Carpenter Tech, Rolls-Royce in Supply Pact - Analyst Blog

May 01 2013 - 1:15PM

Zacks

Specialty alloy maker Carpenter Technology

Corp. (CRS) has landed a supply deal with Rolls-Royce,

which will provide the latter with advanced technology materials

used to make jet engine components.

The five-year agreement, which runs through 2017, is worth roughly

$75 million. The materials, to be supplied under the contract, will

be utilized on existing and future Rolls-Royce engine platforms in

applications including rings, blades, vanes, and airfoils.

Rolls-Royce will be responsible for generating demand for the

materials in the UK and the U.S. These materials will be made at

Carpenter’s Reading, Pa., and Athens, Ala., specialty steelmaking

plants.

Carpenter, which is among the leading players in the specialty

steel industry along with Allegheny Technologies

Inc. (ATI), Haynes International, Inc.

(HAYN) and RTI International (RTI), recently

reported adjusted earnings (barring one-time items) of 69 cents per

share for third-quarter fiscal 2013 (ended Mar 31, 2013), missing

the Zacks Consensus Estimate by 7 cents.

Profit, as reported, was essentially flat year over year at $32.9

million or 62 cents a share. Contributions of the Latrobe Specialty

Steel unit, which Carpenter bought in Feb 2012, were neutralized by

lower earnings in the Specialty Alloy Operations (SAO) division due

to weak mix and increased customer deferrals.

Carpenter raked in net sales of $581.4 million in the quarter, up

roughly 8% year over year. However, it missed the Zacks Consensus

Estimate of $636 million.

Sales were boosted by double-digit gains across the aerospace and

defense and energy markets. Growth in aerospace and defense was

aided by higher aircraft build rates while energy sales were driven

by a rise in ultra-premium materials sales. However, lower titanium

prices and high OEM inventories hurt sales in the medical

market.

Carpenter continues to sees a double-digit year over year expansion

in adjusted operating income for fiscal 2013. However, it noted

that achieving this target will be difficult if the fourth quarter

experiences similar in-quarter mix and deferrals as witnessed in

the third quarter.

Carpenter currently retains a Zacks Rank #5 (Strong Sell).

ALLEGHENY TECH (ATI): Free Stock Analysis Report

CARPENTER TECH (CRS): Free Stock Analysis Report

HAYNES INTL INC (HAYN): Free Stock Analysis Report

RTI INTL METALS (RTI): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

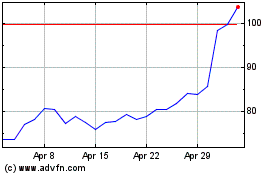

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Jun 2024 to Jul 2024

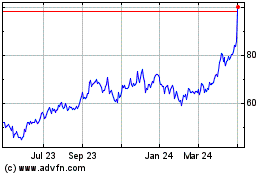

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Jul 2023 to Jul 2024