The Coca-Cola Company’s (KO)

fourth quarter adjusted earnings of 45 cents per share marginally

beat the Zacks Consensus Estimate of 44 cents by a penny. Moreover,

earnings grew 15% from the prior-year quarter as tepid revenue

growth was offset by solid operating margins, which gained from two

extra selling days and lower-than-expected currency headwinds.

Revenues and Margins

In the quarter, net revenue increased 4% year over year to

$11.04 billion, as benefits from volume growth and concentrate

(syrups, powders, etc. used in finished beverages) sales were

largely offset by an almost flat price/mix. Constant currency

revenues increased 5% in the quarter as currency hurt revenues by

1%. The top-line results marginally missed the Zacks Consensus

Estimate of $11.54 billion.

The company recorded adjusted consolidated gross margin of 60.2%

in the fourth quarter of 2012, down 10 basis points both year over

year and sequentially. The gross margin result was in line with

management’s expectation of being sequentially lower than both

second and third quarter margins of 60.3% due to the currency and

mix shift headwinds.

Adjusted selling, general and administrative (SG&A) expenses

increased 1% on a currency neutral basis to $4.42 billion.

Excluding the impact of currency, SG&A expenses were flat due

to better operating expense leverage in the quarter.

Adjusted operating margin was 21.7% in the quarter, up 140 basis

points from the prior-year quarter. The constant currency operating

income increased 14% to $2.48 billion in the quarter, in line with

management’s expectation of double-digit improvement.

Operating profits accelerated as the operating expense leverage

was better in the quarter due to two additional selling days.

Lower-than-expected headwinds from currency also benefited

operating profits. Foreign exchange unfavorably impacted operating

income in the fourth quarter by 4%, lower than management’s

expectations of a negative impact in the mid-single-digit

range.

Volume and Pricing Growth in Detail

The cola giant witnessed volume growth of 3% in the reported

quarter. International volumes grew 4% against a 1% increase in

North America. The company saw volume growth in North America,

Eurasia and Africa, and Latin America while European volumes

declined due to persistent economic uncertainty. Moreover, China

and Japan volumes declined in the quarter, which hurt overall

volumes of the Pacific segment, for the second quarter in a

row.

Among the non-alcoholic ready-to-drink (NARTD) beverages,

sparkling beverages, like Coca Cola, Fanta and Sprite, grew 1% in

terms of volume, lower than last quarter’s 3% growth. Changing

consumer preferences, increasing health consciousness and growing

regulatory pressures are affecting the company’s sparkling beverage

sales.

Still beverages such as Minute Maid, Simply and POWERade grew 9%

in terms of volume, registering much better volume growth than the

popular soft drinks as consumers have grown health conscious.

Coca-Cola is slowly expanding its portfolio of non-carbonated

drinks to reduce its huge dependence on carbonated beverages. Among

the still beverages, packaged water, ready-to-drink tea and energy

drinks recorded double-digit growth in the quarter.

The impact of price/mix was almost flat in the quarter as only

the Latin American segment showed some positive growth.

Geographic Analysis

Geographically, the Eurasia & Africa

division recorded revenues of $697 million, up 5% over the

prior-year quarter as benefits from volume growth and concentrate

sales were offset by price/mix and currency headwinds. Constant

currency revenues increased 9% in the quarter.

The segment witnessed volume growth of 10% year over year led by

13% organic growth in Middle East and North Africa, 13% in Turkey

and 12% in Russia. Sparkling beverages volume was up 7% versus 23%

volume growth for still beverages. Adjusted operating income was up

23% on a currency neutral basis in the quarter to $273 million

driven by pricing gains and better operating expense leverage.

The Latin America segment recorded revenues of

$1.27 billion, up 8% from the prior-year quarter levels driven by

benefits from concentrate sales, positive volume and price/mix,

which offset headwinds from currency and structural changes.

Constant currency revenues increased 12% in the quarter.

Volumes increased 5% in the segment, with Brazil, South Latin,

Latin Center and Mexico all showing positive volume growth. Volume

growth was better than the 4% growth witnessed in the prior-year

quarter.

Sparkling beverages volume was up 3% versus 16% volume growth

for still beverages. Adjusted operating income was up 16% on a

currency neutral basis to $715 million in the quarter, benefiting

from volume growth and favorable pricing in addition to better

operating expense leverage.

The North America segment recorded revenues of

$5.29 billion, up 6% as gains from volume growth and structural

changes was offset by an almost flat price/mix. North American

overall volumes grew 1% in the quarter.

Sparkling beverage volume declined 2% against 8% volume gain for

still beverages as American are increasingly avoiding sugary sodas.

Adjusted operating income was up 11% on a currency neutral basis to

$713 million in the quarter driven by positive volume growth and

better operating expense leverage.

The Pacific segment recorded revenues of $1.35

billion, down 1% over the prior-year quarter due to lukewarm volume

growth and a flat price/mix. Constant currency revenues were flat

in the quarter.

The Pacific Group’s volume grew only 2% in the quarter, below

both prior-year and sequential levels. Volume growth in Thailand,

South Korea and Philippines was offset by sluggish growth in Japan

and China as the latter continues to see some economic slowdown.

Adjusted operating income was up 10% on a currency neutral basis to

$427 million in the quarter due to favorable geographic mix,

productivity gains and better operating expense leverage.

The Europe segmentrecorded revenues of $1.14

billion, down 6% over the prior-year quarter as volumes, price/mix

and currency declined in the quarter. Constant currency revenues

declined 4% in the quarter. Volumes declined 5% in the quarter.

Sparkling beverage volume declined 5% while still beverages went

down 3% in the quarter. Adjusted operating income improved 12% on a

currency neutral basis to $670 million due to better operating

expense leverage and tight cost management.

Annual Results

In fiscal 2012, the company witnessed a 3.0% increase in

revenues to $48.02 billion, slightly missing the Zacks Consensus

Estimate of $48.13 billion.

Adjusted earnings were $2.01 per share, which beat the Zacks

Consensus Estimate of $2.00 by a penny. Adjusted earnings increased

5.0% from the prior year.

Other Stocks to Consider

Coca-Cola currently carries a Zacks Rank #4 (Sell). Rival

PepsiCo, Inc. (PEP) will report on Feb 14. Some of

Coca-Cola’s bottling companies are currently doing well and have a

bright outlook. These include Coca-Cola FEMSA S.A.B de

C.V. (KOF) and Coca-Cola Enterprises Inc.

(CCE), both carrying a Zacks Rank #2 (Buy)

COCA-COLA ENTRP (CCE): Free Stock Analysis Report

COCA COLA CO (KO): Free Stock Analysis Report

COCA-COLA FEMSA (KOF): Free Stock Analysis Report

PEPSICO INC (PEP): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

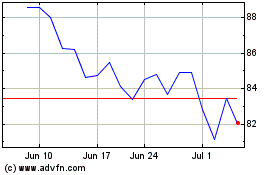

Coca Cola FEMSA SAB De CV (NYSE:KOF)

Historical Stock Chart

From Aug 2024 to Sep 2024

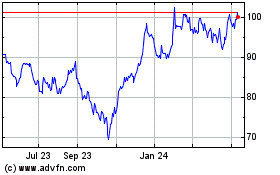

Coca Cola FEMSA SAB De CV (NYSE:KOF)

Historical Stock Chart

From Sep 2023 to Sep 2024