Expands Legacy of Community Commitment by

Launching Partnership Program Awarding $50,000 Grant Focused on

Mental Health and Well-Being in San Francisco

Citizens Financial Group, Inc. (NYSE: CFG) today announced the

next phase in its West Coast expansion strategy, adding a top

Private Banking team in Southern California and announcing plans to

add new Private Bank office locations in the market. This move

comes on the heels of previous announcements around Citizens’

California expansion strategy, designed to serve the market in an

integrated and complete way that drives growth across Private

Banking, Wealth Management, and Corporate & Investment

Banking.

Citizens has opened two new Private Banking offices in Mill

Valley and Downtown San Francisco, Calif., representing the first

West Coast branches in the bank’s growing portfolio. The new

Citizens Private Bank offices provide holistic, high-touch Private

Banking and wealth management solutions to high-net-worth

individuals, families, businesses, innovation economy

entrepreneurs, and philanthropic organizations. These locations

stand out as centers of excellence within Citizens' portfolio,

offering an array of bespoke financial services tailored to the

unique needs of clients in the Northern California market. All

Citizens customers in the region are welcome to visit the new

Private Banking offices for their everyday banking needs.

To further expand its presence, Citizens Private Bank has added

a highly experienced Private Banking team in Southern California to

serve the San Diego and Newport Beach markets. The new team is led

by Victor Mena, Private Bank Market Executive, who brings extensive

area expertise, deep regional relationships, and a proven track

record of delivering exceptional client service. Mena will report

to Susan deTray, Head of Citizens Private Bank, and he and his team

of experienced bankers will extend Citizens Private Bank’s growth

in California. Citizens Private Bank intends to open additional

Private Banking offices throughout California, including Newport

Beach, San Diego and Silicon Valley by mid-2025.

“We’re pleased to continue executing against the Citizens

Private Bank growth strategy with the opening of our first two

Private Banking offices in the San Francisco Bay Area, and the

addition of experienced bankers in Southern California,” said Susan

deTray, Head of Citizens Private Bank. “We look forward to

deepening our presence and delivering a robust suite of

comprehensive banking and wealth management services with an

emphasis on personal relationships, extraordinary service, and

tailored solutions and advice.”

Building on a Foundation of Service While these mark

Citizens’ latest moves in its West Coast expansion, the bank has a

strong and growing Commercial Banking presence in California

providing investment banking, equity research, and sales and

trading services. In addition, Citizens recently hired an

experienced corporate banker in San Francisco to build a team of

advisors supporting middle market companies across the state.

“California would be the fifth largest economy in the world if

it were a country, and its businesses continue to be key drivers of

innovation and growth,” said Mark Lehmann, CEO of Citizens JMP and

Citizens California President. “Citizens’ bankers have been working

closely with California’s top innovators for years as trusted

advisors and we are here for the long haul to invest, deepen

relationships, and partner with clients to help further expand the

California economy and support our local communities.”

Engaging Local Communities As part of Citizens’ ongoing

commitment to create lasting change in local communities, Citizens

is proud to introduce its Champions in Action grant program in

California – a corporate-wide initiative that celebrates and

supports local nonprofits with operating budgets under $5 million

that are making a meaningful and measurable impact in the

communities they serve across the United States. Citizens recently

launched this program in San Francisco to award $50,000 in

unrestricted funding, volunteer and promotional support to a local

non-profit organization focused on improving access to mental

health and well-being programming.

Since the program’s launch 22 years ago, Citizens has awarded

more than $11 million in contributions and promotional support to

over 380 nonprofits across the bank’s footprint. To learn more,

please visit www.citizensbank.com/champions.

About Citizens Financial Group,

Inc. Citizens Financial Group, Inc. is one of the

nation’s oldest and largest financial institutions, with $219.9

billion in assets as of June 30, 2024. Headquartered in Providence,

Rhode Island, Citizens offers a broad range of retail and

commercial banking products and services to individuals, small

businesses, middle-market companies, large corporations and

institutions. Citizens helps its customers reach their potential by

listening to them and by understanding their needs in order to

offer tailored advice, ideas and solutions. In Consumer Banking,

Citizens provides an integrated experience that includes mobile and

online banking, a full-service customer contact center and the

convenience of approximately 3,300 ATMs and approximately 1,000

branches in 14 states and the District of Columbia. Consumer

Banking products and services include a full range of banking,

lending, savings, wealth management and small business offerings.

In Commercial Banking, Citizens offers a broad complement of

financial products and solutions, including lending and leasing,

deposit and treasury management services, foreign exchange,

interest rate and commodity risk management solutions, as well as

loan syndication, corporate finance, merger and acquisition, and

debt and equity capital markets capabilities. More information is

available at www.citizensbank.com or visit us on X (formerly

Twitter), LinkedIn or Facebook.

Cautionary Statement About

Forward-Looking Statements This news release contains

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Any statement that does

not describe historical or current facts is a forward-looking

statement. These statements often include the words “believes,”

“expects,” “anticipates,” “estimates,” “intends,” “plans,” “goals,”

“targets,” “initiatives,” “potentially,” “probably,” “projects,”

“outlook,” “hopeful,” “guidance” or similar expressions or future

or conditional verbs such as “may,” “will,” “should,” “would,” and

“could.” Forward-looking statements are based upon the current

beliefs and expectations of management, and on information

currently available to management. Our statements speak as of the

date hereof, and we do not assume any obligation to update these

statements or to update the reasons why actual results could differ

from those contained in such statements in light of new information

or future events. We caution you, therefore, against relying on any

of these forward-looking statements. They are neither statements of

historical fact nor guarantees or assurances of future performance.

More information about factors that could cause actual results to

differ materially from those described in the forward-looking

statements can be found under “Risk Factors” in our Annual Report

on Form 10-K for the year ended December 31, 2022, as filed with

the United States Securities and Exchange Commission.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241002946132/en/

Media: Jaclyn Bingold Jaclyn.bingold@citizensbank.com

917-699-1432

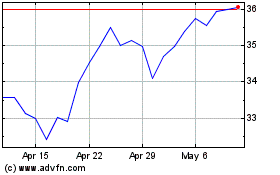

Citizens Financial (NYSE:CFG)

Historical Stock Chart

From Nov 2024 to Dec 2024

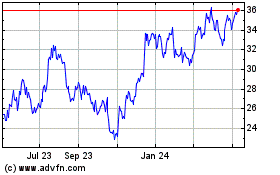

Citizens Financial (NYSE:CFG)

Historical Stock Chart

From Dec 2023 to Dec 2024