Core Labs Walks the Neutral Lane - Analyst Blog

September 26 2012 - 9:45AM

Zacks

We are maintaining a Neutral

recommendation on Core Laboratories (CLB) – an

oilfield service company that provides reservoir management and

production enhancement services to the oil and gas industry on a

global basis.

The company posted mixed second-quarter 2012 results with earnings

per share exceeding the Zacks Consensus Estimate and revenue

falling short of the same. The quarterly performance was influenced

by superior performances across all the three business units,

partially offset by steeper operating expenses.

For the coming quarters, Core Labs’ deep portfolio of proprietary

products and services along with strong presence in the emerging

shale plays and a global footprint – including markets in the

Middle East, Asia Pacific, and East and West Africa – are expected

to facilitate steady growth rates going forward.

Over the last few years, Core Labs has laid a lot of emphasis on

international crude oil ventures, especially in deepwater regions

and unconventional resource plays, which generate high returns. The

company expects to see greater pre-salt activities in the Kwanza

basin offshore Angola as well as in Iraq and Asia Pacific in the

coming days.

Coupled with the development of advanced and superior technologies,

Core Labs intends to seize attractive opportunities overseas and

boost its growth momentum over the next few quarters.

Armed with strong liquidity position, Core Labs gets the

opportunity to buy back shares and pay dividends (during first half

of 2012, dividend and share repurchases equaled $76 million). It

also allows Core Labs the scope for acquiring companies that fit

their strategic profile, as well as taking on extra capacity in

growing regions like the Middle East.

Notwithstanding the positive aspects, we remain concerned about the

volatile macro environment, which will likely impact the company’s

profitability in the coming quarters.

With operations spanning over many countries and a large portion of

total revenue coming from international markets, Core Labs’

operations remain vulnerable to risks such as embargoes and/or

expropriation of assets, exchange rate risks, terrorism and

political/civil sentiment in critical countries like Iran, Iraq,

Nigeria and Venezuela.

Moreover, the use, storage and disposal of chemicals inherent in

Core Labs’ analytical technologies may leave them susceptible to

strict laws and regulations in compliance with environmental

safety. Restrictions and laws enforced by the government may

require the purchase of costly equipment, or it could involve steep

fines and suspension of operations for non compliance.

Considering, these factors we expect the company to perform in-line

with the broader market. Core Labs – which collaborated with

Petroleo Brasileiro S.A. or

Petrobras (PBR) for a number of reservoir analysis

ventures in onshore and offshore Brazil – currently retains a Zacks

#3 Rank, translating into a short-term Hold rating.

CORE LABS NV (CLB): Free Stock Analysis Report

PETROBRAS-ADR C (PBR): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

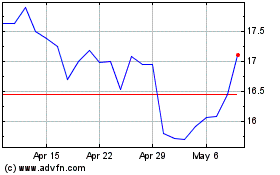

Core Laboratories (NYSE:CLB)

Historical Stock Chart

From Jun 2024 to Jul 2024

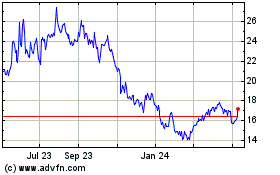

Core Laboratories (NYSE:CLB)

Historical Stock Chart

From Jul 2023 to Jul 2024