Eldorado Gold Corporation, (“Eldorado” or “the Company”) today

reports the Company’s financial and operational results for the

fourth quarter and year ended December 31, 2023. For further

information please see the Company’s Consolidated Financial

Statements and Management’s Discussion and Analysis (“MD&A”)

filed on SEDAR+ at www.sedarplus.com under the Company’s profile.

Q4 2023 and Full-Year

Summary

Operations

-

Gold production: 143,166 ounces

in Q4 2023 reflecting continued improvements across the portfolio.

Full year production of 485,139 ounces in 2023 was at the midpoint

of the tightened guidance range and an increase of 7% from 2022

production of 453,916 ounces, driven by operational upgrades at

Kisladag and increased productivity at Olympias.

- Gold

sales: 144,827 ounces in Q4 2023 at an average realized

gold price per ounce sold(1) of $1,999, and 483,978 ounces in 2023

at an average realized gold price per ounce sold of $1,944.

- Production

costs: $137.6 million in Q4 2023, and $478.9 million in

2023, compared to $122.2 million in Q4 2022, and $459.6 million in

2022. The increases are due to higher volumes of production and

sales, as well as higher royalty expense.

- Cash

operating costs(1): $716 per ounce sold in Q4 2023 and

$743 per ounce sold in 2023, within the lowered guidance range, and

a decrease from $741 per ounce sold in Q4 2022 and $788 per ounce

sold in 2022. The decrease in both periods was primarily due to

higher production and slightly lower unit costs for key

consumables, including energy and fuel.

- All-in

sustaining costs(1) ("AISC"): $1,207 per

ounce sold in Q4 2023 and $1,220 per ounce sold in 2023, within the

tightened guidance range for the year, and lower than $1,246 per

ounce sold in Q4 2022 and $1,276 per ounce sold in 2022. Decreases

in both periods primarily reflect the decrease in cash operating

costs per ounce sold, partially offset by higher royalties due to

higher metal prices. The decrease in the year was also due to lower

sustaining capital expenditures.

- Total

capital expenditures: $128.6 million in Q4 2023, and

$401.9 million in 2023, including $52.5 million and $153.8 million

of growth capital(1) invested at our Skouries project in the

respective periods. Growth capital at the operating mines of $121.1

million in 2023 was primarily focused at Kisladag, including waste

stripping to support mine life extension, construction of the first

phase of the North Heap Leach Pad ("NHLP"), and upgraded

higher-capacity conveyors. Sustaining capital at operating

mines(1) totaled $121.8 million in 2023, including $72.7 million at

Lamaque primarily related to underground development, equipment

rebuilds, and expansion of the tailings management facility.

Financial

-

Revenue: $306.9 million in Q4 2023 an increase of

25% from revenue of $246.2 million in Q4 2022, and $1,008.5 million

in 2023, an increase of 16% from revenue of $872.0 million in 2022,

both due to higher average realized gold prices and higher volumes

sold.

- Net cash

generated from operating activities of continuing

operations: $159.6 million in Q4 2023, an increase from

$96.2 million in Q4 2022, and $382.9 million in 2023, an increase

from $211.2 million in 2022. Increases in both periods were due to

higher revenue, lower unit operating costs, lower income taxes

paid, and lower mine standby costs.

- Cash flow

from operating activities, before changes in working

capital(2): $138.0 million in Q4 2023, an

increase from $85.2 million in Q4 2022 and $411.2 million in 2023,

an increase from $239.5 million in 2022. Increases in both periods

were primarily due to higher net cash generated from operating

activities.

- Cash, cash

equivalents and term deposits: $541.6 million as at

December 31, 2023, up from $314.7 million as at

December 31, 2022.

- Net

earnings (loss) attributable to shareholders from continuing

operations: $91.8 million in Q4 2023, an increase from

$41.9 million in Q4 2022, and $106.2 million in 2023, an increase

from net loss of $49.2 million in 2022. Increases in both periods

were primarily due to higher revenue, and lower mine standby costs,

write-downs of assets, and income taxes.

- Adjusted

net earnings before interest, taxes, depreciation and amortization

("Adjusted EBITDA")(2): $147.2 million in

Q4 2023, an increase from $97.1 million in Q4 2022, and $463.3

million in 2023, an increase from $321.5 million in 2022. These

increases were driven by higher net earnings, combined with the

reversal of unrealized losses on derivative instruments of $24.6

million in Q4 2023 and $9.6 million in 2023, among other

adjustments.

- Adjusted

net earnings(2): $49.3 million or $0.24

per share in Q4 2023, an increase from $25.8 million or $0.14 per

share in Q4 2022, and $110.7 million or $0.57 per share in 2023, an

increase from $10.1 million or $0.05 per share in 2022. Adjusted

net earnings in Q4 2023 removes a $59.4 million gain on deferred

income taxes due to the Turkiye hyperinflationary tax basis

adjustment and added back a $24.6 million loss on derivative

instruments, among other adjustments. Adjusted net earnings in 2023

removes a $59.4 million gain on deferred income taxes due to the

Turkiye hyperinflationary tax basis adjustment and added back a

one-time deferred tax expense adjustment of $22.6 million related

to a retroactive income tax rate increase from 20% to 25% in

Turkiye as well as a $29.3 million loss on foreign exchange

translation of deferred tax balances, among other things.

- Free cash

flow(2): $29.3 million in Q4 2023, and negative $47.2

million in 2023 due to significant investment in growth capital.

Free cash flow excluding capital expenditures at Skouries(2) was

$82.0 million in Q4 2023 and $112.6 million in 2023.

- Project

Term Facility Drawdowns: Drawdowns on the Skouries Term

Facility as of December 31, 2023 totaled €153.2 million.

“Eldorado finished 2023 with its strongest

quarter of production, delivering 143,166 ounces of gold,” said

George Burns, President and CEO of Eldorado Gold. “Across our four

operating mines we produced 485,139 ounces of gold at an all-in

sustaining cost of $1,220 per ounce, within our guidance range.

This was an important year as we delivered 7% production growth, a

6% lower cash cost per ounce and a 4% lower AISC per ounce compared

to 2022. We achieved this in a challenging inflationary environment

and successfully delivered key initiatives across our operations.

Kisladag successfully commissioned the new agglomeration drum and

North Heap Leach Pad; Olympias started up its ventilation system

and bulk emulsion explosives; Lamaque converted a portion of the

Ormaque inferred resources into indicated in preparation for an

initial reserve later in 2024. By completing these critical

activities we have set up our operations for success to deliver

consistent, sustainable results through continued execution.”

“In 2023, following the closing of the €680

million project financing facility with two Greek Banks we advanced

into full construction on our transformational Skouries project in

Greece. In addition, we completed a C$81.5 million strategic

investment in Eldorado with the European Bank for Reconstruction

and Development. As we advanced on finalizing key contracts in

2023, we remained within the original capital cost estimate from

the December 2021 feasibility study. More recent and pending

contracts incorporate labor rates and labor hours established

through a diligent tendering process that are higher than the

feasibility study. This has positioned us to provide an update to

the overall capital cost estimate which has increased by 9% to $920

million from $845 million. With the project financing in place and

a robust balance sheet we remain fully funded to complete the

construction of Skouries. We look forward to bringing online this

world class copper-gold asset that will deliver an additional 40%

of high-quality gold production growth for our company by

2027.”

“I would like to thank our global team for all

their contributions during the year. We are well positioned for a

strong 2024 and beyond as we continue to benefit from our efforts

over the past several years to optimize our asset portfolio. With a

solid balance sheet we are well funded to complete construction of

Skouries and to advance on continuous improvement projects across

our assets. Our focus in 2024 is on safety, productivity and

driving efficiencies across our portfolio to generate free cash

flow," concluded George Burns.

Skouries Highlights

Capital Estimate and Schedule

After finalizing key contracts in 2023, the

capital cost estimate remained in line with the December 2021

feasibility study estimate. More recent and pending contracts

incorporate labor rates and labor hours established through a

diligent tendering process that are higher than the feasibility

study. This has resulted in a revised capital estimate of $920

million, an increase of 9% over the original estimate of $845

million.

The time invested in diligently negotiating the

key project contracts has increased execution confidence with a

modest effect on the production schedule. First production of the

copper-gold concentrate is now expected in the third quarter of

2025 from prior guidance of mid-2025. As such, the 2025 gold

production range has been lowered to between 50,000 to 60,000

ounces from prior guidance of 80,000 to 90,000 ounces. Copper

production is expected to be between 15 to 20 million pounds in

2025. A steep ramp up curve is expected over that second half of

2025 and remains on track for commercial production at the end of

2025. We are assessing our plans with the goal of increasing

our 2026 gold and copper production profile at Skouries.

Between the Skouries project finance facility

and our balance sheet the project remains fully

funded.

Capital spend towards the original estimate of

$845 million totalled $52.5 million in Q4 2023, and

$153.8 million in 2023.

As at December 31, 2023:

- Overall project progress was 38%

complete and 70% complete when including the first phase of

construction;

- Detailed engineering was 61%

complete and procurement was 82% complete;

- Project execution and ramp-up

continued for major earthworks including construction of haul roads

to support construction of earthworks structures;

- Mobilized contractor and commenced

work on the tailings filtration infrastructure earthworks and

pilings;

- Progress advanced on the foundation

construction of the primary crusher; and

- Completed the upgrade of the

underground power supply from 400V to 690V and the ventilation

upgrade.

As the project advances in 2024 the capital spend is expected to

be between $375 and $425 million.

Upcoming milestones in 2024 include:

Procurement and Engineering

- Substantial completion of procurement and engineering

Process Plant

- Commence construction of the control room and electrical room

building

- Commence construction of the tailings thickeners

Tailings filter facility

- Awarding the filter facility contract

- Preassembly of the filter press plates and frames

- Completion of the structural steel

IEWMF

- Completion of the coffer dam

Underground

- Awarding the underground development and test stoping

contract

- Completion of approximately 2,200 metres of underground

development

Construction Progress

Work continues to ramp up on construction for

the build of major earth works structures including the haul roads,

IEWMF construction, low-grade stockpile, water management, process

facilities, crusher and filter buildings. In addition, work will

focus on the underground development to support test stope mining

in 2025. Mechanical, piping and electrical installations will also

progress in all process and infrastructure areas.

On the critical path is the filter plant

building which continues to advance, with the piling work having

commenced. In Q2 2024 it is expected that the filter building

contract will be awarded which will include the building structure,

assembly of equipment within the building, including air

compressors, conveyors, filter presses and other ancillary

equipment, in addition to the piping and electrical work. The

filter press plates arrived on site in Q1 2024 with the frames for

supporting the filter press plates fabricated and expected to ship

in Q2 2024. Preassembly is expected to start Q2 2024.

Work for the mill/flotation building is in

progress with commissioning work on overhead cranes, installation

of construction lighting and scaffolding, and the commencement of

structural steel work. Mechanical, piping and electrical work for

the process plant are mobilizing with work commencing in Q1

2024.

By the end of 2024 we expect to have completed

the IEWMF coffer dam and significantly advanced the IEWMF

earthworks, water management facilities, process plant and filter

plants.

The first four Company owned Cat 745 trucks have

arrived on site with the remaining 15 scheduled for delivery

through the end of Q2 2024. These trucks will be used once Skouries

is in operation to build the lifts that will be required on the dry

stack tailings facility. During construction of the civil works

these trucks will be used as part of an integrated fleet with the

earthwork's construction contractor for construction of the IEWMF

facilities.

Underground Development

The upgrade of the underground power supply from

400V to 690V has been completed. The ventilation upgrade is also

complete, and the new contact water pumping system will be fully

operational in 2024.

The first phase of underground development

continues to advance the West Decline and access to the test stopes

with a local contractor. The second underground development

contract proposals are in the final evaluation stage and awarding

of the contract is planned for Q2 2024. This contract includes the

test stope work as well as additional development and services work

to support the development of the underground mine. We expect to

complete approximately 2,200 metres of underground development by

the end of 2024.

Engineering

At December 31, 2023, engineering has been fully

transitioned to Greece and was 61% complete with anticipated

substantial completion in Q3 2024. Detailed engineering work

continues to advance in all areas. The release of structural steel

for fabrication is nearing completion and construction drawings are

being issued to support the project schedule.

Procurement

At December 31, 2023, procurement was at 82%

with substantial completion expected in Q2 2024. All long lead

items have been procured and focus is now shifting to managing

fabrication and deliveries.

Operational Readiness

Recruitment of qualified and experienced people

began in 2023 and will continue through 2024 as we build workforce

capability as Skouries advances towards first production. Under the

direction of Louw Smith, Eldorado’s EVP, Development in Greece, we

are progressing with establishing the Skouries operating team with

approximately 40 personnel now on board. This includes 12 in

leadership roles, 10 embedded in the construction projects teams of

open pit mining, underground mining and dry stack tailings

construction; and 9 in sustainability. Recruitment activities are

on track with the operational workforce plan.

Workforce

In addition to the Operational Readiness team as

of December 31, 2023, there were approximately 550 personnel on

site which is expected to ramp up to 1,300 during 2024.

Year in Review: Execution Focus and

Delivery

- Health and

Safety: The Company’s lost-time injury frequency rate per

million person-hours worked ("LTIFR") was 0.42 in Q4 2023, which

was consistent with the LTIFR of Q4 2022 and overall was 0.65 in

2023, a 45% improvement from the LTIFR of 1.19 in 2022. We continue

to take proactive steps to improve workplace safety and to ensure a

safe working environment for our employees and contractors.

- Skouries

Project Financing Completed: In April 2023, Eldorado

closed on a low-cost strategic €680.4 million project

financing facility for the development of the Skouries project in

Northern Greece. The facility is structured to provide 80% of the

funding required to complete the project. Skouries is on schedule

to have first production in Q3 2025 and commercial production by

the end of 2025.

- Strategic

Investment by EBRD: In June 2023, Eldorado closed the CDN

$81.5 million strategic financing from the European Bank for

Reconstruction and Development ("EBRD"). The funds are being

invested in the Skouries project in Northern Greece, and are

credited against the Company’s 20% equity funding commitment for

the Skouries Project.

- Bought

Deal: In June 2023, the Company completed a bought deal

offering for gross proceeds of CDN $135.2 million

($101.1 million). Proceeds from the offering are expected to

be used to fund growth initiatives across Eldorado's portfolio, as

well as for general corporate and working capital purposes.

- Modified

EIA Approval - Kassandra Mines: In April 2023, the

modification to the Kassandra Mines Environmental Impact Assessment

("EIA") was approved by the Ministry of Environment and Energy,

allowing the expansion of the Olympias processing facility to 650

ktpa and improvements to the Stratoni port.

- Gold Collar

Contracts: In May 2023, Eldorado entered into a series of

zero-cost gold collar contracts in order to manage potential cash

flow variability during the Skouries construction period.

- Record Gold

Production in Quebec and Greece: The Lamaque Complex in

Quebec delivered record gold production of 177,069 ounces in 2023,

driven by increased grade and mill throughput. At the Olympias Mine

in Greece, record gold production of 67,133 ounces in 2023 was

achieved, a direct result of transformation initiatives implemented

at the site including increased ventilation capacity, bulk

emulsion, and productivity improvements at the mine and the

mill.

- Enhanced

Capacity at Kisladag: In July 2023, stacking commenced on

the newly constructed North Heap Leach Pad, with three cells under

leach. Additionally, in March 2023, the commissioning of the

upgraded materials handling and fine-ore agglomeration circuit was

completed. These productivity initiatives drove an increase in

throughput and record tonnes placed on the pads and higher

irrigation rates.

- Efemcukuru

Met Guidance for the 9th Consecutive Year: Since 2014,

Efemcukuru has met annual guidance expectations.

- Notable

awards and recognitions across the business:

- Recognized by

Resourcing Tomorrow with the Project Financing of the Year Award

for the Skouries Project Financing Facility.

- Eldorado placed 1st

overall in the Materials sector that includes Mining in the Globe

& Mail's 2023 Board Games. Board Games ranks Canada’s corporate

boards in the S&P/TSX Composite Index to assess the quality of

their governance practice and disclosure. Since 2020, Eldorado has

improved its index wide ranking from 104th to 27th.

- In Greece, the team

completed their first verification against the Mining Association

of Canada’s ‘Towards Sustainable Mining’ protocols, achieving

“Triple A” ratings across all indicators for Tailings Management

and Biodiversity, underlining the Company's commitment to

responsible mining practices.

- In Turkiye, the

team was awarded with the 2023 Euromines Silver Safety Award, which

recognizes innovation and best practices for mitigating safety

risks. The health and safety team showcased an employee engagement

project that addressed management of critical lifting equipment to

enable real-time monitoring, equipment integrity, and enhanced

controls for storage and use.

- In Turkiye, the

team received an appreciation letter from the Governorship of Usak

for the support of containers and water tanks they provided to the

earthquake zone. Additionally, our first mine rescue team was

deployed within 24 hours of the earthquake and rescued 4 people

from the earthquake rubble.

- In Canada, the team

in Quebec recently obtained the UL ECOLOGO® certification for the

application of best environmental and social practices in the

mineral exploration process. The certification evaluates on factors

such as environmental impact, personal safety, the well-being of

affected communities, business practices, the efficiency of

financial resources and the use of responsible technologies.

- Simon Hille, EVP

Technical Services and Operations, raised over $45,000 for Covenant

House Vancouver by participating in the Annual Executive Sleep Out

in Vancouver. 2023 was the second time Simon participated in the

event to raise funds and awareness for youths experiencing

homelessness, and Eldorado's 5th consecutive year. Since 2018,

Eldorado, including employee matching campaigns, has raised over

$200,000 for Covenant House Vancouver.

Multimedia

- On February 22,

2024, Eldorado updated its corporate branding. Download our updated

logo here.

- High-resolution

photos of construction at the Skouries project can be downloaded

here.

Consolidated Financial and Operational

Highlights

Summarized Annual Financial Results

|

|

|

2023 |

|

|

2022 |

|

|

2021 |

|

|

Revenue |

$1,008.5 |

|

$872.0 |

|

$940.9 |

|

|

Gold produced (oz) |

|

485,139 |

|

|

453,916 |

|

|

475,850 |

|

|

Gold sold (oz) |

|

483,978 |

|

|

452,953 |

|

|

472,307 |

|

|

Average realized gold price ($/oz sold)(2) |

$1,944 |

|

$1,787 |

|

$1,781 |

|

|

Production costs |

|

478.9 |

|

|

459.6 |

|

|

449.7 |

|

|

Cash operating costs ($/oz sold)(2,3) |

|

743 |

|

|

788 |

|

|

626 |

|

|

Total cash costs ($/oz sold)(2,3) |

|

850 |

|

|

878 |

|

|

715 |

|

|

All-in sustaining costs ($/oz sold)(2,3) |

|

1,220 |

|

|

1,276 |

|

|

1,068 |

|

|

Net earnings (loss) for the period(1) |

|

104.6 |

|

|

(353.8 |

) |

|

(136.0 |

) |

|

Net earnings (loss) per share – basic ($/share)(1) |

|

0.54 |

|

|

(1.93 |

) |

|

(0.75 |

) |

|

Net earnings (loss) per share – diluted ($/share)(1) |

|

0.54 |

|

|

(1.93 |

) |

|

(0.75 |

) |

|

Net earnings (loss) for the period continuing operations(1,4) |

|

106.2 |

|

|

(49.2 |

) |

|

20.9 |

|

|

Net earnings (loss) per share continuing operations – basic

($/share)(1,4) |

|

0.55 |

|

|

(0.27 |

) |

|

0.12 |

|

|

Net earnings (loss) per share continuing operations – diluted

($/share)(1,4) |

|

0.54 |

|

|

(0.27 |

) |

|

0.11 |

|

|

Adjusted net earnings continuing operations – basic(1,2,4) |

|

110.7 |

|

|

10.1 |

|

|

129.5 |

|

|

Adjusted net earnings per share continuing operations - basic

($/share)(1,2,4) |

|

0.57 |

|

|

0.05 |

|

|

0.72 |

|

|

Net cash generated from operating activities |

|

382.9 |

|

|

211.2 |

|

|

366.7 |

|

|

Cash flow from operating activities before changes in working

capital(2) |

|

411.2 |

|

|

239.5 |

|

|

376.5 |

|

|

Free cash flow(2) |

|

(47.2 |

) |

|

(104.5 |

) |

|

63.3 |

|

|

Free cash flow excluding Skouries(2) |

|

112.6 |

|

|

(69.4 |

) |

|

75.6 |

|

|

Cash, cash equivalents and term deposits |

|

541.6 |

|

|

314.7 |

|

|

481.3 |

|

|

Total assets |

|

4,987.6 |

|

|

4,457.9 |

|

|

4,930.7 |

|

|

Debt |

|

636.1 |

|

|

494.4 |

|

|

489.8 |

|

(1) Attributable to

shareholders of the Company. (2) These financial

measures or ratios are non-IFRS financial measures or ratios. See

the section 'Non-IFRS and Other Financial Measures and Ratios' for

explanations and discussion of these non-IFRS financial measures or

ratios. (3) Revenues from silver, lead and

zinc sales are offset against cash operating costs.

(4) Amounts presented are from continuing operations

only and exclude the Romania segment. See Note 6 of our

consolidated financial statements.

Summarized Quarterly Financial Results

|

2023 |

Q1 |

|

Q2 |

|

Q3 |

|

Q4 |

|

|

2023 |

|

|

Revenue(7) |

$227.8 |

|

$229.0 |

|

$244.8 |

|

$306.9 |

|

$1,008.5 |

|

|

Gold produced (oz)(6) |

|

111,509 |

|

|

109,435 |

|

|

121,030 |

|

|

143,166 |

|

|

485,139 |

|

|

Gold sold (oz) |

|

109,817 |

|

|

110,134 |

|

|

119,200 |

|

|

144,827 |

|

|

483,978 |

|

|

Average realized gold price ($/oz sold)(2,3) |

$1,932 |

|

$1,953 |

|

$1,879 |

|

$1,999 |

|

$1,944 |

|

|

Production costs(6,7) |

|

109.7 |

|

|

116.1 |

|

|

115.5 |

|

|

137.6 |

|

|

478.9 |

|

|

Cash operating cost ($/oz sold)(2,3,6) |

|

778 |

|

|

791 |

|

|

698 |

|

|

716 |

|

|

743 |

|

|

Total cash cost ($/oz sold)(2,3,6) |

|

857 |

|

|

928 |

|

|

794 |

|

|

830 |

|

|

850 |

|

|

All-in sustaining cost ($/oz sold)(2,3,6) |

|

1,207 |

|

|

1,296 |

|

|

1,177 |

|

|

1,207 |

|

|

1,220 |

|

|

Net earnings (loss)(4,6) |

|

19.3 |

|

|

0.9 |

|

|

(8.0 |

) |

|

92.4 |

|

|

104.6 |

|

|

Net earnings (loss) per share – basic ($/share)(4,6) |

|

0.10 |

|

|

— |

|

|

(0.04 |

) |

|

0.46 |

|

|

0.54 |

|

|

Net earnings (loss) per share – diluted ($/share)(4,6) |

|

0.10 |

|

|

— |

|

|

(0.04 |

) |

|

0.45 |

|

|

0.54 |

|

|

Net earnings (loss) for the period continuing

operations(1,4,6) |

|

19.4 |

|

|

1.5 |

|

|

(6.6 |

) |

|

91.8 |

|

|

106.2 |

|

|

Net earnings (loss) per share continuing operations – basic

($/share)(1,4,6) |

|

0.11 |

|

|

0.01 |

|

|

(0.03 |

) |

|

0.45 |

|

|

0.55 |

|

|

Net earnings (loss) per share continuing operations – diluted

($/share)(1,4,6) |

|

0.10 |

|

|

0.01 |

|

|

(0.03 |

) |

|

0.45 |

|

|

0.54 |

|

|

Adjusted net earnings (loss) continuing operations(1,2,4,6) |

|

16.7 |

|

|

9.7 |

|

|

35.0 |

|

|

49.3 |

|

|

110.7 |

|

|

Adjusted net earnings (loss) per share continuing operations -

basic($/share)(1,2,4,6) |

|

0.09 |

|

|

0.05 |

|

|

0.17 |

|

|

0.24 |

|

|

0.57 |

|

|

Net cash generated from operating activities(1) |

|

41.0 |

|

|

74.6 |

|

|

107.7 |

|

|

159.6 |

|

|

382.9 |

|

|

Cash flow from operating activities before changes in working

capital(1,2,6) |

|

93.2 |

|

|

82.4 |

|

|

97.5 |

|

|

138.0 |

|

|

411.2 |

|

|

Free cash flow(2) |

|

(34.4 |

) |

|

(22.4 |

) |

|

(19.7 |

) |

|

29.3 |

|

|

(47.2 |

) |

|

Free cash flow excluding Skouries(2) |

|

(19.2 |

) |

|

13.0 |

|

|

36.8 |

|

|

82.0 |

|

|

112.6 |

|

|

Cash, cash equivalents and term deposits |

|

262.3 |

|

|

456.6 |

|

|

476.6 |

|

|

541.6 |

|

|

541.6 |

|

|

Total assets |

|

4,501.0 |

|

|

4,742.1 |

|

|

4,812.2 |

|

|

4,987.6 |

|

|

4,987.6 |

|

|

Debt |

|

493.4 |

|

|

546.0 |

|

|

596.5 |

|

|

636.1 |

|

|

636.1 |

|

|

|

|

|

|

|

|

|

2022 |

Q1 |

|

Q2 |

|

Q3 |

|

Q4 |

|

|

2022 |

|

|

Revenue |

$194.7 |

|

$213.4 |

|

$217.7 |

|

$246.2 |

|

$872.0 |

|

|

Gold produced (oz) |

|

93,209 |

|

|

113,462 |

|

|

118,792 |

|

|

128,453 |

|

|

453,916 |

|

|

Gold sold (oz) |

|

94,472 |

|

|

107,631 |

|

|

118,388 |

|

|

132,462 |

|

|

452,953 |

|

|

Average realized gold price ($/oz sold)(2,3) |

$1,889 |

|

$1,849 |

|

$1,688 |

|

$1,754 |

|

$1,787 |

|

|

Production costs |

|

104.6 |

|

|

109.3 |

|

|

123.5 |

|

|

122.2 |

|

|

459.6 |

|

|

Cash operating cost ($/oz sold)(2,3) |

|

835 |

|

|

789 |

|

|

803 |

|

|

741 |

|

|

788 |

|

|

Total cash cost ($/oz sold)(2,3) |

|

941 |

|

|

879 |

|

|

892 |

|

|

818 |

|

|

878 |

|

|

All-in sustaining cost ($/oz sold)(2,3) |

|

1,346 |

|

|

1,270 |

|

|

1,259 |

|

|

1,246 |

|

|

1,276 |

|

|

Net (loss) earnings(4,5) |

|

(317.6 |

) |

|

(25.3 |

) |

|

(54.6 |

) |

|

43.7 |

|

|

(353.8 |

) |

|

Net (loss) earnings per share – basic ($/share)(4,5) |

|

(1.74 |

) |

|

(0.14 |

) |

|

(0.30 |

) |

|

0.24 |

|

|

(1.93 |

) |

|

Net (loss) earnings per share – diluted ($/share)(4,5) |

|

(1.74 |

) |

|

(0.14 |

) |

|

(0.30 |

) |

|

0.24 |

|

|

(1.93 |

) |

|

Net (loss) earnings for the period continuing

operations(1,4,5) |

|

(39.7 |

) |

|

(22.9 |

) |

|

(28.4 |

) |

|

41.9 |

|

|

(49.2 |

) |

|

Net (loss) earnings per share continuing operations – basic

($/share)(1,4,5) |

|

(0.22 |

) |

|

(0.12 |

) |

|

(0.15 |

) |

|

0.23 |

|

|

(0.27 |

) |

|

Net (loss) earnings per share continuing operations – diluted

($/share)(1,4,5) |

|

(0.22 |

) |

|

(0.12 |

) |

|

(0.15 |

) |

|

0.23 |

|

|

(0.27 |

) |

|

Adjusted net (loss) earnings continuing operations(1,2,4,5) |

|

(19.3 |

) |

|

13.6 |

|

|

(10.0 |

) |

|

25.8 |

|

|

10.1 |

|

|

Adjusted net (loss) earnings per share continuing operations -

basic ($/share)(1,2,4,5) |

|

(0.11 |

) |

|

0.07 |

|

|

(0.05 |

) |

|

0.14 |

|

|

0.05 |

|

|

Net cash flow from operating activities(1) |

|

35.3 |

|

|

27.0 |

|

|

52.7 |

|

|

96.2 |

|

|

211.2 |

|

|

Cash flow from operating activities before changes in working

capital(1,2) |

|

49.4 |

|

|

49.2 |

|

|

55.8 |

|

|

85.2 |

|

|

239.5 |

|

|

Free cash flow(2) |

|

(26.8 |

) |

|

(62.7 |

) |

|

(25.7 |

) |

|

10.7 |

|

|

(104.5 |

) |

|

Free cash flow excluding Skouries(2) |

|

(22.3 |

) |

|

(56.9 |

) |

|

(16.5 |

) |

|

26.3 |

|

|

(69.4 |

) |

|

Cash, cash equivalents and term deposits |

|

434.7 |

|

|

370.0 |

|

|

306.4 |

|

|

314.7 |

|

|

314.7 |

|

|

Total assets |

|

4,510.4 |

|

|

4,504.8 |

|

|

4,402.4 |

|

|

4,457.9 |

|

|

4,457.9 |

|

|

Debt |

|

482.8 |

|

|

497.2 |

|

|

497.3 |

|

|

494.4 |

|

|

494.4 |

|

(1) Amounts presented are

from continuing operations only and exclude the Romania segment.

See Note 6 of our consolidated financial statements.

(2) These financial measures or ratios are non-IFRS

financial measures or ratios. See the section 'Non-IFRS and Other

Financial Measures and Ratios' for explanations and discussion of

these non-IFRS financial measures or

ratios. (3) By-product revenues

are off-set against cash operating

costs.(4) Attributable to shareholders of the

Company.(5) Q1-Q3 2022 amounts have been adjusted to

record additional depreciation expense upon review of the estimated

remaining useful life of the existing heap leach pad and ADR plant

at Kisladag (Q1 2022: $1.0 million, Q2 2022: $3.2 million, Q3 2022:

$5.1 million, YTD 2022: $9.2 million). (6) A concentrate

weight-scale calibration correction at Olympias has resulted in an

adjustment to ending inventory as at March 31, 2023 of 1,024 gold

ounces. Gold production in Q1 2023 has been reduced by this amount,

resulting in additional production costs of $1.3 million and

additional depreciation expense of $0.7 million for Q1

2023.(7) Q1-Q3 2023 revenues and production costs have

been adjusted to reclassify freight-related concentrate sales

pricing adjustments from selling expenses to revenues. The

reclassification was $1.5 million for Q1 2023, $0.9 million for Q2

2023, and $0.4 million for Q3 2023, and has no impact on net

income.

Gold sales in 2023 totaled 483,978 ounces, an

increase of 7% from 452,953 ounces in 2022. The higher sales volume

in 2023 compared with the prior year primarily reflected an

increase of 20,243 ounces sold at Kisladag due to an increase of

tonnes placed on the heap leach pad in 2023 and utilization of the

newly commissioned NHLP. There was also an increase of 10,402

ounces sold at Olympias due to higher tonnes mined, tonnes

processed and average gold grade, and an increase of 3,086 ounces

sold at Lamaque due to increased tonnes mined and processed. These

increases were partially offset by a decrease of 2,706 ounces sold

at Efemcukuru due largely to lower average gold grade. Gold sales

were 144,827 ounces in Q4 2023, an increase of 9% from 132,462

ounces in Q4 2022, primarily due to increased production at

Kisladag and Lamaque in the quarter.

The average realized gold price(3) was $1,944

per ounce sold in 2023, an increase from $1,787 per ounce sold in

2022, primarily driven by strong prices in Q3 and Q4 2023. The

average realized gold price was $1,999 in Q4 2023 ($1,754 in Q4

2022).

Total revenue was $1,008.5 million in 2023, an

increase of 16% from revenue of $872.0 million in 2022. The

increase was due primarily to both higher sales volumes and average

realized gold price. Total revenue was $306.9 million in Q4 2023,

an increase of 25% from revenue of $246.2 million in Q4 2022, which

increased for the same reasons.

Production costs of $478.9 million in 2023

increased from $459.6 million in 2022 and production costs of

$137.6 million in Q4 2023 increased from $122.2 million in Q4 2022.

Increases in both periods were the result of higher tonnes

processed, resulting in increased labour costs and use of key

consumables across most sites. This was partially offset by

decreases in unit costs of key consumables such as electricity in

Turkiye and Greece, and fuel in Turkiye and Canada, as global cost

pressures eased during the year. Additionally, transport costs at

Olympias were lower as a result of improved shipment logistics.

Production costs include royalty expense, which

increased to $51.8 million in 2023 from $40.6 million in 2022, and

to $16.5 million in Q4 2023 from $10.2 million in Q4 2022,

primarily reflecting higher average gold prices combined with

higher sales volumes. In Turkiye, royalties are paid on revenue

less certain costs associated with ore haulage, mineral processing

and related depreciation and are calculated on the basis of a

sliding scale according to the average London Metal Exchange gold

price during the calendar year. In Greece, royalties are paid on

revenue and calculated on a sliding scale tied to international

gold and base metal prices and the EUR:USD exchange rate.

Cash operating costs(3) averaged $743 per ounce

sold in 2023, a decrease from $788 per ounce sold in 2022. In Q4

2023, cash operating costs averaged $716 per ounce sold, a decrease

from $741 per ounce sold in Q4 2022. The decrease in both periods

was primarily due to higher production and slightly lower unit

costs for key consumables, including energy and fuel.

AISC per ounce sold(3)decreased slightly to

$1,220 in 2023 from $1,276 in 2022, and to $1,207 in Q4 2023 from

$1,246 in Q4 2022. Decreases in both periods primarily reflect the

decrease in cash operating costs per ounce sold, partially offset

by higher royalties due to higher metal prices. The decrease in the

year was also due to lower sustaining capital expenditures.

We reported net earnings attributable to

shareholders from continuing operations of $106.2 million ($0.55

earnings per share) in 2023, compared to net loss of $49.2 million

($0.27 per share) in 2022 and net earnings of $91.8 million ($0.45

per share) in Q4 2023, compared to net earnings of $41.9 million

($0.23 earnings per share) in Q4 2022. Net earnings increased in

2023 primarily due to higher revenue, and lower mine standby costs,

write-downs of assets, and income taxes. Net earnings in Q4 2023

reflected higher sales volumes and gold prices, and a higher income

tax recovery, compared to Q4 2022.

Adjusted net earnings from continuing

operations(4) were $110.7 million ($0.57 per share) in 2023,

compared to $10.1 million ($0.05 per share) in 2022. Adjusted net

earnings in 2023 removes a $29.3 million loss on foreign exchange

due to translation of deferred tax balances, $59.4 million gain on

deferred income taxes due to the Turkiye hyperinflationary tax

basis adjustment, $2.0 million gain on the non-cash revaluation of

the derivative related to redemption options in our debt, $9.6

million unrealized loss on derivative instruments, and a $22.6

million deferred tax expense relating to the impact of tax rate

changes in Turkiye. Adjusted net earnings were $49.3 million ($0.24

per share) in Q4 2023 after adjusting for a $3.7 million gain on

foreign exchange due to translation of deferred tax balances, a

$59.4 million gain on deferred income taxes due to the Turkiye

hyperinflationary tax basis adjustment, a $4.0 million gain on the

non-cash revaluation of the derivative related to redemption

options in our debt, and a $24.6 million unrealized loss on

derivative instruments.

Higher sales volumes in 2023, combined with

higher average realized prices, resulted in EBITDA(4) of $442.9

million, including $118.1 million in Q4 2023. Adjusted EBITDA(4) of

$463.3 million in 2023 and $147.2 million in Q4 2023 exclude, among

other things, share based payments and losses on derivative

instruments.

Operations Update

Gold Operations

|

|

3 months ended December 31, |

|

12 months ended December 31, |

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Total |

|

|

|

|

|

Ounces produced |

|

143,166 |

|

|

128,453 |

|

|

485,139 |

|

|

453,916 |

|

|

Ounces sold |

|

144,827 |

|

|

132,462 |

|

|

483,978 |

|

|

452,953 |

|

|

Production costs |

$137.6 |

|

$122.2 |

|

$478.9 |

|

$459.6 |

|

|

Cash operating costs ($/oz sold)(1) |

$716 |

|

$741 |

|

$743 |

|

$788 |

|

|

All-in sustaining costs ($/oz sold)(1) |

$1,207 |

|

$1,246 |

|

$1,220 |

|

$1,276 |

|

|

Sustaining capital expenditures(1) |

$37.9 |

|

$36.9 |

|

$121.8 |

|

$126.5 |

|

|

Kisladag |

|

|

|

|

|

Ounces produced |

|

46,291 |

|

|

40,307 |

|

|

154,849 |

|

|

135,801 |

|

|

Ounces sold |

|

46,051 |

|

|

39,833 |

|

|

154,456 |

|

|

134,213 |

|

|

Production costs |

$36.1 |

|

$32.2 |

|

$122.8 |

|

$120.1 |

|

|

Cash operating costs ($/oz sold)(1) |

$623 |

|

$709 |

|

$657 |

|

$773 |

|

|

All-in sustaining costs ($/oz sold)(1) |

$909 |

|

$884 |

|

$900 |

|

$1,000 |

|

|

Sustaining capital expenditures(1) |

$5.6 |

|

$3.0 |

|

$16.0 |

|

$14.7 |

|

|

Lamaque |

|

|

|

|

|

Ounces produced |

|

56,619 |

|

|

51,349 |

|

|

177,069 |

|

|

174,097 |

|

|

Ounces sold |

|

57,040 |

|

|

51,244 |

|

|

176,495 |

|

|

173,409 |

|

|

Production costs |

$35.1 |

|

$29.2 |

|

$119.5 |

|

$116.7 |

|

|

Cash operating costs ($/oz sold)(1) |

$580 |

|

$541 |

|

$643 |

|

$642 |

|

|

All-in sustaining costs ($/oz sold)(1) |

$977 |

|

$925 |

|

$1,089 |

|

$1,036 |

|

|

Sustaining capital expenditures(1) |

$20.7 |

|

$18.1 |

|

$72.7 |

|

$62.8 |

|

|

Efemcukuru |

|

|

|

|

|

Ounces produced |

|

22,374 |

|

|

21,362 |

|

|

86,088 |

|

|

87,685 |

|

|

Ounces sold |

|

22,497 |

|

|

21,486 |

|

|

86,078 |

|

|

88,784 |

|

|

Production costs |

$21.4 |

|

$17.9 |

|

$80.1 |

|

$73.1 |

|

|

Cash operating costs ($/oz sold)(1) |

$816 |

|

$738 |

|

$797 |

|

$701 |

|

|

All-in sustaining costs ($/oz sold)(1) |

$1,201 |

|

$1,138 |

|

$1,154 |

|

$1,091 |

|

|

Sustaining capital expenditures(1) |

$4.4 |

|

$5.3 |

|

$14.0 |

|

$18.8 |

|

|

Olympias |

|

|

|

|

|

Ounces produced |

|

17,882 |

|

|

15,435 |

|

|

67,133 |

|

|

56,333 |

|

|

Ounces sold |

|

19,239 |

|

|

19,899 |

|

|

66,949 |

|

|

56,547 |

|

|

Production costs |

$44.9 |

|

$42.9 |

|

$156.5 |

|

$149.5 |

|

|

Cash operating costs ($/oz sold)(1) |

$1,224 |

|

$1,325 |

|

$1,133 |

|

$1,409 |

|

|

All-in sustaining costs ($/oz sold)(1) |

$1,872 |

|

$1,998 |

|

$1,688 |

|

$2,155 |

|

|

Sustaining capital expenditures(1) |

$7.2 |

|

$10.5 |

|

$19.0 |

|

$30.3 |

|

(1) These are non-IFRS

financial measures and ratios. Further details on these non-IFRS

financial measures and ratios are provided in the MD&A

accompanying Eldorado’s financial statements filed from time to

time on SEDAR+ at www.sedarplus.com.

Kisladag

Kisladag produced 154,849 ounces of gold in

2023, a 14% increase from 135,801 ounces in 2022. Gold production

of 46,291 ounces in the quarter increased 15% from 40,307 ounces in

Q4 2022, benefiting from the newly commissioned NHLP, along with

ongoing optimization of on-belt ore agglomeration. Recoverable

ounces placed on the combined heap leach pads (North and South)

increased from the prior year as a result of the efficient stacking

enabled by upgrades of the higher capacity overland conveyors and

the commissioning of the NHLP area. Production also benefited from

average grade increasing in 2023 to 0.78 grams per tonne, from an

average grade of 0.74 grams per tonne in 2022.

Revenue increased to $304.8 million in 2023 from

$243.3 million in 2022 and increased to $92.9 million from $69.9

million in Q4 2022, reflecting a combination of higher gold sales

and higher average realized prices in the current year and

quarter.

Production costs increased to $122.8 million in

2023 from $120.1 million in 2022 primarily due to increased ore

mined and processed and consumption of reagents, as well as higher

royalties due to higher average gold prices, partially offset by

decreases in unit costs of fuel and electricity as cost pressures

in Europe eased in the year as compared to the prior year.

Production costs during the quarter increased to $36.1 million from

$32.2 million in Q4 2022 also as a result of higher gold production

and ounces sold.

Depreciation expense increased to $79.9 million

in 2023 from $72.6 million in 2022 in line with higher tonnes mined

and processed, and higher sales during the year. Depreciation in

the quarter was in line with Q4 2022 despite higher sales in the

current period due to less stacking on the South Leap leach pad,

which depreciates at a faster rate given the shorter remaining

useful life in terms of the number of ounces that can be stacked on

the pad.

Cash operating costs per ounce sold in 2023

decreased to $657 from $773 in 2022 and decreased to $623 in Q4

2023 from $709 in Q4 2022. Decreases in both periods were primarily

due to higher gold production and sales, as well as lower unit

costs of consumables.

AISC per ounce sold decreased to $900 in 2023

from $1,000 in 2022 primarily due to lower cash operating costs per

ounce sold, partly offset by higher sustaining capital expenditure.

In the quarter, AISC per ounce sold increased to $909 from $884 in

Q4 2022 primarily due to higher sustaining capital expenditure,

partially offset by lower cash operating costs per ounce sold.

Sustaining capital expenditure of $16.0 million

in 2023, including $5.6 million in Q4 2023, primarily related to

equipment rebuilds, and processing and infrastructure improvements.

Growth capital investment of $83.7 million in 2023, including

$27.8 million in Q4 2023, primarily included waste stripping

to support the mine life extension, construction of the first phase

of the NHLP and related infrastructure, and building relocation due

to pit expansion.

Lamaque

Lamaque produced 177,069 ounces of gold in 2023,

a 2% increase from 174,097 ounces in 2022 as a result of slightly

higher ore throughput in the year and slightly higher grade. This

was despite the mining disruption caused by forest fires earlier in

the year that led to reduced mining faces available for ore

production in Q3. Gold production of 56,619 ounces in the quarter

was higher compared to 51,349 ounces in Q4 2022 and reflected

strong throughput that was achieved due to productivity

improvements at the mine, which allowed the mill to perform at

capacity. Average grade of 7.36 grams per tonne in the quarter was

slightly lower compared to Q4 2022, while average grade of 6.76

grams per tonne in 2023 slightly exceeded 6.65 grams per tonne in

2022.

Revenue increased to $346.3 million in 2023 from

$313.0 million in 2022 primarily reflecting a higher average

realized gold price in the year. In the quarter, both a higher

average realized gold price and higher sales were responsible for

the increase in revenue to $114.9 million from $90.0 million in Q4

2022.

Production costs increased to $119.5 million in

2023 from $116.7 million in 2022, and $35.1 million in Q4 2023 from

$29.2 million in Q4 2022, both primarily due to higher gold

production and increased headcount to enable productivity,

partially offset by slightly lower unit costs of key consumables,

including fuel and cost savings from a weaker Canadian dollar as

compared to the prior year. Cash operating costs per ounce sold was

consistent between 2023 and 2022 but increased to $580 in Q4 2023

from $541 in Q4 2022 despite higher ounces sold primarily due to

extra costs incurred in labour, contractors, and equipment rentals

to increase productivity in the quarter.

AISC per ounce sold increased to $1,089 in 2023

from $1,036 in 2022 and to $977 in Q4 2023 from $925 in Q4 2022

with increases in both periods reflecting higher cash operating

costs per ounce sold and higher sustaining capital expenditure.

Sustaining capital expenditures of $72.7 million

in 2023, including $20.7 million in Q4 2023, primarily related to

underground development, equipment rebuilds, and expansion of the

tailings management facility. Growth capital investments totalled

$23.3 million in 2023, including $8.1 million in Q4 2023, and is

primarily related to construction of underground

infrastructure.

Efemcukuru

Efemcukuru produced 86,088 payable ounces of

gold in 2023, a 2% decrease from 87,685 payable ounces in 2022,

reflecting lower grades and recoveries in the year, partially

offset by higher throughput. Gold production of 22,374 payable

ounces in the quarter was 5% higher than 21,362 payable ounces

produced in Q4 2022, primarily as a result of record throughput

rates in the fourth quarter, averaging 1,500 tpd combined with

higher grades.

Revenue increased to $170.5 million in 2023 from

$155.3 million in 2022 and to $46.7 million in Q4 2023 from $38.4

million in Q4 2022. Increases in both periods were driven primarily

by higher average realized gold prices.

Production costs increased to $80.1 million in

2023 from $73.1 million in 2022 and increased to $21.4 million in

Q4 2023 from $17.9 million in Q4 2022, primarily driven by rising

costs of labour and increased royalties due to higher average

realized gold prices. Operating cost increases and lower gold

production in the year resulted in an increase in cash operating

costs per ounce sold to $797 in 2023, from $701 in 2022. Cost

increases despite higher gold produced in the quarter resulted in

an increase in cash operating cost per ounce sold to $816 in Q4

2023 from $738 in Q4 2022. AISC per ounce sold increased to $1,154

in 2023 from $1,091 in 2022 and to $1,201 in Q4 2023 from $1,138 in

Q4 2022, primarily reflecting higher cash operating costs per ounce

sold.

Sustaining capital expenditure of $14.0 million

in 2023, including $4.4 million in Q4 2023, related primarily to

underground development and equipment rebuilds. Growth capital

investment included both development drilling and resource

conversion drilling at each of the Kokarpinar and Bati vein

systems.

Olympias

Olympias produced 67,133 ounces of gold in 2023,

a 19% increase from 56,333 ounces in 2022, reflecting higher

average gold grade and higher throughput in the year. Throughput in

2023 was 15% higher than in 2022 due to higher mining rates, a

result of key transformation initiatives implemented throughout the

year, enabling stronger mining productivity and record mill

throughput. Achievements in 2023 included a new electrical

substation resulting in increased ventilation capacity,

commissioning of bulk emulsion blasting, ongoing training and

equipment optimization. Gold production of 17,882 ounces in Q4 2023

increased from 15,435 in Q4 2022 as a result of 13% higher

throughput and higher gold grades in the quarter. Lead and silver

production increased as well compared to Q4 2022, primarily

reflecting higher throughput.

Revenue increased to $186.8 million in 2023 from

$159.9 million in 2022 and increased to $52.4 million in Q4 2023

from $47.9 million in Q4 2022 as a result of higher sales volumes

and a higher average realized gold price. From October 1, 2021,

revenue has been impacted by the 13% VAT import charge levied on

customers importing Olympias gold concentrate into China. When

levied, this import charge reduces revenue by a corresponding

amount. Revenues in 2023 benefited from lower gold treatment and

refining charges as we made more shipments to alternative markets

where this 13% import VAT on gold concentrate was not imposed.

Approximately 54% of shipments in 2023 were not subject to the 13%

import VAT.

Production costs increased to $156.5 million in

2023 from $149.5 million in 2022 and to $44.9 million in Q4 2023

from $42.9 million in Q4 2022. Increases in both periods reflect

higher production and volumes of concentrate sold, partially offset

by decreases in unit costs of certain consumables, including

electricity and fuel, and other cost savings as a result of recent

transformation initiatives. Production costs also benefited from

lower transport costs as a result of improved shipment logistics

onsite.

Cash operating costs per ounce sold decreased to

$1,133 in 2023 from $1,409 in 2022, primarily as a result of higher

ounces sold, higher by-product credits, and less shipments to China

incurring the 13% VAT import charge, which is included in cash

operating costs. Similarly, cash operating costs per ounce sold

decreased to $1,224 in Q4 2023 from $1,325 in Q4 2022 primarily due

to higher ounces sold and by-product credits. AISC per ounce sold

decreased to $1,688 in 2023 from $2,155 in 2022 and to $1,872 in Q4

2023 from $1,998 in Q4 2022 primarily due to the decrease in cash

operating costs per ounce sold and lower sustaining capital.

Sustaining capital expenditure decreased to

$19.0 million in 2023 from $30.3 million in 2022 and to $7.2

million in Q4 2023 from $10.5 million in Q4 2022. Spending in both

periods primarily included underground development and underground

infrastructure improvements. Growth capital investments in 2023 and

2022 primarily related to underground development.

For further information on the Company’s

operating results for the year-end and fourth quarter of 2023,

please see the Company’s Management’s Discussion and Analysis filed

on SEDAR+ at www.sedarplus.com under the Company’s

profile.

Conference Call

A conference call to discuss the details of the

Company’s Fourth Quarter and Year-End 2023 Results will be held by

senior management on Friday, February 23, 2024 at 8:30 AM PT (11:30

AM ET). The call will be webcast and can be accessed at Eldorado

Gold’s website: www.eldoradogold.com and via this link:

https://services.choruscall.ca/links/eldoradogold2023q4.html.

Participants may elect to pre-register for the

conference call via this link:

https://services.choruscall.ca/DiamondPassRegistration/register?confirmationNumber=10022833&linkSecurityString=1aa6fd6b8d.

Upon registration, participants will receive a

calendar invitation by email with dial in details and a unique PIN.

This will allow participants to bypass the operator queue and

connect directly to the conference. Registration will remain open

until the end of the conference call.

| Conference

Call Details |

|

Replay

(available until March 29, 2024) |

|

Date: |

February 23, 2024 |

|

Toronto: |

+1 604.638.9010 |

| Time: |

8:30 am PT (11:30 am ET) |

|

Toll Free: |

+1 800.319.6413 |

| Dial in: |

+1 604.638.5340 |

|

Access code: |

0604 |

| Toll free: |

+1 800.319.4610 |

|

|

|

| |

|

|

|

|

About Eldorado Gold

Eldorado is a gold and base metals producer with

mining, development and exploration operations in Turkiye, Canada

and Greece. The Company has a highly skilled and dedicated

workforce, safe and responsible operations, a portfolio of

high-quality assets, and long-term partnerships with local

communities. Eldorado's common shares trade on the Toronto Stock

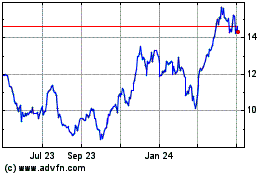

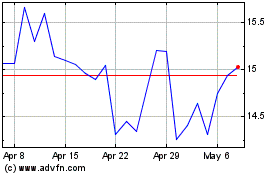

Exchange (TSX: ELD) and the New York Stock Exchange (NYSE:

EGO).

Contact

Investor Relations

Lynette Gould, VP, Investor Relations647 271

2827 or 1 888 353 8166 lynette.gould@eldoradogold.com

Media

Chad Pederson, Director, Communications236 885

6251 or 1 888 353 8166 chad.pederson@eldoradogold.com

Non-IFRS and Other Financial Measures and

Ratios

Certain non-IFRS financial measures and ratios

are included in this press release, including cash operating costs

and cash operating costs per ounce sold, total cash costs and total

cash costs per ounce sold, all-in sustaining costs ("AISC") and

AISC per ounce sold, sustaining and growth capital, average

realized gold price per ounce sold, adjusted net earnings/(loss)

attributable to shareholders, adjusted net earnings/(loss) per

share attributable to shareholders, earnings before interest,

taxes, depreciation and amortization (“EBITDA”), adjusted earnings

before interest, taxes, depreciation and amortization ("Adjusted

EBITDA"), free cash flow, free cash flow excluding Skouries,

working capital and cash flow from operating activities before

changes in working capital.

Please see the December 31, 2023 MD&A

for explanations and discussion of these non-IFRS and other

financial measures and ratios. The Company believes that these

measures and ratios, in addition to conventional measures and

ratios prepared in accordance with International Financial

Reporting Standards (“IFRS”), provide investors an improved ability

to evaluate the underlying performance of the Company. The non-IFRS

and other financial measures and ratios are intended to provide

additional information and should not be considered in isolation or

as a substitute for measures or ratios of performance prepared in

accordance with IFRS. These measures and ratios do not have any

standardized meaning prescribed under IFRS, and therefore may not

be comparable to other issuers. Certain additional disclosures for

these and other financial measures and ratios have been

incorporated by reference and can be found in the section 'Non-IFRS

and Other Financial Measures and Ratios' in the December 31,

2023 MD&A available on SEDAR+ at www.sedarplus.com and on the

Company's website under the 'Investors' section.

Reconciliation of Production Costs to Cash

Operating Costs and Cash Operating Costs per ounce sold:

|

|

Q4 2023 |

|

Q4 2022 |

|

|

2023 |

|

|

2022 |

|

|

2021 |

|

|

Production costs |

$137.6 |

|

$122.2 |

|

$478.9 |

|

$459.6 |

|

$449.7 |

|

|

Stratoni production costs(1) |

|

— |

|

|

— |

|

|

— |

|

|

(0.1 |

) |

|

(47.6 |

) |

|

Production costs – excluding Stratoni |

|

137.6 |

|

|

122.2 |

|

|

478.9 |

|

|

459.4 |

|

|

402.2 |

|

|

By-product credits(2) |

|

(21.9 |

) |

|

(17.0 |

) |

|

(83.4 |

) |

|

(77.3 |

) |

|

(64.7 |

) |

|

Royalty expense(3) |

|

(16.5 |

) |

|

(10.2 |

) |

|

(51.8 |

) |

|

(40.6 |

) |

|

(42.0 |

) |

|

Concentrate deductions(4) |

|

4.5 |

|

|

3.2 |

|

|

15.7 |

|

|

15.5 |

|

|

— |

|

|

Cash operating costs |

$103.7 |

|

$98.2 |

|

$359.4 |

|

$357.0 |

|

$295.5 |

|

|

Gold ounces sold |

|

144,827 |

|

|

132,462 |

|

|

483,978 |

|

|

452,953 |

|

|

472,307 |

|

|

Cash operating cost per ounce sold |

$716 |

|

$741 |

|

$743 |

|

$788 |

|

$626 |

|

(1) Base

metals production, presented for 2021. Operations at Stratoni were

suspended at the end of 2021.(2) Revenue from silver,

lead and zinc sales.(3) Included in production

costs.(4) Included in revenue.

For the three months ended December 31,

2023:

|

|

Direct mining costs |

|

|

By-product credits |

|

|

Refining and selling costs |

|

|

Inventory change(1) |

|

|

Cash operating costs |

|

|

Gold oz sold |

|

|

Cash operating cost/oz sold |

|

|

Kisladag |

$37.4 |

|

|

($0.8 |

) |

|

$0.2 |

|

|

($8.1 |

) |

|

$28.7 |

|

|

46,051 |

|

|

$623 |

|

|

Lamaque |

32.7 |

|

|

(0.5 |

) |

|

0.1 |

|

|

0.8 |

|

|

33.1 |

|

|

57,040 |

|

|

580 |

|

|

Efemcukuru |

16.0 |

|

|

(1.1 |

) |

|

3.7 |

|

|

(0.3 |

) |

|

18.4 |

|

|

22,497 |

|

|

816 |

|

|

Olympias |

35.5 |

|

|

(19.4 |

) |

|

6.3 |

|

|

1.2 |

|

|

23.5 |

|

|

19,239 |

|

|

1,224 |

|

|

Total consolidated |

$121.6 |

|

|

($21.9 |

) |

|

$10.3 |

|

|

($6.3 |

) |

|

$103.7 |

|

|

144,827 |

|

|

$716 |

|

(1) Inventory change adjustments result from timing

differences between when inventory is produced and when it is

sold.

For the year ended December 31, 2023:

|

|

Direct mining costs |

|

|

By-product credits |

|

|

Refining and selling costs |

|

|

Inventory change(1) |

|

|

Cash operating costs |

|

|

Gold oz sold |

|

|

Cash operating cost/oz sold |

|

|

Kisladag |

$128.0 |

|

|

($3.1 |

) |

|

$0.7 |

|

|

($24.1 |

) |

|

$101.4 |

|

|

154,456 |

|

|

$657 |

|

|

Lamaque |

116.3 |

|

|

(1.7 |

) |

|

0.4 |

|

|

(1.5 |

) |

|

113.5 |

|

|

176,495 |

|

|

643 |

|

|

Efemcukuru |

59.1 |

|

|

(4.4 |

) |

|

14.0 |

|

|

(0.1 |

) |

|

68.6 |

|

|

86,078 |

|

|

797 |

|

|

Olympias |

126.3 |

|

|

(74.1 |

) |

|

23.0 |

|

|

0.7 |

|

|

75.9 |

|

|

66,949 |

|

|

1,133 |

|

|

Total consolidated |

$429.7 |

|

|

($83.4 |

) |

|

$38.1 |

|

|

($25.0 |

) |

|

$359.4 |

|

|

483,978 |

|

|

$743 |

|

(1) Inventory change adjustments result from timing

differences between when inventory is produced and when it is

sold.

For the three months ended December 31,

2022:

|

|

Direct mining costs |

|

|

By-product credits |

|

|

Refining and selling costs |

|

|

Inventory change(1) |

|

|

Cash operating costs |

|

|

Gold oz sold |

|

|

Cash operating cost/oz sold |

|

|

Kisladag |

$32.3 |

|

|

($0.7 |

) |

|

$0.2 |

|

|

($3.6 |

) |

|

$28.2 |

|

|

39,833 |

|

|

$709 |

|

|

Lamaque |

26.3 |

|

|

(0.4 |

) |

|

0.1 |

|

|

1.7 |

|

|

27.7 |

|

|

51,244 |

|

|

541 |

|

|

Efemcukuru |

13.5 |

|

|

(1.0 |

) |

|

3.5 |

|

|

(0.2 |

) |

|

15.9 |

|

|

21,486 |

|

|

738 |

|

|

Olympias |

29.1 |

|

|

(15.0 |

) |

|

8.1 |

|

|

4.2 |

|

|

26.4 |

|

|

19,899 |

|

|

1,325 |

|

|

Total consolidated |

$101.1 |

|

|

($17.0 |

) |

|

$12.0 |

|

|

$2.1 |

|

|

$98.2 |

|

|

132,462 |

|

|

$741 |

|

(1) Inventory change adjustments result from timing

differences between when inventory is produced and when it is

sold.

For the year ended December 31, 2022:

|

|

Direct mining costs |

|

|

By-product credits |

|

|

Refining and selling costs |

|

|

Inventory change(1) |

|

|

Cash operating costs |

|

|

Gold oz sold |

|

|

Cash operating cost/oz sold |

|

|

Kisladag |

$110.9 |

|

|

($2.8 |

) |

|

$1.1 |

|

|

($5.5 |

) |

|

$103.7 |

|

|

134,213 |

|

|

$773 |

|

|

Lamaque |

109.9 |

|

|

(1.4 |

) |

|

0.3 |

|

|

2.6 |

|

|

111.3 |

|

|

173,409 |

|

|

642 |

|

|

Efemcukuru |

52.1 |

|

|

(3.3 |

) |

|

13.1 |

|

|

0.3 |

|

|

62.2 |

|

|

88,784 |

|

|

701 |

|

|

Olympias |

113.0 |

|

|

(69.9 |

) |

|

30.0 |

|

|

6.6 |

|

|

79.7 |

|

|

56,547 |

|

|

1,409 |

|

|

Total consolidated |

$385.8 |

|

|

($77.3 |

) |

|

$44.6 |

|

|

$4.0 |

|

|

$357.0 |

|

|

452,953 |

|

|

$788 |

|

(1) Inventory change adjustments result from timing

differences between when inventory is produced and when it is

sold.

Reconciliation of Cash Operating Costs to Total

Cash Costs and Total Cash Costs per ounce sold:

|

|

Q4 2023 |

|

Q4 2022 |

|

2023 |

|

2022 |

|

2021 |

|

|

Cash operating costs |

$103.7 |

|

$98.2 |

|

$359.4 |

|

$357.0 |

|

$295.5 |

|

|

Royalty expense(1) |

16.5 |

|

10.2 |

|

51.8 |

|

40.6 |

|

42.0 |

|

|

Total cash costs |

$120.2 |

|

$108.4 |

|

$411.3 |

|

$397.6 |

|

$337.5 |

|

|

Gold ounces sold |

144,827 |

|

132,462 |

|

483,978 |

|

452,953 |

|

472,307 |

|

|

Total cash costs per ounce sold |

$830 |

|

$818 |

|

$850 |

|

$878 |

|

$715 |

|

(1) Included in production costs.

Reconciliation of All-in Sustaining Costs and

All-in Sustaining Costs per ounce sold:

|

|

Q4 2023 |

|

Q4 2022 |

|

2023 |

|

2022 |

|

2021 |

|

|

Total cash costs |

$120.2 |

|

$108.4 |

|

$411.3 |

|

$397.6 |

|

$337.5 |

|

|

Corporate and allocated G&A |

14.1 |

|

18.2 |

|

46.7 |

|

45.6 |

|

37.4 |

|

|

Exploration and evaluation costs |

0.3 |

|

(0.3 |

) |

1.2 |

|

1.1 |

|

12.3 |

|

|

Reclamation costs and amortization |

2.2 |

|

1.8 |

|

9.3 |

|

7.1 |

|

4.4 |

|

|

Sustaining capital expenditure |

37.9 |

|

36.9 |

|

121.8 |

|

126.5 |

|

113.1 |

|

|

AISC |

$174.8 |

|

$165.0 |

|

$590.3 |

|

$577.9 |

|

$504.6 |

|

|

Gold ounces sold |

144,827 |

|

132,462 |

|

483,978 |

|

452,953 |

|

472,307 |

|

|

AISC per ounce sold |

$1,207 |

|

$1,246 |

|

$1,220 |

|

$1,276 |

|

$1,068 |

|

Reconciliations of adjustments within AISC to the most directly

comparable IFRS measures are presented below.

Reconciliation of general and administrative

expenses included in All-in Sustaining Costs:

|

|

Q4 2023 |

|

Q4 2022 |

|

2023 |

|

2022 |

|

2021 |

|

|

General and administrative expenses(from

consolidated statement of operations) |

$10.5 |

|

$13.9 |

|

$39.8 |

|

$37.0 |

|

$35.5 |

|

|

Add: |

|

|

|

|

|

|