Chegg Announces New $150 Million Accelerated Share Repurchase

November 15 2023 - 6:45AM

Business Wire

Chegg, Inc. (NYSE:CHGG), the leading student-first connected

learning platform, today announced that it has entered into an

accelerated share repurchase agreement (“ASR”) with Morgan Stanley

Bank, National Association, to repurchase $150 million of Chegg’s

common stock.

Under the ASR, Chegg will make an initial payment of $150

million to Morgan Stanley Bank, National Association, and will

receive an initial delivery of approximately 13.5 million shares of

its common stock by November 15, 2023. The final number of shares

to be repurchased will be based on the volume-weighted average

price of Chegg’s common stock during the term of the ASR, less a

discount. The final settlement of the ASR is expected to occur by

the second quarter of 2024.

“We are excited about the opportunities before us and believe

Chegg is in a great position to build the most impactful,

AI-enabled, personal learning assistant for learners around the

world,” said Dan Rosensweig, CEO & President of Chegg, Inc.

“This accelerated share repurchase demonstrates our ability to

generate strong free cash flow and our continued commitment to

enhancing shareholder value.”

The ASR transaction will be effectuated pursuant to Chegg’s

previously announced $2.2 billion securities repurchase program. As

of October 31, 2023, $153.7 million remained available for future

repurchases under this program and $3.7 million will remain

available after completion of the ASR. There is no expiration date

for the repurchase program, and it will continue until otherwise

suspended, terminated or modified at any time for any reason by our

board of directors.

About Chegg

Millions of people all around the world Learn with Chegg. Our

mission is to improve learning and learning outcomes by putting

students first. We support life-long learners starting with their

academic journey and extending into their careers. The Chegg

platform provides products and services to support learners to help

them better understand their academic course materials, and also

provides personal and professional development skills training, to

help them achieve their learning goals. Chegg is a publicly held

company based in Santa Clara, California and trades on the NYSE

under the symbol CHGG. For more information, visit

www.chegg.com.

Forward-Looking Statements

This press release contains forward-looking statements made

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995, which include, without limitation,

statements regarding the long-term opportunity for Chegg, Chegg’s

belief that it is in a great position to build the most impactful,

AI-enabled, personal learning assistant for learners around the

world, the expected completion date of the ASR, and the amount

remaining under the repurchase program after completion of the ASR.

The words “anticipate,” “believe,” “estimate,” “expect,” “intend,”

“project,” “propose,” “endeavor,” “will,” “should,” “future,”

“transition,” “outlook” and similar expressions, as they relate to

Chegg, are intended to identify forward-looking statements. These

statements are not guarantees of future performance, and are based

on management’s expectations as of the date of this press release

and assumptions that are inherently subject to uncertainties, risks

and changes in circumstances that are difficult to predict.

Forward-looking statements involve known and unknown risks,

uncertainties and other factors that may cause actual results,

performance or achievements to differ materially from any future

results, performance or achievements. With respect to our proposed

ASR transaction and Chegg’s long-term opportunities, our ability to

execute such a transaction and take advantage of such opportunities

are subject to risks and uncertainties including, developments or

changes in economic or market conditions, developments or changes

in the securities markets, and fluctuations in the trading volume

and market price of our common stock. Other important factors that

could cause actual results to differ materially from those

expressed or implied by these forward-looking statements include

the following: the effects of AI technology on Chegg's business and

the economy generally; Chegg’s ability to attract new, and retain

existing, students, to increase student engagement, and to increase

monetization; Chegg’s brand and reputation; changes in employment

and wages and the uncertainty surrounding the evolving educational

landscape, enrollment and student behavior; Chegg’s ability to

expand internationally; changes in search engine methodologies that

modify Chegg’s search result page rankings, resulting in decreased

student engagement on Chegg’s website; the success of Chegg’s new

product offerings, including the new Chegg generative AI experience

and personal learning assistant; competition in aspects of Chegg’s

business, and Chegg’s expectation that such competition will

increase; Chegg’s ability to innovate in response to technological

and market developments, including artificial intelligence; Chegg’s

ability to maintain its services and systems without interruption,

including as a result of technical issues, cybersecurity threats,

or cyber-attacks; third-party payment processing risks; adoption of

government regulation of education unfavorable to Chegg; the rate

of adoption of Chegg’s offerings; mobile app stores and mobile

operating systems making Chegg’s apps and mobile website available

to students and to grow Chegg’s user base and increase their

engagement; colleges and governments restricting online access or

access to Chegg’s services; Chegg’s ability to strategically take

advantage of new opportunities; competitive developments, including

pricing pressures and other services targeting students; Chegg’s

ability to build and expand its services offerings; Chegg’s ability

to integrate acquired businesses and assets; the impact of

seasonality and student behavior on the business; the outcome of

any current litigation and investigations; Chegg’s ability to

effectively control operating costs; regulatory changes, in

particular concerning privacy, marketing and education; changes in

the education market, including as a result of AI technology and

COVID-19; and general economic, political and industry conditions,

including inflation, recession and war. All information provided in

this release is as of the date hereof and Chegg undertakes no duty

to update this information except as required by law. These and

other important risk factors are described more fully in documents

filed with the Securities and Exchange Commission, including

Chegg's Annual Report on Form 10-K for the year ended December 31,

2022 filed with the Securities and Exchange Commission on February

21, 2023, and could cause actual results to differ materially from

expectations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231115638967/en/

Media Contact: Tonya B. Hudson, press@chegg.com Investor

Contact: Tracey Ford, IR@chegg.com

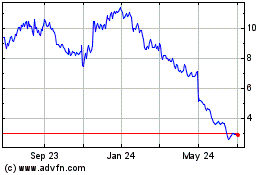

Chegg (NYSE:CHGG)

Historical Stock Chart

From Oct 2024 to Nov 2024

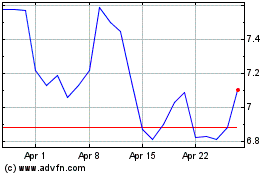

Chegg (NYSE:CHGG)

Historical Stock Chart

From Nov 2023 to Nov 2024