CARPENTER TECHNOLOGY CORP false 0000017843 0000017843 2023-07-27 2023-07-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report: July 27, 2023

CARPENTER TECHNOLOGY CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

1-5828 |

|

23-0458500 |

(State of or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

I.D. No.) |

|

|

|

| 1735 Market Street Philadelphia, Pennsylvania |

|

|

|

19103 |

| (Address of principal executive offices) |

|

|

|

(Zip Code) |

(610) 208-2000

Registrant’s telephone number, including area code

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered or required to be registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol |

|

Name of each exchange

on which registered |

| Common Stock, $5 Par Value |

|

CRS |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b.2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 - Results of Operations and Financial Condition.

On July 27, 2023, Carpenter Technology Corporation held its fourth quarter fiscal year 2023 earnings call, broadcast live by webcast. A copy of the slides presented during the call are furnished as Exhibit 99.1 to this Form 8-K and shall not be deemed to be “filed” for any purpose.

Item 9.01 - Financial Statements and Exhibits

(d) Exhibits

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

| CARPENTER TECHNOLOGY CORPORATION |

|

|

| By |

|

/s/ Timothy Lain |

|

|

Timothy Lain |

|

|

Senior Vice President and Chief Financial Officer |

Date: July 31, 2023

CARPENTER TECHNOLOGY CORPORATION 4th

Quarter Fiscal Year 2023 Earnings Call July 27, 2023 Exhibit 99.1

Cautionary Statement Forward-looking

statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Act of 1995. These forward-looking statements are subject to risks and uncertainties that could cause actual results to differ

from those projected, anticipated or implied. The most significant of these uncertainties are described in Carpenter Technology’s filings with the Securities and Exchange Commission, including its report on Form 10-K for the fiscal year ended

June 30, 2022, Form 10-Q for the fiscal quarters ended September 30, 2022, December 31, 2022, and March 31, 2023, and the exhibits attached to those filings. They include but are not limited to: (1) the cyclical nature of the specialty materials

business and certain end-use markets, including aerospace, defense, medical, transportation, energy, industrial and consumer, or other influences on Carpenter Technology's business such as new competitors, the consolidation of competitors,

customers, and suppliers or the transfer of manufacturing capacity from the United States to foreign countries; (2) the ability of Carpenter Technology to achieve cash generation, growth, earnings, profitability, operating income, cost savings and

reductions, qualifications, productivity improvements or process changes; (3) the ability to recoup increases in the cost of energy, raw materials, freight or other factors; (4) domestic and foreign excess manufacturing capacity for certain metals;

(5) fluctuations in currency exchange rates; (6) the effect of government trade actions; (7) the valuation of the assets and liabilities in Carpenter Technology's pension trusts and the accounting for pension plans; (8) possible labor disputes or

work stoppages; (9) the potential that our customers may substitute alternate materials or adopt different manufacturing practices that replace or limit the suitability of our products; (10) the ability to successfully acquire and integrate

acquisitions; (11) the availability of credit facilities to Carpenter Technology, its customers or other members of the supply chain; (12) the ability to obtain energy or raw materials, especially from suppliers located in countries that may be

subject to unstable political or economic conditions; (13) Carpenter Technology's manufacturing processes are dependent upon highly specialized equipment located primarily in facilities in Reading and Latrobe, Pennsylvania and Athens, Alabama for

which there may be limited alternatives if there are significant equipment failures or a catastrophic event; (14) the ability to hire and retain a qualified workforce and key personnel, including members of the executive management team, management,

metallurgists and other skilled personnel; (15) fluctuations in oil and gas prices and production; (16) the impact of potential cyber attacks and information technology or data security breaches; (17) inability of suppliers to meet obligations due

to supply chain disruptions or otherwise; (18) inability to meet increased demand, production targets or commitments; (19) the ability to manage the impacts of natural disasters, climate change, pandemics and outbreaks of contagious diseases and

other adverse public health developments, such as the COVID-19 pandemic; and (20) geopolitical, economic, and regulatory risks relating to our global business, including geopolitical and diplomatic tensions, instabilities and conflicts, such as the

war in Ukraine, as well as compliance with U.S. and foreign trade and tax laws, sanctions, embargoes and other regulations. Any of these factors could have an adverse and/or fluctuating effect on Carpenter Technology's results of operations. The

forward-looking statements in this document are intended to be subject to the safe harbor protection provided by Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934, as

amended. We caution you not to place undue reliance on forward-looking statements, which speak only as of the date of this presentation or as of the dates otherwise indicated in such forward-looking statements. Carpenter Technology undertakes no

obligation to update or revise any forward-looking statements. Non-GAAP and other financial measures Financial information included in this presentation is unaudited. Some of the information included in this presentation is derived from Carpenter

Technology's consolidated financial information but is not presented in Carpenter Technology's financial statements prepared in accordance with U.S. Generally Accepted Accounting Principles (GAAP). Certain of these data are considered

“non-GAAP financial measures” under SEC rules. These non-GAAP financial measures supplement our GAAP disclosures and should not be considered an alternative to the GAAP measure. Reconciliations to the most directly comparable GAAP

financial measures and management’s rationale for the use of the non-GAAP financial measures can be found in the Appendix to this presentation. © 2023 CRS Holdings, LLC. All rights reserved.

4th QUARTER FISCAL YEAR 2023 Tony

Thene | President and Chief Executive Officer

Safety is Our Highest Value Total Case

Incident Rate (TCIR) © 2023 CRS Holdings, LLC. All rights reserved.

Achieved operating income of $62.9

million, surpassing target to return to pre-pandemic operating income run rate in fourth quarter of fiscal year 2023 SAO segment significantly exceeded expectations with operating income of $80 million and adjusted operating margin reaching 16.8%

Net sales excluding surcharge up 14% sequentially and 39% year-over-year driven by continued strengthening demand conditions across key end-use markets Demonstrated further acceleration in momentum with higher productivity, improving product mix and

higher selling prices Generated $175 million of cash from operations, $144 million in adjusted free cash flow; total liquidity remains healthy at $393 million Exceeded Target to Return to Pre-Pandemic Operating Income Run Rate by end of FY23 ©

2023 CRS Holdings, LLC. All rights reserved. Fourth Quarter Summary

Fourth Quarter End-Use Market

Highlights MARKET Q4-23 NET SALES EX. SURCHARGE ($M)* % VS. Q4-22 VS. Q3-23 COMMENTS AEROSPACE & DEFENSE $294.2 53% +65% +22% Global travel surging and now nearly at pre-COVID levels, with ongoing demand increases More material wanted sooner by

all supply chains Customers prioritizing security of supply Defense spending increasing due to global events MEDICAL $66.6 12% +24% +7% Elective surgery demand high with strong patient backlog OEMs urgently focused on increasing manufacturing

activity to meet demand Customers continue to push for accelerated deliveries TRANSPORTATION $36.8 7% +12% +8% Strong demand for light-duty vehicles, especially in North America Light-duty inventories still well below historical levels ENERGY $34.8

6% +66% +22% Oil & gas capital expenditure outlook remains high Advanced solutions critical for solving world’s energy needs Increasing power generation demand for new builds and overhauls INDUSTRIAL & CONSUMER $96.6 17% +17% +1%

Strong demand across sub-markets, especially semiconductor Ongoing pull from consumer electronics customers for material from hot strip mill at Reading, PA *Excludes sales through Carpenter’s Distribution businesses. © 2023 CRS Holdings,

LLC. All rights reserved.

4th QUARTER FISCAL YEAR 2023 FINANCIAL

OVERVIEW AND BUSINESS UPDATE Tim Lain | Senior Vice President and Chief Financial Officer

Income Statement Summary *Detailed

schedule included in Non-GAAP Schedules in Appendix. © 2023 CRS Holdings, LLC. All rights reserved. $ millions, except pounds and per-share amounts Q4-23 Q4-22 Q3-23 YEAR-OVER-YEAR CHANGE SEQUENTIAL CHANGE Pounds (‘000) 61,428 51,760

57,302 9,668 4,126 Net Sales 758.1 563.8 690.1 194.3 68.0 Net Sales ex. Surcharge Revenue* 560.0 403.2 491.5 156.8 68.5 Gross Profit 119.0 72.0 93.5 47.0 25.5 Selling, General and Administrative Expenses 56.1 47.4 54.2 8.7 1.9 Operating Income 62.9

24.6 39.3 38.3 23.6 Special Items included in Operating Income — (9.7) — 9.7 — Operating Income ex. Special Items* 62.9 14.9 39.3 48.0 23.6 % of Net Sales ex. Surcharge Revenue and Special Items* 11.2% 3.7% 8.0% 7.5 % 3.2%

Effective Tax Rate 21.0% 51.9% 22.5% -30.9% -1.5% Net Income 38.4 2.6 18.6 35.8 19.8 Diluted Earnings per Share $0.78 $0.05 $0.38 $0.73 $0.40 Adjusted Diluted Earnings per Share* $0.78 $0.00 $0.38 $0.78 $0.40

Net sales excluding surcharge

increased 16% sequentially on 9% higher shipment volumes and improving product mix driven primarily by Aerospace and Defense end-use market Exceeded target with significant progression in sequential and year-over-year productivity across facilities

Demand continues to accelerate across end-use markets, especially Aerospace and Defense, and Medical, with customers wanting more material, sooner Focus on increasing productivity and optimizing capacity for higher-value product mix while managing

preventive maintenance schedules Q1-24 operating income expected to be in the range of $72 million to $77 million © 2023 CRS Holdings, LLC. All rights reserved. $ millions Q4-23 Q4-22 Q3-23 YEAR-OVER-YEAR CHANGE SEQUENTIAL CHANGE Pounds ('000)

61,528 51,626 56,516 9,902 5,012 Net Sales 667.0 484.9 603.4 182.1 63.6 Net Sales ex. Surcharge Revenue * 477.2 327.2 411.5 150.0 65.7 Operating Income 80.0 30.0 49.0 50.0 31.0 Adjusted Operating Income * 80.0 20.0 49.0 60.0 31.0 Operating Margin

12.0% 6.2% 8.1% 5.8% 3.9% Adj. Operating Margin ex. Surcharge Rev. and Special Items* 16.8% 6.1% 11.9% 10.7% 4.9% SAO Segment Summary * Detailed schedule included in Non-GAAP schedules in Appendix Q4-23 Business Results Q1-24 Outlook

Net sales excluding surcharge

increased 16% year-over-year and 4% sequentially driven by strong demand for titanium materials used in Aerospace and Defense and Medical end-use markets Operating income decreased sequentially primarily due to near-term timing of operating costs

versus production flows in the Dynamet titanium business as activity levels ramp up to support customer demand Demand conditions expected to remain strong with sequential net sales growth driven by the Dynamet titanium business Ongoing focus on

increasing productivity and throughput rates to support increased sales and improving margins Q1-24 operating income expected to be in the range of $10 million to $11 million * Pounds includes only Dynamet and Additive businesses © 2023 CRS

Holdings, LLC. All rights reserved. $ millions Q4-23 Q4-22 Q3-23 YEAR-OVER-YEAR CHANGE SEQUENTIAL CHANGE Pounds ('000)* 3,328 2,808 3,232 520 96 Net Sales 118.7 95.8 115.1 22.9 3.6 Net Sales ex. Surcharge Revenue ** 107.6 92.9 103.8 14.7 3.8

Operating Income 5.9 10.3 10.2 -4.4 -4.3 Adjusted Operating Income ** 5.9 8.2 10.2 -2.3 -4.3 Operating Margin 5.0% 10.8% 8.9% -5.8% -3.9% Adj. Operating Margin ex. Surcharge Rev. and Special Item ** 5.5% 8.8% 9.8% -3.3% -4.3% PEP Segment Summary **

Detailed schedule included in Non-GAAP schedules in Appendix Q4-23 Business Results Q1-24 Outlook

Adjusted Free Cash Flow Summary The

clerical accuracy of certain amounts may be impacted due to rounding. *Detailed schedule included in Non-GAAP Schedules in Appendix. © 2023 CRS Holdings, LLC. All rights reserved. $ millions Q4-23 Q3-23 Q2-23 Q1-23 FY23 FY22 Net Income +

Non-Cash Items 84 61 49 32 226 86 Inventory 73 13 (106) (121) (140) (72) Working Capital / Other 18 (69) (29) 11 (71) (8) Total Net Working Capital / Other 91 (56) (135) (110) (211) (80) Net Cash Provided from (Used for) Operating Activities 175 5

(86) (78) 15 6 Purchases of Property, Plant, Equipment and Software (31) (21) (18) (13) (82) (91) Proceeds from Disposals of Property, Plant and Equipment and Assets Held for Sale — — — — — 2 Adjusted Free Cash Flow *

144 (16) (104) (91) (67) (83) Cash 45 22 20 53 45 154 Available Borrowing Under Credit Facility 348 190 217 298 348 294 Total Liquidity 393 212 237 351 393 448

$ in millions FY23 FY24 ESTIMATE

Depreciation and Amortization $131 $131 Capital Expenditures $82 $125-130 Pension Contributions $ - $11 Net Pension Expense $20 $24 Interest Expense $54 $52-54 Effective Tax Rate 22% 22-24% Selected Fiscal Year 2024 Guidance © 2023 CRS

Holdings, LLC. All rights reserved.

4th QUARTER FISCAL YEAR 2023

CLOSING COMMENTS Tony Thene | President and Chief Executive Officer

Fourth Quarter Recap Exceeded

target to return to fiscal year 2019 operating income run-rate by the end of fiscal year 2023 Achieved adjusted operating income of $62.9 million, a significant improvement from $39.3 million in the previous quarter and $14.9 million in the fourth

quarter of fiscal year 2022 SAO accelerated productivity improvements and capacity optimization for improving product mix, resulting in a significant increase in adjusted operating income and margin Net sales excluding surcharge up 14% sequentially

and up 39% year-over-year, with increasing demand across end-use markets Demonstrated further acceleration in momentum with higher productivity, improving product mix and higher selling prices Generated $175 million of cash from operations,

supporting healthy liquidity Exceeded Expectations for Fourth Quarter with Momentum to Drive Growth in FY24 © 2023 CRS Holdings, LLC. All rights reserved.

Compelling Near-Term and Long-Term

Financial Outlook Projecting Q1 FY24 operating income performance above historical trend On path to achieve goal of doubling FY19 operating income by FY27 - Projecting FY24 to be meaningful step forward Operating Income ($M) 460-500 2x ~40% CAGR

Annual achievement towards FY27 target will be front-end loaded in FY24 Expect increasing quarterly earnings through FY24 Consistent with historical performance, expect 2nd half FY24 to be greater than 1st half FY24 Progression of productivity gains

could accelerate earnings growth in FY24 This range would exceed the operating income in the first quarter of fiscal year 2020, our most profitable first quarter in recent history Strengthening demand across end-use markets combined with increasing

productivity across facilities, improving product mix and pricing actions drive increasing profitability Managing preventive maintenance schedules to maximize shipments © 2023 CRS Holdings, LLC. All rights reserved. Operating Income ($M) Q1FY24

(projected) 54-60 Previous guidance Previous guidance ~$350M OI 61-67

APPENDIX OF NON-GAAP

SCHEDULES

Non-GAAP Schedules Adjusted diluted

earnings (loss) per share © 2023 CRS Holdings, LLC. All rights reserved. Management believes that earnings (loss) per share adjusted to exclude the impact of special items is helpful in analyzing the operating performance of the Company, as

these items are not indicative of ongoing operating performance. Management uses its results excluding these amounts to evaluate its operating performance and to discuss its business with investment institutions, the Company's board of directors and

others. $ millions, except per-share amounts Q4-23 Q4-22 Q3-23 FY23 FY22 Diluted Earnings (Loss) per Share $0.78 $0.05 $0.38 $1.14 ($1.01) Net Income (Loss) 38.4 2.6 18.6 56.4 (49.1) Special Items, net of tax: COVID-19 Costs — 0.6 —

— 4.6 COVID-19 Employee Retention Credits — (9.9) — — (9.9) Acquisition-related Contingent Liability Release — — — — (3.6) Environmental Site Charge — 1.9 — — 1.9 Debt Extinguishment

Losses, net — 4.7 — — 4.7 Special Items, net of tax: — (2.7) — — (2.3) Net Income (Loss) Excluding Special Items 38.4 (0.1) 18.6 56.4 (51.4) Adjusted Diluted Earnings (Loss) per Share $0.78 $0.00 $0.38 $1.14

($1.06)

Non-GAAP Schedules Adjusted

operating margin, excluding surcharge revenue and special items © 2023 CRS Holdings, LLC. All rights reserved. $ millions Q4-23 Q4-22 Q3-23 FY23 FY22 Net Sales 758.1 563.8 690.1 2,550.3 1,836.3 Less: Surcharge Revenue 198.1 160.6 198.6 702.3

436.3 Net Sales Excluding Surcharge Revenue 560.0 403.2 491.5 1,848.0 1,400.0 Operating Income (Loss) 62.9 24.6 39.3 133.1 (24.9) Special Items: COVID-19 Costs — 0.6 — — 5.9 COVID-19 Employee

Retention Credits — (12.7) — — (12.7) Acquisition-related Contingent Liability Release — — — — (4.7) Environmental Site Charge — 2.4 — — 2.4 Special Items — (9.7) — —

(9.1) Operating Income (Loss) Excluding Special Items 62.9 14.9 39.3 133.1 (34.0) Operating Margin 8.3% 4.4% 5.7% 5.2% -1.4% Adjusted Operating Margin, Excluding Surcharge Revenue and Special Items 11.2% 3.7% 8.0% 7.2% -2.4% Management believes that

removing the impact of raw material surcharge from operating margin provides a more consistent basis for comparing results of operations from period to period, thereby permitting management to evaluate performance and investors to make decisions

based on the ongoing operations of the Company. In addition, management believes that excluding the impact of special items from operating margin is helpful in analyzing the operating performance of the Company, as these items are not indicative of

ongoing operating performance. Management uses its results excluding these amounts to evaluate its operating performance and to discuss its business with investment institutions, the Company's board of directors and others.

Non-GAAP Schedules Adjusted segment

operating margin, excluding surcharge revenue and special items © 2023 CRS Holdings, LLC. All rights reserved. SAO SAO SAO PEP PEP PEP $ millions Q4-23 Q4-22 Q3-23 Q4-23 Q4-22 Q3-23 Net Sales 667.0 484.9 603.4 118.7 95.8 115.1 Less: Surcharge

Revenue 189.8 157.7 191.9 11.1 2.9 11.3 Net Sales Excluding Surcharge Revenue 477.2 327.2 411.5 107.6 92.9 103.8 Operating Income 80.0 30.0 49.0 5.9 10.3 10.2 Special Items: COVID-19 Costs — 0.6

— — — — COVID-19 Employee Retention Credits — (10.6) — — (2.1) — Special Items — (10.0) — — (2.1) — Adj. Operating Income Excluding Special Items 80.0 20.0 49.0 5.9 8.2 10.2

Operating Margin 12.0 % 6.2 % 8.1 % 5.0 % 10.8 % 8.9 % Adj. Operating Margin Excluding Surcharge Revenue and Special Items 16.8 % 6.1 % 11.9 % 5.5 % 8.8 % 9.8 % Management believes that removing the impact of raw material surcharge from operating

margin provides a more consistent basis for comparing results of operations from period to period, thereby permitting management to evaluate performance and investors to make decisions based on the ongoing operations of the Company. In addition,

management believes that excluding the impact of special items from operating margin is helpful in analyzing the operating performance of the Company, as these items are not indicative of ongoing operating performance. Management uses its results

excluding these amounts to evaluate its operating performance and to discuss its business with investment institutions, the Company's board of directors and others.

Non-GAAP Schedules Adjusted Free

Cash Flow © 2023 CRS Holdings, LLC. All rights reserved. $ millions Q4-23 Q3-23 Q2-23 Q1-23 FY23 FY22 Net Cash Provided from (Used for) Operating Activities 174.9 4.3 (86.4) (78.0) 14.7 6.0 Purchases of Property, Plant, Equipment and Software

(30.8) (20.5) (17.5) (13.5) (82.3) (91.3) Proceeds from Disposals of Property, Plant and Equipment and Assets Held for Sale — — — — — 2.2 Adjusted Free Cash Flow 144.1 (16.2) (103.9) (91.5) (67.6) (83.1) Management

believes that the adjusted free cash flow measure provides useful information to investors regarding the Company’s financial condition because it is a measure of cash generated, which management evaluates for alternative uses. Historically,

this non-GAAP financial measure included cash used for dividends paid on outstanding common stock and participating securities. Management believes that excluding cash dividends paid from adjusted free cash flow will provide a more direct comparison

to operating cash flow, a GAAP-defined financial measure. Fiscal year 2022 has been reclassified to conform to the current presentation. The clerical accuracy of certain amounts may be impacted due to rounding.

Your trusted partner in innovation.

Carpenter Technology Corporation (NYSE: CRS) is a global leader in high-performance specialty alloy-based materials and process solutions for critical applications in the aerospace, defense, medical, transportation, energy, industrial and consumer

electronics markets. For additional information, please contact your nearest sales office: info@cartech.com | 610 208 2000 carpentertechnology.com

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

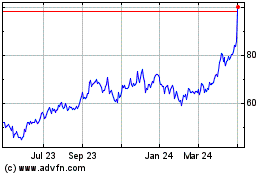

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Jun 2024 to Jul 2024

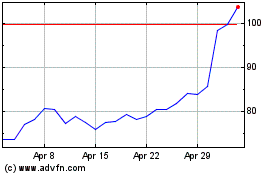

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Jul 2023 to Jul 2024