UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2024

Commission file number: 001-38726

CNFinance Holdings Limited

(Exact Name of Registrant as Specified in Its Charter)

44/F, Tower G, No.

16 Zhujiang Dong Road

Tianhe District, Guangzhou

City, Guangdong Province 510620

People’s Republic

of China

+86-20-62316688

(Address

of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

On August 27, 2024, CNFinance Holdings Limited (the “Company”)

issued press release, a copy of which is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

EXHIBIT INDEX

Signature

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

|

CNFINANCE HOLDINGS LIMITED |

| |

|

|

|

| Date: |

August 27, 2024 |

|

By: |

/s/ Bin Zhai |

| |

|

|

|

Name: |

Bin Zhai |

| |

|

|

|

Title: |

Chief Executive Officer and Chairman |

Exhibit 99.1

CNFinance Announces First Half of 2024

Unaudited Financial Results

GUANGZHOU, China, August 27, 2024 /PRNewswire/

-- CNFinance Holdings Limited (NYSE: CNF) (“CNFinance” or the “Company”),

a leading home equity loan service provider in China, today announced its unaudited financial results for the first half of 2024

ended June 30, 2024.

First Half of 2024 Operational and Financial

Highlights

| ● | Total outstanding loan principal1 was RMB16.0 billion (US$2.2 billion) as of June 30, 2024, representing an increase of 9.6% from RMB14.6 billion as of June

30, 2023. |

| ● | Total interest and fees income were RMB926.5 million (US$127.5

million) in the first half of 2024, representing an increase of 4.7% from RMB884.5 million in the same period of 2023. |

| ● | Net revenue under the commercial bank partnership model was

RMB58.4 million (US$8.0 million) in the first half of 2024, representing an increase of 16.6% from RMB50.1 million in the same period

of 2023. |

| ● | Net interest and fees income after collaboration cost increased

by 5.3% to RMB424.0 million (US$58.3 million) for the first half of 2024 from RMB402.7 million in the same period of 2023. |

“In response to macroeconomic uncertainties, we concentrated

on strengthening our business foundation and ensuring asset quality during the first half of 2024. In the first half of 2024, we originated

loans in total of RMB6.9 billion, bringing total outstanding loan principal to approximately RMB16.0 billion as of June 30, 2024, representing

an approximate 9.6% increase compared to June 30, 2023. Due to the increase of outstanding loan principal, our total interest and fees

income increased by 4.7% to RMB926.5 million. During the first half of 2024, we strengthened our collaboration with an asset management

company in collection of delinquent loans. By enforcing the collection of delinquent loans, the recoveries through settlements have significantly

increased, and we have recorded a recovery rate of 110% in the first half of 2024. In the first half of 2024, we have continued to extend

substantial support to sales partners and helped to ease their liquidity pressure. At the same time, due to the increase of outstanding

loan principal and the fact that we have maintained a prudent approach to evaluating credit losses, our provision for credit losses increased

to RMB170.8 million in the first half of 2024. Taking into account these factors, we recorded a net income of approximately RMB48.0 million

in the first half of 2024.

Facing the uncertainty associated with the general economy condition,

we will prioritize asset quality and profitability of our business. In order to further improve asset quality, we will optimize our credit

assessment models to refine our screening of new applications. We will also strengthen our support to sales partners and foster a collaborative

approach to enable more of our sales partners to continue working with us under the principle of “shared risk, shared returns”.

In order to increase our profit margin, we will work on further reducing financing costs and refine our customer sourcing network. At

the same time, we will continue to leverage our product strengths of being “accessible, affordable and efficient,” while enhance

and diversify our product offerings across various scenarios to sustain growth.” Commented Mr. Zhai Bin, Chairman and CEO of CNFinance.

| 1 | Refers to the total amount of loans outstanding for loans CNFinance

originated under the trust lending model and commercial bank partnership model at the end of the relevant period. |

First Half of 2024 Financial Results

Total interest and fees income increased

by 4.7% to RMB926.5 million (US$127.5 million) for the first half of 2024 from RMB884.5 million in the same period of 2023.

Interest and financing service fees on loans

increased by 3.3% to RMB834.1 million (US$114.8 million) for the first half of 2024 from RMB807.4 million in the same period of 2023,

primarily attributable to the increase of average daily outstanding loan principal in the first half of 2024 as compared to the same period

of 2023.

Interest income charged to sales partners,

representing fee charged to sales partners who choose to repurchase default loans in installments, increased by 25.9% to RMB83.1 million

(US$11.4 million) for the first half of 2024 from RMB66.0 million in the same period of 2023, primarily attributable to an increase in

the loans that were repurchased by the sales partners in installments.

Interest on deposits with banks decreased

by 17.0% to RMB9.3 million (US$1.3 million) for the first half of 2024 from RMB11.2 million in the same period of 2023, primarily due

to decreased average daily balance of time deposits.

Total interest and fees expenses increased

by 9.7% to RMB401.7 million (US$55.3 million) in the first half of 2024 from RMB366.3 million in the same period in 2023.The increase

in total interest and fees expenses was mainly due to the increase in average daily balance of interest-bearing borrowings.

Net interest and fees income was RMB524.8

million (US$72.2 million) for the first half of 2024, representing an increase of 1.3% from RMB518.2 million in the same period of 2023.

Net revenue under the commercial bank partnership

model, representing fees charged to commercial banks for services including introducing borrowers, initial credit assessment, facilitating

loans from the banks to the borrower and providing technical assistance to the borrower and banks, net of fees paid to third-party insurance

company and commissions paid to sales channels, was RMB58.4 million (US$8.0 million) for the first half of 2024 as compared to RMB50.1

million in the same period of 2023. In the first half of 2024, the majority of borrowers were introduced by sales partners and the commission

paid to sales channels has decreased, which has ultimately led to an increase in the net revenue under the commercial bank partnership

model.

Collaboration cost for sales partners decreased

by 3.9% to RMB159.2 million (US$21.9 million) for the first half of 2024 from RMB165.6 million in the same period of 2023.

Net interest and fees income after collaboration

cost increased by 5.3% to RMB424.0 million (US$58.3 million) for the first half of 2024 from RMB402.7 million in the same period of

2023.

Provision for credit losses representing

provision for credit losses under the trust lending model and the expected credit losses of guarantee under the commercial bank partnership

model in relation to certain financial guarantee arrangements the Company entered into with a third-party guarantor, who provides guarantee

services to commercial bank partners, increased by 31.8% to RMB170.8 million (US$23.5 million) for the first half of 2024 from RMB129.

6 million in the same period in 2023. The increase was mainly due to the increase in outstanding loan principal.

Realized gains on sales of investments, net

representing realized gains from the sales of investment securities, were RMB1.2 million (US$0.2 million), compared to RMB15.7 million

for the same period of 2023. The Company purchased less investment securities as compared to the same period of 2023.

Other gains, net were RMB11.1 million (US$1.5

million) for the half of 2024 as compared to gains of RMB16.7 million in the same period of 2023.

Total operating expenses increased by 14.4%

to RMB204.7 million (US$28.2 million) in the first half of 2024, compared with RMB179.0 million in the same period of 2023.

Employee compensation and benefits were

RMB86.9 million (US$12.0 million) in the first half of 2024 as compared to RMB95.0 million in the same period in 2023.

Taxes and surcharges decreased by 26.8% to RMB12.0 million (US$1.7

million) in the first half of 2024 from RMB16.4 million in the same period of 2023, primarily attributable to the decrease of “service

fees charged to trust plans” which is a non-deductible item in value

added tax (“VAT”).

According to the PRC tax regulations, “service fees charged to trust plans” incur a 6% VAT on the subsidiary level, but are

not recorded as an input VAT on a consolidated trust plan level. “Service fees charged to trust plans” decreased in the first

half of 2024 compared to the same period of 2023.

Operating lease cost was RMB8.8 million (US$1.2 million) for

the first half of 2024 as compared to RMB7.8 million for the same period of 2023.

Other expenses increased by 62.2% to RMB97.0 million (US$13.3

million) in the first half of 2024 from RMB59.8 million in the same period of 2023, primarily due to the increase in fees paid to a third-party

asset management company to collect delinquent loans.

Income tax expense was RMB11.0 million

(US$1.5 million) in the first half of 2024, as compared to RMB29.2 million in the same period of 2023, primarily due to the decrease in

taxable income in the first half of 2024 as compared to the same period of 2023.

Effective tax rate was 18.7% in the first

half of 2024 as compared to 23.9% in the same period of 2023. The decrease in effective tax rate was mainly due to that one of the Company’s

subsidiaries was classified as a qualified software enterprise whose revenue is tax-exempted according to the PRC tax regulations.

Net income was RMB48.0 million (US$6.6

million) in the first half of 2024, as compared to RMB93.1 million in the same period of 2023.

Basic and diluted earnings per ADS were RMB0.70 (US$0.10) and

RMB0.70 (US$0.10), respectively, in the first half of 2024, compared to RMB1.36 and RMB1.22, respectively, in the same period of 2023.

As of June 30, 2024, the Company had cash and

cash equivalents and restricted cash of RMB1.6 billion (US$0.2 billion), compared with RMB2.0 billion as of December 31, 2023, including

RMB1.0 billion (US$0.1 billion) and RMB1.5 billion from structured funds as of June 30, 2024 and December 31, 2023, respectively, which

could only be used to grant new loans and activities.

The delinquency ratio (excluding loans held

for sale) for loans originated by the Company increased from 15.5% as of December 31, 2023 to 17.4% as of June 30, 2024. The delinquency

ratio for first lien loans (excluding loans held-for-sale) decreased from 17.4% as of December 31, 2023 to 16.5% as of June 30, 2024,

and the delinquency ratio for second lien loans (excluding loans held-for-sale) increased from 14.4% as of December 31, 2023 to 18.1%

as of June 30, 2024.

The NPL ratio (excluding loans held for sale)

for loans originated by the Company was 1.2% as of June 30, 2024 compared to 1.1% as of December 31, 2023. The NPL ratio for first lien

loans (excluding loans held-for-sale) decreased from 1.4% as of December 31, 2023 to 1.1% as of June 30, 2024, and the NPL ratio for second

lien loans (excluding loans held-for-sale) increased from 0.9% as of December 31, 2023 to 1.3% as of June 30, 2024.

Recent Development

Share Repurchase

On March 16, 2022, the Company’s board of

directors authorized a share repurchase program under which the Company may repurchase up to US$20 million of its ordinary shares

in the form of American depositary shares (“ADSs”) during a period of up to 12 months commencing on March 16, 2022. On March

16, 2024, the Company’s board of directors authorized to extend the share repurchase program for 24 months commencing on March 16,

2024, and raise the cap of such plan to USD30.0 million, commencing on May 27, 2024. As of June 30, 2024, the Company had repurchased

an aggregate of approximately US$17.6 million worth of its ADSs under this share repurchase program.

Conference Call

CNFinance’s management will host an earnings conference call

at 8:00 AM U.S. Eastern Time on Tuesday, August 27, 2024 (8:00 PM Beijing/ Hong Kong Time on the same day).

Dial-in numbers for the live conference call are as follows:

| International: |

+1-412-902-4272 |

| Mainland China |

+86-4001-201203 |

| United States: |

+1-888-346-8982 |

| Hong Kong: |

+852-301-84992 |

| Passcode: |

CNFinance |

A telephone replay of the call will be available after the conclusion

of the conference call until 11:59 PM ET September 2, 2024.

Dial-in numbers for the replay are as follows:

| International: |

+1-412-317-0088 |

| United States: |

+1-877-344-7529 |

| Passcode: |

6689462 |

A live and archived webcast of the conference call will be available

on the Investor Relations section of CNFinance’s website at http://ir.cashchina.cn/.

Exchange Rate

The Company’s business is primarily conducted

in China and all of the revenues are denominated in Renminbi (“RMB”). This announcement contains translations of certain RMB

amounts into U.S. dollars at specified rates solely for the convenience of the reader. Unless otherwise noted, all translations from RMB

to U.S. dollars are made at a rate of RMB7.2672 to US$1.00, the exchange rate set forth in the H.10 statistical release of the Board of

Governors of the Federal Reserve System as of June 30, 2024. No representation is made that the RMB amounts could have been, or could

be, converted, realized or settled into U.S. dollars at that rate on June 30, 2024, or at any other rate.

Safe Harbor Statement

This press release contains forward-looking statements made under the

“safe harbor” provisions of Section 21E of the Securities Exchange Act of 1934, as amended, and the U.S. Private Securities

Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will”, “expects”,

“anticipates”, “future”, “intends”, “plans”, “believes”, “estimates”,

“confident” and similar statements. The Company may also make written or oral forward-looking statements in its reports filed

with or furnished to the U.S. Securities and Exchange Commission, in its annual report to shareholders, in press releases and other written

materials and in oral statements made by its officers, directors or employees to third parties. Any statements that are not historical

facts, including statements about the Company’s beliefs and expectations, are forward-looking statements that involve factors, risks

and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. Such factors and

risks include, but not limited to the following: its goals and strategies, its ability to achieve and maintain profitability, its ability

to retain existing borrowers and attract new borrowers, its ability to maintain and enhance the relationship and business collaboration

with its trust company partners and to secure sufficient funding from them, the effectiveness of its risk assessment process and risk

management system, its ability to maintain low delinquency ratios for loans it originated, fluctuations in general economic and business

conditions in China, and relevant government laws, regulations, rules, policies or guidelines relating to the Company’s corporate

structure, business and industry. Further information regarding these and other risks is included in the Company’s filings with

the U.S. Securities and Exchange Commission. All information provided in this press release is current as of the date of the press release,

and the Company does not undertake any obligation to update such information, except as required under applicable law.

About CNFinance Holdings Limited

CNFinance Holdings Limited (NYSE: CNF) (“CNFinance” or

the “Company”) is a leading home equity loan service provider in China. CNFinance, through its operating subsidiaries in China,

conducts business by connecting demands and supplies through collaborating with sales partners and trust companies under the trust lending

model, and sales partners, local channel partners and commercial banks under the commercial bank partnership model. Sales partners and

local channel partners are responsible for recommending micro- and small-enterprise (“MSE”) owners with financing needs to

the Company and the Company introduces eligible borrowers to licensed financial institutions with sufficient funding sources including

trust companies and commercial banks who will then conduct their own risk assessments and make credit decisions. The Company’s primary

target borrower segment is MSE owners who own real properties in Tier 1 and Tier 2 cities and other major cities in China. The Company’s

risk mitigation mechanism is embedded in the design of its loan products, supported by an integrated online and offline process focusing

on risks of both borrowers and collateral and further enhanced by effective post-loan management procedures.

For more information, please contact:

CNFinance

E-mail: ir@cashchina.cn

CNFINANCE HOLDINGS LIMITED

Unaudited condensed consolidated balance sheets

(In thousands, except for number of shares)

| | |

December 31,

2023 | | |

June

30,

2024

| |

| | |

RMB | | |

RMB | | |

US$ | |

| Assets | |

| | |

| | |

| |

| Cash, cash equivalents and restricted cash | |

| 2,001,602 | | |

| 1,612,140 | | |

| 221,838 | |

| Loans principal, interest and financing service fee receivables | |

| 9,815,754 | | |

| 10,167,752 | | |

| 1,399,129 | |

| Allowance for credit losses | |

| 781,795 | | |

| 755,279 | | |

| 103,930 | |

| Net loans principal, interest and financing service fee receivables | |

| 9,033,959 | | |

| 9,412,473 | | |

| 1,295,199 | |

| Loans held-for-sale | |

| 2,471,414 | | |

| 3,213,653 | | |

| 442,213 | |

| Investment securities | |

| 413,908 | | |

| 320,735 | | |

| 44,135 | |

| Property and equipment | |

| 8,159 | | |

| 190,069 | | |

| 26,154 | |

| Intangible assets and goodwill | |

| 3,015 | | |

| 3,007 | | |

| 414 | |

| Deferred tax assets | |

| 92,225 | | |

| 108,025 | | |

| 14,865 | |

| Deposits | |

| 163,114 | | |

| 174,534 | | |

| 24,017 | |

| Right-of-use assets | |

| 27,828 | | |

| 22,874 | | |

| 3,148 | |

| Guaranteed assets | |

| 875,031 | | |

| 1,003,040 | | |

| 138,023 | |

| Other assets | |

| 1,274,091 | | |

| 1,218,465 | | |

| 167,666 | |

| | |

| | | |

| | | |

| | |

| Total assets | |

| 16,364,346 | | |

| 17,279,015 | | |

| 2,377,672 | |

| | |

| | | |

| | | |

| | |

| Liabilities and shareholders’ equity | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | |

| Interest-bearing borrowings | |

| | | |

| | | |

| | |

| Borrowings under agreements to repurchase | |

| 686,581 | | |

| 1,210,705 | | |

| 166,599 | |

| Other borrowings | |

| 8,243,615 | | |

| 8,316,767 | | |

| 1,144,425 | |

| Accrued employee benefits | |

| 25,663 | | |

| 16,492 | | |

| 2,269 | |

| Income taxes payable | |

| 181,032 | | |

| 188,850 | | |

| 25,987 | |

| Deferred tax liabilities | |

| 72,579 | | |

| 72,289 | | |

| 9,947 | |

| Lease liabilities | |

| 26,073 | | |

| 21,512 | | |

| 2,960 | |

| Credit risk mitigation position | |

| 1,589,184 | | |

| 1,644,925 | | |

| 226,349 | |

| Other liabilities | |

| 1,530,692 | | |

| 1,748,701 | | |

| 240,630 | |

| | |

| | | |

| | | |

| | |

| Total liabilities | |

| 12,355,419 | | |

| 13,220,241 | | |

| 1,819,166 | |

| | |

| | | |

| | | |

| | |

| Ordinary shares (USD0.0001 par value; 3,800,000,000 shares authorized; 1,559,576,960 shares issued and 1,371,643,240 shares outstanding as of December 31, 2023 and June 30, 2024, respectively | |

| 917 | | |

| 917 | | |

| 126 | |

| Treasury stock | |

| (118,323 | ) | |

| (122,396 | ) | |

| (16,842 | ) |

| Additional paid-in capital | |

| 1,031,721 | | |

| 1,031,721 | | |

| 141,970 | |

| Retained earnings | |

| 3,103,957 | | |

| 3,151,897 | | |

| 433,715 | |

| Accumulated other comprehensive losses | |

| (9,345 | ) | |

| (3,365 | ) | |

| (463 | ) |

| Total shareholders’ equity | |

| 4,008,927 | | |

| 4,058,774 | | |

| 558,506 | |

| Total liabilities and shareholders’ equity | |

| 16,364,346 | | |

| 17,279,015 | | |

| 2,377,672 | |

CNFINANCE HOLDINGS LIMITED

Unaudited condensed consolidated statements of

comprehensive income

(In thousands, except for earnings per share and

earnings per ADS)

| | |

Six months ended June 30 | |

| | |

2023 | | |

2024 | | |

2024 | |

| | |

RMB | | |

RMB | | |

US$ | |

| Interest and fees income | |

| | |

| | |

| |

| | |

| | |

| | |

| |

| Interest and financing service fees on loans | |

| 807,372 | | |

| 834,101 | | |

| 114,776 | |

| Interest income charged to sales partners | |

| 65,967 | | |

| 83,089 | | |

| 11,434 | |

| Interest on deposits with banks | |

| 11,162 | | |

| 9,300 | | |

| 1,279 | |

| | |

| | | |

| | | |

| | |

| Total interest and fees income | |

| 884,501 | | |

| 926,490 | | |

| 127,489 | |

| | |

| | | |

| | | |

| | |

| Interest expenses on interest-bearing borrowings | |

| (366,286 | ) | |

| (401,738 | ) | |

| (55,281 | ) |

| | |

| | | |

| | | |

| | |

| Total interest and fees expenses | |

| (366,286 | ) | |

| (401,738 | ) | |

| (55,281 | ) |

| | |

| | | |

| | | |

| | |

| Net interest and fees income | |

| 518,215 | | |

| 524,752 | | |

| 72,208 | |

| | |

| | | |

| | | |

| | |

| Net revenue under the commercial bank partnership model | |

| 50,059 | | |

| 58,390 | | |

| 8,035 | |

| | |

| | | |

| | | |

| | |

| Collaboration cost for sales partners | |

| (165,583 | ) | |

| (159,171 | ) | |

| (21,903 | ) |

| Net interest and fees income after collaboration cost | |

| 402,691 | | |

| 423,971 | | |

| 58,340 | |

| | |

| | | |

| | | |

| | |

| Provision for credit losses | |

| (129,621 | ) | |

| (170,751 | ) | |

| (23,496 | ) |

| | |

| | | |

| | | |

| | |

| Net interest and fees income after collaboration cost and provision for credit losses | |

| 273,070 | | |

| 253,220 | | |

| 34,844 | |

| | |

| | | |

| | | |

| | |

| Realized gains on sales of investments, net | |

| 15,718 | | |

| 1,150 | | |

| 158 | |

| Net losses on sales of loans | |

| (4,163 | ) | |

| (1,754 | ) | |

| (241 | ) |

| Other gains, net | |

| 16,709 | | |

| 11,056 | | |

| 1,521 | |

| | |

| | | |

| | | |

| | |

| Total non-interest income | |

| 28,264 | | |

| 10,452 | | |

| 1,438 | |

| | |

| | | |

| | | |

| | |

| Operating expenses | |

| | | |

| | | |

| | |

| Employee compensation and benefits | |

| (94,962 | ) | |

| (86,926 | ) | |

| (11,961 | ) |

| Taxes and surcharges | |

| (16,435 | ) | |

| (12,023 | ) | |

| (1,654 | ) |

| Operating lease cost | |

| (7,832 | ) | |

| (8,780 | ) | |

| (1,208 | ) |

| Other expenses | |

| (59,769 | ) | |

| (96,954 | ) | |

| (13,342 | ) |

| | |

| | | |

| | | |

| | |

| Total operating expenses | |

| (178,998 | ) | |

| (204,683 | ) | |

| (28,165 | ) |

| Income before income tax expense | |

| 122,336 | | |

| 58,989 | | |

| 8,117 | |

| Income tax expense | |

| (29,221 | ) | |

| (11,049 | ) | |

| (1,520 | ) |

| | |

| | | |

| | | |

| | |

| Net income | |

| 93,115 | | |

| 47,940 | | |

| 6,597 | |

| | |

| | | |

| | | |

| | |

| Earnings per share | |

| | | |

| | | |

| | |

| Basic | |

| 0.07 | | |

| 0.04 | | |

| 0.005 | |

| Diluted | |

| 0.06 | | |

| 0.04 | | |

| 0.005 | |

| Earnings per ADS (1 ADS equals 20 ordinary shares) | |

| | | |

| | | |

| | |

| Basic | |

| 1.36 | | |

| 0.70 | | |

| 0.10 | |

| Diluted | |

| 1.22 | | |

| 0.70 | | |

| 0.10 | |

| | |

| | | |

| | | |

| | |

| Other comprehensive Income | |

| | | |

| | | |

| | |

| Foreign currency translation adjustment | |

| 7,378 | | |

| 5,980 | | |

| 823 | |

| Comprehensive income | |

| 100,493 | | |

| 53,920 | | |

| 7,420 | |

| Less: net income attributable to non-controlling interests | |

| 8,937 | | |

| - | | |

| - | |

| Total comprehensive income attributable to ordinary shareholders | |

| 91,556 | | |

| 53,920 | | |

| 7,420 | |

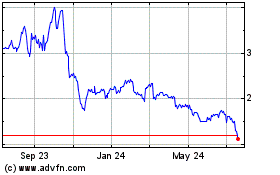

CNFinance (NYSE:CNF)

Historical Stock Chart

From Jan 2025 to Feb 2025

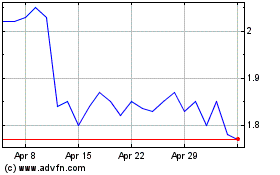

CNFinance (NYSE:CNF)

Historical Stock Chart

From Feb 2024 to Feb 2025