6

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November, 2024

Commission File Number 001-40695

Dole plc

(Exact name of registrant as specified in its charter)

29 North Anne Street, Dublin 7

D07 PH36 Ireland

200 S. Tryon St, Suite #600, Charlotte, NC

United States 28202

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

☒ Form 20-F ◻ Form 40-F

On November 13, 2024, Dole plc (the "Company") will host a conference call and simultaneous webcast to discuss the Company's financial results for the three and nine months ended September 30, 2024. An archived replay of the webcast and the investor presentation used during the webcast will be available shortly after the live event has concluded in the Investors section of the Company's website, www.doleplc.com/investors. A copy of the press release is furnished herewith as Exhibit 99.1 and incorporated by reference herein.

EXHIBIT INDEX

Exhibit No. Description

DOLE PLC

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | |

Date: November 13, 2024 | DOLE PLC (Registrant) |

| | | |

| | | By: /s/ Jacinta Devine |

| | | Name: Jacinta Devine |

| | | Title: Chief Financial Officer |

| | | |

Exhibit 99.1

Dole plc Reports Third Quarter 2024 Financial Results

DUBLIN – November 13, 2024 - Dole plc (NYSE: DOLE) ("Dole" or the "Group" or the "Company") today released its financial results for the three and nine months ended September 30, 2024.

Highlights for the three months ended September 30, 2024:

•Positive third quarter performance, positioning the Company to deliver a strong full year result for 2024

•Revenue of $2.1 billion, an increase of 1.0%. On a like-for-like basis1, revenue increased 5.8%

•Net Income decreased to $21.5 million, primarily due to the benefit of an exceptional $28.8 million gain on sale of a non-core asset recorded in the prior period

•Adjusted EBITDA2 of $82.1 million, a decrease of 3.7%. On a like-for-like basis, Adjusted EBITDA increased 2.3%

•Adjusted Net Income of $18.0 million and Adjusted Diluted EPS of $0.19

•Increasing full year Adjusted EBITDA guidance by $10.0 million. Targeting Adjusted EBITDA of at least $380.0 million for the full year

Financial Highlights - Unaudited

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | September 30, 2024 | | September 30, 2023 | | September 30, 2024 | | September 30, 2023 |

| | | | | | | | |

| | (U.S. Dollars in millions, except per share amounts) |

Revenue | | 2,062 | | | 2,043 | | | 6,308 | | | 6,173 | |

| Income from continuing operations3 | | 15.1 | | | 55.7 | | | 142.7 | | | 154.4 | |

| Net Income | | 21.5 | | | 54.0 | | | 175.0 | | | 126.8 | |

| Net Income attributable to Dole plc | | 14.4 | | | 45.3 | | | 164.7 | | | 101.7 | |

| Diluted EPS from continuing operations | | 0.08 | | | 0.50 | | | 1.39 | | | 1.36 | |

| Diluted EPS | | 0.15 | | | 0.48 | | | 1.73 | | | 1.07 | |

Adjusted EBITDA2 | | 82.1 | | | 85.2 | | | 317.6 | | | 308.3 | |

Adjusted Net Income2 | | 18.0 | | | 22.6 | | | 105.6 | | | 103.2 | |

Adjusted Diluted EPS2 | | 0.19 | | | 0.24 | | | 1.11 | | | 1.09 | |

Commenting on the results, Carl McCann, Executive Chairman, said:

“We are pleased to deliver another positive result for the third quarter of 2024, continuing the good momentum we have built over the course of this year, with Adjusted EBITDA increasing 2.3% to $82.1 million on a like-for-like basis.

Our performance over the first nine months positions us well to deliver a strong result for the full year. Today, we are pleased to raise our full year Adjusted EBITDA target by $10.0 million to at least $380.0 million.”

1 Like-for-like basis refers to the measure excluding the impact of foreign currency translation movements and acquisitions and divestitures.

2 Dole plc reports its financial results in accordance with U.S. Generally Accepted Accounting Principles ("GAAP"). See full GAAP financial results in the appendix. Adjusted EBIT, Adjusted EBITDA, Adjusted Net Income, Adjusted Earnings Per Share, Net Debt and Free Cash Flow from Continuing Operations are non-GAAP financial measures. Refer to the appendix of this release for an explanation and reconciliation of these and other non-GAAP financial measures used in this release to comparable GAAP financial measures.

3 Fresh Vegetables results are reported separately as discontinued operations, net of income taxes, in our condensed consolidated statements of operations, its assets and liabilities are separately presented in our condensed consolidated balance sheets, and its cash flows are presented separately in our condensed consolidated statements of cash flows for all periods presented. Unless otherwise noted, our discussion of our results included herein, outlook and all supplementary tables, including non-GAAP financial measures, are presented on a continuing operations basis.

Group Results - Third Quarter

Revenue increased 1.0%, or $19.7 million primarily due to positive operational performance across all segments and a $12.7 million net favorable impact of foreign currency translation, offset partially due to a net negative impact from acquisitions and divestitures of $110.9 million. On a like-for-like basis, revenue was 5.8%, or $117.9 million, ahead of prior year.

Net Income decreased 60.1%, or $32.5 million, primarily due to the benefit of an exceptional $28.8 million gain on sale of a non-core asset recorded in the prior period. There was also a decrease of other income of $9.3 million, primarily related to fair value adjustments of financial instruments.

Adjusted EBITDA decreased 3.7%, or $3.1 million, primarily driven by decreases in the Fresh Fruit and Diversified Fresh Produce - EMEA segments, partially offset by strong performance in the Diversified Fresh Produce - Americas & ROW segment. On a like-for-like basis, Adjusted EBITDA increased 2.3%, or $1.9 million.

Adjusted Net Income decreased $4.5 million, predominantly due to the decreases in Adjusted EBITDA noted above as well as higher income tax expense, offset partially by lower interest expense. Adjusted Diluted EPS for the three months ended September 30, 2024 was $0.19 compared to $0.24 in the prior year.

Selected Segmental Financial Information (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| September 30, 2024 | | September 30, 2023 |

| | | | | | | |

| (U.S. Dollars in thousands) |

| Revenue | | Adjusted EBITDA | | Revenue | | Adjusted EBITDA |

| Fresh Fruit | $ | 798,781 | | | $ | 42,904 | | | $ | 749,210 | | | $ | 45,111 | |

| Diversified Fresh Produce - EMEA | 899,639 | | | 30,363 | | | 856,351 | | | 34,923 | |

| Diversified Fresh Produce - Americas & ROW | 390,057 | | | 8,805 | | | 470,011 | | | 5,159 | |

| Intersegment | (26,063) | | | — | | | (32,900) | | | — | |

| Total | $ | 2,062,414 | | | $ | 82,072 | | | $ | 2,042,672 | | | $ | 85,193 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended |

| September 30, 2024 | | September 30, 2023 |

| | | | | | | |

| (U.S. Dollars in thousands) |

| Revenue | | Adjusted EBITDA | | Revenue | | Adjusted EBITDA |

| Fresh Fruit | $ | 2,474,461 | | | $ | 182,958 | | | $ | 2,387,163 | | | $ | 180,138 | |

| Diversified Fresh Produce - EMEA | 2,698,088 | | | 99,017 | | | 2,570,080 | | | 100,932 | |

| Diversified Fresh Produce - Americas & ROW | 1,222,996 | | | 35,617 | | | 1,310,407 | | | 27,191 | |

| Intersegment | (87,666) | | | — | | | (94,637) | | | — | |

| Total | $ | 6,307,879 | | | $ | 317,592 | | | $ | 6,173,013 | | | $ | 308,261 | |

Fresh Fruit

Revenue increased 6.6%, or $49.6 million, primarily due to higher worldwide volumes of bananas sold, as well as higher worldwide pricing of bananas and pineapples, partially offset by lower worldwide volumes for pineapples and lower pricing and volume for plantains.

Adjusted EBITDA decreased 4.9%, or $2.2 million, primarily driven by higher shipping costs in the North American market due to scheduled dry dockings as well as lower volumes of pineapples sold and lower commercial cargo profitability, partially offset by higher volumes of bananas sold and higher pricing for bananas and pineapples.

Diversified Fresh Produce – EMEA

Revenue increased 5.1%, or $43.3 million, primarily due to strong performance in Ireland, the U.K. and the Netherlands There was also a favorable impact from foreign currency translation of $13.6 million and an incremental positive impact from acquisitions of $1.8 million. On a like-for-like basis, revenue was 3.3%, or $27.9 million, ahead of prior year.

Adjusted EBITDA decreased 13.1%, or $4.6 million, primarily due to a decrease in the U.K. due to higher one-off IT charges and the impact of lower supply of certain categories and seasonal timing differences in Spain and South Africa. On a like-for-like basis, Adjusted EBITDA was 14.5%, or $5.1 million, behind the prior year.

Diversified Fresh Produce – Americas & ROW

Revenue decreased 17.0%, or $80.0 million, primarily due to the disposal of the Progressive Produce business in mid-March 2024. On a like-for-like basis, revenue was 7.2%, or $33.6 million, ahead of the prior year, primarily due to volume and pricing growth in most commodities in North America.

Adjusted EBITDA increased 70.7%, or $3.6 million, primarily driven by improved performance in our North America berries business and positive margin development in avocados, as well as revenue growth across most commodities in North America. These positive impacts were primarily offset by the disposal of the Progressive Produce business. On a like-for-like basis, Adjusted EBITDA was 178.1%, or $9.2 million, ahead of the prior year.

Capital Expenditures

Cash capital expenditures from continuing operations for the nine months ended September 30, 2024 were $56.8 million, which included investments in shipping containers, farming investments, efficiency projects in our warehouses and ongoing investments in IT and logistics assets. Additions through finance leases from continuing operations were $48.7 million for the nine months ended September 30, 2024. These additions were primarily related to $41.1 million of investments in two vessels during the three months ended September 30, 2024 that we had previously chartered and now have committed to purchase.

Free Cash Flow from Continuing Operations and Net Debt

Free cash flow from continuing operations was $49.5 million for the nine months ended September 30, 2024. Free cash flow was primarily driven by normal seasonal impacts. There were higher outflows from receivables based on higher revenues (excluding the impact of divestitures) and timing of collections and lower inflows from inventories, partly offset by inflows from accounts payables, accrued liabilities and other liabilities. Net Debt as of September 30, 2024 was $732.0 million.

Outlook for Fiscal Year 2024 (forward-looking statement)

We are pleased to have delivered another robust performance in the third quarter putting us in an excellent position to deliver a strong result for the full year.

As we move towards the end of the year, we are raising our full year adjusted EBITDA target by $10.0 million to at least $380.0 million for 2024.

Following our strategic decision to bring two additional vessels into our shipping fleet, we now expect total capital expenditure from continuing operations, including additions by finance lease, to be in the range of $130.0 million to $140.0 million for financial year 2024.

Additionally, as our debt levels and market interest rates have reduced, we now expect our full year interest expense, including discontinued operations, to be approximately $75.0 million for financial year 2024.

Dividend

On November 12, 2024, the Board of Directors of Dole plc declared a cash dividend for the second quarter of 2024 of $0.08 per share, payable on January 3, 2025 to shareholders of record on December 11, 2024. A cash dividend of $0.08 per share was paid on October 3, 2024 for the first second of 2024.

About Dole plc

A global leader in fresh produce, Dole plc produces, markets, and distributes an extensive variety of fresh fruits and vegetables sourced locally and from around the world. Dedicated and passionate in exceeding our customers’ requirements in over 75 countries, our goal is to make the world a healthier and a more sustainable place.

Webcast and Conference Call Information

Dole plc will host a conference call and simultaneous webcast at 08:00 a.m. Eastern Time today to discuss the third quarter 2024 financial results. The webcast can be accessed at www.doleplc.com/investor-relations. The conference call can be accessed by registering at https://registrations.events/direct/Q4I37635213. The conference ID is 37635.

Forward-looking information

Certain statements made in this press release that are not historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are based on management’s beliefs, assumptions, and expectations of our future economic performance, considering the information currently available to management. These statements are not statements of historical fact. The words “believe,” “may,” “could,” “will,” “should,” “would,” “anticipate,” “estimate,” “expect,” “intend,” “objective,” “seek,” “strive,” “target” or similar words, or the negative of these words, identify forward-looking statements. The inclusion of this forward-looking information should not be regarded as a representation by us or any other person that the future plans, estimates, or expectations contemplated by us will be achieved. Such forward-looking statements are subject to various risks and uncertainties and assumptions relating to our operations, financial results, financial condition, business prospects, growth strategy and liquidity. Accordingly, there are, or will be, important factors that could cause our actual results to differ materially from those indicated in these statements. If one or more of these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, our actual results may vary materially from what we may have expressed or implied by these forward-looking statements. We caution that you should not place undue reliance on any of our forward-looking statements. Any forward-looking statement speaks only as of the date on which such statement is made, and we do not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made except as required by the federal securities laws.

Investor Contact:

James O'Regan, Head of Investor Relations, Dole plc

joregan@totalproduce.com

+353 1 887 2794

Media Contact:

Brian Bell, Ogilvy

brian.bell@ogilvy.com

+353 87 2436 130

Appendix

Condensed Consolidated Statements of Operations - Unaudited

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, 2024 | | September 30, 2023 | | September 30, 2024 | | September 30, 2023 |

| | | | | | | |

| (U.S. Dollars and shares in thousands, except per share amounts) |

| Revenues, net | $ | 2,062,414 | | | $ | 2,042,672 | | | $ | 6,307,879 | | | $ | 6,173,013 | |

| Cost of sales | (1,898,375) | | | (1,876,292) | | | (5,748,577) | | | (5,631,021) | |

| Gross profit | 164,039 | | | 166,380 | | | 559,302 | | | 541,992 | |

| Selling, marketing, general and administrative expenses | (115,829) | | | (118,023) | | | (351,383) | | | (354,569) | |

| Gain on disposal of business | — | | | — | | | 75,945 | | | — | |

| Gain on asset sales | 1,573 | | | 28,746 | | | 1,901 | | | 43,442 | |

| Impairment of goodwill | — | | | — | | | (36,684) | | | — | |

| Impairment and asset write-downs of property, plant and equipment | (2,049) | | | — | | | (3,326) | | | — | |

| Operating income | 47,734 | | | 77,103 | | | 245,755 | | | 230,865 | |

| Other (expense) income, net | (4,541) | | | 4,817 | | | 9,458 | | | 7,721 | |

| Interest income | 2,632 | | | 2,311 | | | 8,335 | | | 7,260 | |

| Interest expense | (17,473) | | | (20,899) | | | (54,209) | | | (62,359) | |

| Income from continuing operations before income taxes and equity earnings | 28,352 | | | 63,332 | | | 209,339 | | | 183,487 | |

| Income tax expense | (15,524) | | | (13,017) | | | (75,385) | | | (40,604) | |

| Equity method earnings | 2,303 | | | 5,342 | | | 8,711 | | | 11,508 | |

| Income from continuing operations | 15,131 | | | 55,657 | | | 142,665 | | | 154,391 | |

| Income (loss) from discontinued operations, net of income taxes | 6,384 | | | (1,672) | | | 32,351 | | | (27,616) | |

| Net income | 21,515 | | | 53,985 | | | 175,016 | | | 126,775 | |

| Net income attributable to noncontrolling interests | (7,113) | | | (8,693) | | | (10,354) | | | (25,049) | |

| Net income attributable to Dole plc | $ | 14,402 | | | $ | 45,292 | | | $ | 164,662 | | | $ | 101,726 | |

| | | | | | | |

| Income (loss) per share - basic: | | | | | | | |

| Continuing operations | $ | 0.08 | | | $ | 0.50 | | | $ | 1.39 | | | $ | 1.36 | |

| Discontinued operations | 0.07 | | | (0.02) | | | 0.34 | | | (0.29) | |

| Net income per share attributable to Dole plc - basic | $ | 0.15 | | | $ | 0.48 | | | $ | 1.73 | | | $ | 1.07 | |

| | | | | | | |

| Income (loss) per share - diluted: | | | | | | | |

| Continuing operations | $ | 0.08 | | | $ | 0.50 | | | $ | 1.39 | | | $ | 1.36 | |

| Discontinued operations | 0.07 | | | (0.02) | | | 0.34 | | | (0.29) | |

| Net income per share attributable to Dole plc - diluted | $ | 0.15 | | | $ | 0.48 | | | $ | 1.73 | | | $ | 1.07 | |

| | | | | | | |

| Weighted-average shares: | | | | | | | |

| Basic | 94,990 | | | 94,929 | | | 94,950 | | | 94,912 | |

| Diluted | 95,614 | | | 95,148 | | | 95,395 | | | 95,094 | |

Condensed Consolidated Statements of Cash Flows - Unaudited

| | | | | | | | | | | |

| Nine Months Ended |

| September 30, 2024 | | September 30, 2023 |

| | | |

| Operating Activities | (U.S. Dollars in thousands) |

| Net income | $ | 175,016 | | | $ | 126,775 | |

| (Income) loss from discontinued operations, net of taxes | (32,351) | | | 27,616 | |

| Income from continuing operations | 142,665 | | | 154,391 | |

| Adjustments to reconcile income from continuing operations to net cash provided by (used in) operating activities - continuing operations: | | | |

| Depreciation and amortization | 72,632 | | | 76,908 | |

| Impairment of goodwill | 36,684 | | | — | |

| Impairment and asset write-downs of property, plant and equipment | 3,326 | | | — | |

| Net gain on sale of assets and asset write-offs | (1,901) | | | (43,506) | |

| Net gain on sale of business | (75,945) | | | — | |

| Net gain on financial instruments | (723) | | | (2,043) | |

| Stock-based compensation expense | 6,090 | | | 4,381 | |

| Equity method earnings | (8,711) | | | (11,508) | |

| Amortization of debt discounts and debt issuance costs | 6,255 | | | 4,788 | |

| Deferred tax benefit | (12,353) | | | (11,747) | |

| Pension and other postretirement benefit plan expense | 1,982 | | | 4,160 | |

| Dividends received from equity method investments | 4,994 | | | 6,350 | |

| Other | 178 | | | (4,075) | |

| Changes in operating assets and liabilities: | | | |

| Receivables, net of allowances | (89,014) | | | 13,858 | |

| Inventories | (9,136) | | | 26,642 | |

| Prepaids, other current assets and other assets | (4,032) | | | (25) | |

| Accounts payable, accrued liabilities and other liabilities | 33,255 | | | (61,440) | |

| Net cash provided by operating activities - continuing operations | 106,246 | | | 157,134 | |

| Investing activities | | | |

| Sales of assets | 2,825 | | | 64,103 | |

| Capital expenditures | (56,788) | | | (51,334) | |

| Proceeds from sale of business, net of transaction costs | 117,735 | | | — | |

| Insurance proceeds | 527 | | | 1,850 | |

| Purchases of investments | (262) | | | (1,153) | |

| (Purchases) sales of unconsolidated affiliates | (504) | | | 1,498 | |

| Acquisitions, net of cash acquired | (930) | | | (262) | |

| Other | (1,908) | | | (127) | |

| Net cash provided by (used in) investing activities - continuing operations | 60,695 | | | 14,575 | |

| Financing activities | | | |

| Proceeds from borrowings and overdrafts | 1,273,561 | | | 1,190,596 | |

| Repayments on borrowings and overdrafts | (1,425,422) | | | (1,300,083) | |

| Dividends paid to shareholders | (22,899) | | | (22,873) | |

| Dividends paid to noncontrolling interests | (23,157) | | | (24,824) | |

| Other noncontrolling interest activity, net | 78 | | | (482) | |

| Payment of contingent consideration | (996) | | | (1,169) | |

| Net cash (used in) financing activities - continuing operations | (198,835) | | | (158,835) | |

| Effect of foreign exchange rate changes on cash | 1,613 | | | (1,716) | |

| Net cash provided by (used in) operating activities - discontinued operations | 23,397 | | | (15,772) | |

| Net cash used in investing activities - discontinued operations | (6,139) | | | (6,703) | |

| Cash provided by discontinued operations, net | 17,258 | | | (22,475) | |

| Decrease in cash and cash equivalents | (13,023) | | | (11,317) | |

| Cash and cash equivalents at beginning of period, including discontinued operations | 277,005 | | | 228,840 | |

| Cash and cash equivalents at end of period, including discontinued operations | $ | 263,982 | | | $ | 217,523 | |

| Supplemental cash flow information: | | | |

| Income tax payments, net of refunds | $ | (62,743) | | | $ | (49,142) | |

| Interest payments on borrowings | $ | (50,376) | | | $ | (62,771) | |

Condensed Consolidated Balance Sheets - Unaudited | | | | | | | | | | | |

| September 30, 2024 | | December 31, 2023 |

| | | |

| ASSETS | (U.S. Dollars and shares in thousands) |

| Cash and cash equivalents | $ | 260,588 | | | $ | 275,580 | |

| Short-term investments | 5,794 | | | 5,899 | |

| Trade receivables, net of allowances for credit losses of $21,619 and $18,360, respectively | 561,737 | | | 538,177 | |

| Grower advance receivables, net of allowances for credit losses of $21,025 and $19,839, respectively | 131,708 | | | 109,958 | |

| Other receivables, net of allowances for credit losses of $12,944 and $13,227, respectively | 117,223 | | | 117,069 | |

| Inventories, net of allowances of $4,786 and $4,792, respectively | 377,989 | | | 378,592 | |

| Prepaid expenses | 63,554 | | | 61,724 | |

| Other current assets | 15,883 | | | 17,401 | |

| Fresh Vegetables current assets held for sale | 423,743 | | | 414,457 | |

| Other assets held for sale | 1,654 | | | 1,832 | |

| Total current assets | 1,959,873 | | | 1,920,689 | |

| Long-term investments | 15,661 | | | 15,970 | |

| Investments in unconsolidated affiliates | 136,122 | | | 131,704 | |

| Actively marketed property | 13,781 | | | 13,781 | |

| Property, plant and equipment, net of accumulated depreciation of $506,521 and $444,775, respectively | 1,125,511 | | | 1,102,234 | |

| Operating lease right-of-use assets | 319,730 | | | 340,458 | |

| Goodwill | 441,792 | | | 513,312 | |

| DOLE brand | 306,280 | | | 306,280 | |

| Other intangible assets, net of accumulated amortization of $124,349 and $134,420, respectively | 27,216 | | | 41,232 | |

| Other assets | 100,913 | | | 109,048 | |

| Deferred tax assets, net | 69,475 | | | 66,485 | |

| Total assets | $ | 4,516,354 | | | $ | 4,561,193 | |

| LIABILITIES AND EQUITY | | | |

| Accounts payable | $ | 641,543 | | | $ | 670,904 | |

| Income taxes payable | 66,495 | | | 22,917 | |

| Accrued liabilities | 388,157 | | | 357,427 | |

| Bank overdrafts | 16,451 | | | 11,488 | |

| Current portion of long-term debt, net | 87,023 | | | 222,940 | |

| Current maturities of operating leases | 62,597 | | | 63,653 | |

| Payroll and other tax | 22,094 | | | 27,791 | |

| Contingent consideration | 1,037 | | | 1,788 | |

| Pension and other postretirement benefits | 15,466 | | | 16,570 | |

| Fresh Vegetables current liabilities held for sale | 269,879 | | | 291,342 | |

| Dividends payable and other current liabilities | 14,738 | | | 29,892 | |

| Total current liabilities | 1,585,480 | | | 1,716,712 | |

| Long-term debt, net | 878,785 | | | 845,013 | |

| Operating leases, less current maturities | 262,681 | | | 287,991 | |

| Deferred tax liabilities, net | 79,956 | | | 92,653 | |

| Income taxes payable, less current portion | — | | | 16,664 | |

| Contingent consideration, less current portion | 7,725 | | | 7,327 | |

| Pension and other postretirement benefits, less current portion | 113,718 | | | 121,689 | |

| Other long-term liabilities | 52,962 | | | 52,295 | |

| Total liabilities | 2,981,307 | | | 3,140,344 | |

| | | |

| Redeemable noncontrolling interests | 34,790 | | | 34,185 | |

| Stockholders’ equity: | | | |

| Common stock — $0.01 par value; 300,000 shares authorized; 95,012 and 94,929 shares outstanding as of September 30, 2024 and December 31, 2023 | 950 | | | 949 | |

| Additional paid-in capital | 801,919 | | | 796,800 | |

| Retained earnings | 704,047 | | | 562,562 | |

| Accumulated other comprehensive loss | (117,000) | | | (110,791) | |

| Total equity attributable to Dole plc | 1,389,916 | | | 1,249,520 | |

| Equity attributable to noncontrolling interests | 110,341 | | | 137,144 | |

| Total equity | 1,500,257 | | | 1,386,664 | |

| Total liabilities, redeemable noncontrolling interests and equity | $ | 4,516,354 | | | $ | 4,561,193 | |

Reconciliation from Net Income to Adjusted EBITDA - Unaudited

The following information is provided to give quantitative information related to items impacting comparability. Refer to the 'Non-GAAP Financial Measures' section of this document for additional detail on each item.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, 2024 | | September 30, 2023 | | September 30, 2024 | | September 30, 2023 |

| | | | | | | |

| (U.S. Dollars in thousands) |

| Net income (Reported GAAP) | $ | 21,515 | | | $ | 53,985 | | | $ | 175,016 | | | $ | 126,775 | |

| (Income) loss from discontinued operations, net of income taxes | (6,384) | | | 1,672 | | | (32,351) | | | 27,616 | |

| Income from continuing operations (Reported GAAP) | 15,131 | | | 55,657 | | | 142,665 | | | 154,391 | |

| Income tax expense | 15,524 | | | 13,017 | | | 75,385 | | | 40,604 | |

| Interest expense | 17,473 | | | 20,899 | | | 54,209 | | | 62,359 | |

| Mark to market losses (gains) | 6,301 | | | (4,783) | | | 1,217 | | | (2,926) | |

| Gain on asset sales | (66) | | | (28,802) | | | (35) | | | (43,356) | |

| Gain on disposal of business | — | | | — | | | (75,945) | | | — | |

| Cyber-related incident | — | | | — | | | — | | | 5,321 | |

| Impairment of goodwill | — | | | — | | | 36,684 | | | — | |

| Other items4,5 | (983) | | | 222 | | | (2,709) | | | 1,085 | |

| Adjustments from equity method investments | 2,504 | | | 2,160 | | | 6,964 | | | 6,405 | |

| Adjusted EBIT (Non-GAAP) | 55,884 | | | 58,370 | | | 238,435 | | | 223,883 | |

| Depreciation | 22,616 | | | 21,737 | | | 66,852 | | | 69,182 | |

| Amortization of intangible assets | 1,621 | | | 2,536 | | | 5,780 | | | 7,726 | |

| Depreciation and amortization adjustments from equity method investments | 1,951 | | | 2,550 | | | 6,525 | | | 7,470 | |

| Adjusted EBITDA (Non-GAAP) | $ | 82,072 | | | $ | 85,193 | | | $ | 317,592 | | | $ | 308,261 | |

4 For the three months ended September 30, 2024, other items is primarily comprised of $1.0 million of insurance proceeds, net of asset writedowns. For the three months ended September 30, 2023, other items is primarily comprised of $0.2 million of asset writedowns, net of insurance proceeds.

5 For the nine months ended September 30, 2024, other items is primarily comprised of $2.7 million of insurance proceeds, net of asset writedowns. For the nine months ended September 30, 2023, other items is primarily comprised of $1.1 million of asset writedowns, net of insurance proceeds.

Reconciliation from Net Income attributable to Dole plc to Adjusted Net Income - Unaudited

The following information is provided to give quantitative information related to items impacting comparability. Refer to the 'Non-GAAP Financial Measures' section of this document for additional detail on each item. Refer to the Appendix for supplementary detail.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, 2024 | | September 30, 2023 | | September 30, 2024 | | September 30, 2023 |

| | | | | | | |

| (U.S. Dollars and shares in thousands, except per share amounts) |

| Net income attributable to Dole plc (Reported GAAP) | $ | 14,402 | | | $ | 45,292 | | | $ | 164,662 | | | $ | 101,726 | |

| (Income) loss from discontinued operations, net of income taxes | (6,384) | | | 1,672 | | | (32,351) | | | 27,616 | |

| Income from continuing operations attributable to Dole plc | 8,018 | | | 46,964 | | | 132,311 | | | 129,342 | |

| Adjustments: | | | | | | | |

| Amortization of intangible assets | 1,621 | | | 2,536 | | | 5,780 | | | 7,726 | |

| Mark to market losses (gains) | 6,301 | | | (4,783) | | | 1,217 | | | (2,926) | |

| Gain on asset sales | (66) | | | (28,802) | | | (35) | | | (43,356) | |

| Gain on disposal of business | — | | | — | | | (75,945) | | | — | |

| Cyber-related incident | — | | | — | | | — | | | 5,321 | |

| Impairment of goodwill | — | | | — | | | 36,684 | | | — | |

| Other items6,7 | (983) | | | 222 | | | (2,709) | | | 1,085 | |

| Adjustments from equity method investments | 531 | | | 610 | | | 1,782 | | | 1,352 | |

| Income tax on items above and discrete tax items | 3,393 | | | 6,464 | | | 18,500 | | | 6,952 | |

| NCI impact of items above | (781) | | | (645) | | | (11,968) | | | (2,274) | |

| Adjusted Net Income for Adjusted EPS calculation (Non-GAAP) | $ | 18,034 | | | $ | 22,566 | | | $ | 105,617 | | | $ | 103,222 | |

| | | | | | | |

| Adjusted earnings per share – basic (Non-GAAP) | $ | 0.19 | | | $ | 0.24 | | | $ | 1.11 | | | $ | 1.09 | |

| Adjusted earnings per share – diluted (Non-GAAP) | $ | 0.19 | | | $ | 0.24 | | | $ | 1.11 | | | $ | 1.09 | |

| Weighted average shares outstanding – basic | 94,990 | | | 94,929 | | | 94,950 | | | 94,912 | |

| Weighted average shares outstanding – diluted | 95,614 | | | 95,148 | | | 95,395 | | | 95,094 | |

6 For the three months ended September 30, 2024, other items is primarily comprised of $1.0 million of insurance proceeds, net of asset writedowns. For the three months ended September 30, 2023, other items is primarily comprised of $0.2 million of asset writedowns, net of insurance proceeds.

7 For the nine months ended September 30, 2024, other items is primarily comprised of $2.7 million of insurance proceeds, net of asset writedowns. For the nine months ended September 30, 2023, other items is primarily comprised of $1.1 million of asset writedowns, net of insurance proceeds.

Supplemental Reconciliation from Net Income attributable to Dole plc to Adjusted Net Income - Unaudited

The following information is provided to give quantitative information related to items impacting comparability. Refer to the 'Non-GAAP Financial Measures' section of this document for additional detail on each item.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2024 (U.S. Dollars in thousands) |

| Revenues, net | Cost of sales | Gross profit | Gross Margin % | Selling, marketing, general and administrative expenses | Other operating items8 | Operating Income |

| Reported (GAAP) | $ | 2,062,414 | | (1,898,375) | | 164,039 | | 8.0 | % | (115,829) | | (476) | | $ | 47,734 | |

| (Income) loss from discontinued operations, net of income taxes | — | | — | | — | | | — | | — | | — | |

| Amortization of intangible assets | — | | — | | — | | | 1,621 | | — | | 1,621 | |

| Mark to market losses (gains) | — | | 270 | | 270 | | | — | | — | | 270 | |

| Gain on asset sales | — | | — | | — | | | — | | (66) | | (66) | |

| Gain on disposal of business | — | | — | | — | | | — | | — | | — | |

| | | | | | | |

| Impairment of goodwill | — | | — | | — | | | — | | — | | — | |

| Other items | — | | (986) | | (986) | | | — | | — | | (986) | |

| Adjustments from equity method investments | — | | — | | — | | | — | | — | | — | |

| Income tax on items above and discrete tax items | — | | — | | — | | | — | | — | | — | |

| NCI impact of items above | — | | — | | — | | | — | | — | | — | |

| Adjusted (Non-GAAP) | $ | 2,062,414 | | (1,899,091) | | 163,323 | | 7.9 | % | (114,208) | | (542) | | $ | 48,573 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2023 (U.S. Dollars in thousands) |

| Revenues, net | Cost of sales | Gross profit | Gross Margin % | Selling, marketing, general and administrative expenses | Other operating items9 | Operating Income |

| Reported (GAAP) | $ | 2,042,672 | | (1,876,292) | | 166,380 | | 8.1 | % | (118,023) | | 28,746 | | $ | 77,103 | |

| (Income) loss from discontinued operations, net of income taxes | — | | — | | — | | | — | | — | | — | |

| Amortization of intangible assets | — | | — | | — | | | 2,536 | | — | | 2,536 | |

| Mark to market (gains) losses | — | | (1,113) | | (1,113) | | | — | | — | | (1,113) | |

| Gain on asset sales | — | | — | | — | | | — | | (28,802) | | (28,802) | |

| | | | | | | |

| Cyber-related incident | — | | — | | — | | | — | | — | | — | |

| | | | | | | |

| Other items | — | | 222 | | 222 | | | — | | — | | 222 | |

| Adjustments from equity method investments | — | | — | | — | | | — | | — | | — | |

| Income tax on items above and discrete tax items | — | | — | | — | | | — | | — | | — | |

| NCI impact on items above | — | | — | | — | | | — | | — | | — | |

| Adjusted (Non-GAAP) | $ | 2,042,672 | | (1,877,183) | | 165,489 | | 8.1 | % | (115,487) | | (56) | | $ | 49,946 | |

8 Other operating items for the three months ended September 30, 2024 is primarily comprised of impairment and asset write-downs of property, plant and equipment of $2.0 million, partially offset by a gain on asset sales of $1.6 million, as reported on the Dole plc GAAP Condensed Consolidated Statements of Operations.

9 Other operating items for the three months ended September 30, 2023 is comprised of gains on asset sales of $28.7 million, as reported on the Dole plc GAAP Condensed Consolidated Statements of Operations.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2024 (U.S. Dollars in thousands) |

| Other (expense) income, net | Interest income | Interest expense | Income tax expense | Equity method earnings | Income from continuing operations | Income (loss) from discontinued operations, net of income taxes |

| Reported (GAAP) | $ | (4,541) | | 2,632 | | (17,473) | | (15,524) | | 2,303 | | 15,131 | | 6,384 | |

| (Income) loss from discontinued operations, net of income taxes | — | | — | | — | | — | | — | | — | | (6,384) | |

| Amortization of intangible assets | — | | — | | — | | — | | — | | 1,621 | | — | |

| Mark to market losses (gains) | 6,031 | | — | | — | | — | | — | | 6,301 | | — | |

| Gain on asset sales | — | | — | | — | | — | | — | | (66) | | — | |

| Gain on disposal of business | — | | — | | — | | — | | — | | — | | — | |

| | | | | | | |

| Impairment of goodwill | — | | — | | — | | — | | — | | — | | — | |

| Other items | 3 | | — | | — | | — | | — | | (983) | | — | |

| Adjustments from equity method investments | — | | — | | — | | — | | 531 | | 531 | | — | |

| Income tax on items above and discrete tax items | — | | — | | — | | 3,493 | | (100) | | 3,393 | | — | |

| NCI impact of items above | — | | — | | — | | — | | — | | — | | — | |

| Adjusted (Non-GAAP) | $ | 1,493 | | 2,632 | | (17,473) | | (12,031) | | 2,734 | | 25,928 | | $ | — | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2023 (U.S. Dollars in thousands) |

| Other (expense) income, net | Interest income | Interest expense | Income tax expense | Equity method earnings | Income from continuing operations | Income (loss) from discontinued operations, net of income taxes |

| Reported (GAAP) | $ | 4,817 | | 2,311 | | (20,899) | | (13,017) | | 5,342 | | 55,657 | | (1,672) | |

| (Income) loss from discontinued operations, net of income taxes | — | | — | | — | | — | | — | | — | | 1,672 | |

| Amortization of intangible assets | — | | — | | — | | — | | — | | 2,536 | | — | |

| Mark to market losses (gains) | (3,670) | | — | | — | | — | | — | | (4,783) | | — | |

| Gain on asset sales | — | | — | | — | | — | | — | | (28,802) | | — | |

| | | | | | | |

| Cyber-related incident | — | | — | | — | | — | | — | | — | | — | |

| | | | | | | |

| Other items | — | | — | | — | | — | | — | | 222 | | — | |

| Adjustments from equity method investments | — | | — | | — | | — | | 610 | | 610 | | — | |

| Income tax on items above and discrete tax items | — | | — | | — | | 6,603 | | (139) | | 6,464 | | — | |

| NCI impact of items above | — | | — | | — | | — | | — | | — | | — | |

| Adjusted (Non-GAAP) | $ | 1,147 | | 2,311 | | (20,899) | | (6,414) | | 5,813 | | 31,904 | | $ | — | |

| | | | | | | | | | | | | | |

| Three Months Ended September 30, 2024 U.S. Dollars and shares in thousands, except per share amounts |

|

| Net income | Net income attributable to noncontrolling interests | Net income attributable to Dole plc | Diluted net income per share |

| Reported (GAAP) | $ | 21,515 | | $ | (7,113) | | $ | 14,402 | | $ | 0.15 | |

| (Income) loss from discontinued operations, net of income taxes | (6,384) | | — | | (6,384) | | |

| Amortization of intangible assets | 1,621 | | — | | 1,621 | |

| Mark to market losses (gains) | 6,301 | | — | | 6,301 | |

| Gain on asset sales | (66) | | — | | (66) | |

| Gain on disposal of business | — | | — | | — | |

| | | |

| Impairment of goodwill | — | | — | | — | |

| Other items | (983) | | — | | (983) | |

| Adjustments from equity method investments | 531 | | — | | 531 | |

| Income tax on items above and discrete tax items | 3,393 | | — | | 3,393 | |

| NCI impact of items above | — | | (781) | | (781) | |

| Adjusted (Non-GAAP) | $ | 25,928 | | $ | (7,894) | | $ | 18,034 | | $ | 0.19 | |

| | | | |

| Weighted average shares outstanding – diluted | 95,614 | | | | |

| | | | | | | | | | | | | | |

| Three Months Ended September 30, 2023 U.S. Dollars and shares in thousands, except per share amounts |

|

| Net income | Net income attributable to noncontrolling interests | Net income attributable to Dole plc | Diluted net income per share |

| Reported (GAAP) | $ | 53,985 | | $ | (8,693) | | $ | 45,292 | | $ | 0.48 | |

| (Income) loss from discontinued operations, net of income taxes | 1,672 | | — | | 1,672 | | |

| Amortization of intangible assets | 2,536 | | — | | 2,536 | |

| Mark to market losses (gains) | (4,783) | | — | | (4,783) | |

| Gain on asset sales | (28,802) | | — | | (28,802) | |

| | | |

| Cyber-related incident | — | | — | | — | |

| | | |

| Other items | 222 | | — | | 222 | |

| Adjustments from equity method investments | 610 | | — | | 610 | |

| Income tax on items above and discrete tax items | 6,464 | | — | | 6,464 | |

| NCI impact of items above | — | | (645) | | (645) | |

| Adjusted (Non-GAAP) | $ | 31,904 | | $ | (9,338) | | $ | 22,566 | | $ | 0.24 | |

| | | | |

| Weighted average shares outstanding – diluted | 95,148 | | | | |

Supplemental Reconciliation from Net Income attributable to Dole plc to Adjusted Net Income - Unaudited

The following information is provided to give quantitative information related to items impacting comparability. Refer to the 'Non-GAAP Financial Measures' section of this document for additional detail on each item.

| | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2024 (U.S. Dollars in thousands) |

| Revenues, net | Cost of sales | Gross profit | Gross Margin % | Selling, marketing, general and administrative expenses | Other operating items10 | Operating Income |

| Reported (GAAP) | $ | 6,307,879 | | (5,748,577) | | 559,302 | | 8.9 | % | (351,383) | | 37,836 | | $ | 245,755 | |

| (Income) loss from discontinued operations, net of income taxes | — | | — | | — | | | — | | — | | — | |

| Amortization of intangible assets | — | | — | | — | | | 5,780 | | — | | 5,780 | |

| Mark to market losses (gains) | — | | 150 | | 150 | | | — | | — | | 150 | |

| Gain on asset sales | — | | — | | — | | | — | | (35) | | (35) | |

| Gain on disposal of business | — | | — | | — | | | — | | (75,945) | | (75,945) | |

| | | | | | | |

| Impairment of goodwill | — | | — | | — | | | — | | 36,684 | | 36,684 | |

| Other items | — | | (2,629) | | (2,629) | | | — | | — | | (2,629) | |

| Adjustments from equity method investments | — | | — | | — | | | — | | — | | — | |

| Income tax on items above and discrete tax items | — | | — | | — | | | — | | — | | — | |

| NCI impact of items above | — | | — | | — | | | — | | — | | — | |

| Adjusted (Non-GAAP) | $ | 6,307,879 | | (5,751,056) | | 556,823 | | 8.8 | % | (345,603) | | (1,460) | | $ | 209,760 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2023 (U.S. Dollars in thousands) |

| Revenues, net | Cost of sales | Gross profit | Gross Margin % | Selling, marketing, general and administrative expenses | Other operating items11 | Operating Income |

| Reported (GAAP) | $ | 6,173,013 | | (5,631,021) | | 541,992 | | 8.8 | % | (354,569) | | 43,442 | | $ | 230,865 | |

| (Income) loss from discontinued operations, net of income taxes | — | | — | | — | | | — | | — | | — | |

| Amortization of intangible assets | — | | — | | — | | | 7,726 | | — | | 7,726 | |

| Mark to market losses (gains) | — | | (2,449) | | (2,449) | | | — | | — | | (2,449) | |

| Gain on asset sales | — | | — | | — | | | — | | (43,356) | | (43,356) | |

| | | | | | | |

| Cyber-related incident | — | | — | | — | | | 5,321 | | — | | 5,321 | |

| | | | | | | |

| Other items | — | | 1,085 | | 1,085 | | | — | | — | | 1,085 | |

| Adjustments from equity method investments | — | | — | | — | | | — | | — | | — | |

| Income tax on items above and discrete tax items | — | | — | | — | | | — | | — | | — | |

| NCI impact of items above | — | | — | | — | | | — | | — | | — | |

| Adjusted (Non-GAAP) | $ | 6,173,013 | | (5,632,385) | | 540,628 | | 8.8 | % | (341,522) | | 86 | | $ | 199,192 | |

10 Other operating items for the six months ended September 30, 2024 is primarily comprised of a gain on disposal of business of $75.9 million and gain of asset sales of $1.9 million, primarily offset by a goodwill impairment charge of $36.7 million and impairment and asset write-downs of property, plant and equipment of $3.3 million, as reported on the Dole plc GAAP Condensed Consolidated Statements of Operations.

11 Other operating items for the six months ended September 30, 2023 is comprised of gains on asset sales of $43.4 million, as reported on the Dole plc GAAP Condensed Consolidated Statements of Operations.

| | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2024 (U.S. Dollars in thousands) |

| Other (expense) income, net | Interest income | Interest expense | Income tax expense | Equity method earnings | Income from continuing operations | Income (loss) from discontinued operations, net of income taxes |

| Reported (GAAP) | $ | 9,458 | | 8,335 | | (54,209) | | (75,385) | | 8,711 | | 142,665 | | 32,351 | |

| (Income) loss from discontinued operations, net of income taxes | — | | — | | — | | — | | — | | — | | (32,351) | |

| Amortization of intangible assets | — | | — | | — | | — | | — | | 5,780 | | — | |

| Mark to market losses (gains) | 1,067 | | — | | — | | — | | — | | 1,217 | | — | |

| Gain on asset sales | — | | — | | — | | — | | — | | (35) | | — | |

| Gain on disposal of business | — | | — | | — | | — | | — | | (75,945) | | — | |

| | | | | | | |

| Impairment of goodwill | — | | — | | — | | — | | — | | 36,684 | | — | |

| Other items | (80) | | — | | — | | — | | — | | (2,709) | | — | |

| Adjustments from equity method investments | — | | — | | — | | — | | 1,782 | | 1,782 | | — | |

| Income tax on items above and discrete tax items | — | | — | | — | | 18,800 | | (300) | | 18,500 | | — | |

| NCI impact of items above | — | | — | | — | | — | | — | | — | | — | |

| Adjusted (Non-GAAP) | $ | 10,445 | | 8,335 | | (54,209) | | (56,585) | | 10,193 | | 127,939 | | $ | — | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2023 (U.S. Dollars in thousands) |

| Other (expense) income, net | Interest income | Interest expense | Income tax expense | Equity method earnings | Income from continuing operations | Income (loss) from discontinued operations, net of income taxes |

| Reported (GAAP) | $ | 7,721 | | 7,260 | | (62,359) | | (40,604) | | 11,508 | | 154,391 | | (27,616) | |

| (Income) loss from discontinued operations, net of income taxes | — | | — | | — | | — | | — | | — | | 27,616 | |

| Amortization of intangible assets | — | | — | | — | | — | | — | | 7,726 | | — | |

| Mark to market losses (gains) | (477) | | — | | — | | — | | — | | (2,926) | | — | |

| Gain on asset sales | — | | — | | — | | — | | — | | (43,356) | | — | |

| | | | | | | |

| Cyber-related incident | — | | — | | — | | — | | — | | 5,321 | | — | |

| | | | | | | |

| Other items | — | | — | | — | | — | | — | | 1,085 | | — | |

| Adjustments from equity method investments | — | | — | | — | | — | | 1,352 | | 1,352 | | — | |

| Income tax on items above and discrete tax items | — | | — | | — | | 7,253 | | (301) | | 6,952 | | — | |

| NCI impact of items above | — | | — | | — | | — | | — | | — | | — | |

| Adjusted (Non-GAAP) | $ | 7,244 | | 7,260 | | (62,359) | | (33,351) | | 12,559 | | 130,545 | | $ | — | |

| | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2024 U.S. Dollars and shares in thousands, except per share amounts |

|

| Net income | Net income attributable to noncontrolling interests | Net income attributable to Dole plc | Diluted net income per share |

| Reported (GAAP) | $ | 175,016 | | $ | (10,354) | | $ | 164,662 | | $ | 1.73 | |

| (Income) loss from discontinued operations, net of income taxes | (32,351) | | — | | (32,351) | | |

| Amortization of intangible assets | 5,780 | | — | | 5,780 | |

| Mark to market losses (gains) | 1,217 | | — | | 1,217 | |

| Gain on asset sales | (35) | | — | | (35) | |

| Gain on disposal of business | (75,945) | | — | | (75,945) | |

| | | |

| Impairment of goodwill | 36,684 | | — | | 36,684 | |

| Other items | (2,709) | | — | | (2,709) | |

| Adjustments from equity method investments | 1,782 | | — | | 1,782 | |

| Income tax on items above and discrete tax items | 18,500 | | — | | 18,500 | |

| NCI impact of items above | — | | (11,968) | | (11,968) | |

| Adjusted (Non-GAAP) | $ | 127,939 | | $ | (22,322) | | $ | 105,617 | | $ | 1.11 | |

| | | | |

| Weighted average shares outstanding – diluted | 95,395 | | | | |

| | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2023 U.S. Dollars and shares in thousands, except per share amounts |

|

| Net income | Net income attributable to noncontrolling interests | Net income attributable to Dole plc | Diluted net income per share |

| Reported (GAAP) | $ | 126,775 | | $ | (25,049) | | $ | 101,726 | | $ | 1.07 | |

| (Income) loss from discontinued operations, net of income taxes | 27,616 | | — | | 27,616 | | |

| Amortization of intangible assets | 7,726 | | — | | 7,726 | |

| Mark to market losses (gains) | (2,926) | | — | | (2,926) | |

| Gain on asset sales | (43,356) | | — | | (43,356) | |

| | | |

| Cyber-related incident | 5,321 | | — | | 5,321 | |

| | | |

| Other items | 1,085 | | — | | 1,085 | |

| Adjustments from equity method investments | 1,352 | | — | | 1,352 | |

| Income tax on items above and discrete tax items | 6,952 | | — | | 6,952 | |

| NCI impact of items above | — | | (2,274) | | (2,274) | |

| Adjusted (Non-GAAP) | $ | 130,545 | | $ | (27,323) | | $ | 103,222 | | $ | 1.09 | |

| | | | |

| Weighted average shares outstanding – diluted | 95,094 | | | | |

Supplemental Reconciliation of Prior Year Segment Results to Current Year Segment Results – Unaudited

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenue for the Three Months Ended |

| September 30, 2023 | | Impact of Foreign Currency Translation | | Impact of Acquisitions and Divestitures | | Like-for-like Increase (Decrease) | | September 30, 2024 |

| | | | | | | | | |

| (U.S. Dollars in thousands) |

| Fresh Fruit | $ | 749,210 | | | $ | — | | | $ | — | | | $ | 49,571 | | | $ | 798,781 | |

| Diversified Fresh Produce - EMEA | 856,351 | | | 13,639 | | | 1,761 | | | 27,888 | | | 899,639 | |

| Diversified Fresh Produce - Americas & ROW | 470,011 | | | (974) | | | (112,618) | | | 33,638 | | | 390,057 | |

| Intersegment | (32,900) | | | — | | | — | | | 6,837 | | | (26,063) | |

| Total | $ | 2,042,672 | | | $ | 12,665 | | | $ | (110,857) | | | $ | 117,934 | | | $ | 2,062,414 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted EBITDA for the Three Months Ended |

| September 30, 2023 | | Impact of Foreign Currency Translation | | Impact of Acquisitions and Divestitures | | Like-for-like Increase (Decrease) | | September 30, 2024 |

| | | | | | | | | |

| (U.S. Dollars in thousands) |

| Fresh Fruit | $ | 45,111 | | | $ | (32) | | | $ | — | | | $ | (2,175) | | | $ | 42,904 | |

| Diversified Fresh Produce - EMEA | 34,923 | | | 479 | | | 28 | | | (5,067) | | | 30,363 | |

| Diversified Fresh Produce - Americas & ROW | 5,159 | | | (29) | | | (5,511) | | | 9,186 | | | 8,805 | |

| Total | $ | 85,193 | | | $ | 418 | | | $ | (5,483) | | | $ | 1,944 | | | $ | 82,072 | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenue for the Nine Months Ended |

| September 30, 2023 | | Impact of Foreign Currency Translation | | Impact of Acquisitions and Divestitures | | Like-for-like Increase (Decrease) | | September 30, 2024 |

| | | | | | | | | |

| (U.S. Dollars in thousands) |

| Fresh Fruit | $ | 2,387,163 | | | $ | — | | | $ | — | | | $ | 87,298 | | | $ | 2,474,461 | |

| Diversified Fresh Produce - EMEA | 2,570,080 | | | 17,571 | | | 15,732 | | | 94,705 | | | 2,698,088 | |

| Diversified Fresh Produce - Americas & ROW | 1,310,407 | | | (1,700) | | | (240,119) | | | 154,408 | | | 1,222,996 | |

| Intersegment | (94,637) | | | — | | | — | | | 6,971 | | | (87,666) | |

| Total | $ | 6,173,013 | | | $ | 15,871 | | | $ | (224,387) | | | $ | 343,382 | | | $ | 6,307,879 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted EBITDA for the Nine Months Ended |

| September 30, 2023 | | Impact of Foreign Currency Translation | | Impact of Acquisitions and Divestitures | | Like-for-like Increase (Decrease) | | September 30, 2024 |

| | | | | | | | | |

| (U.S. Dollars in thousands) |

| Fresh Fruit | $ | 180,138 | | | $ | (33) | | | $ | — | | | $ | 2,853 | | | $ | 182,958 | |

| Diversified Fresh Produce - EMEA | 100,932 | | | 515 | | | 153 | | | (2,583) | | | 99,017 | |

| Diversified Fresh Produce - Americas & ROW | 27,191 | | | (48) | | | (14,137) | | | 22,611 | | | 35,617 | |

| Total | $ | 308,261 | | | $ | 434 | | | $ | (13,984) | | | $ | 22,881 | | | $ | 317,592 | |

Net Debt Reconciliation

Net Debt is the primary measure used by management to analyze the Company’s capital structure. Net Debt is a non-GAAP financial measure, calculated as cash and cash equivalents, less current and long-term debt. It also excludes debt discounts and debt issuance costs. The calculation of Net Debt as of September 30, 2024 is presented below. Net Debt as of September 30, 2024 was $732.0 million.

| | | | | | | | | | | |

| September 30, 2024 | | December 31, 2023 |

| | | |

| (U.S. Dollars in thousands) |

| Cash and cash equivalents (Reported GAAP) | $ | 260,588 | | | $ | 275,580 | |

| Debt (Reported GAAP): | | | |

| Long-term debt, net | (878,785) | | | (845,013) | |

| Current maturities | (87,023) | | | (222,940) | |

| Bank overdrafts | (16,451) | | | (11,488) | |

| Total debt, net | (982,259) | | | (1,079,441) | |

| Add: Debt discounts and debt issuance costs (Reported GAAP) | (10,312) | | | (14,395) | |

| Total gross debt | (992,571) | | | (1,093,836) | |

Net Debt (Non-GAAP) | $ | (731,983) | | | $ | (818,256) | |

Free Cash Flow from Continuing Operations Reconciliation

| | | | | | | | | | | |

| Nine Months Ended |

| September 30, 2024 | | September 30, 2023 |

| | | |

| (U.S. Dollars in thousands) |

| Net cash provided by operating activities - continuing operations (Reported GAAP) | $ | 106,246 | | | $ | 157,134 | |

| Less: Capital expenditures (Reported GAAP)12 | (56,788) | | | (51,334) | |

Free cash flow from continuing operations (Non-GAAP) | $ | 49,458 | | | $ | 105,800 | |

12 Capital expenditures do not include amounts attributable to discontinued operations.

Non-GAAP Financial Measures

Dole plc’s results are determined in accordance with U.S. GAAP.

In addition to its results under U.S. GAAP, in this Press Release, we also present Dole plc’s Adjusted EBIT, Adjusted EBITDA, Adjusted Net Income, Adjusted EPS, Free Cash Flow from Continuing Operations and Net Debt, which are supplemental measures of financial performance that are not required by, or presented in accordance with, U.S. GAAP (collectively, the "non-GAAP financial measures"). We present these non-GAAP financial measures, because we believe they assist investors and analysts in comparing our operating performance across reporting periods on a consistent basis by excluding items that we do not believe are indicative of our core operating performance. These non-GAAP financial measures have limitations as analytical tools, and you should not consider them in isolation or as a substitute for analysis of our operating results, cash flows or any other measure prescribed by U.S. GAAP. Our presentation of non-GAAP financial measures should not be construed as an inference that our future results will be unaffected by any of the adjusted items or that any projections and estimates will be realized in their entirety or at all. In addition, adjustment items that are excluded from non-GAAP results can have a material impact on equivalent GAAP earnings, financial measures and cash flows.

Adjusted EBIT is calculated from GAAP net income by: (1) subtracting the income or adding the loss from discontinued operations, net of income taxes; (2) adding the income tax expense or subtracting the income tax benefit; (3) adding interest expense; (4) adding mark to market losses or subtracting mark to market gains related to unrealized impacts from certain derivative instruments and foreign currency denominated borrowings, realized impacts on noncash settled foreign currency denominated borrowings, net foreign currency impacts on liquidated entities and fair value movements on contingent consideration; (5) other items which are separately stated based on materiality, which during the three and nine months ended September 30, 2024 and September 30, 2023, included adding or subtracting asset write-downs from extraordinary events, net of insurance proceeds, subtracting the gain or adding the loss on the disposal of business interests, subtracting the gain or adding the loss on asset sales for assets held for sale and actively marketed property, adding impairment charges on goodwill and adding costs incurred for the cyber-related incident; and (6) the Company’s share of these items from equity method investments.

Adjusted EBITDA is calculated from GAAP net income by: (1) subtracting the income or adding the loss from discontinued operations, net of income taxes; (2) adding the income tax expense or subtracting the income tax benefit; (3) adding interest expense; (4) adding depreciation charges; (5) adding amortization charges on intangible assets; (6) adding mark to market losses or subtracting mark to market gains related to unrealized impacts from certain derivative instruments and foreign currency denominated borrowings, realized impacts on noncash settled foreign currency denominated borrowings, net foreign currency impacts on liquidated entities and fair value movements on contingent consideration; (7) other items which are separately stated based on materiality, which during the three and nine months ended September 30, 2024 and September 30, 2023, included adding or subtracting asset write-downs from extraordinary events, net of insurance proceeds, subtracting the gain or adding the loss on the disposal of business interests, subtracting the gain or adding the loss on asset sales for assets held for sale and actively marketed property, adding impairment charges on goodwill and adding costs incurred for the cyber-related incident; and (8) the Company’s share of these items from equity method investments.

Adjusted Net Income is calculated from GAAP net income attributable to Dole plc by: (1) subtracting the income or adding the loss from discontinued operations, net of income taxes; (2) adding amortization charges on intangible assets; (3) adding mark to market losses or subtracting mark to market gains related to unrealized impacts from certain derivative instruments and foreign currency denominated borrowings, realized impacts on noncash settled foreign currency denominated borrowings, net foreign currency impacts on liquidated entities and fair value movements on contingent consideration; (4) other items which are separately stated based on materiality, which during the three and nine months ended September 30, 2024 and September 30, 2023, included adding or subtracting asset write-downs from extraordinary events, net of insurance proceeds, subtracting the gain or adding the loss on the disposal of business interests, subtracting the gain or adding the loss on asset sales for assets held for sale and actively marketed property, adding impairment charges on goodwill and adding costs incurred for the cyber-related incident; (5) the Company’s share of these items from equity method investments; (6) excluding the tax effect of these items and discrete tax adjustments; and (7) excluding the effect of these items attributable to non-controlling interests.

Adjusted Earnings per Share is calculated from Adjusted Net Income divided by diluted weighted average number of shares in the applicable period.

Net Debt is a non-GAAP financial measure, calculated as GAAP cash and cash equivalents, less GAAP current and long-term debt. It also excludes GAAP unamortized debt discounts and debt issuance costs.

Free cash flow from continuing operations is calculated from GAAP net cash used in or provided by operating activities for continuing operations less GAAP capital expenditures.

Like-for-like basis refers to the U.S. GAAP measure or non-GAAP financial measure excluding the impact of foreign currency translation movements and acquisitions and divestitures.

Dole is not able to provide a reconciliation for projected FY'24 results without taking unreasonable efforts.

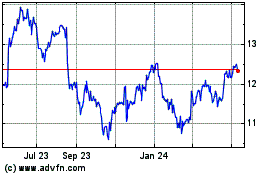

Dole (NYSE:DOLE)

Historical Stock Chart

From Jan 2025 to Feb 2025

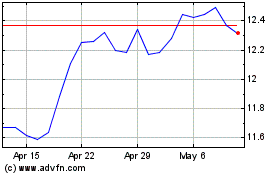

Dole (NYSE:DOLE)

Historical Stock Chart

From Feb 2024 to Feb 2025