Preview -- Barron's

January 06 2023 - 10:00PM

Dow Jones News

Monday 1/9

The Federal Reserve reports consumer credit data for November.

In October, total consumer debt increased at a seasonally adjusted

annual rate of 6.9% to a record $4.73 trillion. Revolving credit,

which is mostly credit-card debt, jumped 10.4% as more consumers

tap credit to pay for living expenses.

Tuesday 1/10

The National Federation of Independent Business releases its

Small Business Optimism Index for December. Consensus estimate is

for a 91.5 reading, roughly even with the November data. The index

remains mired near eight-year lows from last summer as

small-business owners continue to cite inflation as their No. 1

issue.

Wednesday 1/11

The Mortgage Bankers Association releases its Market Composite

Index, a measure of mortgage loan application volume, for the week

ending on Jan. 6. Mortgage activity declined sharply in the second

half of last year as interest rates surged. In October, mortgage

activity hit a 25-year low.

Thursday 1/12

The Department of Labor reports initial jobless claims for the

week ending on Jan. 7. In December, jobless claims averaged

217,500, still low historically. Despite the many announcements of

layoffs in the tech and real estate sectors, the job market remains

tight, as the Bureau of Labor Statistics this past week reported

the unemployment rate edging down to 3.5%, near a half-century low.

The U.S. economy added 4.5 million jobs last year, or about 375,000

a month on average. The second half of 2022 did see a slowing of

job growth from the first half's blistering pace but nothing that

portends a recession in 2023, which the majority of economists are

forecasting.

The BLS releases the consumer price index for December.

Economists forecast a 6.5% year-over-year increase, after a 7.1%

jump in November. The core CPI, which excludes volatile food and

energy prices, is expected to rise 5.7%, slightly slower than the

6% rate of growth previously. The CPI peaked at 9.1% in June of

2022, while the core CPI hit its top at 6.6% in September. The past

two CPI reports have seen a sharp deceleration in inflation, but

the Federal Open Market Committee has stressed that it needs to see

many months of data before even considering an end to its

interest-rate hiking campaign.

Friday 1/13

Bank of New York Mellon, BlackRock, Delta Air Lines, First

Republic Bank, and UnitedHealth Group release earnings.

The University of Michigan releases its Consumer Sentiment index

for January. The consensus call is for a 60.5 reading, about one

point more than previously. In December, consumer expectations for

the year-ahead inflation hit an 18-month low of 4.4%.

To subscribe to Barron's, visit

http://www.barrons.com/subscribe

(END) Dow Jones Newswires

January 06, 2023 21:45 ET (02:45 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

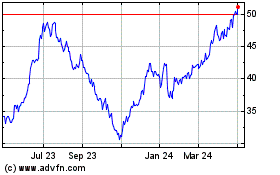

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Oct 2024 to Nov 2024

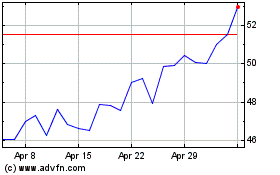

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Nov 2023 to Nov 2024