home. Enhabit’s team of clinicians supports patients and their families where they are most comfortable, with a nationwide footprint spanning 256 home health locations and 112 hospice locations across 34 states. Enhabit leverages advanced technology and compassionate teams to deliver extraordinary patient care. For more information, visit ehab.com.

OTHER INFORMATION

Note regarding presentation and reconciliation of non-GAAP financial measures

The financial data contained in this press release and supplemental information includes non-GAAP (generally accepted accounting principles (GAAP)) financial measures as defined in Regulation G under the Securities Exchange Act of 1934, including Adjusted EBITDA, Adjusted EBITDA margin, Adjusted EPS, and Adjusted free cash flow. See “Supplemental Non-GAAP Information” for reconciliations of the non-GAAP financial measures to the most directly comparable financial measures calculated and presented in accordance with GAAP. Additionally, our Form 10-Q for the three and nine months ended September 30, 2024, provides further information regarding “unusual or nonrecurring items that are not typical of ongoing operations,” a reconciliation item in our Adjusted EBITDA calculation. Such non-GAAP financial measures exclude significant components in understanding and assessing financial performance and should therefore not be considered superior to, as a substitute for or alternative to the GAAP financial measures presented in this press release. The non-GAAP financial measures in the press release may differ from similar measures used by other companies.

The Company is unable to reconcile the guidance for Adjusted EBITDA and Adjusted EPS to their corresponding GAAP measures without unreasonable effort due to the inherent difficulty in predicting, with reasonable certainty, the future impact of items that are outside the control of the Company or otherwise non-indicative of its ongoing operating performance. Accordingly, the Company relies on the exception provided by Item 10(e)(1)(i)(B) of Regulation S-K. Such items include, but are not limited to, gains or losses related to hedging instruments; loss on early extinguishment of debt; adjustments to its income tax provision (such as valuation allowance adjustments and settlements of income tax claims); and items related to corporate and facility restructurings. For the same reasons, the Company is unable to address the probable significance of the unavailable information.

Note regarding presentation of same-store comparisons

The Company uses “same-store” comparisons to explain the changes in certain performance metrics and line items within its financial statements. Same-store comparisons are calculated based on home health and hospice locations open throughout both the full current period and the immediately prior period presented. These comparisons include the financial results of market consolidation transactions in existing markets, as it is difficult to determine, with precision, the incremental impact of these transactions on the Company’s results of operations.

Enhabit, Inc. and Subsidiaries

Condensed Consolidated Statements of Income

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| ($ in millions, except per share data) |

| Net service revenue | $ | 253.6 | | | $ | 258.3 | | | $ | 776.6 | | | $ | 785.7 | |

| Cost of service, excluding depreciation and amortization | 131.7 | | | 134.0 | | | 397.7 | | | 402.1 | |

| | | | | | | |

| General and administrative expenses | 103.8 | | | 108.8 | | | 321.3 | | | 327.1 | |

| Depreciation and amortization | 8.2 | | | 7.7 | | | 23.6 | | | 23.2 | |

| Impairment of goodwill | 107.9 | | | — | | | 107.9 | | | 85.8 | |

| Operating (loss) income | (98.0) | | | 7.8 | | | (73.9) | | | (52.5) | |

| Interest expense and amortization of debt discounts and fees | 10.8 | | | 10.9 | | | 32.8 | | | 30.7 | |

| | | | | | | |

| Other income | — | | | (0.1) | | | — | | | (0.2) | |

| Loss before income taxes and noncontrolling interests | (108.8) | | | (3.0) | | | (106.7) | | | (83.0) | |

| Income tax (benefit) expense | 0.7 | | | (0.8) | | | 1.5 | | | (9.9) | |

| Net loss | (109.5) | | | (2.2) | | | (108.2) | | | (73.1) | |

| Less: Net income attributable to noncontrolling interests | 0.7 | | | 0.2 | | | 2.0 | | | 1.0 | |

| Net loss attributable to Enhabit, Inc. | $ | (110.2) | | | $ | (2.4) | | | $ | (110.2) | | | $ | (74.1) | |

| | | | | | | |

| Weighted average common shares outstanding: | | | | | | | |

| Basic | 50.2 | | | 49.9 | | | 50.2 | | | 49.8 | |

| Diluted | 50.2 | | | 49.9 | | | 50.2 | | | 49.8 | |

| | | | | | | |

| Loss per common share: | | | | | | | |

| Basic loss per share attributable to Enhabit, Inc. common stockholders | $ | (2.20) | | | $ | (0.05) | | | $ | (2.20) | | | $ | (1.48) | |

| Diluted loss per share attributable to Enhabit, Inc. common stockholders | $ | (2.20) | | | $ | (0.05) | | | $ | (2.20) | | | $ | (1.48) | |

Enhabit, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

(Unaudited)

| | | | | | | | | | | |

| September 30,

2024 | | December 31,

2023 |

| ($ in millions) |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 45.7 | | | $ | 27.4 | |

| Restricted cash | 1.7 | | | 2.4 | |

| Accounts receivable, net of allowances | 150.9 | | | 164.7 | |

| | | |

| | | |

| | | |

| | | |

| Prepaid expenses and other current assets | 9.9 | | | 15.6 | |

| Total current assets | 208.2 | | | 210.1 | |

| Property and equipment, net | 19.4 | | | 19.0 | |

| Operating lease right-of-use assets | 54.3 | | | 57.5 | |

| Goodwill | 953.8 | | | 1,061.7 | |

| Intangible assets, net | 63.9 | | | 80.0 | |

| Other long-term assets | 4.7 | | | 5.3 | |

| Total assets | $ | 1,304.3 | | | $ | 1,433.6 | |

| Liabilities and stockholders’ equity | | | |

| Current liabilities: | | | |

| Current portion of long-term debt | $ | 23.0 | | | $ | 22.5 | |

| Current operating lease liabilities | 11.7 | | | 11.8 | |

| Accounts payable | 9.9 | | | 7.6 | |

| Accrued payroll | 47.1 | | | 38.5 | |

| Refunds due patients and other third-party payors | 4.1 | | | 8.2 | |

| | | |

| | | |

| Accrued medical insurance | 8.5 | | | 8.4 | |

| | | |

| | | |

| Other current liabilities | 38.6 | | | 40.7 | |

| Total current liabilities | 142.9 | | | 137.7 | |

| Long-term debt, net of current portion | 502.9 | | | 530.1 | |

| Long-term operating lease liabilities, net of current portion | 43.4 | | | 45.7 | |

| Deferred income tax liabilities | 17.1 | | | 17.1 | |

| Other long-term liabilities | 0.1 | | | 1.3 | |

| Total liabilities | 706.4 | | | 731.9 | |

| | | |

| Redeemable noncontrolling interests | 5.0 | | | 5.0 | |

| Stockholders’ equity: | | | |

| Total Enhabit, Inc. stockholders’ equity | 566.1 | | | 669.7 | |

| Noncontrolling interests | 26.8 | | | 27.0 | |

| Total stockholders’ equity | 592.9 | | | 696.7 | |

| Total liabilities and stockholders’ equity | $ | 1,304.3 | | | $ | 1,433.6 | |

Enhabit, Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows

(Unaudited)

| | | | | | | | | | | | |

| Nine Months Ended September 30, | |

| 2024 | | 2023 | |

| ($ in millions) | |

| Cash flows from operating activities: | | | | |

| Net loss | $ | (108.2) | | | $ | (73.1) | | |

| Adjustments to reconcile net loss to net cash provided by operating activities— | | | | |

| Depreciation and amortization | 23.6 | | | 23.2 | | |

| Amortization of debt related costs | 1.1 | | | 1.0 | | |

| | | | |

| | | | |

| Impairment of goodwill | 107.9 | | | 85.8 | | |

| Stock-based compensation | 7.8 | | | 7.2 | | |

Deferred income taxes | 0.1 | | | (13.1) | | |

Other | (0.7) | | | 0.7 | | |

| Changes in assets and liabilities, net of acquisitions— | | | | |

| Accounts receivable, net of allowances | 13.8 | | | (17.8) | | |

| Prepaid expenses and other assets | 5.9 | | | 19.9 | | |

| Accounts payable | 2.3 | | | 2.2 | | |

| Accrued payroll | 8.6 | | | 13.1 | | |

| Other liabilities | (6.9) | | | (3.6) | | |

| Net cash provided by operating activities | 55.3 | | | 45.5 | | |

| Cash flows from investing activities: | | | | |

| Acquisition of businesses, net of cash acquired | — | | | (2.8) | | |

| Purchases of property and equipment, including capitalized software costs | (3.2) | | | (3.6) | | |

| | | | |

| Other | 1.1 | | | 0.6 | | |

| Net cash used in investing activities | (2.1) | | | (5.8) | | |

| Cash flows from financing activities: | | | | |

| Principal payments on term loan facility | (15.0) | | | (15.0) | | |

| | | | |

| | | | |

| Principal payments on revolving credit facility | (15.0) | | | (10.0) | | |

| | | | |

| Principal payments under finance lease obligations | — | | | — | | |

| Debt issuance costs | — | | | (1.1) | | |

| Distributions paid to noncontrolling interests of consolidated affiliates | (2.2) | | | (2.5) | | |

| | | | |

| | | | |

| | | | |

| Other | (3.4) | | | (3.1) | | |

| Net cash used in financing activities | (35.6) | | | (31.7) | | |

| Increase in cash, cash equivalents, and restricted cash | 17.6 | | | 8.0 | | |

| Cash, cash equivalents, and restricted cash at beginning of period | 29.8 | | | 27.2 | | |

| Cash, cash equivalents, and restricted cash at end of period | $ | 47.4 | | | $ | 35.2 | | |

| | | | |

| | | | |

| | | | |

| | | | |

Enhabit, Inc. and Subsidiaries

Supplemental Non-GAAP Information

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Diluted Earnings Per Share to Adjusted Earnings Per Share |

| | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended

September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Diluted earnings per share, as reported | $ | (2.20) | | | $ | (0.05) | | | $ | (2.20) | | | $ | (1.48) | |

| Adjustments, net of tax: | | | | | | | |

| Impairment of goodwill | 1.93 | | | — | | | 1.93 | | | 1.50 | |

Unusual or nonrecurring items that are not typical of ongoing operations(1) | 0.05 | | | 0.07 | | | 0.18 | | | 0.14 | |

Income tax adjustments(2) | 0.24 | | | — | | | 0.25 | | | 0.01 | |

| Adjusted earnings per share | $ | 0.03 | | | $ | 0.03 | | | $ | 0.17 | | | $ | 0.16 | |

(1) Unusual or nonrecurring items in the three months ended September 30, 2024 include costs associated with shareholder activism and restructuring activities and severance; the nine months ended September 30, 2024 include costs associated with shareholder activism, the strategic review process and nonroutine litigation; in the three months ended September 30, 2023, they include nonroutine litigation, and the strategic review process; the nine months ended September 30, 2023 also include shareholder activism.

(2) Income tax adjustments include the effect of permanent book-tax differences attributable to stock-based compensation and the effect of a valuation allowance recorded against a portion of our deferred tax assets.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Adjusted EBITDA to Adjusted Earnings Per Share | | | | |

| | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | | | |

| | 2024 | | | | |

| | | | Adjustments | | | | | | |

| | As Reported | | Impairment of Goodwill | | Unusual or Nonrecurring Items That are Not Typical of Ongoing Operations | | Income tax Adjustments(3) | | As Adjusted | | | | |

| | ($ in millions, except per share data) | | | | |

Adjusted EBITDA(1) | | $ | 24.5 | | | $ | — | | | $ | — | | | $ | — | | | $ | 24.5 | | | | | |

| Interest expense and amortization of debt discounts and fees | | (10.8) | | | — | | | — | | | — | | | (10.8) | | | | | |

| Depreciation and amortization | | (8.2) | | | — | | | — | | | — | | | (8.2) | | | | | |

| Gain on disposal of assets | | 0.3 | | | — | | | — | | | — | | | 0.3 | | | | | |

| Impairment of goodwill | | (107.9) | | | 107.9 | | | — | | | — | | | — | | | | | |

| Stock-based compensation | | (3.8) | | | — | | | — | | | — | | | (3.8) | | | | | |

Unusual or nonrecurring items that are not typical of ongoing operations(2) | | (3.6) | | | — | | | 3.6 | | | — | | | — | | | | | |

| | | | | | | | | | | | | | |

| (Loss) income before income taxes | | (109.5) | | | 107.9 | | | 3.6 | | | — | | | 2.0 | | | | | |

| Income tax benefit (expense) | | (0.7) | | | (11.0) | | | (1.0) | | | 12.2 | | | (0.5) | | | | | |

| Net (loss) income attributable to Enhabit, Inc. | | $ | (110.2) | | | $ | 96.9 | | | $ | 2.6 | | | $ | 12.2 | | | $ | 1.5 | | | | | |

Diluted EPS | | $ | (2.20) | | | $ | 1.93 | | | $ | 0.05 | | | $ | 0.24 | | | $ | 0.03 | | | | | |

| Diluted shares | | 50.2 | | | | | | | | | 50.8 | | | | | |

(1) Reconciliation to GAAP provided below.

(2) Unusual or nonrecurring items in Q3 2024 include costs associated with shareholder activism and restructuring activities and severance.

(3) Income tax adjustments include the effect of permanent book-tax differences attributable to stock-based compensation and the effect of a valuation allowance recorded against a portion of our deferred tax assets.

(4) Adjusted diluted EPS may not sum due to rounding.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Adjusted EBITDA to Adjusted Earnings Per Share | | |

| | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | |

| | 2023 | | |

| | | Adjustments | | | | |

| | As Reported | | Impairment of Goodwill | | Unusual or Nonrecurring Items That are Not Typical of Ongoing Operations | | Income Tax Adjustments(3) | | | | | | As Adjusted | | |

| | ($ in millions, except per share data) | | |

Adjusted EBITDA(1) | | $ | 23.2 | | | $ | — | | | $ | — | | | $ | — | | | | | | | $ | 23.2 | | | |

| Interest expense and amortization of debt discounts and fees | | (10.9) | | | — | | | — | | | — | | | | | | | (10.9) | | | |

| Depreciation and amortization | | (7.7) | | | — | | | — | | | — | | | | | | | (7.7) | | | |

| Gain on disposal of assets | | 0.2 | | | — | | | — | | | — | | | | | | | 0.2 | | | |

| | | | | | | | | | | | | | | | |

| Stock-based compensation | | (3.1) | | | — | | | — | | | — | | | | | | | (3.1) | | | |

Unusual or nonrecurring items that are not typical of ongoing operations(2) | | (4.9) | | | — | | | 4.9 | | | — | | | | | | | — | | | |

| (Loss) income before income taxes | | (3.2) | | | — | | | 4.9 | | | — | | | | | | | 1.7 | | | |

| Income tax benefit (expense) | | 0.8 | | | — | | | (1.3) | | | 0.1 | | | | | | | (0.4) | | | |

| Net (loss) income attributable to Enhabit, Inc. | | $ | (2.4) | | | $ | — | | | $ | 3.6 | | | $ | 0.1 | | | | | | | $ | 1.3 | | | |

Diluted EPS | | $ | (0.05) | | | $ | — | | | $ | 0.07 | | | $ | — | | | | | | | $ | 0.03 | | | |

| Diluted shares | | 50.1 | | | | | | | | | | | | | 50.1 | | | |

(1) Reconciliation to GAAP provided below.

(2) Unusual or nonrecurring items in 2023 include costs associated with nonroutine litigation, and the strategic review process.

(3) Income tax adjustments include the effect of permanent book-tax differences attributable to stock-based compensation.

(4) Adjusted diluted EPS may not sum due to rounding.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Adjusted EBITDA to Adjusted Earnings Per Share |

| | | | | | | | | | | | |

| | Nine Months Ended September 30, | | |

| | 2024 | | |

| | | | Adjustments | | | | |

| | As Reported | | Impairment of Goodwill | | Unusual or Nonrecurring Items That are Not Typical of Ongoing Operations | | Income Tax Adjustments(3) | | As Adjusted | | |

| | ($ in millions, except per share data) | | |

Adjusted EBITDA(1) | | $ | 75.0 | | | $ | — | | | $ | — | | | $ | — | | | $ | 75.0 | | | |

| Interest expense and amortization of debt discounts and fees | | (32.8) | | | — | | | — | | | — | | | (32.8) | | | |

| Depreciation and amortization | | (23.6) | | | — | | | — | | | — | | | (23.6) | | | |

| Gain on disposal of assets | | 0.5 | | | — | | | — | | | — | | | 0.5 | | | |

| Impairment of goodwill | | (107.9) | | | 107.9 | | | — | | | — | | | — | | | |

| Stock-based compensation | | (7.8) | | | — | | | — | | | — | | | (7.8) | | | |

Unusual or nonrecurring items that are not typical of ongoing operations(2) | | (12.1) | | | — | | | 12.1 | | | — | | | — | | | |

| | | | | | | | | | | | |

| Income before income taxes | | (108.7) | | | 107.9 | | | 12.1 | | | — | | | 11.3 | | | |

| Income tax expense | | (1.5) | | | (11.0) | | | (3.2) | | | 12.8 | | | (2.9) | | | |

| Net income attributable to Enhabit, Inc. | | $ | (110.2) | | | $ | 96.9 | | | $ | 8.9 | | | $ | 12.8 | | | $ | 8.4 | | | |

Diluted EPS | | $ | (2.20) | | | $ | 1.93 | | | $ | 0.18 | | | $ | 0.25 | | | $ | 0.17 | | | |

| Diluted shares | | 50.2 | | | | | | | | | 50.4 | | | |

(1) Reconciliation to GAAP provided below.

(2) Unusual or nonrecurring items in 2024 include costs associated with shareholder activism, the strategic review process, and nonroutine litigation.

(3) Income tax adjustments include the effect of permanent book-tax differences attributable to stock-based compensation and the effect of a valuation allowance recorded against a portion of our deferred tax assets.

(4) Adjusted diluted EPS may not sum due to rounding.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Adjusted EBITDA to Adjusted Earnings Per Share | | | | |

| | | | | | | | | | | | | | | |

| | | Nine Months Ended September 30, | | | | |

| | | 2023 | | | | |

| | | | Adjustments | | | | | |

| | | As Reported | | Impairment of Goodwill | | Unusual or Nonrecurring Items That are Not Typical of Ongoing Operations | | Income Tax Adjustments(3) | | As Adjusted | | | | |

| | | ($ in millions, except per share data) | | | | |

Adjusted EBITDA(1) | | | $ | 72.5 | | | $ | — | | | $ | — | | | $ | — | | | $ | 72.5 | | | | | |

| Interest expense and amortization of debt discounts and fees | | | (30.7) | | | — | | | — | | | — | | | (30.7) | | | | | |

| Depreciation and amortization | | | (23.2) | | | — | | | — | | | — | | | (23.2) | | | | | |

| Gain on disposal of assets | | | 0.2 | | | — | | | — | | | — | | | 0.2 | | | | | |

| Impairment of goodwill | | | (85.8) | | | 85.8 | | | — | | | — | | | — | | | | | |

| Stock-based compensation | | | (7.2) | | | — | | | — | | | — | | | (7.2) | | | | | |

Unusual or nonrecurring items that are not typical of ongoing operations(2) | | | (9.8) | | | — | | | 9.8 | | | — | | | — | | | | | |

| | | | | | | | | | | | | | | |

| (Loss) income before income taxes | | | (84.0) | | | 85.8 | | | 9.8 | | | — | | | 11.6 | | | | | |

| Income tax benefit (expense) | | | 9.9 | | | (11.1) | | | (2.9) | | | 0.6 | | | (3.5) | | | | | |

| Net (loss) income attributable to Enhabit, Inc. | | | $ | (74.1) | | | $ | 74.7 | | | $ | 6.9 | | | $ | 0.6 | | | $ | 8.1 | | | | | |

Diluted EPS | | | $ | (1.48) | | | $ | 1.50 | | | $ | 0.14 | | | $ | 0.01 | | | $ | 0.16 | | | | | |

| Diluted shares | | | 49.9 | | | | | | | | | 49.9 | | | | | |

(1) Reconciliation to GAAP provided below.

(2) Unusual or nonrecurring items in 2023 include costs associated with nonroutine litigation, shareholder activism, and the strategic review process.

(3) Income tax adjustments include the effect of permanent book-tax differences attributable to stock-based compensation.

(4) Adjusted diluted EPS may not sum due to rounding.

| | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Net Loss to Adjusted EBITDA |

| | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | ($ in millions) |

| Net loss | | $ | (109.5) | | | $ | (2.2) | | | $ | (108.2) | | | $ | (73.1) | |

| Interest expense and amortization of debt discounts and fees | | 10.8 | | | 10.9 | | | 32.8 | | | 30.7 | |

| Income tax (benefit) expense | | 0.7 | | | (0.8) | | | 1.5 | | | (9.9) | |

| Depreciation and amortization | | 8.2 | | | 7.7 | | | 23.6 | | | 23.2 | |

| Gains on disposal of assets | | (0.3) | | | (0.2) | | | (0.5) | | | (0.2) | |

| Impairment of goodwill | | 107.9 | | | — | | | 107.9 | | | 85.8 | |

| Stock-based compensation | | 3.8 | | | 3.1 | | | 7.8 | | | 7.2 | |

| Net income attributable to noncontrolling interests | | (0.7) | | | (0.2) | | | (2.0) | | | (1.0) | |

Unusual or nonrecurring items that are not typical of ongoing operations(1) | | 3.6 | | | 4.9 | | | 12.1 | | | 9.8 | |

| Adjusted EBITDA | | $ | 24.5 | | | $ | 23.2 | | | $ | 75.0 | | | $ | 72.5 | |

(1) Unusual or nonrecurring items in the three months ended September 30, 2024 include costs associated with shareholder activism and restructuring activities and severance; the nine months ended September 30, 2024 include costs associated with shareholder activism, the strategic review process and nonroutine litigation; in the three months ended September 30, 2023, they include nonroutine litigation, and the strategic review process; the nine months ended September 30, 2023 also include shareholder activism.

| | | | | | | | | | | | | | | | | | | | | | | | |

Reconciliation of Net Cash Provided by Operating Activities to Adjusted EBITDA |

| | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | ($ in millions) |

| Net cash provided by operating activities | | $ | 28.4 | | | $ | 6.3 | | | $ | 55.3 | | | $ | 45.5 | |

| Interest expense, excluding amortization of debt discounts and fees | | 10.4 | | | 10.7 | | | 31.7 | | | 30.3 | |

| Current portion of income tax expense | | (0.5) | | | 1.3 | | | 1.4 | | | 3.2 | |

| Change in assets and liabilities, excluding derivative instrument | | (16.7) | | | — | | | (23.6) | | | (15.0) | |

| Net income attributable to noncontrolling interests | | (0.7) | | | (0.2) | | | (2.0) | | | (1.0) | |

Unusual or nonrecurring items that are not typical of ongoing operations(1) | | 3.6 | | | 4.9 | | | 12.1 | | | 9.8 | |

| Other | | — | | | 0.2 | | | 0.1 | | | (0.3) | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Adjusted EBITDA | | $ | 24.5 | | | $ | 23.2 | | | $ | 75.0 | | | $ | 72.5 | |

(1) Unusual or nonrecurring items in the three months ended September 30, 2024 include costs associated with shareholder activism and restructuring activities and severance; the nine months ended September 30, 2024 include costs associated with shareholder activism, the strategic review process and nonroutine litigation; in the three months ended September 30, 2023, they include nonroutine litigation, and the strategic review process; the nine months ended September 30, 2023 also include shareholder activism.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Net Cash Provided by Operating Activities to Adjusted Free Cash Flow | | |

| | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, | | |

| | 2024 | | 2023 | | 2024 | | 2023 | | |

| | ($ in millions) | | |

| Net cash provided by operating activities | | $ | 28.4 | | | $ | 6.3 | | | $ | 55.3 | | | $ | 45.5 | | | |

Unusual or nonrecurring items that are not typical of ongoing operations(1) | | 3.6 | | | 4.9 | | | 12.1 | | | 9.8 | | | |

| Capital expenditures for maintenance | | (0.7) | | | (1.9) | | | (3.2) | | | (3.6) | | | |

| Other working capital adjustments | | (1.0) | | | (0.7) | | | (2.7) | | | (1.7) | | | |

| Distributions paid to noncontrolling interests of consolidated affiliates | | — | | | — | | | (2.2) | | | (2.5) | | | |

| | | | | | | | | | |

| Adjusted free cash flow | | $ | 30.3 | | | $ | 8.6 | | | $ | 59.3 | | | $ | 47.5 | | | |

(1) Unusual or nonrecurring items in the three months ended September 30, 2024 include costs associated with shareholder activism and restructuring activities and severance; the nine months ended September 30, 2024 include costs associated with shareholder activism, the strategic review process and nonroutine litigation; in the three months ended September 30, 2023, they include nonroutine litigation, and the strategic review process; the nine months ended September 30, 2023 also include shareholder activism.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Gross Margin to Adjusted EBITDA Margin | | |

| | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, | | |

| | 2024 | | 2023 | | 2024 | | 2023 | | |

| | | | |

| Gross margin as a percentage of revenue | | 48.1 | % | | 48.1 | % | | 48.8 | % | | 48.8 | % | | |

| General and administrative expenses | | (40.9) | % | | (42.1) | % | | (41.4) | % | | (41.6) | % | | |

| Stock-based compensation | | 1.5 | % | | 1.2 | % | | 1.0 | % | | 0.9 | % | | |

| Noncontrolling interests | | (0.3) | % | | (0.1) | % | | (0.3) | % | | (0.1) | % | | |

Unusual or nonrecurring items that are not typical of ongoing operations(1) | | 1.4 | % | | 1.9 | % | | 1.6 | % | | 1.2 | % | | |

| | | | | | | | | | |

| Adjusted EBITDA margin | | 9.7 | % | | 9.0 | % | | 9.6 | % | | 9.2 | % | | |

(1) Unusual or nonrecurring items in the three months ended September 30, 2024 include costs associated with shareholder activism and restructuring activities and severance; the nine months ended September 30, 2024 include costs associated with shareholder activism, the strategic review process and nonroutine litigation; in the three months ended September 30, 2023, they include nonroutine litigation, and the strategic review process; the nine months ended September 30, 2023 also include shareholder activism.

FORWARD-LOOKING STATEMENTS

This press release contains historical information, as well as forward-looking statements (within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) that involve known and unknown risks and relate to, among other things, future events, projections, financial guidance, legislative or regulatory developments, strategy or growth opportunities, our future financial performance, our projected business results, or our projected capital expenditures. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. In some cases, the reader can identify forward-looking statements by terminology such as “may,” “will,” “should,” “could,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “targets,” “potential,” or “continue” or the negative of these terms or other comparable terminology. Any forward-looking statement speaks only as of the date of this release, and the Company undertakes no duty to publicly update or revise such forward-looking information, whether as a result of new information, future events, or otherwise. Such forward-looking statements are necessarily estimates based upon current information and involve a number of risks and uncertainties, many of which are beyond our control. Actual events or results may differ materially from the results anticipated in these forward-looking statements as a result of a variety of factors. While it is impossible to identify all such factors, factors which could cause actual events or results to differ materially from those estimated by the Company include, but are not limited to, our ability to execute on our strategic plans; regulatory and other developments impacting the markets for our services; changes in reimbursement rates; general economic conditions; changes in the episodic versus non-episodic mix of our payors, the case mix of our patients, and payment methodologies; our ability to attract and retain key management personnel and healthcare professionals; potential disruptions or breaches of our or our vendors’, payors’, and other contract counterparties’ information systems; the outcome of litigation; our ability to successfully complete and integrate de novo locations, acquisitions, investments, and joint ventures; the impact of Hurricanes Helene and Milton on our operations; and our ability to control costs, particularly labor and employee benefit costs. Our Annual Report on Form 10-K for the year ended December 31, 2023 dated March 15, 2024, which can be found on the Company’s website at http://investors.ehab.com, discusses these and other risks and factors that could cause actual results to differ materially from those expressed or implied by any forward-looking statement in this press release.

Investor relations contact

Jobie Williams

investorrelations@ehab.com

469-860-6061

Media contact

Erin Volbeda

media@ehab.com

972-338-5141

�������� � ���� � � ���� ������������������������� �!��"���#$�%&%'

�������� ��� �� ����� ������ � ���� ���������������������� !�!"#"�! $%&'�()*+,-+./�0+-'-1,*,&21�321,*&1'�%&',2+&3*.�&142+5*,&216�*'�7-.�*'�42+7*+89.22:&1;�',*,-5-1,'�<7&,%&1�,%-�5-*1&1;�24�=-3,&21�>?@�24�,%-�=-3)+&,&-'�@3,�24�ABCC6�*'�*5-18-86�*18�=-3,&21�>AD�24�,%-�=-3)+&,&-'�DE3%*1;-�@3,�24�ABCF6�*'�*5-18-8�<,%-�GDE3%*1;-�@3,HI�,%*,�&1J2.J-�:1271�*18�)1:1271�+&':'�*18�+-.*,-�,26�*521;�2,%-+�,%&1;'6�4),)+-�-J-1,'6�0+2K-3,&21'6�4&1*13&*.�;)&8*13-6�.-;&'.*,&J-�2+�+-;).*,2+/�8-J-.205-1,'6�',+*,-;/�2+�;+27,%�2002+,)1&,&-'6�2)+�4),)+-�4&1*13&*.�0-+42+5*13-6�2)+�0+2K-3,-8�L)'&1-''�+-').,'6�2+�2)+�0+2K-3,-8�3*0&,*.�-E0-18&,)+-'M�@.�',*,-5-1,'�2,%-+�,%*1�',*,-5-1,'�24�%&',2+&3*.�4*3,�*+-6�2+�5*/�L-�8--5-8�,2�L-6�42+7*+89.22:&1;�',*,-5-1,'M�N1�'25-�3*'-'6�,%-�+-*8-+�3*1�&8-1,&4/�42+7*+89.22:&1;�',*,-5-1,'�L/�,-+5&12.2;/�')3%�*'�G5*/6H�G7&.6H�G'%2).86H�G32).86H�G-E0-3,'6H�G0.*1'6H�G*1,&3&0*,-'6H�GL-.&-J-'6H�G-',&5*,-'6H�G0+-8&3,'6H�G,*+;-,'6H�G02,-1,&*.6H�2+�G321,&1)-H�2+�,%-�1-;*,&J-�24�,%-'-�,-+5'�2+�2,%-+�3250*+*L.-�,-+5&12.2;/M�@1/�42+7*+89.22:&1;�',*,-5-1,�'0-*:'�21./�*'�24�,%-�8*,-�24�,%&'�0+-'-1,*,&216�*18�,%-�O250*1/�)18-+,*:-'�12�8),/�,2�0)L.&3./�)08*,-�2+�+-J&'-�')3%�42+7*+89.22:&1;�&142+5*,&216�7%-,%-+�*'�*�+-').,�24�1-7�&142+5*,&216�4),)+-�-J-1,'6�2+�2,%-+7&'-M�=)3%�42+7*+89.22:&1;�',*,-5-1,'�*+-�1-3-''*+&./�-',&5*,-'�L*'-8�)021�3)+-1,�&142+5*,&21�*18�&1J2.J-�*�1)5L-+�24�+&':'�*18�)13-+,*&1,&-'6�5*1/�24�7%&3%�*+-�L-/218�2)+�321,+2.M�@3,)*.�-J-1,'�2+�+-').,'�5*/�8&4-+�5*,-+&*./�4+25�,%-�+-').,'�*1,&3&0*,-8�&1�,%-'-�42+7*+89.22:&1;�',*,-5-1,'�*'�*�+-').,�24�*�J*+&-,/�24�4*3,2+'M�P%&.-�&,�&'�&502''&L.-�,2�&8-1,&4/�*.�')3%�4*3,2+'6�4*3,2+'�7%&3%�32).8�3*)'-�*3,)*.�-J-1,'�2+�+-').,'�,2�8&4-+�5*,-+&*./�4+25�,%2'-�-',&5*,-8�L/�,%-�O250*1/�&13.)8-6�L),�*+-�12,�.&5&,-8�,26�2)+�*L&.&,/�,2�-E-3),-�21�2)+�',+*,-;&3�0.*1'Q�+-;).*,2+/�*18�2,%-+�8-J-.205-1,'�&50*3,&1;�,%-�5*+:-,'�42+�2)+�'-+J&3-'Q�3%*1;-'�&1�+-&5L)+'-5-1,�+*,-'Q�;-1-+*.�-32125&3�3218&,&21'Q�3%*1;-'�&1�,%-�-0&'28&3�J-+')'�1219-0&'28&3�5&E�24�2)+�0*/2+'6�,%-�3*'-�5&E�24�2)+�0*,&-1,'6�*18�0*/5-1,�5-,%282.2;&-'Q�2)+�*L&.&,/�,2�*,+*3,�*18�+-,*&1�:-/�5*1*;-5-1,�0-+'211-.�*18�%-*.,%3*+-�0+24-''&21*.'Q�02,-1,&*.�8&'+)0,&21'�2+�L+-*3%-'�24�2)+�2+�2)+�J-182+'R6�0*/2+'R6�*18�2,%-+�321,+*3,�32)1,-+0*+,&-'R�&142+5*,&21�'/',-5'Q�,%-�2),325-�24�.&,&;*,&21Q�2)+�*L&.&,/�,2�')33-''4)./�3250.-,-�*18�&1,-;+*,-�8-�12J2�.23*,&21'6�*3()&'&,&21'6�&1J-',5-1,'6�*18�K2&1,�J-1,)+-'Q�,%-�&50*3,�24�S)+&3*1-'�S-.-1-�*18�T&.,21�21�2)+�20-+*,&21'Q�*18�2)+�*L&.&,/�,2�321,+2.�32','6�0*+,&3).*+./�.*L2+�*18�-50.2/--�L-1-4&,�32','M�U)+�@11)*.�V-02+,�21�W2+5�AX9Y�42+�,%-�/-*+�-18-8�Z-3-5L-+�CA6�>X>C�8*,-8�T*+3%�A[6�>X>F6�7%&3%�3*1�L-�42)18�21�,%-�O250*1/R'�7-L'&,-�*,�%,0]&1J-',2+'M-%*LM3256�8&'3)''-'�,%-'-�*18�2,%-+�+&':'�*18�4*3,2+'�,%*,�32).8�3*)'-�*3,)*.�+-').,'�,2�8&4-+�5*,-+&*./�4+25�,%2'-�-E0+-''-8�2+�&50.&-8�L/�*1/�42+7*+89.22:&1;�',*,-5-1,�&1�,%&'�+-02+,M�̂!"��"��������_�" "�!�!�����̀����abccd�̀����e����#"� f�" �$%&'�0+-'-1,*,&21�&13.)8-'�3-+,*&1�G1219g@@h�4&1*13&*.�5-*')+-'H�*'�8-4&1-8�&1�V-;).*,&21�g�)18-+�,%-�DE3%*1;-�@3,6�&13.)8&1;�@8K)',-8�DiN$Z@6�@8K)',-8�DiN$Z@�5*+;&16�@8K)',-8�-*+1&1;'�0-+�'%*+-6�*18�@8K)',-8�4+--�3*'%�4.27M�V-3213&.&*,&21'�24�,%-'-�1219g@@h�4&1*13&*.�5-*')+-'�,2�,%-�52',�8&+-3,./�3250*+*L.-�4&1*13&*.�5-*')+-'�3*.3).*,-8�&1�*332+8*13-�7&,%�g@@h�*+-�0+-'-1,-8�*,�,%-�-18�24�,%&'�0+-'-1,*,&21M�U)+�W2+5�j9Y6�4&.-8�7&,%�,%-�=DO�*'�24�,%-�8*,-�24�,%&'�0+-'-1,*,&216�0+2J&8-'�4)+,%-+�-E0.*1*,&21�*18�8&'3.2')+-�+-;*+8&1;�D1%*L&,R'�)'-�24�1219g@@h�4&1*13&*.�5-*')+-'�*18�'%2).8�L-�+-*8�&1�321K)13,&21�7&,%�,%&'�')00.-5-1,*.�&142+5*,&21M�@88&,&21*./6�2)+�W2+5�AX9k�42+�,%-�,%+--�521,%'�-18-8�=-0,-5L-+�CX6�>X>F6�0+2J&8-'�4)+,%-+�&142+5*,&21�+-;*+8&1;�l)1)')*.�2+�121+-3)+&1;�&,-5'�,%*,�*+-�12,�,/0&3*.�24�21;2&1;�20-+*,&21'6l�*�+-3213&.&*,&21�&,-5�&1�2)+�@8K)',-8�DiN$Z@�3*.3).*,&21M�̂!"��"��������_�" "�!�!�����̀� �#"a !��"�e�#_��� �� $%-�O250*1/�)'-'�G'*5-9',2+-H�3250*+&'21'�,2�-E0.*&1�,%-�3%*1;-'�&1�3-+,*&1�0-+42+5*13-�5-,+&3'�*18�.&1-�&,-5'�7&,%&1�&,'�4&1*13&*.�',*,-5-1,'M�=*5-9',2+-�3250*+&'21'�*+-�3*.3).*,-8�L*'-8�21�%25-�%-*.,%�*18�%2'0&3-�.23*,&21'�20-1�,%+2);%2),�L2,%�,%-�4).�3)+-1,�0-+&28�*18�,%-�&55-8&*,-./�0+&2+�0-+&28�0+-'-1,-8M�$%-'-�3250*+&'21'�&13.)8-�,%-�4&1*13&*.�+-').,'�24�5*+:-,�321'2.&8*,&21�,+*1'*3,&21'�&1�-E&',&1;�5*+:-,'6�*'�&,�&'�8&4&3).,�,2�8-,-+5&1-6�7&,%�0+-3&'&216�,%-�&13+-5-1,*.�&50*3,�24�,%-'-�,+*1'*3,&21'�21�,%-�O250*1/R'�+-').,'�24�20-+*,&21'M

���������� �� �� � ������ ���� �������� �� �� ����������� ������� � ��� ��� �! ����" # ���$� %&�"�� '���(����� )�*+� ,�(� -.��$� ����� /��$��� --�-0�� ���� /��$��� -1�-���� �������� 2�3 ��� �4'5+2 -�+�6� ��� 7�8 ����" 9����� -�2�3 ��� :��� �� :��; -%� ������ -)�-*2�3 ��� :��� �� :��; 2 $����� ��� < � �= :��� �� :��; 0.�0-2�������> '��� ���� ��$���" #(��(��; ? �������������� �� �22& 00��-

�������� ��� �� ����� ������ � � ������������������ ������������������ ����� �� �������� ����� ���� !�"�#��$���� ���$�����"����%&�'%'()*+,-./*�0,1,21�./*�'%3�,'�4.5%/�,''%0.2,%'�-%'2/.-21�.2�,64/%0*+�/.2*178%12�4*/�0,1,2�,'-/*.1*+������5*./�%0*/�5*./79:(+.5�;%14,2.<�/*.+6,11,%'�/.2*��=�=��>*2*/�2;.'�'.2,%'.<�.0*/.?* @ ��������� $�����A������������#�B��$���� ���$�����C0*/.?*�+.,<5�-*'1D1�,'-/*.1*+�1*ED*'2,.<5�*0*/5�6%'2;�1,'-*�F.'D./57C+6,11,%'1�,'-/*.1*+�"�G��5*./�%0*/�5*./C+HD12*+�IJKLMC�?/*3��B�B��5*./�%0*/�5*./7�8%12�4*/�+.5�&<.2�5*./�%0*/�5*./7"=����>*2*/�2;.'�2;*�'.2,%'.<�.0*/.?*�&%/�4.2,*'2�0,1,21�,'�2;*�<.12�+.51�%&�<,&* N*-%'-,<,.2,%'1�2%�OCCP�4/%0,+*+�,'�C44*'+,Q R��A ��������S ���� T �� �������@�UA������VWXY@������� �Z���"��� � ��!� ��Z�=����� � �����"�#������ ������$���� ���$����������� $��A��� �� ��� !�����[���������A��� ��������� ��A���� �������� ������N*+D-*+�>.'�+*>2�>5�Z����� � ��,'�2;*�ED./2*/]�>.'�+*>2�+%3'�Z="��� � ��5*./�%0*/�5*./ ��� �� �� ����� T �� ������ Z�"=�#�*̂2�1*/0,-*�/*0*'D*Z������ Z_����̀*̂2�<%11�.2/,>D2.><*�2%�I';.>,2a�K'-7 N*4%/2*+�IPbZ���"� Z���=C+HD12*+�IJKLMC C+HD12*+�IPb"=�=G� =���#c%6*�c*.<2;�C+6,11,%'1 c%14,-*�C+6,11,%'1=d�d## =�#��c%6*�c*.<2;�)*+,-./*�-%64<*2*+�*4,1%+*1 c%14,-*�C0*/.?*�+.,<5�-*'1D1Z=���d Z�"dc%6*�c*.<2;�)*+,-./*�/*0*'D*�4*/�*4,1%+* c%14,-*�N*0*'D*�4*/�4.2,*'2�+.5ZB� ZGGc%6*�c*.<2;�8%12�4*/�0,1,2 c%14,-*��������8%12�4*/�4.2,*'2�+.5 efghijkf�lmnope�qrstju�vkwr�sxkr�vkwry�zs{j|{hkf�ijrs{q�}rkk�zwiu�}~st�w{f�fkj�rkfhzj|s{y�€wvsr�|{{sxwj|s{�ijrwjkqv�zs{j|{hki�js�}sijkr�kf|zwrk�efxw{jwqk�qrstju�|{�us‚k�ukw~juy�zs{j|{hkf�wxkrwqk�fw|~v�zk{ihi�qrstju�|{�usi€|zk

�������� ��� �� ����� ������ � � �� ����������� ����������������� !" #$�# %��&'% �('$') *+ �,-.�/�0�,-+-1-. -1-+2345�657896�:59�;5<=>?5�<5=5:@5 ABCDEC ABDCEF �GHIJK�L23;M>?5�:59�;5<=>?5�<5=5:@5 NBEO PQEP �RRIS�LT �� �������U/����U�/���� V-�+0W V-�X0+ ��YZ[)�L�]̂�_̀àbc̀ L�]̂�_̀àbc̀d3;9�3e�;5<=>?5 �fRIg�L ADhDEQ �fRIg�L ADhPEC �GRIJK�Li_]jj�kl_mnb �HoIR�L RpRIg �HoIR�L RpHIq �GRIgK�Lr5:5<78�7:s�7s4>:>;9<79>=5�5tM5:;5; �qoIR�L FOEQ �qgIR�L DCDEC �GHIqK�Lu]vlw�]x̀_lvnbm�̀yx̀bj̀j �gSIR�L ABBzEP �gRIS�L ABhNEC �GpIoK�L{965<�>:?345 | }CED~59�>:?345�79<>€@97€85�93�:3:?3:9<38>:�>:95<5;9; � CEQ�� CEB�‚�ƒ�������„…T†‚ V-.0� V-+0- �‡Zˆ�‰(Š‹�$ (�ŒŽ‰��'%‘�� �’0“�” �’01�”…����U����� •�– �—� V˜1“0’ V™ š›‰œ��� �����U������ ��� ���������…��0 Vž˜˜10-Ÿ Vž-0.Ÿ �� � ¡YZ¢)���� U������ ������£¤� Vž-0-1Ÿ Vž101�Ÿ �� �¥¦¦Z¦)�‚�ƒ�������£¤�ž������ �� ��� ��� ��� �����+.�����+�Ÿ V101+ V101+ �§��̈���U� �������������U���/���©���������������� /����� ���©� ���ª�r7>:;�3:�s>;M3;78�3e�7;;59; A}CEh~ A}CEB~«93?¬€7;5s�?34M5:;79>3:�5tM5:;5 AhEz AhED®:@;@78�3<�:3:<5?@<>:�>954;�9679�7<5�:39�9̄M>?78�3e�3:3>:�3M5<79>3:;}D~ AhEO APEF�D�®:@;@78�3<�:3:<5?@<>:�>954;�>:�°h�BCBP�>:?8@s5�?3;9;�7;;3?>795s�±>96�;67<5638s5<�7?9>=>;4²�7:s�<5;9<@?9@<>:�7?9>=>9>5;�7:s�;5=5<7:?5³�>:�°h�BCBh²�965̄�>:?8@s5�:3:<3@9>:5�8>9>79>3:�7:s�965�;9<795>?�<5=>5±�M<3?5;;E�5́?3:?>8>79>3:;�93�rµµ¶�M<3=>s5s�>:�µMM5:s>t

�������� ��� �� ����� ������ � � �� ����������� ����� �������� ����������� !"#$%&'"�($)$*)�&'"���+�$��,&-�'�$���(&*$���%��*'&%*)�&*�$.,'�("#�'&*")/�0�� !"#$%&'"�'"("�1"�,"'�($)$*�$�%'"&)"#�*��23�4�$��565��7)""�)8$#"�9:/;�< =�>�� ?��� ����=���@<�� ��������� �A ���=�B�����=��C�?����@��@= D��E� �� �������=�?��������=������FGEH��� � �I� =�JEKLI�<��=� ?�=�<��=��=���=� <������ � D�=�B�����=��? ���������=��� �� A� D�=�=���=��A����� ����������� ������ �����@����E M"%��%$8$&*$��)�*��NOOP�,'�($#"#�$��O,,"�#$Q � ������������������� �=��� � ����=���@<�R*&�$�S�8"("8)�'".&$��)*'��S�!�)*�'"%"�*�".,8�-""�"�S&S"."�*�)1'("-�$�#$%&*"#��1'�".,8�-"")�&'"�$��*T"�*�,�������T"&8*T%&'"�%�.,&�$")�)1'("-"#�$���$�#$�S�*T"$'�+�'U�."&�$�S�18/ � �� �������C�V�������W>XYC�@=�D�ZE�L�<��=� ?�=�<��=��=���=� <������ �� ��� A�����[������=������ �������=�?�����@= D������� �����E

�������� ��� �� ����� ������ � � ����� ��������������� ������� �������� ���������� ���� �� �������� �!�����"������������ #��$����%�����& '() '(* &'(' +,-�./�.01�2.34�245672�5849:;4<�514�=�>751<�.1�2;8241?�@+-�514�A�>751<�.1�2;8241B �� #$�$����%�����C '(D '(E F(E GG-�./�.01�2.34�245672�5849:;4<�514�=�>751<�.1�2;8241?�HA-�514�A�>751<�.1�2;8241@'*�I��� ����� �%�������� ��%���' &'(F &�(E C'(' -�./�J57;497<�145K3;74K�7.�59�5:074�:514�2.<J;756�L;72;9�=,�K5M<�./�<7517�./�:514�.1�14<03J7;.9�./�:514#�������N���������O����I���� P�O�P�)� �'() )�(Q F'(C -�./�J57;497<�L2.�14:4;R4K�;9�J41<.9�R;<;7<�/1.3�ST�.1�34K;:56�<.:;56�L.1U41�.9�57�645<7�7L.�.07�./�724�/;956�72144�K5M<�./�724�J57;497V<�6;/4 $��������W���#� � � � X ��������� ���������I����� �����Y��� P�"���� �� $����� ��#��P ������ ZZZZB[�056;7M�./�]57;497�̂514�_.]̂ [�>751�S57;98<�5<�./�̀06M�@,@A�/.1�K574<�./�<41R;:4�/06�M451�@,@@?�a:7.b41�@,@@�721.082�>4J743b41�@,@=@[�c.34�c45672�̂514�̂.9<0341�d<<4<<3497�./�c45672:514�]1.R;K41<�_cĉ dc]>[�]57;497�>01R4M�>751�S57;98<�5<�./�̀06M�@,@A�/.1�K574<�./�<41R;:4�̀59051M�Be�@,@=�f�g4:43b41�=Be�@,@==[�S4<451:2�h9<7;7074�/.1�c.34�̂514�@,@=�̂2517b..U�_K575�/1.3�i4K;:514�>759K51K�d956M7;:<�j;64<�/.1�̂k�@,@@[e�l925b;7�K575�;<�5<�./�B�@,@AA[�i4K;:514�/44�/.1�<41R;:4�:65;3<�K575�/1.3�̀59051M�@,@B�7.�g4:43b41�@,@@�_<.01:4�i4K;:514�]1.R;K41�g575�:5756.8�f�d080<7�@,@A[

�������� ��� �� ����� ������ � ��� ����� ���� ����� ����� ���� ������������ ��������� �� �������������������������� ���� ��������������������������� ���� �!��������������������������"#$� ��� �!��������������������� �������� ����� ���� ��� ��������������� ����������%�������� ����� ����� ���� ��� ������������������������ ��� �� �� �!���������������& ' �!��������������������������& ()*+ ()", ()"- ./�00 ./�01 /23�04+$ ),$ )5$ 66$ *�$ "*$ "#$ 78�01 70�01 71�01 74�01 78�04 70�04 71�04 29:�;<=>:;<?�@:;=A<@=BC�B=<A=�D<=EB�:F�G<H�8I�0J01�<;D�K<;L<AH�8I�0J04

�������� ��� �� ����� ������ � ��� ����� ���� ���� ������������� ����� ����� ����������������������� ��� ����� ��� ����������� �������� ���!�� ����������������������� ���� ��"#���!�� ���������� �� ����������������������� �� �$%����� ��������������������������������&��� �������'�� �(��������� ���� ��� �����)�*�����+���� �,���-����� �����(��� ����� ���� ����� ����������� ��. �� �)������ �� "/0 " 0 "#0 /10 //0 //0 //0/0 10 %$0 %/0 �0 �0 �0"10 2#0 2$0 2 0 �%0 �%0 �$0 34567879:5;�<=67>54= ?5@94�A::9B5879:�C9:845>8DE%� # $ E � # $� E$� # $ E/� # $ E%� # / E � # / E$� # / ���� ��� F �&���� ���"% %

�������� ��� �� ����� ������ �� ����������������� ��!���!"��!����#������ ������ ��!����!�"�$��%� ��"� ��&��'�!������������� ��!���!"��!����#������ ������ ��!��!��%�����(��%����!�)�!���� �*������� �!*�%�*+�� �%$����%�'���&,-�./�)%�#�"��!�'������!�"��!�0100��!"�0102����)+!"�!*��!'�� #�! ��!�0103�"��!�'��4�5��6 7 ��8�9���:��� ;�9���7�����:�< 9�:9 =�� >?� >?> >?? >?@A@ ��? ��� ��> B�#��B��� �B������ �>CD�C>� �>CD�C>> �>CD�C>D EF5�>�>G���� >��D�� G�� H��� ��!�I�+! �

�������� ��� �� ����� ������ �� ��� �� ������������������������ �� � !"�#�$� !�!%!" !%!�&�����'#����'�#��(�)*+,-./0+� 122345 126247 �8294:;�<=>?@*+,-./0+ :24A 9346 �B74C�<D0-E/F+�,GFH82; B4B B4A �82B47;�< ������ ���������'#����'�#��(� !%�$% !�%$I �8643;�<J>KF�>L�K+0E-.+ 27A4C 22747 �8543;�<MNOPP�QRNSTU �VWXY�Z �VWX[�Z+?+0/]�/?,�/,̂ -?-KF0/F-E+�+_̀+?K+K A:4B AC47 �8246;�<aFb+0�-?.>̂ + c 8742; �827747;�<=+F�-?.>̂ +�/F0-dGF/d]+�F>�?>?.>?F0>]-?e�-?F+0+KFK 746 74B �27747�<fgh(���g��ijklf m�n$o m"�$p �q�!$rs�tZ�uvwX�xyz{|u�QRNSTU �}[X~�Z �}X[�Z€��'��� �� ����'����q���(� ��� (���s�g���'�)‚,̂ -KK->?K !�ƒ"!! BA„A:A �8:4A;�<…+.+0F-L-./F->?K �nƒ�%� 2C„5B2 �82943;�<J>̂ ]̀+F+,�+̀-K>,+K �pƒpnn 66„5A7 �82B46;�<†-K-FK on�ƒo!o 997„5:7 �82A47;�<†-K-FK�̀+0�+̀-K>,+ �"$" 264C �8546;�<…+E+?G+�̀+0�+̀-K>,+ � m�ƒ%�p�� 15„23C� �8A42;�<& �‡�g���'�)�‚,̂ -KK->?K� !IƒIo% B6„C5: �B742�<…+.+0F-L-./F->?K �"ƒ��! 25„622 �A4B�<†-K-FK oo!ƒp�o A72„396 �274B�<k �� )‚,̂ -KK->?K o�ƒ�r! A7„AB5 �A49�<ˆRQ‰ŠP‹ON‰�‹O‹RŒ�RvQTPPTOUP�SNO‹Ž �X�Z…+.+0F-L-./F->?K �%ƒ!�� 5B„35B �8343;�<ˆRQ‰ŠP‹ON‰�‹O‹RŒ�N‰‰N‹T‘TR‹TOUP�SNO‹Ž �’WX[“�Z†-K-FK � �ƒ��"ƒ�"%�� 2„29B„266� �8642;�<†-K-FK�̀+0�+̀-K>,+ � �"$��� 264C� �8A46;�<J>KF�̀+0�E-K-F � mI"�� 1C5� �242�<82;D0-E/F+�,GFH�0+̀0+K+?FK�]>?e@F+0̂�.>̂ 0̀+b+?K-E+�b>G0]H�?G0K-?e�̂+,-./]�./0+4 …+.>?.-]-/F->?K�F>�‚‚D�̀0>E-,+,�-?�‚̀ +̀?,-_

�������� ��� �� ����� ������ �� ��� �� ������������� �������� ������ ���� �� �������� ����������������������� �������� !"#$%#&'&()&$%*�)$�+,,-�./$0&1"1�&%�,.."%1&2 3 �45��������������� ������6��7���8���� ����� �� �������� ����� 6��� 9����������� ��������:!"0"%;"�1"#'&%"1�<=>=�?&'&$%@�$/�A>BC@�D"(/�$0"/�D"(/�./&?(/&'D�1;"�)$�'$E"/�F"1&#(/"�0$';?"�(*�(�/"*;')�$G�'$E"/�/"#"/)&G&#()&$%*>:!"0"%;"�."/�".&*$1"�&%�HI�JKJI�&%#';1"1�(�.$*&)&0"�&?.(#)�G/$?�#L(%M"*�&%�$;/�"*)&?()"1�/"#$0"/(N&'&)D�$G�%")�*"/0&#"�/"0"%;"@�'"(1&%M�)$�(�%"M()&0"�D"(/�$0"/�D"(/�#$?.(/&*$%�&%�JKJA>O�P�������QRSTO�����������U��V��� � �8� �����W�8������ ��������������� ������� ������������������� �����:X$*)�."/�0&*&)�&%#/"(*"1�Y>YC�D"(/�$0"/�D"(/�./&?(/&'D�1;"�)$�)L"�1"#/"(*"�&%�0&*&)*�(%1�?"/&)�(%1�?(/Z")�&%#/"(*"*@�.(/)&('D�$G*")�ND�(�/"1;#)&$%�&%�#$%)/(#)�'(N$/�(%1�G(0$/(N'"�"2."/&"%#"�&%�E$/Z"/*[�#$?."%*()&$%�(%1�M/$;.�?"1&#('�#'(&?*>]"(/̂)$̂1()"�#$*)�."/�0&*&)�&*�G'()�D"(/�$0"/�D"(/>:_&*&)*�."/�".&*$1"�1"#/"(*"1�̀>AC�D"(/�$0"/�D"(/�)$�YA>Y�./&?(/&'D�1;"�)$�$;/�#$%)&%;"1�G$#;*�$%�"*)(N'&*L&%M�(�a;*)�/&ML)�.'(%�$G�#(/"�G$/�.()&"%)*@�$%M$&%M�#'&%&#&(%�"1;#()&$%@�)"(?�#$'(N$/()&$%@�(%1�)L"�)L$;ML)G;'�&%)"M/()&$%�$G�./"1&#)&0"�(%('D)&#*>

�������� ��� �� ����� ������ �� ��������������������������� �� � !"�#�$� !�!%!" !%!�&�����'#����'�#��(� )*!$+ )",$" ���$%�-./01�/2�0345673 89:; 8<:= �>:9�?@ABCC�DEAFGH �IJKL�M �NOKN�MP3Q34RS�RQT�RTU6Q6014R1653�3VW3Q030 XY:9 X9:> �9:X�?Z31�6Q7/U3�R146[1R[S3�1/�Q/Q7/Q14/S6Q]�6Q1343010 =:̂ _ Z̀abcd(���c��efghb )�%$% ),$, �!i$i�-M�jklK�mnopqj�DEAFGH �JOKL�M �JrKs�Mt��'��� �� ����'�����uvwxu��u��x�w��g �� ��c����� �� �y%"+ !yzz! �*$,�-{RU3|01/43�1/1RS�RTU6006/Q0�]4/}1~ �NKJ�M�������c�€� ���y!", ���y,�i �+$i�-h�����'��c��#�'���� ������ ����€ �%% �%, �‚+$*ƒ�-b#�'����c�� €�����(� �y+!! �y�zz �+$i�-„�#��(����'���������c�€ )�*z )�*! ��$i�-… �����'���������c�€ ),, ),, �†�- ‡37/Q76S6R16/Q0�1/�Paaˆ�W4/56T3T�6Q�aWW3QT6V

�������� ��� �� ����� ������ �� ���������������� ��������� ����������������� ���������������������� ������ ���������� !"#$%#&'&()&$%*�)$�+,,-�./$0&1"1�&%�,.."%1&2 3�����������������45�6��� � �7� �����8 7������ �������������� ������ ����������������������������������������9����������������������������:,1;&**&$%*�&%#/"(*"1�<=>?�@"(/�$0"/�@"(/=:!"0"%A"�."/�1(@�&%#/"(*"1�B=C?�@"(/�$0"/�@"(/�./&;(/&'@�1A"�)$�&%#/"(*"1�D"1&#(/"�/"&;EA/*";"%)�/()"*=�:F%�)G"�)G&/1�HA(/)"/I�)G"�J$;.(%@�(##/A"1�KL=M�;&'&$%�&%�D"1&#(/"�J(.�E&'&%N�'&;&)()&$%*�#$;.(/"1�)$�KOP�)G$A*(%1�&%�)G"�)G&/1�HA(/)"/�$Q�OPOB=R���������� ���������������������� ������ ���������:,0"/(N"�1(&'@�#"%*A*�&%#/"(*"1�*"HA"%)&('@�"0"/@�;$%)G�*&%#"�S(%A(/@�OPOM=R�T�������UVWXR�����������46�Y��� � �7� ��6��� 7������ ���������������� ������� �������������������:J$*)�."/�1(@�Z(*�Q'()�@"(/�$0"/�@"(/=�

�������� ��� �� ����� ������ �� � �� �������������������������� �!�"�# $% &'�()(* +� ,�� �� �������-�.���� &'�()(' +� ,�� �� �������-�.���� ������ �����/�������������������� 01234 05637 ��������/�������������������� 6838 939 ��� ,����/���:� �����������:���.���;������ <==38> �739�? <=231> �683=�?� �� ���������������������� @(*A� @('A( ��� ,����/���:� �����������:���.���;���������������� .����� ���;� ���B�C����� ������ �� � ,������� 0<831> 0<83=>D� �EF������� �������� � 0137 0136G����� � :�� �:���::��/�������������:��� ���H���� � ,� �/ ��/� ��:��� ��I�J 0132 053K<6>�LMNONPQ�RS�MRMSTUNSVMW�VXTYO�VM�Z1�=8=5�VMUQN[T�UROXO�POORUVPXT[�VX]�O]PST]RQ[TS�PUXV̂VOY_�PM[�STOXSNUXNSVMW�PUXV̂VXVTO�PM[�OT̂TSPMUT̀�VM�Z1�=8=1_�X]Ta�VMUQN[T�MRMSRNXVMT�QVXVWPXVRM�PM[�X]T�OXSPXTWVU�ST̂VT�bSRUTOO3� cTURMUVQVPXVRMO�XR�deef�bSR̂V[T[�VM�ebbTM[Vg hiRYT�RjVUT�WTMTSPQ�PM[�P[YVMVOXSPXV̂T�TgbTMOTO�[TUSTPOT[�XR�739?�Rj�URMORQV[PXT[�ST̂TMNT�bSVYPSVQa�[NT�XR�QRTS�VMUTMXV̂T�URYbTMOPXVRM�PM[�X]T�UROX�URMXSRQ�VMVXVPXV̂TO�T�NM[TSXRRk�VM�X]T�OTURM[�]PQj�Rj�=8=1�PM[�X]SRNW]RNX�=8=53hl]SRNW]�X]T�X]VS[�mNPSXTS�Rj�=8=5_�UROX�OXSNUXNST�U]PMWTO�VYbQTYTMXT[�PST�TgbTUXT[�XR�nTMTjVX�]RYT�RjVUT�UROXO�na�PbbSRgVYPXTQa�0=�YVQVRM�PMMNPQa�RM�P�WRojRSPS[�nPOVO3

�������� ��� �� ����� ������ �� ������������������������������ �!�"�#$ %���������&'(�)')* ���������&�(�)')&+,-./012�3/,14�41-56-7/8�041,79�:.07679;<�,31�=>=?@AB@=B CADEF> CAG>F>CH>>�I7675/�914I�65./�:.07679;<�,31�=>=?@AB@JB JE=F? JD?FAK7/./01�61.21�5L678.975/2 GF= EFEM �� ����� NO)OPQ NOO)P�R122S�T.2U�./,�0.2U�1V37-.61/92@HB HEF? =?FHW������� N*X'P) NO)OP)W��������� �Y�Z�������[M�Y�]*̂ � *PX_�� OP*_�M��� ��̀��a� b�c� ����Y�Z�������[M�Y CA>>F= Cd?FDYb�� �� �� �������� NQ*P� N�'PX@AB�eU1�fJ�=>=H�g178U91,�.-14.81�7/914129�4.91�g.2�?FEh�@ijKk�l�041,79�2m41.,�.,n329I1/9�l�=E>�Lm2BF@=B�j/�j095L14�JA<�=>=H<�9U1�T5Im./;�I.,1�./�.,,7975/.6�-563/9.4;�CE�I7675/�m.;I1/9�95�41,301�9U1�41-56-7/8�041,79�:.07679;�53929./,7/8�L.6./01�95�CAD>F>�I7675/F@JB�o/�j095L14�=>==<�p/U.L79�1/9141,�7/95�./�7/914129�4.91�2g.m�95�:7q�9U1�4.91�5/�C=>>�I7675/�5:�792�914I�65./F�eU1�2g.m�:7q12�9U1�ijKk�05Im5/1/9�5:�9U1�7/914129�4.91�.9�HFJhF@HB�r.;456�97I7/8�m52797-16;�7Im.091,�9U1�T5Im./;s2�0.2U�L.6./01�.9�i1m91IL14�J><�=>=HF�+L21/9�9U72�L1/1:79<�9U1�61-14.81�4.975�g536,�U.-1�L11/�EF>qFk105/0767.975/2�95�t++r�m45-7,1,�7/�+mm1/,7q o/�i1m91IL14�=>=H<�9U1�T5Im./;�I.,1�.�b �������NO��� � ���������<�41,307/8�9U1�53929./,7/8�L.6./01�5:�9U1�41-56-7/8�041,79�:.07679;�:45I�CA?>�I7675/�95�CADE�I7675/F

�������� ��� �� ����� ������ �� �������������������� � ����� �!"#��$"�%&'($"#� !)$*!+�%!,�)'$-!'$+.�*���'�,/+*�&0�+&%�'�! &/"*,�'� �$1!2+��!"3�*���*$-$"#�&0�)!.'&+4�5���637/,*�3�0'��� !,��0+&%�!,,/-)*$&",�&"�,+$3��894��5���/,�,�&0�637/,*�3�0'��� !,��0+&%�&"�,+$3��8:4 ;<�=>�?=@=A>BC D� &" $+$!*$&",�*&�E66F�)'&1$3�3�$"�6))�"3$G� 6374�H'���I!,��H+&%�J�K�898L 637/,*�3�MNO�K6 I�!"#��$"�P&'($"#�I!)$*!+�!"3�Q*��' R!$"*�"!" ��I!)$*!+�MG)�"3$*/'�, I!,��O"*�'�,*�F!.-�"*, I!,���!G�F!.-�"*,S�T�*�&0�D�0/"3, 6374�H'���I!,��H+&%�J�K�898UV9V89VU9 VW9VX9 VUY4Z V84Z V[Z48 V[U4XV94U VZ]4LV:X4]

�������� ��� �� ����� ������ �� ������������������������� ��� �������� �����!"�#$�%#&#'$()�*+,*-.�-*/�(01/*�21.13� ���4�5���� � �����6���� ����������� ���������������������������������������� 789:;<=> 789:?:�@A�789:<> 789:>8�@A�789:;<5�B�������CDEF5 7GH=< 78::�@A�78:< 7GI�@A�78:J5�B�������6K 7:=JJ 7:=8G�@A�7:=>H 7:=8G�@A�7:=JG LMNAONPQPR@PAOS�@A�TUUV�WXAYPZMZ�PO�UWWMOZP[

�������� ��� �� ����� ������ �� ���������� ��������� ����������� !��"#�$%&'����(�)�� ���*�����+��,"�-��.�)�!/�#-�-"�0"����"�1(�)�� ��� )0�!!�"�!�,"!-�*���2�!�-������ !��"#�3'�-"�$' ��� �� �� ��������� !��"#�&%4'����(�)�� ���*�����+�#"��5$�-/�".+/�56��������� !��"#� **�"7�0 -�89�:'����(�)�� ���*�����+�#"��5:�,"!-�*���* -���-�) 9������ !��"#�$'�-"�&' ����� �; 7�� -��"#� **�"7�0 -�89�&<'�=�8.-�)�!/ ����".�-�"#� **�"7�0 -�89�>3%<�0�8�"��!/ ��! � �� ������

�������� ��� �� ����� ������ �� �������������������� ���������� �������� �!�"�#$�������������% �������� ���&�� �'��� ���(�����������')* ���(�+�� ���������� �� ���(��������� ��,-./012-�34567, 89:;< 8:=;> 8?>>�1@�8?>< 89A�1@�8?>B�CD0E�FG12H201�2IJ2G02 K>;< LL;? 8K?�1@�8KK 8K?�1@�8KBCD0E�FGM@N2�1DI�JDON2G10�PH2Q/G-0RS�G21 PA;BR P>;<R 8K�1@�8= 8>�1@�8BT@HUFGV�MDJF1DW�DG-�@1E2H L;> PB>;>R 8PLR�1@�8L 8>�1@�8LXDFG12GDGM2�MDJF1DW�2IJ2G-F1/H20 L;K L;B 8=�1@�8?> 8K�1@�8<���������%���������% � YZ[[ YZ]& Y&]�� �YZ[ Y(̂�� �YZZ_ 2̀1�MD0E�FGM@N2�1DI�H2Q/G-0�FG�B>BL�FGMW/-2�1E2�FNJDM1�@Q�D�JDH1FDW�H2Q/G-�@Q�B>BB�@a2HJDON2G1;�_6E2�MEDGV2�FG�b@HUFGV�MDJF1DW�Q@H�c67�B>BK�bD0�JHFNDHFWO�1E2�H20/W1�@Q�W@b2H�DMM@/G10�H2M2FaDdW2�DG-�1E2�1FNFGV�@Q�JDOH@W; e2M@GMFWFD1F@G0�1@�f,,g�JH@aF-2-�FG�,JJ2G-FI

�������� ��� �� ����� ������ �� ����� ���������������������� ���� !�" # $!%&'� �������� ���(�������� �)�*�� �+��� +,-��)�.�������� �)�.��������� ��/0�12324 5676 5878 5679�:2�5;79<=>?@4@:@214A8B 567C 5D 5D/0E:�F0GHIJ01:4�AE2F2K@1L4BM�10: 5;979 5;979 5N979�:2�5NO79A8B�P2JGQ0:0R�:S0�H=>?@4@:@21�2T�UG0=@HQ:I�V2J0�V0HQ:S�PHF0�W1=7�@1�X8�696;�H:�H�G?F=SH40�GF@=0�2T�5;78�J@Q@21M�K@:S�H�S2QR�EH=Y�2T�597;�J@Q@21�0ZG0=:0R�:2�E0�F0Q0H40R�[HF=S�8M�696O7�

�������� ��� �� ����� ������ �� ���������

�������� ��� �� ����� ������ �� �������� �������� !�"� #$��%�� �&"� #$!'�(�$����)!��!#"$��"� #$��%�*+, ���$#$!��(�!-!�(!�#-!�.+��-�./��%���)!��!#"$�*/,0112�3�$�$#"�4!'� #-!���)!��!#"$����!%'�� 5-���%��$#$!���%�(�� ��(!���!-#$!*/, 6�)!�6!#"$��7� #$��%�6���� !�7� #$��%� 6�)!�6!#"$��8�6���� !�9$#$!6�)!�6!#"$��:%";�9$#$! *+,�<���3�9!�$!)=!-�>?@�/?/A�&�'5!�$��� #"!@�%�$�#"�"� #$��%�� #%�=!�-!�-!�!%$!'�=;�"� #$��%#"�)#-B!-�*/,�C#�!'��%�/?//�6�)!�6!#"$��4!'� #-!�-!D!%5!� ���6���� !�7� #$��%�*+,�E16�)!�6!#"$��7� #$��%�*+,F!�#-!�#�"!#'�%G��-�D�'!-��3���)!��!#"$��#%'������ !��!-D� !��$�#$��$-�D!��$���-�D�'!��H���� �I�� ��J�K������������������������������K�����L����������� ���M�-��D!-�/?�;!#-�@�(!ND!��-�D�'!'� #-!�(�$����O�JPH� ��Q� H�� ����=! �)�%G�#���H���R����������3��!#"$���;�$!)�@��#;�-��#%'��$�!-�-��B&=!#-�%G�!%$�$�!��F!���!-#$!�%#$��%#";�# -����>A��$#$!��(�$����IS��T���� Q���F!�3��$!-�#%�����RJ������O��H �H���$�#$����#��$-#$!G� �#'D#%$#G!��%�#$-# $�%G�#%'�-!$#�%�%G�$#"!%$�#%'�#�)#�%� �%$-�=5$�-�$���5-� �%$�%5!'��5 !��

�������� ��� �� ����� ������ �� �������� ������ ��� �� �� ����� ���� � � �� � �������������� !"#"$%�&%'"( )%� *� �+�,-��,� #�.,/%�.% #�.�)%0%12%�3%0%) 4%�5 6,)�"11,0 �",1�*�) �%4678/5),0%�&%'"( )%�9'0 1� 4%�) �%*7�."-�� : 6�-),/�#,:%)�) �%�(,1�) (�*�;),:��.),24.�"1()% *%'�(#"1"( #�*� -"14<� !"#"�6��,� ((%5��1%:�5 6,)*� 1'� #"41/%1��,-�(#"1"( #�)%*,2)(%�2�"#"$ �",1�:"�.�5 �"%1�� (2"�6� 1'�(,/5#%="�"%* �;),:�(%1*2*��.),24.�"/5),0%'�*� -"14�( 5 ("�6�:"�.�( *%�/ 1 4%/%1��/,'%#��; "1�,5%) �"14�#%0%) 4%�"1�.,*5"(%�-"=%'�(,*��*�)2(�2)%�!6�4),:"14�(%1*2*�81()% *%�2*%�,-� 1 #6�"(*��,�')"0%�."4.>?2 #"�6�( )%�0" �( *%�/ 1 4%/%1��/,'%#�@,(2*�,1�%-"("%1("%*�"1�)%-%) #��,� '/"**",1�5),(%** �A5%1�BC�'%�1,0,�#,( �",1*�D /5�25�*� -"14<�)%-%) #� 1'� '/"**",1�4),:�.�"1�'%�1,0,�#,( �",1*�,5%1%'�"1�ECEF �G,1�"12%��,�"1()% *%�1%��-2#>�"/%�12)*"14� 1'��.%) 56�.% '(,21���,�*255,)��.,/%�.% #�.�4),:�.�@,(2*�,1�%/5#,6%%�%14 4%/%1���,�)%� "1�:,)H-,)(%

�������� ��� �� ����� ������ �� � ����������� �

�������� ��� �� ����� ������ �� �������� ��� �� ���� ����������� ���������� ������ ���� ����� ���� ������ �� ��� !�"��������� ��#���$��� �!���%������ �� ��������� !��������� ��� ���������� �� ������ "���������%��������#�����!���� ������ ��#�� ����������"����&���� �� ��������� �������� "� �� ����� ��������#��� ���# ����� "��� ��� �������' ������ ���� ����� �����"������ ����� � "������� ����������(������� ��� �� ���) ����� ���*� !���"��+�� ��,��� -'�. �'�. -'�. �'/. 0'�. �'�. 0'�. 1. -'2. �'�. �'�. 0'�. �'�. 0'0. 34567�689:;;:4<;�=>4?5@ A69BC;54>B�689:;;:4<;�=>4?5@�-��� ����� ����� ����� �-��� ����� �����

�������� ��� �� ����� ������ �� �������� ������� ����������� ��������� ������� ������ ��� ����������� ���������� ��������� ������������������� ������!�������������������������������������� �� ������������ �� ��� !�������������� ���������� "�#������ �� ��� ��� ������������������$�%�$�%� ������& ��� �'����������� ()(%( ()(*+ ()%,- ()%-. (),�$ (),(- (),,( ()*%. ()*�% /����% 0����% &����% 1����% &� ��% /����% /� ��% 1����% "����%

�������� ��� �� ����� ������ �� ��� �� ���������� �� ��������������������������� ��!����"�#�$��% &'��(�) &���(�) &)��(�) &*��(�) +,��(�) &'��(�* &���(�* &)��(�* ,-.��(�*/0123450� 6789:; 67<=:8 6787:; 67<;:= 6>>?:< 67@A:< 67@7:? 677?:< 6<9?:<BCDE/0123450 9?:7 ?7:A 9?:< ?9:A @A<:; A@:9 A9:< A7:> @>;:8F52G4H0�1IHJK7L @:? @:9 @:9 7:A =:? @:< @:@ @:@ 9:?MCN0�O04PHO�D0H�Q05G230�50G0DI0� 6@7>:A 6@7<:A 6@7;:= 6@;=:> 6A>;:7 6@7<:@ 6@7;:@ 6@;7:; 69@8:8�R�� R#�R"$ ���%�S%��T�����UV1N2QQ2CDQ @=W@A> @9WA8> @>W>A> @>W;=; 7;9WA;> @>W=88 @8W;7> @<W8@@ ?<W<A7X0305H2Y234H2CDQ 7=W=<A 7=WAA8 7=W<@7 7AW=?; ?AW77< 7?W9>@ 79W9<= 79W7;7 >;W<=@ZCN[P0H01�0[2QC10Q 8=W@<7 8?W>@A 88W<>; 88W<;> 7A>W878 8<W7?7 87W9@; <AWA99 7@<W9>?2Q2HQ ?@<W<== 9=7WA>? 99;W<A; 9<=W?88 @W?7>W<A; 9<@W;8? >=?W?8@ >97W>@> 7W?=7W<782Q2HQ�[05�0[2QC10 78:? 78:9 78:= 78:8 78:9 78:9 78:8 78:8 78:>X0G0DI0�[05�0[2QC10 6� @W=99�6� @W=<<�6� <W7?=�6� @W=>>�6� <W;;9�6� @W=?@�6� @W=@8�6� <W;7A�6� @W=?;�] �̂��T�����U�V1N2QQ2CDQ� @8W9>A @8W7<; @8W=<A @9W=7? 7;;W98< <;WAA7 <;W@;= @=W=>; =7W;8;X0305H2Y234H2CDQ 77WA8; 7<W8>A 7<W877 7<W;>A >7W?9? 7<W8A= 78W>A? 78W77@ 8@W7AA2Q2HQ 8A@W<;7 >78W;;A >;7W?98 >@@W987 @W;@;W?78 >?7W@A= >A7W<@9 >>@WA7> 7W?;>W8<;- �� UV1N2QQ2CDQ ><W=8< >;W=?> >;W>@< >@W;;? @;?W88A >9WA@> >8W@@8 ><W<?@ 798W8@7X0305H2Y234H2CDQ <7W??A <<W<8@ <@W?<@ <@W;@A 7@=WAA; <7W787 <7W@@9 <;W@7< =@W>A;2Q2HQ 7W@;>W?;; 7W@;>WA9> 7W79@W788 7W79@W<A> 8W?<9W;=8 7W@;<W<<9 7W7?=W;9A 7W778W<8; <W8=9W?882Q2HQ�[05�0[2QC10 78:A 78:9 78:= 78:< 78:9 78:= 78:; 78:7 78:8ZCQH�[05�G2Q2H 6� AA�6� =7�6� =<�6� =@�6� =7�6� =;�6� A=�6� =8�6� =7�K7L�F52G4H0�1IHJ�50[50Q0DHQ�PCD_EH05N�3CN[50O0DQ2G0�OCI5PJ�DI5Q2D_�N01234P�3450:

�������� ��� �� ����� ������ �� ������������� �� ��������������������������� ��!����"�#�$��% &'��(�) &���(�) &)��(�) &*��(�) +,��(�) &'��(�* &���(�* &)��(�* ,-.��(�*/012345�657�1589345�85956:5 ;<=>? ;<@>A ;<B>< ;AC>C ;C=D>E ;<=>E ;AF>< ;AE>D ;CAE>E�G�� G#�G"$ ���%H07IJ�IKL3113061 ?MCEE EM@?B EM@@E EM@BE CCMBC? ?MF?E EM@@@ ?MF<D @M=DDNI73567�KIO1 ?CBMFEB ?CCM<DA ?CCMBC= ?CAM@BF CMEADMF@C ?F@MA<E ?EFMFED ???ME<B =DCM@CAP314QI8R5K�I958IR5�J56R7Q�0S�17IO CC< CF@ CFB CFE CF@ CF< CF@ CFF CFDT958IR5�KI3JO�4561:1 ?MAE? ?M<E? ?M?@@ ?M<?? ?M<<C ?M?=C ?MACB ?MDEE ?MACFU5956:5�258�KIO ;CAD ;CAD ;CAE ;CDE ;CAD ;CA= ;CAB ;CA@ ;CA@V017�258�KIO ;BB ;BB ;BB ;BD ;BB ;B= ;B@ ;BB ;B@

�������� ��� �� ����� ������ �� � �� ����������� ������������� �� !" #$#%&#!"'�&!�())*�+,!-#.�.�#"�)++�".#/ 01�23�42526378�9:;9<=�<9>�7?@>9�A@=@B ���CD� D���� �E���F�G�E������ ����H!I��J�%$&J�"�&�'�,-# ��,�-�"K� LMNOPO LMOQPR �STUVW�XH!'+# ��"�&�'�,-# ��,�-�"K� YRNPN YORPN �ZU[�X� �� �������CF����C�F���� ]]̂Ĝ ]_̀G] �0abcB�dX�ef�ghihjkh X�ef�ghihjkhl!'&�!m�'�,-# � �VnUT�X opqPq �VnUT�X OQNPY �SnUnW�Xrsett�uvswxj �Z[U[�X yz[U{ �Z[U[�X o|oPM �SnUTW�X(�"�,%$�%".�%.I#"#'&,%&#-���/+�"'�' �y[U{�X oQYPp �y{UV�X oYQPo �STUzW�X}e~v�e€hsv~xjw�h€hjtht �{‚Un�X MppPM �{‚Uz�X qYNPO �SnU[W�Xƒ&J�,�#" !I� „ …QPN†‡�&�#" !I��%&,#ˆK&%ˆ$��&!�"!" !"&,!$#"‰�#"&�,�'&' NPQ YPQŠ�‹�������Œ��Š ]̀G� ]�G̀ �Žb�dA‘’7=9A�“”•–—�4@>˜23 �™bš�d �™bc�d����C����� ›�œ �� ž�]GŸ _̀G_ �cb �d¡��� �����C������ ��� ��������¢���G £žž�G�¤ £]�Gž¤ �0¥ bšB�d��� C������ ������¦§� £�G��¤ £žG�_¤ �0¥ b̈B�dŠ�‹�������¦§�£������ �� ��� ��� ��� ������̂������]¤ �Gž] �Gž̂ �̈bŽ�d�©���C� �������������C���F���ª���������������� F����� ���ª� ���«�(%#"�!"�.#'+!'%$�!m�%''�&' L…QPR† L…QPN†¬&! ®ˆ%'�.� !I+�"'%&#!"��/+�"'� LqP| LqPN"̄K'K%$�!,�"!",� K,#"‰�#&�I'�&J%&�%,��"!&�&°+# %$�!m�!"‰!#"‰�!+�,%&#!"'…Y† LYNPY LpP|…Y†�̄ "K'K%$�!,�"!",� K,#"‰�#&�I'�#"�NQNO�#" $K.�� !'&'�%''! #%&�.�±#&J�'J%,�J!$.�,�% &#-#'I²�&J��'&,%&�‰# �,�-#�±�+,! �''²�%".�"!",!K&#"��$#&#‰%&#!"³�#"�NQNo²�&J�°�#" $K.�� !'&'�%''! #%&�.�±#&J�"!",!K&#"��$#&#‰%&#!"²�'J%,�J!$.�,�% &#-#'I²�%".�&J��'&,%&�‰# �,�-#�±�+,! �''P

�������� ��� �� ����� ������ �� ��� �� ��������������� �������������� �!"�#!$!%"&' ���()� )���� �*���+�,�*������ ����-�����(+����(�+����./0123450� 6789:7 6;<8:= �>?7:@A�BCDEF/0123450 <=G:= <G8:< �<?:=�BH52I4J0�1KJL>?A 8:8 9:M �>?=:;A�B ������ ���������(+����(�+���� N��,� N��,O �><:=A�BPDQJ�DR�Q05I230 7<<:9 7<@:= �><:?A�BSTUVV�WXTYZ[ �]̂_�̀ �]̂a�̀b0E054c�4E1�41d2E2QJ54J2I0�0ef0EQ0Q ?98:7 ?M?:7 �><:MA�BgJh05�2E3Dd0 i >G:<A �>?GG:GA�BC0J�2E3Dd0�4J52jKJ4jc0�JD�EDE3DEJ5Dc2Ek�2EJ050QJQ ?:= ?:G �=G:G�Blmn����m��op��l q���,r q��s,r �t�,ru�v`�wxŷ�z{|}~w�WXTYZ[ �€̂]�̀ �‚̂�̀ƒ��(��� �� ����(����t����� ��� ����u„�m���(�.…1d2QQ2DEQ †�‡�s� M?ˆ9?= �>?G:<A�B‰0305J2R234J2DEQ O�‡�r� =@ˆ?;7 �>?;:MA�BPDdfc0J01�0f2QD10Q ���‡NO† ?;?ˆ?G@ �>?<:;A�BŠ2Q2JQ �‡†r�‡��� <ˆG9=ˆ878 �>?7:9A�BŠ2Q2JQ�f05�0f2QD10 ��,O ?;:9 �>?:;A�B‰0I0EK0�f05�0f2QD10 � q�‡r†��� 67ˆG<<� �>?:9A�B- �)„�m���(�.�…1d2QQ2DEQ� r�‡��� 97ˆ9<8 �<7:=�B‰0305J2R234J2DEQ ��‡�ss 7Mˆ9G@ �@:G�BŠ2Q2JQ �‡†�O‡��� ?ˆ;@MˆG97 �?7:M�B� �� .…1d2QQ2DEQ �N�‡��� ?==ˆ;;? �=:M�B‹XWŒVŽUTŒ�ŽUŽX�XxWZVVZU[V�YTUŽ‘ �’̂a�̀‰0305J2R234J2DEQ r�‡Os� @9ˆM=< �>=:;A�B‹XWŒVŽUTŒ�ŽUŽX�TŒ“ŒTŽZ”Z“XŽZU[V�YTUŽ‘ �•’̂a–�̀Š2Q2JQ � �‡�rN‡†���� 7ˆ=97ˆ9G@� �><:<A�BŠ2Q2JQ�f05�0f2QD10 � ��,��� ?;:M� �><:9A�BPDQJ�f05�I2Q2J � qr��� 6@?� �i�B>?A�H52I4J0�1KJL�50f50Q0EJQ�cDEkFJ05d�3Ddf50h0EQ2I0�hDK5cL�EK5Q2Ek�d01234c�3450: ‰03DE32c24J2DEQ�JD�b……H�f5DI2101�2E�…ff0E12e

�������� ��� �� ����� ������ �� ������������������ ���������������� !�" # $!%& ���'(� (���� �)���*�+�)������ ����,�����'*����'�*���� -./�+� -.�/+� ��+0�12345�36�4789:;7 <=>? <@>A �B>B�CDEFGG�HIEJKL �MNOP�Q �MNON�QR7S78TU�TSV�TVW:S:458T5:97�7XY7S474 Z[>= Z[>? �>?�C]75�:S;3W7�T58:̂_5T̂U7�53�S3S;3S583U:S̀�:S5787454 ?>= a ]bcdef����e��gh��d -�0+� -��+i �.�+i�1Q�jklO�mnopqj�HIEJKL �rsOM�Q �rtOu�Qv��'��� �� ����'�����wxyzw#�w"$z!y%&� �� ��e����� �� 0{|ii 0{0�. �.+��1}TW7~45387�535TU�TVW:44:3S4�̀835€ �NOP‚�Qƒ�������e�„� |i.{0./ |��{�.. ��+��1������'��e��*�'���� ������ …����„ .�� ..� �†/+/‡�1d*�'����e�� „������� �{/.� �{��� �.+|�1��*�������'���������e�„ -./0 -./� ��+i�1ˆ �����'���������e�„ -‰0 -‰‰ �.+��1 Š7;3S;:U:T5:3S4�53�Rcc‹�Y839:V7V�:S�cYY7SV:X

�������� ��� �� ����� ������ �� ��� ��� ����������������� �!"� #� $���%& %'��� (���� �$���)�!��*+,�-�, ./.0 ./.� ./.0 ./.� ./.�12345672 889:; :<9:; 8898; :<9<; :=9>;12345672�?3@6AB6C2 <D9D; =:9:; <D9<; =E9F; =F9G;16A6C23�H672 E9F; E9<; F9=; :9:; E9<;12345643 =9=; =9I; G9F; =9<; =9<;JBK27 L; L; G9<; L; G9=;MNB6O =GG9G; =GG9G; =GG9G; =GG9G; =GG9G;P�Q��P��*-R12345672 >E9I; 889F; >E9F; 8898; 8>98;12345672�?3@6AB6C2 <F9>; <=9:; <E9E; <D9<; <D9I;16A6C23�H672 ==9G; =G9G; ==9G; E9E; F9>;12345643 =9=; =9I; =9=; =9I; =9I;JBK27 L; L; G9<; L; G9=;MNB6O =GG9G; =GG9G; =GG9G; =GG9G; =GG9G;P��S+T�12345672 FE9D; FE9>; FE98; F89E; F:9=;16A6C23�H672 G98; L; =9I; <9F; <9>;12345643 =9=; =9>; L; G9D; G9I;JBK27 L; L; L; L; L;MNB6O =GG9G; =GG9G; =GG9G; =GG9G; =GG9G;

�������� ��� �� ����� ������ �� ������ �� ��� ���������������� �!�"�#$�%&'%()�(%*�#+,*%�, "-�)#./01����0�����2��������� /��3�� 4��0 5����4����� 6�7 08� 9����� � 4�: �4���44��;�5�����<�����4��: ��<=���� � 6�>�; ��;�>��4��� �� 5�� ���<�?�/01��������@�A /��/01����0/01����0��B5<C/@DA E��FG EH EH EH E��FGIJKLMLNK�LOPLJNL�QJR�QSTMKUVQKUTJ�TW�RLXK�RUNYTZJKN�QJR�WLLN []̂_̀ a a a []̂_̀bLPMLYUQKUTJ�QJR�QSTMKUVQKUTJ [_̂c̀ a a a [_̂c̀dQUJ�TJ�RUNPTNQe�TW�QNNLKN ]̂f a a a ]̂fISPQUMSLJK�TW�gTTRhUe []îj̀ ]îj a a akKTYlmXQNLR�YTSPLJNQKUTJ [f̂_̀ a a a [f̂_̀nJZNZQe�TM�JTJMLYZMUJg�UKLSN�KoQK�QML�JTK�KpPUYQe�TW�TJgTUJg�TPLMQKUTJN[c̀ [f̂q̀ a f̂q a a[rTNǸ�UJYTSL�XLWTML�UJYTSL�KQOLN []ĵs̀ ]îj f̂q a ĉ]IJYTSL�KQO�XLJLWUK�[LOPLJNL̀ []̂ì [̂]̀ [̂]̀ ĉc []̂s̀:���@ ��A���� �����4������ ��� ��������t�5��F E@DD�F�A EuvFu E�Fv ED�F� EDFGC� ���0���� E@�F��A EDFu� E�F�G E�F�� E�F��C� ���0����4�� G�F� G�Fw[̀�xLYTJYUeUQKUTJ�KT�dyyz�PMT{URLR�TJ�NeURLN�f_�QJR�fĵ[c̀�nJZNZQe�TM�JTJMLYZMUJg�UKLSN�UJ�|f�c]c}�UJYeZRL�YTNKN�QNNTYUQKLR�hUKo�NoQMLoTeRLM�QYKU{UNS�QJR�MLNKMZYKZMUJg�QYKU{UKULN�QJR�NL{LMQJYL̂[f̀�IJYTSL�KQO�QR~ZNKSLJKN�UJYeZRL�KoL�LWLYK�TW�PLMSQJLJK�XTTlmKQO�RUWLMLJYLN�QKMUXZKQXeL�KT�NKTYlmXQNLR�YTSPLJNQKUTJ�QJR�KoL�LWLYK�TW�Q�{QeZQKUTJ�QeThQJYL�MLYTMRLR�QgQUJNK�Q�PTMKUTJ�TW�TZM�RLWLMLR�KQO�QNNLKN̂�[}̀yR~ZNKLR�RUeZKLR�zk�SQp�JTK�NZS�RZL�KT�MTZJRUJĝ

�������� ��� �� ����� ������ �� ������ �� ��� ���������������� �!�"�#$�%&'%()�(%*�#+,*%�, "-�)#./01����0�����2�������� /��3�� 4��0 5����� � 4�6 �4���44��7�8�����9�����4��6 ��9:���� � ;�<�7 ��7�<��4��� �� 8�� ���9�=�/01��������>�? /��/01����0/01����0��@89A/>B? C��D� CE CE C��D�FGHIJIKH�ILMIGKI�NGO�NPQJHRSNHRQG�QT�OIUH�ORKVQWGHK�NGO�TIIK XYZ[] ^ ^ XYZ[]_IMJIVRNHRQG�NGO�NPQJHRSNHRQG X̀[̀] ^ ^ X̀[̀]aNRG�QG�ORKMQKNb�QT�NKKIHK Z[c ^ ^ Z[cdHQVefUNKIO�VQPMIGKNHRQG Xg[Y] ^ ^ Xg[Y]hGWKWNb�QJ�GQGJIVWJRGi�RHIPK�HjNH�NJI�GQH�HkMRVNb�QT�QGiQRGi�QMIJNHRQGKXc] Xl[] l[ ^ ^XmQKK]�RGVQPI�UITQJI�RGVQPI�HNLIK Xg[c] l[ ^ Y[̀FGVQPI�HNL�UIGITRH�XILMIGKI] Z[n XY[g] Z[Y XZ[l]6���> ��?���� �����4������ ��� ��������o�8��D C>�Dp? C�Dq C�DB CBD�A� ���0���� C>�D��? C�D�r CE C�D��A� ���0����4�� ��DB ��DBXY]�sIVQGVRbRNHRQG�HQ�attu�MJQvROIO�QG�KbROIK�gn�NGO�g[Xc]�hGWKWNb�QJ�GQGJIVWJRGi�RHIPK�RG�cZcg�RGVbWOI�VQKHK�NKKQVRNHIO�wRHj�GQGJQWHRGI�bRHRiNHRQGx�NGO�HjI�KHJNHIiRV�JIvRIw�MJQVIKK[Xg]�FGVQPI�HNL�NOyWKHPIGHK�RGVbWOI�HjI�ITIVH�QT�MIJPNGIGH�UQQefHNL�ORTIJIGVIK�NHJRUWHNUbI�HQ�KHQVefUNKIO�VQPMIGKNHRQG[�Xl]tOyWKHIO�ORbWHIO�zud�PNk�GQH�KWP�OWI�HQ�JQWGORGi[

�������� ��� �� ����� ������ �� ������ �� ��� ������������ �!"�#!$!%"&'�()*(+,�+(-�&./-(�/#%0",&1234����3�����5��������� 2��6�� 7��3 8����7����� 9�: 3;� <����� � 7�= �7���77��>�8�����������7��= ���?���� � 9�@�> ��>�@��7��� �� 8�� �����A�234��������B�C 2��234����3234����3��D8��2BEC FGHI� FJ FJ FJ FGHI�KLMNONPM�NQRNLPN�SLT�SUVOMWXSMWVL�VY�TNZM�TWP[VLMP�SLT�YNNP ]̂_̀ab c c c ]̂_̀abdNRON[WSMWVL�SLT�SUVOMWXSMWVL ]_̂ èb c c c ]_̂ èbfSWL�VL�TWPRVPSg�VY�SPPNMP h̀i c c c h̀iKURSWOUNLM�VY�jVVTkWg ]lhm̀nb lhm̀n c c coMV[pqZSPNT�[VURNLPSMWVL ]m̀ab c c c ]m̀abrLPSg�VO�LVLON[OWLj�WMNUP�MsSM�SON�LVM�MtRW[Sg�VY�VLjVWLj�VRNOSMWVLP]_b ]l_̀lb c l_̀l c cKL[VUN�ZNYVON�WL[VUN�MSQNP ]lhàmb lhm̀n l_̀l c ll̀̂KL[VUN�MSQ�NQRNLPN ]l̀ib ]ll̀hb ]̂_̀b l_̀a ]_̀nb=������ �����7������ ��� ��������u�8��I FBEE�I�C Fv�Iv FwIv FE�Iw FwI��� ���3���� FB�I��C FEIv� F�IEw F�I�H F�IEG�� ���3����7�� H�I� H�I�]lb�xN[VL[WgWSMWVL�MV�fyyz�ROV{WTNT�VL�PgWTNP�̂a�SLT�̂ǹ]_b�rLPSg�VO�LVLON[OWLj�WMNUP�WL�_h_|�WL[gTN�[VPMP�SPPV[WSMNT�kWMs�PsSONsVgTNO�S[MW{WPU}�MsN�PMOSMNjW[�ON{WNk�ROV[NPP}�SLT�LVLOVMWLN�gWMWjSMWVL̀]̂b�KL[VUN�MSQ�ST~PMUNLMP�WL[gTN�MsN�NYN[M�VY�RNOUSLNLM�ZVVpqMSQ�TWYNONL[NP�SMOWZMSZgN�MV�PMV[pqZSPNT�[VURNLPSMWVL�SLT�MsN�NYN[M�VY�S�{SgSMWVL�SgVkSL[N�ON[VOTNT�SjSWLPM�S�RVOMWVL�VY�VO�TNYNONT�MSQ�SPPNM̀�]|byT~PMNT�TWgMNT�zo�USt�LVM�PU�TN�MV�OVLTWLj̀