The Board of Trustees of the CBRE Clarion Global Real Estate

Income Fund (NYSE: IGR) (the “Fund”) has declared a monthly

distribution of $0.05 per share for the month of March 2017. The

following dates apply:

Declaration Date Ex-Dividend Date Record Date

Payable Date March 2017 03-01-2017

03-16-2017 03-20-2017

03-31-2017

IGR’s current annualized distribution rate is 8.1% based on the

closing market price of $7.41 on March 7, 2017, and 7.0% based on a

closing NAV of $8.62 as of the same date.

Future earnings of the Fund cannot be guaranteed, and the Fund’s

distribution policy is subject to change. For more information on

the Fund, please visit www.cbreclarion.com.

The Fund’s monthly distribution is set by its Board of Trustees.

The Board reviews the Fund’s distribution on a quarterly basis in

view of its net investment income, realized and unrealized gains,

and other net unrealized appreciation or income expected during the

remainder of the year. The Fund strives to establish a level

monthly distribution that, over the course of the year, will serve

to distribute an amount closely approximating the Fund’s net

investment income and net realized capital gains during the

year.

CBRE Clarion Global Real Estate Income Fund is a closed-end

fund, which is traded on the New York Stock Exchange and

invests primarily in real estate securities. Holdings are subject

to change. Past performance is no guarantee of future results.

For the current fiscal year (January 1, 2017 to March 31, 2017),

the Fund has made or declared three (3) regular monthly

distributions totaling $0.15 per share. The source of the

distributions declared for the current month and fiscal year to

date is estimated as follows:

Estimated Source of Distributions:

Estimated Allocations Net Investment

Net Realized Short- Net

Realized Long- Return of Distribution Income

Term Capital Gains Term Capital Gains Capital Current

$0.05 $0.015 (29%) -- (0%) -- (0%) $0.035 (71%) YTD

$0.15 $0.044 (29%)

-- (0%) -- (0%)

$0.106 (71%)

The allocations reported in this notice are only estimates

and are not provided for tax reporting purposes. The actual

allocations will depend on the Fund’s investment experience during

the remainder of its fiscal year and will not be finalized until

after year-end. In addition, the allocations reported to

shareholders for tax reporting purposes will also reflect

adjustments required under applicable tax regulations. Some of

these tax adjustments are significant, and amounts reported to you

for tax reporting may be substantially different than those

presented in this notice. SHAREHOLDERS WILL BE SENT A FORM 1099-DIV

FOR THE CALENDAR YEAR INDICATING HOW TO REPORT FUND DISTRIBUTIONS

FOR FEDERAL INCOME TAX PURPOSES.

The estimated allocations presented above are based on the

Fund’s monthly calculation of its year-to-date net investment

income, capital gains and returns of capital. The Fund’s investment

income is mainly comprised of distributions received from the real

estate investment trusts (REITs) and other companies in which it

invests. “Net investment income” refers to the Fund’s investment

income offset by its expenditures, which include the fees paid to

the investment adviser and other service providers. “Net realized

capital gains” represents the aggregation of the capital gains and

losses realized by the Fund from its purchase and sale of

investment securities during the year-to-date period. Short-term

capital gains are those arising from the sale of securities held by

the Fund for less than one year. Long-term capital gains are those

arising from the sale of securities held by the Fund for a year or

more. The amount of net realized capital gains is also offset by

capital losses realized in prior years. Adjustments to net

investment income are made based on the character of distributions

received by the Fund. A portion of the distributions the Fund

receives from REITs will be characterized by the REITs as capital

gains or returns of capital. Because REITs often reclassify the

distributions they make, the Fund does not know the ultimate

character of these distributions at the time they are received, so

the Fund estimates the character based on historical information.

The Fund’s net investment income is reduced by the amounts

characterized by the REITs as capital gains and returns of capital.

Amounts characterized by the REITs as capital gains are added to

the Fund’s net realized capital gains. Amounts characterized by the

REITs as return of capital are classified as such by the Fund.

The Fund estimates that it has distributed more than its net

investment income and net realized capital gains; therefore, a

portion of your distribution may be a return of capital. A return

of capital may occur, for example, when some or all of the money

that you invested in the Fund is paid back to you. A return of

capital distribution does not necessarily reflect the Fund’s

investment performance and should not be confused with “yield” or

“income”.

Shareholders should not draw any conclusions about the Fund’s

investment performance from the amount of this distribution or from

the terms of the Fund’s managed distribution policy. The

performance and distribution rate information disclosed in the

table below is based on the Fund’s net asset value (“NAV”). The

Fund’s NAV is calculated as the total market value of all the

securities and other assets held by the Fund minus the total value

of its liabilities. Performance figures are not meant to represent

individual shareholder performance. The value of a shareholder’s

investment in the Fund is determined by the market price of the

Fund’s shares.

The Fund’s Cumulative Total Return for fiscal year to date 2017

(January 1, 2017 through February 28, 2017) is set forth below.

Shareholders should take note of the relationship between the

Cumulative Total Return and the Fund’s Cumulative Distribution Rate

for 2017, as well as its Current Annualized Distribution Rate.

Moreover, the Fund’s Average Annual Total Return for the preceding

five-year period (March 1, 2012 through February 28, 2017) is

set forth below. Shareholders should take note of the relationship

between the Fund’s Average Annual Total Return and its Average

Annual Distribution Rate for the preceding five-year period.

Fund Performance

and Distribution Rate Information:

Year-to-date 01/01/2017 to 02/28/2017 Cumulative

Total Return1 2.56 % Cumulative Distribution Rate2 1.14 %

Preceding Five-Year Period 03/01/2012 to 02/28/2017 Average

Annual Total Return3 7.00 % Average Annual Distribution Rate4 6.04

% Current Annualized Distribution Rate5 6.84 %

1 Cumulative Total Return is the percentage change in the

Fund’s NAV over the year-to-date time period including

distributions paid and assuming reinvestment of those

distributions. 2 Cumulative Distribution Rate for the year-to-date

period (January 1, 2017 through February 28, 2017) is determined by

dividing the dollar value of distributions in the period by the

Fund’s NAV as of February 28, 2017. 3 Average Annual Total Return

represents the simple arithmetic average of the Annual Total

Returns of the Fund for the preceding five-year period. Annual

Total Return is the percentage change in the Fund’s NAV over a year

including distributions paid and assuming reinvestment of those

distributions. 4 Average Annual Distribution Rate is the simple

arithmetic average of the Annual Distribution Rates for the

preceding five-year period. The Annual Distribution Rates are

calculated by taking the total distributions paid during the period

divided by average daily NAV for the period. 5 The Current

Annualized Distribution Rate is the current monthly distribution

rate annualized as a percentage of the Fund’s NAV as of February

28, 2017.

Please refer to the chart below for information about the Fund’s

historical NAVs, change in NAVs, total returns, and distributions

paid.

Average

End of

Daily

Period

Annualized Level Special Total NAV for

NAV Per

Change Total Distribution Distributions Distributions Distributions

Period

Share

in NAV Returns

Rate4

Paid Paid Paid IPO $

15.00

20041

$ 14.39 $ 17.46 16.40 % 28.20 % 5.77 % $ 0.75 $ 0.08 $ 0.83 2005 $

16.81 $ 17.23 -1.32 % 8.13 % 8.75 % $ 1.29 $ 0.18 $ 1.47 2006 $

20.27 $ 22.78 32.21 % 53.42 % 16.13 % $ 1.38 $ 1.89 $ 3.27 2007 $

21.67 $ 16.16 -29.06 % -15.82 % 14.86 % $ 1.38 $ 1.84 $ 3.22 2008 $

11.97 $ 5.63 -65.16 % -61.14 % 10.36 % $ 1.24 $ - $ 1.24 2009 $

5.82 $ 7.51 33.39 % 46.79 % 9.28 % $ 0.54 $ - $ 0.54 2010 $ 7.82 $

8.58 14.25 % 22.41 % 6.91 % $ 0.54 $ - $ 0.54 2011 $ 8.60 $ 8.14

-5.13 % 0.94 % 6.28 % $ 0.54 $ - $ 0.54 2012 $ 8.99 $ 9.48 16.46 %

24.15 % 6.47 % $ 0.54 $ 0.042 $ 0.582 2013 $ 9.57 $ 9.04 -4.64 %

0.91 % 5.64 % $ 0.54 $ - $ 0.54 2014 $ 9.77 $ 10.16 12.39 % 18.73 %

5.52 % $ 0.54 $ - $ 0.54 2015 $ 9.67 $ 9.04 -11.02 % -5.57 % 5.89 %

$ 0.57 $ - $ 0.57 2016 $ 9.11 $ 8.65 -4.31 % 2.17 % 6.58 % $ 0.60 $

- $ 0.60

20172

$ 8.69 $ 8.77 1.39 % 2.56 % 1.15 % $ 0.10 $ - $ 0.10

Average3

9.67 % 8.42 %

Since Inception Annualized Total

Return

4.88%

1 Figures for 2004 are from February 24, 2004,

the Fund’s inception date. 2 2017 figures are year-to-date through

February 28, 2017. 3 Average calculated on number of months and

years since inception. The Fund’s inception date was February 24,

2004. 4 Distribution rate calculated by taking the total

distributions paid within the period divided by average daily NAV

for the period.

Sources: NAV per share amounts and

annualized total returns are published in the Fund’s audited annual

reports for the respective year.

About CBRE Clarion Securities:

CBRE Clarion Securities is a registered investment advisory firm

specializing in the management of global real asset securities for

institutional investors. Headquartered near Philadelphia, the firm

manages $17.5 billion in assets as of December 31, 2016, and

has over 90 employees located in offices in the United States,

United Kingdom, Hong Kong, Japan, and Australia. For more

information about CBRE Clarion Securities, please visit

www.cbreclarion.com.

CBRE Clarion Securities is the listed equity management arm of

CBRE Global Investors. CBRE Global Investors is a global real

estate investment management firm with $86.6 billion in assets

under management* as of December 31, 2016. The firm sponsors

investment programs across the risk/return spectrum for investors

worldwide.

CBRE Global Investors is an independently operated affiliate of

CBRE Group, Inc. (NYSE:CBG). It harnesses the research, investment

sourcing and other resources of the world’s premier, full-service

commercial real estate services and investment company for the

benefit of its investors. CBRE Group, Inc. has more than 75,000

employees in approximately 450 offices (excluding affiliates)

worldwide. For more information about CBRE Global Investors, please

visit www.cbreglobalinvestors.com.

* Assets under management (AUM) refers to the fair market value

of real estate-related assets with respect to which CBRE Global

Investors provides, on a global basis, oversight, investment

management services and other advice, and which generally consist

of investments in real estate; equity in funds and joint ventures;

securities portfolios; operating companies and real estate-related

loans. This AUM is intended principally to reflect the extent of

CBRE Global Investors' presence in the global real estate market,

and its calculation of AUM may differ from the calculations of

other asset managers.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170310005727/en/

Analyst and Press Inquiries:David Leggette,

Principal610-995-2500orInvestor

Relations:888-711-4272www.cbreclarion.com

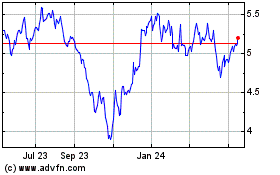

CBRE Global Real Estate ... (NYSE:IGR)

Historical Stock Chart

From Oct 2024 to Nov 2024

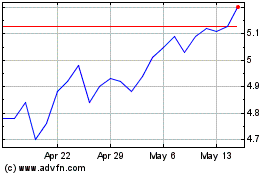

CBRE Global Real Estate ... (NYSE:IGR)

Historical Stock Chart

From Nov 2023 to Nov 2024