MultiPlan Corporation’s Reverse Stock Split Becomes Effective

September 20 2024 - 5:05PM

Business Wire

MultiPlan Common Stock to Begin Trading on a

Split-Adjusted Basis on September 23, 2024

MultiPlan Corporation (“MultiPlan” or the “Company”) (NYSE:

MPLN), a leading provider of technology and data-enabled cost

management, payment, and revenue integrity solutions to the U.S.

health care industry, today announced that the previously announced

1-for-40 reverse stock split of its outstanding shares of Class A

common stock (the “common stock”) became effective as of September

20, 2024 at 5:00 p.m. Eastern Time (the “Split Effective Time”).

The common stock will continue trading on the New York Stock

Exchange (“NYSE”) under the existing symbol (MPLN) and will begin

trading on a split-adjusted basis when the market opens on

September 23, 2024, with the new CUSIP number 62548M 209.

At the Split Effective Time, each share of common stock was

automatically reclassified into one fortieth (1/40th) of a share of

issued and outstanding common stock.

Proportional adjustments will also be made to: (1) all

then-outstanding warrants exercisable for common stock, such that

fewer shares would underlie such securities and the purchase price

per share will be increased; (2) all then-outstanding awards,

including, without limitation, those issued under the Company’s

2020 Omnibus Incentive Plan, as amended, such that fewer shares of

common stock would underlie such awards and the exercise price per

share of the options will be increased; (3) the number of shares of

common stock available for issuance under each of the Company’s

2020 Omnibus Incentive Plan, as amended, and the Company’s 2023

Employee Purchase Plan, such that fewer shares will be available

for issuance under both plans; and (4) the number of shares of

common stock issuable upon conversion of the Company’s

then-outstanding 6.00% / 7.00% Convertible Senior PIK Toggle Notes

due 2027, such that fewer shares will be issuable upon conversion

of such notes and the conversion price will be increased.

No fractional shares of Common Stock will be issued as a result

of the Reverse Stock Split. Stockholders who would otherwise be

entitled to a fractional share of Common Stock are instead entitled

to receive a cash payment (without interest) in an amount equal to

their respective pro rata share of the net proceeds of the sale of

the fractional shares. The Reverse Stock Split will not affect the

number of authorized shares of Common Stock or the par value of

Common Stock.

The reverse stock split is primarily intended to increase the

per share trading price of MultiPlan’s common stock in order to

meet the NYSE’s price criteria for continued listing.

About MultiPlan

MultiPlan is committed to bending the cost curve in healthcare

by delivering transparency, fairness, and affordability to the US

healthcare system. Our focus is on identifying medical savings,

helping to lower out-of- pocket costs, and reducing or eliminating

balance billing for healthcare consumers. Leveraging sophisticated

technology, data analytics, and a team rich with industry

experience, MultiPlan interprets customers’ needs and customizes

innovative solutions that combine its payment and revenue

integrity, network-based, data and decision science, and

analytics-based services. MultiPlan delivers value to more than 700

healthcare payors, over 100,000 employers, 60 million consumers,

and 1.4 million contracted providers. For more information, visit

multiplan.com.

Forward Looking Statements

This press release contains forward-looking statements. These

forward-looking statements can generally be identified by the use

of forward-looking terminology, including the terms “believes,”

“estimates,” “anticipates,” “expects,” “seeks,” “projects,”

“forecasts,” “intends,” “plans,” “may,” “will” or “should” or, in

each case, their negative or other variations or comparable

terminology. These forward-looking statements include all matters

that are not historical facts, including the discussion in this

press release of the reverse stock split and expected benefits. The

forward-looking statements are made pursuant to the Safe Harbor

provisions of the Private Securities Litigation Reform Act of 1995

and speak only as of the date they are made. Any forward-looking

statements that we make herein are not guarantees of future

performance and actual results may differ materially from those in

such forward-looking statements as a result of various factors.

Factors that may impact such forward-looking statements also

include the factors discussed under “Risk Factors” in the Company’s

Annual Report on Form 10-K for the fiscal year ended December 31,

2023 and Quarterly Report on Form 10-Q for the three months ended

June 30, 2024; and other factors beyond our control. Should one or

more of these risks or uncertainties materialize, or should any of

the assumptions prove incorrect, actual results may vary in

material respects from those projected in these forward-looking

statements. The Company’s periodic and other filings are accessible

on the SEC’s website at www.sec.gov. We undertake no obligation to

update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240920870927/en/

Investor Relations Luke Montgomery, CFA SVP, Finance

& Investor Relations MultiPlan 866-909-7427

investor@multiplan.com Shawna Gasik AVP, Investor Relations

MultiPlan 866-909-7427 investor@multiplan.com Media Relations

Pamela Walker AVP, Marketing & Communication MultiPlan

781-895-3118 press@multiplan.com

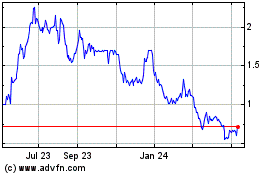

Churchill Capital Corp III (NYSE:MPLN)

Historical Stock Chart

From Nov 2024 to Dec 2024

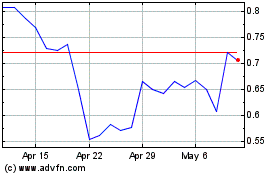

Churchill Capital Corp III (NYSE:MPLN)

Historical Stock Chart

From Dec 2023 to Dec 2024