Eastman Kodak Company (NYSE: KODK) today reported financial results

for the third quarter 2024.

Third-quarter 2024 highlights include:

- Consolidated revenues of $261 million, compared with $269

million for Q3 2023, a decrease of $8 million or 3 percent

- Gross profit of $45 million, compared with $50 million for Q3

2023, a decrease of $5 million or 10 percent

- Gross profit percentage of 17 percent, compared with 19 percent

for Q3 2023, a decrease of 2 percentage points

- GAAP net income of $18 million, compared with net income of $2

million for Q3 2023, an increase of $16 million or 800 percent

- Operational EBITDA of $1 million, compared with $12 million for

Q3 2023, a decrease of $11 million or 92 percent

- A quarter-end cash balance of $214 million, compared with $255

million on December 31, 2023, a decrease of $41 million

“In the third quarter, Kodak continued to focus on

the fundamentals of our long-term strategic plan: increasing

operating efficiency, investing in innovation and driving smart

revenue,” said Jim Continenza, Kodak’s Executive Chairman and CEO.

“Our Advanced Materials & Chemicals group continues to emerge

as a key part of our future and we continue to invest in AM&C

growth initiatives, including the cGMP facility for manufacturing

pharmaceutical ingredients currently nearing completion at Eastman

Business Park. Our legacy AM&C film business is growing

rapidly, and we are investing capex to increase capacity to meet

demand. In our commercial print business, we recently received an

affirmative determination from the U.S. International Trade

Commission in our tariff cases concerning imports of aluminum

printing plates from Japan and China. This is an important win for

the U.S. printing industry and Kodak because it establishes a level

playing field in the U.S. plates business which will allow us to

continue providing our customers with reliable supplies of

high-quality plates. We continue to gain momentum with our

groundbreaking continuous inkjet press portfolio. Looking forward,

we will continue to invest in streamlining our operations and

developing the leading-edge products our customers expect from

Kodak.”

For the quarter ended September 30, 2024, revenues

were $261 million, a decrease of $8 million or 3 percent compared

to the same period in 2023. Excluding the impact of foreign

exchange, revenue declined $9 million or 3 percent.

GAAP net income was $18 million for the quarter,

compared to $2 million in Q3 2023, an increase of $16 million or

800 percent. Operational EBITDA for the quarter ended September 30,

2024 was $1 million, compared to $12 million in Q3 2023, a decrease

of $11 million. The decrease was primarily driven by higher

manufacturing costs driven by an increase in aluminum costs,

changes in employee benefit reserves, inventory reserve adjustment,

as well as an increase in costs associated with certain litigation

matters.

Kodak ended the third quarter with a cash balance

of $214 million, a decrease of $41 million from December 31, 2023.

The decrease was driven by capital expenditures primarily to fund

growth initiatives, investments in technology systems and

organizational structure and lower profitability from operations,

partially offset by improvements in working capital primarily due

to cash proceeds of $40 million from brand licensing in the first

quarter of 2024.

“Kodak continued to execute on its long-term

strategy in the third quarter,” said David Bullwinkle, Kodak’s CFO.

“The decline in revenue, which slowed compared to recent quarters,

reflects our ongoing focus on generating smart revenue to drive

stronger profitability. Kodak ended the quarter with a cash balance

of $214 million, compared with $255 million on December 31, 2023,

which is in line with our expectations. The decline reflects our

continued capex investments in supporting AM&C growth

initiatives, along with building working capital in AM&C to

allow us to keep customers supplied as we make improvements in our

manufacturing facilities. Looking ahead, we plan to invest in

increasing operational efficiency and expanding manufacturing

capacity to continue delivering reliable value to our

customers.”

Revenue and Operational EBITDA by

Reportable Segment Q3 2024 vs. Q3 2023

| ($

millions) |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Q3 2024 Actuals |

Print |

|

Advanced Materials & Chemicals |

|

Brand |

|

Total |

|

Revenue |

$ |

182 |

|

|

$ |

71 |

|

$ |

5 |

|

$ |

258 |

|

| Operational EBITDA

* |

$ |

(9 |

) |

|

$ |

6 |

|

$ |

4 |

|

$ |

1 |

|

| |

|

|

|

|

|

|

|

|

Q3 2023 Actuals |

Print |

|

Advanced Materials & Chemicals |

|

Brand |

|

Total |

| Revenue |

$ |

196 |

|

|

$ |

64 |

|

$ |

4 |

|

$ |

264 |

|

| Operational EBITDA

* |

$ |

4 |

|

|

$ |

4 |

|

$ |

4 |

|

$ |

12 |

|

| |

|

|

|

|

|

|

|

|

Q3 2024 vs. Q3 2023 Actuals

B/(W) |

Print |

|

Advanced Materials & Chemicals |

|

Brand |

|

Total |

| Revenue |

$ |

(14 |

) |

|

$ |

7 |

|

$ |

1 |

|

$ |

(6 |

) |

| Operational EBITDA

* |

$ |

(13 |

) |

|

$ |

2 |

|

$ |

- |

|

$ |

(11 |

) |

| |

|

|

|

|

|

|

|

|

Q3 2024 Actuals on constant currency

** vs. Q3 2023

ActualsB/(W) |

Print |

|

Advanced Materials & Chemicals |

|

Brand |

|

Total |

| Revenue |

$ |

(15 |

) |

|

$ |

7 |

|

$ |

1 |

|

$ |

(7 |

) |

| Operational EBITDA

* |

$ |

(13 |

) |

|

$ |

2 |

|

$ |

- |

|

$ |

(11 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

* Total Operational EBITDA is a non-GAAP financial

measure. The reconciliation between GAAP and non-GAAP measures is

provided in Appendix A of this press release.

** The impact of foreign exchange represents the

foreign exchange impact using average foreign exchange rates for

the three months ended September 30, 2023, rather than the actual

average exchange rates in effect for the three months ended

September 30, 2024.

Eastman Business Park segment is not a reportable

segment and is excluded from the table above.

About KodakKodak (NYSE: KODK) is a

leading global manufacturer focused on commercial print and

advanced materials & chemicals. With 79,000 worldwide patents

earned over 130 years of R&D, we believe in the power of

technology and science to enhance what the world sees and creates.

Our innovative, award-winning products, combined with our

customer-first approach, make us the partner of choice for

commercial printers worldwide. Kodak is committed to environmental

stewardship, including industry leadership in developing

sustainable solutions for print. For additional information on

Kodak, visit us at kodak.com, or follow us on X @Kodak

and LinkedIn.

Cautionary Statement Regarding

Forward-Looking Statements

This press release includes “forward-looking

statements” as that term is defined under the Private Securities

Litigation Reform Act of 1995.

Forward-looking statements include statements

concerning Kodak’s plans, objectives, goals, strategies, future

events, future revenue or performance, capital expenditures,

liquidity, investments, financing needs and business trends and

other information that is not historical information. When used in

this press release, the words “estimates,” “expects,”

“anticipates,” “projects,” “plans,” “intends,” “believes,”

“predicts,” “forecasts,” “strategy,” “continues,” “goals,”

“targets” or future or conditional verbs, such as “will,” “should,”

“could,” or “may,” and similar words and expressions, as well as

statements that do not relate strictly to historical or current

facts, are intended to identify forward-looking statements. All

forward-looking statements, including management’s examination of

historical operating trends and data, are based upon Kodak’s

current expectations and assumptions. Forward-looking statements

are subject to risks, uncertainties and other factors that could

cause actual results to differ materially from historical results

or those expressed in or implied by such forward-looking

statements.

Important factors that could cause actual events or

results to differ materially from the forward-looking statements

include, among others, the risks and uncertainties described in

more detail in Kodak’s Annual Report on Form 10-K for the year

ended December 31, 2023 under the headings “Business,” “Risk

Factors,” “Legal Proceedings,” and/or “Management’s Discussion and

Analysis of Financial Condition and Results of Operations–Liquidity

and Capital Resources,” in the corresponding sections of Kodak’s

Quarterly Reports on Form 10-Q for the quarters ended March 31,

2024, June 30, 2024 and September 30, 2024, and in other filings

Kodak makes with the U.S. Securities and Exchange Commission from

time to time, as well as the following: Kodak’s ability

to improve and sustain its operating structure, cash flow,

profitability and other financial results; Kodak’s ability to

achieve strategic objectives, cash forecasts, financial

projections, and projected growth; Kodak’s ability to achieve the

financial and operational results contained in its business plans;

Kodak’s ability to obtain additional or alternate financing if and

as needed, Kodak’s continued ability to manage world-wide cash

through inter-company loans, distributions and other mechanisms,

and Kodak’s ability to provide or facilitate financing for its

customers; Kodak’s ability to fund continued investments, capital

needs and collateral requirements and service its debt and Series B

Preferred Stock and Series C Preferred Stock; Changes in foreign

currency exchange rates, commodity prices, interest rates and

tariff rates; the impact of the global economic environment,

including inflationary pressures, geopolitical issues such as the

war in Ukraine and conflicts involving Israel, medical epidemics,

and Kodak’s ability to effectively mitigate the associated

increased costs of aluminum and other raw materials, energy, labor,

shipping, delays in shipment and production times, and fluctuations

in demand; Kodak’s ability to effectively compete with large,

well-financed industry participants or with competitors whose cost

structure is lower than Kodak’s; the performance by third parties

of their obligations to supply products, components or services to

Kodak and Kodak’s ability to address supply chain disruptions and

continue to obtain raw materials and components available from

single or limited sources of supply, which may be adversely

affected by the war in Ukraine, the conflicts involving Israel, and

residual effects of the COVID-19 pandemic; Kodak’s ability to

comply with the covenants in its various credit facilities; Kodak’s

ability to effectively anticipate technology and industry trends

and develop and market new products, solutions and technologies,

including products based on its technology and expertise that

relate to industries in which it does not currently conduct

material business; Kodak’s ability to effect strategic

transactions, such as investments, acquisitions, strategic

alliances, divestitures and similar transactions, or to achieve the

benefits sought to be achieved from such strategic transactions;

Kodak’s ability to discontinue, sell or spin-off certain non-core

businesses or operations, or otherwise monetize assets; the impact

of the investigations, litigation and claims arising out of the

circumstances surrounding the announcement on July 28, 2020, by the

U.S. International Development Finance Corporation of the signing

of a non‐binding letter of interest to provide a subsidiary of

Kodak with a potential loan to support the launch of an initiative

for the manufacture of pharmaceutical ingredients for essential

generic drugs; and the potential impact of force majeure events,

cyber‐attacks or other data security incidents or information

technology outages that could disrupt or otherwise harm Kodak’s

operations.

Future events and other factors may cause Kodak’s

actual results to differ materially from the forward-looking

statements. All forward-looking statements attributable to Kodak or

persons acting on its behalf apply only as of the date of this

press release and are expressly qualified in their entirety by the

cautionary statements included or referenced in this press release.

Kodak undertakes no obligation to update or revise forward-looking

statements to reflect events or circumstances that arise after the

date made or to reflect the occurrence of unanticipated events,

except as required by law.

APPENDICES

In this third quarter 2024 financial results news

release, reference is made to the following non-GAAP financial

measures:

- Operational EBITDA; and

- Revenues on a constant currency basis.

Kodak believes that these non-GAAP measures

represent important internal measures of performance. Accordingly,

where they are provided, it is to give investors the same financial

data management uses with the belief that this information will

assist the investment community in properly assessing the

underlying performance of Kodak, its financial condition, results

of operations and cash flow.

Kodak’s segment measure of profit and loss is an

adjusted earnings before interest, taxes, depreciation and

amortization (“Operational EBITDA”). Operational EBITDA represents

the earnings from operations excluding the provision for income

taxes; non-service cost components of pension and other

postemployment benefits income; depreciation and amortization

expense; restructuring costs and other; stock-based compensation

expense; consulting and other costs; interest expense; loss on

extinguishment of debt; and other (income) charges, net.

The change in revenues on a constant currency

basis, as presented in this financial results news release, is

calculated by using average foreign exchange rates for the three

months ended September 30, 2023, rather than the actual average

exchange rates in effect for the three months ended September 30,

2024.

The following table reconciles the most directly

comparable GAAP measure of Net Income to Operational EBITDA for the

three months ended September 30, 2024 and 2023, respectively:

| (in

millions) |

|

|

|

|

|

|

|

| |

Q3 2024 |

|

Q3 2023 |

|

$ Change |

|

% Change |

|

Net Income |

$ |

18 |

|

|

$ |

2 |

|

|

$ |

16 |

|

|

800 |

% |

| All other |

|

(1 |

) |

|

|

(2 |

) |

|

|

1 |

|

|

|

| Depreciation and

amortization |

|

8 |

|

|

|

7 |

|

|

|

1 |

|

|

|

| Restructuring costs and other

(1) |

|

1 |

|

|

|

3 |

|

|

|

(2 |

) |

|

|

| Stock based compensation |

|

1 |

|

|

|

1 |

|

|

|

- |

|

|

|

| Consulting and other costs

(2) |

|

- |

|

|

|

1 |

|

|

|

(1 |

) |

|

|

| Interest expense (3) |

|

14 |

|

|

|

14 |

|

|

|

- |

|

|

|

| Pension income excluding

service cost component (3) |

|

(42 |

) |

|

|

(41 |

) |

|

|

(1 |

) |

|

|

| Loss on extinguishment of debt

(3) |

|

- |

|

|

|

27 |

|

|

|

(27 |

) |

|

|

| Other (income) charges, net

(3) |

|

(1 |

) |

|

|

2 |

|

|

|

(3 |

) |

|

|

| Provision (benefit) for income

taxes (3) |

|

3 |

|

|

|

(2 |

) |

|

|

5 |

|

|

|

| Operational

EBITDA |

$ |

1 |

|

|

$ |

12 |

|

|

$ |

(11 |

) |

|

-92 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Footnote Explanations:

(1) Restructuring costs and other for the three

months ended September 30, 2023 included $1 million which was

reported as Restructuring costs and other and $2 million

representing inventory write-downs which was reported as Cost of

revenues.

(2) Consulting and other costs are primarily

professional services and internal costs associated with certain

corporate strategic initiatives, investigations and litigation.

Consulting and other costs included $1 million of income in the

three months ended September 30, 2023, representing insurance

reimbursement of legal costs previously paid by the Company

associated with investigations and litigation matters.

(3) As reported in the Consolidated Statement of

Operations.

- FINANCIAL

STATEMENTS

| EASTMAN

KODAK COMPANY |

|

CONSOLIDATED STATEMENT OF

OPERATIONS(Unaudited) |

| |

|

|

|

| (in millions, except per share

data) |

Three Months Ended |

|

|

September 30, |

|

|

|

2024 |

|

|

|

2023 |

|

| Revenues |

|

|

|

|

Sales |

$ |

221 |

|

|

$ |

220 |

|

|

Services |

|

40 |

|

|

|

49 |

|

| Total revenues |

|

261 |

|

|

|

269 |

|

| Cost of revenues |

|

|

|

|

Sales |

|

185 |

|

|

|

183 |

|

|

Services |

|

31 |

|

|

|

36 |

|

| Total cost of revenues |

|

216 |

|

|

|

219 |

|

|

Gross profit |

|

45 |

|

|

|

50 |

|

| Selling, general and

administrative expenses |

|

44 |

|

|

|

40 |

|

| Research and development

costs |

|

8 |

|

|

|

7 |

|

| Restructuring costs and

other |

|

1 |

|

|

|

1 |

|

| (Loss) earnings from operations

before interest expense, pension income excluding service cost

component, loss on extinguishment of debt, other (income) charges,

net and income taxes |

|

(8 |

) |

|

|

2 |

|

| Interest expense |

|

14 |

|

|

|

14 |

|

| Pension income excluding service

cost component |

|

(42 |

) |

|

|

(41 |

) |

| Loss on extinguishment of

debt |

|

- |

|

|

|

27 |

|

| Other (income) charges, net |

|

(1 |

) |

|

|

2 |

|

| Earnings from operations before

income taxes |

|

21 |

|

|

|

- |

|

| Provision (benefit) for income

taxes |

|

3 |

|

|

|

(2 |

) |

| NET EARNINGS |

$ |

18 |

|

|

$ |

2 |

|

|

|

|

|

|

| Basic earnings per share

attributable to Eastman Kodak Company common shareholders |

$ |

0.16 |

|

|

$ |

- |

|

| |

|

|

|

| Diluted earnings per share

attributable to Eastman Kodak Company common shareholders |

$ |

0.15 |

|

|

$ |

- |

|

| |

|

|

|

|

|

|

|

The notes accompanying the financial statements

contained in the Company’s third quarter 2024 Form 10-Q are an

integral part of these consolidated financial statements.

| |

|

|

|

| EASTMAN

KODAK COMPANY |

|

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

(Unaudited) |

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

September 30, |

|

December 31, |

|

(in millions) |

|

2024 |

|

|

|

2023 |

|

| ASSETS |

|

|

|

| Cash and cash equivalents |

$ |

214 |

|

|

$ |

255 |

|

| Trade receivables, net of

allowances of $7 and $8, respectively |

|

143 |

|

|

|

195 |

|

| Inventories, net |

|

241 |

|

|

|

217 |

|

| Other current assets |

|

44 |

|

|

|

45 |

|

|

Total current assets |

|

642 |

|

|

|

712 |

|

| Property, plant and equipment,

net of accumulated depreciation of $481 and $470, respectively |

|

190 |

|

|

|

169 |

|

| Goodwill |

|

12 |

|

|

|

12 |

|

| Intangible assets, net |

|

21 |

|

|

|

24 |

|

| Operating lease right-of-use

assets |

|

28 |

|

|

|

30 |

|

| Restricted cash |

|

100 |

|

|

|

110 |

|

| Pension and other postretirement

assets |

|

1,313 |

|

|

|

1,216 |

|

| Other long-term assets |

|

82 |

|

|

|

82 |

|

|

TOTAL ASSETS |

$ |

2,388 |

|

|

$ |

2,355 |

|

|

|

|

|

|

| LIABILITIES, REDEEMABLE

CONVERTIBLE PREFERRED STOCK AND EQUITY |

|

|

|

| Accounts payable, trade |

$ |

128 |

|

|

$ |

125 |

|

| Short-term borrowings and current

portion of long-term debt |

|

1 |

|

|

|

1 |

|

| Current portion of operating

leases |

|

9 |

|

|

|

13 |

|

| Other current liabilities |

|

128 |

|

|

|

144 |

|

|

Total current liabilities |

|

266 |

|

|

|

283 |

|

| Long-term debt, net of current

portion |

|

460 |

|

|

|

457 |

|

| Pension and other postretirement

liabilities |

|

232 |

|

|

|

237 |

|

| Operating leases, net of current

portion |

|

24 |

|

|

|

24 |

|

| Other long-term liabilities |

|

208 |

|

|

|

213 |

|

|

Total liabilities |

|

1,190 |

|

|

|

1,214 |

|

|

|

|

|

|

| Commitments and Contingencies

(Note 6) |

|

|

|

|

|

|

|

|

| Redeemable, convertible preferred

stock, no par value, $100 per share liquidation preference |

|

216 |

|

|

|

210 |

|

|

|

|

|

|

| Equity |

|

|

|

| Common stock, $0.01 par

value |

|

— |

|

|

|

— |

|

| Additional paid in capital |

|

1,152 |

|

|

|

1,156 |

|

| Treasury stock, at cost |

|

(12 |

) |

|

|

(11 |

) |

| Accumulated deficit |

|

(419 |

) |

|

|

(495 |

) |

| Accumulated other comprehensive

income |

|

261 |

|

|

|

281 |

|

| Total shareholders’ equity |

|

982 |

|

|

|

931 |

|

| TOTAL LIABILITIES,

REDEEMABLE CONVERTIBLE PREFERRED STOCK AND EQUITY |

$ |

2,388 |

|

|

$ |

2,355 |

|

| |

|

|

|

|

|

|

|

The notes accompanying the financial statements

contained in the Company’s third quarter 2024 Form 10-Q are an

integral part of these consolidated financial statements.

| |

|

|

|

| EASTMAN

KODAK COMPANY |

|

CONSOLIDATED STATEMENT OF CASH FLOW

(Unaudited) |

| |

|

|

|

| |

Nine Months Ended |

|

|

September 30, |

|

(in millions) |

|

2024 |

|

|

|

2023 |

|

| Cash flows from operating

activities: |

|

|

|

| Net earnings |

$ |

76 |

|

|

$ |

70 |

|

| Adjustments to reconcile to net

cash (used in) provided by operating activities: |

|

|

|

|

Depreciation and amortization |

|

21 |

|

|

|

23 |

|

|

Pension and other postretirement income |

|

(111 |

) |

|

|

(109 |

) |

|

Change in fair value of the Preferred Stock and Convertible Notes

embedded derivatives |

|

— |

|

|

|

2 |

|

|

Non-cash changes in workers' compensation and other employee

benefit reserves |

|

1 |

|

|

|

(3 |

) |

|

Stock based compensation |

|

5 |

|

|

|

6 |

|

|

Net gain on sale of assets |

|

(17 |

) |

|

|

(1 |

) |

|

Loss on extinguishment of debt |

|

— |

|

|

|

27 |

|

|

Decrease (increase) in trade receivables |

|

52 |

|

|

|

(16 |

) |

|

(Increase) decrease in miscellaneous receivables |

|

(6 |

) |

|

|

10 |

|

|

Increase in inventories |

|

(25 |

) |

|

|

(4 |

) |

|

Decrease in trade payables |

|

(1 |

) |

|

|

(15 |

) |

|

(Decrease) increase in liabilities excluding borrowings and trade

payables |

|

(39 |

) |

|

|

23 |

|

|

Other items, net |

|

33 |

|

|

|

8 |

|

|

Total adjustments |

|

(87 |

) |

|

|

(49 |

) |

|

Net cash (used in) provided by operating activities |

|

(11 |

) |

|

|

21 |

|

|

|

|

|

|

| Cash flows from investing

activities: |

|

|

|

|

Additions to properties |

|

(39 |

) |

|

|

(15 |

) |

|

Proceeds from sale of assets |

|

17 |

|

|

|

— |

|

|

Net cash used in investing activities |

|

(22 |

) |

|

|

(15 |

) |

|

|

|

|

|

| Cash flows from financing

activities: |

|

|

|

|

Net proceeds from Amended and Restated Term Loan Credit

Agreement |

|

— |

|

|

|

435 |

|

|

Repayment of Original Term Loan Credit Agreement |

|

— |

|

|

|

(316 |

) |

|

Repayment of Convertible Notes |

|

— |

|

|

|

(28 |

) |

|

Other debt acquisition costs |

|

— |

|

|

|

(1 |

) |

|

Repayment of Amended and Restated Term Loan Agreement |

|

(17 |

) |

|

|

— |

|

|

Preferred stock cash dividend payments |

|

(3 |

) |

|

|

(3 |

) |

|

Treasury stock purchases |

|

(1 |

) |

|

|

— |

|

|

Net cash (used in) provided by financing activities |

|

(21 |

) |

|

|

87 |

|

| Effect of exchange rate changes

on cash, cash equivalents and restricted cash |

|

(1 |

) |

|

|

(5 |

) |

| Net (decrease) increase in cash,

cash equivalents and restricted cash |

|

(55 |

) |

|

|

88 |

|

| Cash, cash equivalents and

restricted cash, beginning of period |

|

377 |

|

|

|

286 |

|

| Cash, cash equivalents and

restricted cash, end of period |

$ |

322 |

|

|

$ |

374 |

|

| |

|

|

|

|

|

|

|

The notes accompanying the financial statements

contained in the Company’s third quarter 2024 Form 10-Q are an

integral part of these consolidated financial statements.

Media

Contact:Kurt Jaeckel, Kodak, +1

585-490-8646, kurt.jaeckel@kodak.com

Investor

Contact:Anthony Redding, Kodak, +1

585-724-4053, shareholderservices@kodak.com

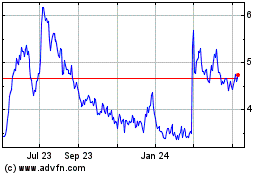

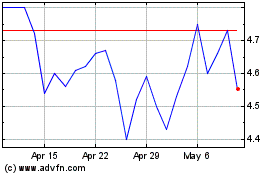

Eastman Kodak (NYSE:KODK)

Historical Stock Chart

From Nov 2024 to Dec 2024

Eastman Kodak (NYSE:KODK)

Historical Stock Chart

From Dec 2023 to Dec 2024