UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 1)

Aspen Technology, Inc.

(Name of Issuer)

Common stock, par value $0.0001 per share

(Title of Class of Securities)

29109X106

(CUSIP Number)

Sara Yang Bosco

Senior Vice President, Secretary &

Chief Legal Officer

Emerson Electric Co.

8000 West Florissant Avenue

St. Louis, MO 63136

314-553-2000

With a Copy to:

Phillip R. Mills

Marc O. Williams

Cheryl Chan

Davis Polk & Wardwell LLP

450 Lexington Avenue

New York, NY 10017

212-450-4000

(Name, Address and Telephone Number of Person

Authorized

to Receive Notices and Communications)

October 6, 2023

(Date of Event Which Requires Filing of this

Statement)

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of § 240.13d-1(e),

240.13d-1(f) or 240.13d-1(g) check the following box ☐.

Note: Schedules filed in paper format shall include

a signed original and five copies of the schedule, including all exhibits. See § 240.13d-7(b) for other parties to whom copies are

to be sent.

* The remainder of this cover page shall be filled

out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent

amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this

cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

SCHEDULE 13D

| CUSIP No. 29109X106 |

|

Page 2 of 15 Pages |

| 1 |

NAMES OF REPORTING PERSONS

Emerson Electric Co.

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions)

(a) ☐

(b) ☐

|

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS (See Instructions)

WC, OO

|

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Missouri

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE VOTING POWER

0

|

| 8 |

SHARED VOTING POWER

36,307,514

|

| 9 |

SOLE DISPOSITIVE POWER

0

|

| 10 |

SHARED DISPOSITIVE POWER

36,307,514

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

36,307,514

|

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

|

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

56.39 %

|

| 14 |

TYPE OF REPORTING PERSON (See Instructions)

CO

|

SCHEDULE 13D

| CUSIP No. 29109X106 |

|

Page 3 of 15 Pages |

| 1 |

NAMES OF REPORTING PERSONS

EMR Holdings, Inc.

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions)

(a) ☐

(b) ☐

|

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS (See Instructions)

WC, OO

|

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE VOTING POWER

0

|

| 8 |

SHARED VOTING POWER

36,307,514

|

| 9 |

SOLE DISPOSITIVE POWER

0

|

| 10 |

SHARED DISPOSITIVE POWER

36,307,514

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

36,307,514

|

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

|

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

56.39%

|

| 14 |

TYPE OF REPORTING PERSON (See Instructions)

CO

|

SCHEDULE 13D

| CUSIP No. 29109X106 |

|

Page 4 of 15 Pages |

| 1 |

NAMES OF REPORTING PERSONS

EMR Worldwide Inc.

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions)

(a) ☐

(b) ☐

|

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS (See Instructions)

WC, OO

|

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE VOTING POWER

0

|

| 8 |

SHARED VOTING POWER

36,307,514

|

| 9 |

SOLE DISPOSITIVE POWER

0

|

| 10 |

SHARED DISPOSITIVE POWER

36,307,514

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

36,307,514

|

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

|

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

56.39%

|

| 14 |

TYPE OF REPORTING PERSON (See Instructions)

CO

|

SCHEDULE 13D

| CUSIP No. 29109X106 |

|

Page 5 of 15 Pages |

| 1 |

NAMES OF REPORTING PERSONS

EMR US Holdings LLC

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions)

(a) ☐

(b) ☐

|

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS (See Instructions)

WC, OO

|

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE VOTING POWER

0

|

| 8 |

SHARED VOTING POWER

36,307,514

|

| 9 |

SOLE DISPOSITIVE POWER

0

|

| 10 |

SHARED DISPOSITIVE POWER

36,307,514

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

36,307,514

|

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

|

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

56.39%

|

| 14 |

TYPE OF REPORTING PERSON (See Instructions)

OO

|

SCHEDULE 13D

| CUSIP No. 29109X106 |

|

Page 6 of 15 Pages |

| 1 |

NAMES OF REPORTING PERSONS

Rutherfurd US LLC

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions)

(a) ☐

(b) ☐

|

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS (See Instructions)

WC, OO

|

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7 |

SOLE VOTING POWER

36,307,514

|

| 8 |

SHARED VOTING POWER

0

|

| 9 |

SOLE DISPOSITIVE POWER

36,307,514

|

| 10 |

SHARED DISPOSITIVE POWER

0

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

36,307,514

|

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

|

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

56.39%

|

| 14 |

TYPE OF REPORTING PERSON (See Instructions)

OO

|

Schedule 13D/A

Explanatory Note

This Amendment No. 1 (this “Amendment No. 1”) amends

the Schedule 13D (the “Schedule 13D”) filed with the U.S. Securities and Exchange Commission (the “Commission”)

on May 26, 2022, and is made pursuant to Rule 13d-1(a) of the Act.

The Schedule 13D is hereby amended and supplemented as detailed below,

and, except as amended and supplemented hereby, the Schedule 13D remains in full force and effect. All capitalized terms not otherwise

defined herein shall have the meaning ascribed to such terms in the Schedule 13D.

The purpose of this Amendment No. 1 is to report (i) a change in beneficial

ownership as a result of (a) the contribution of 36,307,514 shares of Common Stock by EMR Worldwide Inc. (“Emerson Sub”)

to its subsidiary EMR US Holdings LLC (“EMR US Holdings”) and (b) the contribution of 36,307,514 shares of Common Stock

by EMR US Holdings to its subsidiary Rutherfurd US LLC (“EMR US LLC”) and (ii) the joinder of EMR US LLC to the Stockholders

Agreement, dated as of May 16, 2022, between Aspen Technology, Inc, Emerson Electric Co. (“Emerson”) and Emerson Sub

(the “Stockholders Agreement”). The aggregate number of shares of Common Stock that may be deemed to be beneficially

owned by Emerson has not changed from the Schedule 13D filed on May 26, 2022.

| Item 2. |

Identity and Background. |

Item 2 to the Schedule 13D is hereby supplemented and amended by adding

the following as Reporting Persons:

| 4. |

EMR US Holdings, a limited liability company organized under the laws

of the State of Delaware, is a holding company and a subsidiary of Emerson Sub. The principal office address of Emerson Sub is 8000 West

Florissant Avenue, St. Louis, MO 63136.

|

| 5. |

EMR US LLC, a limited liability company organized under the laws of

the State of Delaware, is a holding company and a subsidiary of EMR US Holdings. The principal office address of Emerson Sub is 8000 West

Florissant Avenue, St. Louis, MO 63136.

|

During the last five years, none of the Reporting Persons and, to the

best of each Reporting Person’s knowledge, none of the directors or executive officers of such applicable Reporting Person listed

on Schedules I through V hereto, have been: (i) convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors);

or (ii) a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding

was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject

to, federal or state securities laws or finding any violation with respect to such laws.

|

Item 3. |

Source and Amount of Funds or Other Consideration. |

Item 3 to the Schedule 13D is hereby supplemented and amended by adding

the following:

Emerson Sub contributed 36,307,514 shares of Common Stock to EMR US

Holdings in exchange for 7,289,500 shares in EMR US Holdings.

EMR US Holdings contributed 36,307,514 shares of Common Stock to EMR

US LLC in exchange for 5,179,998 shares in EMR US LLC.

| Item 4. | Purpose of Transaction. |

The information set forth in the cover pages and in Item 2, Item 3

and Item 6 hereof is incorporated by reference into this Item 4.

| Item 5. |

Interest in Securities of the Issuer. |

Item 5 to the Schedule 13D is hereby amended and

restated in its entirety as follows:

(a) Based on the most recent

information available, the aggregate number and percentage of the Common Stock (the securities identified pursuant to Item 1 of this Schedule

13D) that are beneficially owned by such Reporting Person is set forth in boxes (11) and (13), respectively, on the cover page to this

Schedule 13D for each of the Reporting Persons, and such information is incorporated herein by reference. The percentages reported herein

are calculated based upon 64,382,647 issued and outstanding shares of Common Stock as of August 15, 2023 as reported by the Issuer in

its Annual Report on Form 10-K filed with the Commission on August 21, 2023.

To the best knowledge of

the Reporting Persons, none of the individuals named on Schedules I-V attached hereto beneficially own any shares of Common Stock.

(b) EMR US LLC directly holds 36,307,514 shares

of Common Stock and, as such, is deemed to have sole voting power and sole dispositive power with respect to 36,307,514 shares of Common

Stock. EMR US LLC is a subsidiary of EMR US Holdings, EMR US Holdings is a subsidiary of Emerson Sub, Emerson Sub is a subsidiary of EMR

Holdings and EMR Holdings is a direct, wholly owned subsidiary of Emerson and as such, each of Emerson Sub, EMR US Holdings, EMR Holdings

and Emerson is deemed to have shared voting power and shared dispositive power with respect to the 36,307,514 shares of Common Stock held

directly by EMR US LLC.

(c) Other than as disclosed

in this Schedule 13D/A, no transactions involving shares of Common Stock were effected during the past sixty days.

(d) To the best knowledge of the Reporting Persons,

no person has the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of Common Stock

reported herein as beneficially owned by the Reporting Persons other than each of the Reporting Persons.

(e) Not applicable.

| Item 6. |

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer. |

Item 6 to the Schedule 13D is hereby supplemented and amended by adding

the following:

Contribution and Joinder

Emerson Sub contributed 36,307,514 shares of Common Stock to EMR US

Holdings in exchange for 7,289,500 shares in EMR US Holdings, and EMR US Holdings contributed 36,307,514 shares of Common Stock to EMR

US LLC in exchange for 5,179,998 shares in EMR US LLC .

EMR US LLC is a party to the Stockholders Agreement and is a member

of the Emerson Group.

The foregoing summary does not purport to be complete and is qualified

in its entirety by reference to the full text of the Contribution Agreement and the joinder to the Stockholders Agreement, copies of which

are attached hereto as Exhibits 99.2 and 99.3, respectively, and incorporated herein by reference.

| Item 7. |

Materials to be Filed as Exhibits. |

SIGNATURE

After reasonable inquiry and to the best of the

undersigned’s knowledge and belief, the undersigned certifies that the information set forth in this statement is true, complete

and correct.

Dated: October 11, 2023

| |

EMERSON ELECTRIC CO.

|

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ John A. Sperino |

|

| |

Name: |

John A. Sperino |

|

| |

Title: |

Vice President and Assistant Secretary |

|

| |

|

|

|

| |

|

|

|

| |

EMR HOLDINGS, INC.

|

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ John A. Sperino |

|

| |

Name: |

John A. Sperino |

|

| |

Title: |

Vice President and Secretary |

|

| |

|

|

|

| |

|

|

|

| |

EMR WORLDWIDE INC.

|

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ John A. Sperino |

|

| |

Name: |

John A. Sperino |

|

| |

Title: |

Vice President and Secretary |

|

| |

|

|

|

| |

|

|

|

| |

EMR US HOLDINGS LLC

|

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ John A. Sperino |

|

| |

Name: |

John A. Sperino |

|

| |

Title: |

Authorized Signatory |

|

| |

|

|

|

| |

|

|

|

| |

RUTHERFURD US LLC

|

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ John A. Sperino |

|

| |

Name: |

John A. Sperino |

|

| |

Title: |

Authorized Signatory |

|

SCHEDULE I

DIRECTORS AND EXECUTIVE OFFICERS OF

EMERSON ELECTRIC CO.

The following table sets forth certain information

with respect to the directors and executive officers of Emerson Electric Co. The business address of each director and executive officer

of Emerson Electric Co. is 8000 West Florissant Avenue, St. Louis, MO 63136.

| Name |

|

Present Principal Occupation or

Employment |

|

Citizenship |

| James S. Turley (Director) |

|

Chair of the Board, Emerson

St. Louis, MO |

|

United States |

| Mark A. Blinn (Director) |

|

Director, Emerson

St. Louis, MO |

|

United States |

| Joshua B. Bolten (Director) |

|

President and Chief Executive Officer, Business Roundtable

Washington D.C. |

|

United States |

| Martin S. Craighead (Director) |

|

Director, Emerson

St. Louis, MO |

|

United States |

| William H. Easter III (Director) |

|

Director, Emerson

St. Louis, MO |

|

United States |

| Gloria A. Flach (Director) |

|

Director, Emerson

St. Louis, MO |

|

United States |

| Arthur F. Golden (Director) |

|

Senior Counsel, Davis Polk & Wardwell

New York, NY |

|

United States |

| Leticia Goncalves (Director) |

|

President, Global Foods for Archer Daniels Midland Company (ADM)

Chicago, IL |

|

United States |

| Candace Kendle (Director) |

|

Director, Emerson

St. Louis, MO |

|

United States |

| Lori Lee (Director) |

|

CEO, AT&T Latin America & Global Marketing Officer, AT&T

Inc.

Dallas, TX |

|

United States |

| James M. McKelvey (Director) |

|

CEO, Invisibly Inc.

St. Louis, MO |

|

United States |

| Matthew S. Levatich (Director) |

|

Director, Emerson

St. Louis, MO |

|

United States |

| Surendralal (Lal) L. Karsanbhai (Director, President and Chief Executive Officer) |

|

President and Chief Executive Officer, Emerson

St. Louis, MO |

|

United States |

| Michael J. Baughman |

|

Executive Vice President, Chief Financial Officer and Chief Accounting

Officer, Emerson

St. Louis, MO |

|

United States |

| Ram R. Krishnan |

|

Executive Vice President and Chief Operating Officer, Emerson

St. Louis, MO |

|

United States |

| Peter Zornio |

|

Senior Vice President and Chief Technology Officer, Emerson

St. Louis, MO

|

|

United States |

| Name |

|

Present Principal Occupation or

Employment |

|

Citizenship |

| Sara Y. Bosco |

|

Senior Vice President, Secretary and Chief Legal Officer, Emerson

St. Louis, MO |

|

United States |

| Vidya Ramnath |

|

Senior Vice President and Chief Marketing Officer, Emerson

St. Louis, MO |

|

United States |

| Lisa A. Flavin |

|

Senior Vice President, Chief Transformation and Chief Compliance

Officer, Emerson

St. Louis, MO |

|

United States |

| Michael H. Train |

|

Senior Vice President and Chief Sustainability Officer, Emerson

St. Louis, MO |

|

United States |

| Nick Piazza |

|

Senior Vice President and Chief People Officer, Emerson

St. Louis, MO

|

|

United Kingdom |

SCHEDULE II

DIRECTORS AND EXECUTIVE OFFICERS OF

EMR HOLDINGS, INC.

The following table sets forth certain information

with respect to the directors and executive officers of EMR Holdings, Inc. The business address of each director and executive officer

of EMR Holdings, Inc. is 8000 West Florissant Avenue, St. Louis, MO 63136.

| Name |

|

Present Principal Occupation or

Employment |

|

Citizenship |

| Christopher J. Cassulo (Director, President) |

|

Director, State & Local Taxes, Emerson

St. Louis, MO |

|

United States |

| John A. Sperino (Director, Vice President & Secretary) |

|

Vice President - Governance & Securities and Assistant Secretary,

Emerson

St. Louis, MO |

|

United States |

| Kirk A. Wippermann (Director) |

|

Vice President International Tax, Emerson

St. Louis, MO |

|

United States |

SCHEDULE III

DIRECTORS AND EXECUTIVE OFFICERS OF

EMR WORLDWIDE INC.

The following table sets forth certain information

with respect to the directors and executive officers of EMR Worldwide Inc. The business address of each director and executive officer

of EMR Worldwide Inc. is 8000 West Florissant Avenue, St. Louis, MO 63136.

| Name |

|

Present Principal Occupation or

Employment |

|

Citizenship |

| John A. Sperino (Director, President & Secretary) |

|

Vice President - Governance & Securities and Assistant Secretary,

Emerson

St. Louis, MO |

|

United States |

| James H. Thomasson (Director, Treasurer) |

|

Vice President & Treasurer, Emerson

St. Louis, MO |

|

United States |

| Kirk A. Wippermann (Director, Vice President & Assistant Treasurer) |

|

Vice President International Tax, Emerson

St. Louis, MO |

|

United States |

SCHEDULE IV

MANAGERS AND EXECUTIVE OFFICERS OF

EMR US HOLDINGS LLC

The following table sets forth certain information

with respect to the managers and executive officers of EMR US Holdings LLC. The business address of each manager and executive officer

of EMR US Holdings LLC is 8000 West Florissant Avenue, St. Louis, MO 63136.

| Name |

|

Present Principal Occupation or

Employment |

|

Citizenship |

| John A. Sperino (Manager, President & Secretary) |

|

Vice President - Governance & Securities and Assistant Secretary,

Emerson

St. Louis, MO

|

|

United States |

| James H. Thomasson (Manager, Vice President & Treasurer) |

|

Vice President & Treasurer, Emerson

St. Louis, MO

|

|

United States |

| Kirk A. Wippermann (Manager) |

|

Vice President International Tax, Emerson

St. Louis, MO

|

|

United States |

SCHEDULE V

MANAGERS AND EXECUTIVE OFFICERS OF

RUTHERFURD US LLC

The following table sets forth certain information

with respect to the managers and executive officers of Rutherfurd US LLC. The business address of each manager and executive officer of

Rutherfurd US LLC is 8000 West Florissant Avenue, St. Louis, MO 63136.

| Name |

|

Present Principal Occupation or

Employment |

|

Citizenship |

| John A. Sperino (Manager, President & Secretary) |

|

Vice President - Governance & Securities and Assistant Secretary,

Emerson

St. Louis, MO |

|

United States |

| James H. Thomasson (Manager, Vice President & Treasurer) |

|

Vice President & Treasurer, Emerson

St. Louis, MO |

|

United States |

| Kirk A. Wippermann (Manager) |

|

Vice President International Tax, Emerson

St. Louis, MO

|

|

United States |

EXHIBIT 99.1

Joint Filing Agreement by and among the Reporting

Persons

JOINT FILING AGREEMENT

The undersigned hereby agree that the statement

on Schedule 13D/A, dated October 11, 2023 (the “Schedule 13D”), with respect to the common stock, par value $0.0001

per share, of Aspen Technology, Inc., is, and any amendments thereto executed by each of us shall be, filed on behalf of each of us pursuant

to and in accordance with the provisions of Rule 13d-1(k)(1) under the Securities and Exchange Act of 1934, as amended, and that this

Agreement shall be included as an exhibit to the Schedule 13D/A and each such subsequent amendment. Each of the undersigned agrees to

be responsible for the timely filing of the Schedule 13D/A and any subsequent amendments thereto, and for the completeness and accuracy

of the information concerning itself contained therein. This Agreement may be executed in any number of counterparts, all of which taken

together shall constitute one and the same instrument.

IN WITNESS WHEREOF, the undersigned have executed

this Agreement as of the 11th day of October, 2023.

| |

EMERSON ELECTRIC CO. |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ John A. Sperino |

|

| |

Name: |

John A. Sperino |

|

| |

Title: |

Vice President and Assistant

Secretary

|

|

| |

|

|

|

| |

EMR HOLDINGS, INC. |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ John A. Sperino |

|

| |

Name: |

John A. Sperino |

|

| |

Title: |

Vice President and Secretary |

|

| |

|

|

|

| |

|

|

|

| |

EMR WORLDWIDE INC. |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ John A. Sperino |

|

| |

Name: |

John A. Sperino |

|

| |

Title: |

Vice President and Secretary |

|

| |

|

|

|

| |

|

|

|

| |

EMR US HOLDINGS LLC |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ John A. Sperino |

|

| |

Name: |

John A. Sperino |

|

| |

Title: |

Authorized Signatory |

|

| |

|

|

|

| |

|

|

|

| |

RUTHERFURD US LLC |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ John A. Sperino |

|

| |

Name: |

John A. Sperino |

|

| |

Title: |

Authorized Signatory |

|

EXHIBIT 99.2

CONTRIBUTION

AGREEMENT

This

CONTRIBUTION AGREEMENT (this “Agreement”), dated as of October 6, 2023, is entered into by and among EMR Worldwide

Inc., a Delaware corporation (“WWUS”), EMR US Holdings LLC, a Delaware limited liability company (“NewCo”)

and Rutherfurd US LLC, a Delaware limited liability company (“US LLC”).

W I T N E S S

E T H :

WHEREAS,

WWUS owns certain shares of common stock, par value $0.0001 per share (all such shares, the “AZPN Shares”), of Aspen

Technology, Inc., a Delaware corporation (“AZPN”);

WHEREAS,

WWUS desires to contribute to NewCo, and NewCo desires to accept, all of WWUS’s right, title and interest in and to the AZPN Shares,

in exchange for 7,289,500 shares in NewCo;

WHEREAS,

immediately following receipt of WWUS’s right, title and interest in and to the AZPN Shares, NewCo desires to contribute to US

LLC, and US LLC desires to accept, all of NewCo’s right, title and interest in and to the AZPN Shares, in exchange for 5,179,998

Shares (as defined in the Fourth Amended and Restated Limited Liability Company Agreement of US LLC, dated as of October 6, 2023 (the

“US LLCA”)) of US LLC (the “Shares”);

WHEREAS,

WWUS is party to that certain Stockholders Agreement, dated as of May 16, 2022 (the “AZPN SHA”), with AZPN and Emerson

Electric Co., a Missouri corporation (“EMR”);

WHEREAS,

US LLC is a controlled Affiliate (as defined in the AZPN SHA) of EMR and is a permitted transferee under Section 4.2 of the AZPN SHA;

WHEREAS,

pursuant to Section 7.6 of the AZPN SHA, WWUS may assign its rights and obligations under the AZPN SHA to US LLC.

NOW,

THEREFORE, in consideration of the foregoing and the mutual covenants set forth herein and other good and valuable consideration, the

receipt, adequacy and legal sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

Section

1. WWUS Contribution. WWUS hereby contributes, assigns, transfers and delivers to NewCo

all of its right, title and interest in and to the AZPN Shares, effective as of the date hereof, and NewCo hereby accepts all such right,

title and interest in and to the AZPN Shares (the “WWUS Contribution”). The parties agree and acknowledge that the

NewCo contribution is effective at 3:00 pm Central Standard Time on October 6, 2023.

Section

2. NewCo Contribution. NewCo hereby contributes, assigns, transfers and delivers to US LLC

all of its right, title and interest in and to the AZPN Shares, effective as of immediately following the WWUS Contribution, and US LLC

hereby accepts all such

right,

title and interest in and to the AZPN Shares and, in exchange therefor, hereby issues to NewCo the Shares (the “NewCo Contribution”).

The parties agree and acknowledge that the NewCo contribution is effective at 10:00 pm Central Standard Time on October 6, 2023.

Section

3. US LLCA. NewCo hereby agrees to be a party to the US LLCA as of the date hereof, and shall have all of the rights and obligations

of a “Member” thereunder. NewCo hereby ratifies, as of the date hereof, and agrees to be bound by, all of the terms, provisions

and conditions contained in the US LLCA and hereby delivers a counterpart to the US LLCA set forth in Exhibit A hereof.

Section

4. AZPN SHA Assignment. WWUS hereby assigns all of its rights and obligations under the AZPN SHA to US LLC, and US LLC hereby

accepts such assignment and agrees to be bound by, all of the terms, provisions and conditions contained in the AZPN SHA and assumes

any obligations of WWUS thereunder; provided that this Section 4 shall not relieve WWUS of its obligations under the AZPN SHA.

Section

5. Tax Treatment. For U.S. federal income tax purposes (and applicable state and local income tax purposes), the parties hereto

intend for (a) the transaction contemplated by Section 1 to be governed by Section 351 of the Internal Revenue Code of 1986,

as amended (the “Code”) and (b) the transactions contemplated by Section 2 to be governed by Section 721

of the Code.

Section

6. Governing Law. This Agreement shall be governed by and construed in accordance with the law of the State of Delaware, without

regard to the conflicts of law principles.

Section

7. Counterparts. This Agreement may be executed in any number of counterparts, each of which shall be an original with the same

effect as if the signatures thereto and hereto were upon the same instrument.

Section

8. Further Assurances. The parties to this Agreement shall cooperate and use all of their respective best efforts to take or cause

to be taken all appropriate actions and do, or cause to be done, all things necessary or appropriate to consummate and make effective

the transactions contemplated by this Agreement.

[The

remainder of this page is intentionally left blank.]

IN

WITNESS WHEREOF, the parties hereto have caused this Agreement to be duly executed as of the date first written above.

| |

EMR WORLDWIDE INC. |

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ John A. Sperino |

| |

|

Name: |

John A. Sperino |

| |

|

Title: |

President & Secretary |

| |

|

|

|

| |

EMR US HOLDINGS LLC |

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ John A. Sperino |

| |

|

Name: |

John A. Sperino |

| |

|

Title: |

President & Secretary |

| |

|

|

|

| |

RUTHERFURD US LLC |

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ John A. Sperino |

| |

|

Name: |

John A. Sperino |

| |

|

Title: |

President & Secretary |

[Signature Page to Contribution Agreement]

EXHIBIT 99.3

JOINDER

TO

STOCKHOLDERS

AGREEMENT

October 6, 2023

This

Joinder Agreement (“Joinder”) is entered into as of October 6,

2023, by the undersigned (the “Joining Party”) in accordance with the Stockholders Agreement (the “Stockholders

Agreement”), dated as of May 16, 2022, by and among Emerson Electric Co. (the “Emerson Parent”), a Delaware

corporation, Aspen Technology, Inc., a Delaware corporation (“Company”), and EMR Worldwide Inc., a Delaware corporation

(“EMR Worldwide”).

Capitalized

terms used herein but not otherwise defined herein have the meanings ascribed to such terms in the Stockholders Agreement.

1. Joinder. The undersigned Joining Party hereby acknowledges, agrees and confirms that, by its execution of this Joinder,

the Joining Party shall (i) join and become party to the Stockholder Agreement, as of the date hereof, (ii) have all of the rights and

obligations of EMR Worldwide under the Stockholder Agreement, and (iii) perform all obligations and duties of EMR Worldwide under the

Stockholders Agreement, in each case as if the Joining Party were an original signatory to the Stockholders Agreement.

2.

Stockholders Agreement. This Joinder shall be attached to and become a part of the Stockholders Agreement.

3.

Headings; Incorporation by Reference. The headings in this Joinder are for reference only and shall not affect the interpretation

of this Joinder. Section 7.2 (Governing Law) Section 7.8 (Interpretations), and Section 7.11 (Counterparts; Electronic

Transmission of Signatures) of the Stockholders Agreement are hereby incorporated herein by reference, mutatis mutandis, as

if fully set out herein.

[SIGNATURE PAGE

TO FOLLOW]

In

Witness Whereof, the Joining Party has executed this Joinder as of the date first set forth

above.

| |

JOINING PARTY |

| |

|

|

|

| |

RUTHERFURD US LLC |

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ John A.

Sperino |

| |

|

Name: |

John A. Sperino |

| |

|

Title: |

Authorized Signatory |

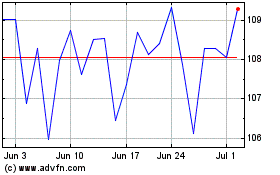

Emerson Electric (NYSE:EMR)

Historical Stock Chart

From Jun 2024 to Jul 2024

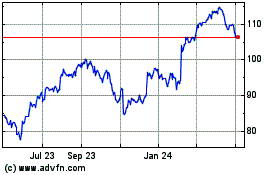

Emerson Electric (NYSE:EMR)

Historical Stock Chart

From Jul 2023 to Jul 2024