CoreSite Announces 2014 Distribution Tax Treatment

January 22 2015 - 8:00AM

Business Wire

CoreSite Realty Corporation (NYSE:COR), a premier provider of

secure, reliable, high-performance data center solutions across the

US, today announced the income tax allocation for federal income

tax purposes of its 2014 distributions on its common and preferred

stock.

Table 1. CoreSite Common Stock (NYSE:COR; CUSIP:

21870Q105)

RecordDate

PayableDate

DistributionPer Share

TaxableOrdinaryDividends

Long-termCapital Gains

Long-termUnrecapturedSection1250 Gain

QualifiedDividends

Return ofCapital

3/31/14 4/15/14 $0.350000

$0.350000 $0.00 $0.00

$0.00 $0.00 6/30/14 7/15/14 0.350000 0.350000 0.00

0.00 0.00 0.00 9/30/14 10/15/14 0.350000 0.350000 0.00 0.00 0.00

0.00 12/31/14 1/15/15 0.098782 0.098782

0.00 0.00 0.00 0.00 Total

$1.148782 $1.148782 $0.00

$0.00 $0.00 $0.00

Table 2. CoreSite Series A Cumulative Redeemable

Preferred Stock (NYSE:CORprA; CUSIP: 21870Q204)

RecordDate

PayableDate

DistributionPer Share

TaxableOrdinaryDividends

Long-termCapitalGains

Long-termUnrecapturedSection1250 Gain

QualifiedDividends

3/31/14 4/15/14 $0.453125

$0.453125 $0.00 $0.00

$0.00 6/30/14 7/15/14 0.453125 0.453125 0.00 0.00 0.00 9/30/14

10/15/14 0.453125 0.453125 0.00 0.00 0.00 12/31/14 1/15/15 0.453125

0.453125 0.00 0.00

0.00 Total $1.812500 $1.812500

$0.00 $0.00 $0.00

Under the tax rules applicable to real estate investment trusts

such as CoreSite, a portion of the $0.42 per common share

distribution at January 15, 2015 applies to tax year 2014 and a

portion applies to tax year 2015.

CoreSite’s tax return for the year ended December 31, 2014, has

not been filed. As a result, the income tax allocation for the

distributions discussed above has been calculated using the best

available information as of the date of this release.

Please note that federal tax laws affect taxpayers differently,

and the information in this release is not intended as advice to

shareholders on how distributions should be reported on their tax

returns. Also note that state and local taxation of real estate

investment trust distributions varies and may not be the same as

the taxation under the federal rules. CoreSite encourages

shareholders to consult with their own tax advisors as to their

specific federal, state, and local income tax treatment of CoreSite

distributions.

About CoreSite

CoreSite Realty Corporation (NYSE:COR) delivers secure,

reliable, high-performance data center solutions across eight key

North American markets. More than 800 of the world’s leading

enterprises, network operators, cloud providers, and supporting

service providers choose CoreSite to connect, protect and optimize

their performance-sensitive data, applications and computing

workloads. Our scalable, flexible solutions and 350+ dedicated

employees consistently deliver unmatched data center options -- all

of which leads to a best-in-class customer experience and lasting

relationships. For more information, visit www.CoreSite.com.

CoreSite Investor Relations ContactGreer Aviv, +1

303-405-1012 | +1 303-222-7276CoreSite Investor Relations

DirectorGreer.Aviv@CoreSite.com

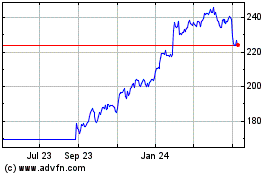

Cencora (NYSE:COR)

Historical Stock Chart

From Jul 2024 to Aug 2024

Cencora (NYSE:COR)

Historical Stock Chart

From Aug 2023 to Aug 2024