false

0000016732

0000016732

2024-02-13

2024-02-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report

(Date of Earliest Event Reported):

February 13, 2024

CAMPBELL SOUP COMPANY

| New Jersey |

1-3822 |

21-0419870 |

| State of Incorporation |

Commission File Number |

I.R.S. Employer

Identification No.

|

One Campbell Place

Camden, New Jersey 08103-1799

Principal Executive Offices

Telephone Number: (856) 342-4800

Check the appropriate box below if the form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2 (b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| |

|

|

|

|

| Title of each class |

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

| Capital Stock, par value $.0375 |

|

CPB |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934

(17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act ☐

As previously disclosed, on August 7, 2023, Campbell

Soup Company, a New Jersey corporation (the “Company”), entered into an Agreement and Plan of Merger (the “Merger

Agreement”) with Sovos Brands, Inc., a Delaware corporation (“Sovos”), and Premium Products Merger Sub, Inc.,

a Delaware corporation and a wholly owned subsidiary of the Company (“Merger Sub”). The Merger Agreement provides,

among other things, that subject to the satisfaction or waiver of the conditions set forth therein, including the expiration or termination

of the applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, Merger Sub will merge with

and into Sovos (the “Merger”) with Sovos surviving as a wholly owned subsidiary of the Company. As previously disclosed,

on October 23, 2023, the Company and Sovos each received a request for additional information (the “Second Request”)

from the U.S. Federal Trade Commission (the “FTC”) in connection with the FTC’s review of the transactions contemplated

by the Merger Agreement.

On February 13, 2024,

the Company and Sovos issued a joint press release announcing that both companies have certified substantial compliance with the Second

Request. A copy of the joint press release is furnished as Exhibit 99.1 hereto.

The certification of

substantial compliance triggers the start of a 30-day waiting period which is expected to expire on March 11, 2024, after which the Merger

can be consummated. Subject to the satisfaction or waiver of customary closing conditions set forth in the Merger Agreement, the Company

and Sovos expect to complete the transaction within days of the March 11, 2024 expiration date.

Cautionary Note Regarding Forward-Looking Statements

Certain statements in this Current Report on Form

8-K regarding the Merger, including any statements regarding the expected timetable for completing the Merger and any other statements

regarding future expectations, beliefs, plans, objectives, financial conditions, assumptions or future events or performance that are

not historical facts are “forward-looking” statements made within the meaning of Section 27A of the Securities

Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended.

The words “aim,” “anticipate,” “believe,” “could,” “ensure,” “estimate,”

“expect,” “forecasts,” “if,” “intend,” “likely,” “may,” “might,”

“outlook,” “plan,” “positioned,” “potential,” “predict,” “probable,”

“project,” “should,” “strategy,” “target,” “will,” “would,” and

similar expressions, and the negative thereof, are intended to identify forward-looking statements.

All forward-looking information is subject to

numerous risks and uncertainties, many of which are beyond the control of the Company, that could cause actual results to differ materially

from the results expressed or implied by the statements. These risks and uncertainties include, but are not limited to:

| · | the conditions to the completion of the Sovos transaction may not be satisfied on the anticipated schedule,

or closing of the Sovos transaction may not occur; |

| · | the timing to consummate the proposed transaction; |

| · | the risk that the cost savings and any other synergies from the Sovos transaction may not be fully realized

or may take longer or cost more to be realized than expected, including that the Sovos transaction may not be accretive within the expected

timeframe or the extent anticipated; |

| · | completing the Sovos transaction may distract the Company’s management from other important matters;

and |

| · | other factors described in the Company’s most recent Form 10-K and subsequent filings with the Securities

and Exchange Commission (the “SEC”). |

Additional information concerning these and other

risk factors can be found in the Company’s and Sovos’s filings with the SEC and available through the SEC’s Electronic

Data Gathering and Analysis Retrieval system at http://www.sec.gov, including the Company’s and Sovos’s most recent Annual

Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K

This discussion of uncertainties is by no means

exhaustive but is designed to highlight important factors that may impact our outlook. The Company disclaims any obligation or intent

to update the forward-looking statements in order to reflect events or circumstances after the date of this release.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

CAMPBELL SOUP COMPANY |

|

| |

|

|

|

|

| Date: February 13, 2024 |

|

|

|

|

| |

|

|

|

|

| |

By: |

/s/ Charles A. Brawley, III |

|

| |

|

Name: |

Charles A. Brawley, III |

|

| |

|

Title: |

Executive Vice President, General Counsel and Corporate Secretary |

|

Exhibit 99.1

Campbell

and Sovos Brands Certify Substantial Compliance with Second Request from FTC; Begins the Start of 30-Day Waiting Period

CAMDEN, N.J. & LOUISVILLE, Colo., Feb. 13, 2024 –

Campbell Soup Company (NYSE: CPB) and Sovos Brands, Inc. (NASDAQ: SOVO) today announced that both companies have certified

substantial compliance with the Request for Additional Information and Documentary Materials ("Second Request") issued by the

Federal Trade Commission (FTC) regarding Campbell’s proposed acquisition of Sovos Brands.

The certification of substantial compliance triggers the start

of a 30-day waiting period which is expected to expire on March 11, 2024, after which the sale can be finalized. Subject to the satisfaction

or waiver of customary closing conditions, the companies expect to complete the transaction within days of the March 11, 2024 expiration

date.

“We’re excited to be one step closer to completing

the acquisition and welcoming the talented Sovos Brands employees to Campbell’s team,” said Campbell’s President and

CEO Mark Clouse. “The Sovos Brands portfolio strengthens our Meals & Beverages division, and paired with our fast-growing Snacks

division, will create one of the best portfolios in the industry and make Campbell one of the most dependable, growth-oriented names in

food.”

“We are delighted to reach this critically important milestone

in the completion of the acquisition. We remain highly confident in Campbell’s ability to continue bringing our products to more

households and further building on our track record as one of the fastest growing food companies of scale in the United States,”

commented Todd Lachman, Founder and Chief Executive Officer of Sovos Brands, Inc.

About Campbell

For more than 150 years, Campbell (NYSE:CPB) has been connecting

people through food they love. Generations of consumers have trusted us to provide delicious and affordable food and beverages. Headquartered

in Camden, N.J. since 1869, the company generated fiscal 2023 net sales of $9.4 billion. Our portfolio includes iconic brands such as

Campbell’s, Cape Cod, Goldfish, Kettle Brand, Lance, Late July, Milano, Pace,

Pacific Foods, Pepperidge Farm, Prego, Snyder’s of Hanover, Swanson and V8. Campbell

has a heritage of giving back and acting as a good steward of the environment. The company is a member of the Standard & Poor's 500

as well as the FTSE4Good and Bloomberg Gender-Equality Indices. For more information, visit www.campbellsoupcompany.com.

About Sovos Brands, Inc.

Sovos Brands, Inc. is a consumer-packaged food company focused

on building disruptive growth brands that bring today’s consumers great tasting food that fits the way they live. The company’s

product offerings include a variety of pasta sauces, dry pasta, soups, frozen entrées, frozen pizza and yogurts, all of which are

sold in North America under the brand names Rao’s,Michael Angelo’s and noosa. All Sovos Brands’ products

are built with authenticity at their core, providing consumers with one- of-a-kind food experiences that are genuine, delicious, and unforgettable.

The company is headquartered in Louisville, Colorado. For more information on Sovos Brands and its products, please visit www.sovosbrands.com.

Forward-Looking Statements

Certain statements in this press release regarding the proposed transaction,

including any statements regarding the expected timetable for completing the proposed transaction, benefits of the proposed transaction,

future opportunities, future financial performance and any other statements regarding future expectations, beliefs, plans, objectives,

financial conditions, assumptions or future events or performance that are not historical facts are “forward-looking” statements

made within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934,

as amended. The words “aim,” “anticipate,” “believe,” “could,” “ensure,” “estimate,”

“expect,” “forecasts,” “if,” “intend,” “likely” “may,” “might,”

“outlook,” “plan,” “positioned,” “potential,” “predict,” “probable,”

“project,” “should,” “strategy,” “target,” “will,” “would,” and

similar expressions, and the negative thereof, are intended to identify forward-looking statements.

All forward- looking information is subject to numerous risks

and uncertainties, many of which are beyond the control of Sovos Brands or Campbell, that could cause actual results to differ materially

from the results expressed or implied by the statements. These risks and uncertainties include, but are not limited to:

| • | the conditions to the completion of the proposed transaction may not be satisfied

or that the closing of the proposed transaction might otherwise not occur; |

| • | the timing to consummate the proposed transaction; |

| • | long-term financing for the proposed transaction may not be obtained by Campbell

on favorable terms, or at all; |

| • | the risk that the cost savings and any other synergies from the proposed transaction may not be fully

realized by Campbell or may take longer or cost more to be realized than expected, including that the Sovos Brands transaction may not

be accretive to Campbell within the expected timeframe or the extent anticipated; |

| • | completing the proposed transaction may distract the management of Campbell and Sovos

Brands from other important matters; |

| • | the risks related to the availability of, and cost inflation in, supply chain inputs,

including labor, raw materials, commodities, packaging and transportation; |

| • | the pendency of the proposed transaction may have an adverse impact on the ability

of Sovos Brands to retain third-party relationships and related talent; |

| • | Campbell’s ability to execute on and realize the expected benefits from its strategy, including growing

sales in snacks and growing/maintaining its market share position in soup; |

| • | the impact of strong competitive responses to Campbell’s efforts to leverage its brand power with

product innovation, promotional programs and new advertising; the risks associated with trade and consumer acceptance of product improvements,

shelving initiatives, new products and pricing and promotional strategies; |

| • | the ability to realize projected cost savings and benefits from cost savings initiatives and the integration

of recent acquisitions; |

| • | disruptions in or inefficiencies to Campbell’s or Sovos Brands’ supply

chain and/or operations, including reliance on key supplier relationships; |

| • | the risks related to the effectiveness of Campbell’s hedging activities and

Campbell’s ability to respond to volatility in commodity prices; |

| • | Campbell’s ability to manage changes to its organizational structure and/or business processes, including

selling, distribution, manufacturing and information management systems or processes; changes in consumer demand for Campbell’s

and Sovos Brands’ products and favorable perception of such brands; |

| • | changing inventory management practices by certain of Campbell’s and Sovos Brands’

key customers; |

| • | a changing customer landscape, with value and e-commerce retailers expanding their market presence, while

certain of the Campbell’s key customers maintain significance to Campbell’s business; product quality and safety issues, including

recalls and product liabilities; |

| • | the possible disruption to the independent contractor distribution models used by certain of Campbell’s

businesses, including as a result of litigation or regulatory actions affecting their independent contractor classification; |

| • | the uncertainties of litigation and regulatory actions against Campbell’s or Sovos Brands; |

| • | the costs, disruption and diversion of management’s attention associated with

activist investors; |

| • | a disruption, failure or security breach of Campbell’s, Campbell’s vendors', Sovos Brands’

or Sovos Brands’ vendors information technology systems, including ransomware attacks; |

| • | impairment to goodwill or other intangible assets; |

| • | Campbell’s and Sovos Brands’ ability to protect their respective intellectual

property rights; |

| • | increased liabilities and costs related to Campbell’s defined benefit pension plans; |

| • | Campbell’s and Sovos Brands’ ability to attract and retain key talent and other employees,

which might require Campbell or Sovos Brands to use more expensive or less effective resources to support their respective businesses; |

| • | goals and initiatives related to, and the impacts of, climate change, including weather-related

events; |

| • | negative changes and volatility in financial and credit markets, |

| • | deteriorating economic conditions and other external factors, including changes in

laws and regulations; and |

| • | unforeseen business disruptions or other impacts due to political instability, civil disobedience, terrorism,

armed hostilities (including the ongoing conflict between Russia and Ukraine and in Israel and Gaza), extreme weather conditions, natural

disasters, other pandemics or other calamities |

Additional information concerning these and other risk factors

can be found in Campbell’s and Sovos Brands filings with the SEC and available through the SEC’s Electronic Data Gathering

and Analysis Retrieval system at http://www.sec.gov, including Campbell’s and Sovos Brands'

most recent Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K.

The discussion of uncertainties is by no means exhaustive but

is designed to highlight important factors that may impact the outlook of Campbell and Sovos Brands. Campbell and Sovos Brands each disclaim

any obligation or intent to update the forward-looking statements in order to reflect events or circumstances after the date of this release

except as required by law.

| Contacts |

|

| |

|

| Campbell Soup Company |

|

| |

|

| Investors |

Media |

| Rebecca_gardy@campbells.com |

James_Regan@campbells.com |

| |

|

| |

|

| Sovos Brands, Inc. |

|

| |

|

| Investors |

Media |

| Joshua Levine |

Lauren Armstrong |

| IR@sovosbrands.com |

media@sovosbrands.com |

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

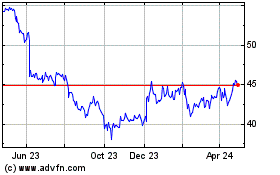

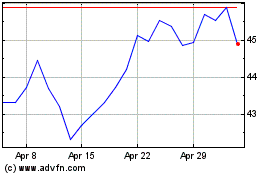

Campbell Soup (NYSE:CPB)

Historical Stock Chart

From Oct 2024 to Nov 2024

Campbell Soup (NYSE:CPB)

Historical Stock Chart

From Nov 2023 to Nov 2024