Allegheny's Earnings in Line, Sales Trail - Analyst Blog

April 24 2013 - 7:42AM

Zacks

Allegheny Technologies

Inc. (ATI) reported first-quarter 2013 earnings of 9 cents

per share, down from 50 cents recorded a year ago. The results were

in line with the Zacks Consensus Estimate. Profit plummeted 82.2%

year over year to $10 million on lower sales.

Revenues slipped 12.8% year over year to $1,179.4 million, missing

the Zacks Consensus Estimate of $1,215 million. Revenues were hurt

by lower demand across several end markets including oil and gas,

jet engine aftermarket, electrical energy, and construction and

mining. Allegheny also witnessed lower pricing for many of its

products and falling raw materials surcharges.

Operating profit dipped 52% year over year to $78.3 million in the

quarter with operating margin contracting to 6.6% from 12.1% a year

ago. Lower shipments related with high value products coupled with

lower base prices resulted in the decrease in operating profits.

The impact of higher raw material costs for products not aligned

with lower raw material surcharges also contributed to the

decline.

Segment Review

Revenues from the High Performance Metals segment fell 11% year

over year to $518.4 million in the quarter due to lower shipments

of nickel-based and specialty steel alloys and zirconium. A decline

in raw material surcharges, lower pricing as well as lower sales of

precision forged and cast components due to lesser demand also

impacted the revenues.

Shipments of nickel-based and specialty alloys went up 7%. Titanium

and titanium alloys mill products shipments soared 25% while

zirconium and related alloys shipments decreased 34% due to weak

demand from nuclear energy market and chemical process industry.

Sales increased 10% in the segment’s largest end market, aerospace,

in the quarter.

Flat-Rolled Products segment revenues were down 12% to $558.1

million on account of reduced raw material surcharges, lower

base-selling pricing and a product mix of higher percentage of

standard stainless products and lower percentage of high-value

products. Shipments of high-value products fell 6% while standard

stainless products shipment climbed 10%. Average selling prices for

standard stainless products remained at low levels. Average

transaction prices for all products decreased 15%.

Sales in the Engineered Products division tumbled 24% to $102.9

million, hurt by weak demand for tungsten-based products and carbon

alloy steel forgings. The company witnessed weak demand for oil and

gas markets however saw marginal improvements in the construction

and mining, cutting tools, transportation, aerospace, and

automotive market.

Financial Position

Allegheny’s cash and cash equivalents of $138 million as of Mar 31,

2013, were down 44.8% year over year. Total debt of $1,479.1

million was flat year over year. Total debt-to-capital ratio was

37.3% as of Mar 31, 2013, down marginally from 37.4% recorded a

year ago.

Outlook

Allegheny, which is among the

prominent players in the U.S. specialty steel industry along with

Carpenter Technology (CRS), Haynes

International (HAYN) and Precision

Castparts (PCP), expects business conditions to remain

challenging through first-half 2013 given the uncertainties

surrounding fiscal policy and weak global economy.

Allegheny expects challenging

economic conditions to prevail, thereby impacting the end-markets

throughout the second quarter of 2013. The company expects its

customers to remain cautious as economic uncertainties persist over

the near term, lead times remain short, and raw material prices

remains under pressure.

Nevertheless, Allegheny expects modest recovery in the domestic

economic growth coupled with demand improvements in its key global

markets.

Allegheny also said that it will focus on implementing cost

reduction actions, identifying market opportunities and taking

measures to reduce managed working capital for achieving long term

profitable growth.

Allegheny currently retains a short-term (1 to 3 months) Zacks Rank

#5 (Strong Sell).

ALLEGHENY TECH (ATI): Free Stock Analysis Report

CARPENTER TECH (CRS): Free Stock Analysis Report

HAYNES INTL INC (HAYN): Free Stock Analysis Report

PRECISION CASTP (PCP): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

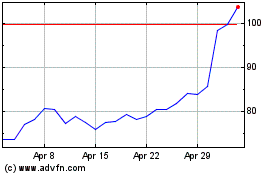

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Jun 2024 to Jul 2024

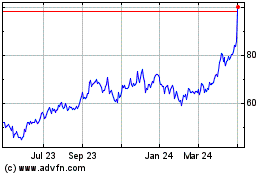

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Jul 2023 to Jul 2024