0001471420falseN-2There are no service or brokerage charges to participants in the dividend investment plan; however, the Fund reserves the right to amend the plan to include a service charge payable to the Fund by the participants. The Fund reserves the right to amend the plan to provide for payment of brokerage fees by the plan participants in the event the plan is changed to provide for open market purchases of Fund Common Stock on behalf of plan participants.The Fund’s management fee is 1.06% of the Fund’s average daily Managed Assets (which means the net asset value of Fund’s outstanding common stock plus the liquidation preference of any issued and outstanding preferred stock of the Fund and the principal amount of any borrowing used for leverage). The management fee rate noted in the table reflects the rate paid by Common Stockholders as a percentage of the Fund’s net assets attributable to Common Stock.“Total Annual Expenses" include acquired fund fees and expenses (expenses the Fund incurs indirectly through its investments in other investment companies) and may be higher than “Total gross expenses” shown in the Financial Highlights section of this report because “Total gross expenses” does not include acquired fund fees and expenses.

0001471420

2024-01-01

2024-12-31

0001471420

cik0001471420:CommonSharesMember

2024-01-01

2024-12-31

0001471420

cik0001471420:DerivativesRiskOptionsRiskMember

2024-01-01

2024-12-31

0001471420

us-gaap:InterestRateRiskMember

2024-01-01

2024-12-31

0001471420

cik0001471420:TransactionsInDerivativesMember

2024-01-01

2024-12-31

0001471420

cik0001471420:ActiveManagementRiskMember

2024-01-01

2024-12-31

0001471420

cik0001471420:SectorRiskMember

2024-01-01

2024-12-31

0001471420

cik0001471420:CommunicationServicesSectorAndInformationTechnologySectorMember

2024-01-01

2024-12-31

0001471420

cik0001471420:SemiconductorAndSemiconductorEquipmentIndustryRiskMember

2024-01-01

2024-12-31

0001471420

cik0001471420:LargeCapStockRiskMember

2024-01-01

2024-12-31

0001471420

cik0001471420:MarketRiskMember

2024-01-01

2024-12-31

0001471420

cik0001471420:MarketTradingDiscountRiskMember

2024-01-01

2024-12-31

0001471420

cik0001471420:NonDiversifiedFundRiskMember

2024-01-01

2024-12-31

0001471420

cik0001471420:OfferingRiskMember

2024-01-01

2024-12-31

0001471420

cik0001471420:SecondaryMarketForTheCommonSharesRiskMember

2024-01-01

2024-12-31

0001471420

cik0001471420:CounterpartyRiskMember

2024-01-01

2024-12-31

0001471420

cik0001471420:CreditRisksMember

2024-01-01

2024-12-31

0001471420

cik0001471420:DerivativesRiskMember

2024-01-01

2024-12-31

0001471420

cik0001471420:ForeignSecuritiesRiskMember

2024-01-01

2024-12-31

0001471420

cik0001471420:IssuerRiskMember

2024-01-01

2024-12-31

0001471420

cik0001471420:SmallAndMidCapStockRiskMember

2024-01-01

2024-12-31

0001471420

cik0001471420:CommonSharesMember

2023-01-01

2023-03-31

0001471420

cik0001471420:CommonSharesMember

2023-04-01

2023-06-30

0001471420

cik0001471420:CommonSharesMember

2023-07-01

2023-09-30

0001471420

cik0001471420:CommonSharesMember

2023-10-01

2023-12-31

0001471420

cik0001471420:CommonSharesMember

2024-01-01

2024-03-31

0001471420

cik0001471420:CommonSharesMember

2024-04-01

2024-06-30

0001471420

cik0001471420:CommonSharesMember

2024-07-01

2024-09-30

0001471420

cik0001471420:CommonSharesMember

2024-10-01

2024-12-31

0001471420

cik0001471420:CommonSharesMember

2024-12-31

iso4217:USD

xbrli:shares

xbrli:pure

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

811-22328

Columbia Seligman Premium Technology Growth Fund, Inc.

(Exact name of registrant as specified in charter)

290 Congress Street, Boston, MA 02210

(Address of principal executive offices) (Zip code)

Daniel J. Beckman

c/o Columbia Management Investment Advisers, LLC

290 Congress Street

Boston, MA 02210

Ryan C. Larrenaga, Esq.

c/o Columbia Management Investment Advisers, LLC

290 Congress Street

Boston, MA 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

(800) 345-6611

Date of fiscal year end:

Last Day of December

Date of reporting period:

December 31, 2024

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Columbia Seligman Premium

Technology Growth Fund, Inc.

| No Financial Institution Guarantee | |

Under the managed distribution policy of Columbia Seligman Premium Technology Growth Fund, Inc. (the Fund) and subject to

the approval of the Fund’s Board of Directors (the Board), the Fund expects to make quarterly cash distributions (in February,

May, August and November) to holders of common stock (Common Stockholders). On December 6, 2024, the Fund declared

a special fourth quarter distribution, beyond its typical quarterly managed distribution policy, in the amount of $3.2669 per

share. A federal excise tax of 4% applies to funds that do not distribute substantially all of their annual income (including net

gains) before the end of the calendar year. The Fund’s income for 2024 exceeded the amounts previously distributed

pursuant to the Fund’s quarterly managed distribution policy. As a result, the Fund distributed this excess income so that it

will not incur the 4% federal excise tax in 2024. The Fund’s most recent distribution under its managed distribution policy

(paid on February 25, 2025) amounted to $0.4625 per share, which is equal to a quarterly rate of 1.4062% (5.62%

annualized) of the Fund’s market price of $32.89 per share as of January 31, 2025. You should not draw any conclusions

about the Fund’s investment performance from the amount of the distributions or from the terms of the Fund’s managed

distribution policy. Historically, the Fund has at times distributed more than its income and net realized capital gains, which

has resulted in Fund distributions substantially consisting of return of capital or other capital source. A return of capital may

occur, for example, when some or all of the money that you invested in the Fund is paid back to you. A return of capital

distribution does not necessarily reflect the Fund’s investment performance and should not be confused with ‘yield’ or

‘income’. The Fund’s Board may determine in the future that the Fund’s managed distribution policy and the amount or timing

of the distributions should not be continued in light of changes in the Fund’s portfolio holdings, market or other conditions or

factors, including that the distribution rate under such policy may not be dependent upon the amount of the Fund’s earned

income or realized capital gains. The Board could also consider amending or terminating the current managed distribution

policy because of potential adverse tax consequences associated with maintaining the policy. In certain situations, returns of

capital could be taxable for federal income tax purposes, and all or a portion of the Fund’s capital loss carryforwards from

prior years, if any, could effectively be forfeited. The Board may amend or terminate the Fund’s managed distribution policy at

any time without prior notice to Fund stockholders; any such change or termination may have an adverse effect on the market

price of the Fund’s shares.

See Notes to Financial Statements for additional information related to the Fund’s managed distribution policy.

Columbia Seligman Premium Technology Growth Fund, Inc. | 2024

Columbia Seligman Premium Technology Growth Fund, Inc. (the Fund) mails one stockholder report to each stockholder

address. If you would like more than one report, please call shareholder services at 800.937.5449 and additional reports will

be sent to you.

Proxy voting policies and procedures

The policy of the Board is to vote the proxies of the companies in which the Fund holds investments consistent with the

procedures that can be found by visiting

columbiathreadneedleus.com/investor/

. Information regarding how the Fund voted

proxies relating to portfolio securities is filed with the SEC by August 31 for the most recent 12-month period ending June 30

of that year, and is available without charge by visiting

columbiathreadneedleus.com/investor/

; or searching the website of

the SEC at

sec.gov

.

Quarterly schedule of investments

The Fund files a complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on

Form N-PORT. The Fund’s Form N-PORT filings are available on the SEC’s website at

sec.gov

. The Fund’s complete schedule

of portfolio holdings, as filed on Form N-PORT, can also be obtained without charge, upon request, by calling 800.937.5449.

Additional Fund information

For more information, go online to

columbiathreadneedleus.com/investor/

; or call Equiniti Trust Company, LLC, the Fund’s

Stockholder Servicing and Transfer Agent, at 866.666.1532. Customer Service Representatives are available to answer your

questions Monday through Friday from 8 a.m. to 8 p.m. Eastern time.

Columbia Management Investment Advisers, LLC (the Investment Manager)

Equinity Trust Company, LLC

Columbia Seligman Premium Technology Growth Fund, Inc. | 2024

Fund at a Glance

(Unaudited)

Average Annual Total Returns (%) |

| | | |

| | | |

| | | |

S&P North American Technology Sector Index | | | |

| | | |

| Effective August 1, 2024, the Fund compares its performance to the Russell 3000 ® Index, a broad-based performance index. The Fund’s performance also continues to be compared to its prior benchmark, which management believes more closely represents the market sectors and/or asset classes in which the Fund primarily invests. |

Past performance does not guarantee future performance. Performance does not reflect the deduction of taxes

that a stockholder may pay on fund distributions or on the sale of fund shares. Performance results reflect the

effect of any fee waivers / expense reimbursements, if applicable. All results shown assume reinvestment of

columbiathreadneedleus.com/investment-products/closed-end-funds

for more recent performance

Returns reflect changes in market price or net asset value, as applicable, and assume reinvestment of

distributions. Returns do not reflect the deduction of taxes that investors may pay on distributions or the sale of

Distributions Paid Per Common Share |

| |

| |

| |

| |

| |

| |

| |

(a) The Fund paid this special 2023 fourth quarter distribution beyond its typical quarterly managed distribution policy

to stockholders of record on December 18, 2023.

(b) The Fund paid this special 2024 fourth quarter distribution beyond its typical quarterly managed distribution policy

to stockholders of record on December 16, 2024.

The net asset value of the Fund’s shares may not always correspond to the market price of such shares. Common stock

of many closed-end funds frequently trade at a discount from their net asset value. The Fund is subject to stock market

risk, which is the risk that stock prices overall will decline over short or long periods, adversely affecting the value of an

investment in the Fund.

Columbia Seligman Premium Technology Growth Fund, Inc. | 2024

Fund at a Glance

(continued)

(Unaudited)

Performance of a hypothetical $10,000 investment (

The chart above shows the change in value of a hypothetical $10,000 investment in Columbia Seligman Premium Technology Growth Fund, Inc. during the stated time period, and does

not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the sale of Fund shares.

The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets as of

December 31, 2024. Derivatives are excluded from the tables unless otherwise noted. The Fund’s portfolio composition is

subject to change.

|

| |

| |

| |

| |

| |

| |

Bloom Energy Corp., Class A | |

| |

| |

Meta Platforms, Inc., Class A | |

Information Technology Sub-industry Allocation |

| |

| |

Technology Hardware, Storage & Peripherals | |

Semiconductor Materials & Equipment | |

| |

| |

Internet Services & Infrastructure | |

Electronic Equipment & Instruments | |

| |

Columbia Seligman Premium Technology Growth Fund, Inc. | 2024

Manager Discussion of Fund Performance

(Unaudited)

Top Performance Contributors

Selections in the IT services, technology hardware storage & peripherals and communications equipment

industries contributed to the Fund’s return relative to the benchmark.

Allocations to the semiconductors & semiconductor equipment industry contributed positively to performance

relative to the benchmark. Underweight allocations to the software, IT services and electronic equipment instruments and

components industries contributed positively to performance relative to the benchmark.

Positions in Broadcom, Inc., a developer, manufacturer, and global supplier of semiconductors;

Microsoft Corp., a developer of software solutions; GoDaddy, Inc, a domain registrar and web hosting company; Semtech

Corporation, a supplier of analog and mixed-signal semiconductors and Cisco Systems, Inc., a communications technology

company all contributed to performance relative to the fund’s benchmark.

Top Performance Detractors

Selections in the semiconductors & semiconductor equipment industry as well as the software and

electronic equipment instruments and components industry detracted from performance relative to the benchmark.

An off-benchmark allocation to the specialized REITs and ground transportation industry detracted from the

Fund’s performance relative to the benchmark as well as an allocation to the financial services industry.

Positions in NVIDIA Corp., a developer and distributor of semiconductor chips; Synaptics, Inc, a

developer of computer-to-human interface devices; Dropbox, Inc., a company offering cloud storage Global Payments, Inc., a

provider of payment services to merchants and Western Digital Corp., a data storage company all detracted from performance

relative to the Fund’s benchmark during the year.

Columbia Seligman Premium Technology Growth Fund, Inc. | 2024

Fund Investment Objective, Strategies, Policies and

Principal Risks

(Unaudited)

Fund Investment Objective

The Fund’s investment objective is to seek growth of capital and current income. The Fund’s investment objective is

non-fundamental and may be changed by the Board without approval of the Fund’s stockholders.

Fund Investment Strategies and Policies

Under normal market conditions, the Fund invests at least 80% of its “Managed Assets” (as defined below) in a portfolio of

equity securities of technology and technology-related companies that Columbia Management Investment Advisers, LLC (the

Investment Manager) believes offer attractive opportunities for capital appreciation. Under normal market conditions, the

Fund’s investment program consists primarily of (i) investing in a portfolio of common stocks of technology and technology-related

companies that seeks to exceed the total return, before fees and expenses, of the S&P North American Technology

Sector Index (described further below) and (ii) writing call options on the NASDAQ 100 Index

®

, an unmanaged index of the

100 largest non-financial domestic and international companies listed on the NASDAQ Stock Market based on market

capitalization, or an exchange-traded fund (ETF) equivalent (the NASDAQ 100) on a month-to-month basis, with an aggregate

notional amount typically ranging from 0%-90% of the underlying value of the Fund’s holdings of common stock (the

Rules-based Option Strategy, as further described below). The Fund expects to generate current income from premiums

received from writing call options on the NASDAQ 100. The Fund concentrates its investments in technology and

technology-related stocks. The Fund may invest in companies of any size, including small-, mid-, and large-cap companies, as

well as foreign companies.

Technology and technology-related companies in which the Fund invests are companies operating in the information

technology and communications services sectors, as well as other related industries, applying a global industry classification

standard, as it may be amended from time to time, to determine industry/sector classifications. These related industry

companies may also include companies operating in the consumer discretionary and healthcare sectors, particularly those

that are principally engaged in offering or developing products, processes, or services that benefit significantly from

technological advances and improvements. By way of example, technology and technology-related companies may include

semiconductor, semiconductor equipment, technology hardware, storage and peripherals, software, communication

equipment and services, electronic equipment and instruments, internet services and infrastructure, media, health care

equipment and supplies, and medical technology companies. The Fund tends to focus its technology and technology-related

investments on companies in the information technology sector and/or the semiconductor and semiconductor equipment

industry.

In determining the level (i.e., 0% to 90%) of call options to be written on the NASDAQ 100, the Investment Manager’s

Rules-based Option Strategy is based on the CBOE NASDAQ-100 Volatility Index

SM

(the VXN Index). The VXN Index measures

the market’s expectation of 30-day volatility implicit in the prices of near-term NASDAQ 100 Index options. The VXN Index,

which is quoted in percentage points (e.g., 19.36), is a leading barometer of investor sentiment and market volatility relating

to the NASDAQ 100 Index. In general, the Investment Manager intends to write more call options when market volatility, as

represented by the VXN Index, is high (and premiums received for writing the option are high) and write fewer call options

when market volatility, as represented by the VXN Index, is low (and premiums for writing the option are low).

The Fund’s Rules-based Option Strategy with respect to writing call options is as follows:

| Aggregate Notional Amount of Written Call Options as a Holdings in Common Stocks |

| |

Greater than 17, but less than 18 | |

At least 18, but less than 33 | |

At least 33, but less than 34 | |

At least 34, but less than 55 | |

| |

Columbia Seligman Premium Technology Growth Fund, Inc. | 2024

Fund Investment Objective, Strategies, Policies and

Principal Risks

(continued)

(Unaudited)

In addition to the Rules-based Option Strategy, the Fund may write additional calls with aggregate notional amounts of up to

25% of the value of the Fund’s holdings in common stock (to a maximum of 90% when aggregated with the call options

written pursuant to the Rules-based Option Strategy) when the Investment Manager believes call premiums are attractive

relative to the risk of the price of the NASDAQ 100. The Fund may also close (or buy back) a written call option if the

Investment Manager believes that a substantial amount of the premium (typically, 70% or more) to be received by the Fund

has been captured before exercise, potentially reducing the call position to 0% of total equity until additional calls are written.

The Fund, subject to the above-mentioned aggregate notional amount of 90% of the underlying value of the Fund’s holdings of

common stock, may also buy or write other call and put options on securities, indices, ETFs and market baskets of securities

to generate additional income or return or to provide the portfolio with downside protection.

The S&P North American Technology Sector Index is a benchmark that represents U.S. securities classified under the GICS

®

information technology sector as well as the internet and direct marketing retail, interactive home entertainment, and

interactive media and services sub-industries.

The Fund’s investment policy of investing at least 80% of its Managed Assets in equity securities of technology and

technology-related companies and its policy with respect to the use of the Rules-based Option Strategy on a month-to-month

basis may be changed by the Board without stockholder approval only with 60 days’ prior written notice to stockholders.

The Fund is a non-diversified fund. A non-diversified fund is permitted to invest a greater percentage of its total assets in

fewer issuers than a diversified fund. This policy may not be changed without a stockholder vote.

The Fund has a fundamental policy of investing at least 25% of the value of its Managed Assets in technology and

technology-related stocks. This policy may not be changed without a stockholder vote.

The Fund may also invest: up to 15% of its Managed Assets in illiquid securities (i.e., securities that at the time of purchase

are not readily marketable); up to 20% of its Managed Assets in debt securities (including convertible and non-convertible

debt securities), such as debt securities issued by technology and technology-related companies and obligations of the

U.S. Government, its agencies and instrumentalities, and government-sponsored enterprises, as well as below-investment

grade securities (i.e., high-yield or junk bonds); and up to 25% of its Managed Assets in equity securities of companies

organized outside of the United States. The Fund may hold foreign securities of issuers located or doing substantial business

in emerging markets. Each of these policies may be changed by the Board without stockholder approval.

The Fund has other fundamental policies that may not be changed without a stockholder vote. Under these policies, the Fund

may not:

• Purchase or sell commodities or commodity contracts, except to the extent permissible under applicable law and

interpretations, as they may be amended from time to time, and except this shall not prevent the Fund from buying or selling

options, futures contracts and foreign currency or from entering into forward currency contracts or from investing in securities

or other instruments backed by, or whose value is derived from, physical commodities;

• Issue senior securities or borrow money, except as permitted by the Investment Company Act of 1940, as amended (1940

Act) or any rule thereunder, any Securities and Exchange Commission (SEC) or SEC staff interpretations thereof or any

exemptions therefrom which may be granted by the SEC;

• Make loans, except as permitted by the 1940 Act or any rule thereunder, any SEC or SEC staff interpretations thereof or

any exemptions therefrom which may be granted by the SEC;

• Underwrite the securities of other issuers, except insofar as the Fund may be deemed an underwriter under the Securities

Act of 1933 (1933 Act) in disposing of a portfolio security or in connection with investments in other investment companies;

• Buy or sell real estate, unless acquired as a result of ownership of securities or other instruments, except this shall not

prevent the Fund from investing in securities or other instruments backed by real estate or securities of companies engaged

in the real estate business or real estate investment trusts; and

Columbia Seligman Premium Technology Growth Fund, Inc. | 2024

Fund Investment Objective, Strategies, Policies and

Principal Risks

(continued)

(Unaudited)

• Invest 25% or more of its Managed Assets (as defined below), at market value, in the securities of issuers in any particular

industry, except that the Fund will invest at least 25% of the value of its Managed Assets in technology and technology-related

stocks (in which the Fund intends to concentrate) and may invest without limit in securities issued or guaranteed by

the U.S. Government, its agencies or instrumentalities, or government-sponsored enterprises, as described in the Fund’s

prospectus, which may be amended from time to time.

“Managed Assets” means the net asset value of the Fund’s outstanding common shares plus any liquidation preference of

any issued and outstanding shares of Fund preferred stock ("Preferred Shares") and the principal amount of any borrowings

used for leverage.

Certain of the Fund’s fundamental policies set forth above prohibit transactions “except as permitted by the 1940 Act or any

rule thereunder, any SEC or SEC staff interpretations thereof or any exemptions therefrom which may be granted by the SEC.”

The following discussion summarizes the flexibility that the Fund currently gains from these exceptions. To the extent the

1940 Act or the rules and regulations thereunder may, in the future, be amended to provide greater flexibility, or to the extent

the SEC may in the future grant exemptive relief providing greater flexibility, the Fund will be able to use that flexibility without

seeking shareholder approval of its fundamental policies.

Issuing senior securities — A “senior security” is an obligation with respect to the earnings or assets of a company that

takes precedence over the claims of that company’s common stock with respect to the same earnings or assets. The 1940

Act limits a closed-end fund’s issuance of senior securities, but Rule 18f-4 provides relief from that prohibition as to certain

transactions that could be considered issuances of senior securities, provided that the Fund complies with its conditions.

The exception in the fundamental policy allows the Fund to operate in accordance with Rule 18f-4.

Borrowing money — The 1940 Act permits the Fund to borrow up to 33 1/3% of its Managed Assets, plus an additional 5% of

its Managed Assets for temporary purposes. The Fund’s compliance with its policy on borrowing is not determined by

applying the time of purchase standard.

Making loans — The 1940 Act generally prohibits the Fund from making loans to affiliated persons but does not otherwise

restrict the Fund’s ability to make loans.

Under the 1940 Act, the Fund’s fundamental policies may not be changed without the approval of the holders of a “majority

of the outstanding” common shares and, if issued, preferred shares voting together as a single class, and of the holders of a

“majority of the outstanding” preferred shares voting as a separate class. When used with respect to particular shares of the

Fund, a “majority of the outstanding” shares means the lesser of: (i) 67% or more of the shares present at a stockholder

meeting, if the holders of more than 50% of the outstanding shares are present at the meeting or represented by proxy, or (ii)

more than 50% of the outstanding shares of the Fund.

An investment in the Fund involves risks. The principal risks of investing in the Fund are provided below. There is no

assurance that the Fund will achieve its investment objective and you may lose money. The value of the Fund’s holdings may

decline, and the Fund’s net asset value (NAV) and share price may go down. An investment in the Fund is not a bank deposit

and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The

significance of any specific risk to an investment in the Fund will vary over time depending on the composition of the Fund’s

portfolio, market conditions, and other factors. You should read all of the risk information below carefully, because any one or

more of these risks may result in losses to the Fund. See also the Fund’s "Significant Risks" in the Notes to Financial

Statements section.

The Fund is actively managed and its performance therefore will reflect, in part, the ability of the

portfolio managers to make investment decisions that seek to achieve the Fund’s investment objective. Due to its active

management, the Fund could underperform its benchmark index and/or other funds with similar investment objectives

and/or strategies.

Columbia Seligman Premium Technology Growth Fund, Inc. | 2024

Fund Investment Objective, Strategies, Policies and

Principal Risks

(continued)

(Unaudited)

. The risk ex

is

ts that a counterparty to a transaction in a financial instrument held by the Fund or by a

special purpose or structured vehicle in which the Fund invests may become insolvent or otherwise fail to perform its

obligations, including making payments to the Fund, due to financial difficulties. The Fund may obtain no or limited recovery in

a bankruptcy or other reorganizational proceedings, and any recovery may be significantly delayed. Transactions that the Fund

enters into may involve counterparties in the financial services sector and, as a result, events affecting the financial services

sector may cause the Fund’s NAV to fluctuate.

Credit risk is the risk that the value of debt instruments may decline if the issuer thereof defaults or otherwise

becomes unable or unwilling, or is perceived to be unable or unwilling, to honor its financial obligations, such as making

payments to the Fund when due. Various factors could affect the actual or perceived willingness or ability of the issuer to

make timely interest or principal payments, including changes in the financial condition of the issuer or in general economic

conditions. Credit rating agencies, such as S&P Global Ratings, Moody’s Ratings, Fitch, DBRS and KBRA, assign credit

ratings to certain debt instruments to indicate their credit risk. A rating downgrade by such agencies can negatively impact

the value of such instruments. Lower-rated or unrated instruments held by the Fund may present increased credit risk as

compared to higher-rated instruments. Non-investment grade debt instruments may be subject to greater price fluctuations

and are more likely to experience a default than investment grade debt instruments and therefore may expose the Fund to

increased credit risk. If the Fund purchases unrated instruments, or if the ratings of instruments held by the Fund are lowered

after purchase, the Fund will depend on analysis of credit risk more heavily than usual.

Derivatives may involve significant risks. Derivatives are financial instruments, traded on an exchange or in

the over-the-counter (OTC) markets, with a value in relation to, or derived from, the value of an underlying asset(s) (such as a

security, commodity or currency) or other reference, such as an index, rate or other economic indicator (each an underlying

reference). Derivatives may include those that are privately placed or otherwise exempt from SEC registration, including

certain Rule 144A eligible securities. Derivatives could result in Fund losses if the underlying reference does not perform as

anticipated. Use of derivatives is a highly specialized activity that can involve investment techniques, risks, and tax planning

different from those associated with more traditional investment instruments. The Fund’s derivatives strategy may not be

successful and use of certain derivatives could result in substantial, potentially unlimited, losses to the Fund regardless of

the Fund’s actual investment. A relatively small movement in the price, rate or other economic indicator associated with the

underlying reference may result in substantial losses for the Fund. Derivatives may be more volatile than other types of

investments. Derivatives can increase the Fund’s risk exposure to underlying references and their attendant risks, including

the risk of an adverse credit event associated with the underlying reference (credit risk), the risk of an adverse movement in

the value, price or rate of the underlying reference (market risk), the risk of an adverse movement in the value of underlying

currencies (foreign currency risk) and the risk of an adverse movement in underlying interest rates (interest rate risk).

Derivatives may expose the Fund to additional risks, including the risk of loss due to a derivative position that is imperfectly

correlated with the underlying reference it is intended to hedge or replicate (correlation risk), the risk that a counterparty will

fail to perform as agreed (counterparty risk), the risk that a hedging strategy may fail to mitigate losses, and may offset gains

(hedging risk), the risk that the return on an investment may not keep pace with inflation (inflation risk), the risk that losses

may be greater than the amount invested (leverage risk), the risk that the Fund may be unable to sell an investment at an

advantageous time or price (liquidity risk), the risk that the investment may be difficult to value (pricing risk), and the risk that

the price or value of the investment fluctuates significantly over short periods of time (volatility risk). The value of derivatives

may be influenced by a variety of factors, including national and international political and economic developments. Potential

changes to the regulation of the derivatives markets may make derivatives more costly, may limit the market for derivatives,

or may otherwise adversely affect the value or performance of derivatives.

Derivatives Risk – Options Risk.

Options are deri

va

tives that give the pu

rchase

r the option to buy (call) or sell (put) an

underlying reference from or to a counterparty at a specified price (the strike price) on or before an expiration date. The Fund

may purchase or write (i.e., sell) put and call options on an underlying reference it is otherwise permitted to invest in. When

writing options, the Fund is exposed to the risk that it may be required to buy or sell the underlying reference at a

disadvantageous price on or before the expiration date. If the Fund sells a put option, the Fund may be required to buy the

underlying reference at a strike price that is above market price, resulting in a loss. If the Fund sells a call option, the Fund

may be required to sell the underlying reference at a strike price that is below market price, resulting in a loss. If the Fund

sells a call option that is not covered (it does not own the underlying reference), the Fund’s losses are potentially unlimited.

Columbia Seligman Premium Technology Growth Fund, Inc. | 2024

Fund Investment Objective, Strategies, Policies and

Principal Risks

(continued)

(Unaudited)

Options may involve economic leverage, which could result in greater volatility in price movement. Options may be traded on

a securities exchange or in the over-the-counter market. At or prior to maturity of an options contract, the Fund may enter into

an offsetting contract and may incur a loss to the extent there has been adverse movement in options prices. Options can

increase the Fund’s risk exposure to underlying references and their attendant risks such as credit risk, market risk, foreign

currency risk and interest rate risk, while pot

e

ntially exposing the Fund to correlation risk, counterparty risk, hedging risk,

inflation risk, leverage ris

k, liq

uidity risk, pricing risk and volatility risk.

Investments in or exposure to securities of foreign companies may involve heightened risks relative

to investments in or exposure to securities of U.S. companies. For example, foreign markets can be extremely volatile.

Foreign securities may also be less liquid, making them more difficult to trade, than securities of U.S. companies so that the

Fund may, at times, be unable to sell foreign securities at desirable times or prices. Brokerage commissions, custodial costs

and other fees are also generally higher for foreign securities. The Fund may have limited or no legal recourse in the event of

default with respect to certain foreign securities, including those issued by foreign governments. In addition, foreign

governments may impose withholding or other taxes on the Fund’s income, capital gains or proceeds from the disposition of

foreign securities, which could reduce the Fund’s return on such securities. In some cases, such withholding or other taxes

could potentially be confiscatory. Other risks include: possible delays in the settlement of transactions or in the payment of

income; generally less publicly available information about foreign companies; the impact of economic, political, social,

diplomatic or other conditions or events (including, for example, military confrontations and actions, war, other conflicts,

terrorism and disease/virus outbreaks and epidemics), possible seizure, expropriation or nationalization of a company or its

assets or the assets of a particular investor or category of investors; accounting, auditing and financial reporting standards

that may be less comprehensive and stringent than those applicable to domestic companies; the imposition of economic and

other sanctions against a particular foreign country, its nationals or industries or businesses within the country; and the

generally less stringent standard of care to which local agents may be held in the local markets. In addition, it may be difficult

to obtain reliable information about the securities and business operations of certain foreign issuers. Governments or trade

groups may compel local agents to hold securities in designated depositories that are not subject to independent evaluation.

The less developed a country’s securities market is, the greater the level of risks. Economic sanctions may be, and have

been, imposed against certain countries, organizations, companies, entities and/or individuals. Economic sanctions and

other similar governmental actions could, among other things, effectively restrict or eliminate the Fund’s ability to purchase or

sell securities, and thus may make the Fund’s investments in such securities less liquid or more difficult to value. In addition,

as a result of economic sanctions, the Fund may be forced to sell or otherwise dispose of investments at inopportune times

or prices, which could result in losses to the Fund and increased transaction costs. These conditions may be in place for a

substantial period of time and enacted with limited advance notice to the Fund. The risks posed by sanctions against a

particular foreign country, its nationals or industries or businesses within the country may be heightened to the extent the

Fund invests significantly in the affected country or region or in issuers from the affected country that depend on global

markets. Additionally, investments in certain countries may subject the Fund to a number of tax rules, the application of

which may be uncertain. Countries may amend or revise their existing tax laws, regulations and/or procedures in the future,

possibly with retroactive effect. Changes in or uncertainties regarding the laws, regulations or procedures of a country could

reduce the after-tax profits of the Fund, directly or indirectly, including by reducing the after-tax profits of companies located in

such countries in which the Fund invests, or result in unexpected tax liabilities for the Fund. The performance of the Fund

may also be negatively affected by fluctuations in a foreign currency’s strength or weakness relative to the U.S. dollar,

particularly to the extent the Fund invests a significant percentage of its assets in foreign securities or other assets

denominated in currencies other than the U.S. dollar. Currency rates in foreign countries may fluctuate significantly over short

or long periods of time for a number of reasons, including changes in interest rates, imposition of currency exchange controls

and economic or political developments in the U.S. or abroad. The Fund may also incur currency conversion costs when

converting foreign currencies into U.S. dollars and vice versa.

Interest rate risk is the risk of losses attributable to changes in interest rates. In general, if interest rates

rise, the values of debt instruments tend to fall, and if interest rates fall, the values of debt instruments tend to rise. Changes

in the value of a debt instrument usually will not affect the amount of income the Fund receives from it but will generally affect

the value of your investment in the Fund. Changes in interest rates may also affect the liquidity of the Fund’s investments in

debt instruments. In g

en

eral, the longer the maturity or duration of a debt instrument, the greater its sensitivity to changes in

Columbia Seligman Premium Technology Growth Fund, Inc. | 2024

Fund Investment Objective, Strategies, Policies and

Principal Risks

(continued)

(Unaudited)

interest rates. For example, a th

re

e-year duration means a bond is expected to decrease in value by 3% if interest rates rise

1% and increase in value by 3% if interest rates fall 1%. Interest rate declines also may increase prepayments of debt

obligations, which, in turn, would increase prepayment risk (the risk that the Fund will have to reinvest the money received in

securities that have lower yields). The Fund is subject to the risk that the income generated by its investments may not keep

pace with inflation. Actions by governments and central banking authorities can result in increases or decreases in interest

rates. Higher periods of inflation could lead such authorities to raise interest rates. Such actions may negatively affect the

value of debt instruments held by the Fund, resulting in a negative impact on the Fund’s performance and NAV. Any interest

rate increases could cause the value of the Fund’s inv

e

stments in debt instruments to decrease.

An issuer in which the Fund invests or to which it has exposure may perform poorly or below expectations and

the value of its securities may therefore decline, which may negatively affect the Fund’s performance. Underperformance of

an issuer may be caused by poor management decisions, competitive pressures, breakthroughs in technology, reliance on

suppliers, labor problems or shortages, corporate restructurings, fraudulent disclosures, natural disasters, military

confrontations and actions, war, other conflicts, terrorism, disease/virus outbreaks, epidemics or other events, conditions

and factors which may impair the value of your investment in the Fund and could result in a greater premium or discount

between the market price and the NAV of the Fund’s shares and wider bid/ask spreads than those experienced by other

closed-end funds.

Small- and Mid-Cap Stock Risk.

Securities of small- and mid-cap companies can, in certain circumstances, have a higher

potential for gains than securities of larger companies but are more likely to have more risk than larger companies. For

example, small- and mid-cap companies may be more vulnerable to market downturns and adverse business or economic

events than larger companies because they may have more limited financial resources and business operations. Small- and

mid-cap companies are also more likely than larger companies to have more limited product lines and operating histories and

to depend on smaller and generally less experienced management teams. Securities of small- and mid-cap companies may

trade less frequently and in smaller volumes and may be less liquid and fluctuate more sharply in value than securities of

larger companies. When the Fund takes significant positions in small- and mid-cap companies with limited trading volumes,

the liquidation of those positions, particularly in a distressed market, could be prolonged and result in Fund investment

losses that would affect the value of your investment in the Fund. In addition, some small- and mid-cap companies may not

be widely followed by the investment community, which can lower the demand for their stocks.

Investments in larger, more established companies (larger companies), may involve certain risks

associated with their larger size. For instance, larger companies may be less able to respond quickly to new competitive

challenges, such as changes in consumer tastes or innovation from smaller competitors. Also, larger companies are

sometimes less able to achieve as high growth rates as successful smaller companies, especially during extended periods of

economic expansion.

The Fund may incur lo

s

ses due to declines in the value of one or more securities in which it invests. These

declines may be due to factors affecting a particular issuer, or the result of, among other things, political, regulatory, market,

economic or social developments affecting the relevant market(s) more generally. In addition, turbulence in financial markets

and reduced liquidity in equity, credit and/or fixed income markets may negatively affect many issuers, which could adversely

affect the Fund’s ability to price or value hard-to-value assets in thinly traded and closed markets and could cause operational

challenges. Global economies and financial markets are increasingly interconnected, and conditions and events in one

country, region or financial market may adversely impact issuers in a different country, region or financial market. These risks

may be magnified if certain events or developments adversely interrupt the global supply chain; in these and other

circumstances, such risks might affect companies worldwide. As a result, local, regional or global events such as terrorism,

war, other conflicts, natural disasters, disease/virus outbreaks and epidemics or other public health issues, recessions,

depressions or other events – or the potential for such events – could have a significant negative impact on global

economic and market conditions and could result in a greater premium or discount between the market price and the NAV of

the Fund’s shares and wider bid/ask spreads than those experienced by other closed-end funds.

Columbia Seligman Premium Technology Growth Fund, Inc. | 2024

Fund Investment Objective, Strategies, Policies and

Principal Risks

(continued)

(Unaudited)

Market Trading Discount Risk.

The Fund’s Common Shares can and have traded at a discount to the Fund’s NAV. The shares

of closed-end management investment companies frequently trade at a discount from their NAV. This is a risk separate and

distinct from the risk that the Fund’s NAV

ma

y decrease.

Non-Diversified Fund Risk.

The Fund is non-diversified, which generally means that it may invest a greater percentage of its

total assets in the securities of fewer issuers than a “diversified” fund. This increases the risk that a change in the value of

any one investment held by the Fund could affect the overall value of the Fund more than it would affect that of a diversified

fund holding a greater number of investments. Accordingly, the Fund’s value will likely be more volatile than the value of a

more diversified fund.

The provisions of the 1940 Act generally require that the public offering price of an investment company’s

common shares (less any underwriting commissions and discounts) must equal or exceed the NAV per share of an

investment company’s common stock (calculated within 48 hours of pricing), plus any sales commission charged in

connection with the offering. In the offering described in the Fund’s current Prospectus, the Fund may, subject to market

conditions, raise additional equity capital by issuing new Common Shares from time to time in varying amounts at a net price

at or above the Fund’s NAV per Common Share (calculated within 48 hours of pricing). To the extent that Fund Common

Shares do not trade at a premium, the Fund may be unable to issue additional Common Shares, and may incur costs

associated with maintaining an “at the market” program without the potential benefits. The offering described in the Fund’s

Prospectus may allow the Fund to pursue additional investment opportunities without the need to sell existing portfolio

investments and will increase the asset size of the Fund and thus cause the Fund’s fixed expenses to be spread over a

larger asset base. However, the issuance may not necessarily result in an increase to net income for stockholders, which

depends upon available investment opportunities and other factors. The Fund cannot predict whether its Common Shares will

trade in the future at a premium to Fund NAV per Common Share. Shares of common stock of closed-end investment

companies frequently trade at a discount from NAV, which may increase investors’ risk of loss. In no event will Common

Shares be issued at a price below the Fund’s NAV per Common Share (calculated within 48 hours of pricing) plus any sales

commission charged in connection with the offering. The offering described in the Fund’s Prospectus entails potential risks to

existing common stockholders. Although the issuance of additional Common Shares may facilitate a more active market in

the Fund’s Common Shares by increasing the amount of Common Shares outstanding, the issuance of additional Common

Shares may also have an adverse effect on prices for the Fund’s Common Shares in the secondary market by increasing the

supply of Common Shares available for sale. The issuance of additional Common Shares will dilute the voting power of

already outstanding Common Shares.

Secondary Market for the Common Shares Risk.

The is

s

uance of Common Shares through the Fund’s Prospectus offering

may have an adverse effect on the secondary market for the Common Shares. The increase in the amount of the Fund’s

outstanding Common Shares resulting from this offering may put downward pressure on the market price for the Common

Shares of the Fund. Common Shares will not be issued pursuant to the offering at any time when Common Shares are

trading at a price lower than a price equal to the Fund’s NAV per Common Share plus the per Common Share amount of

commissions. The Fund also issues Common Shares of the Fund through its Dividend Investment Plan. See “Dividend

Investment Plan” in the Fund’s Prospectus. Common Shares may be issued under the plan at a discount to the market price

for such Common Shares, which may put downward pressure on the market price for Common Shares of the Fund. When the

Common Shares are trading at a premium, the Fund may also issue Common Shares of the Fund that are sold through

transactions effected on the NYSE. The increase in the amount of the Fund’s outstanding Common Shares resulting from

that offering may also put downward pressure on the market price for the Common Shares of the Fund. The voting power of

current Common Stockholders will be diluted to the extent that such stockholders do not purchase shares in any future

Common Share offerings or do not purchase sufficient shares to maintain their percentage interest. In addition, if the

Investment Manager is unable to invest the proceeds of such offering as intended, the Fund’s per share distribution may

decrease (or may consist of return of capital) and the Fund may not participate in market advances to the same extent as if

such proceeds were fully invested as planned.

Columbia Seligman Premium Technology Growth Fund, Inc. | 2024

Fund Investment Objective, Strategies, Policies and

Principal Risks

(continued)

(Unaudited)

At times, the F

u

nd may have a significant portion of its assets invested in securities of companies conducting

business in a related group of industries within one or more economic sectors, including the communication services sector

and information technology sector. Companies in the same sector may be similarly affected by economic, regulatory, political

or market events or conditions, which may make the Fund vulnerable to unfavorable developments in that group of industries

or economic sector.

Communication Services Sector and Information Technology Sector.

The Fund is vulnerable to the particular risks that may

affect companies in the communication services sector and the information technology sector. Companies in these sectors

are subject to certain risks, including the risk that new services, equipment or technologies will not be accepted by

consumers and businesses or will become rapidly obsolete. Performance of such companies may be affected by factors

including obtaining and protecting patents (or the failure to do so) and significant competitive pressures, including aggressive

pricing of their products or services, new market entrants, competition for market share and short product cycles due to an

accelerated rate of technological developments. Such competitive pressures may lead to limited earnings and/or falling profit

margins. As a result, the value of their securities may fall or fail to rise. In addition, many communication services sector and

information technology sector companies have limited operating histories and prices of these companies’ securities

historically have been more volatile than other securities, especially over the short term. Some companies in these sectors

are facing increased government and regulatory scrutiny and may be subject to adverse government or regulatory action,

which could negatively impact the value of their securities.

Semiconductor and Semiconductor Equipment Industry Risk.

The Fund’s investment in the semiconductor and semiconductor

equipment industry subjects the Fund to the risks of investments in the industry, including: intense competition, both

domestically and internationally, including competition from subsidized foreign competitors with lower production costs; wide

fluctuations in securities prices due to risks of rapid obsolescence of products and related technology; economic

performance of the customers of semiconductor and related companies; their research costs and the risks that their

products may not prove commercially successful; and thin capitalization and limited product lines, markets, financial

resources or quality management and personnel. Semiconductor design and process methodologies are subject to rapid

technological change requiring large expenditures, potentially requiring financing that may be difficult or impossible to obtain,

for research and development in order to improve product performance and increase manufacturing yields. These companies

rely on a combination of patents, trade secret laws and contractual provisions to protect their technologies. The process of

seeking patent protection can be long and expensive. The industry is characterized by frequent litigation regarding patent and

other intellectual property rights, which may require such companies to defend against competitors’ assertions of intellectual

property infringement or misappropriation. Some companies are also engaged in other lines of business unrelated to the

semiconductor business, and these companies may experience problems with these lines of business that could adversely

affect their operating results. The international operations of many companies expose them to the ri

sk

s associated with

instability and changes in economic and political conditions, foreign currency fluctuations, changes in foreign regulations,

tariffs, and trade disputes. Business conditions in this industry can change rapidly from periods of strong demand to periods

of weak demand. Any future downturn in the industry could harm the business and operating results of these companies. The

stock prices of companies in the industry have been and will likely continue to be volatile relative to the overall market.

Transactions in Derivatives.

The Fund may enter into derivative transactions or otherwise have exposure to derivative

transactions through underlying investments. Derivatives are financial contracts whose values are, for example, based on (or

“derived” from) traditional securities (such as a stock or bond), assets (such as a commodity like gold or a foreign currency),

reference rates (s

u

ch as the Secured Overnight Financing Rate (commonly known as SOFR)) or market indices (such as the

Standard & Poor’s 500

®

Index). The use of derivatives is a highly specialized activity which involves investment techniques

and risks different from those associated with ordinary portfolio securities transactions. Derivatives involve special risks and

may result in losses or may limit the Fund’s potential gain from favorable market movements. Derivative strategies often

involve leverage, which may exaggerate a loss, potentially causing the Fund to lose more money than it would have lost had it

invested in the underlying security or other asset directly. The values of derivatives may move in unexpected ways, especially

in unusual market conditions, and may result in increased volatility in the value of the derivative and/or the Fund’s shares,

among other consequences. The use of derivatives may also increase the amount of taxes payable by stockholders holding

shares in a taxable account. See the

section in the Fund’s Statement of Additional Information for more information.

Other risks arise from the Fund’s potential inability to terminate or to sell derivative positions. A liquid secondary market may

Columbia Seligman Premium Technology Growth Fund, Inc. | 2024

Fund Investment Objective, Strategies, Policies and

Principal Risks

(continued)

(Unaudited)

not always exist for the Fund’s derivative positions at times when the Fund might wish to terminate or to sell such positions.

Over-the-counter instruments (investments not traded on an exchange) may be illiquid, and transactions in derivatives traded

in the over-the-counter market are subject to the risk that the other party will not meet its obligations. The use of derivatives

also involves the risks of m

i

spricing or improper valuation and that changes in the value of the derivative may not correlate

perfectly with the underlying security, asset, reference rate or index. The Fund also may not be able to find a suitable

derivative transaction counterparty, and thus may be unable to engage in derivative transactions when it is deemed favorable

to do so, or at all. The U.S. government and the European Union (and some other jurisdictions) have enacted regulations and

similar requirements that prescribe clearing, margin, reporting and registration requirements for participants in the derivatives

market. These requirements are evolving and their ultimate impact on the Fund remains unclear, but such impact could

include restricting and/or imposing significant costs or other burdens upon the Fund’s participation in derivatives

transactions. Additionally regulations governing the use of derivatives by registered investment companies, such as the Fund

require, among other things, that a fund that invests in derivative instruments beyond a specified limited amount apply a

value-at-risk-based limit to its portfolio and establish a comprehensive derivatives risk management program. As of the date

of this report, the Fund is required to maintain a comprehensive derivatives risk management program. For more inf

ormation

on the risks of derivative investments and strategies, see the Statement of Additional Information.

Columbia Seligman Premium Technology Growth Fund, Inc. | 2024

Fees and Expenses and Share Price

Dat

a

(Unaudited)

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy, hold and sell

Common Shares.

You may pay other

fees, such as brokerage commissions and other fees to financial intermediaries, which

are not reflected in the tables and

examples below.

Stockholder Transaction Expenses |

Dividend Investment Plan and Stock Re pu rchase Program Fees | |

Annual Expenses (as a percentage of net assets attributable to common shares) |

| |

| |

Acquired fund fees and expenses | |

| |

There are no service or brokerage charges to participants in the di

vi

dend investment plan; however, the Fund reserves the right to amend the plan to include a service charge

payable to the Fund by the participants. The Fund reserves the right to amend the plan to provide for payment of brokerage fees by the plan participants in the event the plan is

changed to provide for open market purchases of Fund Common Stock on behalf of plan participants.

The Fund’s management fee is 1.06% of the Fund’s average daily Managed Assets (which means the net asset value of Fund’s outstanding common stock plus the liquidation

preference of any issued and outstanding preferred stock of the Fund and the principal amount of any borrowing used for leverage). The management fee rate noted in the table

reflects the rate paid by Common Stockholders as a percentage of the Fund’s net assets attributable to Common Stock.

“Total Annual Expenses" include acquired fund fees and expenses (expenses the Fund incurs indirectly through its investments in other investment companies) and may be higher

than “Total gross expenses” shown in the

section of this report because “Total gross expenses” does not include acquired fund fees and expenses.

The following example is intended to help you compare the cost of investing in the Fund with the cost of investing in other

funds. The example illustrates the hypothetical expenses that you would incur over the time periods indicated, and assumes

that:

• you invest $1,000 in the Fund for the periods indicated,

• your investment has a 5% return each year, and

• the Fund’s total annual operating expenses remain the same as shown in the Annual Fund Operating Expenses table

above.

Although your actual costs may be higher or lower, based on the assumptions listed above, your costs would be:

| | | | |

Columbia Seligman Premium Technology Growth Fund, Inc. Common Stock | | | | |

The purpose of the tables above is to assist you in understanding the various costs and expenses you will bear directly or

indirectly.

Columbia Seligman Premium Technology Growth Fund, Inc. | 2024

Fees and Expenses and Share Price Data

(continued)

(Unaudited)

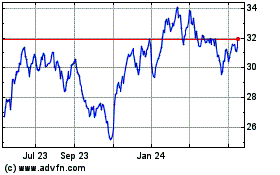

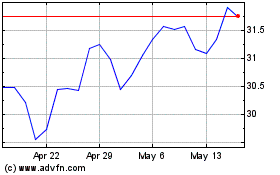

The Fund’s Common Stock is traded primarily on the New York Stock Exchange (the Exchange). The following table shows the

high and low closing prices of the Fund’s Common Stock on the Exchange for each calendar quarter since the beginning of

2023, as well as the net asset values and the range of the percentage (discounts)/premiums to net asset value per share

that correspond to such prices.

| | | Corresponding (Discount)/Premium to NAV (%) |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

The Fund’s Common Stock has historically fluctuated between trading on the market at a discount to net asset value and at a

premium to net asset value. The closing market price, net asset value and percentage (discount)/premium to net asset value

per share of the Fund’s Common Stock on December 31, 2024 were $31.95, $31.84, and 0.35%, respectively.

Columbia Seligman Premium Technology Growth Fund, Inc. | 2024

Portfolio of Investments

December 31, 2024

(Percentages represent value of investments compared to net assets)

Investments in securities

|

| | |

Communication Services 14.7% |

|

| | |

Interactive Home Entertainment 0.3% |

| | |

Interactive Media & Services 12.1% |

Alphabet, Inc., Class A (a) | | |

| | |

| | |

Meta Platforms, Inc., Class A | | |

Pinterest, Inc., Class A (b) | | |

| | |

| |

Movies & Entertainment 1.1% |

| | |

Total Communication Services | |

Consumer Discretionary 5.6% |

|

| | |

| | |

| |

Total Consumer Discretionary | |

|

Transaction & Payment Processing Services 7.4% |

| | |

| | |

Shift4 Payments, Inc., Class A (b) | | |

| | |

| |

| |

|

Heavy Electrical Equipment 4.3% |

Bloom Energy Corp., Class A (b) | | |

Passenger Ground Transportation 1.0% |

| | |

| |

Information Technology 74.2% |

Common Stocks (continued) |

| | |

Application Software 8.3% |

| | |

| | |

Dropbox, Inc., Class A (b) | | |

| | |

RingCentral, Inc., Class A (b) | | |

| | |

| | |

| | |

| |

Communications Equipment 4.6% |

| | |

| | |

| | |

| | |

| |

Electronic Equipment & Instruments 1.2% |

Advanced Energy Industries, Inc. | | |

Internet Services & Infrastructure 2.5% |

GoDaddy, Inc., Class A (a),(b) | | |

IT Consulting & Other Services 0.7% |

| | |

Semiconductor Materials & Equipment 9.8% |

| | |

| | |

| | |

| |

|

| | |

| | |

| | |

| | |

| | |

ON Semiconductor Corp. (b) | | |

Renesas Electronics Corp. (b) | | |

| | |

| | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Seligman Premium Technology Growth Fund, Inc. | 2024

Portfolio of Investments

(continued)

December 31, 2024

Common Stocks (continued) |

| | |

Taiwan Semiconductor Manufacturing Co., Ltd., ADR | | |

| |

|

| | |

| | |

| | |

| | |

Palo Alto Networks, Inc. (b) | | |

Tenable Holdings, Inc. (b) | | |

| | |

| |

Technology Distributors 0.1% |

Ingram Micro Holding Corp. (b) | | |

Technology Hardware, Storage & Peripherals 10.1% |

| | |

Hewlett Packard Enterprise Co. | | |

| | |

Common Stocks (continued) |

| | |

| | |

| |

Total Information Technology | |

| |

|

|

| | |

Columbia Short-Term Cash Fund, 4.573% (c),(d) | | |

| |

Total Investments in Securities | |

Other Assets & Liabilities, Net | | |

| |

At December 31, 2024, securities and/or cash totaling $81,309,053 were pledged as collateral.

Investments in derivatives

Call option contracts written |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Notes to Portfolio of Investments

| This security or a portion of this security has been pledged as collateral in connection with derivative contracts. |

| Non-income producing investment. |

| The rate shown is the seven-day current annualized yield at December 31, 2024. |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Seligman Premium Technology Growth Fund, Inc. | 2024

Portfolio of Investments

(continued)

December 31, 2024

Notes to Portfolio of Investments

| As defined in the Investment Company Act of 1940, as amended, an affiliated company is one in which the Fund owns 5% or more of the company’s outstanding voting securities, or a company which is under common ownership or control with the Fund. The value of the holdings and transactions in these affiliated companies during the year ended December 31, 2024 are as follows: |

| | | | | | | | |

Columbia Short-Term Cash Fund, 4.573% |

| | | | | | | | |

| American Depositary Receipt |

The Fund categorizes its fair value measurements according to a three-level hierarchy that maximizes the use of observable inputs and minimizes the use of unobservable inputs by

prioritizing that the most observable input be used when available. Observable inputs are those that market participants would use in pricing an investment based on market data

obtained from sources independent of the reporting entity. Unobservable inputs are those that reflect the Fund’s assumptions about the information market participants would use in

pricing an investment. An investment’s level within the fair value hierarchy is based on the lowest level of any input that is deemed significant to the asset’s or liability’s fair value

measurement. The input levels are not necessarily an indication of the risk or liquidity associated with investments at that level. For example, certain U.S. government securities are

generally high quality and liquid, however, they are reflected as Level 2 because the inputs used to determine fair value may not always be quoted prices in an active market.

Fair value inputs are summarized in the three broad levels listed below:

Level 1 — Valuations based on quoted prices for investments in active markets that the Fund has the ability to access at the measurement date. Valuation adjustments are not

applied to Level 1 investments.

Level 2 — Valuations based on other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risks, etc.).

Level 3 — Valuations based on significant unobservable inputs (including the Fund’s own assumptions and judgment in determining the fair value of investments).

Inputs that are used in determining fair value of an investment may include price information, credit data, volatility statistics, and other factors. These inputs can be either observable or

unobservable. The availability of observable inputs can vary between investments, and is affected by various factors such as the type of investment, and the volume and level of activity

for that investment or similar investments in the marketplace. The inputs will be considered by the Investment Manager, along with any other relevant factors in the calculation of an

investment’s fair value. The Fund uses prices and inputs that are current as of the measurement date, which may include periods of market dislocations. During these periods, the

availability of prices and inputs may be reduced for many investments. This condition could cause an investment to be reclassified between the various levels within the hierarchy.

Values of foreign equity securities actively traded in markets where there is a significant delay in the local close relative to the New York Stock Exchange may include an adjustment to

reflect the impact of market movements following the close of local trading, as described in Note 2 to the financial statements – Security valuation. When such adjustments have been

made, the foreign equity securities are classified as Level 2.

Investments falling into the Level 3 category, if any, are primarily supported by quoted prices from brokers and dealers participating in the market for those investments. However, these

may be classified as Level 3 investments due to lack of market transparency and corroboration to support these quoted prices. Additionally, valuation models may be used as the

pricing source for any remaining investments classified as Level 3. These models may rely on one or more significant unobservable inputs and/or significant assumptions by the

Investment Manager. Inputs used in valuations may include, but are not limited to, financial statement analysis, capital account balances, discount rates and estimated cash flows,

and comparable company data.

The Fund’s Board of Directors (the Board) has designated the Investment Manager, through its Valuation Committee (the Committee), as valuation designee, responsible for

determining the fair value of the assets of the Fund for which market quotations are not readily available using valuation procedures approved by the Board. The Committee consists of

voting and non-voting members from various groups within the Investment Manager’s organization, including operations and accounting, trading and investments, compliance, risk

management and legal.

The Committee meets at least monthly to review and approve valuation matters, which may include a description of specific valuation determinations, data regarding pricing information

received from approved pricing vendors and brokers and the results of Board-approved valuation policies and procedures (the Policies). The Policies address, among other things,

instances when market quotations are or are not readily available, including recommendations of third party pricing vendors and a determination of appropriate pricing methodologies;

events that require specific valuation determinations and assessment of fair value techniques; securities with a potential for stale pricing, including those that are illiquid, restricted, or

in default; and the effectiveness of third party pricing vendors, including periodic reviews of vendors. The Committee meets more frequently, as needed, to discuss additional valuation

matters, which may include the need to review back-testing results, review time-sensitive information or approve related valuation actions. Representatives of Columbia Management

Investment Advisers, LLC report to the Board at each of its regularly scheduled meetings to discuss valuation matters and actions during the period, similar to those described earlier.

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Seligman Premium Technology Growth Fund, Inc. | 2024

Portfolio of Investments

(continued)

December 31, 2024

The following table is a summary of the inputs used to value the Fund’s investments at December 31, 2024:

| | | | |

Investments in Securities | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Total Investments in Securities | | | | |

Investments in Derivatives | | | | |

| | | | |

Call Option Contracts Written | | | | |

| | | | |

See the Portfolio of Investments for all investment classifications not indicated in the table.

The Fund’s assets assigned to the Level 2 input category are generally valued using the market approach, in which a security’s value is determined through reference to prices and

information from market transactions for similar or identical assets. These assets include certain foreign securities for which a third party statistical pricing service may be employed for

purposes of fair market valuation. The model utilized by such third party statistical pricing service takes into account a security’s correlation to available market data including relevant

general and sector indices, currency fluctuations, depositary receipts, and futures, as applicable.

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Seligman Premium Technology Growth Fund, Inc. | 2024

Statement of Assets and Liabilities

December 31, 2024

| |