0000764065false00007640652024-07-142024-07-14

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): July 14, 2024

CLEVELAND-CLIFFS INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Ohio | | 1-8944 | | 34-1464672 |

| (State or Other Jurisdiction of Incorporation or Organization) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | | | | | | | |

| 200 Public Square, | Suite 3300, | Cleveland, | Ohio | 44114-2315 |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant's telephone number, including area code: (216) 694-5700

| | |

Not Applicable |

(Former name or former address, if changed since last report) |

| | | | | | | | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

| ☐ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered: |

| Common Shares, par value $0.125 per share | | CLF | | New York Stock Exchange |

| | | | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (Section 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (Section 240.12b-2 of this chapter). |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ |

| | | | | | | | |

| Item 5.02. | | Entry into a Material Definitive Agreement. |

On July 14, 2024, Cleveland-Cliffs Inc., an Ohio corporation (“Cliffs” or the “Company”), 13421422 Canada Inc., a Canadian corporation and wholly owned subsidiary of Cliffs (“Purchaser”), and Stelco Holdings Inc., a Canadian corporation (“Stelco”), entered into an Arrangement Agreement (the “Arrangement Agreement”), pursuant to which Purchaser will acquire all of the issued and outstanding common shares of Stelco (“Stelco Shares”) from the holders thereof (the “Stelco Shareholders”). The acquisition of the Stelco Shares and the other transactions contemplated by the Arrangement Agreement will be implemented by way of a statutory plan of arrangement (the “Arrangement”) under the Canada Business Corporation Act (the “CBCA”) on the terms and conditions set out in the plan of arrangement, substantially in the form of Exhibit B to the Arrangement Agreement (the “Plan of Arrangement”).

The Arrangement Agreement and the Plan of Arrangement provide that, following the effective time of the Arrangement (the “Effective Time”), each Stelco Share outstanding immediately prior to the Effective Time (other than Stelco Shares held by a registered Stelco Shareholder who has validly exercised such holder’s dissent rights under the CBCA) will be transferred by the holder thereof to Purchaser in exchange for (a) C$60.00 in cash (the “Cash Consideration”) plus (b) 0.454 of a share of Cliffs’ common stock (“Cliffs Common Stock”), $0.125 par value per share (“Share Consideration” and together with the Cash Consideration and the cash in lieu of fractional shares of Cliffs Common Stock, the “Consideration”).

In addition, following the Effective Time, Stelco’s outstanding equity awards will be treated as follows:

•Each outstanding restricted share unit granted pursuant to Stelco’s Long Term Incentive Plan (the “LTIP”), whether vested or unvested, will be deemed assigned and transferred to Stelco in exchange for the payment and delivery by or on behalf of Stelco of the Consideration (less applicable withholding taxes) and thereafter cancelled;

•Each deferred share unit granted pursuant to Stelco’s Deferred Share Unit Plan will be deemed assigned and transferred to Stelco in exchange for the payment and delivery by or on behalf of Stelco of the Consideration (less applicable withholding taxes) and thereafter cancelled; and

•Each outstanding stock appreciation right granted pursuant to the LTIP, whether vested or unvested, will be deemed assigned and transferred to Stelco in exchange for the payment and delivery by or on behalf of Stelco equal to a portion of the Consideration determined by reference to a formula described in the Plan of Arrangement.

Representations, Warranties and Covenants

The Arrangement Agreement contains customary representations and warranties from Cliffs, Purchaser and Stelco, and each party has agreed to customary covenants, including, among others, covenants relating to (i) the conduct of its business prior to the closing, (ii) the use of reasonable best efforts to consummate the Arrangement and (iii) solely in the case of Stelco, holding a meeting of the Stelco Shareholders to obtain their requisite approval in connection with the Arrangement and, subject to certain exceptions, the board of directors of Stelco recommending to the Stelco Shareholders that such approval be provided. The Arrangement Agreement also prohibits Stelco from soliciting competing acquisition proposals, except that, subject to customary exceptions and limitations, Stelco may provide information to, and negotiate with, a third party that makes an unsolicited acquisition proposal if the board of directors of Stelco determines that such acquisition proposal constitutes or would reasonably be expected to result in a superior proposal.

Closing Conditions

Completion of the Arrangement is subject to certain conditions set forth in the Arrangement Agreement, including, among others, (i) the approval of 66 ⅔% of the votes cast by Stelco Shareholders and, if required by applicable Canadian securities laws, a simple majority of the votes cast by Stelco Shareholders, excluding Stelco Shares held by persons required to be excluded under such laws, (ii) the granting by the Ontario Superior Court of Justice (Commercial List) of an interim order and a final order in respect of the approval of the Arrangement, (iii) the expiration or termination of any applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, (iv) approval under the Investment Canada Act (Canada), R.S.C. 1985, c.28 (1st Supp.),

(v) approval under the Competition Act (Canada), RSC 1985, c C-34, and (vi) approval from the Minister of Innovation, Science and Industry under the terms of Stelco’s Strategic Innovation Fund Agreement.

Termination Rights

The Arrangement Agreement contains certain termination rights for both the Company and Stelco, including, among others, if (i) the Arrangement is not consummated by April 14, 2025 (which date may be extended in certain circumstances until July 13, 2025), (ii) the Stelco Shareholders fail to approve the Arrangement, (iii) there is a final, non-appealable order prohibiting the closing of the Arrangement or (iv) there has been a breach by the other party that is not cured such that the applicable closing conditions are not satisfied. In addition, Stelco may terminate the Arrangement Agreement under certain specified circumstances in order to accept a superior proposal in respect of an alternative transaction.

If the Arrangement Agreement is terminated in connection with the acceptance by Stelco of a superior proposal, then Stelco will be required to pay to the Company a termination fee of C$100 million. In addition, Stelco will be obligated to make an expense reimbursement payment of up to C$15 million to the Company if the Arrangement Agreement is terminated as a result of the Stelco Shareholders failing to approve the Arrangement.

If the Arrangement Agreement is terminated in certain circumstances relating to the failure to obtain required regulatory approvals or the imposition of an order prohibiting, restraining or rendering illegal the Arrangement, then Purchaser will be required to pay to Stelco a termination fee of C$131 million.

Financing

Cliffs intends to finance the aggregate Cash Consideration payable under the Arrangement with the proceeds from debt financings, which could include debt securities issued in capital markets transactions, term loans, revolving loans, bridge loans or any combination thereof.

Voting Support Agreements

Contemporaneously with the execution of the Arrangement Agreement, the Company and Purchaser entered into voting support agreements with the directors and certain executive officers of Stelco as well as certain significant Stelco Shareholders, collectively holding and representing approximately 45% of the outstanding Stelco Shares, under which such directors, officers and Stelco Shareholders have agreed, among other things and subject to certain termination rights, to vote all of their Stelco Shares in favor of the Arrangement.

On July 15, 2024, Cliffs issued a press release, a copy of which is attached as Exhibit 99.1 and incorporated by reference in this Current Report on Form 8-K, announcing its entry into the Arrangement Agreement and related matters.

| | | | | | | | |

| Item 9.01. | | Financial Statements and Exhibits. |

| | | | | | | | |

(d)Exhibits. |

Exhibit

Number | | Description |

| |

| | Cleveland-Cliffs Inc. published a news release on July 15, 2024 captioned, “Cleveland-Cliffs Announces the Acquisition of Stelco.” |

| 101 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

| 104 | | The cover page from this Current Report on Form 8-K, formatted as Inline XBRL. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | |

| | CLEVELAND-CLIFFS INC. |

| | | |

| Date: | July 15, 2024 | By: | /s/ James D. Graham |

| | Name: | James D. Graham |

| | Title: | Executive Vice President, Chief Legal and Administrative Officer & Secretary |

CLEVELAND-CLIFFS INC. • 200 PUBLIC SQUARE • SUITE 3300 • CLEVELAND, OH 44114-2544 NEWS RELEASE Cleveland-Cliffs Announces the Acquisition of Stelco CLEVELAND – July 15, 2024 — Cleveland-Cliffs Inc. (NYSE:CLF) (“Cliffs” or “the Company”) is pleased to announce that it has entered into a definitive agreement to acquire Stelco Holdings Inc. (TSX:STLC) (“Stelco”). The acquisition confirms Cliffs’ commitment and leadership in integrated steel production in North America, and also brings an additional 1,800 United Steelworkers (“USW”) union employees into Cliffs’ workforce. Under the terms of the agreement, Stelco shareholders will receive CAD $60.00 per Stelco common share in cash and 0.454 shares of Cliffs common stock per share of Stelco common stock (or CAD $10.00 per share as of July 12, 2024), representing a total consideration of CAD $70.00 per Stelco share. The transaction has received full support from David McCall, International President of the USW union. The transaction implies a total enterprise value of approximately USD $2.5 billion (CAD $3.4 billion) for Stelco and represents an acquisition multiple of 4.8x 3/31/24 LTM Adjusted EBITDA with synergies. Cliffs has a clear line of sight to the achievement of approximately $120 million of estimated annual cost savings with no impact to union jobs. The acquisition is expected to be immediately accretive to 2024 and 2025 EPS. The transaction implies pro forma net leverage of 2.4x 3/31/2024 LTM Adjusted EBITDA. Upon completion of the transaction, Cliffs shareholders will own approximately 95% and Stelco shareholders will own approximately 5% of the combined company, on a fully diluted basis. Stelco is an integrated steelmaker consisting of two operational sites, both located in the province of Ontario: Lake Erie Works, the newest and lowest-cost integrated steelmaking facility in North America; and Hamilton Works, a downstream finishing and cokemaking facility. Stelco ships approximately 2.6 million net tons of flat-rolled steel annually, primarily hot-rolled steel to service center customers. The acquisition of Stelco expands Cliffs’ steelmaking footprint and doubles Cliffs’ exposure to the flat-rolled spot market, with cost advantages in raw materials, energy, healthcare, and currency. Stelco adds capabilities that complement Cliffs’ existing operations and product portfolio, while diversifying its customer base across the construction and industrial sectors. The transaction brings substantial integration opportunities, generating synergies associated with procurement, overhead, and public company related expenses. Voting support agreements for the transaction have been entered into by Fairfax Financial Holdings, Alan Kestenbaum, an affiliate of Lindsay Goldberg and each of the other executive officers and directors of EXHIBIT 99.1

CLEVELAND-CLIFFS INC. • 200 PUBLIC SQUARE • SUITE 3300 • CLEVELAND, OH 44114-2544 2 Stelco, which collectively represent approximately 45% of Stelco’s outstanding shares, pursuant to which such parties have agreed to vote all shares held by them in favor of the transaction, subject to customary exceptions. Upon closing of the transaction, Stelco is expected to continue operations as a wholly-owned subsidiary, preserving the name and legacy of the business. Lourenco Goncalves, Chairman of the Board, President and CEO of Cliffs, stated: “I want to first recognize Alan Kestenbaum and the Stelco team for the remarkable turnaround they executed at Stelco, turning what was an underperforming asset under previous ownership into a very cost-efficient and profit-oriented company. In the process, they restored the Canadian national pride associated with Stelco, and we are going to continue that. We did this deal the way it should be done, reaching a respectful agreement between the two parties that keeps national interests at the forefront and recognizes the importance of the workforce. The enterprise value of this transaction is significantly lower than the cost of building an equivalent replacement mill in the United States, and the cost structure is lower than what a new U.S. mill would provide us. Stelco is a company that respects the Union, treats their employees well, and leans into their cost advantages. With that, they are a perfect fit for Cleveland-Cliffs and our culture. We look forward to proving that our ownership of Stelco will be a net benefit for Canada, the province of Ontario, and the cities of Nanticoke and Hamilton.” Alan Kestenbaum, Executive Chairman of the Board and CEO of Stelco, stated: “I am proud of what we have accomplished over the past seven years, and the value we have generated. This sale crystallizes a 32% CAGR on a Stelco common share investment since our IPO in 2017. Most importantly, we have revitalized Stelco and restored it to its iconic status in Canada. I know that Cliffs will continue to build upon the excellent work and life environment we have created for all of our employees, and continue to be a reliable supplier to our valued customers, while maintaining Stelco’s stature and reputation in Canada and maintaining our Canadian national interests. One of the important drivers for this transaction was receiving a meaningful portion of the consideration in Cliffs shares. I have strong belief and optimism in the North American steel market. I believe that Lourenco and his team have created a winning platform and I intend to remain an investor in Cliffs for a long time to come as he and his team continue to build out their platform and business.” David McCall, International President of the USW, stated: “On behalf of our entire membership, I am excited for this transaction and proud to support a deal that is great for the resilience of manufacturing and Union jobs in North America. Cleveland-Cliffs has a proven track record of making sure the Union always has a seat at the table, and this deal was no different. We are delighted to further expand our already great partnership between Cliffs and the USW.”

CLEVELAND-CLIFFS INC. • 200 PUBLIC SQUARE • SUITE 3300 • CLEVELAND, OH 44114-2544 3 Benefits to Canada Cliffs is excited to expand its current 1,000-employee footprint in Canada, which consists of seven Tooling and Stamping plants and a Ferrous Processing and Trading Company (FPT) location, all in Ontario. The Company is committed to working with stakeholders and to deliver meaningful benefits to Canada, Ontario, and the communities where Stelco operates. Cliffs’ plan is to grow the business in Canada and build on the progress Stelco has made in recent years. In connection with this investment: • Stelco’s headquarters will remain in Hamilton and the name and legacy of Stelco will be preserved in Hamilton, Nanticoke, and Canada. • Stelco will continue its significant operations in Hamilton and Nanticoke, make capital investments of at least CAD $60 million over the next three years, and plans to increase steel production over current levels from those facilities. • Stelco will maintain significant employment levels in Canada and Canadian representation on the management team. • Recognizing the importance of Stelco’s operations to the businesses in the region, Cliffs will ensure existing local supplier arrangements are maintained. • Cliffs values and will continue Stelco’s collaboration with McMaster University and CanmetMATERIALS and will maintain the existing research chairs with McMaster University. • Cliffs respects Stelco’s commitment to charitable and community support and will build on that legacy by increasing the overall charitable support by CAD $2 million per year, to be directed by Stelco’s management team. • Cliffs will continue Stelco’s partnership with the Hamilton Tiger-Cats and Forge FC and will maintain its 40% equity interest and the master lease of Tim Hortons Field. The community engagement program, including the Tiger-Cats High School Mentorship Program will also be maintained. • Cliffs is committed to operating the business and approaching sustainability in a way that supports the United Nations’ Sustainable Development Goals (UN SDGs) and will ensure the Canadian operations operate in accordance with the Company’s sustainability priorities. Additional Details The transaction has been unanimously approved by Cliffs’ and Stelco’s respective Boards. The Stelco Board formed a special committee of directors which, following review and consideration of the transaction, unanimously recommended the Stelco Board approve the transaction. The transaction is expected to close in the fourth quarter of 2024, subject to approval by Stelco shareholders, receipt of regulatory approvals and satisfaction of other customary closing conditions.

CLEVELAND-CLIFFS INC. • 200 PUBLIC SQUARE • SUITE 3300 • CLEVELAND, OH 44114-2544 4 Advisors and Counsel Wells Fargo, J.P. Morgan and Moelis & Company LLC are acting as financial advisors to Cliffs. Davis Polk & Wardwell LLP and Blake, Cassels & Graydon LLP are serving as legal counsel to Cliffs. In addition, Wells Fargo Bank, N.A. and J.P. Morgan have provided full underwritten financing commitments and are backstopping Cliffs’ existing ABL Facility. BMO Capital Markets is acting as financial advisor to Stelco, and McCarthy Tétrault LLP and A&O Shearman LLP are serving as legal counsel to Stelco. In addition, RBC Capital Markets is acting as financial advisor and Stikeman Elliott LLP as legal counsel to the Special Committee of Stelco’s Board of Directors. Each of BMO Capital Markets and RBC Capital Markets has provided a fairness opinion to the Stelco Board that, as of July 14, 2024, and subject to the various matters, limitations, qualifications and assumptions set forth therein, the consideration to be received by holders of the common shares pursuant to the transaction is fair, from a financial point of view, to such holders. Conference Call & Webcast Information Cliffs will conduct a live conference call and webcast on July 15th, 2024 at 8:30 a.m. Eastern Time. The call will be broadcast live and archived on Cliffs' website at https://www.clevelandcliffs.com/. Presentation slides related to the transaction will also be available on the webcast link and on Cliffs’ Investor Relations page on its website, which includes reconciliations of non-GAAP measures used in this release. About Cleveland-Cliffs Inc. Cleveland-Cliffs is the largest flat-rolled steel producer in North America. Founded in 1847 as a mine operator, Cliffs also is the largest manufacturer of iron ore pellets in North America. The Company is vertically integrated from mined raw materials, direct reduced iron, and ferrous scrap to primary steelmaking and downstream finishing, stamping, tooling, and tubing. Cleveland-Cliffs is the largest supplier of steel to the automotive industry in North America and serves a diverse range of other markets due to its comprehensive offering of flat-rolled steel products. Headquartered in Cleveland, Ohio, Cleveland-Cliffs employs approximately 28,000 people across its operations in the United States and Canada. About Stelco Holdings Inc. Stelco is a low cost, integrated and independent steelmaker with one of the newest and most technologically advanced integrated steelmaking facilities in North America. Stelco produces flat-rolled value-added steels, including premium-quality coated, cold-rolled and hot-rolled steel products, as well as pig iron and metallurgical coke. With first- rate gauge, crown, and shape control, as well as uniform through-coil mechanical properties, Stelco’s steel products are supplied to customers in the construction, automotive, energy, appliance, and pipe and tube industries across Canada and the United States as well as to a variety of steel service centers, which are distributors of steel products. Forward-Looking Statements This release contains statements that constitute "forward-looking statements" within the meaning of the U.S. federal securities laws and applicable Canadian securities laws. All statements other than historical facts, including, without limitation, statements regarding our current expectations, estimates and projections about our industry, our business

CLEVELAND-CLIFFS INC. • 200 PUBLIC SQUARE • SUITE 3300 • CLEVELAND, OH 44114-2544 5 or a transaction with Stelco, are forward-looking statements. We caution investors that any forward-looking statements are subject to risks and uncertainties that may cause actual results and future trends to differ materially from those matters expressed in or implied by such forward-looking statements. Investors are cautioned not to place undue reliance on forward-looking statements. Among the risks and uncertainties that could cause actual results to differ from those described in forward-looking statements are the following: the risk that the proposed transaction with Stelco may not be consummated; the risk that a transaction with Stelco may be less accretive than expected, or may be dilutive, to Cliffs’ earnings per share, which may negatively affect the market price of Cliffs’ common shares; the risk that adverse reactions or changes to business or regulatory relationships may result from the announcement or completion of the transaction; the possibility of the occurrence of any event, change or other circumstance that could give rise to the right of one or both of Cliffs and Stelco to terminate the transaction agreement between the two companies, including, but not limited to, the companies’ inability to obtain necessary regulatory approvals; the risk of shareholder litigation relating to the proposed transaction that could be instituted against Stelco, Cliffs, or their respective directors; the possibility that Cliffs and Stelco will incur significant transaction and other costs in connection with the proposed transaction, which may be in excess of those anticipated by Cliffs; the risk that the financing transactions to be undertaken in connection with a transaction have a negative impact on the combined company’s credit profile, financial condition or financial flexibility; the possibility that the anticipated benefits of the proposed acquisition of Stelco are not realized to the same extent as projected and that the integration of the acquired business into our existing business, including uncertainties associated with maintaining relationships with customers, vendors and employees, is not as successful as expected; the risk that additional future synergies may not be realized; the risk that it may take longer than expected to achieve the anticipated synergies from the proposed transaction; the possibility that the business and management strategies currently in place or implemented in the future for the maintenance, expansion and growth of the combined company’s operations may not be as successful as anticipated; the risk associated with the retention and hiring of key personnel, including those of Stelco; the risk that any announcements relating to, or the completion of, a transaction could have adverse effects on the market price of Cliffs common shares; and the risk of any unforeseen liability and future capital expenditure of Cliffs related to a transaction. For additional factors affecting the business of Cliffs, refer to Part I – Item 1A. Risk Factors of our Annual Report on Form 10-K for the year ended December 31, 2023, and other filings with the U.S. Securities and Exchange Commission. This document shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any jurisdiction. Source: Cleveland-Cliffs Inc. MEDIA CONTACT: Patricia Persico Senior Director, Corporate Communications (216) 694-5316 INVESTOR CONTACT: James Kerr Director, Investor Relations (216) 694-7719

v3.24.2

Cover Document

|

Jul. 14, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jul. 14, 2024

|

| Entity Registrant Name |

CLEVELAND-CLIFFS INC.

|

| Entity Incorporation, State or Country Code |

OH

|

| Entity File Number |

1-8944

|

| Entity Tax Identification Number |

34-1464672

|

| Entity Address, Address Line One |

200 Public Square,

|

| Entity Address, Address Line Two |

Suite 3300,

|

| Entity Address, City or Town |

Cleveland,

|

| Entity Address, State or Province |

OH

|

| Entity Address, Postal Zip Code |

44114-2315

|

| City Area Code |

216

|

| Local Phone Number |

694-5700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Shares, par value $0.125 per share

|

| Trading Symbol |

CLF

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000764065

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

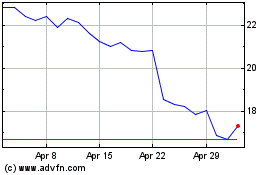

Cleveland Cliffs (NYSE:CLF)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cleveland Cliffs (NYSE:CLF)

Historical Stock Chart

From Jul 2023 to Jul 2024