Eldorado Gold Corporation (“Eldorado” or “the

Company”) announces that the Toronto Stock Exchange (the “TSX”) has

accepted for filing Eldorado’s Notice in respect of a normal course

issuer bid (the “NCIB”). Purchases will be made on the open market

through the facilities of the TSX and/or alternative Canadian

trading systems.

Pursuant to the NCIB, Eldorado may purchase up

to 350,000 of its common shares (the “Shares”) representing

approximately 0.17% of the total 204,909,496 common shares of

Eldorado issued and outstanding as at October 31, 2024. Purchases

will be made at prevailing market prices commencing November 8,

2024 and ending July 31, 2025. Pursuant to TSX policies, daily

purchases will not exceed 83,123 common shares, other than block

purchase exceptions. The average daily trading volume for the

six-month period from May 1, 2024 to October 31, 2024 was 332,492

common shares. Purchases under the NCIB by Eldorado will be the

market price at the time of acquisition.

Eldorado has engaged National Bank Financial

Inc. (the “Broker”) as its broker under an automatic share purchase

plan to undertake purchases under the NCIB. During the term of the

automatic share purchase plan, Eldorado will not communicate any

material undisclosed information to the trading staff at the

Broker, and accordingly the Broker may make purchases regardless of

whether a blackout period is in effect or whether there is material

undisclosed information about Eldorado at the time purchases are

made.

Eldorado believes that the purchase of the

Shares would be an effective use of its funds and is an effective

strategy to enable it to satisfy its future obligations under its

employee restricted share unit plan.

Under the Company’s previous normal course

issuer bid that commenced on July 4, 2023 and terminated on July 3,

2024 under which the Company sought and received approval from the

TSX to purchase up to 500,000 common shares, 500,000 common shares

were purchased on the open market through the facilities of TSX

and/or alternative Canadian trading systems at a volume weighted

average purchase price of C$14.7482 per common

share.

A copy of Eldorado’s Notice filed with the TSX

may be obtained, by any shareholder without charge, by contacting

Eldorado’s Corporate Secretary.

About Eldorado Gold

Eldorado is a gold and base metals producer with

mining, development and exploration operations in Türkiye, Canada

and Greece. The Company has a highly skilled and dedicated

workforce, safe and responsible operations, a portfolio of

high-quality assets, and long-term partnerships with local

communities. Eldorado's common shares trade on the Toronto Stock

Exchange (TSX: ELD) and the New York Stock Exchange (NYSE:

EGO).

Contact

Investor Relations Lynette

Gould, VP, Investor Relations, Communications & External

Affairs647 271 2827 or 1 888 353 8166

lynette.gould@eldoradogold.com

MediaChad Pederson, Director,

Communications and Public Affairs236 885 6251 or 1 888 353 8166

chad.pederson@eldoradogold.com

Cautionary Note About Forward-Looking Statements and

Information

Certain of the statements made and information

provided in this press release are forward-looking statements or

information within the meaning of the United States Private

Securities Litigation Reform Act of 1995 and applicable Canadian

securities laws. Often, these forward-looking statements and

forward-looking information can be identified by the use of words

such as "plans", "expects", "is expected", "budget", “continue”,

“projected”, "scheduled", "estimates", "forecasts", "intends",

"anticipates", or "believes" or the negatives thereof or variations

of such words and phrases or statements that certain actions,

events or results "may", "could", "would", "might" or "will" be

taken, occur or be achieved.

Forward-looking statements and forward-looking

information by their nature are based on assumptions and involve

known and unknown risks, market uncertainties and other factors,

which may cause the actual results, performance or achievements of

the Company to be materially different from any future results,

performance or achievements expressed or implied by such

forward-looking statements or information.

We have made certain assumptions about the

forward-looking statements and information, including assumptions

about: general market conditions, including prevailing market

prices of our common shares and other available investment and

business opportunities. In particular, except where otherwise

stated, we have assumed a continuation of existing business

operations on substantially the same basis as exists at the time of

this release.

Even though our management believes that the

assumptions made and the expectations represented by such

statements or information are reasonable, there can be no assurance

that the forward-looking statement or information will prove to be

accurate. Many assumptions may be difficult to predict and are

beyond our control.

Furthermore, should one or more of the risks,

uncertainties or other factors materialize, or should underlying

assumptions prove incorrect, actual results may vary materially

from those described in forward-looking statements or information.

These risks, uncertainties and other factors include, among others:

our assumptions relating to general market conditions, including

prevailing market prices of our common shares, and other available

investment and business opportunities, as well as those risk

factors discussed in the sections titled “Forward-Looking

Statements” and "Risk factors in our business" in the Company's

most recent Annual Information Form & Form 40-F. The reader is

directed to carefully review the detailed risk discussion in our

most recent Annual Information Form filed on SEDAR+ and EDGAR under

our Company name, which discussion is incorporated by reference in

this release, for a fuller understanding of the risks and

uncertainties that affect the Company’s business and

operations.

The inclusion of forward-looking statements and

information is designed to help you understand management’s current

views of our near- and longer-term prospects, and it may not be

appropriate for other purposes.

There can be no assurance that forward-looking

statements or information will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Accordingly, you should not place

undue reliance on the forward-looking statements or information

contained herein. Except as required by law, we do not expect to

update forward-looking statements and information continually as

conditions change.

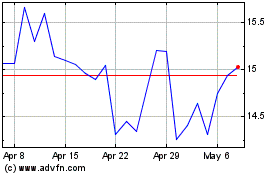

Eldorado Gold (NYSE:EGO)

Historical Stock Chart

From Nov 2024 to Dec 2024

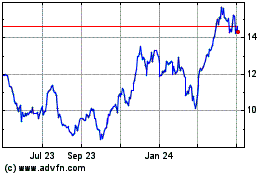

Eldorado Gold (NYSE:EGO)

Historical Stock Chart

From Dec 2023 to Dec 2024