0001694426false00016944262024-09-032024-09-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

September 3, 2024

Date of Report (Date of earliest event reported)

DELEK US HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

Delaware | 001-38142 | 35-2581557 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | |

| | | |

310 Seven Springs Way, Suite 500 | Brentwood | Tennessee | 37027 |

(Address of Principal Executive) | | | (Zip Code) |

(615) 771-6701

(Registrant’s telephone number, including area code)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.01 par value | | DK | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

Effective September 3, 2024, senior management of Delek US Holdings, Inc. (the “Company”) will begin using the materials included in Exhibit 99.2 to this report (the “Investor Presentation”) in connection with presentations to existing and prospective investors. The Investor Presentation is incorporated into this Item 7.01 by this reference and will also be available on the Company's website at www.delekus.com.

The information in this Item 7.01 is being furnished, not filed, pursuant to Regulation FD. Accordingly, the information in Item 7.01 of this report will not be incorporated by reference into any registration statement filed by the Company under the Securities Act of 1933, as amended, unless specifically identified therein as being incorporated therein by reference. The furnishing of the information in this report is not intended to, and does not, constitute a determination or admission by the Company that the information in this report is material or complete, or that investors should consider this information before making an investment decision with respect to any security of the Company or any of its affiliates.

Item 8.01 Other Events.

On September 3, 2024, the Company announced that its Board of Directors approved a $400 million increase in its share repurchase authorization, bringing the total amount available for repurchases under current authorizations to approximately $562 million.

The Company’s press release regarding the share repurchase authorization is included as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| | |

| | |

| | |

| | |

| 104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

Dated: September 3, 2024 | DELEK US HOLDINGS, INC.

|

| |

| /s/ Reuven Spiegel |

| Name: Reuven Spiegel |

| Title: Executive Vice President and Chief Financial Officer (Principal Financial Officer) |

Delek US Holdings Approves a $400 million Increase in its Share Repurchase Authorization

BRENTWOOD, Tenn., Sep. 3, 2024 -- Delek US Holdings, Inc. (NYSE: DK) (the "Company" or "Delek US") announced that its Board of Directors approved a $400 million increase in its share repurchase authorization, bringing the total amount available for repurchases under current authorizations to approximately $562 million.

Avigal Soreq, President and Chief Executive Officer of Delek US, stated, "Generating value for our shareholders is a key priority and the enhanced share repurchase authorization reflects our desire to deliver increased cash returns to our shareholders. We see a lot of value in our equity and, subject to market conditions, we will continue to use share buybacks to return incremental value to our shareholders."

About Delek US Holdings, Inc.

Delek US Holdings, Inc. is a diversified downstream energy company with assets in petroleum refining, logistics, pipelines, and renewable fuels. The refining assets consist primarily of refineries operated in Tyler and Big Spring, Texas, El Dorado, Arkansas and Krotz Springs, Louisiana with a combined nameplate crude throughput capacity of 302,000 barrels per day.

The logistics operations consist of Delek Logistics. Delek US and its affiliates also own the general partner and an approximate 72.5% percent limited partner interest in Delek Logistics. Delek Logistics is a growth-oriented master limited partnership focused on owning and operating midstream energy infrastructure assets.

Safe Harbor Provisions Regarding Forward-Looking Statements

This press release contains forward-looking statements that are based upon current expectations and involve a number of risks and uncertainties. Statements concerning current estimates, expectations and projections about future results, performance, prospects, opportunities, plans, actions and events and other statements, concerns, or matters that are not historical facts are "forward-looking statements," as that term is defined under the federal securities laws. Investors are cautioned that risks described in the Company's filings with the United States Securities and Exchange Commission, among others, may affect these forward-looking statements. Forward-looking statements should not be read as a guarantee of future performance or results and will not be accurate indications of the times at, or by, which such performance or results will be achieved. Forward-looking information is based on information available at the time and/or management's good faith belief with respect to future events and is subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in the statements. The Company undertakes no obligation to update or revise any such forward-looking statements to reflect events or circumstances that occur or that the Company becomes aware of after the date hereof, except as required by applicable law or regulation.

Investor Relations and Media/Public Affairs Contact:

investor.relations@delekus.com

Barclays 38th Annual CEO Energy-Power Conference Avigal Soreq Exhibit 99.2

Forward-Looking Statements Delek US Holdings, Inc. (“Delek US”) and Delek Logistics Partners, LP (“Delek Logistics”; and collectively with Delek US, “we” or “our”) are traded on the New York Stock Exchange in the United States under the symbols “DK” and ”DKL”, respectively. These slides and any accompanying oral or written presentations contain forward-looking statements within the meaning of federal securities laws that are based upon current expectations and involve a number of risks and uncertainties. Statements concerning current estimates, expectations and projections about future results, performance, prospects, opportunities, plans, actions and events and other statements, concerns, or matters that are not historical facts are “forward-looking statements,” as that term is defined under the federal securities laws. Words such as "may," "will," "should," "could," "would," "predicts," "potential," "continue," "expects," "anticipates," "future," "intends," "plans," "believes," "estimates," "appears," "projects" and similar expressions, as well as statements in future tense, identify forward-looking statements. These forward-looking statements include, but are not limited to, the statements regarding the following: financial and operating guidance for future and uncompleted financial periods; projected costs savings and other benefits from cost reductions and Enterprise Optimization Plan; percentages of future Delek Logistics cash flow and EBITDA from third parties; execution of strategic initiatives, including potential deconsolidation of Delek Logistics, and the benefits therefrom; financial strength and flexibility; potential for and projections of growth; return of cash to shareholders, stock repurchases and the payment of dividends, including the amount and timing thereof; crude oil throughput; and the performance of our joint venture investments, and the benefits, flexibility, returns and EBITDA therefrom. Investors are cautioned that risks contained in Delek US’ and Delek Logistics’ filings with the United States Securities and Exchange Commission (the “SEC”) may affect these forward-looking statements. Forward-looking statements should not be read as a guarantee of future performance or results, and will not be accurate indications of the times at, or by which such performance or results will be achieved. Forward-looking information is based on information available at the time and/or management’s good faith belief with respect to future events, and is subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in the statements. Neither Delek US nor Delek Logistics undertakes any obligation to update or revise any such forward-looking statements. To reflect events or circumstances that occur, or which Delek US becomes aware of, after the date hereof, except as required by applicable law or regulation. This presentation includes certain forward looking non-GAAP financial measures as defined under SEC Regulation G, including estimated adjusted EBITDA. Due to the forward-looking nature of the aforementioned non-GAAP financial measures, management cannot reliably or reasonably predict certain of the necessary components of the most directly comparable forward-looking GAAP measures without unreasonable effort. Accordingly, we are unable to present a quantitative reconciliation of such forward-looking non-GAAP financial measures to their most directly comparable forward-looking GAAP financial measures. 2

Executing DK Objective 3 EOP: Leaner cost Stronger margins SOTP: Clear path to complete Deconsolidation Improved Base Operations: Big Spring Progress; Higher throughputs; Lower Opex and G&A People: Assembled an experienced, skilled, and committed management team

Next Step: Enterprise Optimization Plan (EOP) EOP initiatives are focused on improving DK’s financial health & ability to generate free cash flow Expect to be at the run-rate of ~$100mm through EOP by the end of 2025 EOP Action Items Leaner (Costs) - Lower G&A (Sustainable restructuring) - Lower Opex (Big Spring/Krotz Springs) - Lower interest expense (Balanced approach for cash proceeds) Stronger (Margins) - Accretive Refining projects (Minimal CapEx) - Commercial Improvements (Market optionality, product slate and optimization) 4

5 DK (Safe, Reliable, & Efficient Refiner) 3. Midstream • "Right assets under right buckets" • Progress Deconsolidation DKL (Full-service Permian-focused midstream provider) 1. Full Suite Midstream Provider • Gas, Water, & Crude • One stop shop 2. Increase self reliance • ~Two-thirds of DKL EBITDA expected to come from third parties in 12-18 months 3. Quality Assets/Strong Dividend • Wink to Webster ("W2W"), Strategic processing plant • Peer leading distribution yield DK & DKL: independent, strong FCF entities 1. Maximize Operating Leverage • Better Reliability ◦ Throughput ◦ Optimized yields • Lower Costs 2. Financial Strength & Returns • Monetize retail • Proceeds to B/S & Returns DK/DKL Strategy 5

Supplemental Information 6

• Retail assets sold for proceeds of ~$385mm • Executed a 10 year supply agreement • Continue to partner with FEMSA SOTP Progress: Summary of DK & DKL Transactions Announced in 3Q'24 1. Retail Sale • H2O for ~$230mm ($160mm cash + $70mm preferred) • Same footprint & customers as DKL • Transaction immediately accretive to EBITDA (acquisition @5x) & free cash flow, synergies with DKL’s Midland operations 3. Acquisition of H2O Midstream • W2W is a premier long haul crude pipeline backed by investment grade counterparties • W2W is at the right maturity in its cash flow cycle to be at DKL 2. Drop-Down of W2W into DKL • FID on new 110 mmscfpd gas processing plant in the Delaware basin expected to generate a cash on cash return of ~20% • The plant is expected to be online 1H’2025 & is expected to fill up quickly upon commissioning 4. New Gas Processing Plant • DK amended & extended agreements with DKL for a period of up to seven years • Amend & extend agreements include cancellation of a marketing agreement & other adjustments to facilitate the W2W drop-down 5. Amend & Extend 7

SOTP Progress: DK & DKL Actions 8 DK Contract Value / ITF (-Units) DKL Gas Plant, H2O Acquisition W2W (-Cash, -Units) Amend & Extend (+Units) Retail W2W (+Cash, +Units) Movement Contracts between DK & DKL amended and extended for up to 7 years Our Intent is to make DK & DKL stronger & more independent companies through this process

Bottom line: DK (standalone) has a cash infusion of ~$515mm (before tax) without any significant projected loss of EBITDA Bottom line: DKL (standalone) adds ~$70mm in projected third party cash flow on course to majority of its EBITDA coming from non-affiliated counterparties SOTP Progress: Projected implications for DK & DKL * includes $70mm of convertible preferred to be issued to the H2O Midstream 9

Lower Costs & Improved Reliability 10 Guidance Mid-Point Guidance Range 7.1% 5.8% 4.0% 3.5% 3.2% 3.3% 3.3% 3.3%

11 Guidance 3rd Quarter 2024 $'s in Millions Low High Operating Expenses $205 $215 General and Administrative Expenses $60 $65 Depreciation and Amortization $90 $95 Net Interest Expense $80 $85 Barrels per day (bpd) Low High Total Crude Throughput 290,000 305,000 Total Throughput 301,000 315,000 Total Throughput by Refinery: Tyler, TX 74,000 77,000 El Dorado, AR 79,000 82,000 Big Spring, TX 69,000 73,000 Krotz Spring, LA 79,000 83,000 11

Reconciliation of U.S. GAAP Net Income (Loss) to Adjusted Net Income (Loss) 12

Reconciliation of Segment EBITDA Attributable to Delek US to Adjusted Segment EBITDA 13 (1) See further discussion in the "Significant Transactions During the Quarter Impacting Results" section in the Q2 2024 Earnings Release. (2) Starting with the quarter ended September 30, 2023, we updated our other inventory impact calculation to exclude the impact of certain pipeline inventories not used in our refinery operations. The impact to historical non-GAAP financial measures is immaterial. (3) Starting with the quarter ended March 31, 2024, we updated our non-GAAP financial measures to include the impact of unrealized gains and losses related to RINs where the hedged item is not yet recognized in the financial statements. The impact to historical non-GAAP financial measures is immaterial.

v3.24.2.u1

Cover Page Document

|

Sep. 03, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Sep. 03, 2024

|

| Entity Registrant Name |

DELEK US HOLDINGS, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-38142

|

| Entity Tax Identification Number |

35-2581557

|

| Entity Address, Address Line Two |

Suite 500

|

| Entity Address, City or Town |

Brentwood

|

| Entity Address, State or Province |

TN

|

| Entity Address, Postal Zip Code |

37027

|

| City Area Code |

615

|

| Local Phone Number |

771-6701

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value

|

| Trading Symbol |

DK

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001694426

|

| Amendment Flag |

false

|

| Entity Address, Address Line One |

310 Seven Springs Way

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

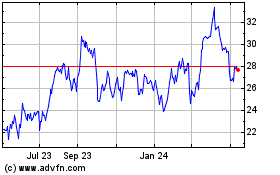

Delek US (NYSE:DK)

Historical Stock Chart

From Nov 2024 to Dec 2024

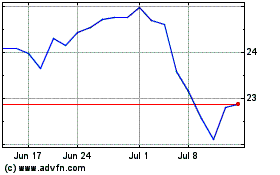

Delek US (NYSE:DK)

Historical Stock Chart

From Dec 2023 to Dec 2024