Evergreen Resources, Inc. Announces Pricing of $200 Million Offering of Senior Subordinated Notes

March 05 2004 - 12:14PM

PR Newswire (US)

Evergreen Resources, Inc. Announces Pricing of $200 Million

Offering of Senior Subordinated Notes DENVER, March 5

/PRNewswire-FirstCall/ -- EVERGREEN RESOURCES, INC. announced today

that it has priced a private offering of $200 million of Senior

Subordinated Notes due 2012. The securities were priced at 99.213%

of par with a coupon of 5.875%. The offering is expected to close

on March 10, 2004 and is subject to satisfaction of customary

closing conditions. Evergreen intends to use the net proceeds of

the offering to completely discharge outstanding indebtedness under

its existing credit facilities and provide funding for future

development expenditures and for general corporate purposes. This

announcement is neither an offer to sell nor a solicitation of an

offer to buy any of these securities. The securities being sold

have not been registered under the Securities Act of 1933, as

amended (the "Securities Act"), or any state securities laws and,

unless so registered, the securities may not be offered or sold in

the United States except pursuant to an exemption from, or in a

transaction not subject to, the registration requirements of the

Securities Act and applicable state securities laws. Evergreen

Resources is an independent energy company engaged primarily in the

exploration, development, production, operation and acquisition of

unconventional natural gas properties. Evergreen is one of the

leading developers of coal bed methane reserves in the United

States. Evergreen's current operations are principally focused on

developing and expanding its coal bed methane project located in

the Raton Basin in southern Colorado. Evergreen has also begun coal

bed methane projects in Alaska and the Forest City Basin of eastern

Kansas and holds conventional oil and gas producing property

interests in the Piceance Basin in western Colorado, the Uintah

Basin in eastern Utah, and in the Western Canadian Sedimentary

Basin in south-central Alberta, Canada. Evergreen's common stock is

traded on the New York Stock Exchange under the symbol "EVG." This

press release contains forward-looking statements within the

meaning of federal securities laws, including statements regarding,

among other things, Evergreen's growth strategies; anticipated

trends in Evergreen's business and its future results of

operations; market conditions in the oil and gas industry; the

ability of Evergreen to make and integrate acquisitions; and the

impact of government regulations. These forward-looking statements

are based largely on Evergreen's expectations and are subject to a

number of risks and uncertainties, many of which are beyond

Evergreen's control. Actual results could differ materially from

those implied by these forward-looking statements as a result of,

among other things, a decline in natural gas production, a decline

in natural gas prices, incorrect estimations of required capital

expenditures, increases in the cost of drilling, completion and gas

collection, an increase in the cost of production and operations,

an inability to meet projections, and/or changes in general

economic conditions. In light of these and other risks and

uncertainties of which Evergreen may be unaware or which Evergreen

currently deems immaterial, there can be no assurance that actual

results will be as projected in the forward-looking statements.

These and other risks and uncertainties are described in more

detail in the company's most recent Annual Report on Form 10-K

filed with the Securities and Exchange Commission. DATASOURCE:

Evergreen Resources, Inc. CONTACT: John B. Kelso, Director of

Investor Relations of Evergreen Resources, Inc., +1-303-298-8100

Copyright

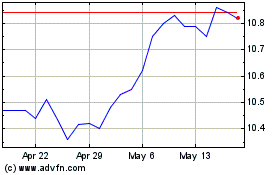

Eaton Vance Short Durati... (NYSE:EVG)

Historical Stock Chart

From Sep 2024 to Oct 2024

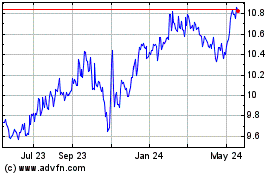

Eaton Vance Short Durati... (NYSE:EVG)

Historical Stock Chart

From Oct 2023 to Oct 2024