|

Key sales activity items Housing orders: 5,871

housing units: +9.1% vs 2013 €1,128.5M (incl. VAT): +14.0% vs 2013

Office orders: €295.1M (incl. VAT) vs €87.5M in 2013

Key financial items Revenues: €1,083M

vs €1,026M in 2013 Gross margin: €194.3M vs €196.8M in 2013

Attributable net income: €38.4M vs €40.8M in 2013 Net

cash flow of €2.1M at end 2014 vs €50M in net financial debt at

end 2013 Key growth indicators Total

backlog at Nov. 30: +14% €1,161.5M vs €1,018.6M at end 2013

Housing backlog: €1,015.7M vs €965.1M at end 2013 Housing

property portfolio at Nov. 30: +16% 17,695 lots vs 15,205

lots at end 2013 |

2014 results in line with

the objectives announced Property portfolio up to 16%

Housing: orders in value + 14% Offices: orders up

sharply to €295M (including VAT) The

Kaufman & Broad SA Board of Directors reviewed the

unaudited results for fiscal year 2014 (December 1, 2013 to

November 30, 2014). Nordine Hachemi, Chairman and Chief Executive

Officer of Kaufman & Broad SA, made the following

statement: Kaufman & Broad's 2014 results are in line

with the objectives announced at the beginning of the fiscal year.

Throughout the year, the Group continued to actively prepare for

the future while at the same time pursuing the improvement of its

financial structure. In the Housing segment, as announced at

the beginning of the year, the number of new program launches

increased 15% with a steady pace in the 4th quarter after a less

robust first half. The increase in orders throughout the

fiscal year, both in volume and in value, shows the relevance of

the product/price positioning of Kaufman & Broad's offer.

The ability to find the response to our customers'

well-identified needs is an essential factor in our growth outlook,

not without the help of our continuously growing property

portfolio. The Commercial property segment - an important

lever of growth for the group - ended the fiscal year with a 23,000

sq.m Paris Rive Gauche Mixed Development Zone (ZAC) sale before

completion. The late December 2014 acquisition of Concerto ED, a

specialist in logistics development, allows Kaufman & Broad to

broaden its general developer expertise. At the same time,

its financial structure has continued to improve with a gross

financial debt reduced by more than €90 million and a zero net debt

at fiscal year-end. Regarding the 2015 outlook, stabilizing

macro-economic and tax environments should result in a revenues and

a gross margin comparable to 2014. At last, the Board of

Directors is considering to pay in March an interim dividend of

€0.68 per share on the €1.36 dividend per share which will be

proposed to the Shareholders' Meeting on April 16, based on the

audited 2014 financial statements. |

Over the entire fiscal year 2014, housing orders

rose 9.1% in volume to 5,871 orders. In the 4th quarter 2014, 1,921

housing units were ordered versus 1,436 in the 4th quarter 2013. In

value, housing orders totaled €1,128.5 million (including VAT),

i.e. a 14.0% increase compared to 2013.

Apartments

In fiscal year 2014, 5,687 apartments were

ordered, for revenues of €1,079.5 million (including VAT).

Apartment orders were up 13.0% in volume and 22.0% in value

compared to 2013.

Single-family homes in communities

Orders of Single-family homes in communities

totaled €49.0 million (including VAT), compared to €105.6

million (including VAT) in 2013.

Customer-base structure

In 2014, orders by investors remained unchanged

at 34%. Orders from homebuyers accounted for 37% (26% from

first-time homebuyers and 11% from second-time homebuyers). Block

orders totaled 28%.

- Commercial property segment

In early November, Kaufman & Broad

delivered to OPCIMMO (AMUNDI) the 8,000 sq.m CAP 14 building

located in Paris' 14th arrondissement.

Construction works are in progress on the "YOU"

building (9,300 sq.m), located in the EcoQuartier - Île Seguin

- Rives de Seine in Boulogne-Billancourt and sold before completion

in 2013 to Boursorama for its future headquarters.

In addition, the entire Paris Rive Gauche

development (23,000 sq.m) was sold before completion to an

institutional investor represented by DTZ Investors France and

leased for a fixed 12-year period to the SNI Group, a real estate

subsidiary of the Caisse des Dépôts group.

Kaufman & Broad also obtained the

building permits for projects of significant size in Paris and

Hauts de Seine representing nearly 32,000 sq.m of office

space.

- Forward indicators of sales activity

At November 30, 2014, total backlog amounted to

€1,161.5 million (excluding VAT), up 14.0% compared to November 30,

2013.

Housing backlog totaled €1,015.7 million

(excluding VAT), or more than 13 months of business.

The Commercial property backlog totaled 145.7

million (excluding VAT) versus €52.7 million (excluding VAT) at

November 30, 2013.

At November 30, 2014,

Kaufman & Broad had 158 housing programs on the

market representing a total of 3,484 housing units, of which 1,236

were in Île-de-France and 2,248 were in the Regions.

The Housing property portfolio included 17,695

lots, for potential revenues corresponding to three years of

business and an increase of 16.4% compared with the total of 15,205

lots at end-November 2013.

In the 1st quarter of 2015, the group plans to

launch 20 new programs including 6 launches in Île-de-France

representing 576 lots and 14 launches in the Regions representing

1,049 lots.

Total revenues for fiscal year 2014 rose 5.6% to

€1,083.3 million (excluding VAT), compared to €1,026.0 million

(excluding VAT) in 2013. In the 4th quarter 2014 alone, revenues

recorded a rise of 23.7% compared to the 4th quarter 2013 to reach

€428.8 million.

For the entire fiscal year 2014, Housing

revenues, which account for 85.5% of total revenues, totaled

€925.8 million (excluding VAT) compared to €967.5 million

(excluding VAT) in 2013.

Revenues for the Apartments segment were down

8.2% to €844.3 million (excluding VAT) versus €919.3 million

(excluding VAT) in 2013. They accounted for 91.2% of the Housing

segment revenues. Revenues generated by the Single-family homes in

communities segment totaled €81.5 million (excluding VAT),

compared to €48.2 million (excluding VAT) in 2013.

Commercial property revenues totaled €150.4

million (excluding VAT) compared to €51.2 million in fiscal year

2013. The other business activities generated revenues of €7.2

million (excluding VAT).

Gross margin was €194.3 million, compared

to €196.8 million in 2013. The gross margin rate was 17.9%,

versus 19.2% for fiscal year 2013, reflecting the change in the

Housing/Commercial property product mix. In the 4th quarter, the

gross margin rose 7.8% to €71.7 million versus €66.5 million in the

4th quarter 2013.

Current operating expenses amounted to €119.8

million (11.1% of revenues) versus €120.7 million in 2013 (11.8% of

revenues).

Current operating income totaled

€74.4 million, compared to €76.0 million in 2013. The

current operating margin was 6.9% versus 7.4% in 2013.

The cost of net financial debt was €0.3 million

versus €2.8 million in 2013.

Attributable net income totaled €38.4 million

versus €40.8 million euros in 2013. In the 4th quarter alone, it

was up 11.4 % to €19.0 million.

- Financial structure and liquidity

As of November 30, 2014, net financial debt was

reduced by €52.1 million compared to November 30, 2013

and, accordingly, net cash flow was €2.1 million.

Cash assets (available cash and investment

securities) totaled €150.0 million compared to €188.3 million

at November 30, 2013 bringing Kaufman & Broad's

financial capacity to €200 million.

Working capital requirements totaled €111.2

million (10.3% of revenues), compared to €126.8 million at November

30, 2013 (12.4%).

This press release is available from the website

www.ketb.com

- Next regular publication date:

April 15, 2015: 1st quarter 2015 results (after

market close)

April 16, 2015: Annual Shareholders' Meeting

Contacts

| Chief

Financial Officer |

Press Relations |

| Bruno

Coche +33 (1) 41 43 44 73 Infos-invest@ketb.com |

Camille

Petit Burson-Marsteller +33 (1) 56 03 12 80

contact.presse@ketb.com |

- About Kaufman & Broad - For more than 40

years, Kaufman & Broad has been designing, building and selling

single-family homes in communities, apartments and offices on

behalf of third parties. Kaufman & Broad is a leading

French property builder and developer in view of its size, earnings

and power of its brand.

Disclaimer - This document contains

forward-looking information. This information is liable to be

affected by known or unknown factors that KBSA cannot easily

control or forecast which may render the results materially

different from those stated, implied or projected by the company.

These risks specifically include those listed under "Risk Factors"

in the Registration Document filed with the AMF under number

D.14-0121 on March 6, 2014.

Orders: measured in volume (Units) and in

value, orders reflect the group's sales activity. Orders are

recognized in revenue based on the time necessary for the

"conversion" of an order into a signed and notarized deed, which is

the point at which income is generated. In addition, for apartment

programs that include mixed-use buildings (apartments/business

premises/retail space/offices), all floor space is converted into

housing equivalents.

Units: Units are used to define the

number of housing units or equivalent housing units (for mixed

programs) of any given program. The number of equivalent housing

units is calculated as a ratio of the surface area by type

(business premises/retail space/offices) to the average surface

area of the housing units previously obtained.

EHU: EHUs (Equivalent Housing Units

delivered) directly reflect sales. The number of EHUs is a function

of multiplying (i) the number of housing units of a given program

for which notarized sales deeds have been signed by (ii) the ratio

between the group's property expenses and construction expenses

incurred on said program and the total expense budget for said

program.

Take-up rate: the number of orders in

relation to the average commercial offer for the period.

Commercial offer: the total inventory of

properties available for sale as of the date in question, i.e., all

unordered housing units as of such date (less the programs that

have not entered the marketing phase).

Gross margin: corresponds to revenues

less cost of sales. Cost of sales consists of the price of land,

the related property costs and construction costs.

Backlog: a summary at any given moment

used for forecasting future revenues for the coming months.

Property portfolio: all real estate for

which a deed or commitment to sell has been signed.

APPENDICES

Key consolidated data

| in €

millions |

Q4

2014 |

Fiscal

2014 |

Q4

2013 |

Fiscal

2013 |

| Revenues |

428.8 |

1,083.3 |

346.6 |

1,026.0 |

| of which Housing |

297.5 |

925.8 |

307.3 |

967.5 |

| of which Commercial property |

129.1 |

150.4 |

37.7 |

51.2 |

| of which Other |

2.2 |

7.2 |

1.7 |

7.2 |

| |

|

|

|

|

| Gross margin |

71.7 |

194.3 |

66.5 |

196.8 |

| Gross margin rate (%) |

16.7% |

17.9% |

19.2% |

19.2% |

| Current operating income |

35.8 |

74.4 |

30.7 |

76.0 |

| Current operating margin (%) |

8.4% |

6.9% |

8.9% |

7.4% |

| Attributable net income |

19.0 |

38.4 |

17.1 |

40.8 |

| Attributable net income

per share (€/share) * |

0.88 |

1.78 |

0.79 |

1.89 |

* Based on the number of shares composing the

capital of Kaufman & Broad SA, i.e., 21,584,658

shares

Consolidated income statement*

| in € thousands |

Q4 2014 |

Fiscal 2014 |

Q4 2013 |

Fiscal 2013 |

| Revenues |

428,830 |

1,083,342 |

346,641 |

1,025,954 |

| Cost of sales |

(357,104) |

(889,070) |

(280,131) |

(829,185) |

| Gross margin |

71,726 |

194,272 |

66,510 |

196,769 |

| Selling expenses |

(9,702) |

(29,243) |

(9,092) |

(30,619) |

| Administrative expenses |

(15,713) |

(53,770) |

(17,774) |

(54,936) |

| Technical and customer service expenses |

(5,013) |

(18,375) |

(4,598) |

(19,258) |

| Development and program expenses |

(5,467) |

(18,437) |

(4,306) |

(15,926) |

| Current operating income |

35,831 |

74,446 |

30,740 |

76,030 |

| Other non-recurring income and expenses |

(805) |

(673) |

6 |

(1) |

| Operating income |

35,026 |

73,773 |

30,746 |

76,029 |

| Cost of net financial debt |

(656) |

(250) |

(2,027) |

(2,807) |

| Other financial income and expenses |

- |

- |

- |

- |

| Income tax |

(13,371) |

(25,295) |

(8,868) |

(21,961) |

| Share of income (loss) of equity affiliates and

joint ventures |

1,710 |

2,586 |

288 |

642 |

| Income (loss) attributable to

shareholders |

22,709 |

50,815 |

20,140 |

51,903 |

| Minority interests |

3,705 |

12,373 |

3,079 |

11,055 |

| Attributable net

income |

19,004 |

38,442 |

17,061 |

40,848 |

* Unaudited and not approved by the Board of

Directors

Consolidated balance sheet*

| in €

thousands |

Nov.

30, 2014 |

Nov.

30, 2013 |

| ASSETS |

|

|

| Goodwill |

68,511 |

68,511 |

| Intangible Assets |

85,075 |

85,376 |

| Property, plant and equipment |

4,323 |

4,713 |

| Equity affiliates and joint ventures |

11,314 |

8,181 |

| Other non-current financial assets |

1,843 |

20,139 |

| Non-current assets |

171,065 |

186,920 |

| Inventories |

323,119 |

324,962 |

| Accounts receivable |

336,561 |

291,778 |

| Other receivables |

176,606 |

153,404 |

| Cash and cash equivalents |

149,993 |

188,258 |

| Prepaid expenses |

1,437 |

867 |

| Current

assets |

987,715 |

959,270 |

| TOTAL ASSETS |

1,158,780 |

1,146,190 |

| |

|

|

| EQUITY AND

LIABILITIES |

|

| Capital stock |

5,612 |

5,612 |

| Additional paid-in capital |

164,661 |

130,931 |

| Attributable net income |

38,442 |

40,847 |

| Attributable shareholders' equity |

208,715 |

177,390 |

| Minority interests |

8,748 |

10,811 |

| Shareholders' equity |

217,463 |

188,201 |

| Non-current provisions |

21,485 |

33,422 |

| Borrowings and other non-current financial

liabilities (> 1 year) |

135,815 |

218,959 |

| Deferred tax liabilities |

43,227 |

40,365 |

| Non-current liabilities |

200,527 |

292,746 |

| Current provisions |

2,168 |

1,724 |

| Other current financial liabilities (< 1

year) |

12,101 |

19,340 |

| Accounts payable |

617,953 |

550,233 |

| Other payables |

106,858 |

92,729 |

| Deferred income |

1,709 |

1,217 |

| Current

liabilities |

740,790 |

665,242 |

| TOTAL EQUITY AND

LIABILITIES |

1,158,780 |

1,146,190 |

* Unaudited and not approved by the Board of

Directors

|

Housing |

Q4

2014 |

Fiscal 2014 |

Q4

2013 |

Fiscal 2013 |

| |

|

|

|

|

| Revenues (€m, excluding VAT) |

297.5 |

925.8 |

307.3 |

967.5 |

| of which Apartments |

274.9 |

844.3 |

288.4 |

919.3 |

| of which Single-family homes in communities |

22.7 |

81.5 |

18.9 |

48.2 |

| |

|

|

|

|

| Deliveries (EHUs) |

1,810 |

5,623 |

1,937 |

5,839 |

| of which Apartments |

1,714 |

5,303 |

1,844 |

5,606 |

| of which Single-family

homes in communities |

96 |

320 |

93 |

233 |

| |

|

|

|

|

| Net orders (number) |

1,921 |

5,871 |

1,436 |

5,379 |

| of which Apartments |

1,874 |

5,687 |

1,367 |

5,031 |

| of which Single-family homes in communities |

47 |

184 |

69 |

348 |

| |

|

|

|

|

| |

|

|

|

|

| Net orders (€m, including VAT) |

358.5 |

1,128.5 |

246.1 |

990.3 |

| of which Apartments |

351.6 |

1,079.5 |

218.6 |

884.7 |

| of which Single-family homes in communities |

6.9 |

49.0 |

27.5 |

105.6 |

| |

|

|

|

|

| |

|

|

|

|

| Commercial offer at period end (number) |

3,484 |

3,550 |

|

|

|

|

|

|

| Backlog at period end |

|

|

|

|

| In value (€m, excluding VAT) |

1,015.7 |

965.1 |

| of which Apartments |

961.6 |

870.4 |

| of which Single-family homes in communities |

54.1 |

94.7 |

| In months of business |

13.2 |

12.0 |

| |

|

|

| Property portfolio at

period end (number) |

17,695 |

15,205 |

|

Commercial property |

Q4

2014 |

Fiscal 2014 |

Q4

2013 |

Fiscal 2013 |

| |

|

|

|

|

| Revenues (€M, excluding VAT) |

129.1 |

150.4 |

37.7 |

51.2 |

| Net orders (€M, including VAT) |

283.6 |

295.1 |

76.0 |

87.5 |

| Backlog at period end

(€M, excluding VAT) |

145.7 |

52.7 |

Press Release 2014 Annual Results

http://hugin.info/165249/R/1888987/668560.pdf

HUG#1888987

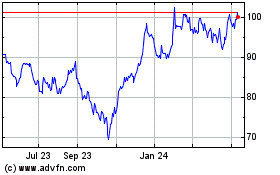

Coca Cola FEMSA SAB De CV (NYSE:KOF)

Historical Stock Chart

From Oct 2024 to Nov 2024

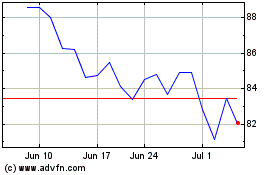

Coca Cola FEMSA SAB De CV (NYSE:KOF)

Historical Stock Chart

From Nov 2023 to Nov 2024