- Net income attributable to all partners of $32.6

million

- Quarterly EBITDA of $101.5 million

- Distributable cash flow of $68.0 million, DCF coverage ratio

of 1.35x

- In 2024, successfully executed $850 million debt offering

and $138 million equity offering:

- Improved liquidity from approximately $300.0 million to

$800.0 million

- Added 3.6 million units for a total 47.2 million outstanding

units and increased volume activity

- Improved leverage ratio to 4.01x from 4.34x at year-end

2023

- Delivered 45 consecutive quarters of distribution growth

with recent increase to $1.070/unit

Delek Logistics Partners, LP (NYSE: DKL) ("Delek Logistics")

today announced its financial results for the first quarter 2024,

with reported net income attributable to all partners of $32.6

million, or $0.73 per diluted common limited partner unit. This

compares to net income attributable to all partners of $37.4

million, or $0.86 per diluted common limited partner unit, in the

first quarter 2023. The decrease in net income attributable to all

partners was driven by higher interest expense. Net cash provided

in operating activities was $43.9 million in the first quarter 2024

compared to $29.2 million in the first quarter 2023. Distributable

cash flow was $68.0 million in the first quarter 2024, compared to

$61.8 million in the first quarter 2023.

For the first quarter 2024, earnings before interest, taxes,

depreciation and amortization ("EBITDA") was $101.5 million

compared to $93.2 million in the first quarter 2023.

“Delek Logistics had a strong quarter, delivering another solid

financial and operational performance,” said Avigal Soreq,

President of Delek Logistics' general partner.

"I'm proud of the team for successfully executing the debt and

equity offerings during the quarter," Soreq continued. "We improved

DKL's financial strength and flexibility with these transactions.

The leverage ratio was lowered to 4.01x, down from 4.34x at

year-end 2023, and liquidity was improved to approximately $800.0

million. Additionally, we saw new investor interest and increased

volume activity in the units, enhancing our opportunities with

DKL."

“In April, the Board continued its commitment to return value to

unitholders and approved the 45th consecutive increase in the

quarterly distribution to $1.070 per unit," Mr. Soreq

concluded.

Distribution and

Liquidity

On April 25, 2024, Delek Logistics declared a quarterly cash

distribution of $1.070 per common limited partner unit for the

first quarter 2024. This distribution will be paid on May 15, 2024

to unitholders of record on May 8, 2024. This represents a 1.4%

increase from the fourth quarter 2023 distribution of $1.055 per

common limited partner unit, and a 4.4% increase over Delek

Logistics’ first quarter 2023 distribution of $1.025 per common

limited partner unit. For the first quarter 2024, the total cash

distribution declared to all partners was approximately $50.5

million, resulting in a distributable cash flow ("DCF") coverage

ratio of 1.35x.

As of March 31, 2024, Delek Logistics had total debt of

approximately $1.60 billion and cash of $9.7 million. Additional

borrowing capacity, subject to certain covenants, under the $1.15

billion third party revolving credit facility was $584.8 million.

The total leverage ratio as of March 31, 2024 of approximately

4.01x was within the requirements of the maximum allowable leverage

ratio under the credit facility.

Consolidated Operating

Results

First quarter 2024, EBITDA was $101.5 million compared with

$93.2 million in the first quarter 2023. The $8.3 million increase

reflects higher contributions from the Delaware Gathering systems,

terminalling and marketing rate increases, as well as continued

strong throughput on joint venture pipelines. The increase was

partially offset by higher operating expenses driven by the growth

in operations.

Gathering and Processing

Segment

EBITDA in the first quarter 2024 was $57.8 million compared with

$55.4 million in the first quarter 2023. The increase was primarily

due to higher throughput from Permian Basin assets.

Wholesale Marketing and Terminalling

Segment

EBITDA in the first quarter 2024 was $25.3 million, compared

with first quarter 2023 EBITDA of $22.0 million. The increase was

primarily due to higher terminalling utilization.

Storage and Transportation

Segment

EBITDA in the first quarter 2024 was $18.1 million, compared

with $13.4 million in the first quarter 2023. The increase was

primarily due to increased storage and transportation rates.

Investments in Pipeline Joint Ventures

Segment

During the first quarter 2024, income from equity method

investments was $8.5 million compared to $6.3 million in the first

quarter 2023.

Corporate

EBITDA in the first quarter 2024 was a loss of $8.1 million

compared to a loss of $4.0 million in the first quarter 2023.

First Quarter 2024 Results | Conference

Call Information

Delek Logistics will hold a conference call to discuss its first

quarter 2024 results on Tuesday, May 7, 2024 at 11:30 a.m. Central

Time. Investors will have the opportunity to listen to the

conference call live by going to www.DelekLogistics.com.

Participants are encouraged to register at least 15 minutes early

to download and install any necessary software. An archived version

of the replay will also be available at www.DelekLogistics.com for

90 days.

About Delek Logistics Partners,

LP

Delek Logistics is a midstream energy master limited partnership

headquartered in Brentwood, Tennessee. Through its owned assets and

joint ventures located primarily in and around the Permian Basin,

the Delaware Basin and other select areas in the Gulf Coast region,

Delek Logistics provides gathering, pipeline and other

transportation services primarily for crude oil and natural gas

customers, storage, wholesale marketing and terminalling services

primarily for intermediate and refined product customers, and water

disposal and recycling services. Delek US Holdings, Inc. ("Delek

US") owns the general partner interest as well as a majority

limited partner interest in Delek Logistics, and is also a

significant customer.

Safe Harbor Provisions Regarding

Forward-Looking Statements

This press release contains forward-looking statements that are

based upon current expectations and involve a number of risks and

uncertainties. Statements concerning current estimates,

expectations and projections about future results, performance,

prospects, opportunities, plans, actions and events and other

statements, concerns, or matters that are not historical facts are

“forward-looking statements,” as that term is defined under the

federal securities laws. These statements contain words such as

“possible,” “believe,” “should,” “could,” “would,” “predict,”

“plan,” “estimate,” “intend,” “may,” “anticipate,” “will,” “if,”

“expect” or similar expressions, as well as statements in the

future tense, and can be impacted by numerous factors, including

the fact that a significant portion of Delek Logistics' revenue is

derived from Delek US, thereby subjecting us to Delek US' business

risks; risks relating to the securities markets generally; risks

and costs relating to the age and operational hazards of our assets

including, without limitation, costs, penalties, regulatory or

legal actions and other effects related to releases, spills and

other hazards inherent in transporting and storing crude oil and

intermediate and finished petroleum products; the impact of adverse

market conditions affecting the utilization of Delek Logistics'

assets and business performance, including margins generated by its

wholesale fuel business; risks and uncertainties related to the

integration of the 3 Bear business following the recent

acquisition; uncertainties regarding future decisions by OPEC

regarding production and pricing disputes between OPEC members and

Russia; an inability of Delek US to grow as expected as it relates

to our potential future growth opportunities, including dropdowns,

and other potential benefits; projected capital expenditures,

scheduled turnaround activity; the results of our investments in

joint ventures; adverse changes in laws including with respect to

tax and regulatory matters; and other risks as disclosed in our

Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and

other reports and filings with the United States Securities and

Exchange Commission. Forward-looking statements include, but are

not limited to, statements regarding future growth at Delek

Logistics; distributions and the amounts and timing thereof;

potential dropdown inventory; projected benefits of the Delaware

Gathering acquisition; expected earnings or returns from joint

ventures or other acquisitions; expansion projects; ability to

create long-term value for our unit holders; financial flexibility

and borrowing capacity; and distribution growth. Forward-looking

statements should not be read as a guarantee of future performance

or results and will not be accurate indications of the times at, or

by, which such performance or results will be achieved.

Forward-looking information is based on information available at

the time and/or management's good faith belief with respect to

future events, and is subject to risks and uncertainties that could

cause actual performance or results to differ materially from those

expressed in the statements. Delek Logistics undertakes no

obligation to update or revise any such forward-looking statements

to reflect events or circumstances that occur, or which Delek

Logistics becomes aware of, after the date hereof, except as

required by applicable law or regulation.

Non-GAAP Disclosures:

Our management uses certain "non-GAAP" operational measures to

evaluate our operating segment performance and non-GAAP financial

measures to evaluate past performance and prospects for the future

to supplement our GAAP financial information presented in

accordance with U.S. GAAP. These financial and operational non-GAAP

measures are important factors in assessing our operating results

and profitability and include:

- Earnings before interest, taxes, depreciation and amortization

("EBITDA") - calculated as net income before net interest expense,

income tax expense, depreciation and amortization expense,

including amortization of customer contract intangible assets,

which is included as a component of net revenues in our

accompanying consolidated statements of income.

- Distributable cash flow - calculated as net cash flow from

operating activities plus or minus changes in assets and

liabilities, less maintenance capital expenditures net of

reimbursements and other adjustments not expected to settle in

cash. Delek Logistics believes this is an appropriate reflection of

a liquidity measure by which users of its financial statements can

assess its ability to generate cash.

Our EBITDA and distributable cash flow measures are non GAAP

supplemental financial measures that management and external users

of our consolidated financial statements, such as industry

analysts, investors, lenders and rating agencies, may use to

assess:

- Delek Logistics' operating performance as compared to other

publicly traded partnerships in the midstream energy industry,

without regard to historical cost basis or, in the case of EBITDA,

financing methods;

- the ability of our assets to generate sufficient cash flow to

make distributions to our unitholders on a current and on-going

basis;

- Delek Logistics' ability to incur and service debt and fund

capital expenditures; and

- the viability of acquisitions and other capital expenditure

projects and the returns on investment of various investment

opportunities.

We believe that the presentation of EBITDA and distributable

cash flow measures provide information useful to investors in

assessing our financial condition and results of operations and

assists in evaluating our ongoing operating performance for current

and comparative periods. EBITDA and distributable cash flow should

not be considered alternatives to net income, operating income,

cash flow from operating activities or any other measure of

financial performance or liquidity presented in accordance with

U.S. GAAP. EBITDA and distributable cash flow have important

limitations as analytical tools because they exclude some, but not

all, items that affect net income and net cash provided by

operating activities. Additionally, because EBITDA and

distributable cash flow may be defined differently by other

partnerships in our industry, our definitions of EBITDA and

distributable cash flow may not be comparable to similarly titled

measures of other partnerships, thereby diminishing their utility.

For a reconciliation of EBITDA and distributable cash flow to their

most directly comparable financial measures calculated and

presented in accordance with U.S. GAAP, please refer to "Results of

Operations" below. See the accompanying tables in this earnings

release for a reconciliation of these non-GAAP measures to the most

directly comparable GAAP measures.

Delek Logistics Partners, LP

Consolidated Balance Sheets

(Unaudited)

(In thousands, except unit

data)

March 31, 2024

December 31, 2023

ASSETS

Current assets:

Cash and cash equivalents

$

9,672

$

3,755

Accounts receivable

56,993

41,131

Accounts receivable from related

parties

36,588

28,443

Inventory

1,655

2,264

Other current assets

615

676

Total current assets

105,523

76,269

Property, plant and equipment:

Property, plant and equipment

1,336,053

1,320,510

Less: accumulated depreciation

(406,009

)

(384,359

)

Property, plant and equipment, net

930,044

936,151

Equity method investments

238,185

241,337

Customer relationship intangible, net

176,811

181,336

Marketing contract intangible, net

100,352

102,155

Rights-of-way, net

60,141

59,536

Goodwill

12,203

12,203

Operating lease right-of-use assets

17,641

19,043

Other non-current assets

13,471

14,216

Total assets

$

1,654,371

$

1,642,246

LIABILITIES AND DEFICIT

Current liabilities:

Accounts payable

$

26,313

$

26,290

Current portion of long-term debt

—

30,000

Interest payable

12,710

5,805

Excise and other taxes payable

7,638

10,321

Current portion of operating lease

liabilities

6,442

6,697

Accrued expenses and other current

liabilities

4,098

11,477

Total current liabilities

57,201

90,590

Non-current liabilities:

Long-term debt, net of current portion

1,601,226

1,673,789

Operating lease liabilities, net of

current portion

7,367

8,335

Asset retirement obligations

10,225

10,038

Other non-current liabilities

20,819

21,363

Total non-current liabilities

1,639,637

1,713,525

Total liabilities

1,696,838

1,804,115

Equity (Deficit):

Common unitholders - public; 12,898,253

units issued and outstanding at March 31, 2024 (9,299,763 at

December 31, 2023)

290,051

160,402

Common unitholders - Delek Holdings;

34,311,278 units issued and outstanding at March 31, 2024

(34,311,278 at December 31, 2023)

(332,518

)

(322,271

)

Total deficit

(42,467

)

(161,869

)

Total liabilities and deficit

$

1,654,371

$

1,642,246

Delek Logistics Partners, LP

Consolidated Statement of Income and

Comprehensive Income (Unaudited)

(In thousands, except unit and per unit

data)

Three Months Ended March

31,

2024

2023

Net revenues:

Affiliate

$

139,625

$

124,999

Third-party

112,450

118,526

Net revenues

252,075

243,525

Cost of sales:

Cost of materials and other -

affiliate

92,882

91,071

Cost of materials and other - third

party

30,810

35,025

Operating expenses (excluding depreciation

and amortization presented below)

31,695

24,215

Depreciation and amortization

25,167

19,764

Total cost of sales

180,554

170,075

Operating expenses related to wholesale

business (excluding depreciation and amortization presented

below)

221

525

General and administrative expenses

4,863

7,510

Depreciation and amortization

1,328

1,341

Loss on disposal of assets

567

142

Total operating costs and expenses

187,533

179,593

Operating income

64,542

63,932

Interest expense, net

40,229

32,581

Income from equity method investments

(8,490

)

(6,316

)

Other income, net

(171

)

(2

)

Total non-operating expenses, net

31,568

26,263

Income before income tax expense

32,974

37,669

Income tax expense

326

302

Net income attributable to partners

$

32,648

$

37,367

Comprehensive income attributable to

partners

$

32,648

$

37,367

Net income per limited partner

unit:

Basic

$

0.74

$

0.86

Diluted

$

0.73

$

0.86

Weighted average limited partner units

outstanding:

Basic

44,406,356

43,569,963

Diluted

44,422,817

43,585,297

Cash distribution per common limited

partner unit

$

1.070

$

1.025

Delek Logistics Partners, LP

Condensed Consolidated Statements of

Cash Flows (In thousands)

(Unaudited)

Three Months Ended March

31,

2024

2023

Cash flows from operating

activities

Net cash provided by operating

activities

$

43,858

$

29,190

Cash flows from investing

activities

Net cash used in investing activities

(9,861

)

(26,979

)

Cash flows from financing

activities

Net cash (used in) provided by financing

activities

(28,080

)

783

Net increase in cash and cash

equivalents

5,917

2,994

Cash and cash equivalents at the beginning

of the period

3,755

7,970

Cash and cash equivalents at the end of

the period

$

9,672

$

10,964

Delek Logistics Partners, LP

Reconciliation of Amounts Reported

Under U.S. GAAP (Unaudited)

(In thousands)

Three Months Ended March

31,

2024

2023

Reconciliation of Net Income to

EBITDA:

Net income

$

32,648

$

37,367

Add:

Income tax expense

326

302

Depreciation and amortization

26,495

21,105

Amortization of marketing contract

intangible

1,803

1,803

Interest expense, net

40,229

32,581

EBITDA

$

101,501

$

93,158

Reconciliation of net cash from

operating activities to distributable cash flow:

Net cash provided by operating

activities

$

43,858

$

29,190

Changes in assets and liabilities

25,787

37,670

Non-cash lease expense

(1,939

)

(2,200

)

Distributions from equity method

investments in investing activities

2,133

1,440

Regulatory and sustaining capital

expenditures not distributable

(1,279

)

(4,246

)

Reimbursement from Delek Holdings for

capital expenditures

286

337

Accretion of asset retirement

obligations

(187

)

(176

)

Deferred income taxes

(101

)

(111

)

Loss on disposal of assets

(567

)

(142

)

Distributable Cash Flow

$

67,991

$

61,762

Delek Logistics Partners, LP

Distributable Coverage Ratio

Calculation (Unaudited)

(In thousands)

Three Months Ended March

31,

2024

2023

Distributions to partners of Delek

Logistics, LP

$

50,514

$

44,664

Distributable cash flow

$

67,991

$

61,762

Distributable cash flow coverage ratio

(1)

1.35x

1.38x

(1) Distributable cash flow coverage ratio

is calculated by dividing distributable cash flow by distributions

to be paid in each respective period.

Delek Logistics Partners, LP

Segment Data (Unaudited)

(In thousands)

Three Months Ended March 31,

2024

Gathering and

Processing

Wholesale Marketing and

Terminalling

Storage and

Transportation

Investments in Pipeline Joint

Ventures

Corporate and Other

Consolidated

Net revenues:

Affiliate

$

52,553

$

52,882

$

34,190

$

—

$

—

$

139,625

Third party

43,330

66,388

2,732

—

—

112,450

Total revenue

$

95,883

$

119,270

$

36,922

$

—

$

—

$

252,075

Segment EBITDA

$

57,772

$

25,274

$

18,127

$

8,477

$

(8,149

)

$

101,501

Depreciation and amortization

21,154

1,712

2,775

—

854

26,495

Amortization of customer contract

intangible

—

1,803

—

—

—

1,803

Interest expense, net

—

—

—

—

40,229

40,229

Income tax expense

326

Net income

$

32,648

Capital spending

$

14,723

$

(84

)

$

526

$

—

$

—

$

15,165

Three Months Ended March 31,

2023

Gathering and

Processing

Wholesale Marketing and

Terminalling

Storage and

Transportation

Investments in Pipeline Joint

Ventures

Corporate and Other

Consolidated

Net revenues:

Affiliate

$

52,761

$

33,751

$

38,487

$

—

$

—

$

124,999

Third party

39,671

78,558

297

—

—

118,526

Total revenue

$

92,432

$

112,309

$

38,784

$

—

$

—

$

243,525

Segment EBITDA

$

55,445

$

21,954

$

13,422

$

6,316

$

(3,979

)

$

93,158

Depreciation and amortization

16,447

1,689

2,102

—

867

21,105

Amortization of customer contract

intangible

—

1,803

—

—

—

1,803

Interest expense, net

—

—

—

—

32,581

32,581

Income tax expense

302

Net income

$

37,367

Capital spending

$

32,789

$

3,116

$

196

$

—

$

—

$

36,101

Delek Logistics Partners, LP

Segment Capital Spending

(In thousands)

Three Months Ended March

31,

Gathering and Processing

2024

2023

Regulatory capital spending

$

—

$

—

Sustaining capital spending

837

—

Growth capital spending

13,886

32,789

Segment capital spending

$

14,723

$

32,789

Wholesale Marketing and

Terminalling

Regulatory capital spending

(72

)

61

Sustaining capital spending

(12

)

2,931

Growth capital spending

—

124

Segment capital spending

$

(84

)

$

3,116

Storage and Transportation

Regulatory capital spending

$

—

$

24

Sustaining capital spending

526

172

Growth capital spending

$

—

$

—

Segment capital spending

$

526

$

196

Consolidated

Regulatory capital spending

$

(72

)

$

85

Sustaining capital spending

1,351

3,103

Growth capital spending

13,886

32,913

Total capital spending

$

15,165

$

36,101

Delek Logistics Partners, LP

Segment Operating Data

(Unaudited)

Three Months Ended March

31,

2024

2023

Gathering and Processing

Segment:

Throughputs (average bpd)

El Dorado Assets:

Crude pipelines (non-gathered)

73,011

63,528

Refined products pipelines to Enterprise

Systems

63,234

55,003

El Dorado Gathering System

12,987

13,872

East Texas Crude Logistics System

19,702

22,670

Midland Gathering System

213,458

222,112

Plains Connection System

256,844

240,597

Delaware Gathering Assets:

Natural Gas Gathering and Processing

(Mcfd(1))

76,322

74,716

Crude Oil Gathering (average bpd)

123,509

103,725

Water Disposal and Recycling (average

bpd)

120,269

88,182

Wholesale Marketing and Terminalling

Segment:

East Texas - Tyler Refinery sales volumes

(average bpd) (2)

66,475

34,816

Big Spring marketing throughputs (average

bpd)

76,615

78,380

West Texas marketing throughputs (average

bpd)

9,976

8,696

West Texas gross margin per barrel

$

2.15

$

5.47

Terminalling throughputs (average bpd)

(3)

136,614

93,305

(1) Mcfd - average thousand cubic feet per

day.

(2) Excludes jet fuel and petroleum

coke.

(3) Consists of terminalling throughputs

at our Tyler, Big Spring, Big Sandy and Mount Pleasant, Texas, El

Dorado and North Little Rock, Arkansas and Memphis and Nashville,

Tennessee terminals.

Information about Delek Logistics Partners, LP can be found on

its website (www.deleklogistics.com), investor relations webpage

(https://www.deleklogistics.com/investor-relations), news webpage

(https://www.deleklogistics.com/news-releases) and its X account

(@DelekLogistics).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240507761042/en/

Investor Relations and Media/Public

Affairs Contact: Rosy Zuklic, Vice President of Investor

Relations and Market Intelligence investor.relations@delekus.com;

rosy.zuklic@delekus.com; 615-767-4344

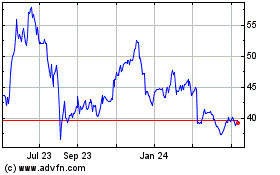

Delek Logistics Partners (NYSE:DKL)

Historical Stock Chart

From Oct 2024 to Nov 2024

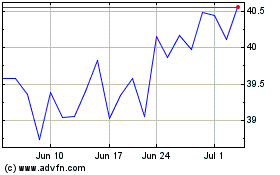

Delek Logistics Partners (NYSE:DKL)

Historical Stock Chart

From Nov 2023 to Nov 2024